Key Insights

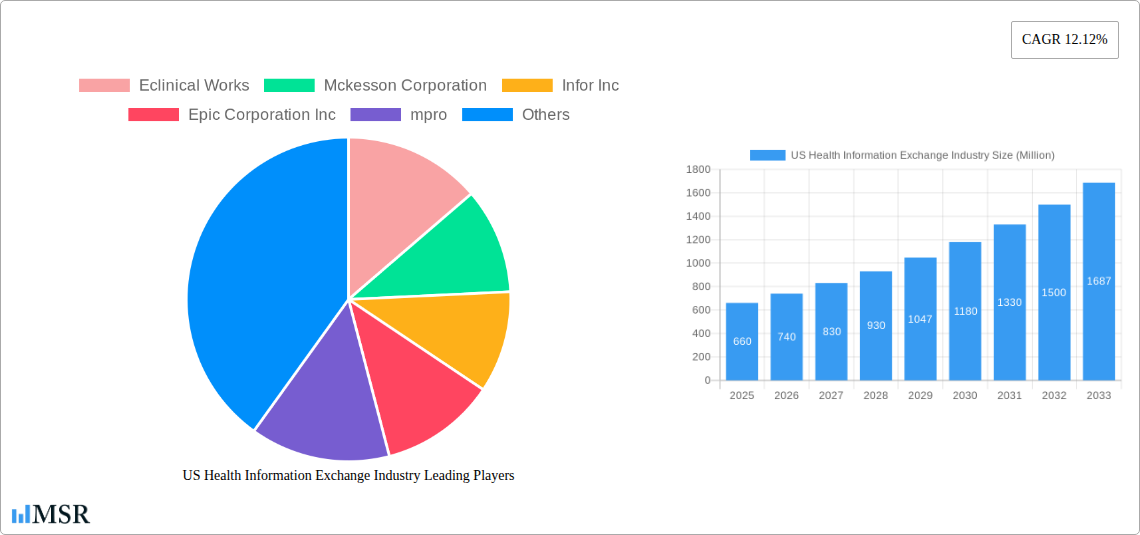

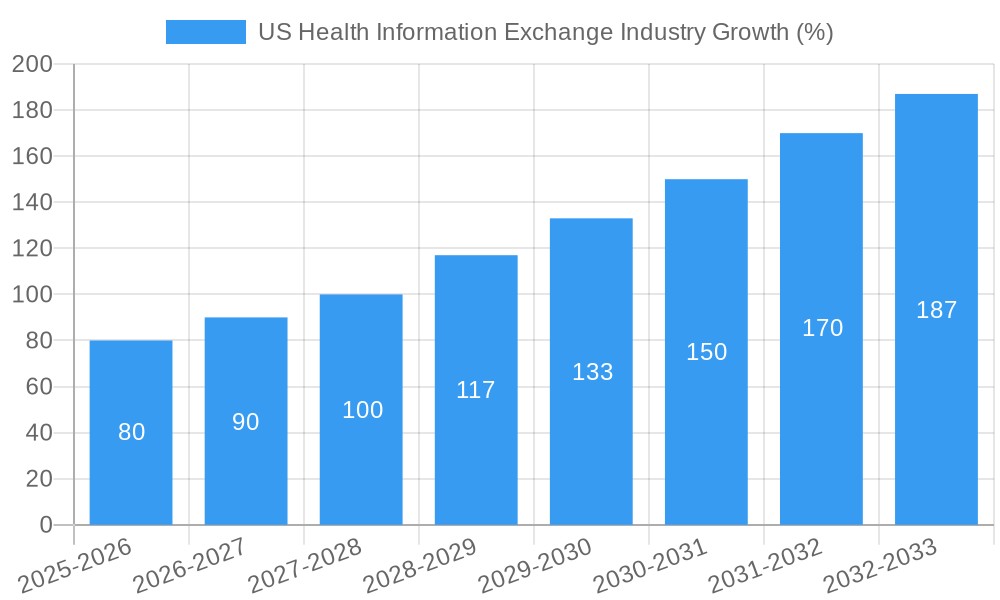

The US Health Information Exchange (HIE) market, valued at $0.66 billion in 2025, is projected to experience robust growth, driven by increasing demand for interoperability, improved patient care coordination, and the nationwide push for value-based care models. A Compound Annual Growth Rate (CAGR) of 12.12% from 2025 to 2033 indicates a significant market expansion, exceeding $1.8 billion by 2033. This growth is fueled by several key factors. The rising adoption of electronic health records (EHRs) creates a greater need for seamless data exchange between healthcare providers. Furthermore, government initiatives promoting interoperability, such as the 21st Century Cures Act, are incentivizing HIE adoption and driving market expansion. The increasing prevalence of chronic diseases and the aging population also contribute to the demand for efficient patient data sharing to facilitate better disease management and improved outcomes. Different exchange types, such as direct exchange, query-based exchange, and consumer-mediated exchange, cater to diverse needs within the healthcare ecosystem, driving segment-specific growth. The market is segmented further by component (EMPI, HPD, RLS, etc.), implementation model (centralized, decentralized, hybrid), setup type (private, public), and application (internal interfacing, secure messaging, etc.), offering various solutions tailored to specific healthcare organizations’ requirements. Leading vendors such as Epic, Cerner, McKesson, and Allscripts are key players in this rapidly evolving landscape, constantly innovating to meet the increasing demand for sophisticated and secure HIE solutions.

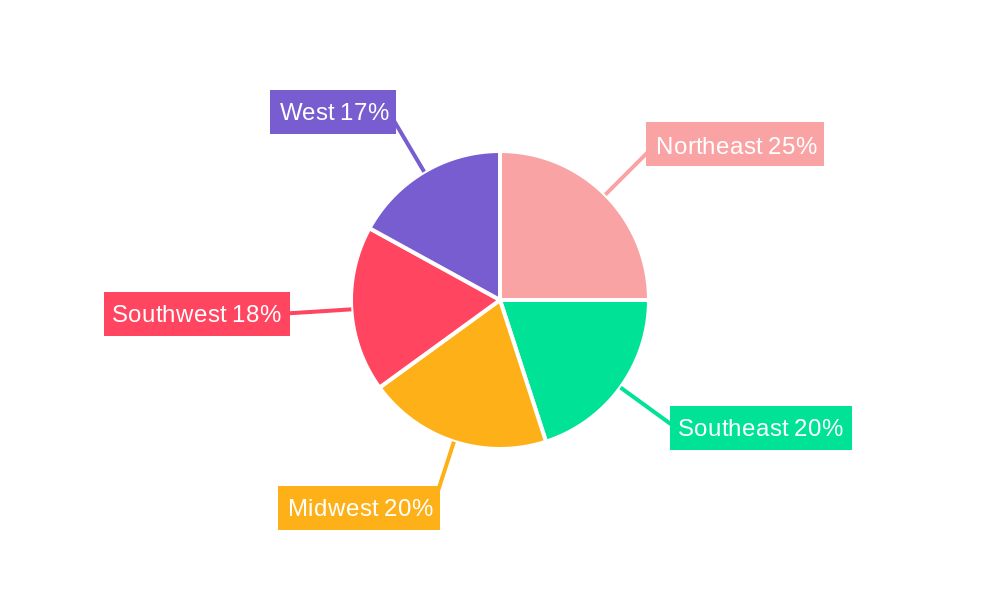

The regional breakdown within the US market shows varied growth potential across different regions (Northeast, Southeast, Midwest, Southwest, West). While precise regional market share data is unavailable, it's reasonable to assume that regions with higher concentrations of healthcare providers and a strong adoption of EHRs, such as the Northeast and West Coast, will exhibit faster growth. However, the overall growth is expected to be widespread across all regions as the benefits of HIE become more widely recognized and implemented across the US healthcare system. The competitive landscape is characterized by both established players and emerging innovative companies, leading to ongoing technological advancements and the development of more comprehensive and efficient HIE solutions. This dynamic market is expected to continue its robust growth trajectory, driven by ongoing regulatory changes, technological innovations, and the increasing need for improved patient care coordination.

US Health Information Exchange Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US Health Information Exchange (HIE) industry, covering market dynamics, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic planners. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

US Health Information Exchange Industry Market Concentration & Dynamics

The US HIE market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller niche players fosters innovation and competition. The market is characterized by a dynamic interplay of factors:

- Market Share: Major players like Epic Corporation Inc, Cerner Corporation, and McKesson Corporation collectively hold an estimated xx% market share, while smaller players contribute the remaining xx%. This suggests opportunities for both expansion by established companies and market penetration by newer entrants.

- M&A Activity: The industry has witnessed xx M&A deals in the historical period (2019-2024), indicating a trend of consolidation among players seeking to expand their service offerings and geographic reach. This activity is expected to continue during the forecast period.

- Innovation Ecosystems: The market is driven by continuous technological advancements, including the development of advanced analytics, AI-powered solutions, and improved interoperability standards. This has led to the emergence of specialized niche players focusing on specific components of HIE, such as EMPI or RLS.

- Regulatory Frameworks: Government regulations, such as HIPAA and the 21st Century Cures Act, significantly impact the market by setting standards for data privacy, security, and interoperability. These regulations are crucial for maintaining patient trust and ensuring the ethical handling of sensitive data.

- Substitute Products: Although limited direct substitutes exist, alternative methods of information exchange, such as fax or email, continue to compete, but are limited by security and efficiency concerns.

- End-User Trends: Increasing adoption of electronic health records (EHRs) and the growing demand for seamless data exchange are major drivers of market growth. The increasing focus on patient-centric care and the rise of consumer-mediated exchanges further fuel the adoption of HIE solutions.

US Health Information Exchange Industry Industry Insights & Trends

The US HIE market is experiencing robust growth fueled by several key factors:

- The increasing adoption of EHRs across healthcare settings is driving the demand for efficient and secure data exchange solutions. The ongoing transition to value-based care models further emphasizes the need for comprehensive patient data access. This has increased the demand for secure messaging and workflow management capabilities within HIE systems, resulting in a greater need for integration and interoperability. The market size in 2025 is estimated to be xx Million.

- Technological advancements, such as cloud computing, big data analytics, and artificial intelligence (AI), are transforming the HIE landscape, enabling improved data management, enhanced security, and advanced analytics capabilities. The integration of these technologies is improving the efficiency and effectiveness of HIE systems, making data analysis more precise and meaningful.

- Evolving consumer behaviors, particularly increased patient engagement and demand for greater transparency and control over their health information, are shaping the market. The rise of consumer-mediated exchanges, like Mpowered Health's xChange, demonstrates a shift towards empowering patients in managing their own healthcare data.

- The rising prevalence of chronic diseases and an aging population are contributing to increased healthcare utilization and the need for better coordination of care. HIE facilitates improved care coordination across various healthcare providers and settings, resulting in more efficient and cost-effective treatment. This is particularly important for managing complex patients with multiple health conditions.

Key Markets & Segments Leading US Health Information Exchange Industry

The US HIE market is experiencing growth across various segments:

- Dominant Region: The market is predominantly concentrated in urban areas with high healthcare utilization, driven by large hospital systems and advanced healthcare infrastructure.

- Exchange Type: Direct exchange and query-based exchange continue to dominate, but consumer-mediated exchange is witnessing significant growth. The increasing demand for patient control over their healthcare data is a major driver for this segment.

- Component: EMPI (Enterprise Master Person Index) and HPD (Healthcare Provider Directory) are critical components with high demand, followed by Record Locator Service (RLS) and Clinical Data Repository.

- Implementation Model: Decentralized/Federated models are increasingly preferred due to their flexibility and scalability, catering to the diverse needs of varying healthcare organizations.

- Setup Type: Private setups are common among large healthcare systems, while public setups are gaining traction with the aim of wider data sharing.

- Application: Secure Messaging, Workflow Management, and Web Portal Development are crucial applications driving industry growth.

Growth Drivers:

- Increased government investments in healthcare IT infrastructure.

- Growing adoption of EHRs and other digital health technologies.

- Improving interoperability standards.

- Growing focus on population health management.

US Health Information Exchange Industry Product Developments

Recent product innovations include AI-powered solutions for improved data analysis, enhanced security features to comply with stringent data privacy regulations, and cloud-based platforms for improved scalability and accessibility. These advancements provide competitive advantages by offering enhanced efficiency, improved accuracy, and better data security for HIE systems.

Challenges in the US Health Information Exchange Industry Market

The market faces challenges including:

- Regulatory hurdles: Navigating complex regulations related to data privacy and security is a significant challenge impacting operational costs and implementation timelines.

- Interoperability issues: Differences in data standards and systems across various healthcare organizations create obstacles to seamless data exchange.

- High implementation costs: Implementing and maintaining HIE systems requires substantial upfront investments in infrastructure, software, and personnel. These costs, estimated to be xx Million annually across the market, pose a significant barrier to entry for smaller players.

Forces Driving US Health Information Exchange Industry Growth

Key growth drivers include:

- Technological advancements: AI and machine learning enhance data analysis and decision-making.

- Economic factors: Government funding and private sector investment boost infrastructure development and system upgrades.

- Regulatory changes: Initiatives supporting data sharing and interoperability.

Challenges in the US Health Information Exchange Industry Market

Long-term growth hinges on overcoming interoperability challenges, streamlining data standards, and fostering collaborations among stakeholders to achieve seamless data exchange across the healthcare ecosystem.

Emerging Opportunities in US Health Information Exchange Industry

Emerging opportunities include expansion into rural areas, integration with telehealth platforms, and development of patient-centric applications that empower individuals to manage their health information. The market for personalized medicine and predictive analytics also presents substantial opportunities for HIE companies.

Leading Players in the US Health Information Exchange Industry Sector

- Eclinical Works

- Mckesson Corporation

- Infor Inc

- Epic Corporation Inc

- mpro

- Cerner Corporation

- Optum Inc

- Allscripts Healthcare Solutions Inc

- Nextgen Healthcare Information Systems LLC

- Newgen Software Technologies

- Conifer Health Solutions

- Medicity Inc

Key Milestones in US Health Information Exchange Industry Industry

- October 2022: Mpowered Health launched xChange, a consumer-mediated healthcare data exchange, impacting market dynamics by increasing patient control over data.

- March 2022: mpro5 Inc entered the US market, focusing on real-time data leveraging, promising improved operational efficiency for hospitals.

Strategic Outlook for US Health Information Exchange Industry Market

The future of the US HIE market is bright, driven by increasing demand for data-driven healthcare, technological advancements, and supportive regulatory frameworks. Strategic opportunities lie in expanding into underserved markets, developing innovative solutions to enhance interoperability, and focusing on patient-centric applications. The market holds significant potential for growth through strategic partnerships, acquisitions, and technological innovations, making it an attractive sector for investment and expansion.

US Health Information Exchange Industry Segmentation

-

1. Implementation Model

- 1.1. Centralized/Consolidated Models

- 1.2. Decentralized/Federated Models

- 1.3. Hybrid Model

-

2. Setup Type

- 2.1. Private

- 2.2. Public

-

3. Application

- 3.1. Internal Interfacing

- 3.2. Secure Messaging

- 3.3. Workflow Management

- 3.4. Web Portal Development

- 3.5. Patient Safety

-

4. Exchange Type

- 4.1. Direct Exchange

- 4.2. Query-based Exchange

- 4.3. Consumer-mediated Exchange

-

5. Component

- 5.1. Enterprise Master Person Index (EMPI)

- 5.2. Healthcare Provider Directory (HPD)

- 5.3. Record Locator Service (RLS)

- 5.4. Clinical Data Repository

- 5.5. Other Components

US Health Information Exchange Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Health Information Exchange Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Electronic Health Records Resulting in the Expansion of the Market; Government Support via Various Programs and Incentives; Reduction in Healthcare Cost and Improved Efficacy

- 3.3. Market Restrains

- 3.3.1. Huge Initial Infrastructural Investment and Slow Return on Investment; Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. The Decentralized/Federated Model is Expected to Hold a Notable Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Implementation Model

- 5.1.1. Centralized/Consolidated Models

- 5.1.2. Decentralized/Federated Models

- 5.1.3. Hybrid Model

- 5.2. Market Analysis, Insights and Forecast - by Setup Type

- 5.2.1. Private

- 5.2.2. Public

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Internal Interfacing

- 5.3.2. Secure Messaging

- 5.3.3. Workflow Management

- 5.3.4. Web Portal Development

- 5.3.5. Patient Safety

- 5.4. Market Analysis, Insights and Forecast - by Exchange Type

- 5.4.1. Direct Exchange

- 5.4.2. Query-based Exchange

- 5.4.3. Consumer-mediated Exchange

- 5.5. Market Analysis, Insights and Forecast - by Component

- 5.5.1. Enterprise Master Person Index (EMPI)

- 5.5.2. Healthcare Provider Directory (HPD)

- 5.5.3. Record Locator Service (RLS)

- 5.5.4. Clinical Data Repository

- 5.5.5. Other Components

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Implementation Model

- 6. North America US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Implementation Model

- 6.1.1. Centralized/Consolidated Models

- 6.1.2. Decentralized/Federated Models

- 6.1.3. Hybrid Model

- 6.2. Market Analysis, Insights and Forecast - by Setup Type

- 6.2.1. Private

- 6.2.2. Public

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Internal Interfacing

- 6.3.2. Secure Messaging

- 6.3.3. Workflow Management

- 6.3.4. Web Portal Development

- 6.3.5. Patient Safety

- 6.4. Market Analysis, Insights and Forecast - by Exchange Type

- 6.4.1. Direct Exchange

- 6.4.2. Query-based Exchange

- 6.4.3. Consumer-mediated Exchange

- 6.5. Market Analysis, Insights and Forecast - by Component

- 6.5.1. Enterprise Master Person Index (EMPI)

- 6.5.2. Healthcare Provider Directory (HPD)

- 6.5.3. Record Locator Service (RLS)

- 6.5.4. Clinical Data Repository

- 6.5.5. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Implementation Model

- 7. South America US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Implementation Model

- 7.1.1. Centralized/Consolidated Models

- 7.1.2. Decentralized/Federated Models

- 7.1.3. Hybrid Model

- 7.2. Market Analysis, Insights and Forecast - by Setup Type

- 7.2.1. Private

- 7.2.2. Public

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Internal Interfacing

- 7.3.2. Secure Messaging

- 7.3.3. Workflow Management

- 7.3.4. Web Portal Development

- 7.3.5. Patient Safety

- 7.4. Market Analysis, Insights and Forecast - by Exchange Type

- 7.4.1. Direct Exchange

- 7.4.2. Query-based Exchange

- 7.4.3. Consumer-mediated Exchange

- 7.5. Market Analysis, Insights and Forecast - by Component

- 7.5.1. Enterprise Master Person Index (EMPI)

- 7.5.2. Healthcare Provider Directory (HPD)

- 7.5.3. Record Locator Service (RLS)

- 7.5.4. Clinical Data Repository

- 7.5.5. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Implementation Model

- 8. Europe US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Implementation Model

- 8.1.1. Centralized/Consolidated Models

- 8.1.2. Decentralized/Federated Models

- 8.1.3. Hybrid Model

- 8.2. Market Analysis, Insights and Forecast - by Setup Type

- 8.2.1. Private

- 8.2.2. Public

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Internal Interfacing

- 8.3.2. Secure Messaging

- 8.3.3. Workflow Management

- 8.3.4. Web Portal Development

- 8.3.5. Patient Safety

- 8.4. Market Analysis, Insights and Forecast - by Exchange Type

- 8.4.1. Direct Exchange

- 8.4.2. Query-based Exchange

- 8.4.3. Consumer-mediated Exchange

- 8.5. Market Analysis, Insights and Forecast - by Component

- 8.5.1. Enterprise Master Person Index (EMPI)

- 8.5.2. Healthcare Provider Directory (HPD)

- 8.5.3. Record Locator Service (RLS)

- 8.5.4. Clinical Data Repository

- 8.5.5. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Implementation Model

- 9. Middle East & Africa US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Implementation Model

- 9.1.1. Centralized/Consolidated Models

- 9.1.2. Decentralized/Federated Models

- 9.1.3. Hybrid Model

- 9.2. Market Analysis, Insights and Forecast - by Setup Type

- 9.2.1. Private

- 9.2.2. Public

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Internal Interfacing

- 9.3.2. Secure Messaging

- 9.3.3. Workflow Management

- 9.3.4. Web Portal Development

- 9.3.5. Patient Safety

- 9.4. Market Analysis, Insights and Forecast - by Exchange Type

- 9.4.1. Direct Exchange

- 9.4.2. Query-based Exchange

- 9.4.3. Consumer-mediated Exchange

- 9.5. Market Analysis, Insights and Forecast - by Component

- 9.5.1. Enterprise Master Person Index (EMPI)

- 9.5.2. Healthcare Provider Directory (HPD)

- 9.5.3. Record Locator Service (RLS)

- 9.5.4. Clinical Data Repository

- 9.5.5. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Implementation Model

- 10. Asia Pacific US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Implementation Model

- 10.1.1. Centralized/Consolidated Models

- 10.1.2. Decentralized/Federated Models

- 10.1.3. Hybrid Model

- 10.2. Market Analysis, Insights and Forecast - by Setup Type

- 10.2.1. Private

- 10.2.2. Public

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Internal Interfacing

- 10.3.2. Secure Messaging

- 10.3.3. Workflow Management

- 10.3.4. Web Portal Development

- 10.3.5. Patient Safety

- 10.4. Market Analysis, Insights and Forecast - by Exchange Type

- 10.4.1. Direct Exchange

- 10.4.2. Query-based Exchange

- 10.4.3. Consumer-mediated Exchange

- 10.5. Market Analysis, Insights and Forecast - by Component

- 10.5.1. Enterprise Master Person Index (EMPI)

- 10.5.2. Healthcare Provider Directory (HPD)

- 10.5.3. Record Locator Service (RLS)

- 10.5.4. Clinical Data Repository

- 10.5.5. Other Components

- 10.1. Market Analysis, Insights and Forecast - by Implementation Model

- 11. Northeast US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Health Information Exchange Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Eclinical Works

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Mckesson Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Infor Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Epic Corporation Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 mpro

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cerner Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Optum Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Allscripts Healthcare Solutions Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Nextgen Healthcare Information Systems LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Newgen Software Technologies

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Conifer Health Solutions

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Medicity Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Eclinical Works

List of Figures

- Figure 1: Global US Health Information Exchange Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Health Information Exchange Industry Revenue (Million), by Implementation Model 2024 & 2032

- Figure 5: North America US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2024 & 2032

- Figure 6: North America US Health Information Exchange Industry Revenue (Million), by Setup Type 2024 & 2032

- Figure 7: North America US Health Information Exchange Industry Revenue Share (%), by Setup Type 2024 & 2032

- Figure 8: North America US Health Information Exchange Industry Revenue (Million), by Application 2024 & 2032

- Figure 9: North America US Health Information Exchange Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America US Health Information Exchange Industry Revenue (Million), by Exchange Type 2024 & 2032

- Figure 11: North America US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2024 & 2032

- Figure 12: North America US Health Information Exchange Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America US Health Information Exchange Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America US Health Information Exchange Industry Revenue (Million), by Implementation Model 2024 & 2032

- Figure 17: South America US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2024 & 2032

- Figure 18: South America US Health Information Exchange Industry Revenue (Million), by Setup Type 2024 & 2032

- Figure 19: South America US Health Information Exchange Industry Revenue Share (%), by Setup Type 2024 & 2032

- Figure 20: South America US Health Information Exchange Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: South America US Health Information Exchange Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America US Health Information Exchange Industry Revenue (Million), by Exchange Type 2024 & 2032

- Figure 23: South America US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2024 & 2032

- Figure 24: South America US Health Information Exchange Industry Revenue (Million), by Component 2024 & 2032

- Figure 25: South America US Health Information Exchange Industry Revenue Share (%), by Component 2024 & 2032

- Figure 26: South America US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe US Health Information Exchange Industry Revenue (Million), by Implementation Model 2024 & 2032

- Figure 29: Europe US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2024 & 2032

- Figure 30: Europe US Health Information Exchange Industry Revenue (Million), by Setup Type 2024 & 2032

- Figure 31: Europe US Health Information Exchange Industry Revenue Share (%), by Setup Type 2024 & 2032

- Figure 32: Europe US Health Information Exchange Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Europe US Health Information Exchange Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Europe US Health Information Exchange Industry Revenue (Million), by Exchange Type 2024 & 2032

- Figure 35: Europe US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2024 & 2032

- Figure 36: Europe US Health Information Exchange Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Europe US Health Information Exchange Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Europe US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Europe US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Implementation Model 2024 & 2032

- Figure 41: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2024 & 2032

- Figure 42: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Setup Type 2024 & 2032

- Figure 43: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Setup Type 2024 & 2032

- Figure 44: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Application 2024 & 2032

- Figure 45: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Exchange Type 2024 & 2032

- Figure 47: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2024 & 2032

- Figure 48: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Component 2024 & 2032

- Figure 49: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Component 2024 & 2032

- Figure 50: Middle East & Africa US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East & Africa US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Implementation Model 2024 & 2032

- Figure 53: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Implementation Model 2024 & 2032

- Figure 54: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Setup Type 2024 & 2032

- Figure 55: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Setup Type 2024 & 2032

- Figure 56: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Application 2024 & 2032

- Figure 57: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Exchange Type 2024 & 2032

- Figure 59: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Exchange Type 2024 & 2032

- Figure 60: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Component 2024 & 2032

- Figure 61: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Component 2024 & 2032

- Figure 62: Asia Pacific US Health Information Exchange Industry Revenue (Million), by Country 2024 & 2032

- Figure 63: Asia Pacific US Health Information Exchange Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Health Information Exchange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 3: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 4: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 6: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 7: Global US Health Information Exchange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northeast US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southeast US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Midwest US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southwest US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: West US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 15: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 16: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 18: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 24: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 25: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 27: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 33: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 34: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 36: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 37: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Benelux US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Nordics US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 48: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 49: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 51: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 52: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global US Health Information Exchange Industry Revenue Million Forecast, by Implementation Model 2019 & 2032

- Table 60: Global US Health Information Exchange Industry Revenue Million Forecast, by Setup Type 2019 & 2032

- Table 61: Global US Health Information Exchange Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global US Health Information Exchange Industry Revenue Million Forecast, by Exchange Type 2019 & 2032

- Table 63: Global US Health Information Exchange Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 64: Global US Health Information Exchange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: ASEAN US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Oceania US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Asia Pacific US Health Information Exchange Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Health Information Exchange Industry?

The projected CAGR is approximately 12.12%.

2. Which companies are prominent players in the US Health Information Exchange Industry?

Key companies in the market include Eclinical Works, Mckesson Corporation, Infor Inc, Epic Corporation Inc, mpro, Cerner Corporation, Optum Inc, Allscripts Healthcare Solutions Inc, Nextgen Healthcare Information Systems LLC, Newgen Software Technologies, Conifer Health Solutions, Medicity Inc.

3. What are the main segments of the US Health Information Exchange Industry?

The market segments include Implementation Model, Setup Type, Application, Exchange Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Electronic Health Records Resulting in the Expansion of the Market; Government Support via Various Programs and Incentives; Reduction in Healthcare Cost and Improved Efficacy.

6. What are the notable trends driving market growth?

The Decentralized/Federated Model is Expected to Hold a Notable Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Huge Initial Infrastructural Investment and Slow Return on Investment; Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

In October 2022, Mpowered Health launched its xChange, the United States consumer-mediated healthcare data exchange. The exchange enables health plans, health systems, and other healthcare organizations to request and obtain medical records from consumers with their consent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Health Information Exchange Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Health Information Exchange Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Health Information Exchange Industry?

To stay informed about further developments, trends, and reports in the US Health Information Exchange Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence