Key Insights

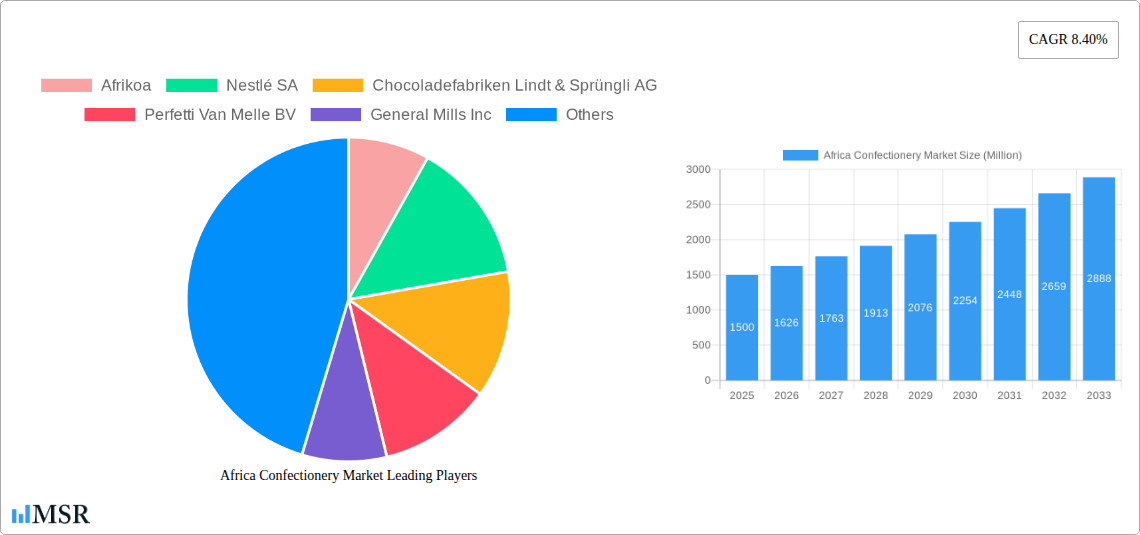

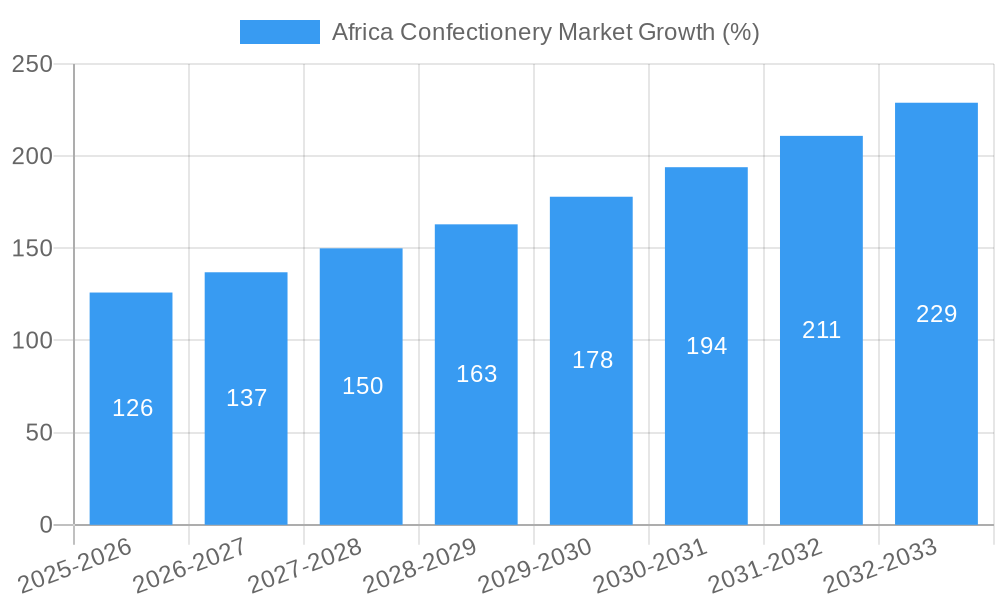

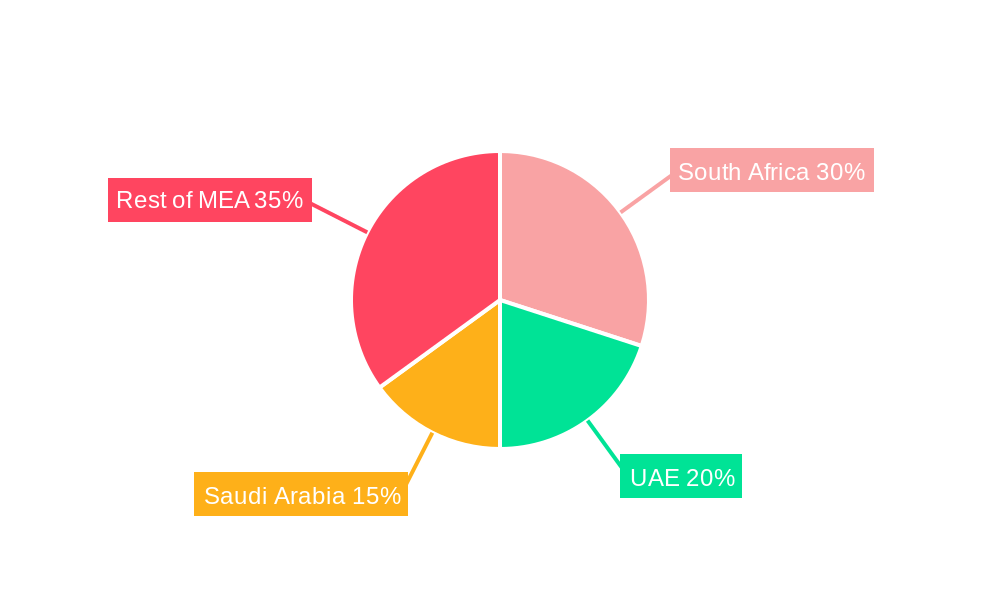

The African confectionery market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 8.40% and the stated market size "XX Million"), is projected to experience robust growth over the forecast period (2025-2033). This expansion is driven primarily by rising disposable incomes, particularly within the burgeoning middle class across several key African nations like South Africa, UAE, and Saudi Arabia. Increased urbanization and exposure to Westernized food habits are further fueling demand for diverse confectionery products, ranging from chocolate and sugar confectionery to more specialized items. The convenience store channel is witnessing significant growth, reflecting the evolving consumer preference for on-the-go snacks. However, challenges remain, including fluctuating raw material prices, particularly sugar and cocoa, which can impact profitability. Furthermore, the market faces competitive pressures from both established multinational players like Nestlé and Mars, and increasingly from local and regional brands capitalizing on specific regional tastes. The segmentation analysis shows a clear preference for chocolate confectionery, followed by sugar confectionery, with "other confectionery" accounting for a smaller, but growing, segment. The market's future trajectory indicates sustained growth, driven by innovative product launches, strategic partnerships, and expanding distribution networks.

The competitive landscape is dominated by multinational giants, including Nestlé SA, Mondelez International, and Mars Incorporated, which leverage their established brands and distribution channels to maintain market share. However, local and regional players are successfully carving out niches, catering to specific local preferences and utilizing cost-effective production strategies. The strategic focus for many companies is on adapting product offerings to suit the diverse tastes and affordability levels across different African regions. This includes introducing smaller pack sizes at more accessible price points, broadening flavor profiles to cater to local preferences, and investing in sustainable sourcing practices to enhance brand image and consumer trust. The forecast period will see a continuous shift towards healthier confectionery options, in line with global health trends and growing consumer awareness, although this segment is currently smaller.

Africa Confectionery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa confectionery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a detailed understanding of market dynamics, trends, and future growth potential. The market is segmented by product type (chocolate confectionery, sugar confectionery, other confectionery), distribution channel (convenience store, online retail store, supermarket/hypermarket, others), and confection type (chocolate, others). Key players analyzed include Afrikoa, Nestlé SA, Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding AŞ, Arcor S.A.I.C., HARIBO Holding GmbH & Co. KG, Mondelēz International Inc, The Hershey Company, and Kellogg Company. The report projects a market value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Africa Confectionery Market Market Concentration & Dynamics

The Africa confectionery market exhibits a moderately concentrated landscape, dominated by multinational corporations alongside regional players. Market share data reveals that Nestlé SA and Mars Incorporated currently hold significant positions, while regional brands like Afrikoa are steadily expanding their presence. The innovation ecosystem is dynamic, with ongoing R&D focused on adapting product offerings to local tastes and preferences. Regulatory frameworks vary across African nations, posing challenges related to food safety, labeling, and import/export regulations. Substitute products, such as locally produced snacks and beverages, exert competitive pressure. End-user trends reveal a growing demand for healthier options and convenient packaging formats. M&A activities have been moderate, with a few key acquisitions shaping the competitive landscape in recent years. A total of xx M&A deals were recorded between 2019 and 2024.

- Market Share: Nestlé SA (xx%), Mars Incorporated (xx%), Afrikoa (xx%), others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Varying food safety standards across countries.

- Substitute Products: Locally produced snacks and fresh fruit.

- Innovation Focus: Healthier options, convenient packaging, local flavors.

Africa Confectionery Market Industry Insights & Trends

The Africa confectionery market is experiencing robust growth, driven by rising disposable incomes, urbanization, and a burgeoning young population. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, such as improved manufacturing processes and packaging innovations, are enhancing efficiency and product quality. Evolving consumer behaviors are shaping market trends, with growing preference for premium and healthier confectionery products, particularly amongst the increasingly affluent middle class. The market shows considerable potential for growth, driven by changing consumer preferences and the rising influence of Westernized diets. However, challenges remain concerning infrastructure deficits and uneven economic development across the continent. Furthermore, health concerns related to sugar consumption are also impacting growth, prompting the introduction of sugar-reduced and healthier alternatives.

Key Markets & Segments Leading Africa Confectionery Market

While the market shows significant growth potential across various African nations, South Africa and Nigeria emerge as leading markets due to their large populations, relatively developed economies, and higher disposable incomes. The chocolate confectionery segment dominates the product type category due to its widespread popularity and cultural relevance. Supermarkets/hypermarkets remain the primary distribution channel, benefiting from their extensive reach and established infrastructure.

Leading Regions/Countries:

- South Africa: High per capita consumption, strong retail infrastructure.

- Nigeria: Large population, rising disposable incomes, growing middle class.

Dominant Segments:

- Product Type: Chocolate confectionery (due to strong demand and cultural preference).

- Distribution Channel: Supermarket/hypermarket (due to extensive reach and established infrastructure).

- Confection Type: Chocolate (due to wide preference).

Drivers:

- Rising disposable incomes across many African countries

- Increasing urbanization leads to shifts in consumer purchasing power and habits

- Expanding retail infrastructure improves distribution and accessibility of products

Africa Confectionery Market Product Developments

Recent product innovations focus on catering to evolving consumer preferences, such as healthier options (e.g., reduced sugar, vegan choices) and convenient formats. Technological advancements in manufacturing processes are improving product quality and efficiency. Key players are leveraging these advancements to gain a competitive edge by offering unique product features and enhanced taste profiles. The introduction of vegan products by Lindt & Sprüngli AG exemplifies this trend. Similarly, new flavors from Mondelēz International Inc. demonstrate the focus on appealing to evolving consumer preferences for indulgence.

Challenges in the Africa Confectionery Market Market

The Africa confectionery market faces several challenges, including inconsistent infrastructure in many regions, hindering efficient distribution and increasing costs. Regulatory hurdles and varying food safety standards across different countries add to operational complexities. Furthermore, intense competition from both established multinational companies and emerging local brands puts pressure on profit margins. Fluctuations in raw material prices also pose risks to profitability. The estimated impact of these factors on overall market growth is a reduction of approximately xx% annually.

Forces Driving Africa Confectionery Market Growth

Several key factors propel the growth of the Africa confectionery market. Rising disposable incomes across several African nations translate to increased consumer spending on discretionary items like confectionery. Rapid urbanization is shifting consumer behavior, leading to increased demand for convenience foods and packaged goods. The youth population boom is also creating a significant consumer base for confectionery products. Increased foreign direct investment in the food processing sector is bringing in advanced technologies and expertise to improve production capabilities. Favorable government policies supporting the food processing industry are also facilitating the growth of the market.

Challenges in the Africa Confectionery Market Market (Long-Term Growth Catalysts)

Long-term growth in the Africa confectionery market hinges on addressing infrastructure gaps and ensuring consistent supply chains. Strategic partnerships between multinational and local companies will play a crucial role in tapping into local expertise and distribution networks. Investing in research and development focused on adapting products to specific regional preferences and health consciousness will shape the future of the market. Expanding into new markets across the continent presents significant opportunities for growth.

Emerging Opportunities in Africa Confectionery Market

The burgeoning middle class presents significant opportunities, with increasing demand for premium and healthier confectionery options. The rise of e-commerce provides new avenues for distribution and reaching a wider customer base. Innovations in packaging, such as sustainable and eco-friendly options, will also appeal to the growing segment of environmentally conscious consumers. Furthermore, tapping into specific regional tastes and cultural preferences will create unique product offerings to increase market penetration and brand recognition.

Leading Players in the Africa Confectionery Market Sector

- Afrikoa

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- General Mills Inc

- PepsiCo Inc

- Tiger Brands

- August Storck KG

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding AŞ

- Arcor S.A.I.C.

- HARIBO Holding GmbH & Co. KG

- Mondelēz International Inc

- The Hershey Company

- Kellogg Company

Key Milestones in Africa Confectionery Market Industry

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa, expanding product offerings to cater to growing consumer demand for plant-based alternatives. This move highlights the increasing importance of catering to evolving consumer preferences within the confectionery market.

May 2023: Mondelēz International Inc. launched three new special edition flavors, demonstrating a focus on innovation and catering to consumer demand for indulgent treats. The success of these limited-edition flavors could signal future product development strategies within the company.

April 2023: The Hershey Company launched a peanut butter & jelly flavored protein bar under its ONE brand. This indicates a trend towards healthier, protein-rich confectionery options, reflecting changing consumer demands.

Strategic Outlook for Africa Confectionery Market Market

The future of the Africa confectionery market is bright, characterized by sustained growth driven by increasing disposable incomes, urbanization, and population growth. Strategic opportunities lie in adapting products to cater to regional tastes, expanding distribution networks, and investing in sustainable and eco-friendly packaging. Companies that effectively navigate the challenges of infrastructure development and regulatory frameworks will be best positioned to capitalize on the significant market potential. Further diversification of product offerings, including healthier choices, and effective branding strategies will play a crucial role in shaping future market leadership.

Africa Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Africa Confectionery Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. UAE Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Afrikoa

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestlé SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Perfetti Van Melle BV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Mills Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PepsiCo Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Tiger Brands

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 August Storck KG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ferrero International SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mars Incorporated

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yıldız Holding A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Arcor S A I C

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 HARIBO Holding GmbH & Co KG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Mondelēz International Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Hershey Company

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Kellogg Company

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Afrikoa

List of Figures

- Figure 1: Africa Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 3: Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 11: Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Confectionery Market?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Africa Confectionery Market?

Key companies in the market include Afrikoa, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Arcor S A I C, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company, Kellogg Company.

3. What are the main segments of the Africa Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa. The products are available in two vegan flavors – Lindt Vegan Smooth Chocolate (made with oats and almonds to deliver a smooth, creamy texture) and Lindt Vegan Hazelnut Chocolate (made with roasted hazelnuts and premium vegan chocolate for a nutty flavor).May 2023: Under its brand, Mondelēz International Inc. launched three new special edition flavors that deliver indulgence with much-loved flavor combinations. The 150 g slabs include Dairy Milk Fudge Cookie Crumble, Fudge Mint Crisp, and Dream Coconut & Hazelnut Bliss.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Confectionery Market?

To stay informed about further developments, trends, and reports in the Africa Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence