Key Insights

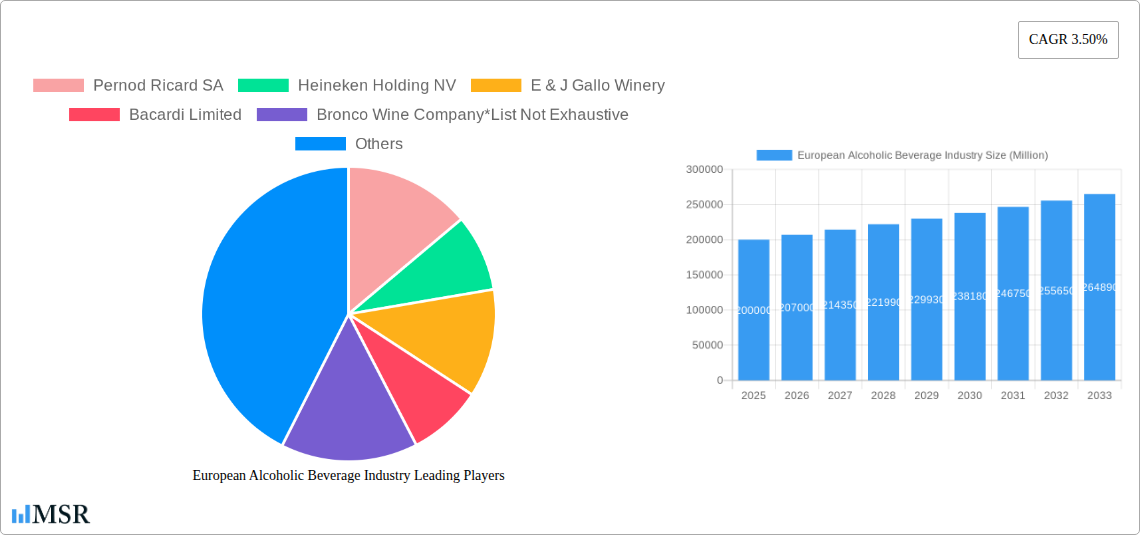

The European alcoholic beverage market, valued at 278.56 billion in 2025, is projected for robust growth at a Compound Annual Growth Rate (CAGR) of 4.48% from 2025 to 2033. This expansion is attributed to rising disposable incomes in key European economies, such as the UK and Germany, stimulating premium beverage consumption. Evolving consumer preferences for craft beers, artisanal spirits, and organic wines are creating niche market opportunities. The proliferation of e-commerce and online delivery platforms is significantly enhancing off-trade distribution convenience. However, market growth is tempered by health concerns, stringent government regulations, and potential economic volatility impacting production and distribution costs. Segmentation by product (beer, wine, spirits) and distribution (on-trade, off-trade) reveals distinct growth patterns. While the on-trade sector shows a gradual recovery, off-trade channels continue to gain traction. Germany, the UK, France, and Italy are the primary market drivers. Leading companies including Pernod Ricard, Heineken, Diageo, and Anheuser-Busch InBev are actively innovating, diversifying portfolios, and pursuing strategic acquisitions to adapt to the evolving consumer landscape.

European Alcoholic Beverage Industry Market Size (In Billion)

The competitive environment is dynamic, characterized by a mix of multinational corporations and specialized producers. Future success hinges on adapting to consumer tastes, navigating regulatory frameworks, and leveraging technology for optimized distribution and marketing. The 2025-2033 forecast period offers significant opportunities for companies that can align with shifting consumer demands and effectively utilize digital channels. Strategic planning must account for regional variations in consumer behavior, regulations, and economic conditions. Emphasis on sustainability and responsible consumption is increasingly vital for brand reputation and attracting socially conscious consumers.

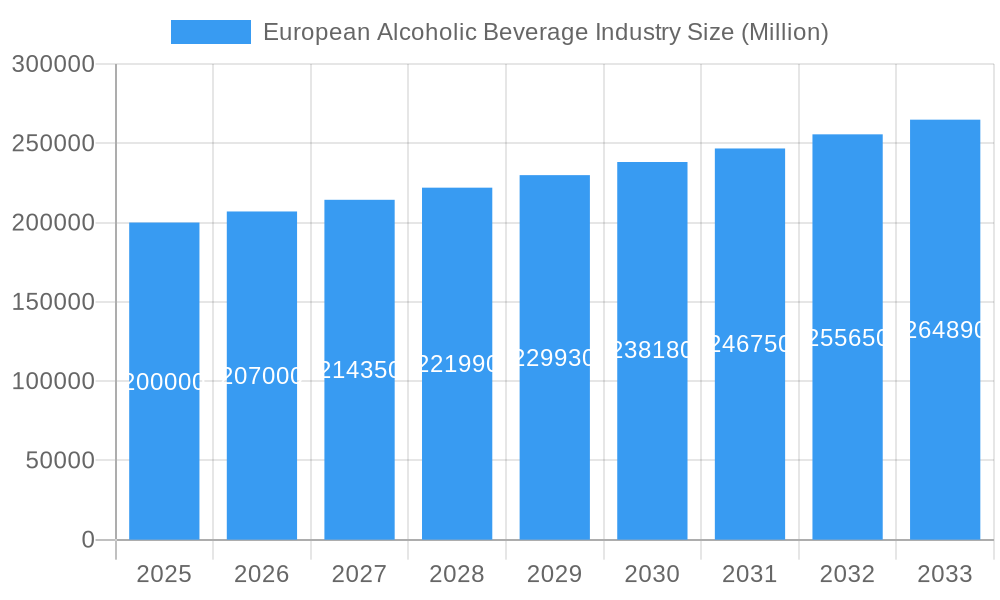

European Alcoholic Beverage Industry Company Market Share

European Alcoholic Beverage Industry: Market Outlook 2025-2033

This comprehensive report analyzes the European alcoholic beverage industry from 2025 to 2033, focusing on market dynamics, key players, and growth prospects. It offers essential insights for stakeholders, investors, and industry analysts. With a 2025 base year and a forecast to 2033, the report delivers crucial market intelligence. The estimated market size for 2025 is 278.56 billion, with an anticipated CAGR of 4.48%. Key industry players such as Pernod Ricard SA, Heineken Holding NV, and Diageo PLC are profiled to provide a detailed understanding of the competitive landscape.

European Alcoholic Beverage Industry Market Concentration & Dynamics

The European alcoholic beverage market is characterized by a concentrated landscape dominated by a few multinational players, alongside a significant number of smaller regional and local producers. Market share is highly variable across product types and geographic regions, with beer and spirits holding considerable weight.

- Market Concentration: The top 10 players hold an estimated xx% of the market share in 2025.

- Innovation Ecosystems: Significant investments are being directed toward innovation in product development, packaging, and distribution channels. Hard seltzers and premium lagers represent notable examples of recent innovation.

- Regulatory Frameworks: Varying regulations across European countries significantly influence market access, pricing, and product availability. The ongoing evolution of regulations related to alcohol advertising, labeling, and taxation impacts industry dynamics.

- Substitute Products: The market faces competition from non-alcoholic beverages and other leisure activities. Health concerns are driving growth in low-alcohol and non-alcoholic alternatives.

- End-User Trends: Shifting consumer preferences towards premiumization, health consciousness, and experiences are influencing product development and marketing strategies.

- M&A Activities: The industry has witnessed a considerable number of mergers and acquisitions (xx in the past five years), indicating ongoing consolidation and expansion of major players.

European Alcoholic Beverage Industry Industry Insights & Trends

The European alcoholic beverage industry exhibits a complex interplay of factors driving its growth and evolution. Key market drivers include: increasing disposable incomes in several regions; a growing preference for premium and craft alcoholic beverages; expansion of e-commerce channels; and the adaptation to changing consumer tastes and preferences. Conversely, challenges include heightened competition, increasing health consciousness, and stringent regulatory frameworks. Technological advancements such as personalized marketing, sophisticated supply chain management, and smart packaging enhance efficiency and competitiveness.

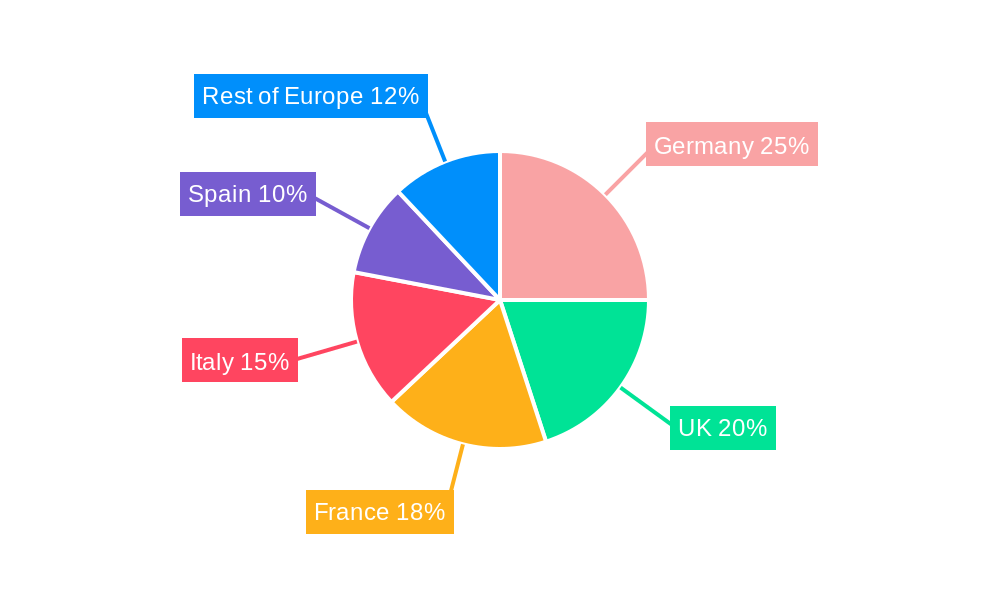

Key Markets & Segments Leading European Alcoholic Beverage Industry

The United Kingdom, Germany, France, and Spain are among the largest markets for alcoholic beverages in Europe.

Dominant Segments:

- Product Type: Beer remains the largest segment by volume, followed by wine and spirits. The growth of ready-to-drink (RTD) beverages continues to be strong.

- Distribution Channel: The off-trade channel (supermarkets, hypermarkets, and off-licenses) accounts for a significant portion of total sales, though the on-trade (bars, pubs, restaurants) continues to be important.

- Country: The UK, Germany, and France represent consistently large markets due to their high population density and robust economies.

Drivers of Market Dominance:

- United Kingdom: Strong consumer spending, developed retail infrastructure, and established distribution networks.

- Germany: High beer consumption, established brewing traditions, and strong export markets.

- France: Significant wine production and consumption, a developed tourism sector, and robust on-trade.

- Spain: High wine production, substantial tourist influx, and established export markets.

European Alcoholic Beverage Industry Product Developments

Recent product innovations have focused on premiumization, health-conscious options, and convenience. The launch of hard seltzers (like Heineken's Pure Piraña), low-alcohol beers, and innovative packaging formats reflect this trend. Technological advancements in brewing and winemaking processes are contributing to improved quality, consistency, and sustainability. Companies are utilizing data analytics and AI to optimize production, distribution, and marketing efforts.

Challenges in the European Alcoholic Beverage Industry Market

The industry faces several challenges, including: increasing regulatory scrutiny; fluctuating raw material costs; growing consumer concerns regarding alcohol consumption; and intense competition amongst established and emerging brands. Supply chain disruptions, particularly post-pandemic, have also caused significant impacts. This has resulted in estimated xx Million in losses for the industry in 2022.

Forces Driving European Alcoholic Beverage Industry Growth

Key growth drivers include: rising disposable incomes across many European countries; continued preference for premium products; expansion of e-commerce and online distribution; rising tourism in key regions, and innovative product launches tapping into evolving consumer trends. Favorable regulatory environments in certain areas further stimulate growth.

Challenges in the European Alcoholic Beverage Industry Market

Long-term growth will be catalyzed by strategic partnerships, investments in sustainability initiatives, further expansion into emerging markets, and the development of innovative products catering to specific health-conscious consumer segments.

Emerging Opportunities in European Alcoholic Beverage Industry

Opportunities exist in the growth of premiumization, low/no alcohol options, RTD cocktails, and personalized beverage experiences. Expansion into emerging markets within Europe and capitalizing on evolving consumer preferences for sustainable and ethically sourced products will be crucial. Investment in digital technologies and data analytics will allow businesses to stay ahead of the curve.

Leading Players in the European Alcoholic Beverage Industry Sector

Key Milestones in European Alcoholic Beverage Industry Industry

- March 2021: Heineken launched Pure Piraña hard seltzer in Europe.

- February 2022: Anheuser-Busch InBev launched Stella Artois Unfiltered in the UK.

- March 2022: Heineken launched Heineken Silver, targeting Gen Y and Z.

Strategic Outlook for European Alcoholic Beverage Industry Market

The future of the European alcoholic beverage market is promising, driven by a confluence of factors including evolving consumer preferences, technological innovations, and strategic investments. Companies that successfully adapt to changing regulations, embrace sustainability, and focus on innovation will experience significant growth. The market is poised for continued expansion, with opportunities arising from premiumization, diversification of product offerings, and penetration into new markets and channels.

European Alcoholic Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialist Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off-trade Channels

European Alcoholic Beverage Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Alcoholic Beverage Industry Regional Market Share

Geographic Coverage of European Alcoholic Beverage Industry

European Alcoholic Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players

- 3.3. Market Restrains

- 3.3.1. Consumers Desire For Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Increased Demand for Craft Beer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialist Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pernod Ricard SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Heineken Holding NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 E & J Gallo Winery

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bacardi Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bronco Wine Company*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carlsberg Breweries A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Anheuser-Busch InBev SA/NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Molson Coors Brewing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LVMH Moët Hennessy Louis Vuitton

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diageo PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pernod Ricard SA

List of Figures

- Figure 1: European Alcoholic Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: European Alcoholic Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: European Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: European Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: European Alcoholic Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: European Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: European Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: European Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark European Alcoholic Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Alcoholic Beverage Industry?

The projected CAGR is approximately 4.48%.

2. Which companies are prominent players in the European Alcoholic Beverage Industry?

Key companies in the market include Pernod Ricard SA, Heineken Holding NV, E & J Gallo Winery, Bacardi Limited, Bronco Wine Company*List Not Exhaustive, Carlsberg Breweries A/S, Anheuser-Busch InBev SA/NV, Molson Coors Brewing Company, LVMH Moët Hennessy Louis Vuitton, Diageo PLC.

3. What are the main segments of the European Alcoholic Beverage Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 278.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players.

6. What are the notable trends driving market growth?

Increased Demand for Craft Beer.

7. Are there any restraints impacting market growth?

Consumers Desire For Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

March 2022: Heineken launched Heineken Silver, a premium lager aimed at Gen Y and Z drinkers in the United Kingdom and European Union. The new lager (4% ABV) is available in 4x330ml bottles, 12x330ml bottles, and 6x330ml slim-line cans. The range offers a premium and modern packaging design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Alcoholic Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Alcoholic Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Alcoholic Beverage Industry?

To stay informed about further developments, trends, and reports in the European Alcoholic Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence