Key Insights

The Canadian food preservatives market is poised for significant expansion, projected to reach approximately USD 3.63 billion in 2025. This growth is driven by an increasing consumer demand for longer shelf-life food products, coupled with a rising awareness of food safety and quality standards across the nation. Key market drivers include the growing processed food industry, advancements in preservation technologies, and evolving consumer preferences towards convenience and ready-to-eat meals. The natural segment is anticipated to witness robust growth as consumers increasingly seek "clean label" products, prompting manufacturers to integrate natural preservatives derived from sources like fruits, vegetables, and herbs. Synthetic preservatives, while facing some consumer apprehension, continue to hold a substantial share due to their cost-effectiveness and broad applicability in various food categories.

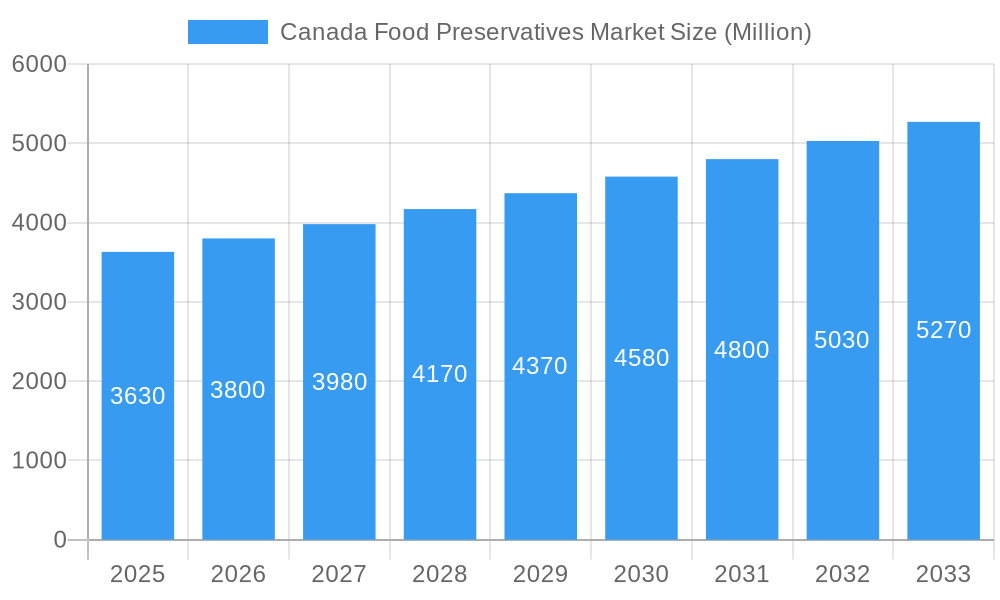

Canada Food Preservatives Market Market Size (In Billion)

The market is set to expand at a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033, indicating sustained momentum. Key applications like beverages, dairy & frozen products, and bakery are expected to lead the demand for food preservatives, owing to their susceptibility to spoilage. However, challenges such as stringent regulatory frameworks concerning the use of certain preservatives and fluctuating raw material prices could pose some restraints. Despite these, the competitive landscape features prominent players like DuPont de Nemours Inc., Cargill Incorporated, and Kerry Group plc, who are actively investing in research and development to innovate and cater to the evolving demands of the Canadian food industry. The focus will be on developing effective, safe, and consumer-acceptable preservation solutions.

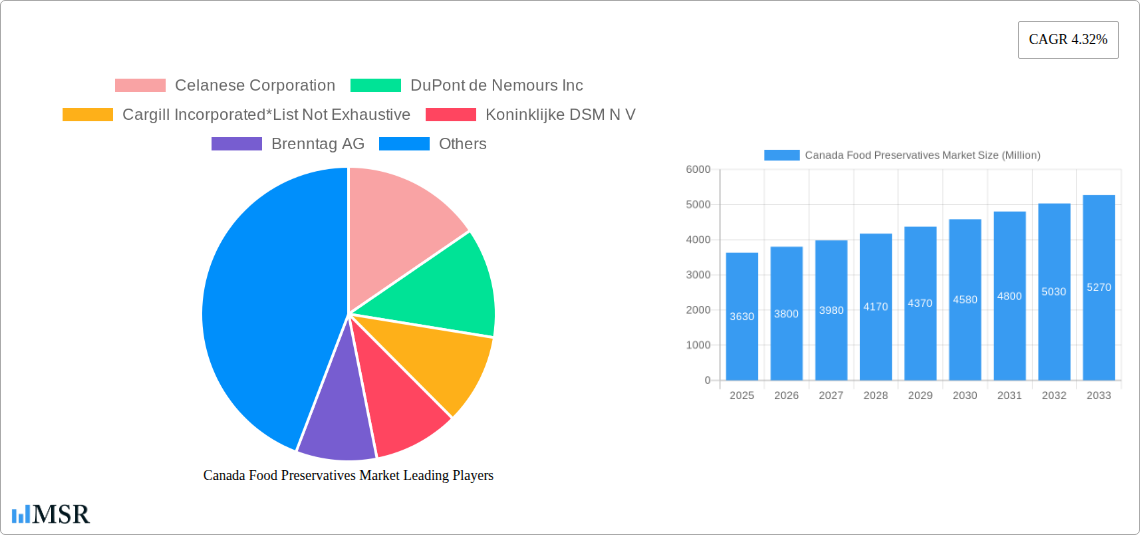

Canada Food Preservatives Market Company Market Share

Unlocking the Future of Food Preservation: Comprehensive Canada Food Preservatives Market Report (2019-2033)

Navigate the dynamic Canadian food preservation landscape with this in-depth market analysis. This report provides critical insights into the Canada food preservatives market size, growth, trends, and competitive strategies, essential for stakeholders seeking to capitalize on this evolving sector. Covering the study period from 2019–2033, with a base and estimated year of 2025, and a forecast period from 2025–2033, this report offers unparalleled data on natural and synthetic preservatives across diverse applications like beverages, dairy & frozen products, bakery, meat, poultry & seafood, confectionery, sauces and salad mixes, and others. Discover key market players, emerging opportunities, and the challenges shaping the Canada food preservatives market.

Canada Food Preservatives Market Market Concentration & Dynamics

The Canada food preservatives market exhibits a moderate level of concentration, with key global players like Celanese Corporation, DuPont de Nemours Inc., and Cargill Incorporated holding significant market share. The innovation ecosystem is characterized by a growing emphasis on natural preservatives, driven by consumer demand and regulatory shifts. Robust regulatory frameworks, overseen by Health Canada, govern the approval and usage of food preservatives, influencing product development and market entry. Substitute products, such as advanced packaging technologies and processing methods, present a dynamic competitive force, prompting manufacturers to continually innovate and enhance the efficacy and safety of their preservative offerings. End-user trends are increasingly favoring clean-label ingredients and plant-based solutions, compelling ingredient suppliers to diversify their portfolios. Mergers and acquisitions (M&A) activities, exemplified by DuPont's acquisition of Danisco in 2011, continue to shape market dynamics, leading to portfolio expansion and enhanced competitive capabilities. The market is expected to witness around 2-3 significant M&A deals within the forecast period, further consolidating the industry.

Canada Food Preservatives Market Industry Insights & Trends

The Canada food preservatives market is poised for substantial growth, driven by a confluence of factors including escalating demand for processed and convenience foods, a burgeoning population, and an increasing awareness of food safety and shelf-life extension among Canadian consumers. The market size for food preservatives in Canada is projected to reach approximately USD 1.2 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Technological disruptions are playing a pivotal role, with advancements in biotechnology leading to the development of novel antimicrobial compounds and fermentation-derived preservatives. Furthermore, the increasing adoption of smart packaging solutions, which often incorporate preservative technologies, is contributing to market expansion. Evolving consumer behaviors, particularly the persistent demand for healthier and more natural food options, are compelling manufacturers to invest heavily in research and development for natural food preservatives derived from sources like fruits, vegetables, and herbs. This shift is not only responding to consumer preferences but also aligning with global sustainability initiatives and a desire for transparent ingredient lists. The robust growth is further underpinned by Canada's strong agricultural sector and its established food processing industry, which requires effective preservation solutions to maintain product quality and minimize waste throughout the supply chain. The continued emphasis on food safety regulations and the need to comply with international standards also act as a significant market driver, ensuring the consistent demand for reliable and approved food preservative solutions.

Key Markets & Segments Leading Canada Food Preservatives Market

The Beverages segment is a dominant force within the Canada food preservatives market, driven by the vast and diverse nature of the beverage industry, encompassing everything from soft drinks and juices to alcoholic beverages and functional drinks. This segment's growth is propelled by several factors, including the high consumption rates of ready-to-drink beverages, the increasing popularity of novel flavor profiles requiring extended shelf life, and the continuous innovation in product formulations. Economic growth in Canada, leading to higher disposable incomes, further fuels consumer spending on a wide array of beverages, thereby increasing the demand for preservatives to maintain freshness and prevent spoilage.

- Drivers for Beverages Dominance:

- High Consumption Rates: Canadians consume a significant volume of diverse beverages, necessitating preservation.

- Product Innovation: Development of new beverage types and flavors requires effective shelf-life extension solutions.

- Convenience Food Trend: The rise of ready-to-drink options directly translates to increased preservative use.

- Global Supply Chain Integration: Canada's participation in global trade requires robust preservation methods for exported and imported beverages.

Another significant segment is Dairy & Frozen Products, which benefits from consistent consumer demand for products like milk, cheese, yogurt, ice cream, and frozen meals. The inherent perishability of dairy products and the storage requirements of frozen goods make preservatives indispensable for ensuring product safety and maintaining quality over extended periods. The expanding frozen food market, catering to busy lifestyles and single-person households, further bolsters demand.

- Drivers for Dairy & Frozen Products Dominance:

- Perishability: Dairy products are highly susceptible to microbial spoilage.

- Extended Shelf-Life Needs: Freezing and chilling processes benefit from preservative support.

- Growing Frozen Food Market: Increased demand for convenience and variety in frozen meals.

- Food Safety Regulations: Stringent regulations for dairy and frozen products necessitate effective preservation.

The Meat, Poultry & Seafood segment also commands a substantial share. The natural tendency of these products to spoil rapidly makes preservation a critical aspect of their processing and distribution. The demand for pre-packaged and ready-to-cook meat products, coupled with stringent food safety standards for these protein sources, fuels the need for effective preservatives.

- Drivers for Meat, Poultry & Seafood Dominance:

- High Spoilage Rate: These products are highly perishable and prone to microbial contamination.

- Consumer Demand for Convenience: Increased popularity of processed and ready-to-cook meat products.

- Food Safety Imperative: Critical for preventing foodborne illnesses.

- International Trade: Preservation is vital for exporting and importing these sensitive goods.

The Bakery segment is also a key contributor, with preservatives used to extend the shelf life of bread, cakes, pastries, and other baked goods, preventing mold growth and staleness. The growing artisanal bakery trend and the demand for longer-lasting packaged bakery items contribute to this segment's sustained growth.

Canada Food Preservatives Market Product Developments

Product developments in the Canada food preservatives market are increasingly focused on natural and bio-based solutions, aligning with consumer demand for clean-label ingredients. Innovations include the extraction and application of natural antioxidants from sources like rosemary and green tea, as well as the development of fermentation-derived preservatives. Companies are also investing in research to enhance the efficacy of existing synthetic preservatives while exploring novel combinations and delivery systems for improved performance and broader application across food categories such as beverages, dairy, bakery, and meat products. The market relevance of these developments lies in their ability to address consumer concerns regarding artificial additives and to meet evolving regulatory landscapes.

Challenges in the Canada Food Preservatives Market Market

The Canada food preservatives market faces several significant challenges. Navigating complex and evolving regulatory frameworks, particularly concerning the approval and labeling of natural preservatives, can be a substantial hurdle for new market entrants and product developers. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials for preservative production. Furthermore, increasing consumer skepticism towards synthetic food additives necessitates a continuous investment in research and development of natural alternatives, which can be resource-intensive. Competitive pressures from both established global players and emerging specialized ingredient suppliers also intensify the market landscape, requiring a constant focus on innovation and cost-effectiveness. The cost of compliance with stringent food safety standards also adds to operational expenses.

Forces Driving Canada Food Preservatives Market Growth

Several powerful forces are propelling the growth of the Canada food preservatives market. The escalating consumer demand for convenient and ready-to-eat food products directly translates to a higher need for effective preservation solutions to extend shelf life and maintain quality. Technological advancements in food processing and the development of innovative preservative technologies, including bio-preservatives and natural extracts, are expanding the application range and efficacy of these ingredients. Furthermore, Canada's robust food processing industry, coupled with stringent government regulations emphasizing food safety and quality, creates a sustained demand for reliable preservative solutions. Growing health consciousness and a preference for food products with longer shelf lives, driven by busy lifestyles and the desire to reduce food waste, are also significant growth catalysts.

Challenges in the Canada Food Preservatives Market Market

Long-term growth catalysts for the Canada food preservatives market are deeply intertwined with ongoing innovation and strategic market expansions. The continuous development of novel natural preservatives, derived from sustainable sources and offering enhanced functionalities, will be crucial for capturing evolving consumer preferences. Strategic partnerships and collaborations between ingredient manufacturers, food processors, and research institutions are expected to accelerate the development and adoption of cutting-edge preservation technologies. Furthermore, exploring untapped market segments within Canada, such as plant-based foods and functional beverages, presents significant expansion opportunities. The increasing focus on reducing food waste throughout the supply chain will also drive the demand for advanced preservation solutions, fostering a circular economy approach.

Emerging Opportunities in Canada Food Preservatives Market

Emerging opportunities in the Canada food preservatives market are largely shaped by evolving consumer preferences and technological advancements. The growing demand for "clean-label" products is creating a significant opportunity for natural preservatives derived from fruits, vegetables, and fermented sources. The plant-based food sector, experiencing rapid expansion, requires specialized preservation solutions to maintain its appeal and shelf life, presenting a lucrative niche. advancements in biotechnology and encapsulation technologies are enabling the development of more effective and targeted preservative systems. Furthermore, Canada's commitment to reducing food waste offers a substantial opportunity for preservatives that enhance product longevity and minimize spoilage across the entire food supply chain, from production to consumption.

Leading Players in the Canada Food Preservatives Market Sector

- Celanese Corporation

- DuPont de Nemours Inc.

- Cargill Incorporated

- Koninklijke DSM N V

- Brenntag AG

- Corbion NV

- Kerry Group plc

Key Milestones in Canada Food Preservatives Market Industry

- 2011: DuPont acquired Danisco, a significant move that significantly expanded DuPont's portfolio of food ingredients, including a comprehensive range of food preservatives, solidifying its market position.

- Ongoing (post-2011): Cargill has consistently launched innovative natural preservatives, such as rosemary extract and vinegar-based solutions, responding to the growing consumer demand for clean-label ingredients and expanding its sustainable offerings in the Canadian market.

- Ongoing (post-2011): Brenntag AG and Corbion NV have engaged in collaborations aimed at developing and promoting sustainable and effective food preservatives, focusing on solutions that meet both regulatory requirements and consumer expectations for eco-friendly products.

Strategic Outlook for Canada Food Preservatives Market Market

The strategic outlook for the Canada food preservatives market is highly promising, driven by sustained consumer demand for convenience, safety, and increasingly, natural ingredients. Future growth will be accelerated by continued investment in research and development for innovative natural and bio-based preservatives, addressing the clean-label trend. Strategic partnerships and collaborations between ingredient suppliers and food manufacturers will be crucial for co-creating tailored preservation solutions. Furthermore, the growing focus on food waste reduction presents a significant market opportunity for advanced preservation technologies that extend shelf life and maintain product integrity throughout the supply chain. Companies that can effectively navigate regulatory landscapes and adapt to evolving consumer preferences will be well-positioned for success.

Canada Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Beverages

- 2.2. Dairy & Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry & Seafood

- 2.5. Confectionery

- 2.6. Sauces and Salad Mixes

- 2.7. Others

Canada Food Preservatives Market Segmentation By Geography

- 1. Canada

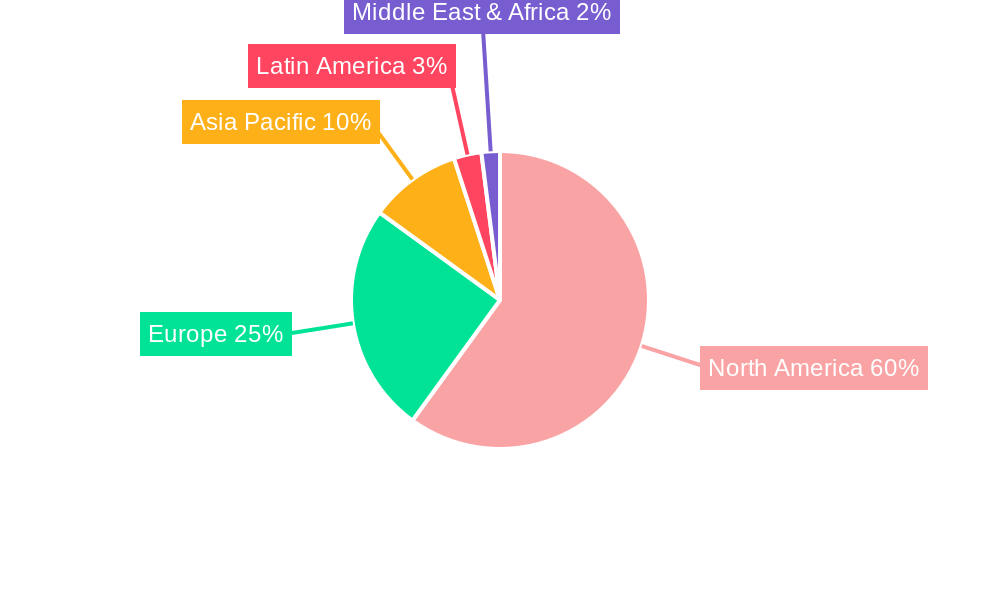

Canada Food Preservatives Market Regional Market Share

Geographic Coverage of Canada Food Preservatives Market

Canada Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Flavonoids

- 3.4. Market Trends

- 3.4.1. Strategic Investment Towards Specility Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy & Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry & Seafood

- 5.2.5. Confectionery

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Celanese Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Incorporated*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke DSM N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brenntag AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corbion NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Celanese Corporation

List of Figures

- Figure 1: Canada Food Preservatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Canada Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Canada Food Preservatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Canada Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Canada Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Food Preservatives Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Canada Food Preservatives Market?

Key companies in the market include Celanese Corporation, DuPont de Nemours Inc, Cargill Incorporated*List Not Exhaustive, Koninklijke DSM N V, Brenntag AG, Corbion NV, Kerry Group plc.

3. What are the main segments of the Canada Food Preservatives Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework.

6. What are the notable trends driving market growth?

Strategic Investment Towards Specility Ingredients.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Flavonoids.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Danisco by DuPont in 2011, expanding its portfolio of food preservatives 2.Launch of innovative natural preservatives by Cargill, such as rosemary extract and vinegar-based solutions 3. Collaboration between Brenntag and Corbion to develop sustainable and effective food preservatives

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Canada Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence