Key Insights

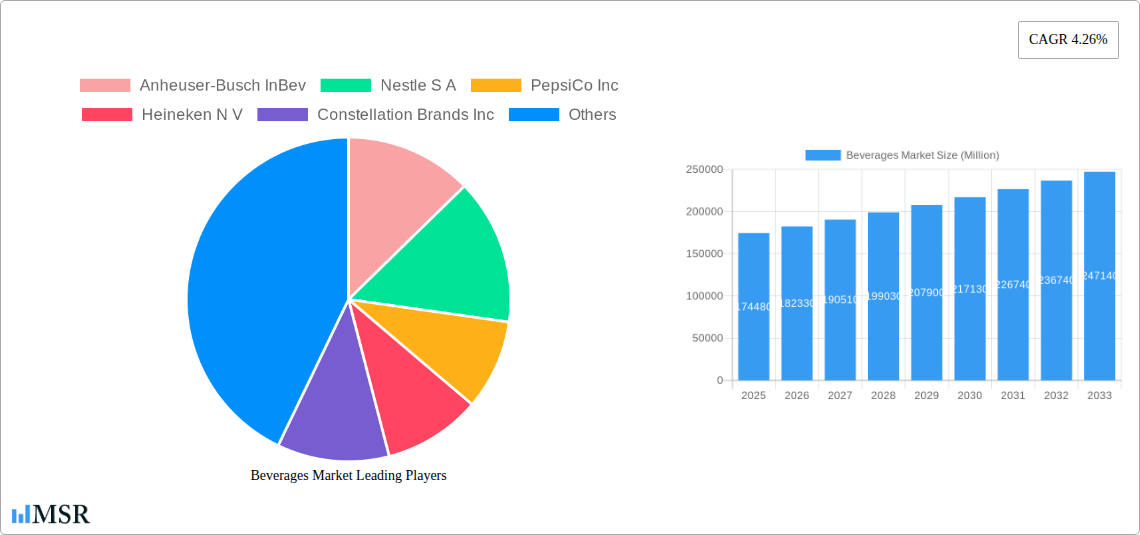

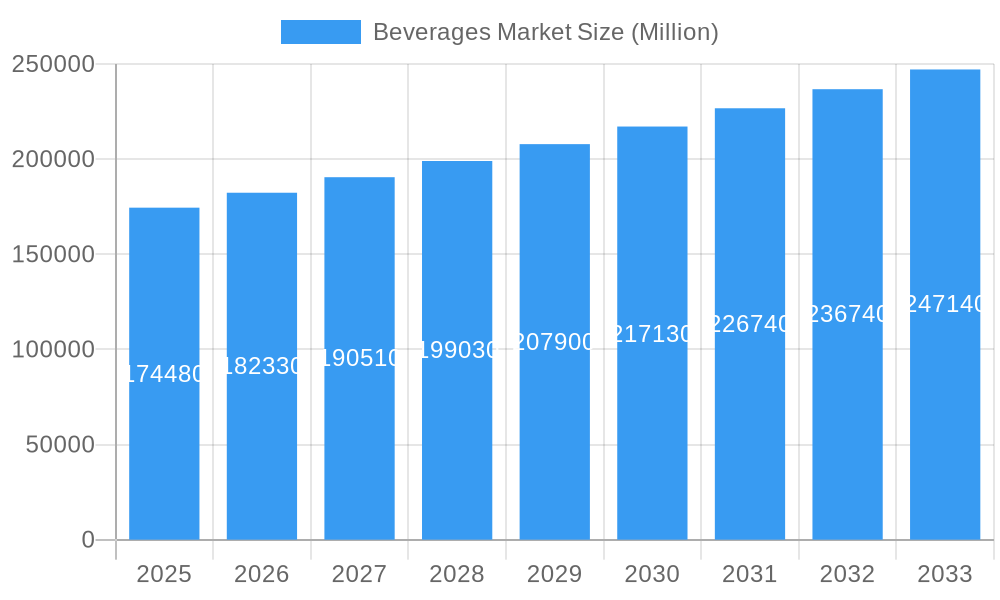

The global Beverages Market is poised for robust expansion, projected to reach a substantial $174.48 billion by 2025, driven by a CAGR of 4.5%. This growth trajectory is underpinned by evolving consumer preferences, a rising global population, and increasing disposable incomes, particularly in emerging economies. Key drivers include the growing demand for health and wellness beverages, such as functional drinks and natural juices, as consumers become more conscious of their dietary choices. Furthermore, the convenience offered by ready-to-drink (RTD) products, coupled with innovative packaging and diverse flavor profiles, is significantly fueling market penetration across both alcoholic and non-alcoholic segments. The rise of premiumization within the alcoholic beverage sector, with a focus on craft beers, artisanal spirits, and fine wines, also contributes to this upward trend, indicating a shift towards higher-value products.

Beverages Market Market Size (In Billion)

The market's dynamic nature is further shaped by distinct trends and strategic market positioning by leading global players. A significant trend is the increasing penetration of online retail channels for beverage sales, offering consumers greater accessibility and a wider selection. Conversely, traditional off-trade channels like supermarkets and hypermarkets continue to hold considerable sway. Within the non-alcoholic segment, energy and sports drinks are experiencing notable growth, catering to an active lifestyle demographic. The competitive landscape is characterized by the presence of major corporations such as Anheuser-Busch InBev, Nestle S.A., PepsiCo Inc., and The Coca-Cola Company, who are actively engaged in product innovation, strategic acquisitions, and market expansion to capitalize on evolving consumer demands and regional growth opportunities. The forecast period (2025-2033) indicates sustained growth, reflecting the industry's resilience and adaptability.

Beverages Market Company Market Share

Unlock critical insights into the dynamic global Beverages Market with this in-depth report. Covering the historical period of 2019-2024 and projecting robust growth through 2033, with a base and estimated year of 2025, this study provides actionable intelligence for beverage manufacturers, distributors, investors, and industry stakeholders. Explore market size exceeding $1.5 trillion, analyze segment dominance, and understand the strategic imperatives driving success in this multi-billion dollar industry. Keywords: Beverages Market, Alcoholic Beverages, Non-Alcoholic Beverages, Energy Drinks, Soft Drinks, Bottled Water, Beer Market, Wine Market, Spirits Market, RTD Tea and Coffee, Distribution Channels, On-trade, Off-trade, Market Size, CAGR, Market Trends, Industry Analysis, Growth Drivers, Emerging Opportunities, Key Players.

Beverages Market Market Concentration & Dynamics

The global Beverages Market exhibits a moderately concentrated landscape, with a few major multinational corporations holding significant market share. Leading players like The Coca-Cola Company, PepsiCo Inc., and Anheuser-Busch InBev command substantial influence, leveraging extensive distribution networks and brand equity. However, the market also features a vibrant ecosystem of niche players and innovative startups, particularly within segments like craft beverages and functional drinks. Innovation is a key differentiator, with companies investing heavily in R&D to develop healthier, sustainable, and novel product offerings. Regulatory frameworks, encompassing food safety, labeling, and taxation, play a crucial role in shaping market entry and product development. Substitute products, such as home-prepared beverages and milk, present ongoing competition, albeit with varying consumer preferences. End-user trends are shifting towards health and wellness, premiumization, and convenience, influencing product formulation and packaging. Merger and acquisition (M&A) activities remain a strategic tool for market consolidation, expansion into new geographies, and diversification of product portfolios, with an estimated 250+ M&A deals annually across the sector.

- Market Concentration: Dominated by a few key global players, but with significant room for niche innovation.

- Innovation Ecosystems: Driven by consumer demand for health, sustainability, and novel experiences.

- Regulatory Frameworks: Stringent but evolving, impacting product development and market access.

- Substitute Products: Diverse, ranging from homemade beverages to dairy alternatives.

- End-User Trends: Health & wellness, premiumization, convenience, and sustainability.

- M&A Activities: Strategic tool for growth, consolidation, and portfolio expansion.

Beverages Market Industry Insights & Trends

The global Beverages Market is poised for substantial growth, projected to reach a market size exceeding $1.5 trillion by 2033, driven by a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including rising disposable incomes in emerging economies, increasing urbanization, and a growing global population. Technological disruptions are reshaping production, distribution, and consumer engagement. Advanced automation in manufacturing, sophisticated supply chain management systems, and the burgeoning e-commerce landscape are critical elements. Evolving consumer behaviors are paramount, with a pronounced shift towards healthier alternatives, including low-sugar and zero-calorie options, plant-based beverages, and functional drinks fortified with vitamins and probiotics. The demand for sustainable packaging, ethical sourcing, and transparent production processes is also gaining significant traction, influencing brand loyalty and purchasing decisions. The premiumization trend continues to manifest, with consumers willing to pay more for artisanal products, unique flavor profiles, and brands with strong ethical credentials. The convenience factor, driven by busy lifestyles, is propelling the growth of ready-to-drink (RTD) formats across various beverage categories.

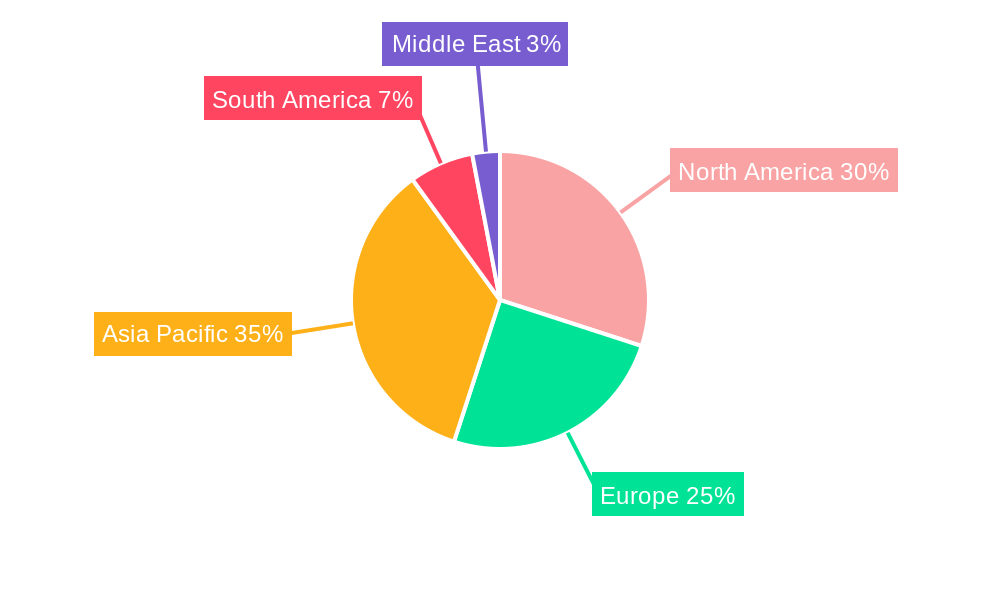

Key Markets & Segments Leading Beverages Market

The Non-Alcoholic Beverages segment is anticipated to lead the global Beverages Market, primarily driven by the robust performance of Soft Drinks, Bottled Water, and Energy & Sports Drink categories. Within Non-Alcoholic Beverages, the market size for Bottled Water is estimated to be over $300 billion, followed by Soft Drinks at approximately $280 billion, and Energy & Sports Drinks around $90 billion. The Asia-Pacific region is expected to be the dominant geographical market, with China and India spearheading growth due to their massive populations, expanding middle class, and increasing per capita consumption.

Dominant Segment: Non-Alcoholic Beverages.

- Soft Drinks: High per capita consumption, strong brand presence, and diverse product innovation.

- Bottled Water: Growing awareness of health and hydration, coupled with concerns over tap water quality.

- Energy & Sports Drink: Rising health and fitness consciousness, demand for performance-enhancing beverages, and expansion into lifestyle consumption.

- Packaged Juice: Increasing demand for natural and vitamin-enriched beverages.

- RTD Tea and Coffee: Convenience, growing coffee culture, and evolving flavor profiles.

Dominant Distribution Channel: Off-trade channels, particularly Supermarkets/Hypermarkets, are expected to maintain their lead.

- Supermarkets/Hypermarkets: Offering vast product selection, competitive pricing, and convenient one-stop shopping experiences. The market size for this channel is estimated to be over $600 billion.

- Convenience/Grocery Stores: Catering to impulse purchases and immediate consumption needs.

- Online Retail Stores: Experiencing rapid growth due to increasing e-commerce penetration, offering wider reach and personalized shopping. The online segment is projected to grow at a CAGR of 12%.

Dominant Region: Asia-Pacific, driven by:

- Economic Growth: Rising disposable incomes and expanding middle-class populations.

- Urbanization: Increasing demand for convenience and packaged beverages in urban centers.

- Population Growth: Large and growing consumer base.

- Infrastructure Development: Improved logistics and retail penetration.

The Alcoholic Beverages segment, while mature in developed markets, continues to see growth driven by premiumization and the expansion of craft options. Beer, with an estimated market size of $700 billion, remains the largest category, followed by Spirits ($400 billion) and Wine ($200 billion).

Beverages Market Product Developments

Product innovation is a cornerstone of success in the Beverages Market. Companies are increasingly focusing on creating beverages that cater to evolving consumer preferences for health, natural ingredients, and unique flavor experiences. Recent developments include the introduction of plant-based alternatives, functional beverages with added health benefits, and low-sugar or sugar-free formulations. The demand for RTD (Ready-to-Drink) formats continues to surge, offering convenience without compromising on taste or quality. Sustainable packaging solutions, such as recyclable materials and reduced plastic usage, are also gaining prominence, appealing to environmentally conscious consumers. Technological advancements in processing and preservation are enabling extended shelf life and the development of novel textures and flavor combinations, providing a competitive edge.

Challenges in the Beverages Market Market

The Beverages Market faces several challenges that can impede growth. Regulatory hurdles, including varying food safety standards, labeling requirements, and taxation policies across different regions, can create complexities. Supply chain disruptions, stemming from geopolitical events, climate change impacts, or raw material availability, can affect production costs and product availability. Intense competitive pressures, with established players and new entrants vying for market share, necessitate continuous innovation and aggressive marketing strategies. The increasing consumer awareness and demand for healthier options also pose a challenge for traditional high-sugar beverage manufacturers, requiring product reformulation or diversification.

- Regulatory Hurdles: Complex and varying standards across regions.

- Supply Chain Volatility: Vulnerability to geopolitical, environmental, and resource-related disruptions.

- Intense Competition: Market saturation and the need for constant differentiation.

- Shifting Consumer Preferences: Growing demand for healthier, sustainable, and ethically sourced products.

Forces Driving Beverages Market Growth

The growth of the Beverages Market is propelled by several significant forces. Economic factors, such as rising disposable incomes in developing nations and a growing global middle class, are increasing consumer spending power on beverages. Technological advancements in production, packaging, and distribution are enhancing efficiency and expanding market reach. Evolving consumer lifestyles, characterized by increased urbanization and busy schedules, are driving demand for convenient and ready-to-consume options. Growing health and wellness consciousness is fueling the demand for healthier beverage choices, including low-sugar, functional, and natural products. Furthermore, strategic marketing campaigns and product innovation by leading players continue to stimulate consumer interest and drive consumption.

Challenges in the Beverages Market Market

Long-term growth catalysts in the Beverages Market are deeply intertwined with continuous innovation and strategic market expansion. The increasing focus on sustainability, from ingredient sourcing to packaging, presents a significant opportunity for companies that can authentically integrate eco-friendly practices into their operations. Innovations in product formulation, such as the development of novel functional ingredients and enhanced taste profiles for healthier alternatives, will be crucial for capturing evolving consumer demand. Strategic partnerships and collaborations, particularly in emerging markets or for niche product categories, can unlock new growth avenues. Furthermore, companies that can effectively leverage digital technologies for direct-to-consumer sales and personalized marketing will gain a competitive advantage.

Emerging Opportunities in Beverages Market

Emerging opportunities in the Beverages Market are diverse and promising. The growing demand for functional beverages, offering benefits beyond basic hydration such as improved immunity, cognitive function, and digestive health, presents a significant avenue for growth. The expansion of the RTD (Ready-to-Drink) category, particularly in alcoholic beverages like hard seltzers and canned cocktails, continues to attract new consumers. The increasing consumer interest in plant-based and dairy-free alternatives offers a vast untapped market. Furthermore, the development of innovative, sustainable packaging solutions that address environmental concerns will resonate strongly with conscious consumers. Digital transformation, including personalized e-commerce experiences and direct-to-consumer models, opens up new channels for engagement and sales.

Leading Players in the Beverages Market Sector

- Anheuser-Busch InBev

- Nestle S A

- PepsiCo Inc

- Heineken N V

- Constellation Brands Inc

- Suntory Holdings Limited

- Red Bull GmbH

- Keurig Dr Pepper

- The Coca-Cola Company

- Diageo plc

Key Milestones in Beverages Market Industry

- March 2023: Red Bull unveiled its Summer Edition product line in the United Kingdom, featuring an exciting new flavor - Juneberry. These Juneberry-flavored energy drinks are now widely accessible, being distributed across major retailers throughout the country. Consumers can enjoy them in both single-serving and multipack options.

- October 2022: VictoriaTM introduced Vicky Chamoy, a unique beer with a Mexican twist. Infused with the distinct flavors of chamoy, this beer offers a delightful blend of sweet, salty, spicy, and sour notes. Imported from Mexico, Vicky Chamoy is available in convenient 24-ounce single-serve cans.

- October 2022: Budweiser APAC opened its state-of-the-art brewery in Putian, China. This strategic move is part of Anheuser-Busch InBev's plan to drive economic growth in China and cater to the evolving preferences of consumers. Situated in the Fujian province, this Budweiser craft brewery stands as the largest of its kind in the Asia-Pacific region.

Strategic Outlook for Beverages Market Market

The strategic outlook for the Beverages Market remains exceptionally strong, with continued growth driven by innovation and evolving consumer preferences. Companies that can effectively navigate the demand for healthier and more sustainable options, while also embracing digital transformation for enhanced consumer engagement and efficient distribution, will be best positioned for long-term success. Expansion into emerging markets, coupled with strategic acquisitions and product diversification, will be key growth accelerators. The market will likely witness a continued rise in premiumization and the expansion of niche categories, offering opportunities for both established players and agile newcomers to capture market share. Investing in advanced supply chain technologies and sustainable practices will be crucial for building resilience and brand loyalty.

Beverages Market Segmentation

-

1. Product Type

-

1.1. Alcoholic Beverages

- 1.1.1. Beer

- 1.1.2. Wine

- 1.1.3. Spirits

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Energy & Sports Drink

- 1.2.2. Soft Drinks

- 1.2.3. Bottled Water

- 1.2.4. Packaged Juice

- 1.2.5. RTD Tea and Coffee

- 1.2.6. Other Non-Alcoholic Beverages

-

1.1. Alcoholic Beverages

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off Trade Channels

Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Beverages Market Regional Market Share

Geographic Coverage of Beverages Market

Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated With Beverages

- 3.4. Market Trends

- 3.4.1. Consumer Inclination Toward Sugar-Free Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcoholic Beverages

- 5.1.1.1. Beer

- 5.1.1.2. Wine

- 5.1.1.3. Spirits

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Energy & Sports Drink

- 5.1.2.2. Soft Drinks

- 5.1.2.3. Bottled Water

- 5.1.2.4. Packaged Juice

- 5.1.2.5. RTD Tea and Coffee

- 5.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1. Alcoholic Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Alcoholic Beverages

- 6.1.1.1. Beer

- 6.1.1.2. Wine

- 6.1.1.3. Spirits

- 6.1.2. Non-Alcoholic Beverages

- 6.1.2.1. Energy & Sports Drink

- 6.1.2.2. Soft Drinks

- 6.1.2.3. Bottled Water

- 6.1.2.4. Packaged Juice

- 6.1.2.5. RTD Tea and Coffee

- 6.1.2.6. Other Non-Alcoholic Beverages

- 6.1.1. Alcoholic Beverages

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Retail Stores

- 6.2.2.4. Other Off Trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Alcoholic Beverages

- 7.1.1.1. Beer

- 7.1.1.2. Wine

- 7.1.1.3. Spirits

- 7.1.2. Non-Alcoholic Beverages

- 7.1.2.1. Energy & Sports Drink

- 7.1.2.2. Soft Drinks

- 7.1.2.3. Bottled Water

- 7.1.2.4. Packaged Juice

- 7.1.2.5. RTD Tea and Coffee

- 7.1.2.6. Other Non-Alcoholic Beverages

- 7.1.1. Alcoholic Beverages

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Retail Stores

- 7.2.2.4. Other Off Trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Alcoholic Beverages

- 8.1.1.1. Beer

- 8.1.1.2. Wine

- 8.1.1.3. Spirits

- 8.1.2. Non-Alcoholic Beverages

- 8.1.2.1. Energy & Sports Drink

- 8.1.2.2. Soft Drinks

- 8.1.2.3. Bottled Water

- 8.1.2.4. Packaged Juice

- 8.1.2.5. RTD Tea and Coffee

- 8.1.2.6. Other Non-Alcoholic Beverages

- 8.1.1. Alcoholic Beverages

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Retail Stores

- 8.2.2.4. Other Off Trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Alcoholic Beverages

- 9.1.1.1. Beer

- 9.1.1.2. Wine

- 9.1.1.3. Spirits

- 9.1.2. Non-Alcoholic Beverages

- 9.1.2.1. Energy & Sports Drink

- 9.1.2.2. Soft Drinks

- 9.1.2.3. Bottled Water

- 9.1.2.4. Packaged Juice

- 9.1.2.5. RTD Tea and Coffee

- 9.1.2.6. Other Non-Alcoholic Beverages

- 9.1.1. Alcoholic Beverages

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Retail Stores

- 9.2.2.4. Other Off Trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Alcoholic Beverages

- 10.1.1.1. Beer

- 10.1.1.2. Wine

- 10.1.1.3. Spirits

- 10.1.2. Non-Alcoholic Beverages

- 10.1.2.1. Energy & Sports Drink

- 10.1.2.2. Soft Drinks

- 10.1.2.3. Bottled Water

- 10.1.2.4. Packaged Juice

- 10.1.2.5. RTD Tea and Coffee

- 10.1.2.6. Other Non-Alcoholic Beverages

- 10.1.1. Alcoholic Beverages

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Retail Stores

- 10.2.2.4. Other Off Trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Beverages Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Alcoholic Beverages

- 11.1.1.1. Beer

- 11.1.1.2. Wine

- 11.1.1.3. Spirits

- 11.1.2. Non-Alcoholic Beverages

- 11.1.2.1. Energy & Sports Drink

- 11.1.2.2. Soft Drinks

- 11.1.2.3. Bottled Water

- 11.1.2.4. Packaged Juice

- 11.1.2.5. RTD Tea and Coffee

- 11.1.2.6. Other Non-Alcoholic Beverages

- 11.1.1. Alcoholic Beverages

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience/Grocery Stores

- 11.2.2.3. Online Retail Stores

- 11.2.2.4. Other Off Trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Anheuser-Busch InBev

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nestle S A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PepsiCo Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Heineken N V

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Constellation Brands Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Suntory Holdings Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Red Bull GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Keurig Dr Pepper*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Coca-Cola Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Diageo plc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: Global Beverages Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Saudi Arabia Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Saudi Arabia Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Beverages Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 39: Global Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: South Africa Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beverages Market?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the Beverages Market?

Key companies in the market include Anheuser-Busch InBev, Nestle S A, PepsiCo Inc, Heineken N V, Constellation Brands Inc, Suntory Holdings Limited, Red Bull GmbH, Keurig Dr Pepper*List Not Exhaustive, The Coca-Cola Company, Diageo plc.

3. What are the main segments of the Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks.

6. What are the notable trends driving market growth?

Consumer Inclination Toward Sugar-Free Drinks.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated With Beverages.

8. Can you provide examples of recent developments in the market?

March 2023: Red Bull unveiled its Summer Edition product line in the United Kingdom, featuring an exciting new flavor - Juneberry. These Juneberry-flavored energy drinks are now widely accessible, being distributed across major retailers throughout the country. Consumers can enjoy them in both single-serving and multipack options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beverages Market?

To stay informed about further developments, trends, and reports in the Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence