Key Insights

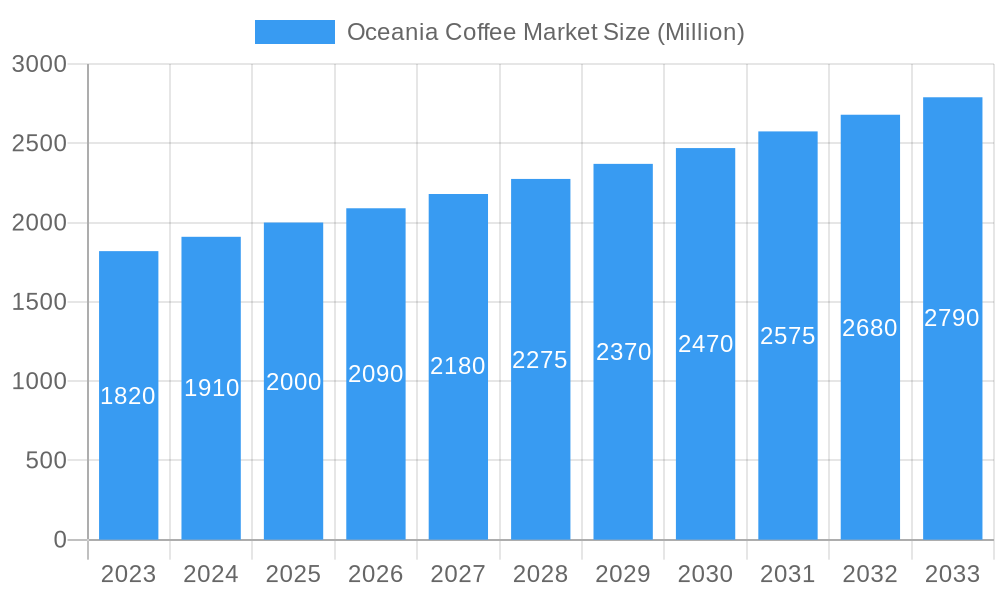

The Oceania coffee market is poised for steady expansion, projected to reach an estimated USD 1.91 billion in 2024, with a compound annual growth rate (CAGR) of 4.6% anticipated through 2033. This robust growth is fueled by a confluence of evolving consumer preferences and expanding accessibility. A key driver is the increasing demand for premium and specialty coffee experiences, including whole-bean and meticulously roasted varieties, as consumers in the region become more discerning about quality and origin. The burgeoning café culture, particularly in Australia and New Zealand, continues to be a significant contributor, alongside a growing appreciation for home-brewed specialty coffee. Furthermore, the convenience of instant coffee, while perhaps less premium, maintains its strong market presence, catering to busy lifestyles and offering an accessible entry point into coffee consumption. The distribution landscape is also evolving, with a significant shift towards off-trade channels, especially supermarkets and hypermarkets, as they increasingly stock a diverse range of coffee products, from mainstream brands to niche offerings.

Oceania Coffee Market Market Size (In Billion)

The market's expansion is further bolstered by the ongoing trend of health-conscious consumption, leading to increased interest in organic and sustainably sourced coffee. This aligns with a broader global movement towards ethical consumption and a desire to support responsible production practices. While the market enjoys a positive trajectory, certain factors could influence its pace. High raw material costs for coffee beans, subject to global supply chain volatilities and climatic conditions, represent a potential restraint. Additionally, intense competition among established global players and emerging local roasters necessitates continuous innovation in product development, marketing, and distribution strategies to maintain market share and capture new consumer segments. Addressing these challenges through strategic partnerships and focusing on unique value propositions will be crucial for sustained success in the dynamic Oceania coffee market.

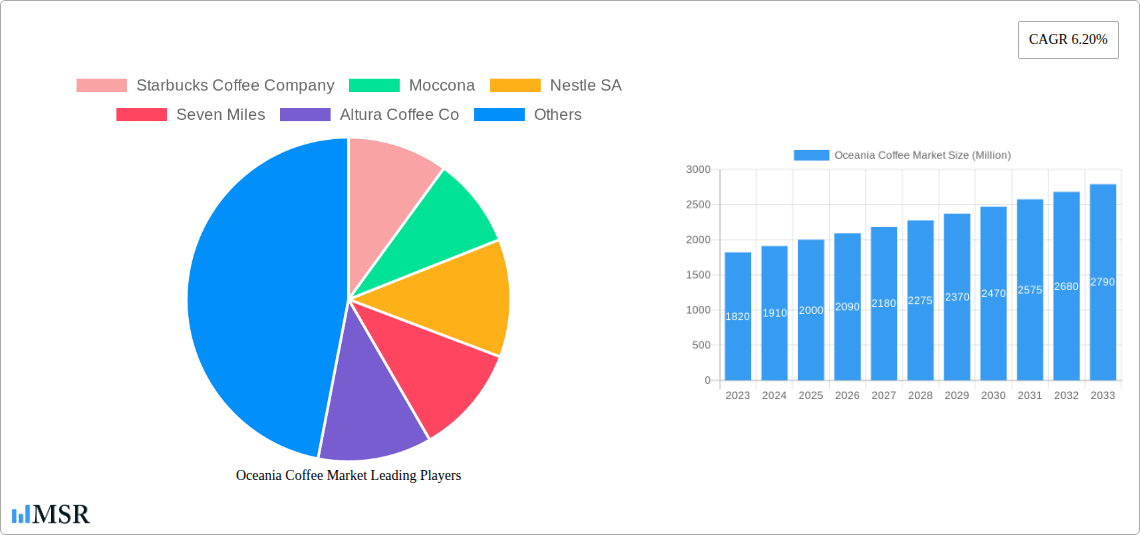

Oceania Coffee Market Company Market Share

Oceania Coffee Market: Comprehensive Growth Analysis & Forecast (2019-2033)

Unlock critical insights into the burgeoning Oceania coffee market with this in-depth report, your definitive guide to understanding market dynamics, key players, and future trajectories. Spanning from 2019 to 2033, this analysis delves into a market projected to reach over $XX billion by 2033, driven by evolving consumer preferences and robust distribution networks. Discover actionable intelligence on market concentration, industry trends, segment dominance, product innovation, challenges, growth drivers, and emerging opportunities. Essential for coffee roasters, distributors, investors, and retail giants seeking to capitalize on this vibrant sector.

Oceania Coffee Market Market Concentration & Dynamics

The Oceania coffee market exhibits a dynamic yet moderately concentrated landscape. Key players like Starbucks Coffee Company, Moccona, Nestle SA, and Jacobs Douwe Egberts command significant market share, particularly within the instant and ground coffee segments. However, a growing cohort of specialist roasters and independent brands, including Seven Miles, Altura Coffee Co, Cantarella Bros Pty Ltd, Ospina Coffee, McDonald's (through its McCafe offerings), and Kokako Organic Coffee Roaster, contribute to a vibrant innovation ecosystem. This ecosystem thrives on an increasing focus on premiumization, single-origin beans, and sustainable sourcing, pushing the boundaries of product development and consumer engagement.

Regulatory frameworks across Oceania, while largely supportive of business growth, introduce nuances in import/export regulations and labeling standards that can influence market entry and operational costs. The threat of substitute products, primarily other hot beverages like tea and energy drinks, remains a constant consideration, yet the entrenched cultural appeal and diverse product offerings of coffee continue to mitigate this risk. End-user trends are increasingly shifting towards convenience, health consciousness, and ethical consumption, driving demand for ready-to-drink options and ethically sourced coffee. Merger and acquisition (M&A) activities, while not as prolific as in larger global markets, are strategic, often involving consolidation within specific segments or acquisitions aimed at expanding distribution reach and product portfolios. The estimated M&A deal count for the historical period (2019-2024) is approximately XX deals, with a projected increase in the forecast period as larger entities seek to solidify their market positions.

Oceania Coffee Market Industry Insights & Trends

The Oceania coffee market is experiencing robust growth, projected to expand significantly from an estimated market size of $XX billion in the base year 2025 to over $XX billion by 2033, registering a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This upward trajectory is underpinned by several key market growth drivers. A fundamental driver is the escalating disposable income across key Oceania economies, enabling consumers to allocate more resources towards premium coffee experiences. Furthermore, a burgeoning café culture and the increasing popularity of specialty coffee shops, particularly in urban centers like Sydney, Melbourne, and Auckland, are fueling demand for high-quality beans and innovative brewing methods. The convenience factor also plays a crucial role, with a growing demand for ready-to-drink (RTD) coffee options and single-serve capsules for home and office consumption.

Technological disruptions are continuously reshaping the industry. Advancements in coffee roasting technology ensure enhanced flavor profiles and consistency, while innovations in packaging, such as improved barrier materials and sustainable options, are addressing consumer concerns about environmental impact and extending product shelf life. The rise of e-commerce platforms has democratized access to a wider variety of coffee products, allowing smaller roasters to reach a national and even international audience. Evolving consumer behaviors are central to this growth. There is a discernible shift towards health-conscious choices, leading to increased demand for organic, fair-trade, and low-acid coffee varieties. Consumers are also demonstrating a greater willingness to experiment with different flavor profiles and brewing techniques, moving beyond traditional offerings. The influence of social media and online reviews plays a significant role in shaping purchasing decisions, with visually appealing coffee creations and positive user experiences driving brand popularity. The integration of smart home devices and automated brewing systems is further enhancing the at-home coffee experience, contributing to a sustained increase in overall coffee consumption.

Key Markets & Segments Leading Oceania Coffee Market

The Oceania coffee market is characterized by the strong performance of certain regions and distribution channels, driven by specific economic and consumer-driven factors. Australia, with its large population and affluent consumer base, consistently emerges as the dominant country within the Oceania region, exhibiting a strong demand for both premium and everyday coffee consumption. New Zealand follows closely, with a growing appreciation for specialty coffee and a robust café culture.

Within the Product Type segment, Whole-Bean Coffee and Ground Coffee are leading the market, primarily driven by:

- Economic Growth & Disposable Income: Higher disposable incomes in Australia and New Zealand allow consumers to invest in higher-quality whole-bean and ground coffee for home brewing.

- Specialty Coffee Culture: The proliferation of independent coffee shops and a growing consumer interest in home barista setups fuels demand for premium whole beans and finely ground coffee for various brewing methods.

- Product Innovation: Roasters are increasingly offering single-origin, ethically sourced, and uniquely blended whole beans, appealing to discerning palates.

The Instant Coffee segment, while mature, continues to hold a significant share due to its unparalleled convenience and affordability, particularly in the Off-Trade distribution channel. The Others category, encompassing RTD coffee, coffee pods, and flavored coffee, is experiencing the fastest growth, fueled by:

- Convenience Demand: Busy lifestyles necessitate quick and easy coffee solutions, driving the popularity of RTD beverages and single-serve pods.

- Product Diversification: Manufacturers are introducing a wide array of flavors and functional benefits (e.g., added vitamins, protein) to cater to diverse consumer preferences.

In terms of Distribution Channel, the Off-Trade segment overwhelmingly dominates the Oceania coffee market, with Supermarkets/Hypermarkets being the primary channel for volume sales, driven by:

- Extensive Reach & Accessibility: Supermarkets and hypermarkets are ubiquitous, offering a one-stop shop for grocery needs, including coffee.

- Competitive Pricing & Promotions: These channels frequently offer competitive pricing, bulk discounts, and promotional deals that attract price-sensitive consumers.

- Brand Visibility: Major coffee brands leverage the extensive shelf space in supermarkets for significant brand visibility.

Convenience Stores are also crucial, catering to immediate consumption needs and impulse purchases. Specialist Retailers, including dedicated coffee bean shops and gourmet food stores, cater to a niche but growing segment of coffee enthusiasts seeking artisanal and premium products. The On-Trade channel, comprising cafés, restaurants, and hotels, remains vital for the overall coffee experience and brand building, but its market share by volume is smaller compared to the off-trade. Infrastructure development, including efficient logistics networks, further supports the widespread availability of coffee products across all these channels.

Oceania Coffee Market Product Developments

Product innovation in the Oceania coffee market is characterized by a strong emphasis on quality, convenience, and sustainability. Advancements in roasting techniques are yielding more nuanced flavor profiles and consistent quality in both whole-bean and ground coffee. The market is witnessing a surge in single-origin offerings and ethically sourced blends, catering to the growing consumer demand for transparency and traceability. Ready-to-drink (RTD) coffee beverages are evolving with new flavor combinations and functional additions like added protein or vitamins, appealing to health-conscious consumers. Furthermore, the development of more environmentally friendly packaging solutions, including compostable pods and recyclable materials, is a key area of focus, enhancing the market relevance of these products and offering a competitive edge to forward-thinking brands.

Challenges in the Oceania Coffee Market Market

The Oceania coffee market, while experiencing robust growth, faces several inherent challenges. Regulatory hurdles, particularly concerning import quotas and varying food safety standards across different Oceania nations, can create complexity and increase operational costs for international suppliers. Supply chain disruptions, exacerbated by global events and climate change impacting coffee-producing regions, pose a significant threat to consistent availability and pricing. Intense competitive pressures from both established global brands and a rising number of local specialty roasters lead to price sensitivity and the constant need for differentiation. Volatile raw material prices, influenced by global commodity markets and weather patterns, directly impact profitability margins. The projected impact of these challenges on market growth is estimated to be a reduction of approximately XX% in the overall CAGR if not effectively mitigated.

Forces Driving Oceania Coffee Market Growth

Several potent forces are driving the expansion of the Oceania coffee market. Technological advancements in cultivation, processing, and brewing equipment are enhancing product quality and consumer experience. The economic stability and rising disposable incomes in key Oceania countries empower consumers to indulge in premium coffee products. Evolving consumer preferences, leaning towards specialty coffee, health-conscious options, and sustainable sourcing, create significant demand for innovative offerings. Supportive government policies that facilitate trade and investment further lubricate market growth. The increasing urbanization and development of a vibrant café culture across Australia and New Zealand also act as powerful catalysts, encouraging regular coffee consumption and exploration of diverse coffee experiences.

Challenges in the Oceania Coffee Market Market

Long-term growth catalysts in the Oceania coffee market are intrinsically linked to sustained innovation and strategic market penetration. The ongoing evolution of the specialty coffee segment, with its focus on unique origins, processing methods, and artisanal roasting, provides a continuous avenue for premiumization and increased consumer engagement. Strategic partnerships between coffee roasters and food service providers, as well as collaborations with technology firms to enhance the at-home brewing experience, are poised to unlock new growth potentials. Furthermore, market expansions into underserved demographics or regions within Oceania, coupled with a continued focus on sustainable and ethical sourcing practices, will foster brand loyalty and attract a growing segment of conscious consumers, ensuring enduring market relevance.

Emerging Opportunities in Oceania Coffee Market

Emerging opportunities in the Oceania coffee market are ripe for exploration. The ready-to-drink (RTD) coffee segment continues to offer substantial growth potential, with opportunities for product diversification into functional beverages and plant-based milk alternatives. The increasing consumer interest in personalized coffee experiences opens doors for subscription services and custom blend offerings. The growth of e-commerce presents a significant opportunity for direct-to-consumer (DTC) sales, allowing smaller roasters to bypass traditional distribution channels and connect directly with a wider customer base. Furthermore, the "third wave" coffee movement, emphasizing high-quality beans and intricate brewing methods, is creating demand for niche products and specialized brewing equipment, presenting opportunities for specialty retailers and educators.

Leading Players in the Oceania Coffee Market Sector

- Starbucks Coffee Company

- Moccona

- Nestle SA

- Seven Miles

- Altura Coffee Co

- Cantarella Bros Pty Ltd

- Ospina Coffee

- McDonald's

- Jacobs Douwe Egberts

- Kokako Organic Coffee Roaster

Key Milestones in Oceania Coffee Market Industry

- 2019: Increased focus on single-origin coffee and ethical sourcing gaining traction.

- 2020: Significant growth in at-home coffee consumption due to global pandemic. Rise in RTD coffee sales.

- 2021: Expansion of specialty coffee roasters and cafés across major cities. Increased investment in sustainable packaging.

- 2022: Growing demand for plant-based coffee creamer alternatives. E-commerce platforms see substantial growth in coffee bean sales.

- 2023: Introduction of innovative cold brew and nitro coffee products in retail. Growing interest in coffee subscriptions.

- 2024: Further consolidation within the instant coffee market. Increased R&D in functional coffee beverages.

Strategic Outlook for Oceania Coffee Market Market

The strategic outlook for the Oceania coffee market remains exceptionally positive, fueled by sustained consumer demand and ongoing innovation. Growth accelerators include the continued premiumization of coffee products, with a focus on artisanal offerings and unique flavor profiles. The expansion of the ready-to-drink (RTD) segment, particularly functional and health-oriented beverages, presents a significant avenue for market penetration. Leveraging e-commerce and direct-to-consumer (DTC) models will be crucial for both established players and emerging brands to reach a wider audience and foster brand loyalty. Furthermore, a deep commitment to sustainable and ethical sourcing practices will not only resonate with a growing segment of conscious consumers but also contribute to long-term supply chain resilience and brand reputation, ensuring sustained market growth and profitability.

Oceania Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Others

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Others

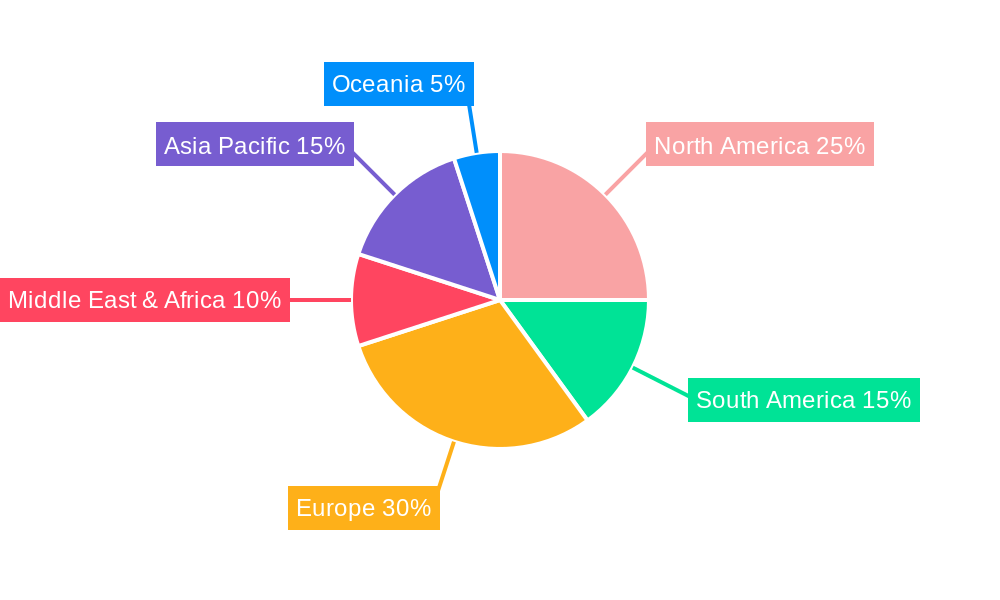

Oceania Coffee Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oceania Coffee Market Regional Market Share

Geographic Coverage of Oceania Coffee Market

Oceania Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players

- 3.3. Market Restrains

- 3.3.1. Need for Stringent Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Rising Demand For Instant Coffee in The Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole-Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarket/Hypermarket

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole-Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarket/Hypermarket

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole-Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarket/Hypermarket

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole-Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarket/Hypermarket

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Oceania Coffee Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whole-Bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffee

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarket/Hypermarket

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Specialist Retailers

- 10.2.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Starbucks Coffee Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Moccona

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nestle SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Seven Miles

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Altura Coffee Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cantarella Bros Pty Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ospina Coffee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McDonald's

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jacobs Douwe Egberts

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kokako Organic Coffee Roaster

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Starbucks Coffee Company

List of Figures

- Figure 1: Global Oceania Coffee Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oceania Coffee Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Oceania Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Oceania Coffee Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Oceania Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Oceania Coffee Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Oceania Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Oceania Coffee Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America Oceania Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Oceania Coffee Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America Oceania Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Oceania Coffee Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Oceania Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Oceania Coffee Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Oceania Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Oceania Coffee Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe Oceania Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Oceania Coffee Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Oceania Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Oceania Coffee Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Oceania Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Oceania Coffee Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Oceania Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Oceania Coffee Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Oceania Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Oceania Coffee Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Oceania Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Oceania Coffee Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Oceania Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Oceania Coffee Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Oceania Coffee Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Oceania Coffee Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Oceania Coffee Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Oceania Coffee Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Oceania Coffee Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Oceania Coffee Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Oceania Coffee Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Oceania Coffee Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Oceania Coffee Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Oceania Coffee Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oceania Coffee Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Oceania Coffee Market?

Key companies in the market include Starbucks Coffee Company, Moccona, Nestle SA, Seven Miles, Altura Coffee Co, Cantarella Bros Pty Ltd, Ospina Coffee, McDonald's, Jacobs Douwe Egberts, Kokako Organic Coffee Roaster.

3. What are the main segments of the Oceania Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players.

6. What are the notable trends driving market growth?

Rising Demand For Instant Coffee in The Region.

7. Are there any restraints impacting market growth?

Need for Stringent Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oceania Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oceania Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oceania Coffee Market?

To stay informed about further developments, trends, and reports in the Oceania Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence