Key Insights

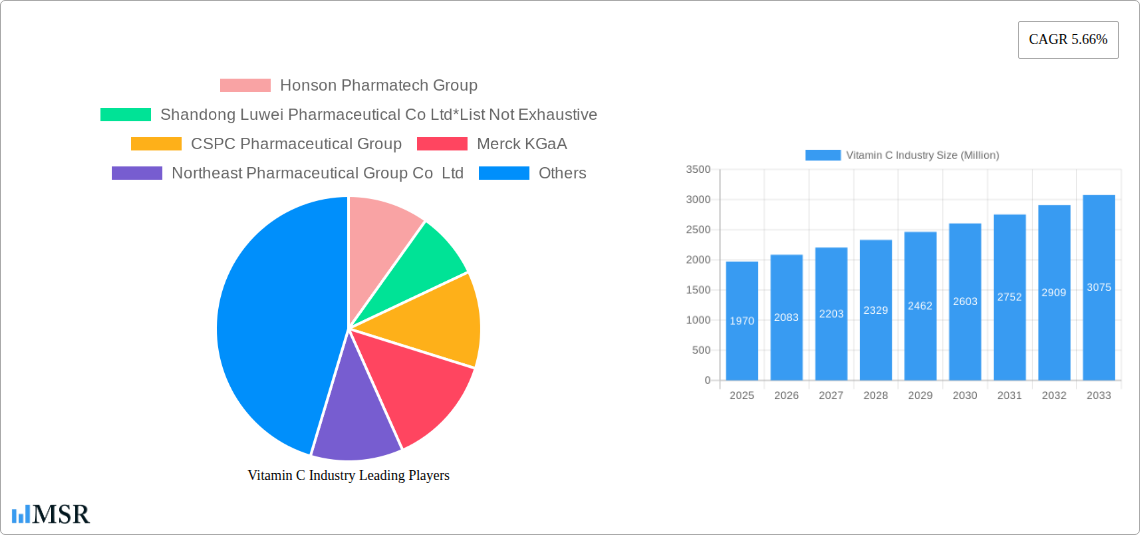

The global Vitamin C market is poised for significant expansion, projected to reach USD 1.97 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.66% throughout the forecast period. This growth is fueled by an increasing awareness of Vitamin C's multifaceted health benefits, encompassing its role as a potent antioxidant, immune system booster, and its application in skincare for its collagen-boosting and skin-brightening properties. The food and beverage industry continues to be a primary consumer, leveraging Vitamin C for fortification and preservation, while the pharmaceuticals and healthcare sector utilizes it extensively in supplements and medical treatments. The beauty and personal care segment is also witnessing a surge in demand, with consumers actively seeking out products that offer natural anti-aging and protective qualities. Furthermore, the animal feed industry is adopting Vitamin C to enhance livestock health and productivity, contributing to the overall market expansion.

Vitamin C Industry Market Size (In Billion)

Emerging trends such as the growing preference for natural and organic ingredients, coupled with advancements in production technologies that enhance purity and bioavailability, are expected to further propel the Vitamin C market. However, the market may encounter certain restraints, including price volatility of raw materials and potential regulatory changes impacting manufacturing processes and product labeling. Despite these challenges, the overarching positive outlook for Vitamin C is supported by its indispensable role in human and animal health, as well as its diverse applications across key industries. Companies like Honson Pharmatech Group, Shandong Luwei Pharmaceutical Co Ltd, and BASF SE are key players actively shaping the market landscape through innovation and strategic expansions.

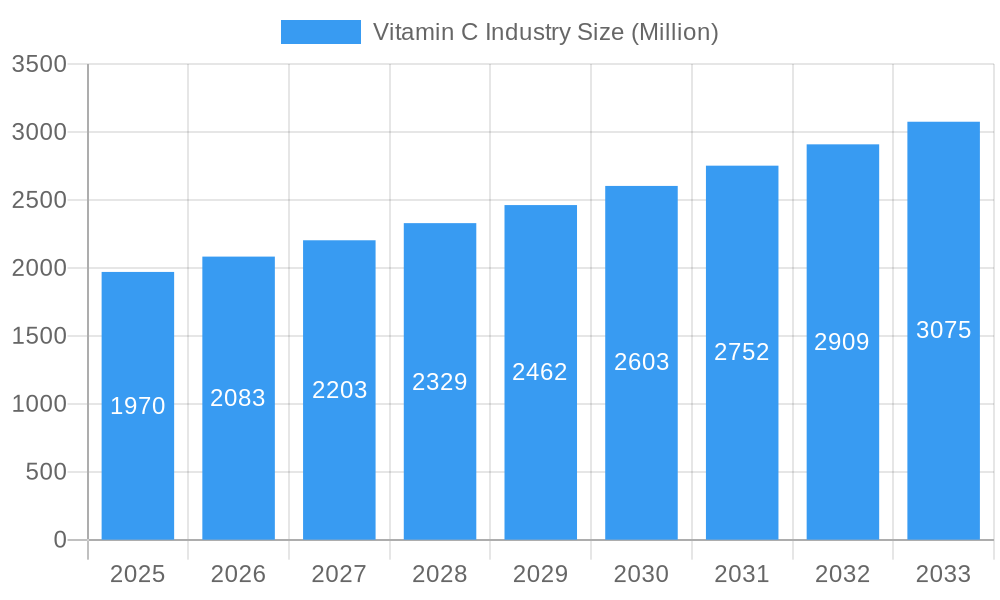

Vitamin C Industry Company Market Share

Comprehensive Vitamin C Industry Market Analysis: Growth, Trends, and Opportunities 2019-2033

This in-depth report provides a definitive analysis of the global Vitamin C market, offering critical insights for pharmaceutical companies, food and beverage manufacturers, beauty and personal care brands, animal feed producers, and chemical suppliers. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this research delves into market dynamics, key drivers, emerging opportunities, and competitive landscapes. Uncover actionable intelligence to inform your strategic decisions in the thriving Vitamin C industry.

Vitamin C Industry Market Concentration & Dynamics

The global Vitamin C market exhibits a moderate to high level of concentration, with a few key players dominating production and supply. Companies like Honson Pharmatech Group, Shandong Luwei Pharmaceutical Co Ltd, CSPC Pharmaceutical Group, Merck KGaA, Northeast Pharmaceutical Group Co Ltd, BASF SE, Freshine Chem, Koninklijke DSM NV, Foodchem International Corporation, and MC Biotec Inc. are prominent. Innovation ecosystems are characterized by ongoing research into improved production methods, higher purity grades, and novel delivery systems for Vitamin C applications. Regulatory frameworks, primarily focused on food safety, pharmaceutical standards, and cosmetic ingredient approval, play a crucial role in shaping market entry and product development. Substitute products, such as other antioxidants, exist but often lack the broad efficacy and widespread consumer recognition of Vitamin C. End-user trends highlight a growing demand for fortified foods, dietary supplements, and cosmeceuticals, directly impacting the Vitamin C market size. Mergers and acquisitions (M&A) activities, though not at an extreme level, are strategic moves to consolidate market share, expand product portfolios, and gain access to new technologies. For instance, the merger of Royal DSM with Firmenich in May 2022, creating DSM-Firmenich with significant combined sales, underscores the trend towards consolidation and diversification within the broader health and nutrition sector, impacting the Vitamin C supply chain.

Vitamin C Industry Industry Insights & Trends

The Vitamin C industry is poised for significant expansion, driven by a confluence of factors including increasing consumer awareness regarding health and wellness, the rising prevalence of chronic diseases, and the expanding applications of Vitamin C across diverse sectors. The global market size for Vitamin C is projected to reach substantial figures, with a Compound Annual Growth Rate (CAGR) estimated to be robust during the forecast period of 2025–2033. This growth is underpinned by the inherent biological importance of Vitamin C as a potent antioxidant, its role in immune system support, and its essential function in collagen synthesis, making it a highly sought-after ingredient in pharmaceuticals and healthcare. Technological disruptions are primarily focused on optimizing production processes, such as fermentation and synthesis, to enhance yield, reduce costs, and improve the environmental sustainability of Vitamin C manufacturing. Innovations in nanotechnology are also emerging, exploring novel ways to encapsulate Vitamin C for improved bioavailability and targeted delivery in beauty and personal care products. Evolving consumer behaviors reflect a clear preference for natural and scientifically-backed ingredients. Consumers are increasingly seeking to proactively manage their health through dietary supplements and functional foods, directly boosting demand for high-quality Vitamin C. Furthermore, the trend towards clean beauty and natural skincare formulations is propelling the adoption of Vitamin C in cosmetics, where its skin-brightening and anti-aging properties are highly valued. The animal feed segment also contributes to market growth, as Vitamin C is recognized for its role in animal health and immune function, particularly during periods of stress or disease. The historical period from 2019 to 2024 has witnessed a steady upward trajectory, setting a strong foundation for continued growth in the coming years.

Key Markets & Segments Leading Vitamin C Industry

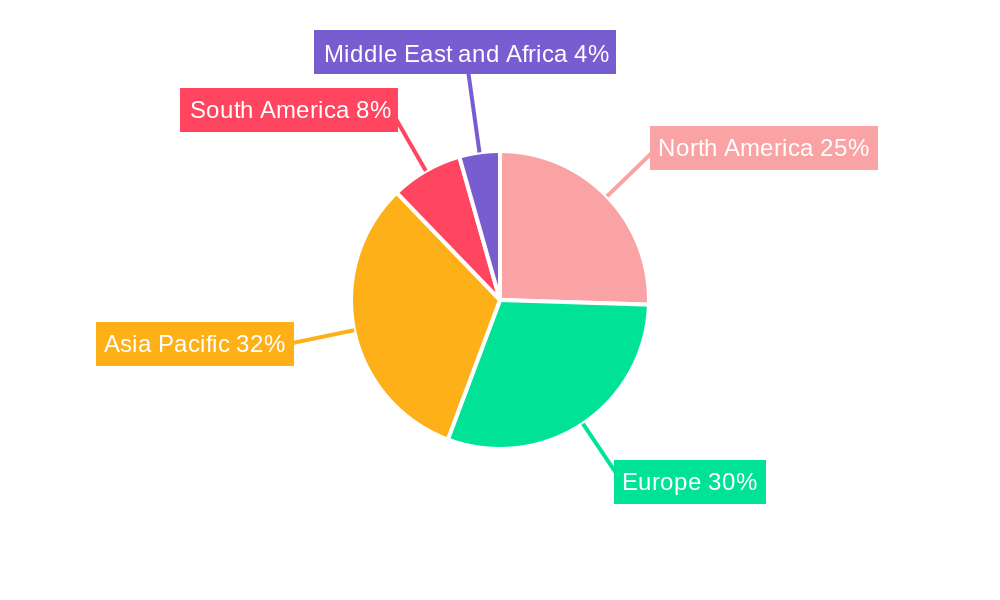

The global Vitamin C market is characterized by dominant regions and segments, each fueled by unique economic and demographic factors.

Dominant Region: Asia Pacific

- Economic Growth: Rapid industrialization and increasing disposable incomes in countries like China and India are driving demand across all Vitamin C application segments.

- Manufacturing Hub: Asia Pacific, particularly China, is a major manufacturing hub for Vitamin C production, leading to competitive pricing and substantial export volumes.

- Growing Healthcare Expenditure: Rising healthcare awareness and increased spending on pharmaceuticals and dietary supplements in the region are significant growth catalysts.

Dominant Segment: Pharmaceuticals and Healthcare

- Immune Support: The ongoing global focus on immune health and the prevention of diseases fuels demand for Vitamin C as a dietary supplement and active pharmaceutical ingredient (API).

- Antioxidant Properties: Its well-established antioxidant benefits are crucial for developing drugs targeting oxidative stress-related conditions.

- Regulatory Approvals: Stringent regulatory standards in this sector necessitate high-purity Vitamin C, often produced through advanced manufacturing processes.

Strong Performing Segment: Food and Beverage

- Fortification Trends: The widespread use of Vitamin C for fortifying juices, cereals, dairy products, and other food items to enhance nutritional value and shelf life is a primary driver.

- Consumer Demand for Healthy Products: The increasing consumer preference for healthier food options and functional beverages directly translates to higher Vitamin C consumption.

- Preservative Applications: Vitamin C also acts as a natural antioxidant preservative in various food products, further boosting its demand.

Emerging Segment: Beauty and Personal Care

- Anti-Aging and Skin Brightening: The recognized efficacy of Vitamin C in reducing wrinkles, improving skin tone, and protecting against UV damage has led to its surge in popularity in skincare products.

- Natural Ingredient Demand: The growing consumer preference for natural and effective skincare ingredients aligns perfectly with Vitamin C's profile.

- Innovations in Formulation: Advancements in formulation technologies are enabling the stable and effective incorporation of Vitamin C into a wider range of cosmetic products.

The dominance of the Asia Pacific region, coupled with the robust performance of the Pharmaceuticals and Healthcare and Food and Beverage segments, signifies the core pillars of the global Vitamin C market. The Beauty and Personal Care segment, while currently smaller, presents a significant growth trajectory driven by evolving consumer preferences and innovative product development.

Vitamin C Industry Product Developments

The Vitamin C industry is experiencing dynamic product development, focusing on enhancing purity, bioavailability, and specific functionalities. Innovations are centered on optimizing manufacturing processes, such as advanced fermentation techniques and enzymatic synthesis, to achieve higher yields and more sustainable production of Vitamin C raw materials. Furthermore, there is a growing trend towards developing specialized forms of Vitamin C, including stabilized derivatives and encapsulated versions, for improved efficacy in cosmetics and pharmaceuticals. These advancements aim to address challenges like oxidation and to ensure targeted delivery, thereby enhancing the market relevance and competitive edge of Vitamin C in its diverse applications.

Challenges in the Vitamin C Industry Market

The Vitamin C industry faces several challenges that can impact its growth trajectory. Regulatory hurdles related to differing standards across regions for food, pharmaceutical, and cosmetic applications can complicate market entry and product approvals. Supply chain disruptions, exacerbated by geopolitical factors, natural disasters, or fluctuations in raw material availability, can lead to price volatility and affect production capacities. Intense competitive pressures among manufacturers, particularly in high-volume markets, can squeeze profit margins. Furthermore, the price sensitivity of certain end-user segments, especially in the animal feed and basic food fortification sectors, can limit the adoption of premium-priced or specialized Vitamin C forms.

Forces Driving Vitamin C Industry Growth

The Vitamin C industry is propelled by several potent growth drivers. Technologically, advancements in bioprocesses and fermentation are leading to more efficient and cost-effective production of Vitamin C, thereby increasing its accessibility. Economically, rising disposable incomes globally are fueling increased consumer spending on health-enhancing products, including dietary supplements and fortified foods, where Vitamin C is a key ingredient. Regulatory factors, such as the increasing emphasis on nutritional labeling and the approval of Vitamin C for various health claims in regions like Europe and North America, are also significant drivers. Moreover, the growing awareness among consumers about the health benefits of Vitamin C, particularly its antioxidant and immune-boosting properties, is a fundamental economic and social force underpinning market expansion.

Challenges in the Vitamin C Industry Market

The long-term growth of the Vitamin C industry is intrinsically linked to continuous innovation and strategic market expansion. Overcoming challenges will require a focus on developing novel applications, such as specialized Vitamin C derivatives for targeted therapeutic interventions in pharmaceuticals and healthcare. Strategic partnerships and collaborations between ingredient manufacturers and end-product formulators can accelerate product development cycles and market penetration. Furthermore, expanding into emerging geographical markets with a growing middle class and increasing health consciousness presents significant long-term growth opportunities. Companies that invest in sustainable production practices and transparent sourcing will also gain a competitive advantage, aligning with evolving consumer and regulatory expectations.

Emerging Opportunities in Vitamin C Industry

Emerging opportunities in the Vitamin C industry are diverse and promising. The burgeoning demand for nutraceuticals and functional foods offers a significant avenue for growth, as consumers increasingly seek preventative health solutions. Innovations in cosmeceuticals and advanced skincare formulations, leveraging Vitamin C's potent anti-aging and skin-brightening properties, represent a rapidly expanding market. The development of novel drug delivery systems for Vitamin C in pharmaceutical applications, enhancing its therapeutic efficacy for various conditions, also presents a substantial opportunity. Furthermore, exploring new applications in areas like aquaculture and specialized animal nutrition, where Vitamin C plays a crucial role in animal health and resilience, opens up untapped market potential.

Leading Players in the Vitamin C Industry Sector

- Honson Pharmatech Group

- Shandong Luwei Pharmaceutical Co Ltd

- CSPC Pharmaceutical Group

- Merck KGaA

- Northeast Pharmaceutical Group Co Ltd

- BASF SE

- Freshine Chem

- Koninklijke DSM NV

- Foodchem International Corporation

- MC Biotec Inc

Key Milestones in Vitamin C Industry Industry

- December 2022: Merck KGaA and Mersana Therapeutics announced a joint partnership to create novel immunostimulatory antibody-drug conjugates. This collaboration strengthens the internal expertise and internal ADC strategy of Merck KGaA, Darmstadt, Germany.

- May 2022: Royal DSM merged with Firmenich. DSM-Firmenich has four business units such as perfumery and beauty, food and beverage, health and nutrition, and animal nutrition with combined sales of approximately EUR 11.5 billion.

Strategic Outlook for Vitamin C Industry Market

The strategic outlook for the Vitamin C industry is overwhelmingly positive, driven by enduring trends in health and wellness, a robust demand for functional ingredients, and continuous product innovation. Key growth accelerators include the expanding applications in the pharmaceuticals and healthcare sector, particularly for immune support and the development of novel therapeutic agents. The food and beverage industry will continue to rely on Vitamin C for fortification and preservation, while the beauty and personal care market offers significant expansion opportunities with the rise of anti-aging and skin-brightening formulations. Future market potential will also be influenced by advancements in sustainable manufacturing practices and the exploration of untapped geographical markets. Strategic investments in R&D, focused on enhancing bioavailability and developing specialized Vitamin C derivatives, will be crucial for maintaining a competitive edge and capitalizing on emerging opportunities within this dynamic industry.

Vitamin C Industry Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Pharmaceuticals and Healthcare

- 1.3. Beauty and Personal Care

- 1.4. Animal Feed

Vitamin C Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Vitamin C Industry Regional Market Share

Geographic Coverage of Vitamin C Industry

Vitamin C Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Fortified/Functional Food and Beverage Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Pharmaceuticals and Healthcare

- 5.1.3. Beauty and Personal Care

- 5.1.4. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Pharmaceuticals and Healthcare

- 6.1.3. Beauty and Personal Care

- 6.1.4. Animal Feed

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Pharmaceuticals and Healthcare

- 7.1.3. Beauty and Personal Care

- 7.1.4. Animal Feed

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Pharmaceuticals and Healthcare

- 8.1.3. Beauty and Personal Care

- 8.1.4. Animal Feed

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Pharmaceuticals and Healthcare

- 9.1.3. Beauty and Personal Care

- 9.1.4. Animal Feed

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage

- 10.1.2. Pharmaceuticals and Healthcare

- 10.1.3. Beauty and Personal Care

- 10.1.4. Animal Feed

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honson Pharmatech Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shandong Luwei Pharmaceutical Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSPC Pharmaceutical Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Northeast Pharmaceutical Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Freshine Chem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke DSM NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Foodchem International Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MC Biotec Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honson Pharmatech Group

List of Figures

- Figure 1: Global Vitamin C Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Vitamin C Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Spain Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South Africa Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vitamin C Industry?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Vitamin C Industry?

Key companies in the market include Honson Pharmatech Group, Shandong Luwei Pharmaceutical Co Ltd*List Not Exhaustive, CSPC Pharmaceutical Group, Merck KGaA, Northeast Pharmaceutical Group Co Ltd, BASF SE, Freshine Chem, Koninklijke DSM NV, Foodchem International Corporation, MC Biotec Inc.

3. What are the main segments of the Vitamin C Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increasing Demand from Fortified/Functional Food and Beverage Application.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

In December 2022, Merck KGaA and Mersana Therapeutics announced a joint partnership to create novel immunostimulatory antibody-drug conjugates. This collaboration strengthens the internal expertise and internal ADC strategy of Merck KGaA, Darmstadt, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vitamin C Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vitamin C Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vitamin C Industry?

To stay informed about further developments, trends, and reports in the Vitamin C Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence