Key Insights

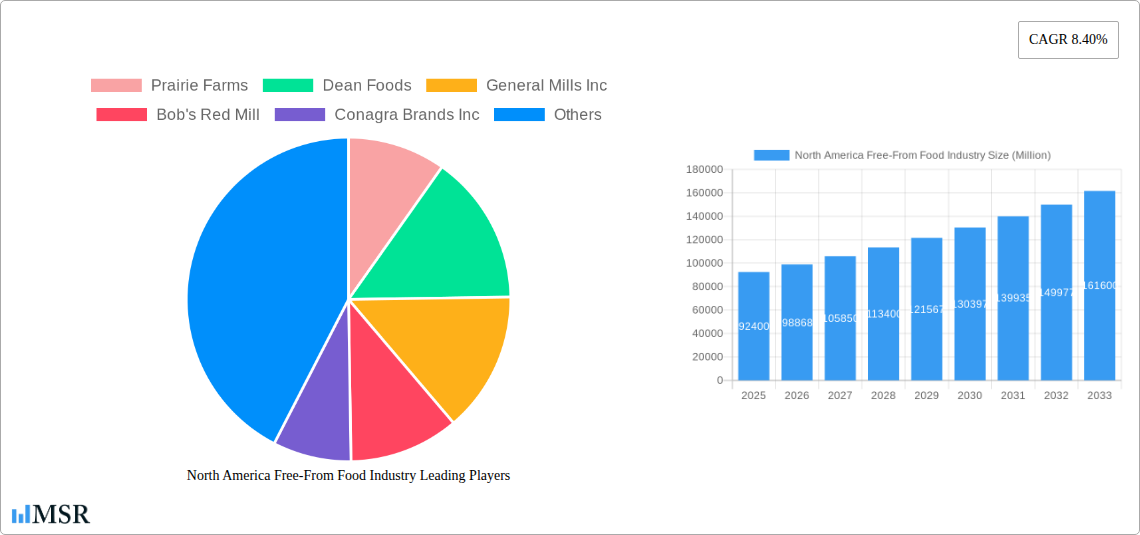

The North American Free-From Food Industry is poised for significant expansion, with a projected market size of USD 92.4 billion in 2025. This growth is fueled by a compelling CAGR of 7% expected throughout the forecast period of 2025-2033. The primary drivers behind this surge are increasing consumer awareness regarding health and wellness, a growing prevalence of food allergies and intolerances, and a heightened demand for transparent labeling and ethically sourced products. Consumers are actively seeking alternatives to gluten, dairy, and common allergens, leading to a robust market for specialized food products. This trend is further amplified by the proactive product development and strategic expansions undertaken by key industry players, who are continuously innovating to cater to evolving dietary needs and preferences. The industry's ability to adapt to these consumer demands and integrate innovative solutions will be crucial for sustained growth.

North America Free-From Food Industry Market Size (In Billion)

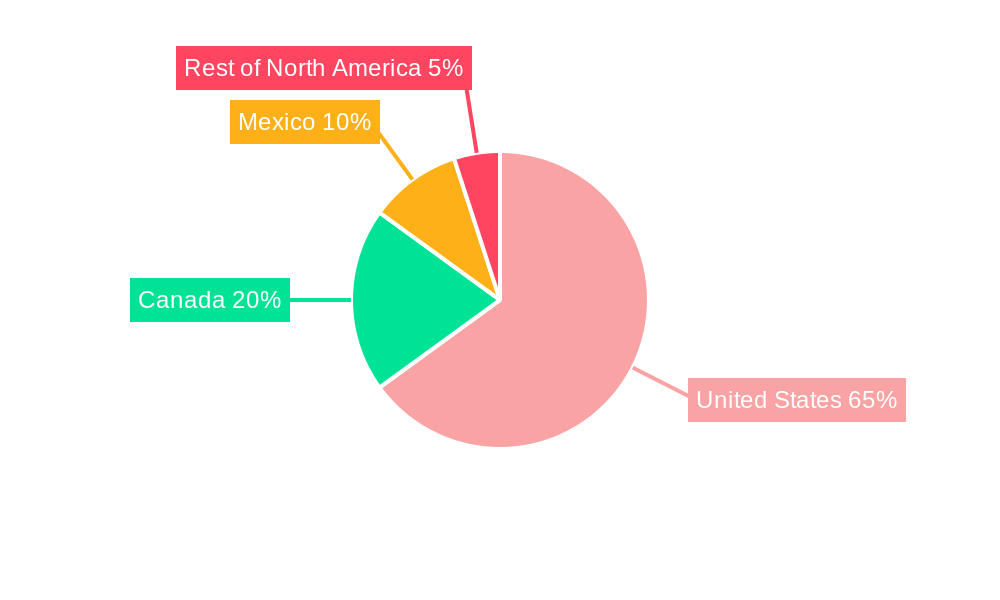

The market's trajectory is further shaped by evolving consumer lifestyles and dietary choices, with significant growth anticipated across various segments. Bakery and confectionery, dairy-free foods, and snacks are emerging as dominant end-product categories, reflecting a broader shift towards healthier snacking and indulgence alternatives. Distribution channels are also diversifying, with online retail stores experiencing accelerated adoption alongside traditional supermarkets and hypermarkets, offering consumers unparalleled convenience. Geographically, the United States continues to lead the market, but Canada and Mexico are exhibiting promising growth rates. While the market is characterized by strong demand, potential restraints include the higher cost of raw materials for free-from products, complex manufacturing processes, and the need for stringent quality control to prevent cross-contamination, which could impact pricing and accessibility. Nevertheless, the overarching trend towards health-conscious eating and the increasing availability of diverse free-from options underscore a vibrant and expanding North American market.

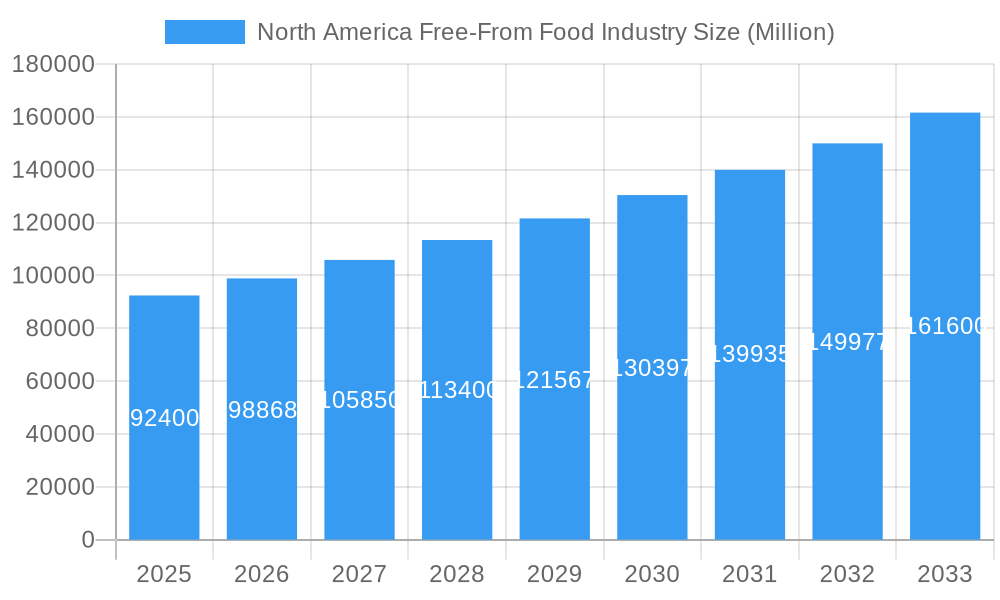

North America Free-From Food Industry Company Market Share

Here is an SEO-optimized report description for the North America Free-From Food Industry, incorporating your specific requirements and keywords.

Report Title: North America Free-From Food Industry: Market Size, Trends, Innovations, and Forecast (2025-2033)

Report Description: Unlock critical insights into the booming North America Free-From Food Industry. This comprehensive report delivers a deep dive into market dynamics, growth drivers, and strategic opportunities, empowering stakeholders to navigate this rapidly evolving landscape. Discover the latest trends in gluten-free food, dairy-free products, and allergen-free foods. Analyze key segments including bakery and confectionery, dairy-free foods, and snacks. Understand the influence of supermarkets/hypermarkets and online retail stores on distribution. With detailed market analysis for the United States, Canada, and Mexico, and covering the historical period 2019–2024 and a forecast period 2025–2033, this report is an essential resource for food manufacturers, ingredient suppliers, retailers, and investors seeking to capitalize on the free-from food market.

North America Free-From Food Industry Market Concentration & Dynamics

The North America Free-From Food Industry exhibits a dynamic and moderately concentrated market, driven by escalating consumer demand for healthier and specialized dietary options. Innovation ecosystems are flourishing, with a significant surge in new product development across gluten-free, dairy-free, and allergen-free categories. Regulatory frameworks are continuously evolving to ensure product safety and transparent labeling, fostering consumer trust and market growth. The threat of substitute products remains moderate, as the "free-from" attributes are often primary purchasing drivers. End-user trends are heavily influenced by rising health consciousness, increasing prevalence of food allergies and intolerances, and a growing vegan and plant-based movement. Mergers and acquisitions (M&A) activities are a key indicator of market maturation, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, the historical period (2019-2024) saw an estimated 50+ M&A deals, indicating active consolidation. Market share distribution is projected to see continued fragmentation with niche players gaining traction.

North America Free-From Food Industry Industry Insights & Trends

The North America Free-From Food Industry is poised for substantial expansion, driven by a confluence of factors that are reshaping consumer preferences and food manufacturing. The market size is estimated to reach approximately $75 billion in the base year 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This robust growth is primarily fueled by heightened consumer awareness regarding health and wellness. An increasing number of individuals are actively seeking foods free from gluten, dairy, common allergens, and artificial ingredients, either due to medical necessity (celiac disease, lactose intolerance, allergies) or lifestyle choices (veganism, paleo diets, general health optimization). This escalating demand directly translates into increased sales volumes for manufacturers specializing in these products.

Technological disruptions are playing a pivotal role in this industry's evolution. Advances in food processing technologies, ingredient innovation, and formulation techniques are enabling the creation of free-from products that not only meet dietary restrictions but also deliver superior taste, texture, and nutritional profiles, thereby overcoming historical perceptions of compromise. For example, novel plant-based protein sources and alternative flours are allowing for more diverse and appealing bakery and confectionery items.

Evolving consumer behaviors further underpin market growth. Consumers are becoming more discerning, demanding transparency in ingredient sourcing and manufacturing processes. They are actively researching product labels, seeking out certifications, and valuing brands that align with their ethical and health-conscious values. The rise of e-commerce has also democratized access to a wider range of free-from products, allowing consumers to easily discover and purchase specialized items from both large corporations and smaller artisanal producers. This accessibility, coupled with the continued rise of "clean label" demands, positions the North America Free-From Food Industry for sustained and significant growth in the coming years, with the market value projected to exceed $140 billion by 2033.

Key Markets & Segments Leading North America Free-From Food Industry

The North America Free-From Food Industry is largely dominated by the United States, which accounts for over 65% of the total market value. This dominance is attributed to a combination of factors including a large and health-conscious consumer base, a well-established retail infrastructure, and significant investment in food research and development. Canada and Mexico are also key contributors, with their respective markets exhibiting strong growth trajectories fueled by similar, albeit smaller, consumer trends.

Within the product segments, Dairy-Free Foods currently represent the largest market share, estimated at over $25 billion in 2025. This segment's growth is propelled by the widespread prevalence of lactose intolerance, the increasing adoption of vegan and plant-based diets, and a general perception of dairy as a potential inflammatory agent for some consumers.

The Gluten-Free segment is also a significant powerhouse, valued at approximately $20 billion in 2025, driven by the diagnosis of celiac disease and the growing trend of adopting gluten-free lifestyles for perceived health benefits. The Allergen-Free segment, while more niche, is experiencing rapid growth due to heightened awareness and diagnosis of various food allergies, commanding a market share of around $15 billion.

In terms of end products, Dairy-free Foods (including plant-based milks, yogurts, cheeses) and Snacks (such as bars, crisps, and confectionery) are leading the charge. The Bakery and Confectionery segment is also a major contributor, with innovations in gluten-free and allergen-free baked goods gaining significant traction. Beverages (juices, plant-based drinks, specialized waters) form another substantial category.

The Supermarkets/Hypermarkets distribution channel continues to be the primary avenue for free-from food sales, benefiting from wide product availability and consumer shopping habits. However, Online Retail Stores are rapidly gaining market share, offering convenience, wider selection, and direct-to-consumer options, especially for specialized or niche products.

Key Drivers for Dominance:

- United States:

- High disposable income and consumer spending on health and wellness products.

- Extensive network of supermarkets and specialty health food stores.

- Strong presence of leading food manufacturers investing heavily in R&D for free-from products.

- Increased awareness and diagnosis of food allergies and intolerances.

- Dairy-Free Foods Segment:

- Growing vegan and plant-based lifestyle adoption.

- High prevalence of lactose intolerance across the population.

- Innovation in plant-based alternatives mimicking taste and texture of dairy.

- Snacks End Product:

- Convenience-driven consumption patterns.

- Demand for healthier, guilt-free snacking options.

- Versatility of free-from ingredients in snack formulations.

- Supermarkets/Hypermarkets Distribution Channel:

- Established consumer shopping habits and broad product accessibility.

- Effective merchandising and promotional strategies for free-from categories.

North America Free-From Food Industry Product Developments

Product innovation within the North America Free-From Food Industry is characterized by a relentless pursuit of taste, texture, and nutritional parity with conventional counterparts. Companies are leveraging advancements in ingredient science, such as novel plant-based proteins and gluten-free flours derived from ancient grains and legumes, to create compelling alternatives. For instance, the development of creamy, dairy-free ice creams and cheeses that genuinely mimic their traditional counterparts is a significant achievement. Similarly, allergen-free baked goods now offer improved crumb structure and flavor profiles, moving beyond chalky or dense textures. The market relevance is high, as these advancements directly address consumer pain points and expand the appeal of free-from options to a broader audience, driving trial and repeat purchases, and solidifying their place in mainstream diets.

Challenges in the North America Free-From Food Industry Market

The North America Free-From Food Industry faces several key challenges that could temper its otherwise robust growth. Regulatory hurdles, particularly regarding the definition and labeling of "free-from" claims and cross-contamination prevention, can create complexities for manufacturers. Supply chain issues, including the sourcing of specialized ingredients and ensuring consistent availability and quality, present ongoing logistical challenges. Competitive pressures are intensifying as both established food giants and nimble startups vie for market share, leading to price wars and demanding product differentiation. The cost of production for many free-from ingredients can also be higher, translating into premium pricing that may deter price-sensitive consumers. Quantifiable impacts include an estimated 5-10% higher production cost for many free-from products compared to their conventional counterparts.

Forces Driving North America Free-From Food Industry Growth

Several powerful forces are propelling the growth of the North America Free-From Food Industry. Technological advancements in food science are enabling the creation of superior tasting and textured free-from products, bridging the gap between dietary needs and consumer desires. Economic factors, such as rising disposable incomes and a growing middle class's willingness to spend on health-oriented foods, are significant contributors. Regulatory bodies are also increasingly supporting clear labeling and allergen awareness, which indirectly boosts consumer confidence and market demand. Furthermore, the burgeoning awareness of the health benefits associated with reducing or eliminating certain ingredients, coupled with the increasing diagnoses of food allergies and intolerances, acts as a substantial growth catalyst.

Challenges in the North America Free-From Food Industry Market

The sustained expansion of the North America Free-From Food Industry is underpinned by several long-term growth catalysts. Continuous innovation in ingredient technology, such as the development of novel sweeteners, emulsifiers, and binders that mimic conventional counterparts without allergens or gluten, is crucial. Strategic partnerships between ingredient suppliers, food manufacturers, and retailers will facilitate wider product availability and consumer education. Market expansions into underserved demographics and geographical regions, alongside a deeper understanding of diverse dietary needs beyond the primary categories, will unlock new avenues for growth. The increasing focus on sustainability and ethical sourcing within the free-from space also presents a significant opportunity for brands to differentiate themselves and attract a values-driven consumer base.

Emerging Opportunities in North America Free-From Food Industry

Emerging opportunities within the North America Free-From Food Industry are abundant and span several key areas. The growing demand for plant-based alternatives to meat and seafood, extending beyond dairy, presents a significant untapped market. Personalized nutrition solutions, tailored to individual genetic predispositions and dietary needs, are poised to revolutionize how consumers approach free-from diets. The expansion of convenience food offerings that are also free-from, such as ready-to-eat meals and snacks, caters to busy lifestyles. Furthermore, the rest of North America, encompassing emerging markets and evolving consumer preferences in regions beyond the major hubs, offers substantial growth potential. Technologies like AI-driven recipe development and blockchain for supply chain transparency can also create new competitive advantages.

Leading Players in the North America Free-From Food Industry Sector

- Prairie Farms

- Dean Foods

- General Mills Inc

- Bob's Red Mill

- Conagra Brands Inc

- Hain Celestial Group Inc

- Johnson & Johnson (Lactaid)

- AMY'S KITCHEN INC

Key Milestones in North America Free-From Food Industry Industry

- 2019: Increased prevalence of gluten-free product certifications and expanded availability in mainstream grocery stores.

- 2020: Significant surge in demand for plant-based dairy alternatives due to growing veganism and health consciousness, exacerbated by the global pandemic.

- 2021: Innovations in allergen-free baking, offering improved taste and texture for consumers with multiple allergies.

- 2022: Expansion of online retail channels for free-from foods, increasing accessibility and product discovery for niche brands.

- 2023: Growing consumer focus on clean label ingredients and transparent sourcing within the free-from food market.

- 2024: Increased investment in research and development for advanced plant-based protein technologies for meat and dairy substitutes.

Strategic Outlook for North America Free-From Food Industry Market

The strategic outlook for the North America Free-From Food Industry is exceptionally positive, with continued robust growth anticipated. Key accelerators include further innovation in taste and texture to rival conventional products, and expansion into emerging consumer segments like flexitarians and health-conscious individuals seeking cleaner labels. Strategic opportunities lie in leveraging digital platforms for direct-to-consumer sales, enhancing supply chain resilience for specialized ingredients, and focusing on sustainability to meet evolving consumer values. Partnerships and collaborations will be crucial for market penetration and product diversification, ensuring the industry remains at the forefront of dietary evolution and health trends.

North America Free-From Food Industry Segmentation

-

1. Type

- 1.1. Gluten Free

- 1.2. Dairy Free

- 1.3. Allergen Free

- 1.4. Other Types

-

2. End Product

- 2.1. Bakery and Confectionery

- 2.2. Dairy-free Foods

- 2.3. Snacks

- 2.4. Beverages

- 2.5. Other End Products

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Convenience Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Free-From Food Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Free-From Food Industry Regional Market Share

Geographic Coverage of North America Free-From Food Industry

North America Free-From Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Allergen Free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Free-From Food Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gluten Free

- 5.1.2. Dairy Free

- 5.1.3. Allergen Free

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End Product

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy-free Foods

- 5.2.3. Snacks

- 5.2.4. Beverages

- 5.2.5. Other End Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Convenience Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Free-From Food Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gluten Free

- 6.1.2. Dairy Free

- 6.1.3. Allergen Free

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End Product

- 6.2.1. Bakery and Confectionery

- 6.2.2. Dairy-free Foods

- 6.2.3. Snacks

- 6.2.4. Beverages

- 6.2.5. Other End Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Convenience Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Free-From Food Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gluten Free

- 7.1.2. Dairy Free

- 7.1.3. Allergen Free

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End Product

- 7.2.1. Bakery and Confectionery

- 7.2.2. Dairy-free Foods

- 7.2.3. Snacks

- 7.2.4. Beverages

- 7.2.5. Other End Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Convenience Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Free-From Food Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gluten Free

- 8.1.2. Dairy Free

- 8.1.3. Allergen Free

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End Product

- 8.2.1. Bakery and Confectionery

- 8.2.2. Dairy-free Foods

- 8.2.3. Snacks

- 8.2.4. Beverages

- 8.2.5. Other End Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Convenience Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Free-From Food Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gluten Free

- 9.1.2. Dairy Free

- 9.1.3. Allergen Free

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End Product

- 9.2.1. Bakery and Confectionery

- 9.2.2. Dairy-free Foods

- 9.2.3. Snacks

- 9.2.4. Beverages

- 9.2.5. Other End Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Online Retail Stores

- 9.3.3. Convenience Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Prairie Farms

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dean Foods

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bob's Red Mill

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Conagra Brands Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hain Celestial Group Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson (Lactaid)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AMY'S KITCHEN INC*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Prairie Farms

List of Figures

- Figure 1: North America Free-From Food Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Free-From Food Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Free-From Food Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Free-From Food Industry Revenue undefined Forecast, by End Product 2020 & 2033

- Table 3: North America Free-From Food Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Free-From Food Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: North America Free-From Food Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Free-From Food Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: North America Free-From Food Industry Revenue undefined Forecast, by End Product 2020 & 2033

- Table 8: North America Free-From Food Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Free-From Food Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: North America Free-From Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Free-From Food Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: North America Free-From Food Industry Revenue undefined Forecast, by End Product 2020 & 2033

- Table 13: North America Free-From Food Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Free-From Food Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: North America Free-From Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Free-From Food Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: North America Free-From Food Industry Revenue undefined Forecast, by End Product 2020 & 2033

- Table 18: North America Free-From Food Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Free-From Food Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Free-From Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: North America Free-From Food Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: North America Free-From Food Industry Revenue undefined Forecast, by End Product 2020 & 2033

- Table 23: North America Free-From Food Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: North America Free-From Food Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: North America Free-From Food Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Free-From Food Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the North America Free-From Food Industry?

Key companies in the market include Prairie Farms, Dean Foods, General Mills Inc, Bob's Red Mill, Conagra Brands Inc, Hain Celestial Group Inc, Johnson & Johnson (Lactaid), AMY'S KITCHEN INC*List Not Exhaustive.

3. What are the main segments of the North America Free-From Food Industry?

The market segments include Type, End Product, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks.

6. What are the notable trends driving market growth?

Increasing Demand For Allergen Free Products.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Free-From Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Free-From Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Free-From Food Industry?

To stay informed about further developments, trends, and reports in the North America Free-From Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence