Key Insights

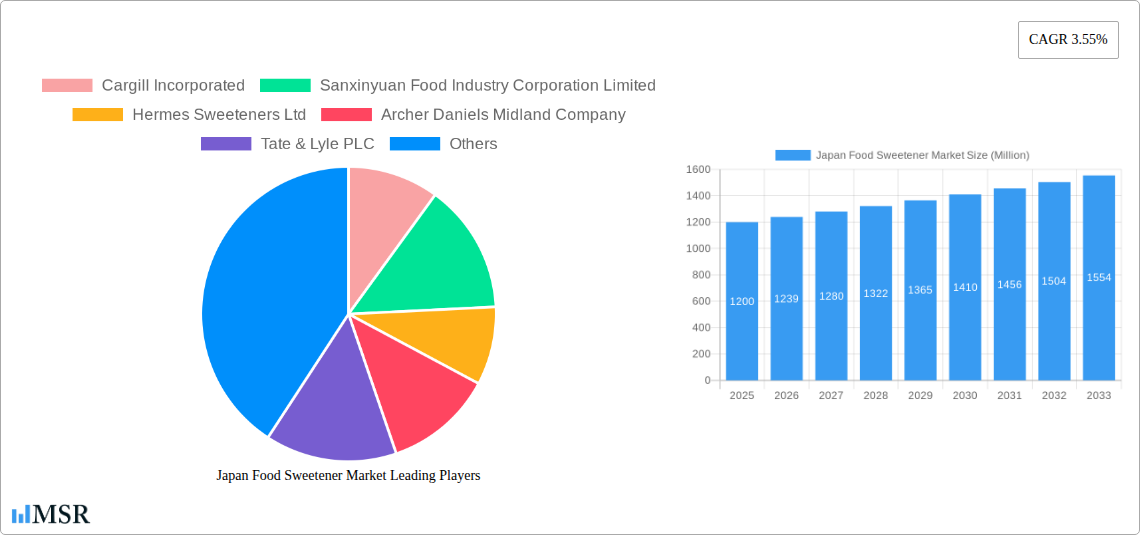

The Japanese food sweetener market is poised for steady growth, with a projected market size of $1.2 billion in 2025. This expansion is driven by a confluence of evolving consumer preferences and the ongoing innovation within the food and beverage industry. A significant factor contributing to this growth is the increasing demand for reduced-sugar and calorie-conscious options, prompting manufacturers to explore a wider array of sweeteners, including high-intensity sweeteners and sugar alcohols. Furthermore, the bakery and confectionery sector, a dominant application segment in Japan, continues to be a key demand generator, supported by the enduring popularity of traditional sweets and the emergence of novel dessert trends. The beverage industry also plays a crucial role, with a growing segment of consumers seeking healthier alternatives that do not compromise on taste.

Japan Food Sweetener Market Market Size (In Billion)

Looking ahead, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 3.3% from 2025 to 2033. This sustained growth trajectory is underpinned by several key drivers. The rising health and wellness consciousness among Japanese consumers, coupled with an aging population that is more mindful of dietary intake, fuels the demand for sweeteners that offer health benefits or lower caloric content. Innovations in sweetener technology, such as the development of more natural and functional sweeteners, are also expected to open up new avenues for market expansion. While the market benefits from these positive trends, it also navigates certain restraints, including stringent regulatory frameworks surrounding food additives and the fluctuating raw material costs associated with certain sweetener production. Nonetheless, the overall outlook for the Japanese food sweetener market remains robust, driven by consumer demand for healthier and more diverse sweetening solutions.

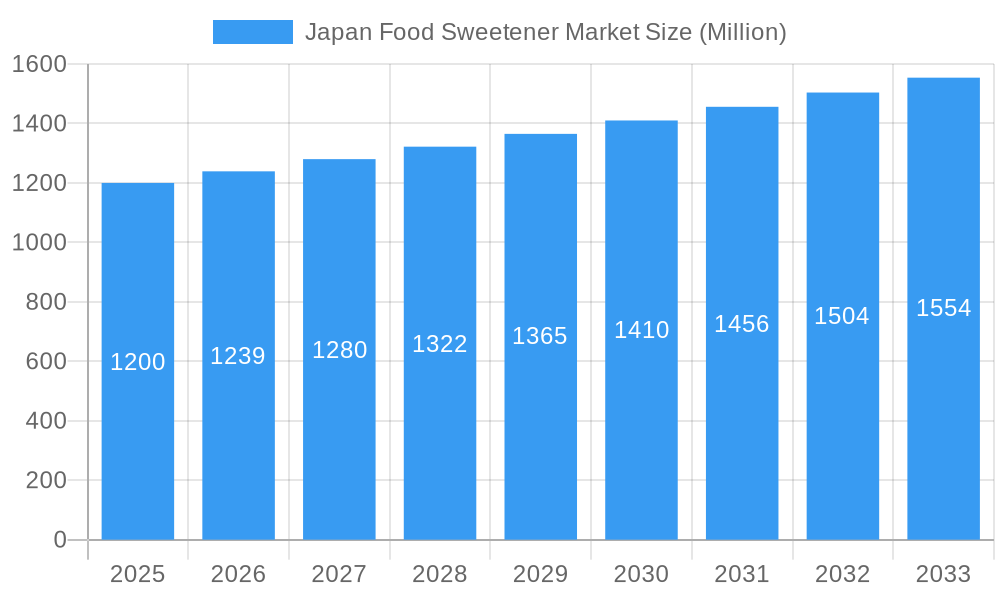

Japan Food Sweetener Market Company Market Share

Unlocking Sweet Opportunities: Japan Food Sweetener Market Report 2025-2033

This comprehensive report offers an in-depth analysis of the Japan food sweetener market, projecting a robust growth trajectory from 2025 to 2033. Driven by evolving consumer preferences for healthier alternatives, technological advancements in sweetener production, and strategic industry developments, the market is poised for significant expansion. We provide critical insights into market dynamics, industry trends, key segments, product innovations, challenges, growth drivers, emerging opportunities, leading players, and pivotal milestones, equipping stakeholders with actionable intelligence to navigate this dynamic landscape. The Japan food sweetener market size is estimated to reach $XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Japan Food Sweetener Market Market Concentration & Dynamics

The Japan food sweetener market exhibits a moderately consolidated structure, with key players actively engaging in strategic initiatives to gain market share. Innovation plays a crucial role, fueled by extensive research and development in creating novel, healthier, and cost-effective sweetening solutions. The regulatory landscape, particularly concerning food safety and labeling standards for sweeteners, is a significant factor influencing market entry and product formulations. Substitute products, such as natural sweeteners and sugar reduction technologies, are continuously emerging, posing a competitive challenge. End-user trends are increasingly leaning towards reduced sugar intake, driving demand for low-calorie and natural sweeteners. Mergers and acquisitions (M&A) activities are observed, aimed at expanding product portfolios and market reach. The market has witnessed XX M&A deals in the historical period, indicating a trend towards consolidation and strategic partnerships. Cargill Incorporated holds an estimated XX% market share in the starch sweeteners segment, while Tate & Lyle PLC is a leading player in the high-intensity sweeteners segment with an estimated XX% share.

Japan Food Sweetener Market Industry Insights & Trends

The Japan food sweetener market is experiencing robust growth driven by several pivotal factors. A primary driver is the escalating consumer awareness regarding health and wellness, leading to a significant demand for reduced-sugar and sugar-free food and beverage products. This trend is further amplified by government initiatives promoting healthier lifestyles and stricter regulations on sugar content in processed foods. Technological disruptions are revolutionizing the production and application of sweeteners. The development of advanced extraction and purification techniques for natural sweeteners like stevia and monk fruit, coupled with breakthroughs in fermentation technologies for producing sugar alcohols, are enhancing product quality, affordability, and scalability. Evolving consumer behaviors, including a growing preference for natural ingredients and clean-label products, are compelling manufacturers to reformulate their offerings. The demand for functional sweeteners, which offer additional health benefits beyond sweetening, is also on the rise. The market is characterized by a sustained focus on research and development, leading to the introduction of innovative sweeteners with improved taste profiles and functionalities. The Japan food sweetener market size was valued at approximately $XX billion in 2024 and is projected to expand at a CAGR of XX% from 2025 to 2033. The increasing adoption of sugar substitutes in diverse food applications, from beverages and confectionery to savory products, underscores the market's expansion.

Key Markets & Segments Leading Japan Food Sweetener Market

The Japan food sweetener market is segmented by product type and application, each presenting distinct growth dynamics.

Product Type Dominance:

High-intensity Sweeteners (HIS): This segment is a significant growth engine, driven by the increasing demand for low-calorie and sugar-free products.

- Stevia: The rising popularity of natural sweeteners makes stevia a dominant force within the HIS category. Its zero-calorie profile and plant-based origin align perfectly with consumer preferences.

- Sucralose: Continues to hold a substantial market share due to its stability, taste profile, and wide applicability across various food and beverage categories.

- Other High-intensity Sweeteners: Innovations in this sub-segment are continually introducing new options with improved taste and functionality, contributing to market growth.

Starch Sweeteners and Sugar Alcohols: These remain crucial components in the sweetener market, offering a balance of sweetness, texture, and cost-effectiveness.

- High Fructose Corn Syrup (HFCS): Despite health concerns in some regions, HFCS remains a widely used sweetener in Japan due to its economic viability and functional properties, particularly in beverages and processed foods.

- Dextrose: Essential for its role in baking and confectionery, providing browning and texture enhancement.

- Maltodextrin: Widely used as a bulking agent and texture modifier in various food products.

- Sorbitol and Xylitol: Popular sugar alcohols with applications in sugar-free products, particularly in confectionery and oral care products due to their non-cariogenic properties.

Application Dominance:

Beverages: This is the largest application segment, driven by the immense popularity of carbonated drinks, juices, and functional beverages that increasingly opt for reduced-sugar formulations. The demand for sugar-free and diet beverages significantly fuels the consumption of HIS.

Bakery and Confectionery: This segment is a consistent contributor to market growth. Consumers are seeking indulgent treats with lower sugar content, leading manufacturers to incorporate a variety of sweeteners to achieve desired taste and texture profiles. The demand for stevia and sugar alcohols in sugar-free confectionery is particularly notable.

Dairy and Desserts: The growing demand for healthier dairy products and desserts, such as low-sugar yogurts, ice creams, and puddings, is a key driver for sweetener usage in this segment.

Soups, Sauces, and Dressings: While a smaller segment compared to beverages and confectionery, the trend towards healthier, low-sugar condiments and seasonings is contributing to the growth of sweetener adoption in this category.

Japan Food Sweetener Market Product Developments

Product innovation is a cornerstone of the Japan food sweetener market. Key developments include the introduction of novel high-intensity sweeteners with improved taste profiles and synergistic effects when blended. The focus on natural sweeteners, particularly stevia and monk fruit derivatives, continues to drive research into enhanced extraction and purification methods to reduce off-notes and improve cost-effectiveness. Sugar alcohols are seeing advancements in terms of functionality, with new applications being explored beyond traditional sugar-free products. The development of all-natural blends that mimic the taste and mouthfeel of sucrose is a significant trend, catering to manufacturers seeking to reduce sugar without compromising on sensory experience.

Challenges in the Japan Food Sweetener Market Market

Despite its growth, the Japan food sweetener market faces several challenges. Regulatory hurdles regarding the approval and labeling of novel sweeteners can slow down market entry and product adoption. Fluctuations in raw material prices, particularly for natural sweeteners, can impact profit margins and product affordability. Intense competition from both established players and emerging brands necessitates continuous innovation and competitive pricing strategies. Consumer perception and acceptance of certain artificial sweeteners can also pose a challenge, driving the demand for naturally derived alternatives. The sweetener supply chain in Japan can be susceptible to disruptions, impacting the availability and cost of key ingredients.

Forces Driving Japan Food Sweetener Market Growth

Several forces are propelling the growth of the Japan food sweetener market. The increasing prevalence of lifestyle diseases such as diabetes and obesity has created a strong demand for low-calorie sweeteners and sugar alternatives. Government initiatives promoting public health and well-being, including campaigns to reduce sugar consumption, are further bolstering this trend. Technological advancements in sweetener production, such as improved fermentation processes for sugar alcohols and advanced extraction methods for natural sweeteners, are making these options more accessible and cost-effective. The growing global trend towards clean-label and natural ingredients is also significantly influencing the Japanese market, driving demand for natural sweeteners. The beverage industry remains a primary driver, with a continuous stream of low-sugar and sugar-free product launches.

Challenges in the Japan Food Sweetener Market Market

While opportunities abound, the Japan food sweetener market faces certain long-term growth catalysts that need to be navigated. Overcoming consumer skepticism and educating the public about the safety and benefits of various sweeteners are crucial. Continued investment in research and development to create sweeteners with even better taste profiles and functionalities will be essential to maintain market leadership. Strategic partnerships and collaborations between ingredient manufacturers, food and beverage companies, and research institutions can accelerate innovation and market penetration. Expanding the application base of existing sweeteners into new food categories and exploring novel sweetening technologies will also be key growth accelerators.

Emerging Opportunities in Japan Food Sweetener Market

Emerging opportunities within the Japan food sweetener market are multifaceted. The growing demand for stevia sweeteners and other natural, plant-based alternatives presents a significant avenue for expansion. The increasing interest in sugar alcohols for their functional benefits, such as dental health and prebiotic properties, opens up new product development possibilities. The market for specialized sweeteners tailored for specific dietary needs, such as keto-friendly or diabetic-friendly products, is expected to grow. Furthermore, advancements in flavor masking technologies will allow for wider adoption of sweeteners with potentially challenging taste profiles. The export potential of Japanese-developed sweetener technologies and finished products also represents an emerging opportunity.

Leading Players in the Japan Food Sweetener Market Sector

- Cargill Incorporated

- Sanxinyuan Food Industry Corporation Limited

- Hermes Sweeteners Ltd

- Archer Daniels Midland Company

- Tate & Lyle PLC

- DuPont de Nemours Inc

- Ingredion Incorporated

- A&Z Food Additives Company Limited

- Corbion NV

- Kerry Group plc

Key Milestones in Japan Food Sweetener Market Industry

- November 2022: Tate & Lyle PLC launched Erytesse Erythritol in Japan and worldwide, a zero-calorie sweetener with 70% of sucrose's sweetness, suitable for beverages, dairy, bakery, and confectionery.

- March 2022: Cargill announced the commercial availability of its EverSweet + ClearFlo stevia sweetener technology in Japan and worldwide, enabling blended natural tastes with improved solubility and stability.

- July 2021: Ingredion Incorporated completed the acquisition of PureCircle Limited, a leading stevia producer, enhancing its global stevia portfolio and capabilities for the Japanese market.

Strategic Outlook for Japan Food Sweetener Market Market

The strategic outlook for the Japan food sweetener market is overwhelmingly positive, fueled by a persistent demand for healthier food options and ongoing technological innovation. Key growth accelerators include the continued development and market penetration of natural sweeteners like stevia, alongside the expansion of sugar alcohol applications in various food matrices. Strategic partnerships between ingredient suppliers and food manufacturers will be crucial for co-creating innovative products that meet evolving consumer needs. The market's trajectory will also be influenced by proactive engagement with regulatory bodies to streamline the introduction of novel sweetening solutions. The focus on taste optimization and cost-competitiveness will remain paramount for sustained market success.

Japan Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose

-

1.2. Starch Sweeteners and Sugar Alcohols

- 1.2.1. Dextrose

- 1.2.2. High Fructose Corn Syrup

- 1.2.3. Maltodextrin

- 1.2.4. Sorbitol

- 1.2.5. Xylitol

- 1.2.6. Other Starch Sweeteners and Sugar Alcohols

-

1.3. High-intensity Sweeteners (HIS)

- 1.3.1. Sucralose

- 1.3.2. Aspartame

- 1.3.3. Saccharin

- 1.3.4. Cyclamate

- 1.3.5. Acesulfame potassium (Ace-K)

- 1.3.6. Neotame

- 1.3.7. Stevia

- 1.3.8. Other High-intensity Sweeteners

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Dairy and Desserts

- 2.3. Beverages

- 2.4. Meat and Meat Products

- 2.5. Soups, Sauces, and Dressings

- 2.6. Other Applications

Japan Food Sweetener Market Segmentation By Geography

- 1. Japan

Japan Food Sweetener Market Regional Market Share

Geographic Coverage of Japan Food Sweetener Market

Japan Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Increasing Diabetic Population in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.2.1. Dextrose

- 5.1.2.2. High Fructose Corn Syrup

- 5.1.2.3. Maltodextrin

- 5.1.2.4. Sorbitol

- 5.1.2.5. Xylitol

- 5.1.2.6. Other Starch Sweeteners and Sugar Alcohols

- 5.1.3. High-intensity Sweeteners (HIS)

- 5.1.3.1. Sucralose

- 5.1.3.2. Aspartame

- 5.1.3.3. Saccharin

- 5.1.3.4. Cyclamate

- 5.1.3.5. Acesulfame potassium (Ace-K)

- 5.1.3.6. Neotame

- 5.1.3.7. Stevia

- 5.1.3.8. Other High-intensity Sweeteners

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy and Desserts

- 5.2.3. Beverages

- 5.2.4. Meat and Meat Products

- 5.2.5. Soups, Sauces, and Dressings

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanxinyuan Food Industry Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes Sweeteners Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tate & Lyle PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont de Nemours Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A&Z Food Additives Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corbion NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Japan Food Sweetener Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Japan Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Japan Food Sweetener Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Japan Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Japan Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Japan Food Sweetener Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Food Sweetener Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Japan Food Sweetener Market?

Key companies in the market include Cargill Incorporated, Sanxinyuan Food Industry Corporation Limited, Hermes Sweeteners Ltd, Archer Daniels Midland Company, Tate & Lyle PLC, DuPont de Nemours Inc , Ingredion Incorporated, A&Z Food Additives Company Limited, Corbion NV, Kerry Group plc.

3. What are the main segments of the Japan Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Increasing Diabetic Population in the Country.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

November 2022: Tate & Lyle PLC launched a new sweetener, Erytesse Erythritol, in Japan and worldwide. It has 70% of the sweetness of sucrose and a similar temporal profile with zero calories. It can be used in a range of categories, including beverages, dairy, bakery, and confectionery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Japan Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence