Key Insights

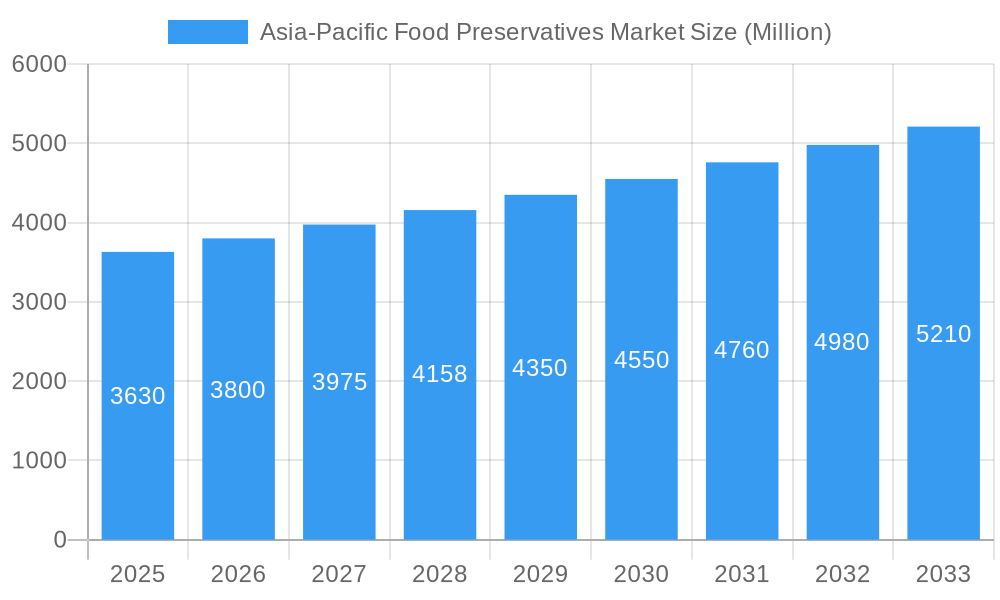

The Asia-Pacific Food Preservatives Market is poised for significant expansion, driven by evolving consumer preferences for longer shelf-life products and increasing awareness of food safety. The market is projected to reach USD 3.63 billion in 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This upward trajectory is fueled by several key factors. The rising disposable incomes across the region, particularly in emerging economies like China and India, are leading to greater demand for processed and convenience foods, which inherently rely on effective preservation techniques. Furthermore, the burgeoning food processing industry, coupled with stringent government regulations on food quality and safety, is compelling manufacturers to adopt advanced food preservative solutions. The increasing urbanization and changing lifestyles also contribute to the consumption of packaged goods, further bolstering market growth. The demand for both natural and synthetic preservatives is expected to rise, catering to diverse product categories and consumer demands for cleaner labels and extended freshness.

Asia-Pacific Food Preservatives Market Market Size (In Billion)

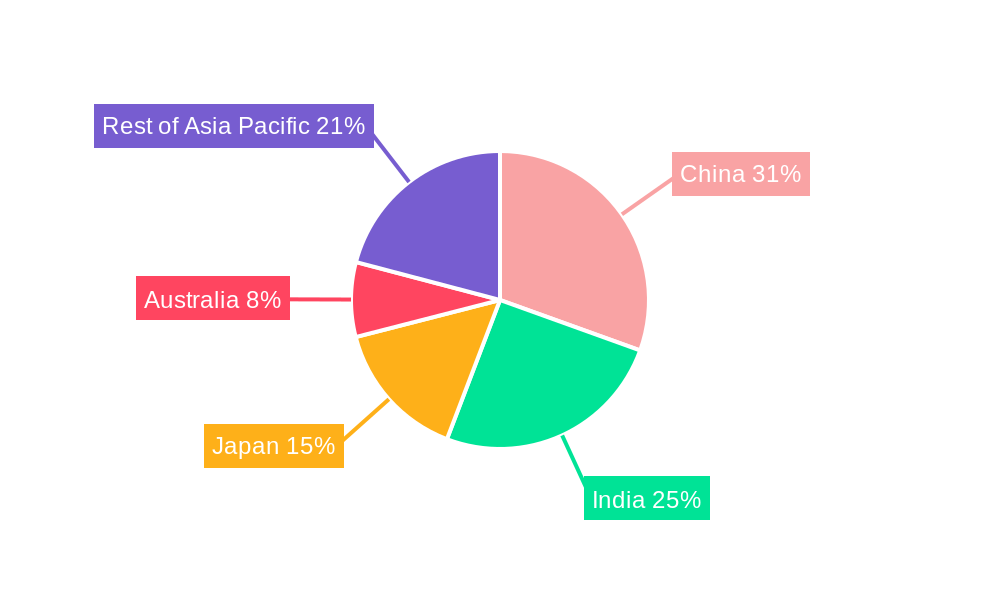

The market's expansion is not without its challenges. While the demand for food preservatives is high, concerns regarding the potential health impacts of certain synthetic preservatives are leading to a growing preference for natural alternatives. This presents an opportunity for innovation and development in the natural food preservatives segment. Geographically, China and India are expected to be the dominant markets due to their large populations and rapidly developing food industries. The "Rest of Asia-Pacific" region, encompassing nations like Southeast Asian countries, also presents substantial growth potential as food processing capabilities advance. Key players are actively investing in research and development to offer a wider range of preservative solutions that align with consumer trends for healthier and safer food options. The market is characterized by a dynamic interplay between technological advancements, regulatory landscapes, and consumer perception, all contributing to its anticipated robust growth in the coming years.

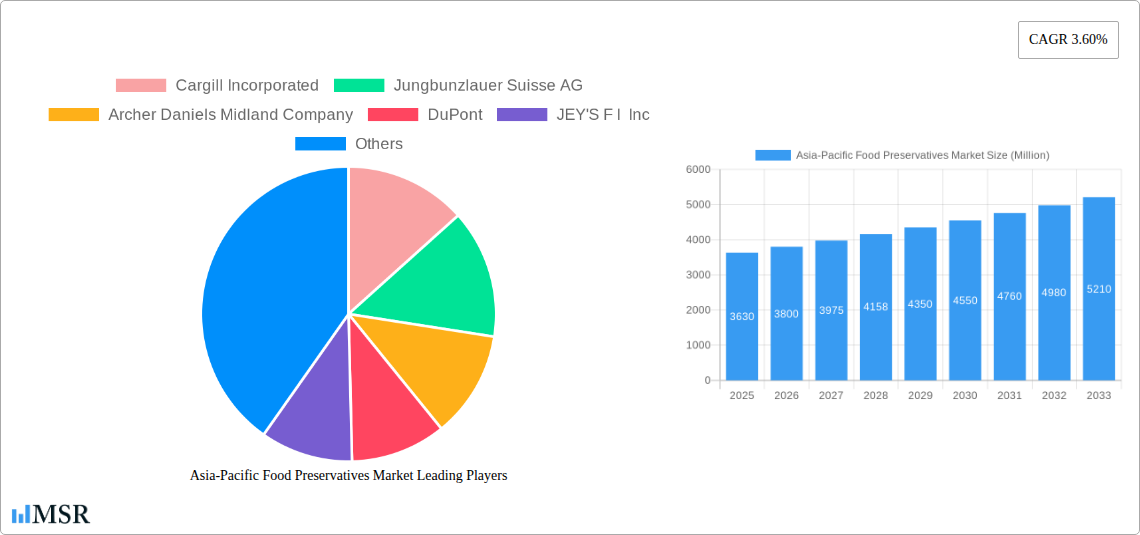

Asia-Pacific Food Preservatives Market Company Market Share

This in-depth report provides a definitive analysis of the Asia-Pacific Food Preservatives Market, a dynamic sector critical to food safety, shelf-life extension, and consumer demand for quality. Covering the historical period from 2019 to 2024, base year 2025, and a comprehensive forecast period extending to 2033, this study offers unparalleled insights into market dynamics, key players, emerging trends, and strategic opportunities. Our research meticulously analyzes the market size, projected to reach $XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Delve into segment-specific growth across Natural and Synthetic preservatives, and gain actionable intelligence on applications spanning Bakery, Dairy and Frozen Products, Confectionery, Meat, Poultry and Seafood, Beverages, Sauces and Salad Mixes, and Other Applications.

Asia-Pacific Food Preservatives Market Market Concentration & Dynamics

The Asia-Pacific food preservatives market exhibits a moderate to high concentration, with a few key players like Cargill Incorporated, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, DuPont, JEY'S F I Inc, Kerry Group, Koninklijke DSM NV, and Corbion NV holding significant market share. Innovation ecosystems are robust, driven by increasing R&D investments in natural and clean-label preservative solutions. Regulatory frameworks vary across countries, influencing the adoption of specific preservative types and demanding adherence to stringent food safety standards. The threat of substitute products, such as advanced packaging technologies and stringent cold chain management, remains a factor, though preservatives continue to play a crucial role in extending shelf life and preventing spoilage. End-user trends are shifting towards demand for natural ingredients, organic certifications, and reduced artificial additives. Mergers and Acquisitions (M&A) activities are strategically shaping the market landscape, with an estimated XX M&A deal counts within the historical period. These dynamics are essential for understanding competitive advantages and future market trajectories.

Asia-Pacific Food Preservatives Market Industry Insights & Trends

The Asia-Pacific food preservatives market is experiencing robust growth, driven by a confluence of escalating population, rising disposable incomes, and a heightened consumer awareness regarding food safety and extended shelf life. The market size, estimated at $XX billion in the base year 2025, is projected to witness significant expansion throughout the forecast period (2025–2033). Technological advancements are at the forefront, with a notable surge in the development and adoption of natural preservative solutions derived from plant extracts, fermentation, and essential oils. This trend is a direct response to evolving consumer preferences for clean-label products and a desire to move away from synthetic additives. Companies are actively investing in research and development (R&D) to enhance the efficacy and cost-effectiveness of these natural alternatives.

Furthermore, the expanding food processing industry across the region, particularly in emerging economies, is a significant growth catalyst. Increased urbanization and changing lifestyles have led to a greater reliance on processed and convenience foods, thereby amplifying the demand for effective food preservation techniques. The meat, poultry, and seafood segment, along with the dairy and frozen products sector, are key application areas demonstrating substantial demand for preservatives due to their susceptibility to microbial spoilage. Innovations in synthetic preservatives also continue, focusing on improved performance and broader application spectrums, even as natural alternatives gain traction. The regulatory landscape, while sometimes complex, is also evolving to align with global food safety standards, encouraging manufacturers to adopt compliant and advanced preservative systems. This dynamic interplay of consumer demand, technological innovation, and industry expansion underpins the strong growth trajectory of the Asia-Pacific food preservatives market.

Key Markets & Segments Leading Asia-Pacific Food Preservatives Market

China stands as a dominant force in the Asia-Pacific food preservatives market, propelled by its massive population, rapid industrialization, and a burgeoning middle class with increasing purchasing power. Economic growth in China has spurred significant investment in its food processing sector, creating a substantial demand for a wide array of food preservatives.

- Dominant Geography: China

- Drivers:

- Economic Growth & Urbanization: Rapid economic development and increasing urbanization lead to higher demand for processed and packaged foods, necessitating effective preservation.

- Large Consumer Base: China's vast population creates an inherently large market for all food products, directly translating to preservative demand.

- Government Support & Regulations: Favorable government policies supporting the food industry and evolving food safety regulations encourage the adoption of advanced preservation techniques.

- Expanding Food Export Industry: China's role as a global food exporter mandates adherence to international quality and safety standards, including robust preservation methods.

- Drivers:

India follows closely, driven by its large and young population, a rapidly growing food processing industry, and increasing consumer awareness about food safety and quality. The Meat, Poultry and Seafood segment exhibits particularly strong growth in both China and India, owing to increasing consumption of protein-rich diets and the need to maintain the freshness and safety of these perishable products.

- Dominant Application: Meat, Poultry and Seafood

- Drivers:

- Increasing Protein Consumption: Rising disposable incomes and changing dietary habits are driving higher consumption of meat, poultry, and seafood.

- Perishability & Spoilage Concerns: These products are highly susceptible to microbial growth and spoilage, making effective preservatives essential for extending shelf life and ensuring safety.

- Food Safety Regulations: Stringent regulations concerning the handling and sale of meat, poultry, and seafood necessitate robust preservation solutions.

- Global Trade Demands: The export of these products to international markets requires compliance with global quality and safety standards, including effective preservation.

- Drivers:

In terms of preservative types, the Natural segment is witnessing accelerated growth, mirroring global trends towards clean-label products. Consumers are increasingly seeking food products with recognizable and naturally derived ingredients, pushing manufacturers to reformulate their products.

- Growing Segment: Natural Preservatives

- Drivers:

- Consumer Demand for Clean Labels: A growing preference for transparent ingredient lists and avoidance of artificial additives.

- Health and Wellness Trends: Perception of natural ingredients as healthier and safer.

- Technological Advancements: Improved extraction and application methods for natural preservatives are enhancing their efficacy.

- Regulatory Push: Some regions are encouraging or mandating the use of natural alternatives.

- Drivers:

While China and India lead in overall market volume, Japan and Australia also represent significant markets, particularly for premium and specialty food products, where high-quality natural preservatives are often preferred. The "Rest of Asia-Pacific" region, encompassing Southeast Asian nations, is also an emerging market with substantial growth potential due to increasing disposable incomes and a growing food processing sector.

Asia-Pacific Food Preservatives Market Product Developments

Product developments in the Asia-Pacific food preservatives market are heavily focused on the innovation of natural and clean-label solutions. Companies are investing in R&D to isolate and optimize novel antimicrobial compounds from natural sources such as plant extracts, essential oils, and fermentation byproducts. These advancements aim to enhance efficacy, improve sensory profiles, and ensure cost-competitiveness with synthetic alternatives. The application of these new preservatives is being explored across a wider range of food matrices, including dairy, bakery, and processed meats, to meet evolving consumer preferences for healthier and more sustainable food options.

Challenges in the Asia-Pacific Food Preservatives Market Market

The Asia-Pacific food preservatives market faces several challenges that can impede its growth. Regulatory complexities and variations across different countries necessitate extensive compliance efforts for manufacturers, potentially increasing operational costs and slowing down market entry. The volatile pricing of raw materials, particularly for natural preservatives, can impact profit margins and market stability. Furthermore, the growing consumer skepticism towards any form of preservative, even natural ones, and the increasing demand for "preservative-free" products, present a significant challenge, pushing for innovative solutions that genuinely extend shelf life without compromising consumer perception. Supply chain disruptions, as witnessed in recent global events, can also affect the availability and cost of key ingredients and finished products.

Forces Driving Asia-Pacific Food Preservatives Market Growth

Several powerful forces are propelling the growth of the Asia-Pacific food preservatives market. The ever-increasing global population, particularly in the Asia-Pacific region, translates to a sustained and growing demand for food products that require preservation to ensure safety and reduce waste. Economic development and rising disposable incomes are leading to greater consumption of processed and convenience foods, which inherently rely on preservatives for shelf-life extension. Furthermore, heightened consumer awareness regarding food safety standards and a desire for longer-lasting, spoilage-free products are driving the adoption of advanced preservation technologies. Technological advancements in developing more effective and consumer-friendly natural preservatives are also a key growth driver, responding to the clean-label trend.

Challenges in the Asia-Pacific Food Preservatives Market Market

The Asia-Pacific food preservatives market faces long-term growth catalysts that are deeply intertwined with its evolving landscape. The persistent drive towards natural and organic ingredients, coupled with significant investments in R&D for plant-based preservatives, presents a substantial opportunity for market expansion and differentiation. Strategic partnerships and collaborations between ingredient suppliers and food manufacturers are fostering innovation and accelerating the adoption of novel preservation technologies. The expanding food export market from the region also necessitates adherence to stringent global food safety regulations, pushing for the use of sophisticated and compliant preservative systems, thereby ensuring sustained demand.

Emerging Opportunities in Asia-Pacific Food Preservatives Market

Emerging opportunities within the Asia-Pacific food preservatives market are vast and varied. The growing demand for functional foods and beverages presents an avenue for preservatives that can also offer health benefits. Innovations in fermentation-based preservatives and antimicrobial packaging technologies offer novel approaches to food preservation beyond traditional methods. The untapped potential in developing economies within the "Rest of Asia-Pacific" region, characterized by a growing middle class and increasing food processing capabilities, offers significant market expansion opportunities. Furthermore, the increasing focus on sustainable sourcing and production of preservatives aligns with global environmental concerns, creating a niche for eco-friendly solutions.

Leading Players in the Asia-Pacific Food Preservatives Market Sector

- Cargill Incorporated

- Jungbunzlauer Suisse AG

- Archer Daniels Midland Company

- DuPont

- JEY'S F I Inc

- Kerry Group

- Koninklijke DSM NV

- Corbion NV

Key Milestones in Asia-Pacific Food Preservatives Market Industry

- 2022: Corbion NV's acquisition of Thai Preservatives, strengthening its presence and product portfolio in the Asian market.

- 2021: DuPont's launch of innovative natural preservative solutions, catering to the growing demand for clean-label ingredients.

- 2020: Archer Daniels Midland Company's significant investment in the R&D of plant-based preservatives, signaling a strategic shift towards sustainable and natural alternatives.

Strategic Outlook for Asia-Pacific Food Preservatives Market Market

The strategic outlook for the Asia-Pacific food preservatives market is overwhelmingly positive, driven by ongoing global trends and regional dynamics. The continuous consumer demand for safe, fresh, and longer-lasting food products, coupled with the escalating growth of the food processing industry, ensures a sustained market for preservatives. Emphasis on R&D for novel, natural, and sustainable preservative solutions will be a key differentiator, allowing companies to capture market share in the burgeoning clean-label segment. Strategic acquisitions and partnerships will continue to be vital for expanding geographical reach and technological capabilities. Furthermore, navigating the evolving regulatory landscape with agility and investing in supply chain resilience will be crucial for long-term success in this dynamic and critical market.

Asia-Pacific Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Bakery

- 2.2. Dairy and Frozen Products

- 2.3. Confectionery

- 2.4. Meat, Poultry and Seafood

- 2.5. Beverages

- 2.6. Sauces and Salad Mixes

- 2.7. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Food Preservatives Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Food Preservatives Market Regional Market Share

Geographic Coverage of Asia-Pacific Food Preservatives Market

Asia-Pacific Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. China Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Confectionery

- 5.2.4. Meat, Poultry and Seafood

- 5.2.5. Beverages

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Dairy and Frozen Products

- 6.2.3. Confectionery

- 6.2.4. Meat, Poultry and Seafood

- 6.2.5. Beverages

- 6.2.6. Sauces and Salad Mixes

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Dairy and Frozen Products

- 7.2.3. Confectionery

- 7.2.4. Meat, Poultry and Seafood

- 7.2.5. Beverages

- 7.2.6. Sauces and Salad Mixes

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Dairy and Frozen Products

- 8.2.3. Confectionery

- 8.2.4. Meat, Poultry and Seafood

- 8.2.5. Beverages

- 8.2.6. Sauces and Salad Mixes

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Dairy and Frozen Products

- 9.2.3. Confectionery

- 9.2.4. Meat, Poultry and Seafood

- 9.2.5. Beverages

- 9.2.6. Sauces and Salad Mixes

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Dairy and Frozen Products

- 10.2.3. Confectionery

- 10.2.4. Meat, Poultry and Seafood

- 10.2.5. Beverages

- 10.2.6. Sauces and Salad Mixes

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jungbunzlauer Suisse AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JEY'S F I Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kerry Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke DSM NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corbion NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Food Preservatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Preservatives Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Asia-Pacific Food Preservatives Market?

Key companies in the market include Cargill Incorporated, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, DuPont, JEY'S F I Inc, Kerry Group, Koninklijke DSM NV, Corbion NV.

3. What are the main segments of the Asia-Pacific Food Preservatives Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

China Dominates the Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Thai Preservatives by Corbion in 2022 2. Launch of natural preservative solutions by DuPont in 2021 3. Investment in R&D of plant-based preservatives by Archer Daniels Midland Company in 2020

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence