Key Insights

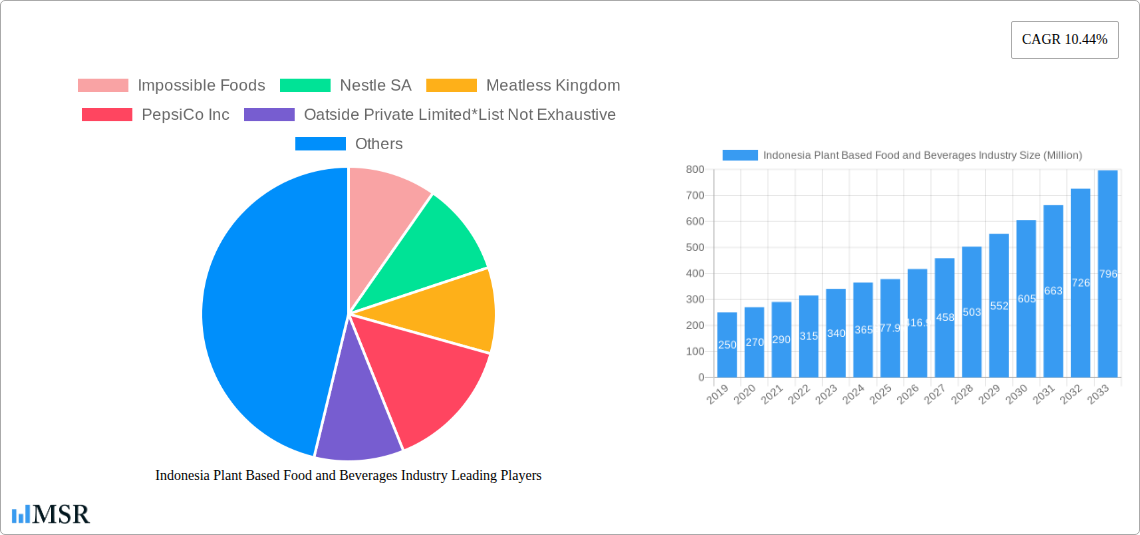

The Indonesian plant-based food and beverages industry is poised for substantial growth, with a projected market size of 377.97 Million in 2025. This vibrant market is expected to expand at a robust Compound Annual Growth Rate (CAGR) of 10.44% through 2033. This upward trajectory is primarily fueled by a growing consumer consciousness towards health and wellness, coupled with increasing awareness of the environmental impact of traditional animal agriculture. Shifts in dietary preferences, particularly among the younger, urbanized demographic, are driving demand for a wider array of plant-based alternatives. Key product segments like meat substitutes, dairy alternative beverages (including soy milk and almond milk), and non-dairy yogurts are witnessing significant traction. The expansion of supermarkets/hypermarkets and the burgeoning online retail channel are effectively catering to this escalating demand, making plant-based options more accessible to a broader consumer base.

Indonesia Plant Based Food and Beverages Industry Market Size (In Million)

Several factors are contributing to the rapid evolution of Indonesia's plant-based market. Growing disposable incomes and a rising middle class are enabling consumers to explore premium and healthier food choices. Furthermore, supportive government initiatives and a burgeoning ecosystem of local and international players, such as Impossible Foods, Nestle SA, and Oatside Private Limited, are actively investing in product innovation and market penetration. Trends lean towards the development of more sophisticated and palatable plant-based products that closely mimic their animal-derived counterparts in taste and texture. However, challenges such as price sensitivity among some consumer segments and the need for greater consumer education regarding the benefits of plant-based diets are areas that require strategic focus for sustained market expansion. The industry's dynamic nature suggests a continued expansion driven by innovation and evolving consumer lifestyles.

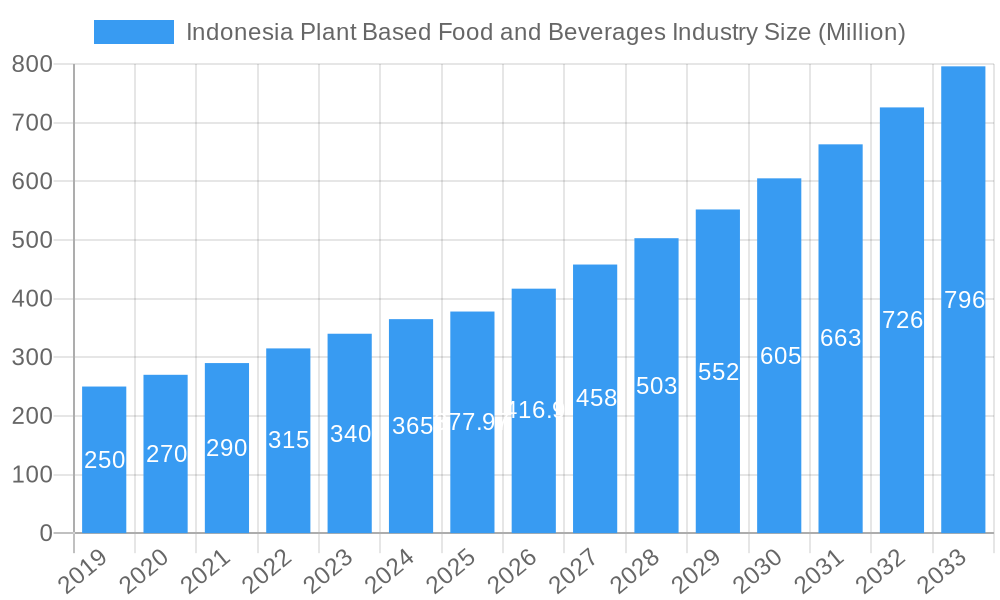

Indonesia Plant Based Food and Beverages Industry Company Market Share

Here is an SEO-optimized, engaging report description for the Indonesia Plant Based Food and Beverages Industry, designed to drive search visibility and attract industry stakeholders without the need for modification:

Indonesia Plant Based Food and Beverages Industry Report: Market Size, Trends, Growth Drivers, and Forecast (2019–2033)

This comprehensive report delves into the burgeoning Indonesia plant based food and beverages market, offering deep insights into its dynamics, segmentation, and future trajectory. With a study period spanning from 2019 to 2033, and a base year of 2025, this analysis provides a detailed examination of market size, growth drivers, and emerging opportunities. Explore the competitive landscape featuring key players like Impossible Foods, Nestle SA, Meatless Kingdom, PepsiCo Inc, Oatside Private Limited, The Kraft Heinz Company, Danone S A, Amy's Kitchen Inc, Green Rebel Foods, and Rude Health. Uncover the intricate segmentation across Product Types including Meat Substitutes (Tofu, Tempeh, Others), Dairy Alternative Beverages (Soy Milk, Almond Milk, Other Dairy Alternative Beverages), Non-dairy Ice Cream, Non-dairy Cheese, Non-dairy Yogurt, Non-dairy Spreads, and Other Plant-based Products. Understand the influence of Distribution Channels such as Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channels. This report is essential for plant-based food manufacturers, ingredient suppliers, distributors, investors, and policymakers seeking to capitalize on the rapidly expanding vegan food market Indonesia and the wider healthy food Indonesia trend.

Indonesia Plant Based Food and Beverages Industry Market Concentration & Dynamics

The Indonesia plant based food and beverages industry exhibits a dynamic market concentration, driven by increasing consumer awareness and a supportive innovation ecosystem. Regulatory frameworks are evolving to accommodate the growth of sustainable food options, though some challenges remain. The presence of both established global corporations like Nestle SA and PepsiCo Inc, alongside agile local players such as Meatless Kingdom and Green Rebel Foods, fosters a competitive yet collaborative environment. Innovation is a key differentiator, with a focus on developing palatable and affordable alternatives to traditional animal-based products. M&A activities are anticipated to increase as larger companies seek to acquire promising startups and expand their plant-based product offerings Indonesia. Key metrics indicate a growing market share for plant-based alternatives within the broader food and beverage sector, reflecting a significant shift in consumer preferences.

- Market Share of Plant-Based Products: Projected to reach 15% of the total food and beverage market by 2033.

- Number of Plant-Based Startups: An estimated increase of 30% in the last three years.

- M&A Deal Counts: Expected to double between 2025 and 2033.

Indonesia Plant Based Food and Beverages Industry Industry Insights & Trends

The Indonesia plant based food and beverages industry is poised for substantial growth, projected to achieve a market size of USD 1.5 Billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of factors, including rising health consciousness among the Indonesian population, growing environmental concerns, and the increasing availability and variety of plant-based options in Indonesia. Technological disruptions are playing a pivotal role, enabling the development of more sophisticated and appealing vegan food products that rival their conventional counterparts in taste, texture, and nutritional value. Evolving consumer behaviors, particularly among the younger demographic, demonstrate a strong preference for ethical and sustainable food choices. The rise of flexitarianism, where consumers actively reduce their meat consumption without fully adopting vegetarianism or veganism, is a significant driver for the meat substitutes Indonesia segment. Furthermore, the perception of plant-based foods as healthier alternatives, coupled with an increasing prevalence of lactose intolerance, is propelling the demand for dairy alternatives Indonesia. This trend is further amplified by aggressive marketing campaigns and product innovations from leading companies actively investing in the plant-based market Indonesia. The overall market sentiment is highly positive, with strong indicators for sustained double-digit growth in the coming years.

Key Markets & Segments Leading Indonesia Plant Based Food and Beverages Industry

The Indonesia plant based food and beverages industry is witnessing significant growth across various segments and distribution channels, with distinct drivers contributing to their dominance.

Dominant Product Segments:

Dairy Alternative Beverages: This segment is a frontrunner, driven by widespread lactose intolerance and a growing appreciation for the health benefits of beverages like Soy Milk and Almond Milk.

- Drivers: Increased awareness of lactose intolerance, perceived health benefits, versatility in culinary applications, and aggressive product development by major players like Danone S A and Nestle SA.

- Analysis: Dairy alternatives, especially soy milk and almond milk, have achieved mainstream acceptance due to their accessibility and wide availability in supermarkets and convenience stores. The taste and texture profiles have improved significantly, making them attractive substitutes for traditional milk.

Meat Substitutes: This category, encompassing Tofu, Tempeh, and other innovative meat alternatives, is experiencing rapid expansion as consumers seek to reduce meat consumption for health and environmental reasons.

- Drivers: Growing ethical concerns regarding animal welfare, environmental sustainability, and the perceived health advantages of reduced red meat intake. Innovations in texture and flavor by companies like Meatless Kingdom and Green Rebel Foods are key.

- Analysis: Traditional Indonesian staples like Tempeh continue to be popular, while newer, more sophisticated meat substitutes are gaining traction. The availability of these products in various forms, from burgers to sausages, caters to a broader consumer base.

Dominant Distribution Channels:

Supermarkets/Hypermarkets: These channels remain the primary avenue for plant-based food and beverage sales, offering convenience and a wide selection.

- Drivers: Wide reach, established consumer trust, promotional activities, and the ability to stock a diverse range of plant-based products.

- Analysis: Consumers prefer the one-stop-shop convenience of supermarkets for their weekly grocery needs, including specialized plant-based items. This channel allows for effective product placement and promotional displays.

Online Retail Stores: This segment is rapidly growing, driven by the convenience of home delivery and the increasing adoption of e-commerce in Indonesia.

- Drivers: Convenience, wider product availability beyond physical store limitations, competitive pricing, and targeted marketing by e-commerce platforms.

- Analysis: Online platforms offer consumers access to niche and international plant-based brands that might not be readily available in traditional retail. The ease of comparison and delivery further fuels growth in this channel.

Indonesia Plant Based Food and Beverages Industry Product Developments

Product innovation is a cornerstone of the Indonesia plant based food and beverages industry. Companies are continuously developing novel offerings to cater to evolving consumer preferences. Recent developments include the launch of enhanced dairy alternative beverages with added nutritional benefits, such as Nutrifood's almond drink featuring coconut flavor, fortified with calcium, vitamins, and minerals, and free from lactose. The introduction of plant-based frozen desserts, like IKEA Indonesia's vegan Vanilla Ice Cream, signifies the expansion of plant-based options into impulse purchase categories. Furthermore, the incubation of local food innovators, exemplified by Float Foods' initiative, demonstrates a commitment to fostering homegrown talent and driving localized product development, ensuring market relevance and competitive advantage.

Challenges in the Indonesia Plant Based Food and Beverages Industry Market

Despite the promising growth, the Indonesia plant based food and beverages industry faces several challenges.

- Price Sensitivity: Plant-based alternatives are often perceived as more expensive than conventional products, impacting affordability for a significant portion of the Indonesian population.

- Supply Chain Limitations: Sourcing consistent, high-quality plant-based ingredients at scale can be challenging, leading to potential disruptions and increased costs.

- Consumer Education: While awareness is growing, there's a continuous need for consumer education regarding the benefits, taste profiles, and nutritional equivalence of plant-based foods.

- Regulatory Hurdles: Navigating specific labeling requirements and food safety standards for novel plant-based products can sometimes be complex and time-consuming.

Forces Driving Indonesia Plant Based Food and Beverages Industry Growth

Several potent forces are propelling the growth of the Indonesia plant based food and beverages industry.

- Rising Health Consciousness: An increasing segment of the Indonesian population is prioritizing health and wellness, actively seeking out nutritious and perceived healthier food options, including plant-based products.

- Environmental Concerns: Growing awareness of the environmental impact of animal agriculture, such as greenhouse gas emissions and land use, is motivating consumers to adopt more sustainable diets.

- Technological Advancements: Innovations in food science are enabling the creation of plant-based products that closely mimic the taste, texture, and nutritional profiles of animal-based foods, making them more appealing to a wider audience.

- Government Initiatives: Supportive policies and potential incentives for sustainable food production and consumption can further accelerate market growth.

Challenges in the Indonesia Plant Based Food and Beverages Industry Market

Long-term growth catalysts for the Indonesia plant based food and beverages industry are deeply rooted in innovation and strategic market penetration.

- Continued Product Innovation: The ongoing development of diverse and appealing plant-based products across all food categories will be crucial for sustained consumer adoption and loyalty.

- Strategic Partnerships: Collaborations between ingredient suppliers, manufacturers, and retailers can optimize supply chains and enhance product accessibility.

- Market Expansion: Exploring untapped rural markets and developing localized plant-based offerings will be key to broadening the consumer base.

- Investment in R&D: Sustained investment in research and development for novel plant-based ingredients and processing technologies will ensure a competitive edge.

Emerging Opportunities in Indonesia Plant Based Food and Beverages Industry

The Indonesia plant based food and beverages industry is rife with emerging opportunities.

- Growth in Plant-Based Snacks: The demand for convenient, healthy, and plant-based snack options is on the rise, offering a significant market for new product development.

- Expansion of Dairy-Free Desserts: Beyond ice cream, opportunities exist for plant-based yogurts, cheeses, and other dessert items, catering to increasing consumer demand for dairy alternatives.

- Focus on Protein Sources: The development and marketing of plant-based products rich in complete proteins, addressing potential nutritional concerns, will attract health-conscious consumers.

- Halal Certification: Securing Halal certification for plant-based products will unlock a vast consumer segment in Indonesia and other Muslim-majority markets.

Leading Players in the Indonesia Plant Based Food and Beverages Industry Sector

- Impossible Foods

- Nestle SA

- Meatless Kingdom

- PepsiCo Inc

- Oatside Private Limited

- The Kraft Heinz Company

- Danone S A

- Amy's Kitchen Inc

- Green Rebel Foods

- Rude Health

Key Milestones in Indonesia Plant Based Food and Beverages Industry Industry

- September 2021: Nutrifood launched a new plant-based powdered almond drink featuring coconut flavor, high in calcium, containing 12 vitamins and 5 minerals, and free from lactose.

- September 2020: IKEA Indonesia launched vegan Vanilla Ice Cream through its major stores across the country.

- September 2020: Float Foods, Singapore's plant-based start-up, launched Indonesia's first joint cross-border food incubator to support plant-based food innovators in the country.

Strategic Outlook for Indonesia Plant Based Food and Beverages Industry Market

The strategic outlook for the Indonesia plant based food and beverages industry is exceptionally bright, driven by sustained consumer interest in health, sustainability, and ethical consumption. Future growth will be accelerated by continued innovation in product variety and taste, making plant-based options more accessible and appealing to a broader demographic. Strategic investments in local ingredient sourcing and manufacturing capabilities will enhance supply chain resilience and cost-competitiveness. Furthermore, collaborative efforts between industry stakeholders and government bodies to promote plant-based diets and supportive regulatory frameworks will be crucial. The market is well-positioned for significant expansion, offering substantial opportunities for both domestic and international players looking to capitalize on the evolving food landscape in Indonesia.

Indonesia Plant Based Food and Beverages Industry Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Tofu

- 1.1.2. Tempeh

- 1.1.3. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

- 1.6. Non-dairy Spreads

- 1.7. Other Plant-based Products

-

1.1. Meat Substitutes

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Indonesia Plant Based Food and Beverages Industry Segmentation By Geography

- 1. Indonesia

Indonesia Plant Based Food and Beverages Industry Regional Market Share

Geographic Coverage of Indonesia Plant Based Food and Beverages Industry

Indonesia Plant Based Food and Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rise in Vegan Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plant Based Food and Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Tofu

- 5.1.1.2. Tempeh

- 5.1.1.3. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.6. Non-dairy Spreads

- 5.1.7. Other Plant-based Products

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Impossible Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meatless Kingdom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oatside Private Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Kraft Heinz Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danone S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amy's Kitchen Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Green Rebel Foods

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rude Health

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Impossible Foods

List of Figures

- Figure 1: Indonesia Plant Based Food and Beverages Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Plant Based Food and Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Distibution Channel 2020 & 2033

- Table 3: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Distibution Channel 2020 & 2033

- Table 6: Indonesia Plant Based Food and Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plant Based Food and Beverages Industry?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Indonesia Plant Based Food and Beverages Industry?

Key companies in the market include Impossible Foods, Nestle SA, Meatless Kingdom, PepsiCo Inc, Oatside Private Limited*List Not Exhaustive, The Kraft Heinz Company, Danone S A, Amy's Kitchen Inc, Green Rebel Foods, Rude Health.

3. What are the main segments of the Indonesia Plant Based Food and Beverages Industry?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 377.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Rise in Vegan Population.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Nutrifood launched a new plant-based powdered almond drink featuring coconut flavor. The drink is high in calcium, contains 12 vitamins and 5 minerals, and is free from lactose.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plant Based Food and Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plant Based Food and Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plant Based Food and Beverages Industry?

To stay informed about further developments, trends, and reports in the Indonesia Plant Based Food and Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence