Key Insights

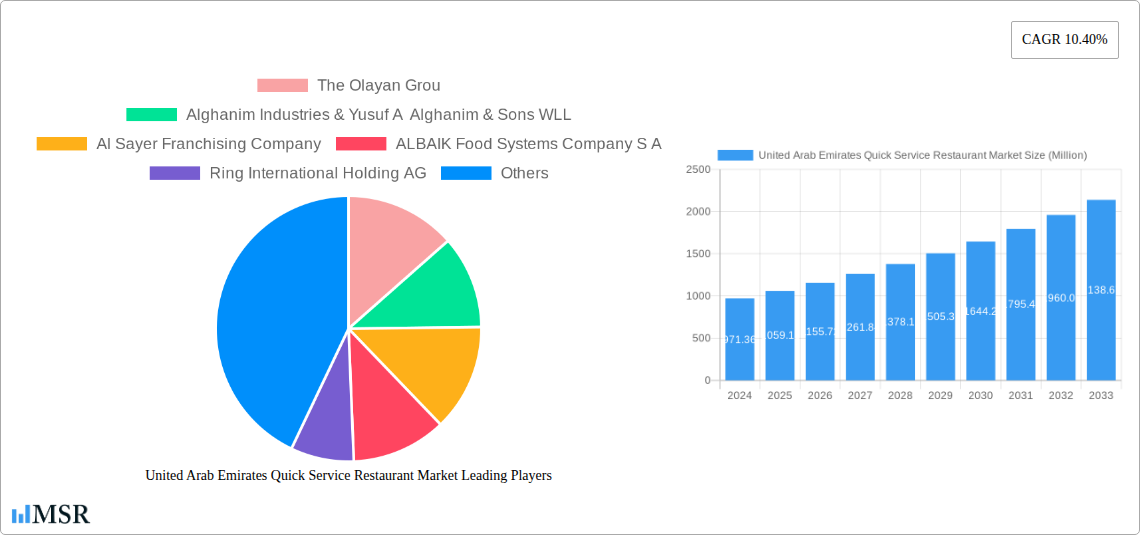

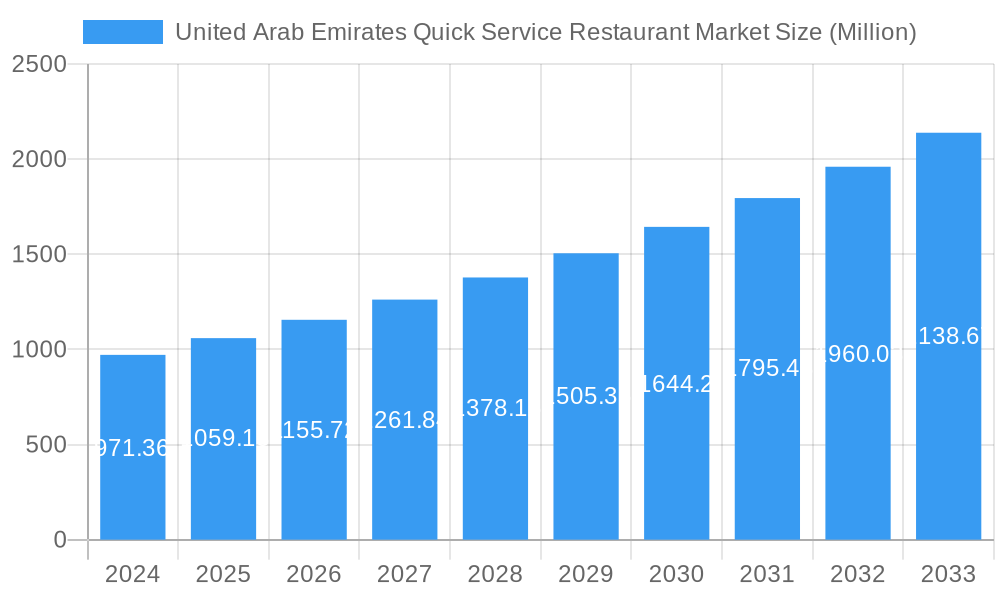

The United Arab Emirates Quick Service Restaurant (QSR) market is poised for robust expansion, projected to reach an estimated USD 971.36 billion by 2024, fueled by a compelling Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period of 2025-2033. This significant growth is primarily driven by evolving consumer lifestyles, a burgeoning tourism sector, and the increasing disposable incomes across the UAE. The convenience and affordability offered by QSRs align perfectly with the fast-paced urban environments and the preferences of the diverse population. The market's segmentation reveals a dynamic landscape, with Bakeries, Burger, and Pizza cuisines showing strong consumer demand, indicating a preference for universally appealing and quick-to-consume food options. Chained outlets are expected to continue dominating the market due to their standardized offerings and strong brand recognition, although independent outlets are carving out niches with unique culinary experiences. Geographically, the United Arab Emirates stands as a key growth engine within the broader Middle Eastern QSR sector, benefiting from its status as a global hub for business and leisure.

United Arab Emirates Quick Service Restaurant Market Market Size (In Million)

Further analysis of the UAE's QSR market highlights key trends and strategic imperatives for stakeholders. The increasing adoption of digital ordering platforms, delivery apps, and drive-thru services is revolutionizing customer accessibility and convenience, directly contributing to market expansion. Consumers are increasingly seeking healthier and more diverse menu options, pushing QSR brands to innovate and cater to evolving dietary preferences, including plant-based and gourmet offerings. While the market experiences significant growth, potential restraints include intense competition, rising operational costs, and evolving regulatory landscapes. However, the sheer volume of inbound tourism and the government's continuous efforts to boost the hospitality sector provide substantial tailwinds. Major players like Americana Restaurants International PLC and M H Alshaya Co WLL are at the forefront of this growth, leveraging strategic expansions and innovative marketing campaigns to capture market share. The QSR market in the UAE is a vibrant and adaptive sector, continually responding to consumer demands and technological advancements.

United Arab Emirates Quick Service Restaurant Market Company Market Share

United Arab Emirates Quick Service Restaurant Market: A Comprehensive Analysis (2019–2033)

This in-depth report offers a definitive analysis of the United Arab Emirates Quick Service Restaurant (QSR) market, projecting its trajectory from 2019 to 2033. Leveraging comprehensive data from the base year 2025, our forecast period of 2025–2033 provides actionable insights into market size, growth drivers, and emerging opportunities. We delve into the vibrant UAE QSR landscape, examining key players like Americana Restaurants International PLC, M H Alshaya Co WLL, and Apparel Group, and dissecting its segmentation by cuisine (Burger, Pizza, Ice Cream), outlet type (Chained Outlets, Independent Outlets), and location (Retail, Travel, Leisure). Discover the fastest-growing QSR segments and understand the impact of technological advancements and changing consumer preferences on this dynamic sector. This report is essential for QSR investors, franchise owners, food service brands, and market strategists seeking to capitalize on the booming UAE food and beverage market.

United Arab Emirates Quick Service Restaurant Market Market Concentration & Dynamics

The United Arab Emirates Quick Service Restaurant market exhibits a moderately concentrated structure, with a few prominent players holding significant market share. The market share of leading entities is estimated to be substantial, driven by aggressive expansion strategies and strong brand recognition. Innovation ecosystems are thriving, fueled by a constant influx of international brands and a local appetite for new culinary experiences. Regulatory frameworks in the UAE, while ensuring food safety and quality, generally foster a business-friendly environment for QSR operators. Substitute products, primarily from the casual dining sector and home delivery services, present a competitive challenge, but the convenience and affordability of QSRs continue to dominate. End-user trends lean towards convenience, value for money, and increasingly, healthier options. Mergers & Acquisitions (M&A) activities, though not extensively publicized, are anticipated to play a crucial role in shaping future market dynamics, with M&A deal counts expected to rise as companies seek to consolidate their market position and expand their portfolios.

- Key Dynamics:

- Significant market share held by top QSR operators.

- Thriving innovation driven by international and local players.

- Supportive regulatory environment balanced with food safety standards.

- Competition from casual dining and home delivery services.

- End-user preference for convenience, value, and emerging health consciousness.

- Anticipated increase in M&A activities for market consolidation and expansion.

United Arab Emirates Quick Service Restaurant Market Industry Insights & Trends

The United Arab Emirates Quick Service Restaurant market is poised for significant growth, driven by a confluence of economic, demographic, and behavioral factors. The estimated market size for the UAE QSR market is projected to reach $XX billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is fueled by the UAE's robust tourism sector, a growing expatriate population, and a high disposable income among its residents, all of which contribute to a sustained demand for convenient and affordable dining options. Technological disruptions are profoundly reshaping the industry, with the widespread adoption of online ordering platforms, mobile applications, and sophisticated delivery logistics significantly enhancing accessibility and customer experience. The rise of food delivery apps has been a game-changer, expanding the reach of QSR brands beyond their physical outlets and into the comfort of consumers' homes. Furthermore, the integration of AI-powered chatbots for customer service and data analytics for personalized marketing are becoming increasingly prevalent. Evolving consumer behaviors are also a critical trend. UAE consumers are becoming more health-conscious, leading to a growing demand for healthier menu options, including plant-based alternatives and calorie-conscious choices. Transparency in ingredients and nutritional information is also gaining importance. The fast-paced lifestyle of the UAE population further amplifies the appeal of quick service formats. Digitalization of the QSR experience is paramount, with investments in touch-screen kiosks, contactless payment solutions, and loyalty programs designed to enhance customer engagement and streamline operations. The market is also witnessing a trend towards experiential dining, even within the QSR segment, with brands focusing on creating unique store designs and offering limited-time promotional menus to drive foot traffic and social media buzz. The increasing focus on sustainability, including eco-friendly packaging and responsible sourcing, is also beginning to influence consumer choices and brand strategies. The overall UAE fast food market is characterized by its dynamism, adaptability, and a keen responsiveness to changing consumer demands and technological advancements.

Key Markets & Segments Leading United Arab Emirates Quick Service Restaurant Market

The United Arab Emirates Quick Service Restaurant market's dominance is significantly influenced by several key factors, with Chained Outlets representing the most influential segment. The Retail location segment also plays a pivotal role in driving QSR growth, owing to its high foot traffic and accessibility.

Cuisine Dominance

- Burger: The Burger segment consistently leads the UAE QSR market, benefiting from its universal appeal and continuous innovation by major international and regional players. Iconic brands consistently introduce new flavor profiles and limited-edition offerings, capturing a substantial market share.

- Pizza: The Pizza segment also holds a strong position, driven by the convenience and shareability of its products, making it a popular choice for families and social gatherings. Delivery-focused models have further solidified its dominance.

- Meat-based Cuisines: This segment, encompassing various grilled and fried meat options, caters to a significant portion of the population seeking substantial and quick meals.

Outlet Type Dominance

- Chained Outlets: This segment overwhelmingly leads the market. Dominance is driven by economies of scale, strong brand equity, standardized quality, and extensive marketing budgets. Major players like Americana Restaurants International PLC and M H Alshaya Co WLL have established vast networks of chained outlets, leveraging their franchise models for rapid expansion across the Emirates.

- Drivers of Dominance:

- Strong brand recognition and customer loyalty.

- Efficient supply chain management and operational standardization.

- Substantial marketing and promotional investments.

- Strategic prime locations secured through extensive real estate networks.

- Continuous menu innovation and adaptation to local tastes.

- Drivers of Dominance:

- Independent Outlets: While smaller in market share, independent outlets offer niche cuisines and personalized experiences, catering to specific local communities and specialized preferences.

Location Dominance

- Retail: QSR outlets located within Retail environments, such as shopping malls and community centers, are prime drivers of market growth. High foot traffic from shoppers provides a constant stream of potential customers, making these locations strategically vital for QSR brands.

- Drivers of Dominance:

- High footfall and captive audience.

- Convenience for shoppers seeking quick meal options.

- Synergy with retail tenants, enhancing overall shopping experience.

- Proximity to entertainment and leisure facilities within malls.

- Drivers of Dominance:

- Travel: Airports and other transportation hubs form another significant location segment, catering to transient populations requiring swift and convenient food options.

- Leisure: Locations within entertainment venues, theme parks, and recreational areas capitalize on impulse purchases and the need for quick refueling during leisure activities.

- Standalone: While less dominant than retail-centric locations, standalone outlets in high-traffic urban areas and residential neighborhoods also contribute to market reach and accessibility.

United Arab Emirates Quick Service Restaurant Market Product Developments

Product developments in the UAE Quick Service Restaurant market are heavily focused on innovation and customization to meet evolving consumer demands. This includes the introduction of healthier menu alternatives, plant-based options, and globally inspired flavors. Brands are also leveraging technology for enhanced product customization through mobile apps and self-order kiosks. The emphasis on fresh, high-quality ingredients and sustainable sourcing is becoming a competitive edge, attracting environmentally conscious consumers. Limited-time offers and seasonal promotions continue to be key strategies for driving trial and repeat purchases, further pushing product relevance in a competitive landscape.

Challenges in the United Arab Emirates Quick Service Restaurant Market Market

The United Arab Emirates Quick Service Restaurant market faces several challenges that can impact its growth trajectory. These include increasing operational costs, such as rising rental prices in prime locations and the cost of labor and raw materials. Intense competition from both international and local players, as well as the growing popularity of food delivery aggregators, creates significant pressure on pricing and market share. Stringent food safety regulations and evolving health standards require continuous investment in compliance. Additionally, a saturated market in certain prime areas can lead to challenges in securing optimal locations and maintaining foot traffic.

- Key Barriers:

- Rising operational expenses (rent, labor, ingredients).

- Intensifying market competition.

- Navigating evolving food safety and health regulations.

- Market saturation in high-demand locations.

- Consumer price sensitivity amidst economic fluctuations.

Forces Driving United Arab Emirates Quick Service Restaurant Market Growth

Several powerful forces are propelling the growth of the United Arab Emirates Quick Service Restaurant market. The burgeoning tourism sector, coupled with a rapidly growing expatriate population, fuels a consistent demand for convenient and affordable dining solutions. Economic stability and a high disposable income among residents further bolster consumer spending power on dining out. Technological advancements, particularly in online ordering, delivery platforms, and payment solutions, have significantly enhanced accessibility and customer convenience. Furthermore, government initiatives promoting entrepreneurship and foreign investment create a favorable business environment for QSR expansion.

Challenges in the United Arab Emirates Quick Service Restaurant Market Market

Long-term growth catalysts for the United Arab Emirates Quick Service Restaurant market are deeply rooted in continuous innovation and strategic market expansion. The integration of advanced technologies, such as AI for personalized customer experiences and robotics for operational efficiency, will be crucial. Strategic partnerships and franchise agreements with emerging global brands will continue to introduce fresh concepts and diversify the market offering. Furthermore, a sustained focus on adapting menus to cater to the evolving health consciousness and diverse cultural preferences of the UAE population will ensure sustained relevance and loyalty.

Emerging Opportunities in United Arab Emirates Quick Service Restaurant Market

Emerging opportunities in the United Arab Emirates Quick Service Restaurant market are abundant and diverse. The growing demand for specialized dietary options, such as vegan, gluten-free, and low-calorie menus, presents a significant untapped market. Expansion into less saturated suburban areas and smaller cities within the UAE offers new avenues for growth. The increasing adoption of smart technologies for customer engagement, like augmented reality menus and gamified loyalty programs, will create unique brand experiences. Furthermore, exploring ghost kitchen models and dark stores can optimize delivery operations and reduce overhead costs, catering to the ever-increasing reliance on food delivery services.

Leading Players in the United Arab Emirates Quick Service Restaurant Market Sector

- The Olayan Group

- Alghanim Industries & Yusuf A Alghanim & Sons WLL

- Al Sayer Franchising Company

- ALBAIK Food Systems Company S A

- Ring International Holding AG

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Kamal Osman Jamjoom Group LLC

- Apparel Group

- AlAmar Foods Company

Key Milestones in United Arab Emirates Quick Service Restaurant Market Industry

- January 2023: Maristo Hospitality signed a master franchisee agreement with German Doner Kebab (GDK), signifying a significant expansion into the United Arab Emirates and the broader Middle East market with plans for new openings.

- December 2022: Apparel Group achieved a major milestone by launching its 250th Tim Hortons store across the Middle East, with a new outlet opening in Dubai's Mirdif City Centre. This underscores aggressive expansion plans, with an aim to open an additional 500 outlets across the region by 2025.

- October 2022: Maristo Hospitality further diversified its culinary offerings with the opening of Sisi's Eatery, an Australian cuisine restaurant, in Dubai Hills Mall, Dubai, United Arab Emirates, highlighting a strategic move into niche international dining experiences within the QSR framework.

Strategic Outlook for United Arab Emirates Quick Service Restaurant Market Market

The strategic outlook for the United Arab Emirates Quick Service Restaurant market is overwhelmingly positive, driven by a sustained demand for convenience and a dynamic consumer base. Growth accelerators include the continued expansion of delivery networks, the integration of advanced digital technologies for enhanced customer experience, and a commitment to menu diversification catering to evolving health and dietary trends. Strategic opportunities lie in tapping into underpenetrated geographical areas within the UAE and forging partnerships that bring innovative global QSR concepts to the market. A keen focus on operational efficiency and sustainable practices will be paramount for long-term success in this competitive and rapidly evolving sector.

United Arab Emirates Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Arab Emirates Quick Service Restaurant Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Quick Service Restaurant Market Regional Market Share

Geographic Coverage of United Arab Emirates Quick Service Restaurant Market

United Arab Emirates Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Increase in the number of QSRs and rise in demand for fast food to fuel the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Olayan Grou

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alghanim Industries & Yusuf A Alghanim & Sons WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Sayer Franchising Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALBAIK Food Systems Company S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ring International Holding AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Americana Restaurants International PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M H Alshaya Co WLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kamal Osman Jamjoom Group LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apparel Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AlAmar Foods Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Olayan Grou

List of Figures

- Figure 1: United Arab Emirates Quick Service Restaurant Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Quick Service Restaurant Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Cuisine 2020 & 2033

- Table 2: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2020 & 2033

- Table 3: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Outlet 2020 & 2033

- Table 4: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2020 & 2033

- Table 5: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 6: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2020 & 2033

- Table 7: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Region 2020 & 2033

- Table 9: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Cuisine 2020 & 2033

- Table 10: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2020 & 2033

- Table 11: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Outlet 2020 & 2033

- Table 12: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2020 & 2033

- Table 13: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 14: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2020 & 2033

- Table 15: United Arab Emirates Quick Service Restaurant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Quick Service Restaurant Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the United Arab Emirates Quick Service Restaurant Market?

Key companies in the market include The Olayan Grou, Alghanim Industries & Yusuf A Alghanim & Sons WLL, Al Sayer Franchising Company, ALBAIK Food Systems Company S A, Ring International Holding AG, Americana Restaurants International PLC, M H Alshaya Co WLL, Kamal Osman Jamjoom Group LLC, Apparel Group, AlAmar Foods Company.

3. What are the main segments of the United Arab Emirates Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Increase in the number of QSRs and rise in demand for fast food to fuel the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2023: Maristo Hospitality signed a master franchisee agreement with German Doner Kebab (GDK), with plans to expand in the United Arab Emirates and the Middle East.December 2022: Apparel Group launched its 250th Tim Hortons store across the Middle East with a new store in Dubai's Mirdif City Centre. It plans to open 500 outlets across the region by 2025.October 2022: Maristo Hospitality opened Sisi's Eatery, its Australian cuisine restaurant, in Dubai Hills Mall, Dubai, United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence