Key Insights

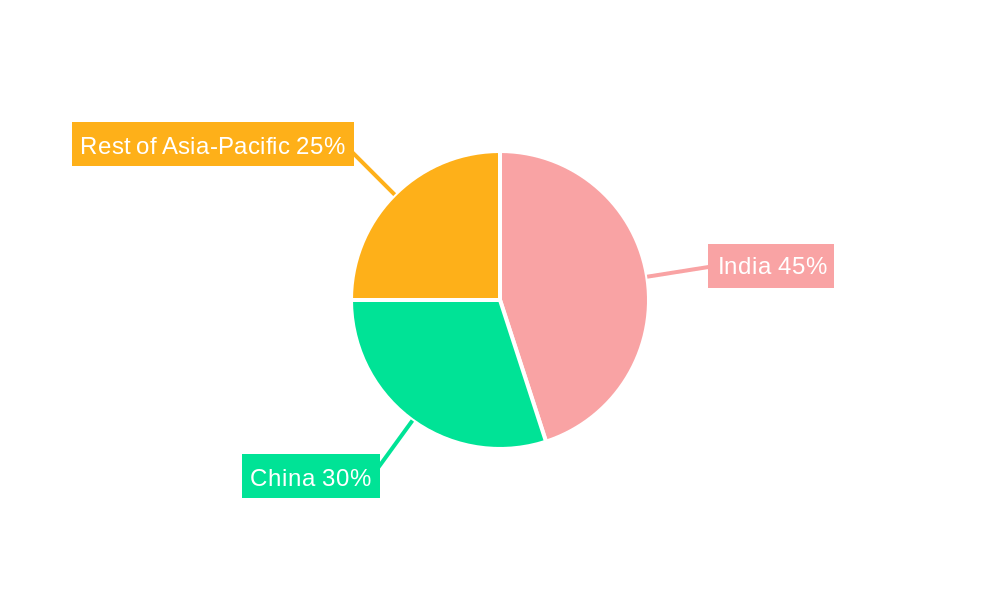

The Asia electric three-wheeler market, currently experiencing robust growth with a Compound Annual Growth Rate (CAGR) exceeding 9%, presents a compelling investment opportunity. Driven by increasing urbanization, stringent emission regulations, and the rising demand for last-mile delivery solutions, this sector is poised for significant expansion throughout the forecast period (2025-2033). The market's segmentation, encompassing various vehicle types (passenger and goods carriers) and fuel types (petrol, CNG/LPG, diesel, and electric), reflects the diverse needs of the region. Electric three-wheelers are gaining significant traction, fueled by government incentives promoting sustainable transportation and the decreasing cost of battery technology. Leading players like Bajaj Auto, Mahindra & Mahindra, and TVS Motor Company are actively shaping the market landscape through innovation and strategic partnerships, further stimulating growth. While challenges remain, including infrastructure limitations for charging stations and the initial higher purchase price compared to traditional three-wheelers, the long-term benefits of electric mobility are expected to outweigh these hurdles. The Asia Pacific region, particularly India and China, are key growth drivers, accounting for a substantial portion of the market share due to their large populations and burgeoning e-commerce sectors. The market's expansion is expected to continue throughout the forecast period, with a projected market size significantly larger in 2033 than in 2025.

The continued growth in the electric three-wheeler market in Asia will be significantly influenced by government policies supporting electric vehicle adoption, advancements in battery technology leading to increased range and reduced charging times, and the ongoing expansion of charging infrastructure. The market's success also hinges on the development of robust after-sales service networks to address consumer concerns regarding maintenance and repairs. Furthermore, the evolving preferences of consumers, particularly towards enhanced safety features and technologically advanced models, will necessitate continuous innovation from manufacturers. The competitive landscape is dynamic, with both established automotive giants and emerging players vying for market share. This competitive pressure will likely drive further technological advancements, improved product offerings, and price reductions, ultimately benefitting consumers and furthering the market's expansion. The anticipated growth is projected to be particularly strong in rapidly developing economies across the Asia-Pacific region, where three-wheelers serve as an essential mode of transportation and last-mile delivery.

Asia Electric Three-Wheeler Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia electric three-wheeler industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report leverages data from the historical period (2019-2024) to offer valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on the burgeoning electric three-wheeler market in Asia.

Asia Electric Three-Wheeler Industry Market Concentration & Dynamics

The Asia electric three-wheeler market presents a dynamic landscape characterized by moderate concentration among established players and a surge in smaller, innovative companies, especially within the electric vehicle (EV) sector. Key players like Bajaj Auto Limited, TVS Motor Company, and Mahindra & Mahindra Ltd. command significant market share, but the competitive environment is rapidly evolving. Several key factors influence this dynamic:

- Rapid Technological Advancements: Continuous innovation in battery technology (including advancements in solid-state and lithium-ion chemistries), motor efficiency, and charging infrastructure are significantly impacting the market. Improvements in battery range, charging speed, and overall vehicle performance are key drivers of growth.

- Supportive Government Policies: Government initiatives across various Asian nations play a crucial role. These include substantial subsidies, tax incentives, favorable emission regulations, and the development of dedicated charging infrastructure networks, all of which are accelerating the adoption of electric three-wheelers.

- Intense Competition and Substitute Products: The market faces competition from both traditional fuel-powered three-wheelers and alternative last-mile transportation solutions, such as e-scooters and e-bikes. This necessitates continuous innovation and competitive pricing strategies.

- Evolving Consumer Preferences: Increasing environmental awareness, coupled with the need for affordable and efficient transportation, particularly in densely populated urban areas, fuels the demand for electric three-wheelers. Consumers are increasingly prioritizing sustainability and lower running costs.

- Strategic Mergers and Acquisitions (M&A): The Asia electric three-wheeler industry has witnessed a rise in M&A activity in recent years. Larger companies are strategically acquiring smaller players to expand their market reach, bolster technological capabilities, and secure access to innovative technologies. While precise figures are confidential, a significant number of M&A transactions have occurred, indicating considerable industry consolidation.

Asia Electric Three-Wheeler Industry Industry Insights & Trends

The Asia electric three-wheeler market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at $xx Million, and is projected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Key growth drivers include:

- Rising urbanization and increasing demand for last-mile connectivity: This is a significant factor pushing the demand for efficient and affordable transportation solutions.

- Government support and incentives for electric vehicles: Various government initiatives and policies are encouraging adoption of electric three-wheelers.

- Technological advancements in battery technology and charging infrastructure: Improvements in battery life, range, and charging speed are making electric three-wheelers a more attractive option.

- Increasing environmental concerns and stricter emission regulations: The need to reduce carbon emissions is driving the transition towards electric vehicles.

- Falling battery prices and improving affordability of electric three-wheelers: This is making electric three-wheelers more accessible to a wider range of consumers.

Key Markets & Segments Leading Asia Electric Three-Wheeler Industry

India currently dominates the Asia electric three-wheeler market, driven by strong government support, a large population base, and growing urbanization. However, other countries like Indonesia, Bangladesh, and Vietnam are also experiencing significant growth.

- Dominant Segment: The electric passenger carrier segment is currently the largest and fastest-growing segment, contributing to approximately xx% of the total market revenue in 2025.

- Key Market Drivers:

- Rapid Urbanization: The increasing concentration of population in urban areas is creating a higher demand for efficient and affordable transportation options.

- Improving Infrastructure: Better road networks and charging infrastructure are supporting the expansion of the electric three-wheeler market.

- Government Regulations: Favorable policies and regulations are promoting the adoption of electric vehicles.

The electric fuel type segment is expected to dominate the market, fuelled by environmental concerns and government policies favoring EVs. While petrol and CNG/LPG segments still hold a significant share, their market share is expected to decline over the forecast period.

Asia Electric Three-Wheeler Industry Product Developments

Significant advancements are occurring in battery technology, leading to increased range and reduced charging times. Manufacturers are also focusing on improved vehicle design and features, such as enhanced safety systems and better comfort for passengers. These innovations are enhancing the overall appeal and competitiveness of electric three-wheelers in the market. The integration of smart technologies, such as telematics and IoT, is another area seeing rapid development, offering features like remote diagnostics and fleet management capabilities.

Challenges in the Asia Electric Three-Wheeler Industry Market

Despite considerable growth potential, the Asia electric three-wheeler industry confronts several challenges. High upfront costs for electric three-wheelers remain a barrier to entry for many potential buyers, particularly in rural areas with lower disposable incomes. The uneven distribution and limited availability of charging infrastructure, especially in less developed regions, pose a significant hurdle. Furthermore, inconsistencies in the supply chain, particularly concerning crucial components like batteries and electronic controllers, can lead to production delays and increased costs. This is compounded by competition from established fuel-powered three-wheelers, which often benefit from a more established distribution network. These challenges directly impact market penetration rates and overall growth trajectory.

Forces Driving Asia Electric Three-Wheeler Industry Growth

The Asia electric three-wheeler market is experiencing significant growth driven by a confluence of factors:

- Government Support and Incentives: Substantial government incentives, including financial subsidies and tax breaks, are making electric three-wheelers significantly more affordable and accessible to a wider range of consumers.

- Technological Advancements & Cost Reductions: Ongoing advancements in battery technology, resulting in improved range, longer lifespan, and reduced costs, are making electric three-wheelers more competitive and attractive. Simultaneous improvements in charging infrastructure are enhancing convenience and reducing range anxiety.

- Growing Environmental Consciousness: A rising awareness of environmental issues and the urgent need to reduce carbon emissions is driving a shift toward cleaner and more sustainable transportation options, favoring electric vehicles.

- Urbanization and Last-Mile Connectivity: Rapid urbanization and the increasing demand for efficient last-mile transportation solutions are creating a substantial and expanding market for electric three-wheelers, particularly in densely populated cities and suburban areas.

Long-Term Growth Catalysts in the Asia Electric Three-Wheeler Industry

Long-term growth will be fueled by continued technological innovation, strategic partnerships between manufacturers and charging infrastructure providers, and expansion into new markets across Asia. Government policies supporting the electrification of transportation will remain critical in sustaining this growth.

Emerging Opportunities in Asia Electric Three-Wheeler Industry

Significant opportunities exist for growth and innovation within the Asia electric three-wheeler industry. These include developing robust and accessible charging infrastructure networks, particularly in underserved areas. Integrating smart technologies, such as telematics and IoT capabilities, can enhance efficiency, safety, and fleet management. Expanding into new market segments, such as commercial deliveries (e-commerce logistics) and ride-sharing services, presents considerable potential. Furthermore, creating customized solutions tailored to specific applications and continuing to explore advanced battery technologies (such as solid-state batteries) will unlock further growth avenues.

Leading Players in the Asia Electric Three-Wheeler Industry Sector

- Lohia Auto Industries

- ElecTrike Japa

- Bajaj Auto Limited

- Atul Auto Limited

- Ningbo Dowedo International Trade Co Ltd

- Mahindra and Mahindra Ltd

- TVS Motor Company

- Piaggio & C SpA

- ChongQing Zongshen Tricycle Manufacturing Co Ltd

- Scooters India Ltd

Key Milestones in Asia Electric Three-Wheeler Industry Industry

- 2020: Several key players launched new electric three-wheeler models.

- 2021: Government policies promoting electric vehicle adoption were implemented in several Asian countries.

- 2022: Significant investments were made in charging infrastructure development.

- 2023: Several mergers and acquisitions took place in the industry.

- 2024: Technological advancements in battery technology led to improved range and performance of electric three-wheelers.

Strategic Outlook for Asia Electric Three-Wheeler Industry Market

The Asia electric three-wheeler market presents significant growth opportunities over the next decade. Strategic partnerships, technological innovation, and expansion into new markets will be crucial for success. Continued government support and a focus on addressing existing challenges will pave the way for sustained, long-term growth.

Asia Electric Three-Wheeler Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Carrier

- 1.2. Goods Carrier

-

2. Fuel Type

- 2.1. Petrol

- 2.2. CNG/LPG

- 2.3. Diesel

- 2.4. Electric

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Bangladesh

- 3.5. Sri Lanka

- 3.6. Rest of Asia

Asia Electric Three-Wheeler Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Bangladesh

- 5. Sri Lanka

- 6. Rest of Asia

Asia Electric Three-Wheeler Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Industry’s Shift Toward the Adoption of Electric Three Wheelers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Carrier

- 5.1.2. Goods Carrier

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. CNG/LPG

- 5.2.3. Diesel

- 5.2.4. Electric

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Bangladesh

- 5.3.5. Sri Lanka

- 5.3.6. Rest of Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Indonesia

- 5.4.4. Bangladesh

- 5.4.5. Sri Lanka

- 5.4.6. Rest of Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Carrier

- 6.1.2. Goods Carrier

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. CNG/LPG

- 6.2.3. Diesel

- 6.2.4. Electric

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Indonesia

- 6.3.4. Bangladesh

- 6.3.5. Sri Lanka

- 6.3.6. Rest of Asia

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Carrier

- 7.1.2. Goods Carrier

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. CNG/LPG

- 7.2.3. Diesel

- 7.2.4. Electric

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Indonesia

- 7.3.4. Bangladesh

- 7.3.5. Sri Lanka

- 7.3.6. Rest of Asia

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Indonesia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Carrier

- 8.1.2. Goods Carrier

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. CNG/LPG

- 8.2.3. Diesel

- 8.2.4. Electric

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Indonesia

- 8.3.4. Bangladesh

- 8.3.5. Sri Lanka

- 8.3.6. Rest of Asia

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Bangladesh Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Carrier

- 9.1.2. Goods Carrier

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. CNG/LPG

- 9.2.3. Diesel

- 9.2.4. Electric

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Indonesia

- 9.3.4. Bangladesh

- 9.3.5. Sri Lanka

- 9.3.6. Rest of Asia

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Sri Lanka Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Carrier

- 10.1.2. Goods Carrier

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. CNG/LPG

- 10.2.3. Diesel

- 10.2.4. Electric

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Indonesia

- 10.3.4. Bangladesh

- 10.3.5. Sri Lanka

- 10.3.6. Rest of Asia

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Passenger Carrier

- 11.1.2. Goods Carrier

- 11.2. Market Analysis, Insights and Forecast - by Fuel Type

- 11.2.1. Petrol

- 11.2.2. CNG/LPG

- 11.2.3. Diesel

- 11.2.4. Electric

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Indonesia

- 11.3.4. Bangladesh

- 11.3.5. Sri Lanka

- 11.3.6. Rest of Asia

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. China Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Lohia Auto Industries

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 ElecTrike Japa

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Bajaj Auto Limited

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Atul Auto Limited

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Ningbo Dowedo International Trade Co Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Mahindra and Mahindra Ltd

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 TVS Motor Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Piaggio & C SpA

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 ChongQing Zongshen Tricycle Manufacturing Co Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Scooters India Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Lohia Auto Industries

List of Figures

- Figure 1: Asia Electric Three-Wheeler Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Electric Three-Wheeler Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Electric Three-Wheeler Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 24: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 36: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia Electric Three-Wheeler Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Electric Three-Wheeler Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Asia Electric Three-Wheeler Industry?

Key companies in the market include Lohia Auto Industries, ElecTrike Japa, Bajaj Auto Limited, Atul Auto Limited, Ningbo Dowedo International Trade Co Ltd, Mahindra and Mahindra Ltd, TVS Motor Company, Piaggio & C SpA, ChongQing Zongshen Tricycle Manufacturing Co Ltd, Scooters India Ltd.

3. What are the main segments of the Asia Electric Three-Wheeler Industry?

The market segments include Vehicle Type, Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Industry’s Shift Toward the Adoption of Electric Three Wheelers.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Electric Three-Wheeler Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Electric Three-Wheeler Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Electric Three-Wheeler Industry?

To stay informed about further developments, trends, and reports in the Asia Electric Three-Wheeler Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence