Key Insights

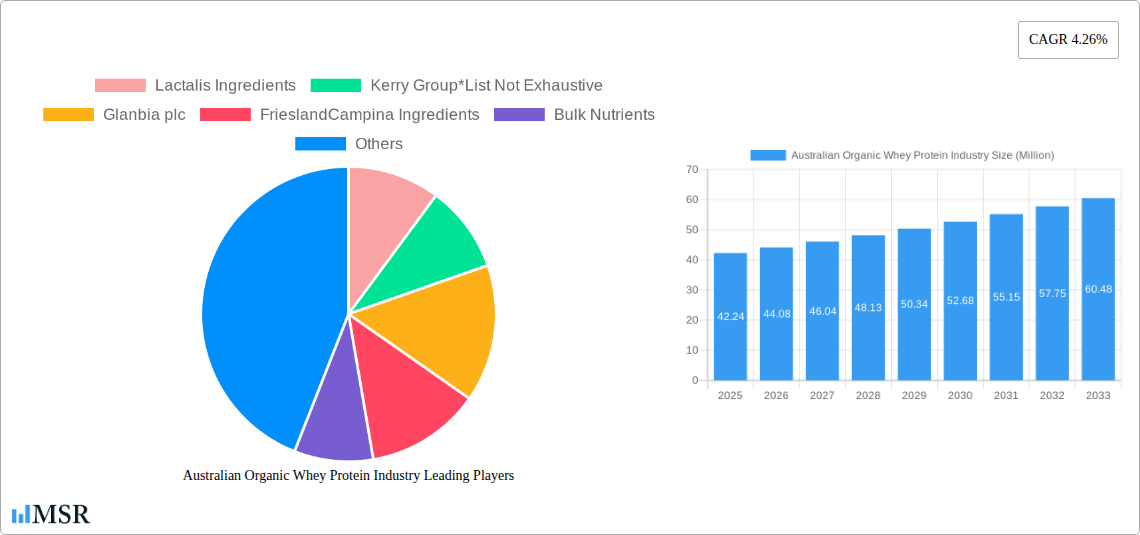

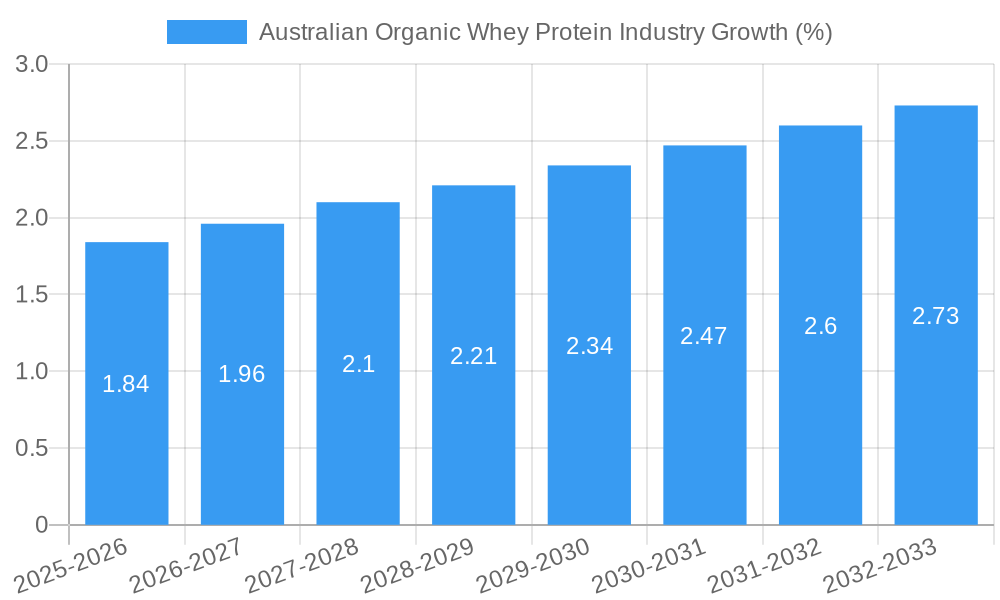

The Australian organic whey protein market, valued at approximately AUD 42.24 million in 2025, is projected to experience steady growth, driven by increasing consumer awareness of health and wellness, rising demand for clean-label and sustainably sourced products, and the growing popularity of plant-based diets leading to a segment of consumers seeking high-protein alternatives. The market's Compound Annual Growth Rate (CAGR) of 4.26% from 2019 to 2024 suggests a continued expansion through 2033, reaching an estimated AUD 60 million by 2033. Key segments driving this growth include whey protein isolates, favored for their purity and high protein content, and applications in sports nutrition, reflecting the strong fitness culture in Australia. The increasing demand for organic and ethically sourced ingredients is a significant factor, with consumers willing to pay a premium for transparency and sustainability. While potential restraints include fluctuating raw material prices and stringent regulations surrounding organic certification, the overall market outlook remains positive, fueled by the burgeoning health and wellness sector and the increasing adoption of organic lifestyles.

The market is characterized by a mix of both large multinational players like Lactalis Ingredients, Kerry Group, and Glanbia plc, and smaller, specialized Australian companies like Bulk Nutrients and Protein Supplies Australia. These smaller companies often cater to niche markets with specialized products and branding, targeting specific consumer segments focused on organic sourcing and particular dietary needs. Competition is likely to intensify with the entry of new players, particularly those focusing on innovative product formulations and sustainable practices. Future growth will depend on factors including effective marketing campaigns highlighting the health benefits and sustainability credentials of organic whey protein, and the continued development of innovative product applications across diverse food and beverage sectors. Furthermore, maintaining transparency and traceability throughout the supply chain will be critical to maintaining consumer trust and driving sustained market expansion.

Australian Organic Whey Protein Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Australian organic whey protein industry, offering invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report covers the period 2019-2033, with a focus on the estimated year 2025. Key aspects analyzed include market size, CAGR, segment performance, leading players, and future growth opportunities. The Australian organic whey protein market is projected to reach xx Million by 2033, demonstrating significant potential for expansion.

Australian Organic Whey Protein Industry Market Concentration & Dynamics

The Australian organic whey protein market exhibits a moderately concentrated structure, with several multinational corporations and domestic players vying for market share. Market leader Lactalis Ingredients holds an estimated xx% market share in 2025, followed by Kerry Group with an estimated xx%. Other key players include Glanbia plc, FrieslandCampina Ingredients, and Bulk Nutrients, each commanding a significant portion of the market. The market is characterized by a dynamic innovation ecosystem, with ongoing research and development focused on enhancing product quality, functionality, and sustainability.

Regulatory frameworks, specifically those governing organic certification and food safety, play a crucial role in shaping market dynamics. Substitute products, such as plant-based protein powders, pose a competitive challenge, though the demand for organic whey protein remains robust due to its nutritional profile. End-user trends, particularly the growing preference for health and wellness products, are driving market growth. M&A activity in the sector has been moderate over the historical period (2019-2024), with approximately xx deals recorded. This activity is expected to increase in the forecast period (2025-2033) as companies seek to consolidate their market positions and expand their product portfolios.

- Market Leaders (2025): Lactalis Ingredients (xx%), Kerry Group (xx%), Glanbia plc (xx%), FrieslandCampina Ingredients (xx%), Bulk Nutrients (xx%)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Organic certification standards, food safety regulations.

Australian Organic Whey Protein Industry Industry Insights & Trends

The Australian organic whey protein industry is experiencing robust growth, driven by several key factors. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Rising health consciousness among Australian consumers is a major driver, fueling demand for high-protein, organic food products. The growing popularity of sports and fitness activities further propels the demand for whey protein supplements. Technological advancements in whey protein processing, leading to improved product quality and functionality, also contribute to market growth. Changing consumer preferences towards natural and sustainable products also significantly impact industry growth. Emerging trends, such as personalized nutrition and the increasing demand for functional foods, offer additional growth avenues for the industry. Technological disruptions, such as the introduction of innovative processing techniques and novel whey protein ingredients, are transforming the market landscape. The industry also faces challenges including fluctuations in raw material prices and increasing competition from substitute products.

Key Markets & Segments Leading Australian Organic Whey Protein Industry

The Australian organic whey protein market is primarily driven by the sports and performance nutrition segment. This segment accounts for the largest market share (xx%) in 2025 due to the high demand for protein supplements among athletes and fitness enthusiasts. The infant formula segment also shows promising growth potential, driven by the increasing awareness of the health benefits of whey protein for infants. Within product types, whey protein isolates dominate the market, followed by whey protein concentrates. Hydrolyzed whey protein, while a smaller segment, is also growing rapidly due to its enhanced digestibility and absorption.

- Dominant Segment: Sports and performance nutrition (xx%)

- Fastest-Growing Segment: Infant Formula

- Dominant Product Type: Whey Protein Isolates

Drivers for Key Segments:

- Sports and Performance Nutrition: Growing health consciousness, increasing participation in sports and fitness activities, demand for high-quality protein supplements.

- Infant Formula: Growing awareness of the benefits of whey protein for infant development, increasing demand for organic and high-quality infant formula.

- Functional/Fortified Foods: Demand for convenient and nutritious food options, incorporation of whey protein in various functional food products.

Australian Organic Whey Protein Industry Product Developments

Recent years have witnessed significant product innovations within the Australian organic whey protein industry. Companies are focusing on developing specialized whey protein formulations tailored to specific consumer needs, such as low-lactose, high-protein blends, and products enriched with additional nutrients. The introduction of novel processing technologies is further enhancing product quality, digestibility, and functionality. FrieslandCampina's launch of Aequival 2'-fucosyl lactose, an ingredient containing HMOs for infant formula, exemplifies the industry's commitment to innovation. This focus on innovation is generating a competitive edge, driving market expansion, and meeting evolving consumer preferences.

Challenges in the Australian Organic Whey Protein Industry Market

The Australian organic whey protein industry faces challenges including fluctuations in raw material prices, increasing competition from both domestic and international players, and the rising cost of organic certification. Supply chain disruptions, particularly those related to raw material sourcing and transportation, can impact production and pricing. Stringent regulatory requirements and quality control measures add to the operational costs. The growing prevalence of plant-based protein alternatives also puts competitive pressure on organic whey protein producers. These factors collectively impact profitability and necessitate strategic adaptation for continued success within the market.

Forces Driving Australian Organic Whey Protein Industry Growth

Several factors contribute to the growth of the Australian organic whey protein market. Strong economic growth in Australia contributes to increased consumer spending on health and wellness products, driving demand for whey protein supplements. Technological advancements, including improved processing techniques and innovative product formulations, are enhancing product quality and creating new market opportunities. Favorable government policies and regulations supporting the organic food industry create a conducive environment for business expansion. The rising popularity of fitness and wellness lifestyles further fuels the demand for protein supplements.

Challenges in the Australian Organic Whey Protein Industry Market

Long-term growth in the Australian organic whey protein market hinges on strategic partnerships, collaborations, and market expansion initiatives. Companies are focusing on investing in research and development to create innovative products with superior functionalities and health benefits. Expanding into new markets and geographic regions presents significant growth potential. Strategic alliances with retailers and distributors can enhance market penetration and brand awareness. Continuous improvement in production processes, coupled with stringent quality control measures, helps in maintaining a strong competitive edge in the market.

Emerging Opportunities in Australian Organic Whey Protein Industry

Emerging opportunities in the Australian organic whey protein industry include the growing demand for personalized nutrition, which is creating a market for customized protein blends tailored to individual needs. The increasing use of whey protein in functional foods, such as protein bars, shakes, and baked goods, presents substantial growth prospects. The expanding popularity of plant-based protein alternatives also offers potential for companies to create hybrid products that combine the benefits of both whey and plant-based proteins.

Leading Players in the Australian Organic Whey Protein Industry Sector

- Lactalis Ingredients

- Kerry Group

- Glanbia plc

- FrieslandCampina Ingredients

- Bulk Nutrients

- Arla Foods Ingredients Group P/S

- Milkiland

- AB Rokiskio suris

- Protein Supplies Australia

- Bega Cheese Limited

Key Milestones in Australian Organic Whey Protein Industry Industry

- November 2022: FrieslandCampina launched Aequival 2'-fucosyl lactose, a whey protein ingredient with HMOs for infant formula.

- November 2022: Kerry Ingredients opened a new USD 2.5 Million innovation center focused on whey-based ingredients.

- January 2018: Fonterra Co-operative invested AUD 165 Million (USD 120.45 Million) in expanding its Australian operations.

Strategic Outlook for Australian Organic Whey Protein Industry Market

The Australian organic whey protein market is poised for continued growth, driven by strong consumer demand, technological advancements, and a favorable regulatory environment. Companies with a focus on innovation, strategic partnerships, and effective marketing strategies are well-positioned to capitalize on emerging opportunities. Further expansion into new segments, such as functional foods and personalized nutrition, will be crucial for sustained market leadership. A focus on sustainability and environmentally friendly practices will also be essential for long-term success.

Australian Organic Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrates

- 1.2. Whey Protein Isolates

- 1.3. Hydrolyzed Whey Proteins

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Australian Organic Whey Protein Industry Segmentation By Geography

- 1. Australia

Australian Organic Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Increasing awareness towards health among consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Organic Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrates

- 5.1.2. Whey Protein Isolates

- 5.1.3. Hydrolyzed Whey Proteins

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lactalis Ingredients

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kerry Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glanbia plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FrieslandCampina Ingredients

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bulk Nutrients

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arla Foods Ingredients Group P/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milkiland

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AB Rokiskio suris

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protein Supplies Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bega Cheese Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lactalis Ingredients

List of Figures

- Figure 1: Australian Organic Whey Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australian Organic Whey Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Australian Organic Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Australian Organic Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Australian Organic Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Australian Organic Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Australian Organic Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Australian Organic Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 13: Australian Organic Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 15: Australian Organic Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australian Organic Whey Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Organic Whey Protein Industry?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Australian Organic Whey Protein Industry?

Key companies in the market include Lactalis Ingredients, Kerry Group*List Not Exhaustive, Glanbia plc, FrieslandCampina Ingredients, Bulk Nutrients, Arla Foods Ingredients Group P/S, Milkiland, AB Rokiskio suris, Protein Supplies Australia, Bega Cheese Limited.

3. What are the main segments of the Australian Organic Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 42240 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Increasing awareness towards health among consumers.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

November 2022: FrieslandCampina unveiled a groundbreaking whey protein ingredient known as Aequival 2'-fucosyl lactose. This remarkable component includes Human Milk Oligosaccharides (HMOs) that create an optimal environment for nurturing beneficial gut bacteria in infants, thereby fostering healthy infant development. This innovative ingredient finds application in the production of infant formula.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Organic Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Organic Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Organic Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Australian Organic Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence