Key Insights

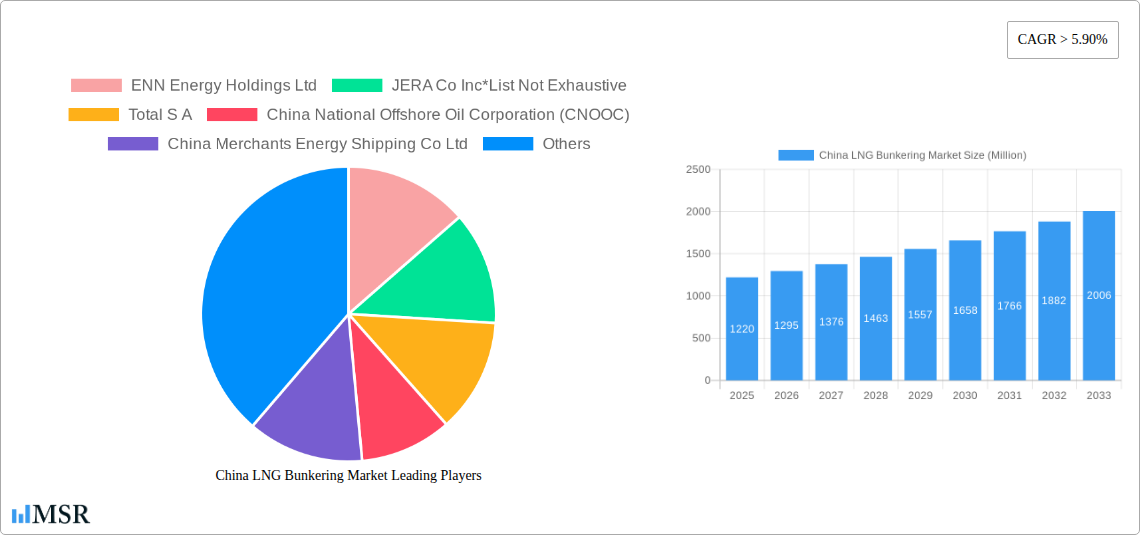

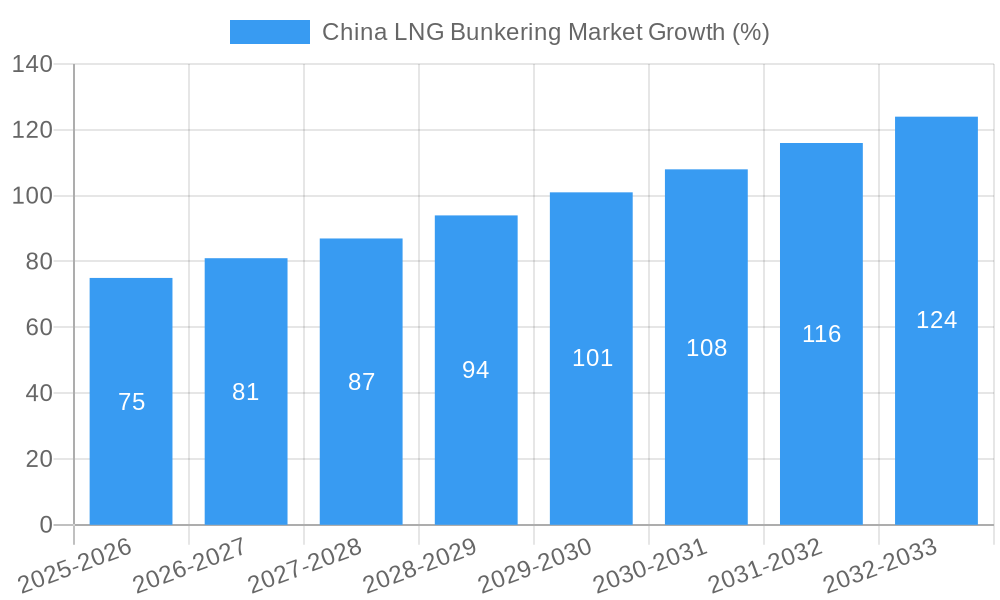

The China LNG bunkering market, valued at $1220 million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5.90% from 2025 to 2033. This growth is fueled by China's commitment to decarbonizing its maritime sector, stringent emission regulations targeting sulfur oxides and particulate matter, and the increasing availability of LNG as a cleaner marine fuel. The burgeoning demand for LNG bunkering is driven primarily by the tanker fleet, followed by container fleets and bulk carriers, as these segments actively seek to comply with global environmental standards. Major players like ENN Energy Holdings Ltd, JERA Co Inc, TotalEnergies, CNOOC, and Sinopec are strategically investing in LNG bunkering infrastructure and supply chains, solidifying their market positions. However, the market faces challenges including the high initial investment costs associated with LNG bunkering infrastructure development and the relatively limited availability of LNG bunkering ports compared to conventional fuel options. Despite these constraints, the long-term outlook remains positive, driven by government incentives, technological advancements improving LNG bunkering efficiency, and growing environmental awareness within the shipping industry. The market's geographic concentration within China reflects the nation’s proactive stance on environmental sustainability and its role as a global shipping hub.

Further growth will be spurred by advancements in LNG carrier technology leading to increased efficiency and reduced costs. The expansion of LNG bunkering infrastructure, both in terms of port facilities and bunkering vessels, will play a crucial role in unlocking the market's full potential. Government policies promoting the use of LNG as a marine fuel, coupled with incentives for both shipowners and infrastructure developers, will be vital in sustaining this growth trajectory. Competition among existing players and the potential entry of new entrants will shape the market dynamics, leading to innovative pricing strategies and a more diverse range of services within the sector. The continuous monitoring of global LNG prices and their impact on bunkering costs will remain a key factor influencing market behavior and future growth projections.

Unlocking Growth in China's Booming LNG Bunkering Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China LNG bunkering market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, growth drivers, key players, and future potential. The report projects a market size of xx Million by 2033, demonstrating significant growth potential. Download now to gain a competitive edge!

China LNG Bunkering Market Market Concentration & Dynamics

The China LNG bunkering market is experiencing rapid growth, driven by increasing environmental regulations and the government's commitment to carbon neutrality by 2060. Market concentration is currently moderate, with several key players vying for dominance. However, the market is expected to consolidate further as larger companies acquire smaller players. The regulatory framework is evolving, with ongoing efforts to streamline permitting and licensing processes. Substitute products, such as traditional marine fuels, face increasing pressure due to environmental concerns. End-user trends favor LNG as a cleaner alternative, particularly within the tanker and container fleets.

- Market Share: CNPC and Sinopec currently hold the largest market shares, estimated at xx% and xx% respectively in 2025. Other significant players include CNOOC, ENN Energy Holdings Ltd, and JERA Co Inc. The remaining market share is fragmented among smaller regional players.

- M&A Activity: The number of M&A deals in the sector has increased in recent years, reaching xx in 2024, signaling consolidation and investment. This trend is expected to continue throughout the forecast period.

- Innovation Ecosystem: The development of LNG bunkering infrastructure and related technologies is actively supported by government initiatives, fostering innovation and collaboration among various stakeholders.

China LNG Bunkering Market Industry Insights & Trends

The China LNG bunkering market is experiencing robust growth, driven by stringent environmental regulations, increasing demand for cleaner fuels, and supportive government policies. The market size reached xx Million in 2024 and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching an estimated xx Million by 2033. Technological advancements, such as the development of more efficient LNG bunkering vessels and infrastructure, are further accelerating market growth. Consumer behavior is shifting towards environmentally friendly options, pushing the adoption of LNG as a preferred marine fuel. Government subsidies and incentives are playing a crucial role in stimulating market expansion. The carbon neutrality targets set by the Chinese government are creating a strong impetus for widespread LNG adoption.

Key Markets & Segments Leading China LNG Bunkering Market

The Yangtze River Delta region is currently the leading market for LNG bunkering in China, driven by its high concentration of ports and shipping activity. The tanker fleet segment represents the largest end-user segment, followed by the container fleet. Growth in these segments is fueled by increasing trade volumes and stricter emission regulations.

- Tanker Fleet:

- Drivers: Expanding global trade, stringent emission regulations (IMO 2020), and government incentives for LNG bunkering.

- Container Fleet:

- Drivers: Growth in e-commerce and containerized cargo, port infrastructure improvements, and environmental concerns.

- Bulk and General Cargo Fleet:

- Drivers: Increasing demand for efficient and environmentally friendly transportation solutions for bulk commodities.

- Ferries and OSV:

- Drivers: Growing passenger and cargo traffic, increasing demand for cleaner fuels in coastal and inland waterways.

- Others: This segment includes smaller vessels and specialized ships, representing a niche but growing market segment.

The dominance of the Yangtze River Delta region stems from its established port infrastructure, significant shipping activity, and proactive government support for LNG bunkering development.

China LNG Bunkering Market Product Developments

Recent advancements focus on improving the efficiency and safety of LNG bunkering operations. This includes the development of advanced LNG bunkering vessels, improved cryogenic storage and transfer technologies, and sophisticated safety systems. These innovations are enhancing the competitiveness and market appeal of LNG as a marine fuel, and are crucial for addressing the challenges associated with handling cryogenic fuels.

Challenges in the China LNG Bunkering Market Market

The China LNG bunkering market faces challenges related to infrastructure development, the high initial investment costs associated with LNG bunkering infrastructure, and potential supply chain bottlenecks. Regulatory uncertainties and the need for further standardization of LNG bunkering procedures also pose hurdles. Competition from existing marine fuels and the need to address safety concerns related to LNG handling present further challenges. These factors could hinder market growth if not properly addressed.

Forces Driving China LNG Bunkering Market Growth

Several factors are driving the growth of the China LNG bunkering market, including government policies promoting cleaner fuels, increasing environmental regulations, and the rising demand for LNG as a sustainable alternative to traditional marine fuels. Government subsidies and incentives are further accelerating market expansion. Technological advancements in LNG bunkering infrastructure and equipment are also significantly contributing to market growth.

Long-Term Growth Catalysts in the China LNG Bunkering Market

Long-term growth hinges on continued investment in LNG bunkering infrastructure, technological innovations leading to cost reductions and efficiency improvements, and strategic partnerships between key players. Expansion into new markets and the development of new applications for LNG as a marine fuel will also play a vital role in driving future growth.

Emerging Opportunities in China LNG Bunkering Market

Emerging opportunities include expansion into new coastal regions, the development of smaller-scale LNG bunkering solutions for inland waterways, and the integration of digital technologies to optimize bunkering operations. Growing demand from specialized vessels and the potential for LNG-powered ferries and short-sea shipping vessels also present significant opportunities.

Leading Players in the China LNG Bunkering Market Sector

- ENN Energy Holdings Ltd

- JERA Co Inc

- Total S A

- China National Offshore Oil Corporation (CNOOC)

- China Merchants Energy Shipping Co Ltd

- China Petroleum & Chemical Corporation (Sinopec)

- China National Petroleum Corporation (CNPC)

- Shanghai LNG

- China National Chemical Corporation (ChemChina)

- China Gas Holdings Limited

Key Milestones in China LNG Bunkering Market Industry

- 2021: The Chinese government announced its goal to become carbon neutral by 2060, significantly boosting the LNG bunkering market's prospects.

- 2022: Launch of China's first LNG bunkering vessel, the "Huanghai Sino," marking a significant step towards establishing LNG bunkering infrastructure.

- 2023: Announcement of new government subsidies for LNG bunkering facilities and vessels, further stimulating market development.

Strategic Outlook for China LNG Bunkering Market Market

The China LNG bunkering market exhibits strong growth potential, driven by environmental regulations, technological advancements, and supportive government policies. Strategic opportunities lie in expanding infrastructure, developing innovative technologies, and fostering collaborations across the industry value chain. The market's future success relies on addressing existing challenges, such as infrastructure development costs and supply chain management. Companies adopting proactive strategies will be well-positioned to capitalize on the significant growth opportunities.

China LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

China LNG Bunkering Market Segmentation By Geography

- 1. China

China LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ENN Energy Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JERA Co Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Total S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Offshore Oil Corporation (CNOOC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Merchants Energy Shipping Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Petroleum & Chemical Corporation (Sinopec)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China National Petroleum Corporation (CNPC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai LNG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China National Chemical Corporation (ChemChina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Gas Holdings Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ENN Energy Holdings Ltd

List of Figures

- Figure 1: China LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: China LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China LNG Bunkering Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: China LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2019 & 2032

- Table 5: China LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China LNG Bunkering Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: China LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China LNG Bunkering Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: China LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2019 & 2032

- Table 11: China LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China LNG Bunkering Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China LNG Bunkering Market?

The projected CAGR is approximately > 5.90%.

2. Which companies are prominent players in the China LNG Bunkering Market?

Key companies in the market include ENN Energy Holdings Ltd, JERA Co Inc*List Not Exhaustive, Total S A, China National Offshore Oil Corporation (CNOOC), China Merchants Energy Shipping Co Ltd, China Petroleum & Chemical Corporation (Sinopec), China National Petroleum Corporation (CNPC), Shanghai LNG, China National Chemical Corporation (ChemChina), China Gas Holdings Limited.

3. What are the main segments of the China LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1220 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy.

6. What are the notable trends driving market growth?

Ferries and OSV Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In 2021, the Chinese government announced its to become carbon neutral by 2060. This is expected to further drive the development of the LNG bunkering market in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the China LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence