Key Insights

The India Uninterruptible Power Supply (UPS) market, valued at $277.8 million in 2024, is projected for significant expansion. This growth is fueled by escalating electricity demand, the proliferation of data centers, and increased UPS adoption across critical sectors including healthcare and telecommunications. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 4.4% from 2024 to 2033, underscoring a consistent upward trend.

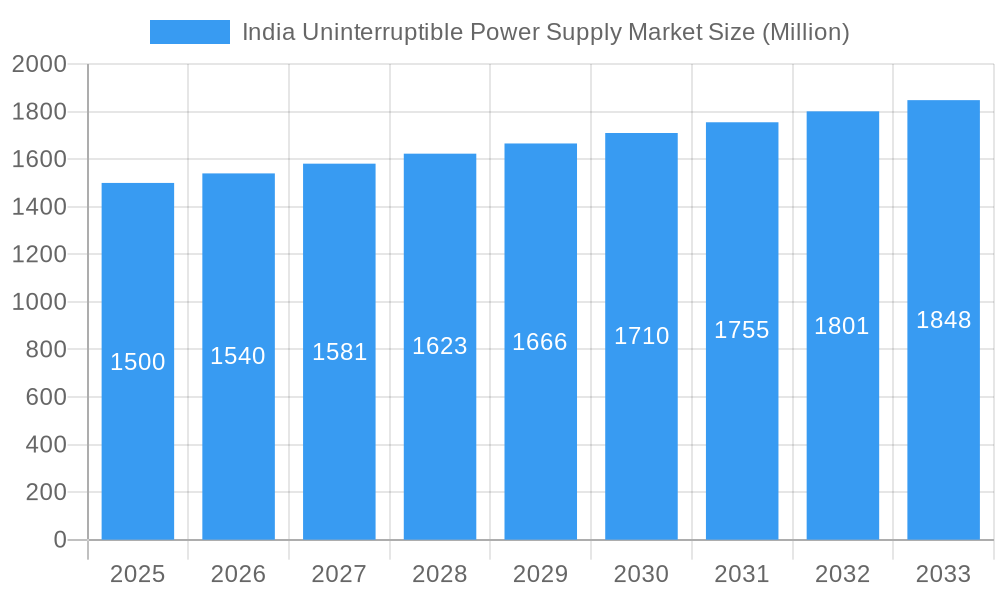

India Uninterruptible Power Supply Market Market Size (In Million)

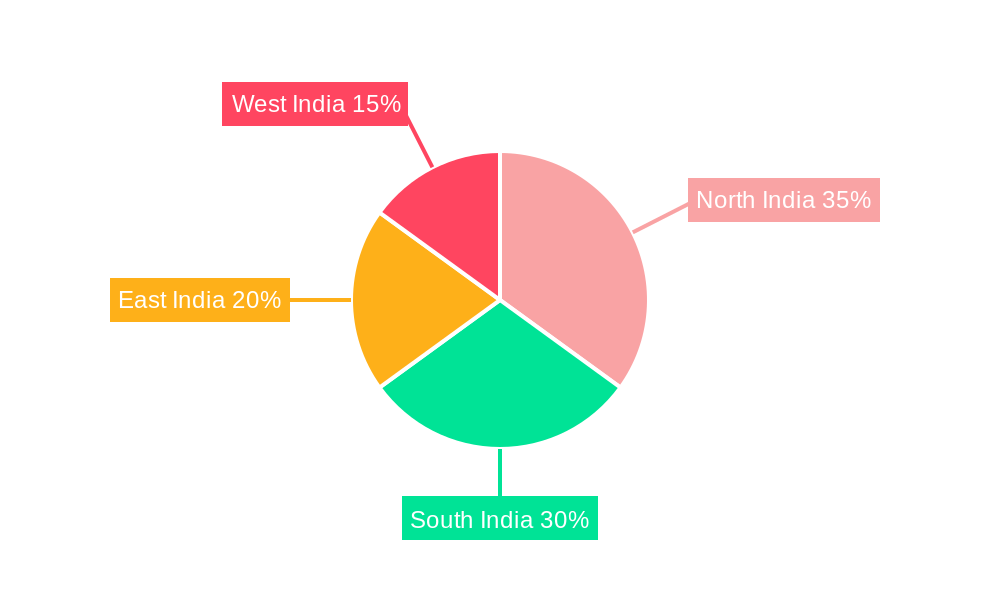

Key growth drivers include the imperative for reliable power backup amidst frequent outages, the expanding adoption of cloud computing and data centers necessitating uninterrupted power, and stringent government mandates promoting energy efficiency and data security. Analysis indicates that higher capacity UPS segments (above 100 kVA) are poised for accelerated growth, driven by the demands of large-scale data centers and industrial applications. Within UPS types, online UPS systems lead, offering continuous power supply, while standby and line-interactive systems serve niche requirements with cost-effectiveness as a primary consideration. Regional dynamics suggest varied growth potential, with urbanized and industrialized regions expected to lead expansion.

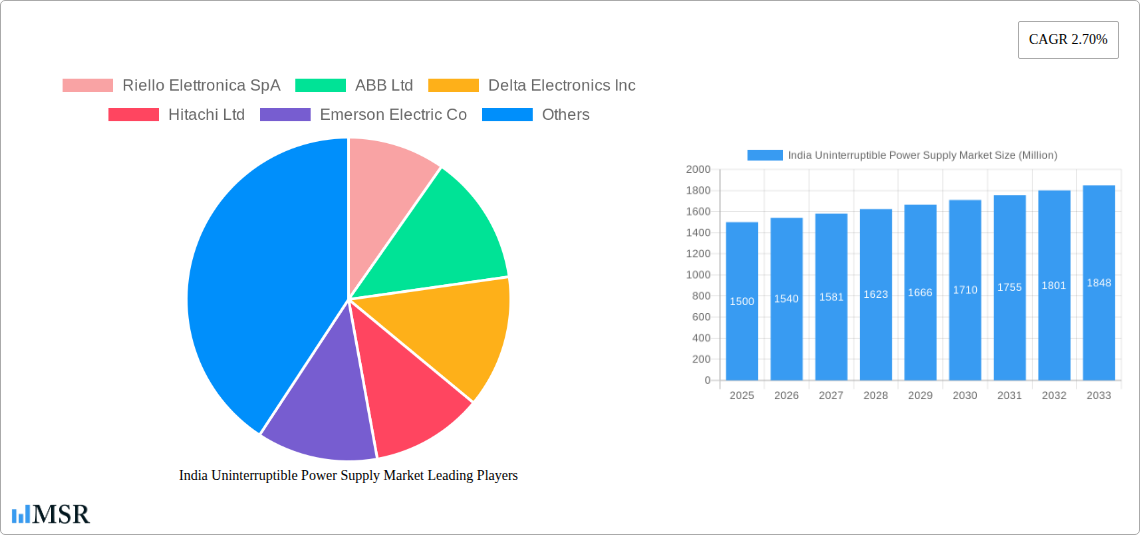

India Uninterruptible Power Supply Market Company Market Share

The competitive landscape is dynamic, featuring key players such as Riello Elettronica SpA, ABB Ltd, and Schneider Electric SE actively engaging in innovation, strategic alliances, and assertive market strategies to secure market share.

The forecast period (2024-2033) presents substantial opportunities for UPS providers. While high initial investment costs may pose a challenge for smaller enterprises, manufacturers are expected to address this through cost-effective solutions and flexible financing. Continuous innovation will focus on energy efficiency and advanced features like remote monitoring, driven by sustainability imperatives and the demand for enhanced system reliability. The sustained growth trajectory, coupled with technological advancements and diversification into new application areas, positions the India UPS market as a compelling investment opportunity.

India Uninterruptible Power Supply (UPS) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Uninterruptible Power Supply (UPS) market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with 2025 as the base year, this report unveils the market's size, growth trajectory, and key trends. The report delves into market segmentation by capacity (Less than 10 kVA, 10-100 kVA, Above 100 kVA), type (Standby UPS System, Online UPS System, Line-interactive UPS System), and application (Data Centers, Telecommunications, Healthcare, Industrial, Other Applications), offering a granular understanding of market dynamics. Expect detailed competitive analysis featuring key players such as Riello Elettronica SpA, ABB Ltd, Delta Electronics Inc, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, EATON Corporation PLC, General Electric Company, and Cyber Power Systems Inc. The report's forecast period extends to 2033, providing a long-term perspective on market opportunities and challenges.

India Uninterruptible Power Supply Market Market Concentration & Dynamics

The Indian UPS market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. The market's dynamics are shaped by several factors, including:

Market Concentration: The top five players collectively hold approximately xx% of the market share in 2025, indicating a moderate level of concentration. This is expected to slightly decrease by 2033 to xx%.

Innovation Ecosystem: The market is witnessing increasing innovation in battery technologies (like lithium-ion), energy efficiency, and smart features. Startups are playing a crucial role in driving this innovation.

Regulatory Framework: Government initiatives promoting renewable energy and industrial growth indirectly support UPS market expansion. However, regulatory complexities related to import/export and standards compliance can pose challenges.

Substitute Products: Diesel generators remain a significant competitor, particularly in areas with unreliable grid power. However, the increasing cost and environmental concerns associated with DGs are driving a shift toward UPS systems.

End-User Trends: The growing adoption of data centers, increasing reliance on IT infrastructure, and expanding healthcare facilities are driving the demand for reliable power backup solutions.

M&A Activities: The number of M&A deals in the Indian UPS market between 2019 and 2024 was approximately xx, indicating moderate consolidation activity. This is anticipated to increase to xx by 2033.

India Uninterruptible Power Supply Market Industry Insights & Trends

The Indian UPS market is experiencing robust growth, driven by several factors. The market size in 2025 is estimated at xx Million USD, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by:

Increasing Electrification: The expanding power grid and increased industrial activity necessitate reliable power backup solutions.

Rising Demand for Data Centers: India's burgeoning IT sector and the growing adoption of cloud computing and data analytics are driving demand for high-capacity UPS systems in data centers.

Technological Advancements: Innovations in battery technology, such as lithium-ion batteries, are improving UPS efficiency, reducing costs, and extending lifespan.

Government Initiatives: Government policies promoting renewable energy integration and industrial development are indirectly fostering the growth of the UPS market.

Evolving Consumer Behavior: Businesses and consumers are increasingly prioritizing reliable power supply to minimize disruptions and protect critical assets.

Infrastructure Development: Ongoing investments in infrastructure across various sectors are creating substantial demand for reliable power backup systems.

Key Markets & Segments Leading India Uninterruptible Power Supply Market

The Indian UPS market demonstrates significant growth across various segments and regions.

Dominant Segments:

Capacity: The 10-100 kVA segment holds the largest market share, driven by its suitability for a wide range of applications across various industries. The Above 100 kVA segment is experiencing the fastest growth rate, primarily due to the increasing demand from large data centers and industrial facilities.

Type: Online UPS systems are gaining traction due to their superior performance and reliability, although Standby UPS systems continue to dominate due to their cost-effectiveness.

Application: Data centers are the leading application segment, followed closely by the telecommunications and healthcare sectors. The industrial sector is also a significant contributor.

Growth Drivers:

Economic Growth: India's robust economic growth fuels industrial expansion and infrastructure development, driving the need for reliable power backup.

Infrastructure Development: Investments in power grids, telecommunications networks, and healthcare facilities are creating demand for UPS systems.

Government Policies: Government initiatives promoting renewable energy integration and industrial growth indirectly support the UPS market.

India Uninterruptible Power Supply Market Product Developments

Recent product developments in the Indian UPS market highlight a trend toward higher efficiency, improved reliability, and smarter features. Companies are introducing UPS systems with advanced battery technologies (like lithium-ion), improved power conversion efficiency, and remote monitoring capabilities. This focus on innovation and enhanced performance is crucial for capturing market share in a competitive landscape. The introduction of three-phase UPS systems with higher power ratings and bi-directional capabilities, as seen with Su-vastika's launch, exemplifies this trend.

Challenges in the India Uninterruptible Power Supply Market Market

The Indian UPS market faces challenges, including:

High Initial Investment Costs: The upfront cost of UPS systems can be a barrier to entry for smaller businesses.

Fluctuating Raw Material Prices: Dependence on imported components exposes the market to price volatility.

Competition from Diesel Generators: Diesel generators remain a significant competitor, especially in regions with unreliable grid power.

Technical Expertise: Proper installation and maintenance require specialized technical expertise, creating hurdles for some users.

Forces Driving India Uninterruptible Power Supply Market Growth

Several factors are driving the growth of the Indian UPS market:

Technological Advancements: Innovations in battery technology, power electronics, and control systems are enhancing UPS performance and reliability.

Economic Growth: Rapid economic growth leads to increased industrialization and urbanization, driving demand for power backup solutions.

Government Support: Government initiatives aimed at improving power infrastructure and promoting renewable energy integration are indirectly supporting the market's growth.

Long-Term Growth Catalysts in the India Uninterruptible Power Supply Market

Long-term growth in the Indian UPS market is fueled by:

Continued innovation in battery technologies, specifically focusing on cost reduction and increased energy density. Strategic partnerships between UPS manufacturers and renewable energy providers, enabling the integration of solar and other renewable sources with UPS systems. Expansion into new markets, including rural areas and smaller towns, where demand for reliable power is growing.

Emerging Opportunities in India Uninterruptible Power Supply Market

Emerging opportunities include:

Smart UPS Systems: The integration of IoT and AI capabilities for predictive maintenance and optimized energy management.

Renewable Energy Integration: UPS systems compatible with solar and other renewable energy sources.

Expansion into Rural Markets: Providing affordable and reliable power backup solutions to underserved regions.

Leading Players in the India Uninterruptible Power Supply Market Sector

Key Milestones in India Uninterruptible Power Supply Market Industry

October 2022: Su-vastika launches a lithium battery-based three-phase UPS system, offering a cleaner alternative to diesel generators. This signals a shift towards more sustainable power backup solutions.

June 2022: Vertiv launches a range of UPS solutions, indicating continued investment in product development and market expansion. This highlights the importance of robust distribution channels and customer engagement.

Strategic Outlook for India Uninterruptible Power Supply Market Market

The Indian UPS market holds substantial growth potential, driven by increasing energy demands, infrastructure development, and technological advancements. Strategic opportunities for market players include focusing on innovation in battery technology, developing energy-efficient solutions, and expanding distribution networks to reach underserved markets. Companies that can adapt to evolving consumer needs and leverage technological advancements will be well-positioned for success.

India Uninterruptible Power Supply Market Segmentation

-

1. Capacity

- 1.1. Less than 10 kVA

- 1.2. 10-100 kVA

- 1.3. Above 100kVA

-

2. Type

- 2.1. Standby UPS System

- 2.2. Online UPS System

- 2.3. Line-interactive UPS System

-

3. Application

- 3.1. Data Centers

- 3.2. Telecommunications

- 3.3. Healthcare (Hospitals, Clinics, etc.)

- 3.4. Industrial

- 3.5. Other Applications

India Uninterruptible Power Supply Market Segmentation By Geography

- 1. India

India Uninterruptible Power Supply Market Regional Market Share

Geographic Coverage of India Uninterruptible Power Supply Market

India Uninterruptible Power Supply Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels

- 3.3. Market Restrains

- 3.3.1. 4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy

- 3.4. Market Trends

- 3.4.1. Data Centers Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Uninterruptible Power Supply Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 10 kVA

- 5.1.2. 10-100 kVA

- 5.1.3. Above 100kVA

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Standby UPS System

- 5.2.2. Online UPS System

- 5.2.3. Line-interactive UPS System

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Data Centers

- 5.3.2. Telecommunications

- 5.3.3. Healthcare (Hospitals, Clinics, etc.)

- 5.3.4. Industrial

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riello Elettronica SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delta Electronics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EATON Corporation PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cyber Power Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Riello Elettronica SpA

List of Figures

- Figure 1: India Uninterruptible Power Supply Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Uninterruptible Power Supply Market Share (%) by Company 2025

List of Tables

- Table 1: India Uninterruptible Power Supply Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 2: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Capacity 2020 & 2033

- Table 3: India Uninterruptible Power Supply Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Type 2020 & 2033

- Table 5: India Uninterruptible Power Supply Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Application 2020 & 2033

- Table 7: India Uninterruptible Power Supply Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Region 2020 & 2033

- Table 9: India Uninterruptible Power Supply Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 10: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Capacity 2020 & 2033

- Table 11: India Uninterruptible Power Supply Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Type 2020 & 2033

- Table 13: India Uninterruptible Power Supply Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Application 2020 & 2033

- Table 15: India Uninterruptible Power Supply Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Uninterruptible Power Supply Market Volume kilowatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Uninterruptible Power Supply Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the India Uninterruptible Power Supply Market?

Key companies in the market include Riello Elettronica SpA, ABB Ltd, Delta Electronics Inc, Hitachi Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, EATON Corporation PLC, General Electric Company, Cyber Power Systems Inc.

3. What are the main segments of the India Uninterruptible Power Supply Market?

The market segments include Capacity , Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 277.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels.

6. What are the notable trends driving market growth?

Data Centers Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy.

8. Can you provide examples of recent developments in the market?

October 2022: Gurugram-based solar startup Su-vastika launched a lithium battery-based three-phase uninterruptible power supply (UPS) system that can be widely used as an alternative to polluting diesel generators (DGs) from residential and commercial buildings to educational facilities, hospitals, and shopping malls. The UPS system has power ratings of 10 kVA to 500 kVA and can work on a bi-directional technology based on an insulated-gate bipolar transistor (IGBT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in kilowatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Uninterruptible Power Supply Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Uninterruptible Power Supply Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Uninterruptible Power Supply Market?

To stay informed about further developments, trends, and reports in the India Uninterruptible Power Supply Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence