Key Insights

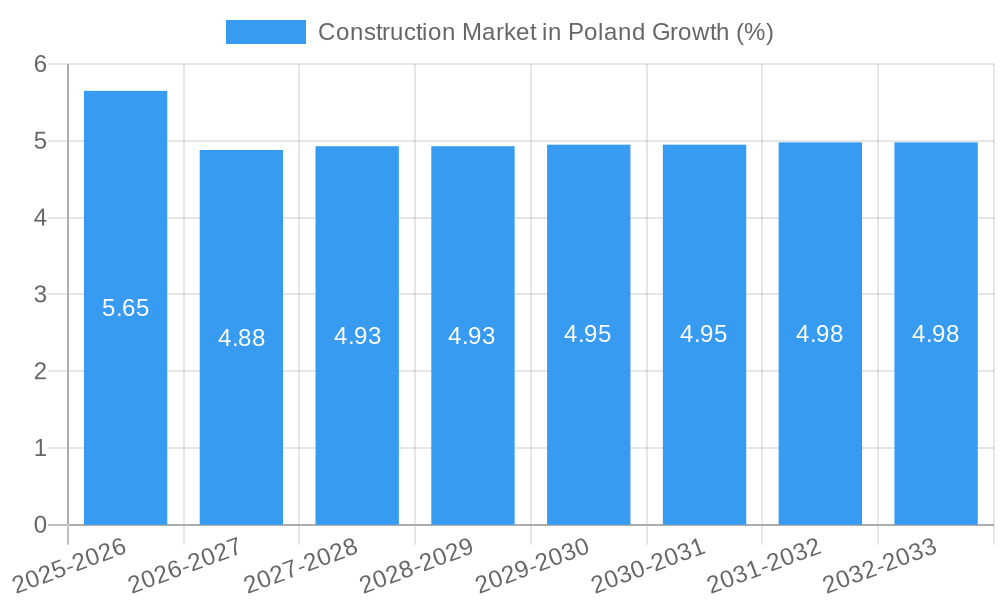

The Polish construction market, valued at €116.22 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.62% from 2025 to 2033. This positive trajectory is fueled by several key drivers. Increased government investment in infrastructure projects, particularly in transportation and energy, is stimulating significant demand. Furthermore, a growing population and rising urbanization are pushing the need for more residential and commercial buildings. The ongoing modernization of existing infrastructure and a focus on sustainable construction practices, including green building technologies, further contribute to market expansion. While potential supply chain disruptions and fluctuations in material costs pose challenges, the overall market outlook remains optimistic. The segmentation of the market reveals a strong presence across residential, commercial, industrial, infrastructure, and energy & utilities sectors, with residential construction potentially leading the growth given Poland's expanding population and rising middle class. Key players such as Panattoni Development Europe, Warbud SA, Strabag Sp z o o, and Budimex SA are well-positioned to capitalize on these growth opportunities.

The competitive landscape is characterized by both large multinational corporations and established domestic players. Competition is likely to intensify as companies strive to secure market share within the various segments. Success will hinge on factors such as project delivery capabilities, cost efficiency, and the ability to adapt to evolving regulatory requirements and sustainable building trends. The market's geographic concentration within Poland presents both opportunities and challenges; regional disparities in economic development could influence growth patterns. Further research into specific regional dynamics is necessary for a more granular understanding of localized market opportunities. The long-term outlook for the Polish construction market is promising, with consistent growth anticipated throughout the forecast period, largely dependent on sustained economic growth and continued government support for infrastructure development.

Construction Market in Poland: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Polish construction market, offering invaluable insights for stakeholders including investors, contractors, and policymakers. With a detailed examination of market dynamics, key players, and future trends, this report is essential for navigating the complexities of this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages historical data (2019-2024) to project future growth and identify key opportunities. Market value is expressed in Millions.

Construction Market in Poland Market Concentration & Dynamics

The Polish construction market exhibits a moderately concentrated landscape, with a few large players holding significant market share. While precise figures are proprietary, estimates suggest that the top 10 companies account for approximately xx% of the total market value in 2025. This concentration is driven by several factors:

- High Barriers to Entry: Significant capital investment, specialized expertise, and stringent regulatory compliance create barriers for new entrants.

- M&A Activity: The historical period (2019-2024) witnessed an average of xx M&A deals annually, with larger firms acquiring smaller ones to expand their market reach and service offerings. This trend is expected to continue, further consolidating the market.

- Innovation Ecosystems: While still developing, Poland's construction innovation ecosystem is gradually improving. Government initiatives and university collaborations are fostering innovation in sustainable building materials and construction technologies.

- Regulatory Frameworks: Stringent regulations surrounding building codes, safety standards, and environmental impact assessments influence market dynamics, creating opportunities for specialized firms.

- End-User Trends: A growing preference for sustainable and energy-efficient buildings is shaping demand and driving innovation in green construction practices.

- Substitute Products: The emergence of prefabricated building components and modular construction methods presents challenges and opportunities for traditional construction firms.

Construction Market in Poland Industry Insights & Trends

The Polish construction market is projected to experience robust growth during the forecast period (2025-2033), driven by several factors. The market size in 2025 is estimated at xx Million, with a Compound Annual Growth Rate (CAGR) of xx% anticipated until 2033. Key drivers include:

- Government Investments: Significant investments in infrastructure projects, particularly transportation and energy infrastructure, are stimulating market growth.

- Residential Construction Boom: Rapid urbanization and population growth are fueling demand for residential properties, particularly in major cities.

- Technological Disruptions: The adoption of Building Information Modeling (BIM) and other digital technologies is enhancing efficiency and productivity, though widespread adoption lags slightly compared to Western European counterparts.

- Evolving Consumer Behavior: Increased demand for sustainable and energy-efficient homes and commercial spaces is shaping market trends and influencing material choices.

Key Markets & Segments Leading Construction Market in Poland

The Polish construction market exhibits diverse growth across various sectors. While the exact dominance is subject to market fluctuations, the current trends point towards:

- Industrial Sector Dominance: Strong growth in e-commerce and manufacturing sectors is driving significant demand for industrial buildings and logistics facilities. Key drivers include foreign direct investment, expansion of existing facilities, and the development of new industrial parks. Panattoni Development Europe Sp z o o is a key player in this segment.

- Residential Sector Growth: The residential sector shows consistent growth, particularly in urban areas, fueled by increasing population and economic development. However, the pace of growth is expected to be slower compared to the industrial sector.

- Infrastructure Development: Government investment in infrastructure projects continues to contribute significantly to overall market expansion.

- Commercial Construction: The commercial sector witnesses moderate growth, driven primarily by office development and retail expansion in major cities.

- Energy and Utilities: This segment displays moderate growth, largely influenced by government initiatives to modernize energy infrastructure and enhance renewable energy capabilities.

Construction Market in Poland Product Developments

Innovation in building materials, construction techniques, and project management software is shaping the Polish construction landscape. The use of prefabricated components, 3D printing in construction, and advanced building materials is increasing efficiency and sustainability. Furthermore, the adoption of BIM (Building Information Modeling) and other digital tools is improving project planning and execution, creating a competitive edge for companies adopting these technologies.

Challenges in the Construction Market in Poland Market

The Polish construction market faces several challenges impacting its growth trajectory:

- Skill Shortages: A shortage of skilled labor is a major constraint, impacting project timelines and costs.

- Supply Chain Disruptions: Global supply chain disruptions, particularly in building materials, can lead to project delays and cost overruns.

- Regulatory Complexity: Navigating complex regulations and obtaining necessary permits can be time-consuming and costly.

- Economic Volatility: Economic fluctuations can impact investment decisions and overall market demand.

Forces Driving Construction Market in Poland Growth

Several forces are driving growth in the Polish construction market:

- EU Funding: EU funds allocated to infrastructure development significantly contribute to project financing and implementation.

- Government Initiatives: Government policies promoting sustainable construction and energy efficiency are driving innovation and growth.

- Foreign Investment: Foreign direct investment in industrial and logistics projects fuels demand for new construction.

Challenges in the Construction Market in Poland Market

Long-term growth will hinge on addressing skill shortages through vocational training initiatives and attracting foreign skilled workers. Sustainable development practices, including the use of eco-friendly building materials and energy-efficient designs, will also be crucial for sustainable expansion.

Emerging Opportunities in Construction Market in Poland

Emerging opportunities lie in green construction, prefabrication, and digital technologies. The growing demand for sustainable and energy-efficient buildings presents significant opportunities for companies offering such solutions. Furthermore, the increasing adoption of digital technologies presents opportunities for improving efficiency and reducing costs.

Leading Players in the Construction Market in Poland Sector

- Panattoni Development Europe Sp z o o

- PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- WARBUD SA

- Strabag Sp z o o

- Mobile Services Team Sp z o o

- ERBUD SA

- EUROVIA POLSKA SA

- UNIBEP SA

- SKANSKA SA

- PORR SA

- TORPOL SA

- BUDIMEX SA

Key Milestones in Construction Market in Poland Industry

- 2021: Launch of a government program promoting sustainable construction practices.

- 2022: Completion of a major highway expansion project.

- 2023: Several significant M&A transactions involving major construction firms.

- 2024: Increased adoption of BIM technology by larger firms.

Strategic Outlook for Construction Market in Poland Market

The Polish construction market is poised for sustained growth, driven by strong fundamentals and government support. Strategic opportunities exist for companies focusing on sustainable construction practices, digital technologies, and addressing the skilled labor shortage. Focusing on these areas will be crucial for realizing the full potential of the Polish construction market in the coming years.

Construction Market in Poland Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Construction Market in Poland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Market in Poland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Demand for Infrastructure to Boost the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WARBUD SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Strabag Sp z o o

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mobile Services Team Sp z o o

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ERBUD SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EUROVIA POLSKA SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UNIBEP SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKANSKA SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PORR SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TORPOL SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BUDIMEX SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

List of Figures

- Figure 1: Global Construction Market in Poland Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Poland Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 3: Poland Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Market in Poland?

The projected CAGR is approximately 4.62%.

2. Which companies are prominent players in the Construction Market in Poland?

Key companies in the market include Panattoni Development Europe Sp z o o *List Not Exhaustive, PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o, WARBUD SA, Strabag Sp z o o, Mobile Services Team Sp z o o, ERBUD SA, EUROVIA POLSKA SA, UNIBEP SA, SKANSKA SA, PORR SA, TORPOL SA, BUDIMEX SA.

3. What are the main segments of the Construction Market in Poland?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Demand for Infrastructure to Boost the Construction Sector.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Market in Poland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Market in Poland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Market in Poland?

To stay informed about further developments, trends, and reports in the Construction Market in Poland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence