Key Insights

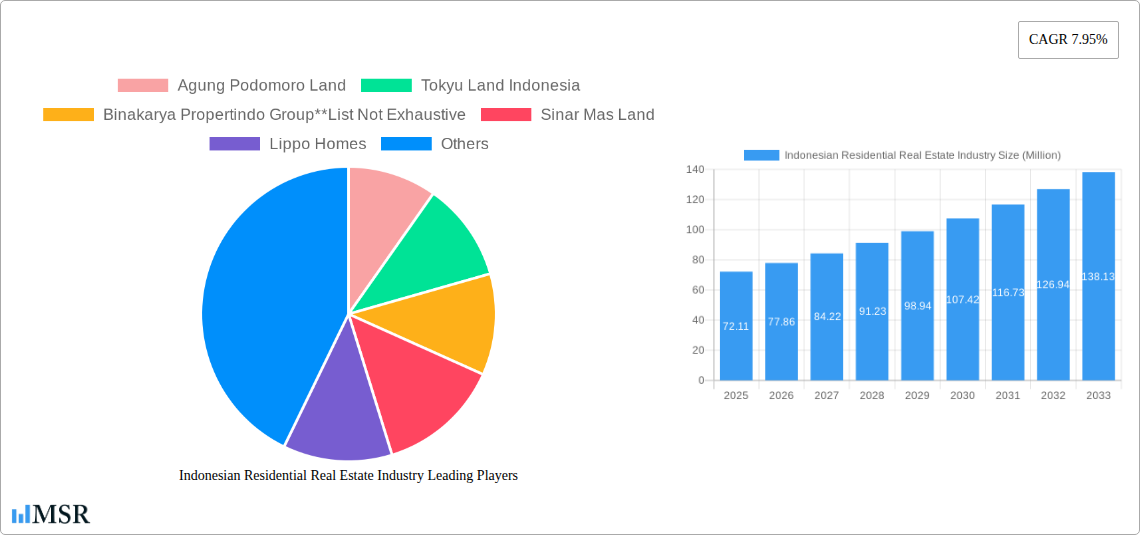

The Indonesian residential real estate market, valued at $72.11 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.95% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable income is a significant factor, coupled with Indonesia's rapidly urbanizing population, particularly in major cities like Jakarta, Surabaya, and Semarang. Government initiatives aimed at improving infrastructure and affordable housing also contribute to market dynamism. The market is segmented by property type (condominiums and apartments, villas and landed houses) and location, reflecting diverse consumer preferences and regional economic disparities. While strong demand drives growth, challenges remain, including land scarcity in prime urban areas, fluctuating interest rates impacting mortgage affordability, and potential regulatory hurdles. The competitive landscape comprises both established players like Agung Podomoro Land, Sinar Mas Land, and Ciputra Group, and emerging developers vying for market share. The market's trajectory suggests continued growth, though careful consideration of macroeconomic factors and regulatory changes will be crucial for long-term success.

Indonesian Residential Real Estate Industry Market Size (In Million)

The forecast period of 2025-2033 presents significant opportunities for investors and developers. However, strategic planning is essential to navigate the potential headwinds. Understanding shifting consumer preferences, adapting to evolving technological advancements in construction and property management, and maintaining a robust risk management strategy will prove vital for navigating the complexities of this dynamic market. The continued focus on sustainable development practices and incorporating environmentally friendly building materials will likely become increasingly important to appeal to a growing segment of environmentally conscious buyers. Furthermore, effective marketing strategies catering to specific demographics and leveraging digital channels are crucial for market penetration and success in this competitive environment.

Indonesian Residential Real Estate Industry Company Market Share

Indonesian Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesian residential real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and emerging trends, enabling informed decision-making in this dynamic sector. The Indonesian residential real estate market, valued at xx Million USD in 2025, is projected to experience significant growth, reaching xx Million USD by 2033.

This report analyzes key segments including condominiums and apartments, villas and landed houses, across major cities like Jakarta, Greater Surabaya, Semarang, and the Rest of Indonesia. Leading players such as Agung Podomoro Land, Tokyu Land Indonesia, Binakarya Propertindo Group, Sinar Mas Land, Lippo Homes, JABABEKA, PT Pakuwon Jati, Ciputra Group, PP Properti, and Duta Anggada Realty are profiled, providing a competitive landscape overview.

Key Report Highlights:

- Comprehensive Market Sizing and Forecasting: Detailed analysis of market size and Compound Annual Growth Rate (CAGR) from 2019 to 2033.

- Segment-Specific Deep Dive: In-depth exploration of condominiums & apartments, villas & landed houses across key Indonesian cities.

- Competitive Landscape Analysis: Evaluation of market share, M&A activity, and competitive strategies of leading players.

- Growth Drivers and Challenges: Identification of key growth catalysts and potential market restraints, including regulatory frameworks and supply chain dynamics.

- Emerging Opportunities: Highlighting future trends and investment prospects in the Indonesian residential real estate market.

Indonesian Residential Real Estate Industry Market Concentration & Dynamics

The Indonesian residential real estate market exhibits a moderately concentrated landscape, with a few large players holding significant market share. Agung Podomoro Land, Sinar Mas Land, and Ciputra Group, for example, command substantial portions of the market, particularly in key metropolitan areas. However, a significant number of smaller developers also contribute to the overall market activity. The industry displays a dynamic interplay between established players and emerging developers, leading to ongoing competition and innovation.

Market Concentration Metrics (2025 Estimates):

- Top 5 players' combined market share: xx%

- Average M&A deal value (2019-2024): xx Million USD

- Number of M&A deals (2019-2024): xx

The regulatory framework influences market dynamics, with government policies impacting land availability, building permits, and financing options. Substitute products, such as rental properties, compete for consumer preferences. End-user trends, particularly among younger generations, increasingly favor modern, sustainable, and technologically integrated housing solutions. M&A activity is driven by expansion strategies, market consolidation, and access to new technologies and resources.

Indonesian Residential Real Estate Industry Industry Insights & Trends

The Indonesian residential real estate market has exhibited robust growth during the historical period (2019-2024), primarily driven by factors such as a growing population, rising urbanization, and increasing disposable incomes. The market size expanded from xx Million USD in 2019 to xx Million USD in 2024, achieving a CAGR of xx%. Technological disruptions, such as the adoption of proptech solutions, are transforming the industry, improving efficiency and transparency. Consumer behaviors are evolving, with greater emphasis on smart home technology, sustainability, and community features. The market is also influenced by government initiatives aimed at increasing housing affordability and infrastructure development. The forecast period (2025-2033) anticipates continued growth fueled by these trends, albeit at a potentially moderated pace due to macroeconomic factors. The estimated market size for 2025 is xx Million USD.

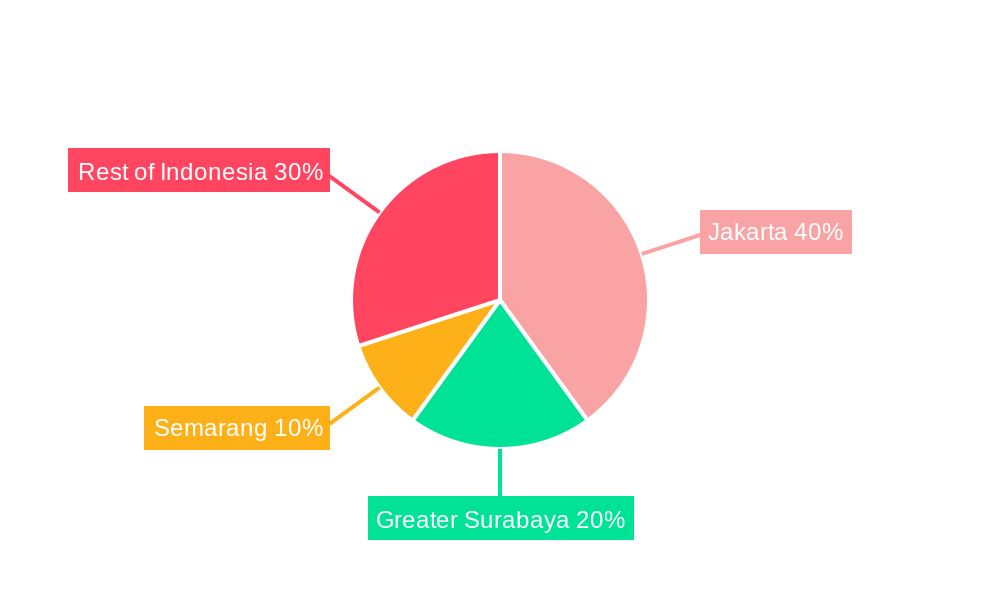

Key Markets & Segments Leading Indonesian Residential Real Estate Industry

Jakarta consistently remains the dominant market, driven by strong economic activity, high population density, and significant infrastructure development. Greater Surabaya represents a substantial secondary market, followed by Semarang and other key cities across Indonesia. The condominium and apartment segment is experiencing significant growth, fueled by demand from urban professionals and investors, while the villas and landed houses segment caters to a more affluent market segment and shows steady growth.

Drivers of Dominance:

- Jakarta: Strong economic activity, high population density, significant infrastructure development, concentration of employment opportunities.

- Greater Surabaya: Significant industrial and commercial activity, growing population, and relatively lower property prices than Jakarta.

- Semarang: Emerging as a key regional center with growing investment in infrastructure and real estate.

- Condominiums & Apartments: High demand from urban professionals, investors, and young families; higher land utilization efficiency.

- Villas & Landed Houses: Appeal to high-net-worth individuals and families; preference for spaciousness and privacy.

Indonesian Residential Real Estate Industry Product Developments

Product innovation focuses on incorporating smart home technology, sustainable building materials, and energy-efficient designs. Developers are increasingly adopting modular construction techniques to accelerate project timelines and reduce costs. The emphasis on enhanced security features, community amenities, and flexible living spaces caters to evolving consumer preferences. These advancements enhance the competitive edge of developers, attracting buyers seeking modern and technologically integrated homes.

Challenges in the Indonesian Residential Real Estate Industry Market

The Indonesian residential real estate market faces challenges such as land scarcity in prime locations, bureaucratic hurdles in obtaining permits, and potential disruptions in the global supply chain affecting construction materials. These factors contribute to increased costs and project delays, impacting overall profitability. Intense competition among developers also puts pressure on pricing and margins. Furthermore, macroeconomic factors like inflation and interest rates can influence consumer demand and investment decisions.

Forces Driving Indonesian Residential Real Estate Industry Growth

Several factors are driving growth, including sustained economic expansion, increasing urbanization, rising middle-class incomes, and government initiatives aimed at promoting affordable housing. Technological advancements such as proptech solutions improve market transparency and efficiency. Infrastructure investments in transportation and utilities further boost market development in key regions.

Long-Term Growth Catalysts in the Indonesian Residential Real Estate Industry

Long-term growth will be fueled by continued infrastructure development, government support for affordable housing initiatives, and the adoption of innovative technologies in construction and property management. Strategic partnerships between developers and technology providers will unlock efficiencies and create new value propositions for consumers. Expansion into secondary and tertiary cities holds significant potential for future market growth.

Emerging Opportunities in Indonesian Residential Real Estate Industry

Emerging opportunities lie in the development of sustainable and environmentally friendly housing solutions, catering to growing consumer demand for eco-conscious living. The integration of smart home technology and proptech solutions offers significant potential for improving operational efficiency and enhancing customer experiences. Expanding into underserved markets in smaller cities and regions presents growth avenues for developers.

Leading Players in the Indonesian Residential Real Estate Industry Sector

- Agung Podomoro Land

- Tokyu Land Indonesia

- Binakarya Propertindo Group

- Sinar Mas Land

- Lippo Homes

- JABABEKA

- PT Pakuwon Jati

- Ciputra Group

- PP Properti

- Duta Anggada Realty

Key Milestones in Indonesian Residential Real Estate Industry Industry

- 2020: Government launches affordable housing initiative.

- 2021: Several major developers announce strategic partnerships with proptech companies.

- 2022: Significant increase in investment in sustainable building technologies.

- 2023: Launch of several large-scale mixed-use developments in major cities.

- 2024: Increased M&A activity among residential developers.

Strategic Outlook for Indonesian Residential Real Estate Industry Market

The Indonesian residential real estate market exhibits strong long-term growth potential, driven by favorable demographic trends, economic expansion, and ongoing urbanization. Strategic opportunities lie in capitalizing on technological advancements, focusing on sustainable development practices, and expanding into emerging markets across the archipelago. By adapting to evolving consumer preferences and proactively addressing industry challenges, developers can capture significant market share and generate substantial returns.

Indonesian Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and landed houses

-

2. Key Cities

- 2.1. Jakarta

- 2.2. Greater Surabaya

- 2.3. Semarang

- 2.4. Rest of Indonesia

Indonesian Residential Real Estate Industry Segmentation By Geography

- 1. Indonesia

Indonesian Residential Real Estate Industry Regional Market Share

Geographic Coverage of Indonesian Residential Real Estate Industry

Indonesian Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw material prices

- 3.4. Market Trends

- 3.4.1. Jakarta Emerging as a Prime Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and landed houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Jakarta

- 5.2.2. Greater Surabaya

- 5.2.3. Semarang

- 5.2.4. Rest of Indonesia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyu Land Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Binakarya Propertindo Group**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinar Mas Land

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lippo Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JABABEKA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pakuwon Jati

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ciputra Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PP Properti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duta Anggada Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesian Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesian Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Residential Real Estate Industry?

The projected CAGR is approximately 7.95%.

2. Which companies are prominent players in the Indonesian Residential Real Estate Industry?

Key companies in the market include Agung Podomoro Land, Tokyu Land Indonesia, Binakarya Propertindo Group**List Not Exhaustive, Sinar Mas Land, Lippo Homes, JABABEKA, PT Pakuwon Jati, Ciputra Group, PP Properti, Duta Anggada Realty.

3. What are the main segments of the Indonesian Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture.

6. What are the notable trends driving market growth?

Jakarta Emerging as a Prime Rental Market.

7. Are there any restraints impacting market growth?

Volatility in Raw material prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Indonesian Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence