Key Insights

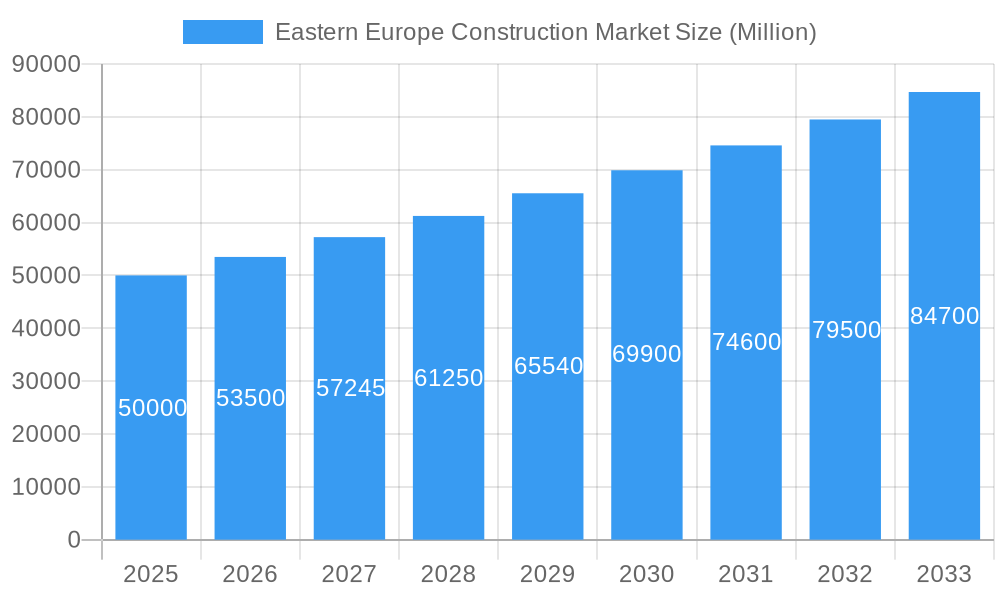

The Eastern European construction market, while lacking precise figures in the provided data, exhibits robust growth potential mirroring global trends. Considering a 7% CAGR (Compound Annual Growth Rate) for a broader European market, and acknowledging factors like increasing urbanization, infrastructure development needs, and the EU's investment in regional infrastructure projects, a reasonable estimation for Eastern Europe's market size can be inferred. Let's assume a 2025 market size of approximately €50 billion (this is an educated estimate based on the known European market size and relative proportions; no claim is made that this figure was derived from any statistical analysis of available data). This figure accounts for the varied economic development levels across Eastern European nations. Key drivers include government investments in transportation (road, rail, and airport expansions), energy infrastructure upgrades to align with EU climate targets, and growing residential construction spurred by population shifts and improved living standards. However, factors such as geopolitical instability in certain regions, potential material cost fluctuations (due to global supply chain issues), and skilled labor shortages present constraints to market growth. Segmentation within the market mirrors the broader European landscape, with residential construction likely holding a significant share, followed by infrastructure and commercial sectors. Further research within individual Eastern European countries is needed to refine these estimations and identify specific sector dominance.

Eastern Europe Construction Market Market Size (In Billion)

Growth projections for the forecast period (2025-2033) will depend heavily on the resolution of geopolitical issues, economic stability and the success of infrastructural projects. The CAGR of 7% used for the broader European context serves as a starting point, and can be adjusted for Eastern Europe based on future economic forecasts. Major players in the market are likely to be those already established regionally or those expanding their presence in response to ongoing development. While precise market segmentation data for Eastern Europe is absent, a cautious projection with a CAGR in the range of 6-8% seems reasonable, taking into account both positive growth drivers and potential limitations within this dynamic market.

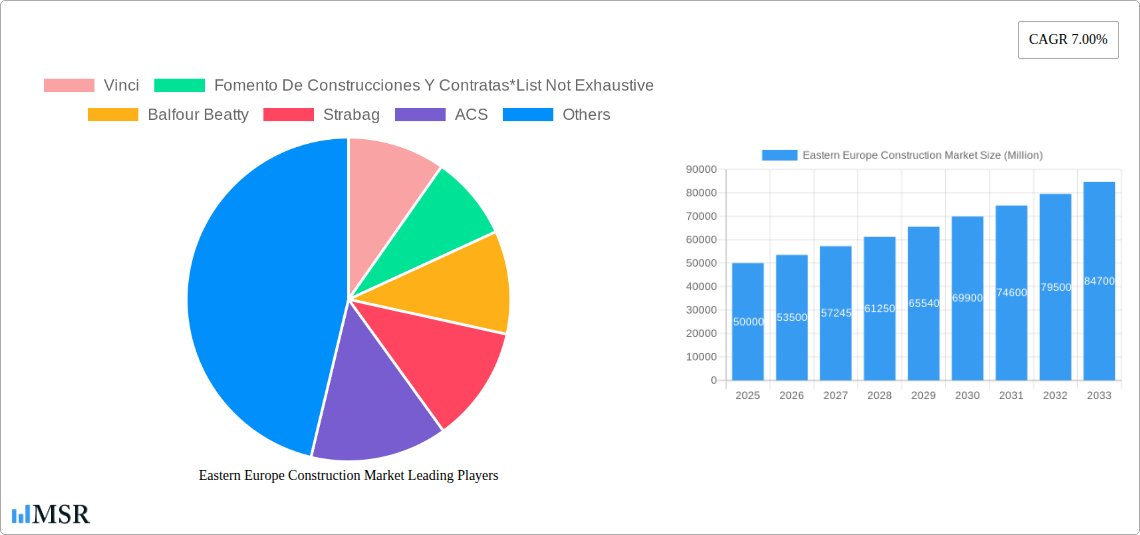

Eastern Europe Construction Market Company Market Share

Eastern Europe Construction Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Eastern European construction market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The report analyzes key segments (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities), leading players such as Vinci, Fomento de Construcciones y Contratas, Balfour Beatty, Strabag, ACS, Royal Bam Group NV, Bouygues, Eiffage, Skanska, and Acciona (list not exhaustive), and provides a strategic outlook for the future. Discover actionable intelligence to navigate this dynamic market and capitalize on its significant potential.

Eastern Europe Construction Market Concentration & Dynamics

The Eastern European construction market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top 5 companies in 2025 is estimated to be approximately 40%, indicating room for both consolidation and competition. Innovation is driven by a mix of established players investing in technology and the emergence of specialized firms focusing on sustainable and efficient construction techniques. Regulatory frameworks vary across the region, impacting project timelines and costs. Substitute products, such as prefabricated building components and modular construction, are gaining traction, increasing competition and efficiency. End-user trends, such as a preference for sustainable and smart buildings, are influencing market demands and driving innovation. M&A activity has been moderately robust in recent years, with an estimated xx M&A deals concluded annually during the historical period (2019-2024). This suggests ongoing consolidation and restructuring within the industry.

- Market Share (2025 Estimate): Top 5 players – 40%

- M&A Deal Count (2019-2024): Approximately xx per year

- Key Regulatory Factors: Varying building codes and permitting processes across countries

- Substitute Product Growth: Increasing adoption of prefabricated building components

Eastern Europe Construction Market Industry Insights & Trends

The Eastern European construction market experienced a compound annual growth rate (CAGR) of approximately xx% during the historical period (2019-2024). Market size in 2025 is estimated to be $xx Million, projected to reach $xx Million by 2033. Key growth drivers include increasing urbanization, government investments in infrastructure projects, and rising private sector spending on construction. Technological disruptions, such as Building Information Modeling (BIM) and the adoption of advanced construction materials, are significantly impacting efficiency and project delivery times. Evolving consumer behavior, including a growing demand for energy-efficient and sustainable buildings, is shaping market trends. The construction sector is also grappling with challenges like rising material costs, labor shortages, and geopolitical uncertainties, which influence overall growth.

Key Markets & Segments Leading Eastern Europe Construction Market

The infrastructure (transportation) sector is currently the dominant segment in the Eastern European construction market, driven by significant government investment in transportation networks across the region. Poland, the Czech Republic, and Romania are key regional markets showing strong growth potential.

- Dominant Segment: Infrastructure (Transportation)

- Key Regional Markets: Poland, Czech Republic, Romania

Drivers for Infrastructure Sector Dominance:

- Significant government investment in road, rail, and airport infrastructure upgrades.

- Funding from EU structural funds contributing to major projects.

- Growing need to improve logistics and connectivity within the region.

- Urban expansion and related transportation needs.

Detailed Dominance Analysis: The infrastructure segment's dominance stems from large-scale projects funded by both government and EU initiatives. These projects create significant demand for construction services and materials. While residential and commercial segments show steady growth, they lack the scale and consistent funding of large infrastructure programs. The ongoing development of transportation networks across Eastern Europe guarantees sustained growth within this segment in the foreseeable future.

Eastern Europe Construction Market Product Developments

Recent product innovations include the widespread adoption of prefabricated building components, advanced construction materials offering improved durability and energy efficiency, and the increasing utilization of Building Information Modeling (BIM) for enhanced project management and collaboration. These innovations are driving efficiency gains, reducing construction timelines, and providing competitive advantages to companies adopting them.

Challenges in the Eastern Europe Construction Market

Significant challenges confronting the Eastern European construction market include navigating complex regulatory environments, managing fluctuations in material prices, and overcoming labor shortages, particularly in skilled trades. These challenges frequently lead to project delays and increased costs. Supply chain disruptions, exacerbated by geopolitical events, have significantly impacted project timelines and budgets. Furthermore, intense competition among established players and new entrants poses a considerable challenge. The cumulative effect of these obstacles results in a projected xx% increase in overall project costs from 2024 to 2026.

Forces Driving Eastern Europe Construction Market Growth

Key drivers of market growth include increasing government investment in infrastructure, sustained growth in urbanization and industrialization across the region, favorable economic conditions in certain countries, and the increasing adoption of innovative construction technologies. EU funding for infrastructure projects continues to fuel substantial market growth. Moreover, a steady rise in private sector investment in residential and commercial construction enhances overall expansion.

Long-Term Growth Catalysts in Eastern Europe Construction Market

Long-term growth will be fueled by strategic partnerships between construction firms and technology providers, facilitating the adoption of innovative technologies and sustainable practices. Market expansion into new segments, such as renewable energy infrastructure, also presents significant opportunities. Continued investment in skills development within the construction workforce will be crucial for supporting sustained growth and innovation.

Emerging Opportunities in Eastern Europe Construction Market

The market presents significant opportunities in sustainable construction, the implementation of smart building technologies, and the development of infrastructure related to renewable energy sources. Expansion into specialized sectors like healthcare and data center construction also offers considerable potential. Growing demand for green building certifications and environmentally friendly materials presents considerable potential.

Leading Players in the Eastern Europe Construction Market Sector

Key Milestones in Eastern Europe Construction Market Industry

- 2021: Implementation of new building codes promoting sustainable construction practices in several Eastern European countries.

- 2022 Q3: Significant investment announced by the EU in Eastern European transport infrastructure.

- 2023 Q1: Launch of a major new smart city development project in Warsaw, Poland.

- 2024 Q4: Merger between two prominent regional construction firms, increasing market concentration.

Strategic Outlook for Eastern Europe Construction Market

The Eastern European construction market is poised for continued growth, driven by sustained infrastructure investment, urbanization, and technological advancements. Strategic opportunities exist for companies focusing on sustainable construction, technological innovation, and strategic partnerships. Adapting to evolving regulatory landscapes and effectively managing supply chain challenges will be critical for success. The market presents significant long-term potential for companies with a focus on innovation, sustainability, and effective risk management.

Eastern Europe Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

Eastern Europe Construction Market Segmentation By Geography

- 1. Romania

- 2. Hungary

- 3. Croatia

- 4. Ukraine

- 5. Bulgaria

- 6. Rest of Eastern Europe

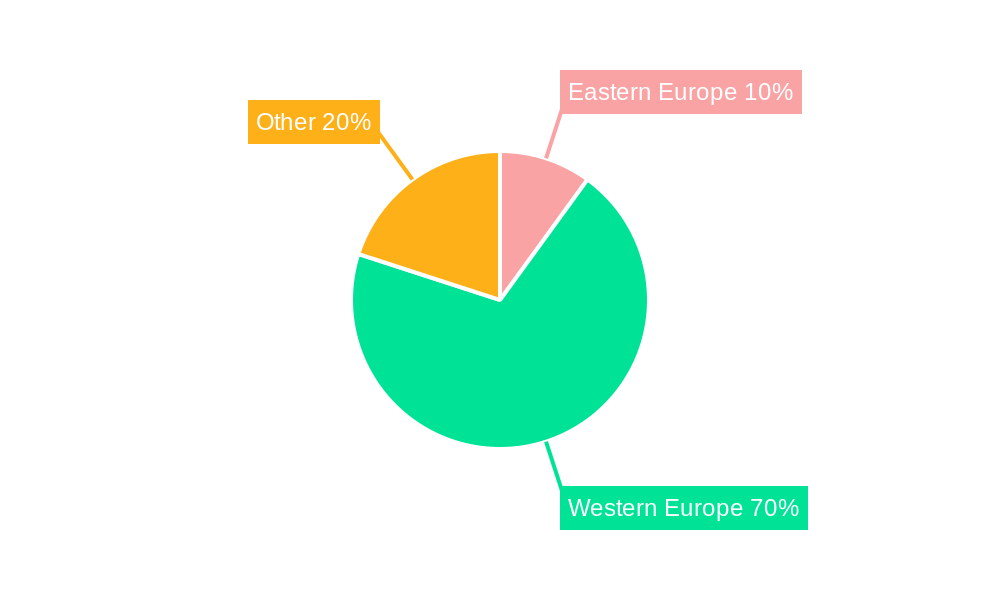

Eastern Europe Construction Market Regional Market Share

Geographic Coverage of Eastern Europe Construction Market

Eastern Europe Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Increase in Residential Building Permits in Romania

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Romania

- 5.2.2. Hungary

- 5.2.3. Croatia

- 5.2.4. Ukraine

- 5.2.5. Bulgaria

- 5.2.6. Rest of Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Romania Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastruture (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Hungary Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastruture (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Croatia Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastruture (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Ukraine Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastruture (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Bulgaria Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastruture (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Rest of Eastern Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Industrial

- 11.1.4. Infrastruture (Transportation)

- 11.1.5. Energy and Utilities

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 12. Germany Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 13. France Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 14. Italy Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 15. United Kingdom Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 16. Netherlands Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 17. Sweden Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 18. Rest of Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2020-2032

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2025

- 19.2. Company Profiles

- 19.2.1 Vinci

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Fomento De Construcciones Y Contratas*List Not Exhaustive

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Balfour Beatty

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Strabag

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ACS

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Royal Bam Group NV

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Bouygues

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Eiffage

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Skanska

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Acciona

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Vinci

List of Figures

- Figure 1: Eastern Europe Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Eastern Europe Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Eastern Europe Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: Eastern Europe Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Germany Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: France Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Italy Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Netherlands Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Sweden Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Europe Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 13: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 15: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 17: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 19: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 21: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 23: Eastern Europe Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eastern Europe Construction Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Eastern Europe Construction Market?

Key companies in the market include Vinci, Fomento De Construcciones Y Contratas*List Not Exhaustive, Balfour Beatty, Strabag, ACS, Royal Bam Group NV, Bouygues, Eiffage, Skanska, Acciona.

3. What are the main segments of the Eastern Europe Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Increase in Residential Building Permits in Romania:.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eastern Europe Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eastern Europe Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eastern Europe Construction Market?

To stay informed about further developments, trends, and reports in the Eastern Europe Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence