Key Insights

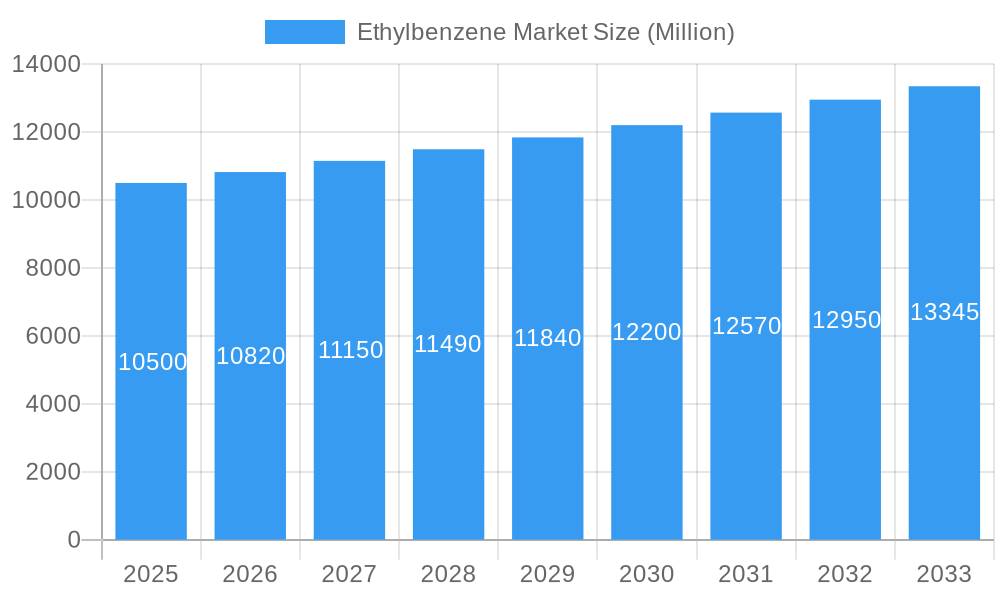

The global Ethylbenzene market is poised for steady expansion, projected to reach an estimated USD 10,500 million in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 3.03% through 2033. This growth is primarily fueled by the robust demand from its downstream applications, particularly in the production of styrene monomers, which are essential for manufacturing a wide array of plastics and polymers. Key drivers include the burgeoning packaging industry, the ever-increasing demand for electronics, and the significant contributions from the automotive and construction sectors. These industries rely heavily on ethylbenzene-derived products for their performance and versatility, indicating a sustained upward trajectory for the market.

Ethylbenzene Market Market Size (In Billion)

However, the market is not without its challenges. Fluctuations in the prices of raw materials, primarily benzene and ethylene, coupled with stringent environmental regulations concerning chemical manufacturing and volatile crude oil prices, can pose significant restraints. Despite these headwinds, emerging economies, especially in the Asia Pacific region, are expected to be major growth engines due to rapid industrialization and increasing consumerism. Innovations in production processes and the development of sustainable alternatives may also shape the future landscape of the ethylbenzene market. The market's segmentation by application reveals the dominance of styrene-based products, with Acrylonitrile-Butadiene-Styrene (ABS) and Styrene-Acrylonitrile (SAN) resins holding substantial market shares.

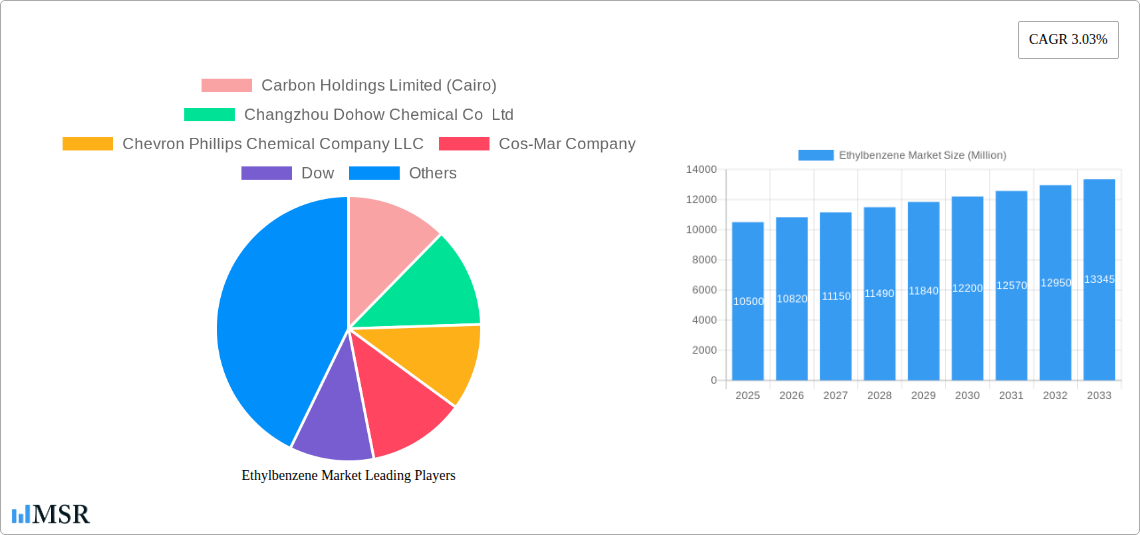

Ethylbenzene Market Company Market Share

Global Ethylbenzene Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the dynamic global Ethylbenzene market with this in-depth report. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report provides a detailed analysis of market size, segmentation, key drivers, challenges, and emerging opportunities. Discover how advancements in styrene production, particularly for Acrylonitrile-Butadiene-Styrene (ABS), Styrene-Acrylonitrile (SAN) resins, and Styrene-Butadiene Elastomers and Latex, are shaping the packaging, electronics, construction, and automotive industries. This report is essential for chemical manufacturers, petrochemical companies, investors, and industry stakeholders seeking to navigate the evolving petrochemical market landscape.

Ethylbenzene Market Market Concentration & Dynamics

The global Ethylbenzene market exhibits a moderate to high concentration, with key players dominating production and supply chains. Innovation ecosystems are rapidly evolving, driven by demand for high-performance materials derived from ethylbenzene. Regulatory frameworks, while generally stable, are increasingly focused on environmental sustainability and safety standards, influencing production processes and raw material sourcing. Substitute products, though present in niche applications, have not significantly impacted the core demand for ethylbenzene, primarily linked to styrene production. End-user trends are a significant determinant, with robust growth in the packaging, electronics, and automotive sectors fueling consistent demand. Merger and acquisition (M&A) activities are strategic, aimed at consolidating market share, acquiring technological capabilities, and expanding geographical reach. For instance, a significant M&A trend involves companies seeking to integrate upstream production of ethylbenzene with downstream styrene manufacturing facilities. Key metrics such as market share by leading producers and the frequency of M&A deals are detailed within the report.

Ethylbenzene Market Industry Insights & Trends

The global Ethylbenzene market is experiencing substantial growth, projected to reach over USD XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This growth is primarily propelled by the escalating demand for styrene and its derivatives, which serve as crucial building blocks for a wide array of polymers and resins. Technological disruptions are playing a pivotal role, with advancements in catalyst technology and process optimization leading to more efficient and cost-effective ethylbenzene production. Evolving consumer behaviors, particularly the increasing preference for lightweight and durable materials in the automotive and electronics sectors, further stimulate demand. The burgeoning construction industry, especially in developing economies, is also a significant contributor, requiring polymers for insulation, pipes, and coatings. Furthermore, the expanding packaging industry, driven by e-commerce and the demand for food preservation, is a consistent driver for styrene-based plastics. The integration of ethylbenzene production with other petrochemical streams, such as naphtha and natural gas, offers synergistic benefits and cost efficiencies, further bolstering market expansion. The report provides granular details on these trends, including historical data from 2019-2024 and precise market size forecasts.

Key Markets & Segments Leading Ethylbenzene Market

The Application segment of Styrene is the undisputed leader in the global Ethylbenzene market. Within this segment, Acrylonitrile-Butadiene-Styrene (ABS) resins command the largest share due to their widespread use in the automotive industry for interior and exterior components, as well as in the electronics sector for casings and appliances. Styrene-Acrylonitrile (SAN) Resins are also witnessing significant growth, driven by their application in consumer goods, packaging, and housewares due to their clarity and chemical resistance.

- Styrene-Butadiene Elastomers and Latex: Crucial for tire manufacturing, footwear, and as binders in coatings and adhesives, this sub-segment's demand is closely linked to the automotive and construction sectors.

- Unsaturated Polyester Resins (UPRs): These are vital for manufacturing fiberglass-reinforced plastics used in construction, marine applications, and automotive body parts.

The End-user Industry contributing most significantly to ethylbenzene demand is Automotive, followed closely by Packaging and Electronics.

- Automotive: The continuous drive for lightweighting vehicles to improve fuel efficiency fuels the demand for ABS and other styrene-based polymers in interior trims, dashboards, and exterior body panels.

- Packaging: The robust growth of the e-commerce sector and the demand for consumer-ready food packaging are major drivers for polystyrene and SAN resins.

- Electronics: The widespread use of plastics in electronic device casings, components, and appliances sustains a steady demand for ethylbenzene derivatives.

- Construction: The use of polystyrene for insulation, PVC pipes, and various coatings in building and infrastructure projects represents another substantial market.

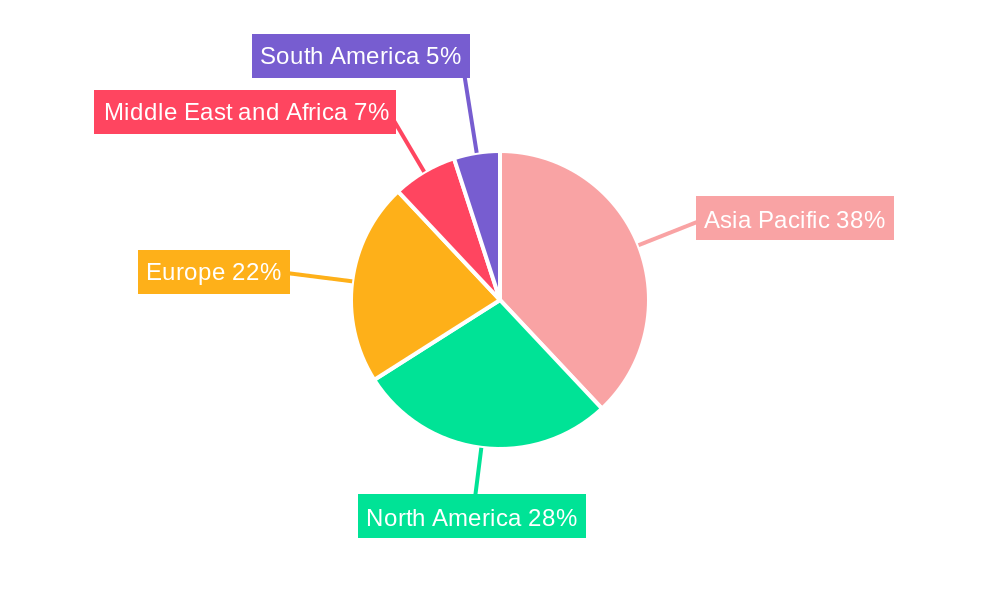

Geographically, Asia Pacific continues to dominate the Ethylbenzene market, driven by its rapid industrialization, large manufacturing base, and increasing domestic consumption. Countries like China and India are at the forefront of this growth, owing to their expanding automotive, electronics, and construction sectors.

Ethylbenzene Market Product Developments

Product developments in the ethylbenzene market are primarily focused on enhancing process efficiency and the quality of downstream styrene-based products. Advancements in catalyst technology are leading to higher yields and reduced energy consumption during ethylbenzene synthesis. For instance, ongoing research into novel zeolite catalysts aims to improve selectivity and longevity, thereby reducing operational costs for manufacturers. Furthermore, innovation in polymerization processes is enabling the creation of advanced styrene derivatives with tailored properties, such as improved impact resistance, heat stability, and flame retardancy, making them suitable for more demanding applications in the automotive and electronics industries. The market relevance of these developments lies in their ability to meet the stringent performance requirements of these high-growth sectors and to offer a competitive edge to producers who adopt these cutting-edge technologies.

Challenges in the Ethylbenzene Market Market

The Ethylbenzene market faces several challenges that can impact its growth trajectory. Volatility in raw material prices, particularly crude oil and natural gas, directly affects production costs and profitability. Stringent environmental regulations concerning emissions and waste management necessitate significant investment in cleaner production technologies and compliance measures. Intensifying competition from established players and emerging markets can lead to price pressures and reduced profit margins. Supply chain disruptions, as witnessed during global events, can impact the availability of feedstock and the timely delivery of finished products, leading to production delays and increased logistics costs. These factors collectively create a complex operating environment for market participants.

Forces Driving Ethylbenzene Market Growth

Several key forces are driving the growth of the Ethylbenzene market. The relentless demand for styrene and its derivatives from burgeoning industries like packaging, electronics, and automotive remains the primary growth engine. Technological advancements in petrochemical processing, including improved catalyst efficiency and energy optimization, are enhancing production economics. Furthermore, economic development and urbanization in emerging economies are leading to increased consumption of plastics and related materials across various sectors. The ongoing trend of lightweighting in the automotive industry to improve fuel efficiency is a significant driver for styrene-based polymers. Government initiatives promoting industrial growth and infrastructure development in various regions also contribute to sustained demand.

Challenges in the Ethylbenzene Market Market

Despite robust growth, the Ethylbenzene market is not without its long-term challenges. The increasing global emphasis on sustainability and the circular economy presents a significant challenge, pushing for the development and adoption of bio-based or recycled alternatives. Geopolitical instability and trade tensions can disrupt global supply chains and impact feedstock availability and pricing. Moreover, the long-term outlook for fossil fuel-based chemicals is subject to scrutiny as the world transitions towards cleaner energy sources, potentially influencing investment decisions and market dynamics. Continuous innovation in product performance and exploration of new applications are crucial for maintaining market relevance and mitigating these long-term challenges.

Emerging Opportunities in Ethylbenzene Market

Emerging opportunities in the Ethylbenzene market are multifaceted, driven by innovation and evolving consumer preferences. The development of advanced styrene copolymers with enhanced properties for specialized applications in high-performance plastics and composites presents significant growth potential. The increasing focus on recycling and the circular economy is opening avenues for developing advanced recycling technologies for polystyrene and other styrene-based plastics, creating a closed-loop system. Furthermore, the expansion of bio-based ethylbenzene production methods offers a sustainable alternative to traditional petrochemical routes, attracting environmentally conscious consumers and businesses. Opportunities also lie in expanding into developing regions with unmet demand for essential materials in construction, packaging, and consumer goods.

Leading Players in the Ethylbenzene Market Sector

- Carbon Holdings Limited

- Changzhou Dohow Chemical Co Ltd

- Chevron Phillips Chemical Company LLC

- Cos-Mar Company

- Dow

- Guangdong Wengjiang Chemical Reagent Co Ltd

- Honeywell International Inc

- INEOS

- J&K Scientific Ltd

- LyondellBasell Industries Holdings B V

- LLC 'Gazprom neftekhim Salavat'

- PJSC "Nizhnekamskneftekhim"

- ROSNEFT

- Shanghai Myrell Chemical Technology Co Ltd

- Sibur-Khimprom CJSC

- TCI Chemicals (India) Pvt Ltd

- Versalis S p A

- Westlake Chemical Corporation

Key Milestones in Ethylbenzene Market Industry

- December 2021: China Petroleum & Chemical Corporation (Sinopec) and plastics, chemical, and refining company LyondellBasell announced the signing of a joint venture agreement to establish a 50:50 reciprocal joint venture to build a PO/SM plant together in China. The joint venture will be named Ningbo Zhenhai Refining & Chemical LyondellBasell New Materials Co. This development is expected to significantly increase the demand for ethylbenzene in the region.

- May 2021: Nizhnekamskneftekhim signed contracts with Lummus Technology LLC for the provision of licenses and technologies for the production of ethylbenzene, styrene, and propylene for the olefin complex. This strategic move aims to enhance production capacity and technological capabilities, impacting regional and global supply dynamics.

Strategic Outlook for Ethylbenzene Market Market

The strategic outlook for the Ethylbenzene market is characterized by continued growth driven by robust demand from key end-user industries and ongoing technological advancements. Companies are strategically investing in capacity expansions, particularly in high-growth regions like Asia Pacific, to meet anticipated demand. Focus on developing more sustainable production methods and exploring bio-based alternatives will be crucial for long-term success. Strategic partnerships and joint ventures, similar to the Sinopec-LyondellBasell collaboration, are expected to play a significant role in market consolidation and technological synergy. Furthermore, continuous innovation in styrene derivatives to cater to evolving application requirements in sectors like electric vehicles and advanced packaging will be a key growth accelerator. The market is poised for sustained expansion, contingent on navigating raw material price volatility and an increasingly stringent regulatory landscape.

Ethylbenzene Market Segmentation

-

1. Application

-

1.1. Styrene

- 1.1.1. Acrylonitrile-Butadiene-Styrene

- 1.1.2. Styrene-Acrylonitrile Resins

- 1.1.3. Styrene-Butadiene Elastomers and Latex

- 1.1.4. Unsaturated Polyester Resins

- 1.2. Gasoline

- 1.3. Diethylbenzene

- 1.4. Natural Gas

- 1.5. Paint

- 1.6. Asphalt and Naphtha

-

1.1. Styrene

-

2. End-user Industry

- 2.1. Packaging

- 2.2. Electronics

- 2.3. Construction

- 2.4. Agriculture

- 2.5. Automotive

- 2.6. Other End-User Industries

Ethylbenzene Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Ethylbenzene Market Regional Market Share

Geographic Coverage of Ethylbenzene Market

Ethylbenzene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Styrene; Increasing Use in Recovery of Natural Gas

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Styrene; Increasing Use in Recovery of Natural Gas

- 3.4. Market Trends

- 3.4.1. Styrene Production to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Styrene

- 5.1.1.1. Acrylonitrile-Butadiene-Styrene

- 5.1.1.2. Styrene-Acrylonitrile Resins

- 5.1.1.3. Styrene-Butadiene Elastomers and Latex

- 5.1.1.4. Unsaturated Polyester Resins

- 5.1.2. Gasoline

- 5.1.3. Diethylbenzene

- 5.1.4. Natural Gas

- 5.1.5. Paint

- 5.1.6. Asphalt and Naphtha

- 5.1.1. Styrene

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Packaging

- 5.2.2. Electronics

- 5.2.3. Construction

- 5.2.4. Agriculture

- 5.2.5. Automotive

- 5.2.6. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Styrene

- 6.1.1.1. Acrylonitrile-Butadiene-Styrene

- 6.1.1.2. Styrene-Acrylonitrile Resins

- 6.1.1.3. Styrene-Butadiene Elastomers and Latex

- 6.1.1.4. Unsaturated Polyester Resins

- 6.1.2. Gasoline

- 6.1.3. Diethylbenzene

- 6.1.4. Natural Gas

- 6.1.5. Paint

- 6.1.6. Asphalt and Naphtha

- 6.1.1. Styrene

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Packaging

- 6.2.2. Electronics

- 6.2.3. Construction

- 6.2.4. Agriculture

- 6.2.5. Automotive

- 6.2.6. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Styrene

- 7.1.1.1. Acrylonitrile-Butadiene-Styrene

- 7.1.1.2. Styrene-Acrylonitrile Resins

- 7.1.1.3. Styrene-Butadiene Elastomers and Latex

- 7.1.1.4. Unsaturated Polyester Resins

- 7.1.2. Gasoline

- 7.1.3. Diethylbenzene

- 7.1.4. Natural Gas

- 7.1.5. Paint

- 7.1.6. Asphalt and Naphtha

- 7.1.1. Styrene

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Packaging

- 7.2.2. Electronics

- 7.2.3. Construction

- 7.2.4. Agriculture

- 7.2.5. Automotive

- 7.2.6. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Styrene

- 8.1.1.1. Acrylonitrile-Butadiene-Styrene

- 8.1.1.2. Styrene-Acrylonitrile Resins

- 8.1.1.3. Styrene-Butadiene Elastomers and Latex

- 8.1.1.4. Unsaturated Polyester Resins

- 8.1.2. Gasoline

- 8.1.3. Diethylbenzene

- 8.1.4. Natural Gas

- 8.1.5. Paint

- 8.1.6. Asphalt and Naphtha

- 8.1.1. Styrene

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Packaging

- 8.2.2. Electronics

- 8.2.3. Construction

- 8.2.4. Agriculture

- 8.2.5. Automotive

- 8.2.6. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Styrene

- 9.1.1.1. Acrylonitrile-Butadiene-Styrene

- 9.1.1.2. Styrene-Acrylonitrile Resins

- 9.1.1.3. Styrene-Butadiene Elastomers and Latex

- 9.1.1.4. Unsaturated Polyester Resins

- 9.1.2. Gasoline

- 9.1.3. Diethylbenzene

- 9.1.4. Natural Gas

- 9.1.5. Paint

- 9.1.6. Asphalt and Naphtha

- 9.1.1. Styrene

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Packaging

- 9.2.2. Electronics

- 9.2.3. Construction

- 9.2.4. Agriculture

- 9.2.5. Automotive

- 9.2.6. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Ethylbenzene Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Styrene

- 10.1.1.1. Acrylonitrile-Butadiene-Styrene

- 10.1.1.2. Styrene-Acrylonitrile Resins

- 10.1.1.3. Styrene-Butadiene Elastomers and Latex

- 10.1.1.4. Unsaturated Polyester Resins

- 10.1.2. Gasoline

- 10.1.3. Diethylbenzene

- 10.1.4. Natural Gas

- 10.1.5. Paint

- 10.1.6. Asphalt and Naphtha

- 10.1.1. Styrene

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Packaging

- 10.2.2. Electronics

- 10.2.3. Construction

- 10.2.4. Agriculture

- 10.2.5. Automotive

- 10.2.6. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Carbon Holdings Limited (Cairo)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Changzhou Dohow Chemical Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Phillips Chemical Company LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cos-Mar Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dow

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangdong Wengjiang Chemical Reagent Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 INEOS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 J&K Scientific Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LyondellBasell Industries Holdings B V

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC 'Gazprom neftekhim Salavat'

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PJSC "Nizhnekamskneftekhim"

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ROSNEFT

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shanghai Myrell Chemical Technology Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sibur-Khimprom CJSC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TCI Chemicals (India) Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Versalis S p A

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Westlake Chemical Corporation*List Not Exhaustive

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Carbon Holdings Limited (Cairo)

List of Figures

- Figure 1: Global Ethylbenzene Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Ethylbenzene Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific Ethylbenzene Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Ethylbenzene Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Ethylbenzene Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Ethylbenzene Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Ethylbenzene Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Ethylbenzene Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Ethylbenzene Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Ethylbenzene Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Ethylbenzene Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Ethylbenzene Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Ethylbenzene Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Ethylbenzene Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Ethylbenzene Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Ethylbenzene Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Ethylbenzene Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Ethylbenzene Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Ethylbenzene Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Ethylbenzene Market Revenue (Million), by Application 2025 & 2033

- Figure 21: South America Ethylbenzene Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Ethylbenzene Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Ethylbenzene Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Ethylbenzene Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Ethylbenzene Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Ethylbenzene Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Ethylbenzene Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Ethylbenzene Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Ethylbenzene Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Ethylbenzene Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Ethylbenzene Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Ethylbenzene Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Ethylbenzene Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Ethylbenzene Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Ethylbenzene Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Russia Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Ethylbenzene Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Ethylbenzene Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Ethylbenzene Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Ethylbenzene Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Ethylbenzene Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethylbenzene Market?

The projected CAGR is approximately 3.03%.

2. Which companies are prominent players in the Ethylbenzene Market?

Key companies in the market include Carbon Holdings Limited (Cairo), Changzhou Dohow Chemical Co Ltd, Chevron Phillips Chemical Company LLC, Cos-Mar Company, Dow, Guangdong Wengjiang Chemical Reagent Co Ltd, Honeywell International Inc, INEOS, J&K Scientific Ltd, LyondellBasell Industries Holdings B V, LLC 'Gazprom neftekhim Salavat', PJSC "Nizhnekamskneftekhim", ROSNEFT, Shanghai Myrell Chemical Technology Co Ltd, Sibur-Khimprom CJSC, TCI Chemicals (India) Pvt Ltd, Versalis S p A, Westlake Chemical Corporation*List Not Exhaustive.

3. What are the main segments of the Ethylbenzene Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Styrene; Increasing Use in Recovery of Natural Gas.

6. What are the notable trends driving market growth?

Styrene Production to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Styrene; Increasing Use in Recovery of Natural Gas.

8. Can you provide examples of recent developments in the market?

December 2021: China Petroleum & Chemical Corporation (Sinopec) and plastics, chemical, and refining company LyondellBasell announced the signing of a joint venture agreement to establish a 50:50 reciprocal joint venture to build a PO/SM plant together in China. The joint venture will be named Ningbo Zhenhai Refining & Chemical LyondellBasell New Materials Co. This will lead to a significant increase in the demand for ethylbenzene.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethylbenzene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethylbenzene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethylbenzene Market?

To stay informed about further developments, trends, and reports in the Ethylbenzene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence