Key Insights

The European automotive exhaust aftertreatment systems market is experiencing robust growth, driven by stringent emission regulations like Euro 7 and a rising demand for cleaner vehicles. The market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 7.20% and a 2019-2024 historical period), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors. Increasing concerns about air quality and the health impacts of vehicle emissions are pushing governments to implement stricter regulations, creating a strong market for advanced aftertreatment technologies. The increasing popularity of diesel and petrol vehicles, coupled with the rising adoption of electric vehicles (though this will have a longer term impact on the market) are also contributing to the market expansion. Furthermore, technological advancements in particulate matter control systems, NOx control systems, and carbon compounds control systems are leading to the development of more efficient and effective aftertreatment solutions. Market segmentation reveals that passenger cars currently dominate the market share, but commercial vehicles are expected to witness significant growth in the coming years driven by similar emission regulations.

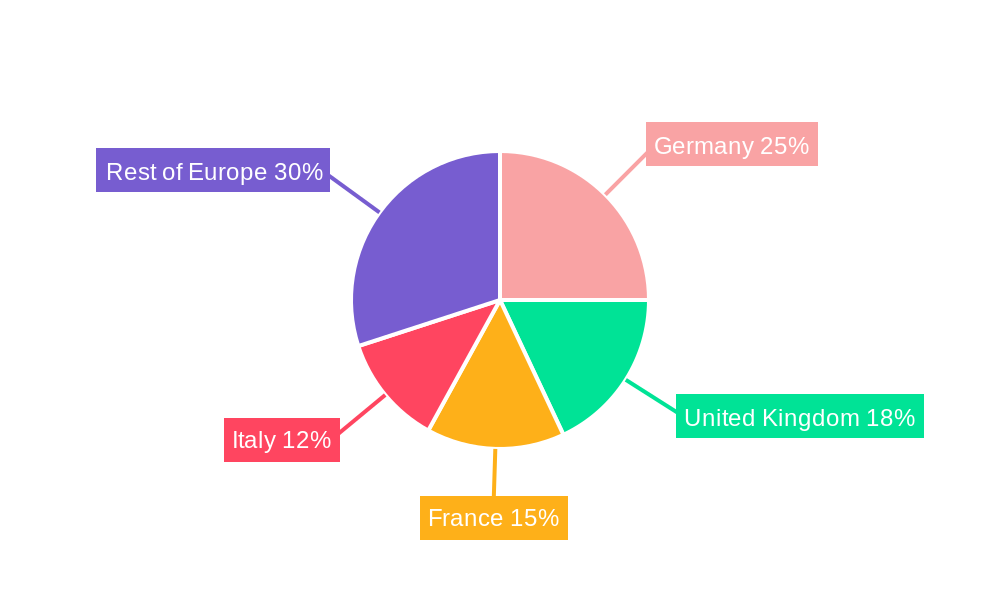

Germany, the United Kingdom, France, and Italy represent the major markets within Europe, reflecting higher vehicle ownership and stricter emission control policies. However, other European countries are also showing considerable growth potential as they adopt more stringent emission standards. Restraints to market growth include the high initial investment costs associated with implementing advanced aftertreatment systems and the potential for technological disruptions from alternative fuel vehicles. Nevertheless, the long-term outlook for the European automotive exhaust aftertreatment systems market remains positive, with continuous innovation and regulatory pressure expected to drive substantial growth over the forecast period. The competitive landscape is characterized by established players such as Johnson Matthey Plc, Bosal Group, and Continental AG, constantly vying for market share through product innovation and strategic partnerships.

Europe Automotive Exhaust Aftertreatment Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Automotive Exhaust Aftertreatment Systems market, offering invaluable insights for stakeholders across the automotive and environmental technology sectors. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key segments, leading players, and emerging trends, ultimately providing a strategic roadmap for future growth. The report analyzes a market expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Automotive Exhaust Aftertreatment Systems Market Concentration & Dynamics

The European Automotive Exhaust Aftertreatment Systems market exhibits a moderately concentrated landscape, with key players holding significant market share. Johnson Matthey Plc, Bosal Group, Continental AG, Tenneco Inc, and Faurecia SE are prominent examples, each contributing significantly to overall market volume. However, the presence of several smaller, specialized players fosters innovation and competition.

The market's dynamics are significantly shaped by stringent emission regulations (Euro 7 and beyond), pushing for continuous advancements in aftertreatment technologies. This creates a dynamic innovation ecosystem focused on improving particulate matter (PM) control, NOx reduction, and carbon compound management. Substitute technologies, such as electric and hydrogen-powered vehicles, pose a long-term challenge, though the substantial existing fleet ensures continued demand for aftertreatment systems in the near to mid-term. End-user trends favor improved fuel efficiency and reduced environmental impact, further driving demand for advanced systems.

M&A activity has been moderate in recent years, with notable examples including the February 2023 collaboration between Faurecia and Cummins. While the exact number of M&A deals varies, the strategic consolidation trend signals an ongoing shift towards larger, more integrated players capable of handling the technological complexities and regulatory hurdles. The market share distribution among the top five players is estimated at approximately xx%, indicating a space for both established players and new entrants.

Europe Automotive Exhaust Aftertreatment Systems Market Industry Insights & Trends

The Europe Automotive Exhaust Aftertreatment Systems market is experiencing significant growth driven by increasingly stringent emission regulations across European Union member states. This necessitates the adoption of advanced aftertreatment technologies capable of meeting ever-more-demanding standards. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033. Growth is fueled by several factors, including the ongoing transition to cleaner fuel technologies, the rising adoption of diesel and petrol vehicles (despite the rise of EVs), and the increasing awareness of the environmental impact of vehicle emissions.

Technological disruptions are also shaping the market, with advancements in materials science leading to the development of more efficient catalysts and filters. The integration of digital technologies is also impacting the market, allowing for real-time monitoring and optimization of exhaust aftertreatment systems. Consumer behavior is shifting towards environmentally conscious choices; this trend contributes to increased demand for vehicles equipped with advanced exhaust systems. The market exhibits significant potential for growth, with the continued development and adoption of advanced aftertreatment solutions expected to drive market expansion.

Key Markets & Segments Leading Europe Automotive Exhaust Aftertreatment Systems Market

- By Filter Type: The Particulate matter control system segment dominates, driven by stringent PM emission limits. The NOx control system segment also shows robust growth due to regulations targeting nitrogen oxide emissions. The Carbon compounds control system and Emission control using Decision Matrix segments are also growing but at a slower pace.

- By Country: Germany, the United Kingdom, and France represent the largest national markets, reflecting high vehicle populations and robust automotive industries. These countries’ strong regulatory environments drive demand.

- By Vehicle Type: Passenger cars comprise the largest segment, followed by commercial vehicles. The latter is experiencing faster growth due to stricter emission norms for heavy-duty vehicles.

- By Fuel Type: Diesel-powered vehicles currently constitute a significant portion of the market due to their prevalence in commercial fleets. However, the rising adoption of petrol vehicles and alternative fuels is expected to reshape this segment’s dynamics in the long term.

Growth drivers vary by segment. For example, strong economic growth in certain regions fuels vehicle sales, directly increasing the demand for exhaust aftertreatment systems. Government investments in infrastructure to support cleaner transportation also contribute to market growth. The automotive industry's continuous investment in R&D further boosts the market. In contrast, the commercial vehicle sector benefits from stringent regulations in the transportation sector and the expansion of logistics and delivery services.

Europe Automotive Exhaust Aftertreatment Systems Market Product Developments

Recent years have witnessed significant innovation in exhaust aftertreatment systems, focusing on enhanced efficiency, durability, and emission reduction capabilities. Developments include improved catalyst formulations, the integration of advanced sensors and control systems, and the utilization of novel materials to optimize performance. These advancements enhance the effectiveness of systems in reducing harmful emissions, aligning with increasingly stringent environmental regulations. The competitive landscape encourages continuous innovation, driving the introduction of new products and technologies with improved efficiency and longevity.

Challenges in the Europe Automotive Exhaust Aftertreatment Systems Market Market

The Europe Automotive Exhaust Aftertreatment Systems market faces several challenges. Stringent emission regulations necessitate continuous technological upgrades, representing a high capital investment for manufacturers. Supply chain disruptions, particularly concerning raw materials, can lead to production bottlenecks and increased costs. Intense competition among established and emerging players puts pressure on profit margins. These challenges, although significant, do not dampen the overall growth potential of the market. The estimated impact of these challenges on market growth is a reduction of approximately xx Million in revenue by 2033.

Forces Driving Europe Automotive Exhaust Aftertreatment Systems Market Growth

Several factors drive market growth. Stringent emission regulations are a primary catalyst, forcing manufacturers to adopt advanced technologies. The growing environmental awareness among consumers is pushing demand for cleaner vehicles. Technological advancements lead to more efficient and cost-effective aftertreatment systems. Continued economic growth in several European countries contributes to higher vehicle sales, thereby increasing demand.

Long-Term Growth Catalysts in the Europe Automotive Exhaust Aftertreatment Systems Market

Long-term growth hinges on continuous innovation in catalyst and filter technologies. Strategic partnerships between automotive manufacturers and aftertreatment system providers will also play a crucial role. Expansion into emerging markets, particularly within Eastern Europe, presents substantial untapped potential. These factors combine to create a robust outlook for sustained market growth.

Emerging Opportunities in Europe Automotive Exhaust Aftertreatment Systems Market

Emerging opportunities include the development of hybrid and electric vehicle-specific aftertreatment solutions. The increasing adoption of alternative fuels presents opportunities for tailored systems. The integration of advanced diagnostics and predictive maintenance technologies is another exciting prospect. These factors point toward a future of innovation and expansion within the European market.

Leading Players in the Europe Automotive Exhaust Aftertreatment Systems Sector

- Johnson Matthey Plc

- Bosal Group

- European Exhaust and Catalyst Ltd

- Continental AG

- Tenneco Inc

- Cummins Inc

- Eberspaecher Group

- Marelli Holdings Co Ltd

- Delphi Technologies PLC

- Faurecia SE

Key Milestones in Europe Automotive Exhaust Aftertreatment Systems Industry

- July 2023: Eberspaecher Group launched the EHC Fractal Heater, improving exhaust after-treatment system efficiency. This innovation enhances the overall performance of existing systems, driving market growth through improved technology.

- February 2023: Faurecia and Cummins' collaboration on the potential sale of a commercial vehicle exhaust after-treatment business segment for USD 164.64 Million demonstrates the ongoing consolidation within the industry. This signals a shift toward larger players with increased market share.

Strategic Outlook for Europe Automotive Exhaust Aftertreatment Systems Market Market

The future of the European Automotive Exhaust Aftertreatment Systems market looks promising. Continued technological advancements, coupled with stringent environmental regulations, will drive sustained growth. Strategic partnerships and acquisitions will further shape the market landscape. The market offers significant potential for players that can effectively navigate regulatory changes and offer innovative, cost-effective solutions. This presents substantial opportunities for both existing players and new entrants to capitalize on the evolving market dynamics.

Europe Automotive Exhaust Aftertreatment Systems Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

-

3. Filter Type

- 3.1. Particulate matter control system

- 3.2. Carbon compounds control system

- 3.3. Emission control using Decision Matrix

- 3.4. NOx control system

Europe Automotive Exhaust Aftertreatment Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Exhaust Aftertreatment Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Fuel Efficient Vehicles

- 3.3. Market Restrains

- 3.3.1. Emergence of Electric Vehicles Will Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Growth in Emission Control Technology in Automotive and Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Filter Type

- 5.3.1. Particulate matter control system

- 5.3.2. Carbon compounds control system

- 5.3.3. Emission control using Decision Matrix

- 5.3.4. NOx control system

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Automotive Exhaust Aftertreatment Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Johnson Matthey Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bosal Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 European Exhaust and Catalyst Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Continental AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tenneco Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cummins Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Eberspaecher Grou

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Marelli Holdings Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Delphi Technologies PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Faurecia SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Johnson Matthey Plc

List of Figures

- Figure 1: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Automotive Exhaust Aftertreatment Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 5: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 17: Europe Automotive Exhaust Aftertreatment Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Automotive Exhaust Aftertreatment Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Exhaust Aftertreatment Systems Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Europe Automotive Exhaust Aftertreatment Systems Market?

Key companies in the market include Johnson Matthey Plc, Bosal Group, European Exhaust and Catalyst Ltd, Continental AG, Tenneco Inc, Cummins Inc, Eberspaecher Grou, Marelli Holdings Co Ltd, Delphi Technologies PLC, Faurecia SE.

3. What are the main segments of the Europe Automotive Exhaust Aftertreatment Systems Market?

The market segments include Vehicle Type, Fuel Type, Filter Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Fuel Efficient Vehicles.

6. What are the notable trends driving market growth?

Growth in Emission Control Technology in Automotive and Transportation Industry.

7. Are there any restraints impacting market growth?

Emergence of Electric Vehicles Will Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

July 2023: Eberspaecher Group introduced the latest generation of the EHC Fractal Heater from Purem by Eberspaecher. It is an innovative electrical heating component that improves the efficiency of exhaust after-treatment systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Exhaust Aftertreatment Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Exhaust Aftertreatment Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Exhaust Aftertreatment Systems Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Exhaust Aftertreatment Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence