Key Insights

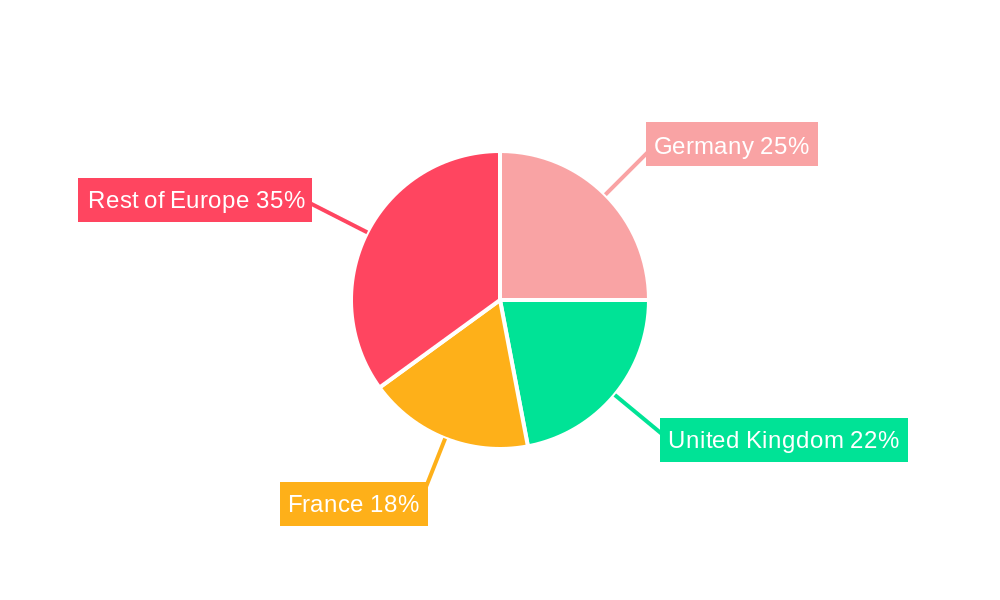

The European Condominiums and Apartments Market is projected for significant expansion, driven by escalating urbanization, evolving lifestyle preferences favoring amenity-rich living, and supportive government policies for sustainable housing. Despite challenges such as rising construction costs and fluctuating interest rates, the market's inherent appeal as a long-term investment with consistent rental income and capital appreciation underpins its resilience. Key contributors to market size include Germany, the United Kingdom, and France, owing to their substantial populations and strong economies. Intense competition among developers like CPI Property Group, Vonovia SE, and Unibail-Rodamco fosters innovation in design, sustainability, and property management.

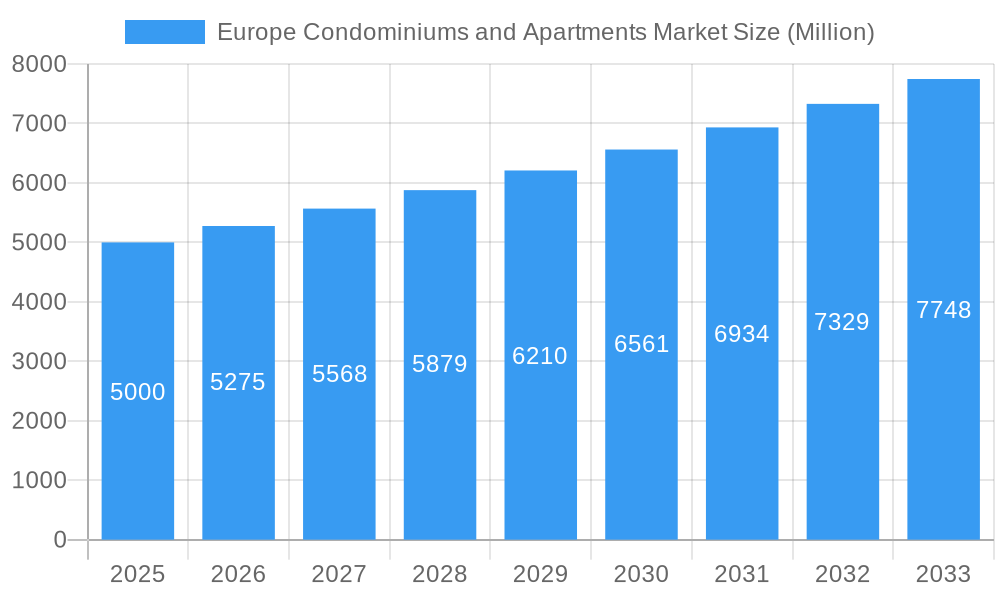

Europe Condominiums and Apartments Market Market Size (In Billion)

The market is anticipated to reach $1279.93 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.9% between 2025 and 2033. This growth trajectory is influenced by economic stability, ongoing infrastructure development, and strategic industry consolidations. A consistent demand for residential spaces, particularly in urban centers, remains a fundamental driver. While short-term economic volatility may occur, the long-term outlook is optimistic, fueled by persistent population growth, urbanization, and evolving consumer needs. Advances in construction technology and sustainable building practices are further enhancing market value and growth potential.

Europe Condominiums and Apartments Market Company Market Share

Europe Condominiums and Apartments Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe condominiums and apartments market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential across major European countries. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Expect detailed data and actionable insights on market size, CAGR, M&A activity, and key industry developments.

Europe Condominiums and Apartments Market Market Concentration & Dynamics

The European condominiums and apartments market exhibits a moderately concentrated landscape, with several major players vying for market share. Market concentration is influenced by factors including national regulations, economic conditions, and the prevalence of large-scale developers. CPI Property Group, Aroundtown Property Holdings, and Vonovia SE, among others, represent some of the dominant players, though the overall market share of the top five players is estimated to be xx%. Innovation within the sector is driven by technological advancements in construction, property management, and rental platforms like Ukio. Regulatory frameworks vary significantly across European countries, impacting development costs and timelines. Substitute products, such as rental apartments or other housing options, exert some competitive pressure. End-user trends favor sustainable, technologically integrated housing with access to amenities. M&A activity within the sector is relatively frequent, with an estimated xx M&A deals occurring between 2019 and 2024.

- Market Share (2024 Estimate): Top 5 players – xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Smart home technology, sustainable building materials, PropTech solutions.

Europe Condominiums and Apartments Market Industry Insights & Trends

The European condominiums and apartments market is experiencing significant growth, driven primarily by urbanization, population growth, and increasing demand for rental properties. The market size in 2024 is estimated to be xx Million, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of PropTech platforms and the adoption of smart home technologies, are reshaping the industry, improving efficiency and enhancing the tenant experience. Evolving consumer behavior shows a preference for flexible rental options, impacting the demand for short-term furnished apartments, as highlighted by Ukio's recent funding round. Government initiatives aimed at increasing affordable housing are also influencing market dynamics, particularly in densely populated urban areas. Growing demand for sustainable and energy-efficient buildings is creating new opportunities for developers focusing on environmentally friendly construction materials and designs.

Key Markets & Segments Leading Europe Condominiums and Apartments Market

The United Kingdom, Germany, and France represent the leading national markets within the European condominiums and apartments sector, accounting for a combined xx% of the total market value in 2024.

United Kingdom:

- Drivers: Strong economic growth in major cities, robust rental market, government initiatives for housing development.

- Dominance Analysis: London remains the dominant market, attracting significant investment and driving luxury condominium development.

Germany:

- Drivers: High population density in urban areas, rising demand for rental housing, increasing government investment in infrastructure.

- Dominance Analysis: Major cities like Munich, Berlin, and Frankfurt show the highest concentration of apartment and condominium developments.

France:

- Drivers: Parisian real estate remains an attractive investment opportunity; strong tourism contributing to high demand for rental properties.

- Dominance Analysis: Parisian market exhibits a higher concentration of luxury apartments and condominiums compared to other regions.

Rest of Europe:

- Drivers: Increasing urbanization in smaller European cities and regions.

- Dominance Analysis: This segment displays diverse growth patterns, varying widely across countries.

Europe Condominiums and Apartments Market Product Developments

Recent product innovations within the European condominiums and apartments market focus on integrating smart home technologies, such as energy-efficient systems and enhanced security features, to attract environmentally conscious and tech-savvy buyers and renters. Sustainable building materials and construction techniques are also gaining traction, reflecting a growing emphasis on environmental responsibility within the industry. These advancements offer competitive edges by increasing property values and attracting a broader customer base.

Challenges in the Europe Condominiums and Apartments Market Market

The European condominiums and apartments market faces several challenges, including stringent building regulations across different countries, supply chain disruptions impacting construction timelines and costs, and intense competition among developers, potentially leading to price wars in certain segments. These factors combine to create pressure on profitability and overall market growth.

Forces Driving Europe Condominiums and Apartments Market Growth

Several factors drive the growth of the European condominiums and apartments market. These include population growth in urban areas, favorable economic conditions boosting investment in real estate, and governmental policies promoting housing development to address affordability concerns. Technological advancements further propel growth by improving construction efficiency and enabling the development of smart, sustainable homes.

Challenges in the Europe Condominiums and Apartments Market Market

Long-term growth hinges on addressing challenges through strategic partnerships and innovation. Focus on sustainable construction, innovative financing models, and technological solutions will be crucial to navigating regulatory hurdles and enhancing market resilience. Expanding into emerging markets within Europe and leveraging data-driven insights can drive further expansion.

Emerging Opportunities in Europe Condominiums and Apartments Market

Emerging opportunities include increased demand for flexible rental options catering to the growing mobile workforce, further adoption of sustainable building practices, and leveraging technological advancements in property management. Expansion into secondary markets within Europe and development of affordable housing solutions present further opportunities for growth.

Leading Players in the Europe Condominiums and Apartments Market Sector

- CPI Property Group

- Aroundtown Property Holdings

- Elm Group

- Altarea Cogedim

- Places for People Group Limited

- Gecina

- Segro

- Vonovia SE

- Castellum AB

- LEG Immobilien AG

- Unibail-Rodamco

- Covivio

- Consus Real Estate AG

Key Milestones in Europe Condominiums and Apartments Market Industry

- September 2022: Gamuda Land announces significant international expansion plans, adding an average of five new overseas projects per year starting FY2023, signaling increased competition and investment in the European market.

- November 2022: Ukio secures EUR 27 Million (USD 28 Million) in Series-A funding, highlighting the growing demand for flexible short-term rental solutions and increased investment in the PropTech sector.

Strategic Outlook for Europe Condominiums and Apartments Market Market

The European condominiums and apartments market possesses significant long-term growth potential. Strategic partnerships, technological advancements, and sustainable development practices will be crucial in capturing market share and navigating emerging challenges. The focus on affordable housing and meeting the evolving needs of a diverse population will be key to maximizing returns.

Europe Condominiums and Apartments Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Condominiums and Apartments Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Europe Condominiums and Apartments Market

Europe Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Developments in the Residential Segment; Investments in the Senior Living Units

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Land Hindering the Market

- 3.4. Market Trends

- 3.4.1. Demand for Affordable Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 CPI Property Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Aroundtown Property Holdings

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Elm Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Altarea Cogedim

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Places for People Group Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gecina**List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Segro

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vonovia SE

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Castellum AB

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LEG Immobilien AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Unibail-Rodamco

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Covivio

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Consus Real Estate AG

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 CPI Property Group

List of Figures

- Figure 1: Europe Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 3: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 7: Europe Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: France Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Netherlands Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 17: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Europe Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: United Kingdom Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Belgium Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Sweden Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Denmark Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Condominiums and Apartments Market?

Key companies in the market include CPI Property Group, Aroundtown Property Holdings, Elm Group, Altarea Cogedim, Places for People Group Limited, Gecina**List Not Exhaustive, Segro, Vonovia SE, Castellum AB, LEG Immobilien AG, Unibail-Rodamco, Covivio, Consus Real Estate AG.

3. What are the main segments of the Europe Condominiums and Apartments Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Developments in the Residential Segment; Investments in the Senior Living Units.

6. What are the notable trends driving market growth?

Demand for Affordable Housing.

7. Are there any restraints impacting market growth?

Limited Availability of Land Hindering the Market.

8. Can you provide examples of recent developments in the market?

November 2022: Ukio, a short-term furnished apartment rental platform aimed at the "flexible workforce," raised a Series-A round of funding totalling EUR 27 million (USD 28 million). The cash injection totalled EUR 17 million (USD 18.03 million) in equity and EUR 10 million (USD 10.61 million) in debt and came 14 months after the Spanish company announced a seed round of funding of EUR 9 million (USD 9.54 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Europe Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence