Key Insights

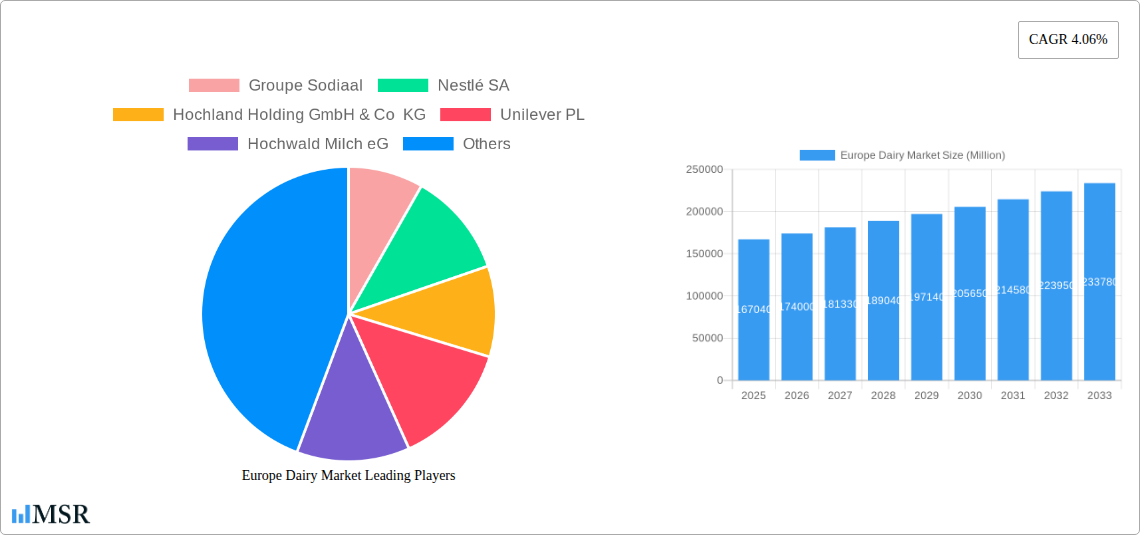

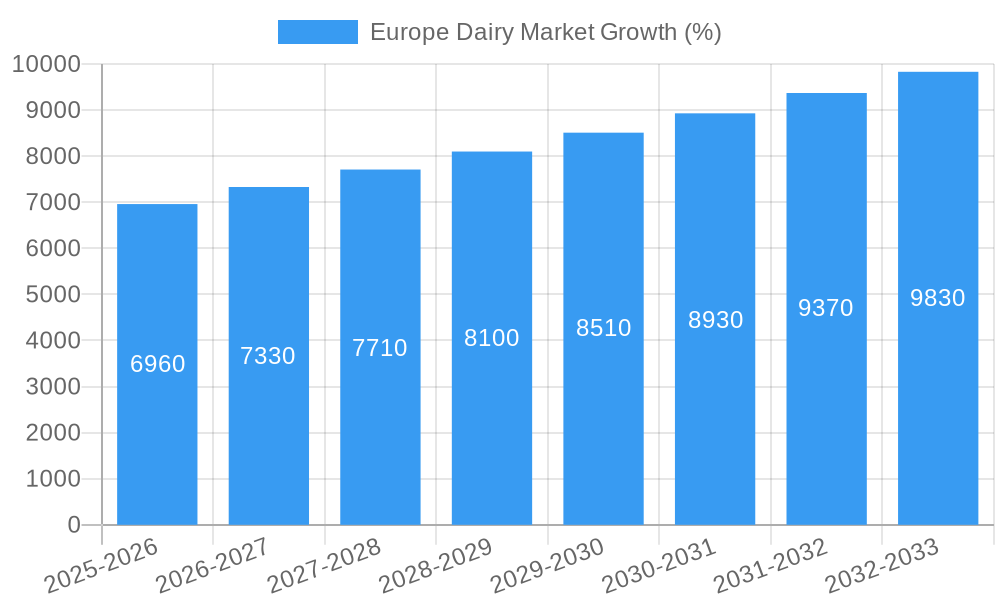

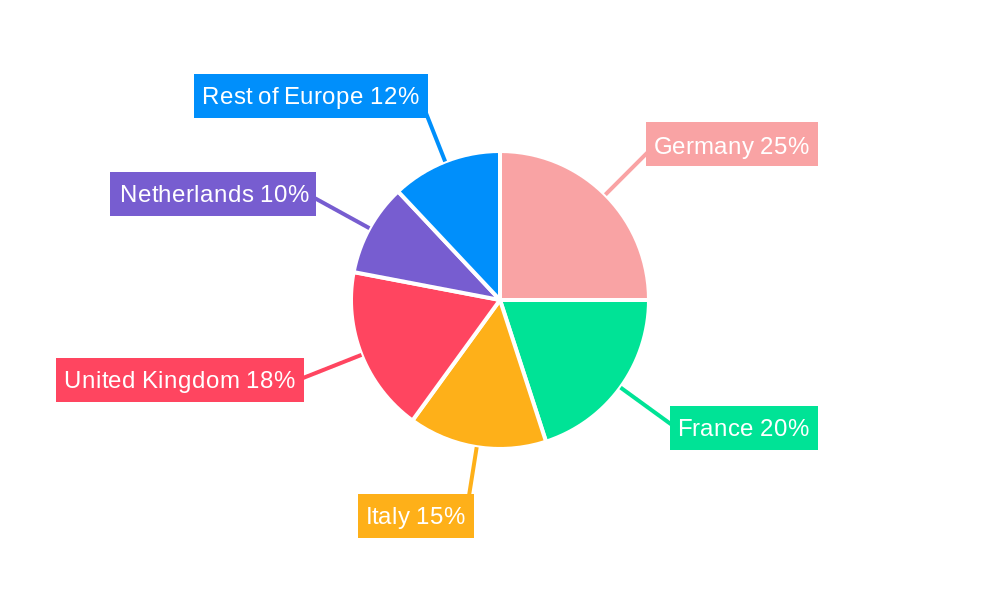

The European dairy market, valued at €167,040 million in 2025, exhibits a robust growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 4.06% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer demand for dairy products, driven by rising health consciousness and the recognition of dairy's nutritional benefits, particularly in protein and calcium, is a significant driver. The rising popularity of functional dairy products, including fortified milk and yogurt with added probiotics or vitamins, further contributes to market expansion. Furthermore, the increasing adoption of convenient packaging formats and the growth of online grocery delivery services are making dairy products more accessible to consumers. The market is segmented by distribution channels (off-trade and on-trade), encompassing diverse retail formats like supermarkets, hypermarkets, convenience stores, warehouse clubs, and gas stations. Geographically, Germany, France, Italy, the United Kingdom, and the Netherlands represent significant market segments, with each country exhibiting unique consumer preferences and market dynamics. Competitive pressures from both established multinational companies like Nestlé SA and Unilever PL, and regional players, drive innovation and product diversification within the market.

The market's growth is not without challenges. Fluctuations in milk production due to factors like weather patterns and feed costs can impact supply and pricing. Moreover, increasing consumer awareness of animal welfare and sustainability concerns may lead to shifts in demand towards ethically sourced and sustainably produced dairy products. This necessitates dairy producers to adopt more sustainable practices and transparent supply chains. The rising cost of raw materials and energy is also putting upward pressure on production costs, requiring businesses to optimize efficiency and explore cost-saving strategies to maintain profitability. However, the overall growth outlook remains positive, with continued innovation and adaptation to changing consumer preferences expected to drive the market's expansion throughout the forecast period.

Europe Dairy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe dairy market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, key players, and future growth prospects across various segments and countries. The study period (2019-2024) informs the forecast period (2025-2033) and base year (2025) analysis, providing a robust understanding of the European dairy landscape.

Europe Dairy Market Market Concentration & Dynamics

The European dairy market exhibits a moderately concentrated structure, dominated by a few large multinational players alongside several regional and national brands. Key players like Groupe Lactalis, Nestlé SA, and Danone SA command significant market share, while regional cooperatives and smaller players cater to niche segments. Market concentration is influenced by factors such as economies of scale, brand recognition, and access to distribution channels. The market demonstrates a dynamic interplay of factors:

- Innovation Ecosystems: Continuous innovation in dairy processing, packaging, and product development is driving market growth. This includes the rise of plant-based alternatives, functional dairy products, and sustainable packaging solutions.

- Regulatory Frameworks: EU regulations concerning food safety, labeling, and sustainability significantly impact market operations. Compliance costs and evolving regulations present both challenges and opportunities for businesses.

- Substitute Products: The growing popularity of plant-based milk alternatives (e.g., soy, almond, oat) poses a competitive threat, especially in specific consumer segments.

- End-User Trends: Health-conscious consumers are driving demand for low-fat, organic, and functional dairy products. Growing awareness of sustainability also influences purchasing decisions.

- M&A Activities: The dairy sector witnesses frequent mergers and acquisitions, shaping market dynamics. Recent deals like the Lactalis acquisition of BMI's Fresh division illustrate the consolidation trend. The number of M&A deals averaged xx annually between 2019 and 2024, contributing to increased market concentration. Market share data for the top 5 players in 2024 is estimated to be around 60%.

Europe Dairy Market Industry Insights & Trends

The European dairy market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. Several factors contribute to this trend:

- Market Size: The total market value in 2024 was estimated at xx Million.

- Growth Drivers: Rising disposable incomes, changing lifestyles, and increasing urbanization contribute to higher dairy consumption. Government support for the dairy sector in some countries also plays a significant role.

- Technological Disruptions: Advancements in processing technologies, including precision fermentation and automation, enhance efficiency and product quality. Technological improvements in packaging extend shelf life and reduce waste.

- Evolving Consumer Behaviors: Health and wellness trends influence demand for products like organic milk and Greek yogurt. Convenience also plays a crucial role, driving the growth of single-serving packs and ready-to-drink products. The increasing demand for sustainable and ethically sourced dairy products further shapes consumer behavior.

Key Markets & Segments Leading Europe Dairy Market

Germany, France, and the United Kingdom represent the largest national markets within the European dairy sector, driven by their high populations and robust dairy industries. The Off-Trade distribution channel dominates the market, accounting for a significant percentage of overall sales. Within product categories, butter holds a substantial share, largely influenced by consumer preferences and traditional food habits.

- Drivers for Dominant Regions and Segments:

- Germany: Strong domestic production, established distribution networks, and high per capita consumption.

- France: Rich dairy farming tradition, high-quality cheese production, and export opportunities.

- United Kingdom: Large population, established retail infrastructure, and diverse consumer preferences.

- Butter: Wide acceptance as a staple ingredient, versatile applications, and established consumer preferences.

- Off-Trade Channel: Convenience, wide availability in supermarkets and grocery stores.

The "Others" segment (Warehouse clubs, gas stations etc.) and On-Trade channels show significant growth potential, driven by increasing consumer convenience and diverse product offerings. Growth in these channels is projected to exceed the overall market CAGR during the forecast period.

Europe Dairy Market Product Developments

Recent product innovations focus on functional dairy products enriched with vitamins and probiotics, responding to health-conscious consumers. The market is seeing expansion in plant-based dairy alternatives to cater to emerging consumer preferences. Technological advancements in packaging, including sustainable and shelf-life-extending materials, are enhancing product appeal and reducing environmental impact. This includes the development of innovative dairy formulations with enhanced nutritional value and extended shelf life, giving companies a competitive edge.

Challenges in the Europe Dairy Market Market

Several factors hinder the Europe dairy market's growth:

- Regulatory Hurdles: Stringent food safety regulations and labeling requirements add to compliance costs.

- Supply Chain Issues: Fluctuations in milk production, logistics bottlenecks, and rising transportation costs affect profitability. For example, the xx% increase in transportation costs in 2023 directly impacted the profitability of xx dairy producers.

- Competitive Pressures: The entry of new players and the rise of plant-based alternatives intensify competition.

Forces Driving Europe Dairy Market Growth

Several factors are driving market expansion:

- Technological Advancements: Automation in dairy processing and innovative packaging technologies are improving efficiency and product shelf life.

- Economic Growth: Increased disposable incomes, particularly in developing regions of Europe, fuel dairy consumption.

- Favorable Regulatory Environment: In some countries, government support for the dairy industry and incentives for sustainable practices create a positive environment for growth.

Long-Term Growth Catalysts in Europe Dairy Market

Long-term growth relies on continued innovation in product development, strategic partnerships, and market expansion into new regions. The development of sustainable and ethically sourced dairy products, coupled with an increased focus on consumer health and wellness, will prove pivotal for the sector's future.

Emerging Opportunities in Europe Dairy Market

Emerging opportunities exist in the development of specialized dairy products targeting niche consumer segments (e.g., lactose-free, organic). Furthermore, market expansion into new European regions and exploring new distribution channels will drive growth. Finally, tapping into the growing demand for functional and convenience foods presents substantial potential.

Leading Players in the Europe Dairy Market Sector

- Groupe Sodiaal

- Nestlé SA

- Hochland Holding GmbH & Co KG

- Unilever PL

- Hochwald Milch eG

- Glanbia PLC

- Danone SA

- Müller Group

- Arla Foods Amba

- Savencia Fromage & Dairy

- DMK Deutsches Milchkontor GmbH

- Groupe Lactalis

Key Milestones in Europe Dairy Market Industry

- June 2022: Hochwald Milch eG invested EUR 200 Million in a new dairy manufacturing facility in Germany, significantly expanding its production capacity. This move strengthens its position in the market and increases its potential for growth.

- June 2022: Hochwald's new plant in Mechernich, with a capacity to process 800 Million kg of milk annually, underlines the company's commitment to growth and innovation in the European dairy market. This marks a significant increase in production capacity and emphasizes the market's overall expansion.

- March 2022: Lactalis Group's acquisition of BMI's Fresh division expands its reach and solidifies its market position, increasing competition and potentially driving innovation in the sector. This reflects the ongoing consolidation within the European dairy landscape.

Strategic Outlook for Europe Dairy Market Market

The European dairy market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic investments by key players. Companies that prioritize innovation, sustainability, and efficient supply chains are well-positioned to capitalize on future opportunities. The market presents a dynamic landscape ripe for expansion and innovation, offering lucrative possibilities for businesses willing to adapt and excel.

Europe Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Dairy Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Germany Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Groupe Sodiaal

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hochland Holding GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unilever PL

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hochwald Milch eG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Glanbia PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Müller Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Arla Foods Amba

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Savencia Fromage & Dairy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 DMK Deutsches Milchkontor GmbH

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Groupe Lactalis

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Groupe Sodiaal

List of Figures

- Figure 1: Europe Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Europe Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 5: Europe Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 26: Europe Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 27: Europe Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dairy Market?

The projected CAGR is approximately 4.06%.

2. Which companies are prominent players in the Europe Dairy Market?

Key companies in the market include Groupe Sodiaal, Nestlé SA, Hochland Holding GmbH & Co KG, Unilever PL, Hochwald Milch eG, Glanbia PLC, Danone SA, Müller Group, Arla Foods Amba, Savencia Fromage & Dairy, DMK Deutsches Milchkontor GmbH, Groupe Lactalis.

3. What are the main segments of the Europe Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 167040 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

June 2022: Hochwald Milch eG invested EUR 200 million to expand its business by opening a new dairy manufacturing facility in Germany. The new plant is located on a 21.5-hectare property and has 60,000 sq. m floor space.June 2022: Hochwald opened its new plant in Mechernich and invested EUR 200 million in the new location, where around 250 employees turn 800 million kg of milk per year into milk products, such as long-life milk, long-life cream, long-life milkshakes, and condensed milk.March 2022: Lactalis Group and Bayerische Milchindustrie eG (BMI) signed a contract for the sale of BMI’s Fresh division with the product groups: Fresh Milk, Yoghurt, and other products. Through this acquisition, Lactalis intends to build a close and long-term partnership with the southern German milk producers to further develop the market for regional products in food retail, national foodservice, and ethnic trade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dairy Market?

To stay informed about further developments, trends, and reports in the Europe Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence