Key Insights

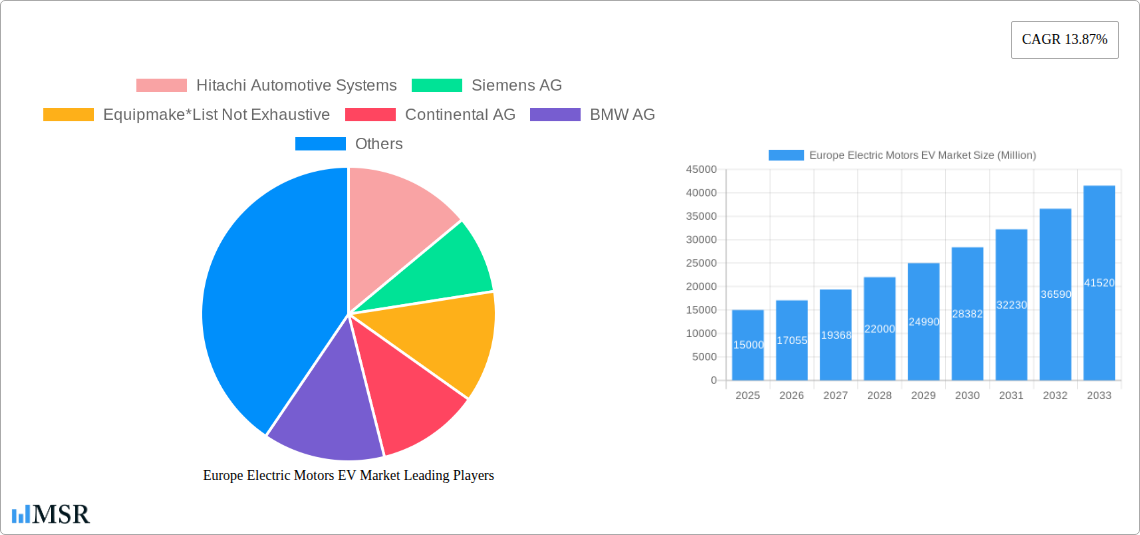

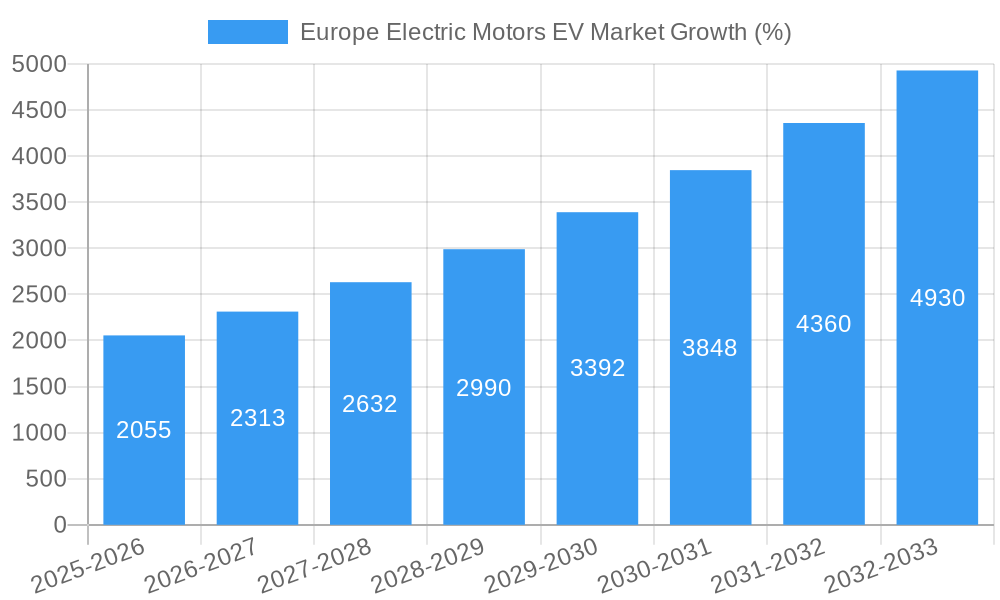

The European electric motor market for electric vehicles (EVs) is experiencing robust growth, driven by stringent emission regulations, increasing environmental awareness, and government incentives promoting EV adoption. The market, valued at approximately €XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size data), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 13.87% from 2025 to 2033. This significant expansion is fueled by the escalating demand for EVs across passenger car and commercial vehicle segments. The transition towards electrification is particularly pronounced in countries like Germany, the United Kingdom, and France, which are leading the charge in EV infrastructure development and technological advancements. The diverse range of electric motor types, including AC and DC motors, caters to varying EV power requirements and performance expectations. While the market faces challenges such as the high initial cost of EVs and the development of robust charging infrastructure, ongoing technological advancements in battery technology, motor efficiency, and charging speeds are mitigating these restraints. The competitive landscape is marked by the presence of established automotive giants like BMW and Bosch, alongside specialized electric motor manufacturers such as Hitachi Automotive Systems and Siemens. This dynamic interplay of innovation and competition will shape the future trajectory of the European EV electric motor market.

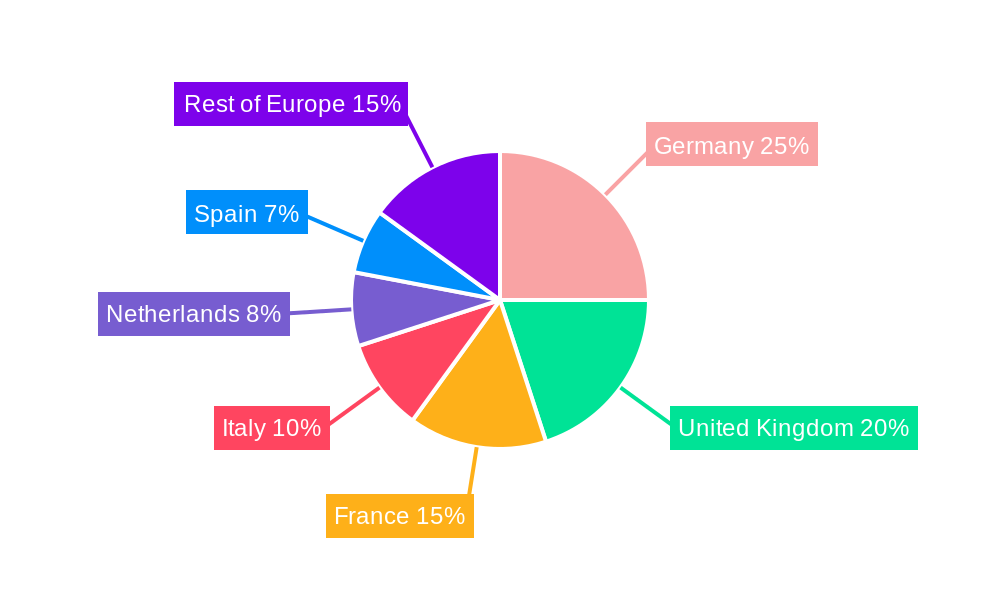

The segmentation of the market across vehicle types (Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Battery/Pure Electric Vehicle), countries (Germany, UK, Italy, France, Netherlands, Spain, and Rest of Europe), application types (Passenger Car, Commercial Vehicle), and motor types (AC Motor, DC Motor) provides valuable insights into specific market dynamics. Understanding these nuances is crucial for effective market strategy and investment decisions. The continued expansion of the EV market in Europe and the ongoing technological advancements suggest a sustained period of growth for electric motors, making it an attractive sector for both established players and new entrants. Further research into specific regional growth patterns and the evolving technological landscape will offer a more granular understanding of investment opportunities and competitive advantages within the market.

Europe Electric Motors EV Market: 2019-2033 Forecast & Analysis

This comprehensive report provides a detailed analysis of the Europe Electric Motors EV Market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities within the rapidly evolving electric vehicle landscape. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Electric Motors EV Market Market Concentration & Dynamics

The European electric motor EV market is characterized by a moderately concentrated landscape with several key players holding significant market share. While exact market share figures for each company vary and are constantly shifting due to M&A activities and new product introductions, companies like Bosch, Continental, and Siemens consistently demonstrate strong presence. The market is dynamic, driven by intense innovation, evolving regulatory frameworks, and the emergence of substitute technologies.

- Market Concentration: The top 5 players account for approximately xx% of the market share (2024 estimate).

- Innovation Ecosystem: Significant R&D investment fuels the development of advanced motor technologies, including high-efficiency motors and power electronics. Collaboration between OEMs, Tier 1 suppliers, and technology startups is prevalent.

- Regulatory Landscape: Stringent emission regulations in Europe are a key driver for electric vehicle adoption, creating favorable conditions for the electric motor market. Government incentives and subsidies further accelerate market growth.

- Substitute Products: While electric motors currently dominate the EV market, alternative technologies like fuel cells are emerging, though their market share remains relatively small currently.

- End-User Trends: The increasing preference for EVs among consumers, driven by environmental concerns and technological advancements, is a major factor driving market demand.

- M&A Activities: The number of mergers and acquisitions in the sector has increased in recent years, as companies seek to expand their market presence and consolidate their technological capabilities. An estimated xx M&A deals were recorded between 2019 and 2024.

Europe Electric Motors EV Market Industry Insights & Trends

The European electric motors EV market has witnessed substantial growth in recent years, propelled by multiple factors. The market size reached xx Million in 2024, and this upward trajectory is projected to continue throughout the forecast period. Several key trends are shaping this market:

Technological disruptions, such as advancements in battery technology and the development of more efficient electric motors, have significantly impacted market growth. Furthermore, evolving consumer behavior, with a growing preference for environmentally friendly vehicles, is another prominent driver. Government policies promoting the adoption of electric vehicles, including stricter emission standards and financial incentives, have also played a crucial role in shaping the market's growth trajectory. The increasing affordability of electric vehicles and improvements in charging infrastructure are further contributing to the expansion of the market. The market exhibits strong growth potential with a predicted CAGR of xx% from 2025 to 2033, driven by the factors mentioned above and increased production capabilities.

Key Markets & Segments Leading Europe Electric Motors EV Market

The European electric motor EV market is segmented by vehicle type, country, application type, and motor type. Analysis reveals significant variations in market dominance across segments.

By Vehicle Type: The Battery/Pure Electric Vehicle (BEV) segment is currently experiencing the most rapid growth, outpacing Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). This is primarily due to increasing consumer demand for longer ranges and zero-emission vehicles.

By Country: Germany holds the largest market share, followed by the United Kingdom, France, and Italy. Germany's strong automotive industry and supportive government policies contribute to its leading position. The Netherlands and Spain also showcase notable growth.

By Application Type: Passenger cars constitute the dominant application segment, driving the majority of market demand. However, the commercial vehicle segment is also growing steadily, fueled by the increasing adoption of electric buses and delivery vans.

By Motor Type: AC motors currently hold a larger market share compared to DC motors, due to their superior efficiency and power density. However, advancements in DC motor technology could lead to increased market share for DC motors in the coming years.

Drivers for Growth across Segments:

- Economic Growth: Rising disposable incomes in several European countries contribute to increased vehicle purchases.

- Government Incentives: Subsidies and tax breaks incentivize EV adoption, fueling demand for electric motors.

- Improved Charging Infrastructure: Expansion of charging networks reduces range anxiety, boosting consumer confidence.

- Technological Advancements: Continual improvements in battery technology and motor efficiency further drive market growth.

Europe Electric Motors EV Market Product Developments

Recent years have seen significant advancements in electric motor technology, focusing on increasing efficiency, reducing size and weight, and enhancing power density. Innovations include the use of permanent magnet synchronous motors (PMSM) with improved magnet materials and optimized designs, as well as advancements in motor control algorithms and power electronics. These developments translate to improved vehicle performance, extended range, and reduced energy consumption. The integration of smart motor control systems that can optimize performance in real-time, further enhances the competitive edge.

Challenges in the Europe Electric Motors EV Market Market

The European electric motor EV market faces several challenges. Regulatory hurdles, particularly concerning the sourcing of raw materials for battery production and stringent emission standards, can pose significant obstacles. Supply chain disruptions, notably in the availability of rare earth elements for permanent magnets, can cause production delays and impact market growth. Intense competition among established players and the entry of new entrants create pressure on pricing and margins. These combined factors are predicted to restrain market growth by approximately xx% in the short-term.

Forces Driving Europe Electric Motors EV Market Growth

Several factors are driving the growth of the European electric motor EV market. Technological advancements in battery technology, leading to increased range and reduced charging times, are a key driver. Government regulations aimed at reducing carbon emissions are significantly promoting EV adoption. Furthermore, increasing consumer awareness of environmental issues and the growing affordability of electric vehicles are positively impacting market growth.

Long-Term Growth Catalysts in Europe Electric Motors EV Market

Long-term growth in the European electric motors EV market will be fueled by continued technological innovation, particularly in battery technology, motor efficiency, and fast charging solutions. Strategic partnerships between OEMs, battery manufacturers, and technology companies will be crucial for accelerating innovation and market expansion. The expansion into new market segments, such as commercial vehicles and two-wheelers, will also contribute to long-term growth.

Emerging Opportunities in Europe Electric Motors EV Market

Emerging opportunities lie in the development of high-performance electric motors for next-generation EVs, particularly for high-performance sports cars and commercial vehicles. The growing demand for electric motor solutions in specialized applications, such as robotics and industrial automation, presents a promising area for expansion. Furthermore, the increasing adoption of connected and autonomous vehicles will create opportunities for advanced motor control systems and integration with other vehicle subsystems.

Leading Players in the Europe Electric Motors EV Market Sector

- Hitachi Automotive Systems

- Siemens AG

- Equipmake

- Continental AG

- BMW AG

- BorgWarner Inc

- Robert Bosch GmbH

- Delphi Technologies

- DENSO Corporation

- LG Electronics

Key Milestones in Europe Electric Motors EV Market Industry

- 2020: Several major OEMs announced significant investments in EV production facilities and battery technology.

- 2021: Stringent new emission regulations came into effect in several European countries.

- 2022: Several key players launched new high-efficiency electric motors for EVs.

- 2023: Significant increase in M&A activities within the EV supply chain.

- 2024: Further expansion of charging infrastructure across Europe.

Strategic Outlook for Europe Electric Motors EV Market Market

The future of the European electric motors EV market appears exceptionally promising. Continued technological advancements, supportive government policies, and rising consumer demand will drive substantial growth over the next decade. Companies that can successfully innovate, secure supply chains, and adapt to evolving market trends are poised to capture significant market share. The focus will shift toward developing sustainable and cost-effective electric motor solutions to support the mass adoption of electric vehicles across various segments.

Europe Electric Motors EV Market Segmentation

-

1. Application Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Motor Type

- 2.1. AC Motor

- 2.2. DC Motor

-

3. Vehicle Type

- 3.1. Hybrid Electric Vehicle

- 3.2. Plug-in Hybrid Electric Vehicle

- 3.3. Battery/Pure Electric Vehicle

Europe Electric Motors EV Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Motors EV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger cars Captures Major Share in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Motor Type

- 5.2.1. AC Motor

- 5.2.2. DC Motor

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Hybrid Electric Vehicle

- 5.3.2. Plug-in Hybrid Electric Vehicle

- 5.3.3. Battery/Pure Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Germany Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Motors EV Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hitachi Automotive Systems

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Equipmake*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Continental AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BMW AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BorgWarner Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Delphi Technologies

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DENSO Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LG Electronics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Hitachi Automotive Systems

List of Figures

- Figure 1: Europe Electric Motors EV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Motors EV Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Motors EV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Motors EV Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Europe Electric Motors EV Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 4: Europe Electric Motors EV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Europe Electric Motors EV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Electric Motors EV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Electric Motors EV Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 15: Europe Electric Motors EV Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 16: Europe Electric Motors EV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Europe Electric Motors EV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Electric Motors EV Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Motors EV Market?

The projected CAGR is approximately 13.87%.

2. Which companies are prominent players in the Europe Electric Motors EV Market?

Key companies in the market include Hitachi Automotive Systems, Siemens AG, Equipmake*List Not Exhaustive, Continental AG, BMW AG, BorgWarner Inc, Robert Bosch GmbH, Delphi Technologies, DENSO Corporation, LG Electronics.

3. What are the main segments of the Europe Electric Motors EV Market?

The market segments include Application Type, Motor Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger cars Captures Major Share in Market.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Motors EV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Motors EV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Motors EV Market?

To stay informed about further developments, trends, and reports in the Europe Electric Motors EV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence