Key Insights

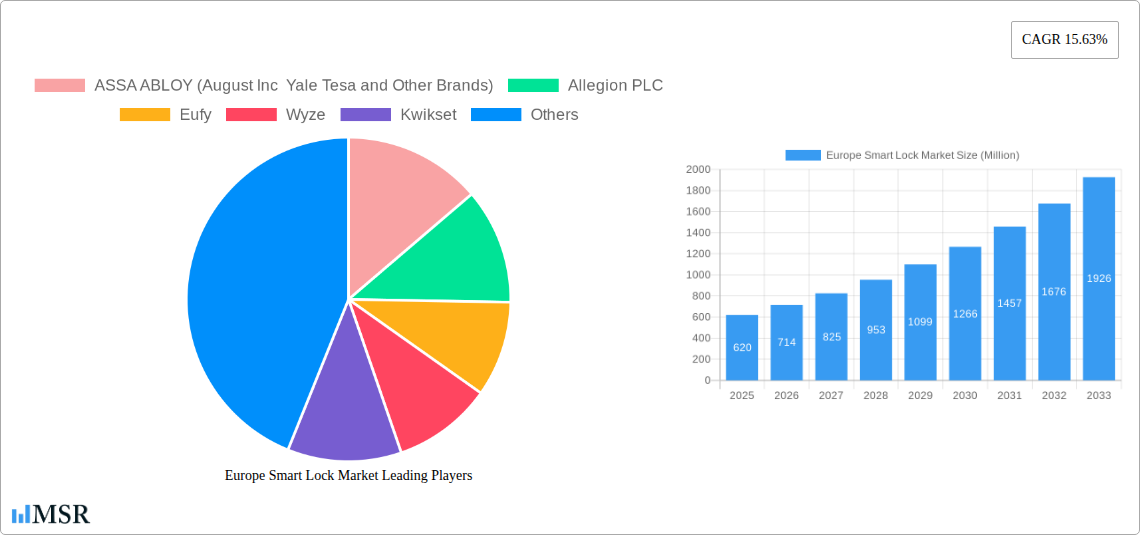

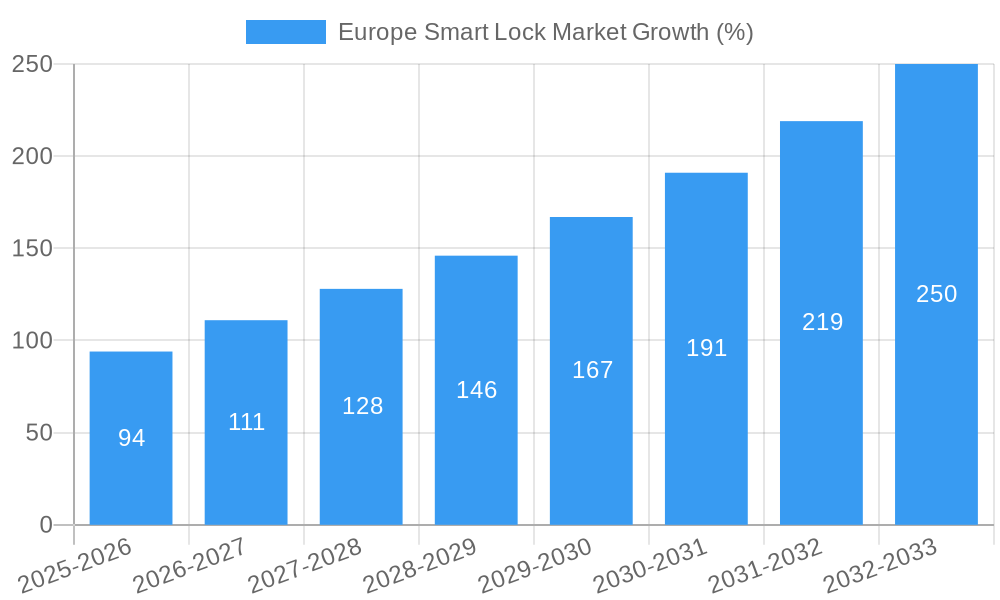

The European smart lock market, valued at €0.62 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.63% from 2025 to 2033. This surge is driven by several key factors. Increasing consumer demand for enhanced home security, coupled with the rising adoption of smart home technologies and the convenience offered by keyless entry systems, are significant drivers. Furthermore, technological advancements leading to improved features like biometric authentication, integration with smart home ecosystems (e.g., Amazon Alexa, Google Home), and enhanced cybersecurity measures are fueling market expansion. The market also benefits from a growing awareness of the vulnerabilities of traditional locking mechanisms and the advantages of remotely managing access. However, high initial investment costs compared to traditional locks and concerns regarding data privacy and security could act as potential restraints on market growth.

The competitive landscape is characterized by a mix of established players like ASSA ABLOY, Allegion PLC, and Schlage, alongside emerging technology companies such as Eufy and Nuki. These companies are actively engaged in product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market positions. The market is segmented based on lock type (e.g., smart deadbolt, smart keypad locks, smart door handles), technology (e.g., Bluetooth, Wi-Fi, Z-Wave), and end-user (e.g., residential, commercial). Future growth will likely be shaped by the increasing integration of smart locks with other smart home devices, the development of more sophisticated security features, and the penetration of smart locks into the commercial sector, particularly in areas like hotels and offices. The market’s expansion within specific European regions will vary, influenced by factors like technological adoption rates, economic conditions, and existing security infrastructure.

Europe Smart Lock Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe smart lock market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market dynamics, leading players, emerging trends, and future growth prospects, utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The study period is 2019-2033, with an estimated year of 2025. The total market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Smart Lock Market Market Concentration & Dynamics

The Europe smart lock market exhibits a moderately consolidated landscape, with key players like ASSA ABLOY (August Inc., Yale, Tesa, and other brands), Allegion PLC, and Dormakaba holding significant market share. However, the presence of numerous smaller players and emerging startups indicates a dynamic and competitive environment. Innovation ecosystems are thriving, with continuous development of new technologies such as biometric authentication, smart home integration, and improved cybersecurity features. Regulatory frameworks, particularly concerning data privacy and security, are shaping market practices. Substitute products, including traditional mechanical locks, pose a challenge, although the convenience and security advantages of smart locks are driving market growth. End-user trends show a growing preference for smart locks among homeowners and businesses, fueled by increasing urbanization and a heightened focus on home security. The market has witnessed several mergers and acquisitions (M&A) in recent years, with xx M&A deals recorded between 2019 and 2024, further consolidating the industry.

- Market Share: ASSA ABLOY holds approximately xx% market share, followed by Allegion PLC with xx% and Dormakaba with xx%.

- M&A Activity: A total of xx M&A deals occurred during the historical period (2019-2024), indicating considerable consolidation.

- Regulatory Landscape: GDPR and other data privacy regulations significantly influence smart lock development and market dynamics.

Europe Smart Lock Market Industry Insights & Trends

The Europe smart lock market is experiencing robust growth driven by several factors. Increasing demand for enhanced home security, coupled with the rising adoption of smart home technology and IoT devices, is a significant driver. Technological advancements such as improved battery life, advanced encryption protocols, and seamless integration with other smart home systems are fueling market expansion. Evolving consumer behaviors, such as a preference for convenience and remote access control, further propel market growth. The market size was valued at xx Million in 2024, and is projected to reach xx Million by 2033. The market’s growth is influenced by increasing urbanization and the rising disposable income of consumers.

Key Markets & Segments Leading Europe Smart Lock Market

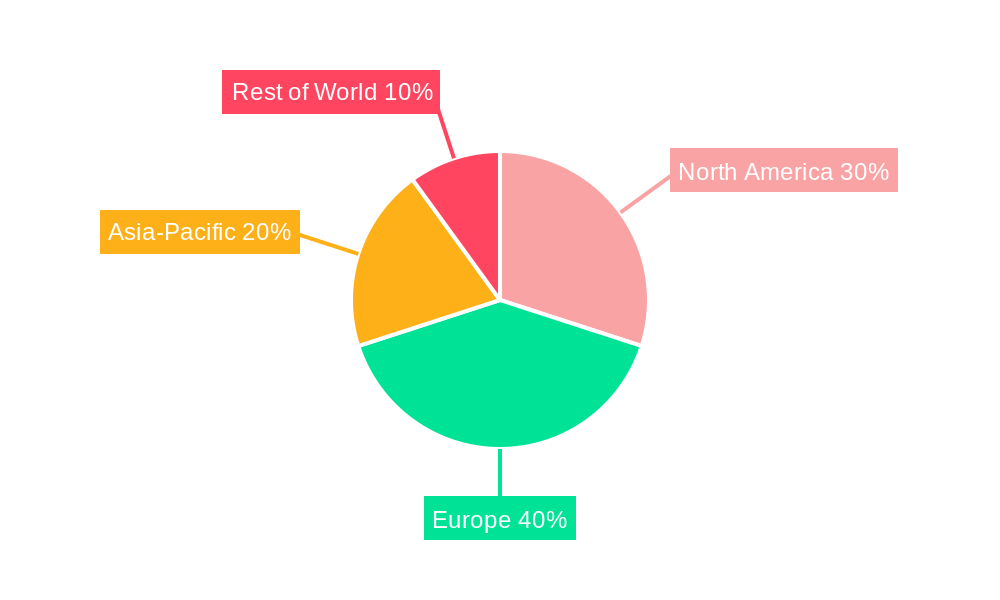

Germany, the UK, and France represent the largest markets within Europe, driven by strong economic growth, high adoption rates of smart home technology, and robust infrastructure. The residential segment dominates the market, driven by the increasing demand for enhanced home security and convenience. However, the commercial segment also presents significant opportunities, with businesses adopting smart locks for improved access control and security management.

- Germany: Strong economic growth, high technological adoption rates, and a focus on home security are key drivers.

- UK: High consumer spending on smart home technologies and a preference for advanced security solutions boost market growth.

- France: Growing urban populations and an increasing preference for convenient and secure access solutions are crucial factors.

Europe Smart Lock Market Product Developments

Recent product developments highlight a focus on enhanced security features, improved usability, and greater integration with smart home ecosystems. Manufacturers are incorporating advanced biometric technologies, such as fingerprint and facial recognition, alongside robust encryption protocols to enhance security. Several new products offer easier installation processes, catering to a broader consumer base. The market is witnessing a trend towards modular designs, allowing for greater customization and flexibility in functionality.

Challenges in the Europe Smart Lock Market Market

The Europe smart lock market faces challenges, including concerns about cybersecurity vulnerabilities, the high initial cost of smart locks compared to traditional locks, and the potential for technical malfunctions. Supply chain disruptions can also impact production and availability, increasing costs. Furthermore, the complexity of installation can deter some consumers from adopting smart locks.

Forces Driving Europe Smart Lock Market Growth

Key growth drivers include rising consumer demand for enhanced home security, increasing adoption of smart home technology, and technological advancements in smart lock features. Government initiatives promoting smart city development also contribute to market growth. The increasing integration of smart locks with various smart home ecosystems further fuels market expansion.

Challenges in the Europe Smart Lock Market Market (Long-Term Growth Catalysts)

Long-term growth will be driven by continuous innovation in areas such as enhanced security features, seamless integration with other smart home devices, and the development of more user-friendly interfaces. Strategic partnerships between smart lock manufacturers and smart home ecosystem providers will also play a critical role in market expansion.

Emerging Opportunities in Europe Smart Lock Market

Emerging opportunities lie in the integration of smart locks with other smart home security systems, the development of advanced biometric authentication methods, and expansion into new markets across Europe. Focus on user-friendly installation and affordable solutions will also open up new market segments.

Leading Players in the Europe Smart Lock Market Sector

- ASSA ABLOY (August Inc., Yale, Tesa and Other Brands)

- Allegion PLC

- Eufy

- Wyze

- Kwikset

- Cansec Systems Inc

- Mul-T-Lock

- Sentrilock LLC

- Dormakaba

- Nuki Home Solutions

- Netatmo (Legrand)

- Schlage

- Salto Systems S.L

- MIWA Lock Co

- ZKTeco Co Ltd

- Codelocks EU B.V

- Master Lock Company LLC

- Lavna Locks

- iLokey

- Vivint Inc

Key Milestones in Europe Smart Lock Market Industry

- February 2024: Ajax Systems partnered with Yale, enhancing smart lock control via the Ajax Security System app.

- March 2024: SwitchBot launched the SwitchBot Lock Pro, a retrofit smart lock prioritizing convenience and security.

Strategic Outlook for Europe Smart Lock Market Market

The Europe smart lock market holds significant potential for future growth, driven by technological advancements, increasing consumer demand for enhanced security, and the expansion of smart home ecosystems. Strategic partnerships, product innovation, and expansion into new markets will be crucial for companies to capture market share and capitalize on emerging opportunities.

Europe Smart Lock Market Segmentation

-

1. Communication Technology

- 1.1. Wi-Fi

- 1.2. Bluetooth

- 1.3. Zigbee

- 1.4. Z-Wave

- 1.5. Other Communication Technologies

-

2. Authentication Mode

- 2.1. Biometric

- 2.2. PIN Code/Keypad

- 2.3. RFID/NFC

- 2.4. Other Authentication Modes

Europe Smart Lock Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Smart Lock Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant Penetration of Smart Phones and the Internet; Standardization of Smart Home Technologies; Urbanization and Changing Housing Trends

- 3.3. Market Restrains

- 3.3.1. Significant Penetration of Smart Phones and the Internet; Standardization of Smart Home Technologies; Urbanization and Changing Housing Trends

- 3.4. Market Trends

- 3.4.1. Biometric Authentication Mode is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Lock Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Communication Technology

- 5.1.1. Wi-Fi

- 5.1.2. Bluetooth

- 5.1.3. Zigbee

- 5.1.4. Z-Wave

- 5.1.5. Other Communication Technologies

- 5.2. Market Analysis, Insights and Forecast - by Authentication Mode

- 5.2.1. Biometric

- 5.2.2. PIN Code/Keypad

- 5.2.3. RFID/NFC

- 5.2.4. Other Authentication Modes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Communication Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ASSA ABLOY (August Inc Yale Tesa and Other Brands)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allegion PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eufy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wyze

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kwikset

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cansec Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mul-T-Lock

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sentrilock LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dormakaba

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuki Home Solutions

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Netatmo (Legrand)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Schlage

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Salto Systems S L

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 MIWA Lock Co

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ZKTeco Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Codelocks EU B V

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Master Lock Company LLC

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Lavna Locks

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 iLokey

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Vivint Inc

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 ASSA ABLOY (August Inc Yale Tesa and Other Brands)

List of Figures

- Figure 1: Europe Smart Lock Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Lock Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Lock Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Lock Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Smart Lock Market Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 4: Europe Smart Lock Market Volume Billion Forecast, by Communication Technology 2019 & 2032

- Table 5: Europe Smart Lock Market Revenue Million Forecast, by Authentication Mode 2019 & 2032

- Table 6: Europe Smart Lock Market Volume Billion Forecast, by Authentication Mode 2019 & 2032

- Table 7: Europe Smart Lock Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Smart Lock Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Europe Smart Lock Market Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 10: Europe Smart Lock Market Volume Billion Forecast, by Communication Technology 2019 & 2032

- Table 11: Europe Smart Lock Market Revenue Million Forecast, by Authentication Mode 2019 & 2032

- Table 12: Europe Smart Lock Market Volume Billion Forecast, by Authentication Mode 2019 & 2032

- Table 13: Europe Smart Lock Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Smart Lock Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: France Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Spain Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Belgium Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Sweden Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Norway Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Norway Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Poland Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Poland Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Denmark Europe Smart Lock Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Denmark Europe Smart Lock Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Lock Market?

The projected CAGR is approximately 15.63%.

2. Which companies are prominent players in the Europe Smart Lock Market?

Key companies in the market include ASSA ABLOY (August Inc Yale Tesa and Other Brands), Allegion PLC, Eufy, Wyze, Kwikset, Cansec Systems Inc, Mul-T-Lock, Sentrilock LLC, Dormakaba, Nuki Home Solutions, Netatmo (Legrand), Schlage, Salto Systems S L, MIWA Lock Co, ZKTeco Co Ltd, Codelocks EU B V, Master Lock Company LLC, Lavna Locks, iLokey, Vivint Inc.

3. What are the main segments of the Europe Smart Lock Market?

The market segments include Communication Technology, Authentication Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Significant Penetration of Smart Phones and the Internet; Standardization of Smart Home Technologies; Urbanization and Changing Housing Trends.

6. What are the notable trends driving market growth?

Biometric Authentication Mode is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Significant Penetration of Smart Phones and the Internet; Standardization of Smart Home Technologies; Urbanization and Changing Housing Trends.

8. Can you provide examples of recent developments in the market?

March 2024 - SwitchBot unveiled the SwitchBot Lock Pro, a retrofit smart lock that prioritizes both convenience and security and boasts an easy retrofit installation method. The SwitchBot Lock Pro offers tailored solutions for EU/UK and US households. Its support for various lock types means users globally can swiftly upgrade their old door locks without drilling or damaging the existing door or lock. Additionally, the installation process retains the original key functionality, ensuring continued usability when needed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Lock Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Lock Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Lock Market?

To stay informed about further developments, trends, and reports in the Europe Smart Lock Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence