Key Insights

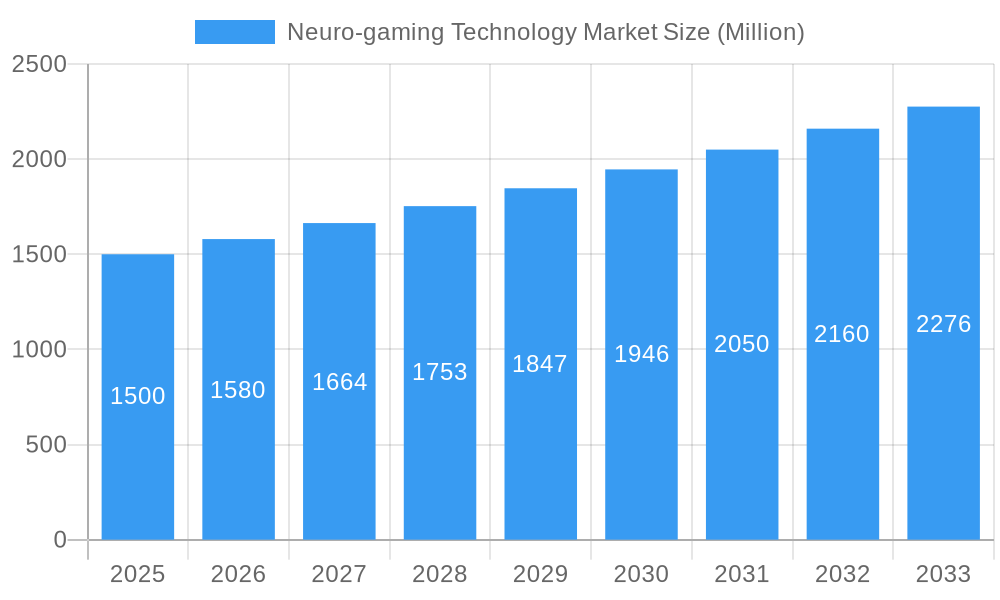

The Neuro-gaming technology market is experiencing robust growth, driven by advancements in brain-computer interfaces (BCIs), increasing demand for immersive gaming experiences, and the rising popularity of esports. The market's compound annual growth rate (CAGR) of 5.30% from 2019 to 2024 suggests a significant expansion, projected to continue into the forecast period (2025-2033). Key segments driving this growth include hardware components like headsets and sensors, and software applications offering enhanced gaming experiences through biofeedback and personalized gameplay. The healthcare sector shows strong potential, leveraging neuro-gaming for therapeutic applications like rehabilitation and cognitive training. The education sector is also adopting these technologies for engaging and personalized learning experiences. While the market is still relatively nascent, challenges remain, such as high initial investment costs for hardware and software, and the need for further research to ensure the safety and efficacy of neuro-gaming technologies. Technological advancements are continuously pushing the boundaries, leading to more sophisticated and accessible products. The rise of virtual and augmented reality (VR/AR) integration is further fueling market expansion, enhancing the overall gaming experience and broadening the appeal beyond hardcore gamers. Competition is intensifying among key players, resulting in innovations and market consolidation. Geographic expansion, particularly in the Asia-Pacific region with its rapidly growing gaming market, presents significant opportunities for growth.

Neuro-gaming Technology Market Market Size (In Billion)

The market segmentation reveals the prominent roles of hardware and software in generating revenue. Hardware components, encompassing sensors, headsets, and other peripherals, are currently the largest segment, but software solutions offer more potential for future growth as they become increasingly sophisticated and integrated. The end-user segments showcase a diverse market, with healthcare increasingly adopting neuro-gaming for therapeutic purposes. The entertainment segment remains the largest current contributor, driven by the desire for enhanced gaming experiences. However, the education segment is poised for significant expansion as schools and universities leverage neuro-gaming's potential for personalized learning and improved engagement. The "Other End Users" segment encompasses research institutions and other organizations exploring the applications of neuro-gaming technology, reflecting the market's broader potential across various fields. Continued technological advancements, particularly in areas like artificial intelligence and machine learning, will further refine the precision and capabilities of neuro-gaming technology, opening doors to new applications and accelerating market growth.

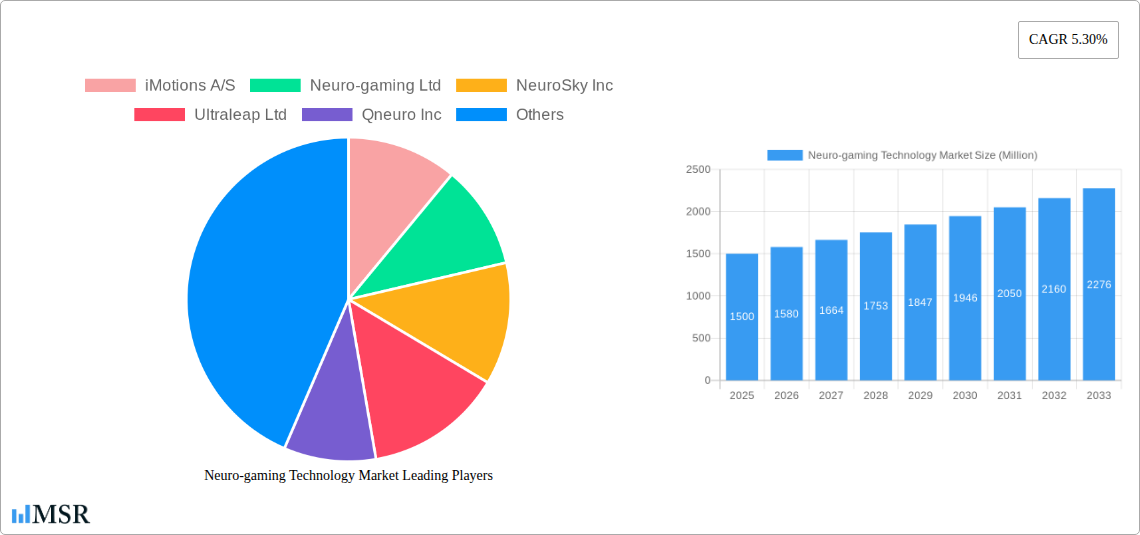

Neuro-gaming Technology Market Company Market Share

Neuro-gaming Technology Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Neuro-gaming Technology Market, offering invaluable insights for industry stakeholders, investors, and researchers. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by component (hardware, software) and end-user (healthcare, education, entertainment, other). We project a xx Million market value in 2025, with a CAGR of xx% during the forecast period. Key players like iMotions A/S, Neuro-gaming Ltd, NeuroSky Inc, Ultraleap Ltd, Qneuro Inc, Emotiv Inc, and Affectiva Inc (acquired by Smart Eye AB) are analyzed for their market share, strategic initiatives, and competitive landscape.

Neuro-gaming Technology Market Market Concentration & Dynamics

The Neuro-gaming technology market exhibits a moderately concentrated landscape, with a few dominant players controlling a significant share. However, the market is witnessing increasing competition from new entrants and smaller companies specializing in niche applications. The innovation ecosystem is vibrant, driven by advancements in brain-computer interfaces (BCIs), virtual reality (VR), and augmented reality (AR) technologies. Regulatory frameworks vary across geographies, posing challenges and opportunities for companies. Substitute products, such as traditional gaming and therapeutic methods, continue to compete, though the unique benefits of neuro-gaming are creating new market segments. End-user trends show a growing adoption of neuro-gaming in healthcare and education, fueled by the potential for personalized therapeutic interventions and enhanced learning experiences. Mergers and acquisitions (M&A) activity is relatively high, with strategic acquisitions consolidating market share and accelerating technological development.

- Market Share: Top 5 players control approximately xx% of the market in 2025.

- M&A Deal Counts: An estimated xx M&A deals occurred between 2019 and 2024.

Neuro-gaming Technology Market Industry Insights & Trends

The Neuro-gaming technology market is experiencing robust growth, driven by several factors. The increasing adoption of VR and AR technologies is creating new avenues for immersive and interactive gaming experiences. Advancements in BCI technology are enabling more sophisticated and personalized neuro-gaming applications, leading to the development of games that can monitor and respond to users' brain activity in real-time. Consumer behavior is shifting towards personalized entertainment and health-focused activities, further fueling market demand. The global market size is projected to reach xx Million by 2025, growing at a CAGR of xx% from 2025 to 2033. This growth is largely attributed to the rising demand for neuro-gaming applications in healthcare and the expanding adoption of advanced technologies in the gaming sector. Technological disruptions, such as the development of more accurate and affordable BCI sensors, are further stimulating market expansion.

Key Markets & Segments Leading Neuro-gaming Technology Market

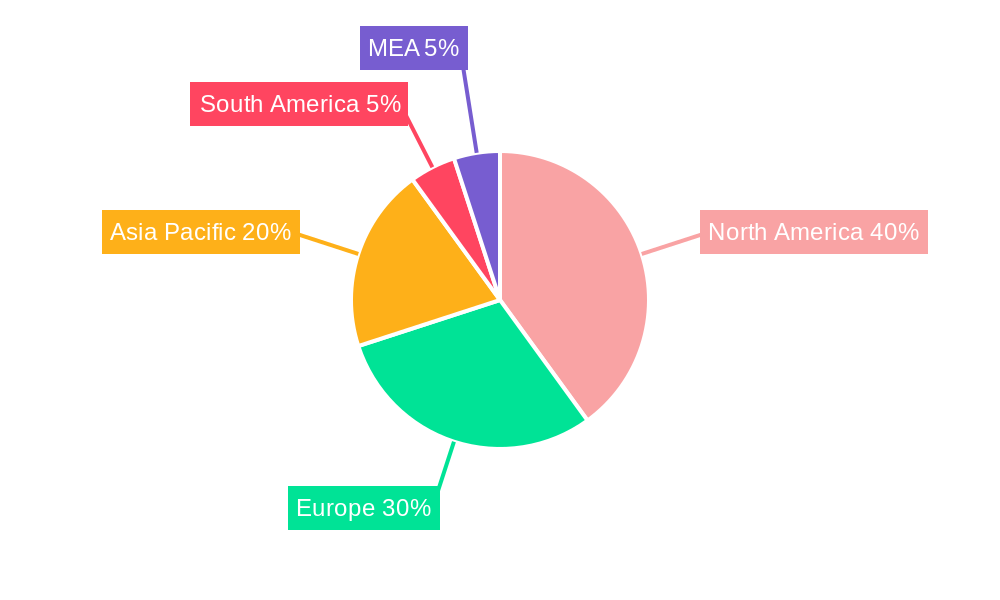

The North American region currently holds the largest market share, driven by strong technological advancements, substantial investments in R&D, and a significant consumer base with a high disposable income. The healthcare segment exhibits the highest growth potential, given the increasing applications of neuro-gaming in treating mental health conditions and neurological disorders.

- By Component: The hardware segment dominates due to the increasing demand for advanced headsets and sensors.

- By End-User: The healthcare segment is the fastest-growing, driven by the potential of neuro-gaming to improve mental and cognitive health.

Drivers for North American Dominance:

- High disposable income and a large consumer base.

- Extensive research and development investments in the neurotechnology sector.

- Strong presence of major players in the neuro-gaming technology market.

- Favorable regulatory environment that promotes innovation and adoption of new technologies.

Drivers for Healthcare Segment Growth:

- Rising prevalence of neurological disorders and mental health conditions.

- Increasing demand for effective and personalized therapeutic interventions.

- Growing awareness of the potential benefits of neuro-gaming in healthcare.

Neuro-gaming Technology Market Product Developments

Recent product innovations include advanced headsets capable of measuring multiple physiological signals simultaneously, such as brain activity, heart rate, and eye movements. These advancements provide richer data for personalized gaming experiences and more effective therapeutic interventions. New applications are emerging in education, with neuro-gaming used to improve learning outcomes and engagement. These developments contribute to a more immersive and personalized gaming experience, creating a competitive edge for companies that invest in innovative technologies.

Challenges in the Neuro-gaming Technology Market Market

The Neuro-gaming technology market faces several challenges, including regulatory hurdles surrounding the use of BCI technology, the high cost of development and manufacturing of advanced hardware, and the potential for data privacy concerns. Supply chain disruptions and intense competition from established gaming companies also pose significant obstacles. These factors can collectively reduce market penetration and limit overall revenue growth by approximately xx Million annually.

Forces Driving Neuro-gaming Technology Market Growth

Several key factors propel the Neuro-gaming Technology market's growth. Technological advancements in BCI, VR, and AR technologies are key, enabling more realistic and interactive experiences. Increasing consumer demand for personalized entertainment and therapeutic applications is also a significant driver. Furthermore, supportive government policies and increased investments in R&D contribute to market expansion. The growing integration of neuro-gaming with other technologies, such as AI and machine learning, further fuels innovation and market expansion.

Challenges in the Neuro-gaming Technology Market Market

Long-term growth hinges on continued technological innovation and strategic partnerships between technology companies, healthcare providers, and educational institutions. Expanding into new markets and developing innovative applications for various end-users will be crucial for sustained market growth.

Emerging Opportunities in Neuro-gaming Technology Market

Emerging opportunities abound, including the development of neuro-gaming applications for specific therapeutic areas like PTSD or ADHD. New markets in developing countries with growing middle classes present significant potential. Integrating neuro-gaming with wearable technology and exploring the metaverse offers further growth avenues. The increasing interest in personalized wellness and mental health presents significant growth opportunities.

Leading Players in the Neuro-gaming Technology Market Sector

- iMotions A/S

- Neuro-gaming Ltd

- NeuroSky Inc

- Ultraleap Ltd

- Qneuro Inc

- Emotiv Inc

- Affectiva Inc (Acquired by Smart Eye AB)

Key Milestones in Neuro-gaming Technology Market Industry

- March 2022: Snap Inc. acquires NextMind, bolstering its AR research and development capabilities. This demonstrates the growing interest in BCI technology within the larger technology sector.

- June 2022: Launch of Varjo Aero, a professional-grade VR/XR headset with integrated bio-sensing capabilities, marks a significant advancement in immersive and data-rich neuro-gaming experiences.

- July 2022: Mindpeers launches a new game incorporating journaling and self-exploration features, showcasing the expanding therapeutic applications of neuro-gaming.

Strategic Outlook for Neuro-gaming Technology Market Market

The future of the Neuro-gaming Technology market is bright. Continued innovation in BCI technology, coupled with the growing demand for personalized entertainment and healthcare solutions, suggests a substantial market expansion. Strategic partnerships and acquisitions will play a critical role in shaping the competitive landscape. Companies focusing on developing user-friendly, affordable, and effective neuro-gaming applications stand to benefit most from the market's growth potential.

Neuro-gaming Technology Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. End User

- 2.1. Healthcare

- 2.2. Education

- 2.3. Entertainment

- 2.4. Other End Users

Neuro-gaming Technology Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Neuro-gaming Technology Market Regional Market Share

Geographic Coverage of Neuro-gaming Technology Market

Neuro-gaming Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Development of Brain Computer Interfaces (BCIs); Increasing Adoption of Smart Devices

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Limited Actions Included in Games

- 3.4. Market Trends

- 3.4.1. Education Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare

- 5.2.2. Education

- 5.2.3. Entertainment

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Healthcare

- 6.2.2. Education

- 6.2.3. Entertainment

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Healthcare

- 7.2.2. Education

- 7.2.3. Entertainment

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Healthcare

- 8.2.2. Education

- 8.2.3. Entertainment

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Neuro-gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Healthcare

- 9.2.2. Education

- 9.2.3. Entertainment

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 iMotions A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Neuro-gaming Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NeuroSky Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ultraleap Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qneuro Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Emotiv Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Affectiva Inc (Acquired by Smart Eye AB)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 iMotions A/S

List of Figures

- Figure 1: Global Neuro-gaming Technology Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by Component 2025 & 2033

- Figure 21: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Neuro-gaming Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Neuro-gaming Technology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 11: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global Neuro-gaming Technology Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Neuro-gaming Technology Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neuro-gaming Technology Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Neuro-gaming Technology Market?

Key companies in the market include iMotions A/S, Neuro-gaming Ltd, NeuroSky Inc, Ultraleap Ltd, Qneuro Inc, Emotiv Inc, Affectiva Inc (Acquired by Smart Eye AB).

3. What are the main segments of the Neuro-gaming Technology Market?

The market segments include Component, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Development of Brain Computer Interfaces (BCIs); Increasing Adoption of Smart Devices.

6. What are the notable trends driving market growth?

Education Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness and Limited Actions Included in Games.

8. Can you provide examples of recent developments in the market?

July 2022: The new game from Mindpeers is a ground-breaking development in health technology. It claims to give its users mental clarity, the ability to express their worries, and a sense of empowerment. As the name implies, the game's intriguing two-step journaling and self-exploration portion aid in clearing the skies or thoughts. According to research, when users express their feelings or thoughts, they can articulate, activating neocortical functioning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Neuro-gaming Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Neuro-gaming Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Neuro-gaming Technology Market?

To stay informed about further developments, trends, and reports in the Neuro-gaming Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence