Key Insights

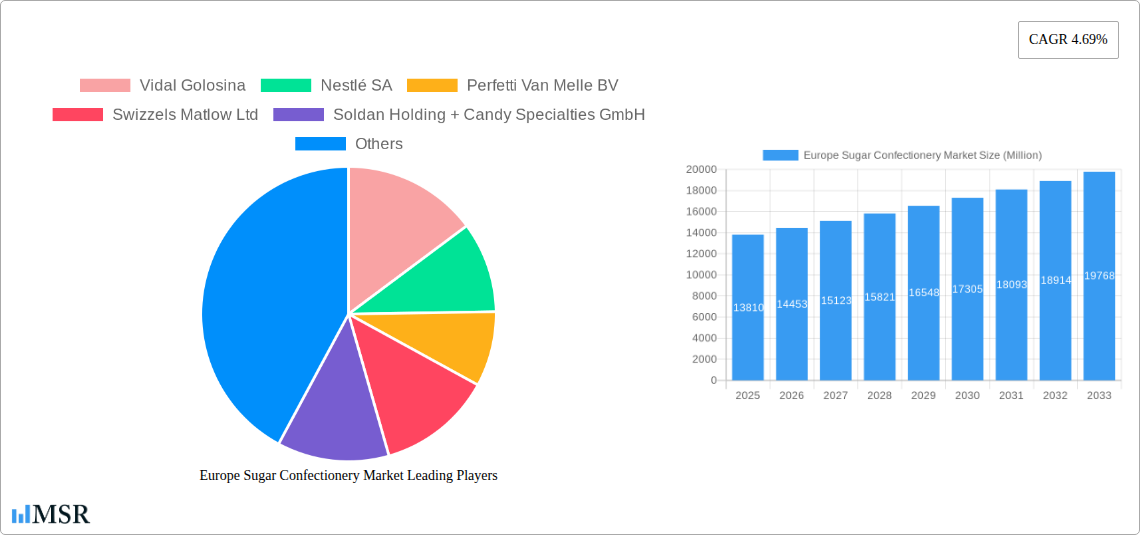

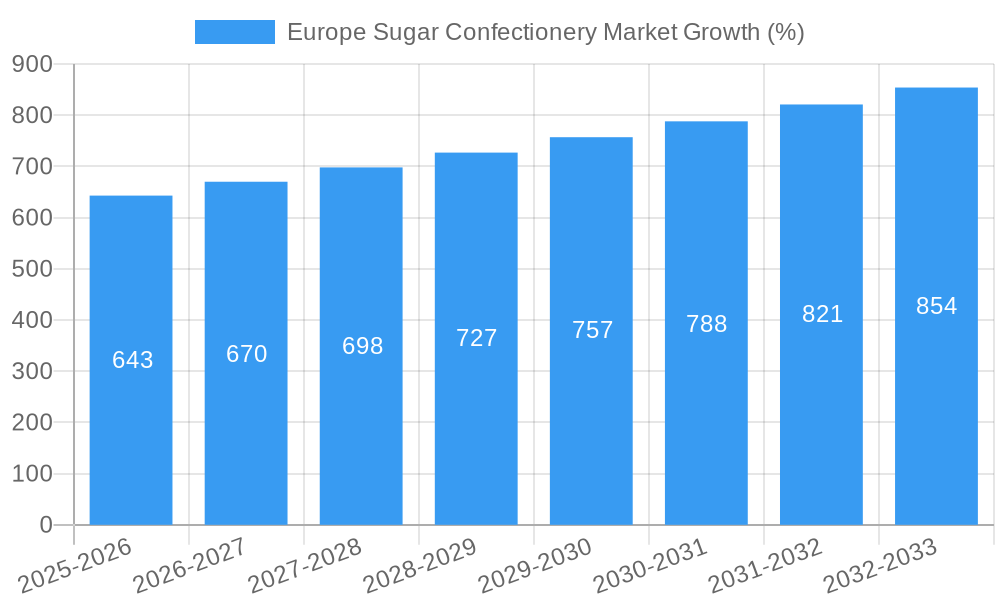

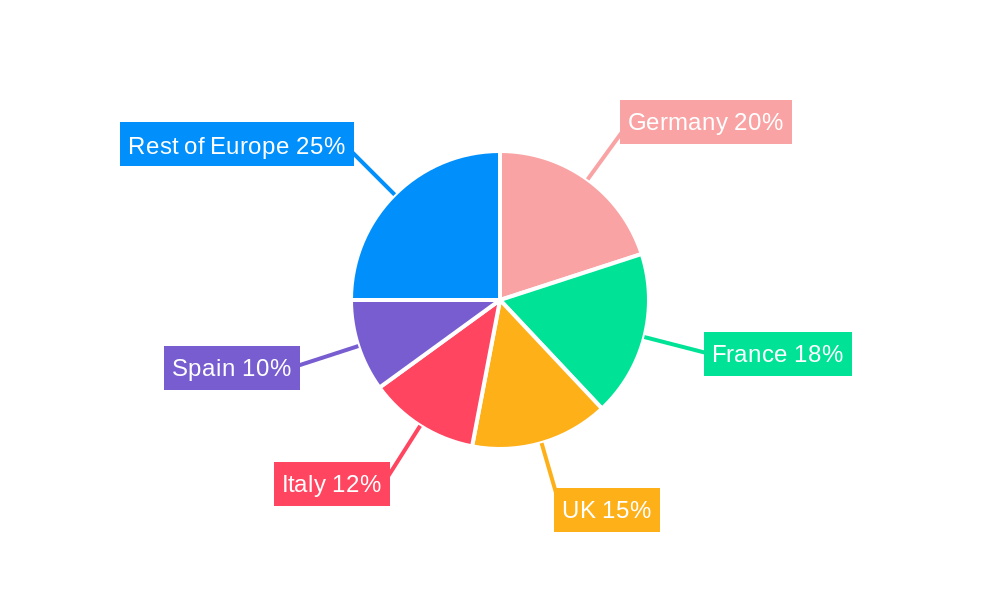

The European sugar confectionery market, valued at €13.81 billion in 2025, is projected to experience steady growth, driven by several key factors. A rising disposable income across several European nations, coupled with increasing urbanization and changing consumer lifestyles, fuels demand for convenient and indulgent treats. The market's segmentation reveals strong performance across various confectionery variants, with hard candies, lollipops, and gummies maintaining high popularity. Supermarkets and hypermarkets remain the dominant distribution channel, although online retail is exhibiting significant growth, particularly among younger consumers. Germany, France, and the UK represent the largest national markets within Europe, contributing substantially to the overall market size. However, changing consumer preferences towards healthier alternatives and increasing health consciousness are creating a restraint on the market's growth. Furthermore, fluctuating sugar prices and stringent regulations on sugar content in food products pose challenges to manufacturers. The competitive landscape is dominated by established multinational players like Nestlé, Ferrero, and Mars, alongside several regional brands catering to specific tastes and preferences. The forecast period (2025-2033) anticipates sustained growth, although at a moderated pace compared to previous years, primarily due to increasing health-conscious consumption patterns.

Despite the aforementioned restraints, innovative product launches, such as sugar-free and organic options, are expected to offset some of the negative impacts. Companies are increasingly investing in research and development to meet the evolving consumer demands for healthier alternatives. Premiumization and the introduction of unique flavors and packaging are also driving growth in specific segments. Regional variations in taste preferences and consumption patterns will continue to shape the market. For example, the popularity of specific confectionery types might vary across countries, influencing the overall market share of each segment. Manufacturers are adapting their strategies to cater to these differences, employing targeted marketing campaigns and product diversification to maintain a strong market position within specific regions. The long-term outlook for the European sugar confectionery market suggests continued growth, albeit at a more measured pace, driven by innovation, targeted marketing, and the sustained appeal of sugar confectionery products, despite growing health concerns.

Europe Sugar Confectionery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Sugar Confectionery Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The European sugar confectionery market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Sugar Confectionery Market Market Concentration & Dynamics

The European sugar confectionery market is characterized by a moderately concentrated landscape, with several multinational giants and regional players vying for market share. Key players such as Nestlé SA, Mars Incorporated, and Ferrero International SA hold significant market positions, leveraging their established brands and extensive distribution networks. However, smaller, specialized companies are also making inroads, particularly those focusing on niche confectionery variants or innovative product offerings.

The market's dynamics are shaped by several key factors:

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025.

- Innovation Ecosystems: A vibrant ecosystem of research and development drives continuous innovation in flavors, textures, and ingredients, catering to evolving consumer preferences.

- Regulatory Frameworks: EU regulations concerning sugar content, labeling, and food safety significantly impact market operations and product development.

- Substitute Products: The increasing popularity of healthier snack alternatives, like fruit-based snacks and sugar-free confectionery, poses a moderate competitive threat.

- End-User Trends: Health-conscious consumers are driving demand for sugar-reduced and functional confectionery products. Premiumization and indulgence trends also contribute to market growth.

- M&A Activities: The confectionery sector has witnessed a significant number of mergers and acquisitions (M&A) in recent years (xx deals between 2019 and 2024), reflecting the industry’s consolidation and expansion strategies.

Europe Sugar Confectionery Market Industry Insights & Trends

The Europe sugar confectionery market is experiencing robust growth, driven by several factors. The market size reached xx Million in 2024 and is projected to reach xx Million in 2025, indicating a strong market performance. This growth can be attributed to increasing disposable incomes, changing lifestyles, and the ongoing demand for indulgent treats. However, health concerns related to sugar consumption present a significant challenge.

Technological disruptions, particularly in packaging and production processes, are improving efficiency and enhancing product quality. Evolving consumer behavior, with increased demand for healthier alternatives and personalized experiences, is reshaping product development strategies. The market is witnessing a rise in premiumization, with consumers willing to pay more for high-quality ingredients and unique flavors. The increasing popularity of online retail channels is also impacting the market's distribution landscape.

Key Markets & Segments Leading Europe Sugar Confectionery Market

The UK, Germany, and France represent the largest national markets within Europe, contributing significantly to the overall market size. However, other countries, like Italy and Spain, are experiencing substantial growth.

Leading Country Segments (2025):

- United Kingdom: Strong consumer spending and a well-established retail infrastructure contribute to market leadership.

- Germany: Large population and a mature confectionery market drive substantial demand.

- France: High consumption of confectionery products and a strong preference for premium brands fuel market growth.

Leading Confectionery Variant Segments (2025):

- Chocolate Confectionery: Maintains its dominance due to widespread appeal and diverse product offerings.

- Gummies and Jellies: Experiencing significant growth due to innovation in flavors and textures.

Leading Distribution Channels (2025):

- Supermarket/Hypermarkets: Remain the primary distribution channel due to wide reach and consumer accessibility.

- Convenience Stores: Capture a significant share due to impulse purchases and convenient locations.

- Online Retail Stores: Experiencing rapid growth, propelled by increasing e-commerce adoption.

Drivers for Growth:

- Rising Disposable Incomes: Increased purchasing power allows consumers to indulge in more confectionery products.

- Growing Urbanization: Urban populations tend to have higher consumption rates of convenience foods, including confectionery.

- Tourism: Tourist spending contributes to significant sales, especially in popular tourist destinations.

Europe Sugar Confectionery Market Product Developments

Recent years have witnessed significant innovations in the Europe sugar confectionery market, focusing on healthier options, unique flavors, and functional ingredients. Companies are increasingly incorporating natural ingredients, reducing sugar content, and introducing novel textures and formats to appeal to health-conscious consumers. Technological advancements in production and packaging are improving efficiency and reducing waste. Competitive advantage is achieved through brand building, product differentiation, and strategic partnerships.

Challenges in the Europe Sugar Confectionery Market Market

The Europe sugar confectionery market faces challenges including increasing health concerns regarding sugar consumption, leading to regulatory pressure and consumer preference shifts towards healthier alternatives. Fluctuations in raw material prices impact profitability, while intense competition from established and emerging players necessitates continuous innovation and effective marketing strategies. Supply chain disruptions due to geopolitical events can also affect market stability. The market share of xx% for healthier alternatives indicates this growing challenge.

Forces Driving Europe Sugar Confectionery Market Growth

Several factors propel the Europe sugar confectionery market's growth. These include the increasing preference for premium and indulgent products, rising disposable incomes leading to higher spending on treats, and the expanding e-commerce sector providing wider access to confectionery. Furthermore, the continuous introduction of innovative flavors and product formats caters to evolving consumer tastes.

Long-Term Growth Catalysts in Europe Sugar Confectionery Market

Long-term growth will be driven by strategic partnerships aimed at expanding product lines and reaching new markets. Investments in research and development will continue to fuel innovation, introducing healthier, more sustainable options. Expansion into emerging markets and tapping into growing consumer segments will be crucial for long-term success.

Emerging Opportunities in Europe Sugar Confectionery Market

Emerging opportunities lie in catering to the growing demand for healthier confectionery alternatives, such as sugar-free and organic options. Expanding into niche markets, like vegan or allergen-free confectionery, presents further potential. The rise of e-commerce offers avenues for enhanced customer engagement and targeted marketing efforts.

Leading Players in the Europe Sugar Confectionery Market Sector

- Vidal Golosina

- Nestlé SA

- Perfetti Van Melle BV

- Swizzels Matlow Ltd

- Soldan Holding + Candy Specialties GmbH

- Lavdas SA

- August Storck KG

- Katjes International GmbH & Co KG

- Ferrero International SA

- Cloetta AB

- Ricola AG

- Mars Incorporated

- HARIBO Holding GmbH & Co KG

- Mondelēz International Inc

- The Hershey Company

Key Milestones in Europe Sugar Confectionery Market Industry

- March 2023: Hershey's launched Hershey's Kisses Milklicious candies.

- April 2023: Swizzels Sweets partnered with Applied Nutrition for sports nutrition products.

- May 2023: Swizzels expanded its Minions product range with Sherbet Dip.

Strategic Outlook for Europe Sugar Confectionery Market Market

The future of the Europe sugar confectionery market hinges on adapting to evolving consumer preferences and embracing sustainable practices. Companies that successfully navigate health concerns, innovate with unique product offerings, and leverage digital channels will thrive. The market's long-term growth potential remains strong, fueled by consistent product innovation and strategic market expansion.

Europe Sugar Confectionery Market Segmentation

-

1. Confectionery Variant

- 1.1. Hard Candy

- 1.2. Lollipops

- 1.3. Mints

- 1.4. Pastilles, Gummies, and Jellies

- 1.5. Toffees and Nougats

- 1.6. Others

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Europe Sugar Confectionery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sugar Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Hard Candy

- 5.1.2. Lollipops

- 5.1.3. Mints

- 5.1.4. Pastilles, Gummies, and Jellies

- 5.1.5. Toffees and Nougats

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Germany Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vidal Golosina

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Perfetti Van Melle BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Swizzels Matlow Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Soldan Holding + Candy Specialties GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lavdas SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 August Storck KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Katjes International GmbH & Co KG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ferrero International SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cloetta AB

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ricola AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Mars Incorporated

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 HARIBO Holding GmbH & Co KG

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Mondelēz International Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 The Hershey Company

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Vidal Golosina

List of Figures

- Figure 1: Europe Sugar Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Sugar Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 4: Europe Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 5: Europe Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 26: Europe Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 27: Europe Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sugar Confectionery Market?

The projected CAGR is approximately 4.69%.

2. Which companies are prominent players in the Europe Sugar Confectionery Market?

Key companies in the market include Vidal Golosina, Nestlé SA, Perfetti Van Melle BV, Swizzels Matlow Ltd, Soldan Holding + Candy Specialties GmbH, Lavdas SA, August Storck KG, Katjes International GmbH & Co KG, Ferrero International SA, Cloetta AB, Ricola AG, Mars Incorporated, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company.

3. What are the main segments of the Europe Sugar Confectionery Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13810 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

May 2023: British sweet manufacturer Swizzels expanded its popular range of Minions products with the addition of a Sherbet Dip. This Minions Sherbet Dip comprises three new flavors: Fizzy Orange, Sour Apple and Tangy Berry, and a classic Swizzelstick for dipping.April 2023: Swizzels Sweets has partnered with Applied Nutrition to launch a range of sports nutrition products in several of Swizzels’ well-known flavors. The sports brand Applied Nutrition announced Drumstick flavor lollies of both its bestselling hydration drink, BodyFuel, and a 60 ml shot variant of its popular pre-workout, A.B.E.March 2023: Hershey's introduced new Hershey's Kisses’ Milklicious candies, featuring a creamy chocolate milk filling packed into the delicious center of a rich, milk chocolate Hershey's Kisses candy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sugar Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sugar Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sugar Confectionery Market?

To stay informed about further developments, trends, and reports in the Europe Sugar Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence