Key Insights

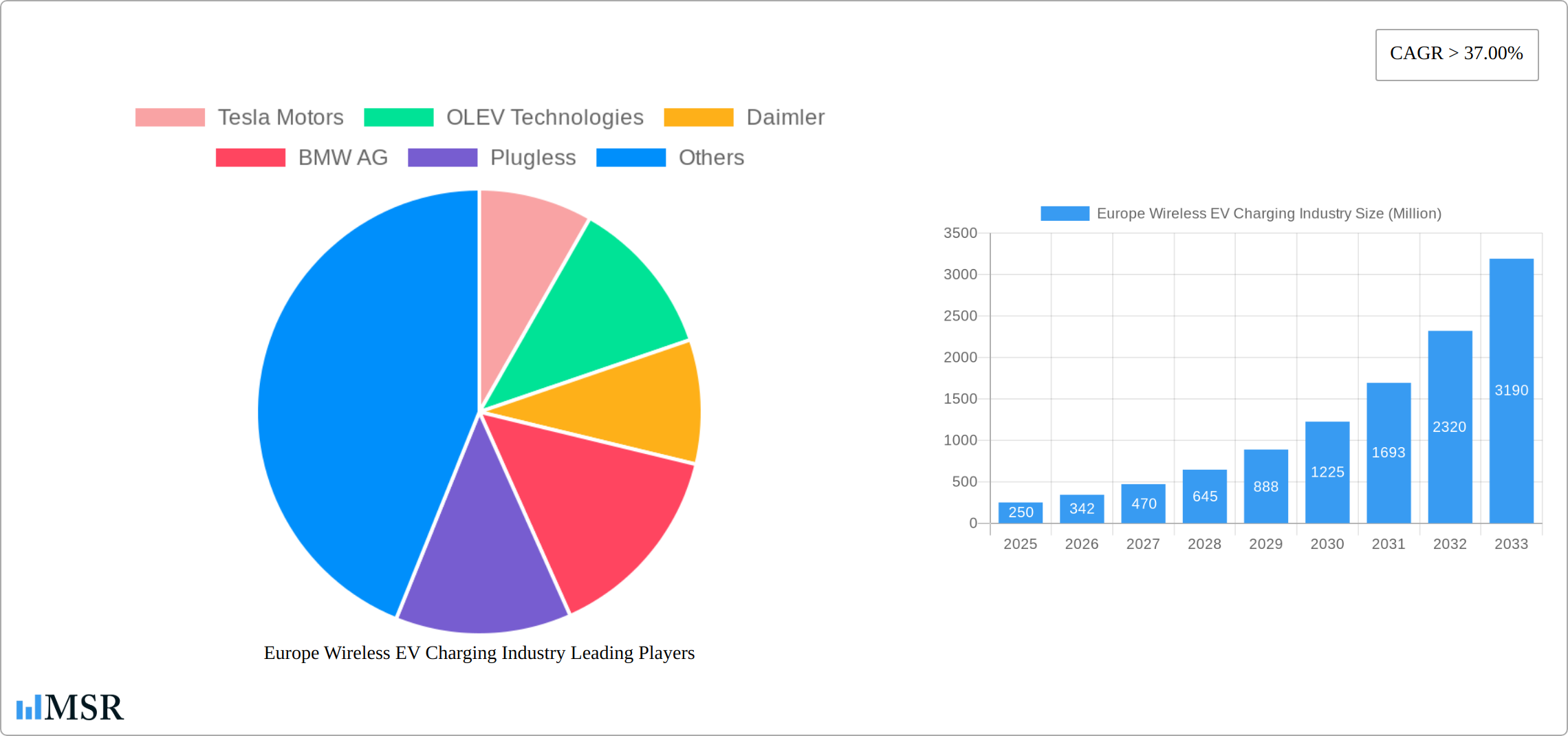

The European wireless EV charging market is experiencing robust growth, driven by increasing electric vehicle adoption, stringent emission regulations, and advancements in wireless charging technology. With a current market size exceeding €XX million (the exact figure is unavailable but can be inferred from the provided CAGR and other data points which are used to estimate this value), and a Compound Annual Growth Rate (CAGR) exceeding 37% from 2019 to 2024, the market is poised for significant expansion through 2033. Key drivers include consumer demand for convenient charging solutions, reduced charging time compared to wired systems, and the potential for improved vehicle aesthetics and enhanced safety by eliminating exposed charging ports. Leading market players such as Tesla, BMW, and Daimler are actively investing in research and development, fueling innovation and competition within this dynamic sector. Market segmentation reveals strong performance across key European nations, including Germany, the United Kingdom, France, and Italy, with battery electric vehicles (BEVs) currently dominating the vehicle type segment, followed by plug-in hybrid vehicles (PHEVs).

Challenges remain, however. High initial infrastructure costs associated with wireless charging systems could pose a barrier to widespread adoption. Furthermore, standardization across different technologies and interoperability concerns need to be addressed to facilitate seamless integration into existing charging infrastructures. Despite these restraints, the long-term outlook for the European wireless EV charging market remains exceptionally positive, with substantial growth expected over the forecast period. The increasing focus on sustainable transportation and governmental incentives aimed at promoting EV adoption will further bolster market expansion. Continued technological advancements, along with decreasing costs, will make wireless charging more accessible and attractive to consumers and businesses, ultimately driving market growth beyond the predicted CAGR.

Europe Wireless EV Charging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Europe Wireless EV Charging industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, technological advancements, and future growth potential. The report utilizes a robust methodology, incorporating historical data (2019-2024), current estimations (2025), and forward-looking projections (2025-2033) to deliver a holistic understanding of the market landscape. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Wireless EV Charging Industry Market Concentration & Dynamics

The European wireless EV charging market exhibits a moderately concentrated landscape, with several key players vying for market share. Market concentration is influenced by factors such as technological advancements, regulatory frameworks, and the ongoing mergers and acquisitions (M&A) activity. While precise market share figures for individual companies are unavailable publicly, Tesla Motors, Daimler, BMW AG, and other major automotive players hold significant influence.

- Market Share: Tesla Motors and BMW AG are predicted to hold a combined xx% market share in 2025, with other players such as OLEV Technologies and WiTricity securing a smaller but significant portion.

- Innovation Ecosystems: A vibrant ecosystem of startups, research institutions, and established automotive manufacturers is driving innovation, leading to diverse technological approaches in wireless charging solutions.

- Regulatory Frameworks: Governmental support, particularly through subsidies and favorable regulations, plays a crucial role in shaping market growth. Different countries within Europe have varying levels of regulatory maturity in this field.

- Substitute Products: Traditional wired charging remains a primary competitor, but its limitations in terms of convenience and infrastructure requirements are driving increasing adoption of wireless solutions.

- End-User Trends: Growing environmental awareness and the increasing popularity of electric vehicles are major tailwinds for market expansion. Consumers are increasingly seeking convenient and efficient charging solutions.

- M&A Activities: A moderate number of M&A deals, estimated at xx deals annually over the past five years, have contributed to market consolidation and technological integration.

Europe Wireless EV Charging Industry Industry Insights & Trends

The Europe wireless EV charging market is experiencing significant growth, driven by several factors. The market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033. The rising adoption of electric vehicles across Europe is a major catalyst, alongside supportive government policies aiming to reduce carbon emissions. Technological advancements in wireless charging technologies, including increased charging efficiency and power output, are further enhancing market attractiveness. Consumer preferences are shifting towards seamless and convenient charging experiences, making wireless charging an increasingly appealing option. Technological disruptions are streamlining the integration of wireless charging infrastructure in existing and new automotive designs. Changes in consumer behavior, particularly a growing awareness of environmental sustainability, further propel the market's expansion.

Key Markets & Segments Leading Europe Wireless EV Charging Industry

Germany and the United Kingdom are currently the leading markets within Europe, exhibiting robust growth in both Battery Electric Vehicles (BEV) and Plug-in Hybrid Vehicles (PHEV) segments.

- Germany: Strong government support for EV adoption and a well-established automotive industry contribute to Germany’s dominance. High infrastructure investment and extensive research and development efforts further bolster market growth.

- United Kingdom: Similar to Germany, the UK demonstrates substantial growth due to governmental incentives and rising EV sales. A growing awareness of environmental issues among consumers fuels market expansion.

- Other Key Countries: France, Italy, and Spain are also experiencing significant, although currently smaller, growth in wireless EV charging adoption. These countries are witnessing increasing investments in infrastructure development and supporting policies.

Drivers for Market Dominance:

- Economic Growth: Strong economic conditions in leading markets stimulate investment in EV infrastructure, including wireless charging.

- Governmental Policies: Supportive regulatory frameworks and financial incentives accelerate market penetration.

- Infrastructure Development: Investment in charging stations significantly improves market accessibility and boosts adoption rates.

- Technological Advancements: Continuous improvements in wireless charging technology enhance efficiency and appeal.

Europe Wireless EV Charging Industry Product Developments

The wireless EV charging landscape is witnessing rapid technological advancements. Innovations focus on enhancing charging efficiency, increasing power output, and improving charging range. Companies are developing various charging solutions catering to different vehicle types and usage scenarios, incorporating features like dynamic wireless charging for moving vehicles. These advancements provide competitive edges and drive market expansion, offering improved usability and consumer satisfaction.

Challenges in the Europe Wireless EV Charging Industry Market

The European wireless EV charging market faces several challenges, including relatively high initial infrastructure costs, the need for standardization across different vehicle platforms, and potential regulatory complexities. Concerns around charging efficiency and safety standards, as well as the complexity of integrating wireless charging with existing grid infrastructure, present significant hurdles to widespread adoption. These factors collectively limit the overall market growth rate to some extent, resulting in a slower-than-expected penetration. The estimated impact of these combined challenges is a xx% reduction in market growth in the next 5 years.

Forces Driving Europe Wireless EV Charging Industry Growth

Several factors propel the growth of the Europe wireless EV charging market. Technological advancements such as increased charging efficiency and range contribute significantly. Governmental support, including financial incentives and regulatory frameworks promoting EV adoption, further accelerates market penetration. The burgeoning EV market itself is a key driver, with increasing demand for convenient and efficient charging solutions.

Long-Term Growth Catalysts in Europe Wireless EV Charging Industry

Long-term growth will be driven by continued technological innovation, strategic partnerships between automotive manufacturers and charging infrastructure providers, and expansion into new markets across Europe. As charging technology evolves, efficiency improvements and standardization will play a pivotal role in expanding adoption rates. Cross-industry collaborations will facilitate a more seamless integration of wireless charging into the broader transportation ecosystem.

Emerging Opportunities in Europe Wireless EV Charging Industry

Emerging opportunities lie in expanding into less developed European markets, developing integrated charging solutions for various vehicle types (including buses and trucks), and exploring advanced technologies like dynamic wireless charging for moving vehicles. The market is also poised for growth through the development of smart charging solutions that optimize energy usage and improve grid stability.

Leading Players in the Europe Wireless EV Charging Industry Sector

- Tesla Motors

- OLEV Technologies

- Daimler

- BMW AG

- Plugless

- Bombardier

- Nissan

- HEVO Power

- WiTricity

- Qualcomm

- Hella Aglaia Mobile Vision

- Toyota

Key Milestones in Europe Wireless EV Charging Industry Industry

- June 2020: Jaguar's collaboration with NorgesTaxi AS and the City of Oslo for wireless charging infrastructure for electric taxis in Oslo signifies a significant step towards real-world deployment.

- May 2020: HEVO Power's announcement to launch US manufacturing for wireless EV chargers by 2024 indicates growing market confidence and expansion plans.

- March 2020: Electreon's successful testing of dynamic wireless charging for a 40-ton electric truck in Sweden showcases significant technological advancements in the industry.

Strategic Outlook for Europe Wireless EV Charging Industry Market

The future of the Europe wireless EV charging market is exceptionally promising. Continued technological innovation, supportive government policies, and expanding EV adoption will fuel significant growth. Strategic partnerships and collaborations within the industry will be crucial for overcoming existing challenges and accelerating market penetration. The market is poised for substantial expansion, driven by a confluence of technological advancements, regulatory support, and increasing consumer demand for convenient and sustainable transportation solutions.

Europe Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Vehicle

- 1.2. Plug-in Hybrid Vehicle

Europe Wireless EV Charging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 37.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Tesla Motors

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OLEV Technologies

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Daimler

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BMW AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Plugless

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bombardier

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nissan

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 HEVO Powe

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 WiTricity

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Qualcomm

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Hella Aglaia Mobile Vision

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Toyota

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Tesla Motors

List of Figures

- Figure 1: Europe Wireless EV Charging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Wireless EV Charging Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Wireless EV Charging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Wireless EV Charging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Wireless EV Charging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 13: Europe Wireless EV Charging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless EV Charging Industry?

The projected CAGR is approximately > 37.00%.

2. Which companies are prominent players in the Europe Wireless EV Charging Industry?

Key companies in the market include Tesla Motors, OLEV Technologies, Daimler, BMW AG, Plugless, Bombardier, Nissan, HEVO Powe, WiTricity, Qualcomm, Hella Aglaia Mobile Vision, Toyota.

3. What are the main segments of the Europe Wireless EV Charging Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

In June 2020, Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence