Key Insights

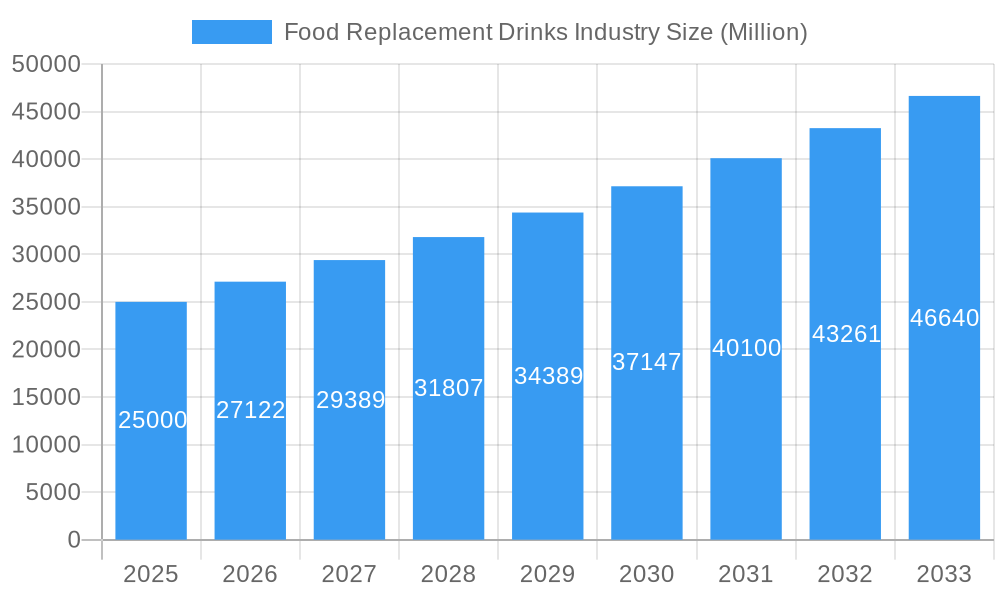

The global Food Replacement Drinks market is projected for significant expansion, anticipated to reach approximately $25.51 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.38%. This growth is primarily driven by shifting consumer lifestyles and increased health and wellness consciousness. Key factors include the rising demand for convenient, nutritionally complete meal solutions, especially among busy professionals, fitness enthusiasts, and those pursuing weight management. The growing prevalence of health concerns and a preference for plant-based and functional beverages further fuel market expansion. The market features a dynamic product mix, with Ready-to-Drink (RTD) products gaining traction due to their convenience, while powdered options offer customization and cost-effectiveness.

Food Replacement Drinks Industry Market Size (In Billion)

The competitive environment includes established food and beverage leaders, specialized nutrition providers, and emerging startups. Distribution channels are evolving, with online retail gaining prominence alongside traditional channels such as convenience stores, supermarkets, and specialty stores. Potential market restraints include concerns about ingredient transparency and naturalness, alongside affordability for lower-income segments. However, ongoing innovation in product formulation, taste, and sustainable packaging is expected to overcome these challenges and drive industry growth.

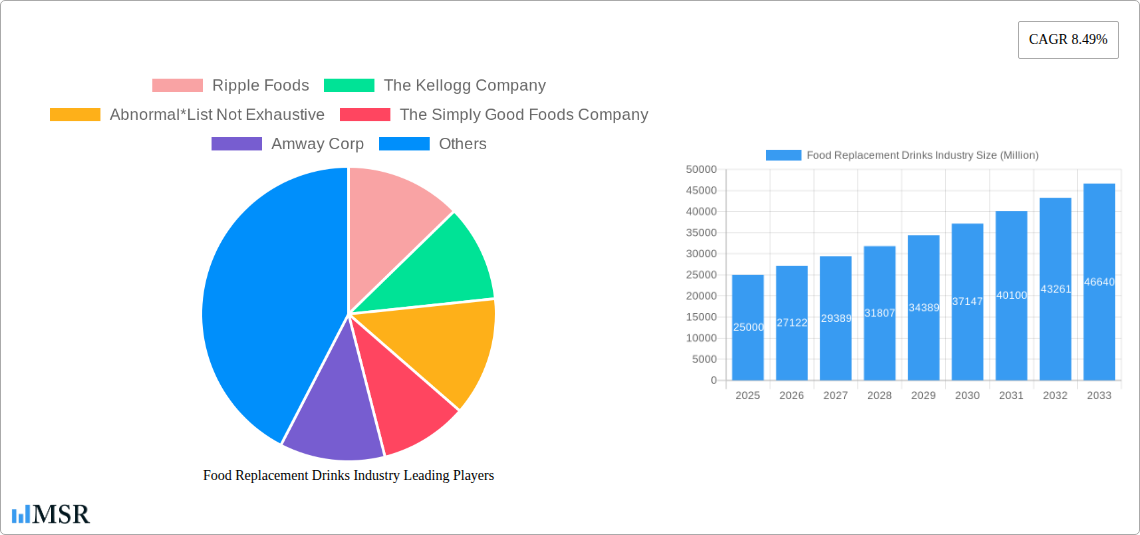

Food Replacement Drinks Industry Company Market Share

Food Replacement Drinks Industry: Unveiling Market Dynamics, Growth Drivers, and Future Opportunities (2019-2033)

Unlock critical insights into the booming Food Replacement Drinks Industry with this comprehensive report. Designed for industry leaders, investors, and strategists, this analysis delves deep into market concentration, innovation, regulatory landscapes, evolving consumer needs, and strategic initiatives shaping the global food replacement drinks market. Covering a study period of 2019-2033, with a base and estimated year of 2025, this report provides actionable intelligence on market size, CAGR, leading segments, product developments, challenges, and emerging opportunities. Leverage high-ranking keywords like "meal replacement drinks," "nutritional beverages," "dietary supplements," "healthy eating trends," and "functional foods" to enhance your strategic planning and market positioning.

Food Replacement Drinks Industry Market Concentration & Dynamics

The Food Replacement Drinks Industry is characterized by a moderate level of market concentration, with a mix of large multinational corporations and agile emerging players. Key companies like Nestlé S.A., The Kraft Heinz Company, and Abbott Laboratories hold significant market share, leveraging their extensive distribution networks and brand recognition. However, specialized brands such as Ripple Foods and The Simply Good Foods Company are carving out substantial niches through innovative product formulations and targeted marketing. The innovation ecosystem is vibrant, driven by increasing consumer demand for convenient, healthy, and personalized nutrition solutions. Regulatory frameworks are evolving, with a growing emphasis on clear nutritional labeling and health claims, influencing product development and marketing strategies. Substitute products, including traditional snacks and home-prepared meals, remain a constant consideration, driving the industry to emphasize convenience, nutritional completeness, and superior taste profiles. End-user trends show a strong preference for plant-based options, functional ingredients, and products catering to specific dietary needs (e.g., low-sugar, high-protein). Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to acquire innovative startups and expand their product portfolios. An estimated 500 million USD in M&A deals are expected within the historical period (2019-2024), signaling a strategic consolidation phase.

Food Replacement Drinks Industry Industry Insights & Trends

The global Food Replacement Drinks Industry is experiencing robust growth, projected to reach an estimated market size of 20,000 million USD by the Base Year of 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% during the Forecast Period of 2025–2033. This growth is propelled by a confluence of factors, including the escalating global health consciousness, a growing demand for convenient dietary solutions amidst increasingly busy lifestyles, and a broader acceptance of meal replacement beverages as a legitimate nutritional alternative. Technological disruptions are playing a pivotal role, with advancements in food science leading to the development of more palatable, nutritionally superior, and specialized formulations. The incorporation of functional ingredients such as probiotics, prebiotics, adaptogens, and specific vitamins and minerals caters to a growing consumer desire for targeted health benefits beyond basic nutrition. Evolving consumer behaviors are marked by a significant shift towards personalized nutrition. Consumers are actively seeking products that align with their specific dietary preferences, health goals, and ethical considerations. This includes a surge in demand for plant-based protein sources, vegan formulations, and options catering to specific allergies or intolerances. The convenience factor remains paramount; ready-to-drink formats are particularly appealing for on-the-go consumption, while powdered products offer cost-effectiveness and customizable serving sizes. The rise of online retail channels has further democratized access to a wider array of brands and product types, enabling consumers to easily research, compare, and purchase these nutritional solutions.

Key Markets & Segments Leading Food Replacement Drinks Industry

The Ready-to-Drink Products segment is a dominant force within the Food Replacement Drinks Industry, driven by unparalleled convenience and immediate consumption appeal. This segment is projected to command a significant market share, estimated at 65% of the total market value in 2025. The ease of use, coupled with sophisticated packaging that ensures shelf stability and portability, makes these beverages a top choice for consumers seeking quick and nutritionally sound meal solutions.

- Drivers for Ready-to-Drink Dominance:

- Convenience: Ideal for busy professionals, students, and individuals with on-the-go lifestyles.

- Taste and Palatability: Continuous innovation in flavor profiles and textures enhances consumer appeal.

- Nutritional Completeness: Formulated to provide a balanced mix of macronutrients and micronutrients, mimicking a complete meal.

- Marketing and Accessibility: Wide availability across various retail channels, from convenience stores to online platforms.

The Online Retail Stores distribution channel is emerging as a critical growth engine, expected to capture 30% of the total distribution market share by 2025. This channel’s ascendancy is fueled by its ability to offer a vast selection of brands and products, competitive pricing, and direct-to-consumer convenience. Consumers increasingly prefer researching and purchasing food replacement drinks online due to the accessibility of product information, customer reviews, and the ability to subscribe for regular deliveries.

- Drivers for Online Retail Growth:

- Wider Product Selection: Access to a broader range of niche and specialty brands.

- Convenience and Home Delivery: Eliminates the need for physical store visits.

- Personalization and Subscription Models: Facilitates tailored purchasing experiences and recurring revenue streams.

- Competitive Pricing and Promotions: Online platforms often offer better deals and discounts.

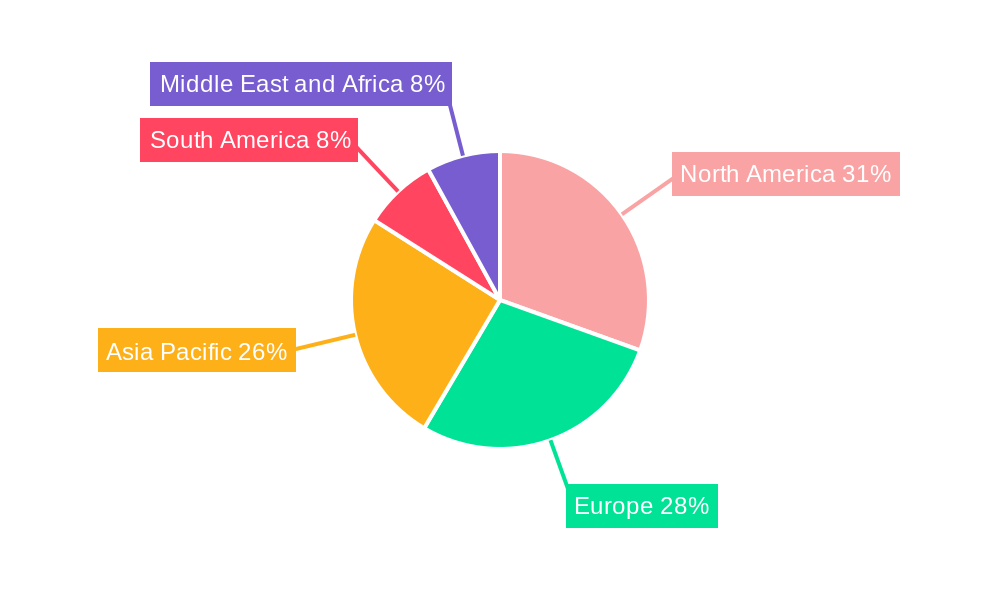

Geographically, North America is anticipated to lead the market, accounting for an estimated 35% of the global market revenue in 2025. This dominance is attributed to high consumer awareness regarding health and wellness, a strong purchasing power, and the early adoption of functional food and beverage trends. The presence of major industry players and a well-established retail infrastructure further bolster its leading position.

- Drivers for North American Dominance:

- High Disposable Income: Enables consumers to invest in premium health products.

- Prevalence of Health & Wellness Trends: Strong consumer focus on nutrition, fitness, and preventative healthcare.

- Established Retail Infrastructure: Extensive network of hypermarkets, supermarkets, and specialty stores.

- Innovation Hub: Proximity to research and development centers fostering new product introductions.

Food Replacement Drinks Industry Product Developments

Product innovation in the Food Replacement Drinks Industry is intensely focused on enhancing nutritional profiles, improving taste, and expanding into specialized dietary needs. Companies are leveraging advancements in ingredient technology to create plant-based formulations that rival traditional dairy-based options in terms of protein content and texture, exemplified by Goodmylk's introduction of Plant-Based Paneer and Plant-Based Nutrition Drink. The integration of functional ingredients like adaptogens for stress management and prebiotics for gut health is becoming increasingly common, offering consumers added value beyond basic caloric replacement. This continuous stream of innovation, driven by a desire for competitive advantage and alignment with evolving consumer preferences for healthier, more sustainable, and personalized nutrition, is crucial for market expansion and brand differentiation.

Challenges in the Food Replacement Drinks Industry Market

The Food Replacement Drinks Industry faces several significant challenges that could impede its growth trajectory. Foremost among these are stringent regulatory hurdles and evolving labeling requirements in different regions, which can increase compliance costs and slow down product launches. Supply chain disruptions, particularly for specialized ingredients and sustainable packaging materials, can impact production efficiency and cost-effectiveness. Furthermore, intense competitive pressure from established food and beverage giants, emerging startups, and the ubiquitous availability of traditional food options necessitates continuous innovation and aggressive marketing. The perception of meal replacements as solely for weight loss, rather than a broader nutritional tool, also poses a marketing challenge, requiring concerted efforts to educate consumers about their diverse applications.

Forces Driving Food Replacement Drinks Industry Growth

Several key forces are propelling the growth of the Food Replacement Drinks Industry. Technological advancements in food science are enabling the creation of more palatable, nutrient-dense, and specialized formulations that cater to diverse dietary needs and preferences. The growing global health consciousness, coupled with an increasing demand for convenient and time-saving meal solutions, is a significant driver, as busy lifestyles leave less time for traditional meal preparation. Furthermore, the expanding acceptance of functional foods and beverages that offer targeted health benefits, such as improved gut health or enhanced cognitive function, is boosting demand. Economic factors, including rising disposable incomes in emerging markets, are also contributing to increased consumer spending on health-oriented products.

Challenges in the Food Replacement Drinks Industry Market

Long-term growth catalysts for the Food Replacement Drinks Industry lie in fostering innovation and strategic market expansions. Continued investment in research and development to unlock novel ingredients, enhance bioavailability of nutrients, and create more appealing sensory experiences will be crucial. Partnerships between established players and agile startups, like Nestlé's investment in YFood, can accelerate the adoption of new technologies and market penetration strategies. Expanding into underserved geographic regions and tailoring product offerings to local tastes and dietary habits will unlock significant potential. The development of sustainable packaging solutions and transparent sourcing practices will also appeal to an increasingly eco-conscious consumer base, solidifying brand loyalty and long-term market relevance.

Emerging Opportunities in Food Replacement Drinks Industry

Emerging opportunities in the Food Replacement Drinks Industry are abundant, driven by evolving consumer demands and technological advancements. The personalized nutrition trend presents a significant avenue, with opportunities in developing AI-powered recommendation engines and customized formulations based on individual health data and genetic profiles. The burgeoning functional foods market offers scope for incorporating ingredients that target specific health concerns such as mental well-being, immune support, and athletic performance enhancement. Furthermore, the increasing global adoption of vegan and flexitarian diets creates a strong demand for innovative, plant-based meal replacement solutions, expanding the market beyond traditional protein sources. Exploring new distribution channels, such as direct-to-consumer subscription boxes and workplace wellness programs, also offers substantial growth potential.

Leading Players in the Food Replacement Drinks Industry Sector

- Ripple Foods

- The Kellogg Company

- Abnormal

- The Simply Good Foods Company

- Amway Corp

- Abbott Laboratories

- Glanbia PLC

- The Kraft Heinz Company

- Herbalife Nutrition

- Bob's Red Mill Natural Foods

- Nestlé S A

Key Milestones in Food Replacement Drinks Industry Industry

- March 2023: Nestlé invested an undisclosed amount of money in meal replacement start-up YFood, a Munich-based company offering meal replacements including snack bars, drinks, and powders, signaling strategic interest in innovative segments.

- September 2021: Abnormal, based in Cheshire, committed GBP 1 million to the introduction of a new personalized, nutritionally balanced meal service, highlighting the trend towards bespoke dietary solutions.

- April 2021: Goodmylk, a vegan dairy alternative producer, released two new products: Plant-Based Paneer and Plant-Based Nutrition Drink, underscoring the growing demand and innovation in plant-based meal replacement options.

Strategic Outlook for Food Replacement Drinks Industry Market

The strategic outlook for the Food Replacement Drinks Industry remains exceptionally positive, with growth accelerators rooted in continuous innovation, strategic partnerships, and market expansion. The increasing consumer demand for convenient, healthy, and personalized nutrition solutions provides a fertile ground for new product development and market penetration. Companies that can effectively leverage technological advancements to create superior formulations, cater to specific dietary needs, and offer engaging consumer experiences are poised for significant success. The projected market size and CAGR indicate substantial opportunities for both established players and agile new entrants to capture market share. A focus on sustainability, transparent ingredient sourcing, and robust digital marketing strategies will be crucial for long-term competitive advantage and brand loyalty in this dynamic and evolving industry.

Food Replacement Drinks Industry Segmentation

-

1. Product Type

- 1.1. Ready-to-Drink Products

- 1.2. Powdered Products

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Hypermarkets/Supermarkets

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Food Replacement Drinks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Food Replacement Drinks Industry Regional Market Share

Geographic Coverage of Food Replacement Drinks Industry

Food Replacement Drinks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenient and Small-Portion Diet Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ready-to-Drink Products

- 5.1.2. Powdered Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Hypermarkets/Supermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ready-to-Drink Products

- 6.1.2. Powdered Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Stores

- 6.2.2. Hypermarkets/Supermarkets

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ready-to-Drink Products

- 7.1.2. Powdered Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Stores

- 7.2.2. Hypermarkets/Supermarkets

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ready-to-Drink Products

- 8.1.2. Powdered Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Stores

- 8.2.2. Hypermarkets/Supermarkets

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ready-to-Drink Products

- 9.1.2. Powdered Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Stores

- 9.2.2. Hypermarkets/Supermarkets

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Food Replacement Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ready-to-Drink Products

- 10.1.2. Powdered Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Stores

- 10.2.2. Hypermarkets/Supermarkets

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ripple Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Kellogg Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abnormal*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Simply Good Foods Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amway Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Glanbia PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Kraft Heinz Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Herbalife Nutrition

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bob's Red Mill Natural Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nestlé S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Ripple Foods

List of Figures

- Figure 1: Global Food Replacement Drinks Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Food Replacement Drinks Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Food Replacement Drinks Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Food Replacement Drinks Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Food Replacement Drinks Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Food Replacement Drinks Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Food Replacement Drinks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Food Replacement Drinks Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Food Replacement Drinks Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Food Replacement Drinks Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Food Replacement Drinks Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Food Replacement Drinks Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Food Replacement Drinks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Food Replacement Drinks Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Food Replacement Drinks Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Food Replacement Drinks Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Food Replacement Drinks Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Food Replacement Drinks Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Food Replacement Drinks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Food Replacement Drinks Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Food Replacement Drinks Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Food Replacement Drinks Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Food Replacement Drinks Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Food Replacement Drinks Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Food Replacement Drinks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Food Replacement Drinks Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Food Replacement Drinks Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Food Replacement Drinks Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Food Replacement Drinks Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Food Replacement Drinks Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Food Replacement Drinks Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Food Replacement Drinks Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Food Replacement Drinks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Food Replacement Drinks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Food Replacement Drinks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Food Replacement Drinks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Food Replacement Drinks Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Food Replacement Drinks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Food Replacement Drinks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Food Replacement Drinks Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Replacement Drinks Industry?

The projected CAGR is approximately 8.38%.

2. Which companies are prominent players in the Food Replacement Drinks Industry?

Key companies in the market include Ripple Foods, The Kellogg Company, Abnormal*List Not Exhaustive, The Simply Good Foods Company, Amway Corp, Abbott Laboratories, Glanbia PLC, The Kraft Heinz Company, Herbalife Nutrition, Bob's Red Mill Natural Foods, Nestlé S A.

3. What are the main segments of the Food Replacement Drinks Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Rising Demand for Convenient and Small-Portion Diet Food.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

March 2023: Nestle invested an undisclosed amount of money in meal replacement start-up YFood. The Munich-based start-up offers meal replacements including meal-replacement snack bars, drinks, and powders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Replacement Drinks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Replacement Drinks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Replacement Drinks Industry?

To stay informed about further developments, trends, and reports in the Food Replacement Drinks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence