Key Insights

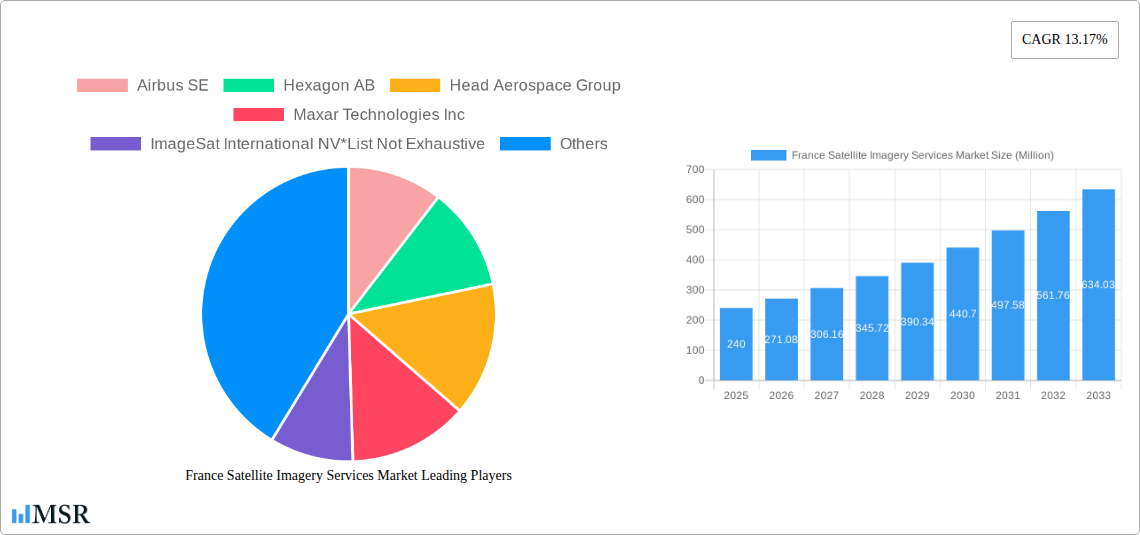

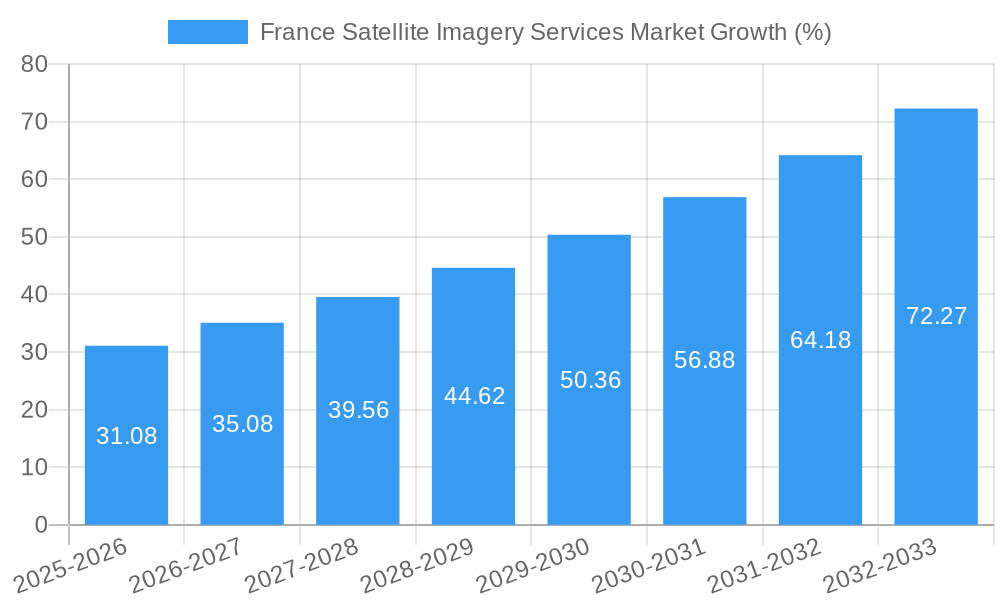

The France satellite imagery services market, valued at €240 million in 2025, is projected to experience robust growth, driven by increasing government investments in national security and infrastructure development, coupled with rising adoption across various sectors like construction, agriculture, and transportation. The market's Compound Annual Growth Rate (CAGR) of 13.17% from 2025 to 2033 indicates a significant expansion, reaching an estimated €700 million by 2033. Key application segments driving this growth include geospatial data acquisition and mapping for urban planning and infrastructure projects, natural resource management for optimized land use, and surveillance and security initiatives bolstering national defense. The substantial presence of major players like Airbus SE, Hexagon AB, and Maxar Technologies, alongside a growing ecosystem of smaller specialized firms, ensures a competitive landscape fostering innovation and service diversification. The French government's commitment to technological advancement and digitalization further accelerates market expansion, particularly in sectors reliant on precise and timely geospatial intelligence.

This growth is expected to be fueled by several factors. Technological advancements leading to higher resolution imagery and improved data processing capabilities will continue to enhance the value proposition of satellite imagery services. Furthermore, the increasing adoption of cloud-based solutions and big data analytics for efficient data processing and analysis will streamline workflows and improve accessibility for various end-users. While potential restraints such as regulatory complexities and data privacy concerns exist, the overall positive outlook for the French economy and the strategic importance of satellite imagery across key sectors will ensure sustained market expansion throughout the forecast period. The dominance of government and military end-users in the market is likely to remain, though increased private sector adoption, particularly in the construction and agriculture sectors, promises diversification and growth.

France Satellite Imagery Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the France Satellite Imagery Services Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is segmented by application (Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, Intelligence) and end-user (Government, Construction, Transportation and Logistics, Military and Defense, Forestry and Agriculture, Others). The report also profiles key players like Airbus SE, Hexagon AB, and others, analyzing market dynamics, growth drivers, and emerging opportunities. The estimated market size in 2025 is xx Million, with a projected CAGR of xx% during the forecast period.

France Satellite Imagery Services Market Market Concentration & Dynamics

The France satellite imagery services market exhibits a moderately concentrated structure, with a few major players holding significant market share. Airbus SE, Hexagon AB, and Maxar Technologies Inc. are among the leading companies, contributing significantly to the overall market revenue. However, the market also features several smaller, specialized companies, creating a dynamic competitive landscape.

Market Concentration Metrics (2024):

- Top 3 players' combined market share: xx%

- Top 5 players' combined market share: xx%

Innovation Ecosystems & Regulatory Frameworks:

The French government actively supports the development of the space industry through initiatives like the France Relance plan, fostering innovation and attracting investment. However, stringent data privacy regulations and licensing requirements can pose challenges for market participants. The presence of a robust research and development ecosystem in France contributes to technological advancements in satellite imagery.

Substitute Products & End-User Trends:

While satellite imagery offers unique advantages, alternative technologies like aerial photography and LiDAR are also available. The increasing demand for high-resolution, real-time data across various sectors is driving the growth of the market. Government agencies remain significant end-users, followed by the construction, transportation, and defense sectors.

M&A Activities:

The market has witnessed several mergers and acquisitions in recent years, reflecting consolidation trends and strategic expansion efforts. The July 2022 discussions between Eutelsat and OneWeb illustrate the ongoing consolidation within the broader satellite industry. The estimated number of M&A deals in the France satellite imagery services market between 2019 and 2024 was xx.

France Satellite Imagery Services Market Industry Insights & Trends

The France satellite imagery services market is experiencing robust growth, driven by several key factors. The increasing adoption of satellite imagery across various sectors, such as urban planning, agriculture, and environmental monitoring, fuels market expansion. Technological advancements, particularly in high-resolution imaging and data analytics, are enhancing the capabilities and applications of satellite imagery, thus creating new opportunities. Furthermore, government initiatives aimed at promoting the development of the space industry are fostering innovation and investment in the sector.

The market size reached xx Million in 2024, and it is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is further propelled by the increasing demand for geospatial data and analytics, coupled with rising government spending on defense and security applications. The evolution of cloud computing and AI-powered data analysis is significantly transforming the way satellite imagery is processed and utilized. Consumer behavior is shifting towards demanding higher-quality data with faster delivery times, requiring providers to continually improve their offerings.

Key Markets & Segments Leading France Satellite Imagery Services Market

Dominant Segments:

The Government sector holds the largest market share among end-users, driven by increasing government spending on defense and national security. Within applications, Geospatial Data Acquisition and Mapping is the leading segment due to its extensive use across various industries.

Key Growth Drivers by Segment:

- Government: Increased investment in national security, infrastructure development, and environmental monitoring.

- Construction: Demand for precise mapping and site surveying for large-scale projects.

- Transportation and Logistics: Optimization of logistics networks and infrastructure management.

- Military and Defense: Surveillance, intelligence gathering, and target identification capabilities.

- Forestry and Agriculture: Precision agriculture, resource monitoring, and forest management.

- Geospatial Data Acquisition and Mapping: The fundamental requirement for diverse sectors needing spatial information.

- Surveillance and Security: Rising security concerns and demand for real-time monitoring.

- Natural Resource Management: Managing water resources, monitoring deforestation, and supporting sustainable practices.

The sustained economic growth of France, coupled with the country’s strategic focus on technological advancements, strongly supports the dominance of these segments. Further market penetration in the remaining segments is anticipated driven by the aforementioned technological improvements in the field.

France Satellite Imagery Services Market Product Developments

Recent advancements in sensor technology, image processing algorithms, and data analytics have significantly improved the resolution, accuracy, and accessibility of satellite imagery. The development of miniaturized satellites and constellations allows for more frequent and cost-effective data acquisition. Integration of AI and machine learning is enabling automated data analysis and extraction of valuable insights from vast datasets. This rapid innovation leads to a competitive advantage for companies that quickly adapt their product offerings to meet the ever-evolving needs of their customers.

Challenges in the France Satellite Imagery Services Market Market

The France satellite imagery services market faces several challenges, including regulatory hurdles regarding data privacy and access, supply chain disruptions affecting sensor and satellite component availability, and intense competition from both domestic and international players. These challenges can lead to increased operational costs and potentially limit market growth if not properly addressed. For instance, increased regulatory scrutiny may lead to delays in project implementations and increase compliance costs by xx Million annually.

Forces Driving France Satellite Imagery Services Market Growth

Several factors drive the growth of the France satellite imagery services market. These include ongoing technological advancements resulting in higher-resolution imagery and improved data processing capabilities; increasing government investment in space technology and related infrastructure; and rising demand from various sectors like agriculture, construction, and defense for geospatial data and analytics. The increasing adoption of cloud-based platforms for data storage and processing is also contributing to market expansion.

Long-Term Growth Catalysts in France Satellite Imagery Services Market

Long-term growth is fueled by strategic partnerships between satellite imagery providers and technology companies specializing in data analytics and AI. The emergence of new applications for satellite imagery, such as precision agriculture and environmental monitoring, will propel market expansion. Furthermore, the development of smaller, more cost-effective satellites will increase the accessibility of this technology to a broader range of users.

Emerging Opportunities in France Satellite Imagery Services Market

Emerging opportunities include the growing demand for real-time data analytics, the development of new applications in fields like autonomous vehicles, and the expansion into new geographical markets within France. The increasing use of satellite imagery for disaster response and climate change monitoring presents a significant growth opportunity.

Leading Players in the France Satellite Imagery Services Market Sector

- Airbus SE

- Hexagon AB

- Head Aerospace Group

- Maxar Technologies Inc

- ImageSat International NV

- Telespazio S p A

- Galileo Group Inc

- L3 Harris Corporation

- Planet Labs PBC

- European Space Imaging (EUSI) GmbH

Key Milestones in France Satellite Imagery Services Market Industry

- April 2023: Prométhée selects Capgemini to develop the mission center for its JAPETUS constellation, supported by CNES and the EU. This signifies a significant investment in the French NewSpace sector and indicates growing demand for earth observation data.

- July 2022: Eutelsat's merger talks with OneWeb represent a major consolidation effort in the European satellite industry, potentially creating a stronger competitor in the global market.

Strategic Outlook for France Satellite Imagery Services Market Market

The France satellite imagery services market holds significant future potential, driven by technological advancements, increasing government support, and growing demand across diverse sectors. Strategic partnerships, investments in R&D, and expansion into new applications will be crucial for companies to capitalize on this growth. The market's future trajectory is positive, with continued expansion anticipated across all segments.

France Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Others

France Satellite Imagery Services Market Segmentation By Geography

- 1. France

France Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Location-based Services; Satellite data usage is increasing

- 3.3. Market Restrains

- 3.3.1. Strict government regulations; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Natural Resource Management is Expected to Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Airbus SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hexagon AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Head Aerospace Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maxar Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ImageSat International NV*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telespazio S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Galileo Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 L3 Harris Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Planet Labs PBC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 European Space Imaging (EUSI) GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Airbus SE

List of Figures

- Figure 1: France Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: France Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: France Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: France Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: France Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: France Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: France Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Satellite Imagery Services Market?

The projected CAGR is approximately 13.17%.

2. Which companies are prominent players in the France Satellite Imagery Services Market?

Key companies in the market include Airbus SE, Hexagon AB, Head Aerospace Group, Maxar Technologies Inc, ImageSat International NV*List Not Exhaustive, Telespazio S p A, Galileo Group Inc, L3 Harris Corporation, Planet Labs PBC, European Space Imaging (EUSI) GmbH.

3. What are the main segments of the France Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Location-based Services; Satellite data usage is increasing.

6. What are the notable trends driving market growth?

Natural Resource Management is Expected to Significant Share.

7. Are there any restraints impacting market growth?

Strict government regulations; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

April 2023: Prométhée, the French NewSpace operator of nanosatellite constellations for earth observation, has selected Capgemini to develop the mission center for its first European constellation, 'JAPETUS.' Supported by CNES, the French Ministry of Economy, Finance and Industrial and Digital Sovereignty as part of the France RelIance plan, and by the European Union as part of NextGenerationEU, JAPETUS aims to offer earth observation data to players in the environment and the fight against climate change space, as well as security and defense.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the France Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence