Key Insights

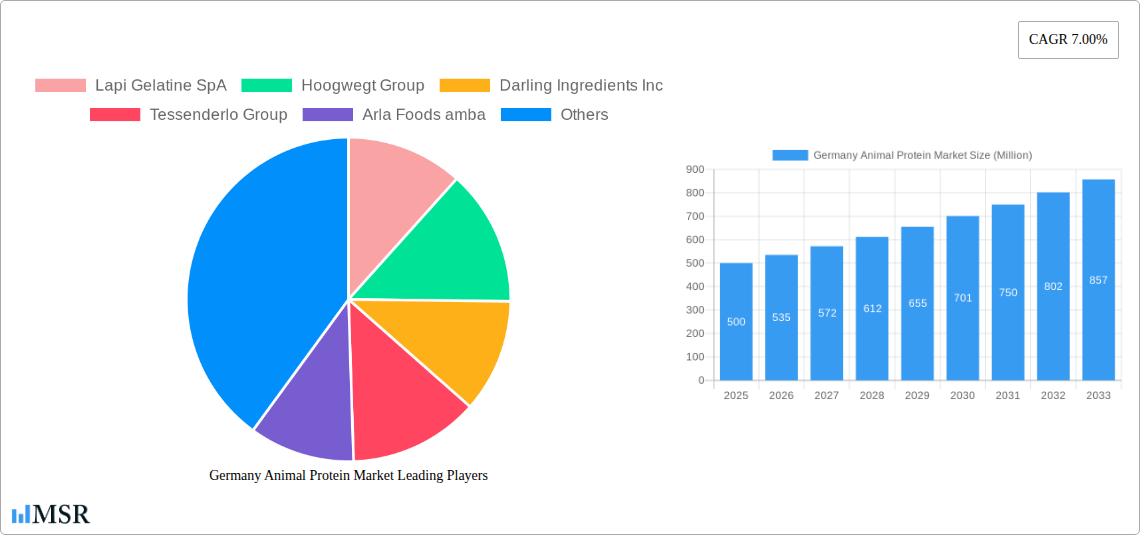

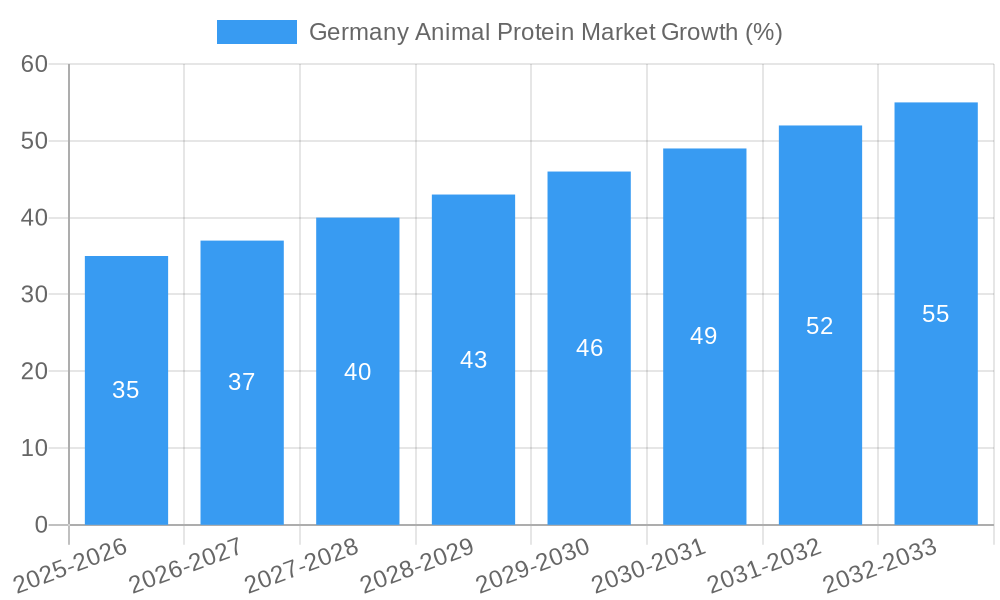

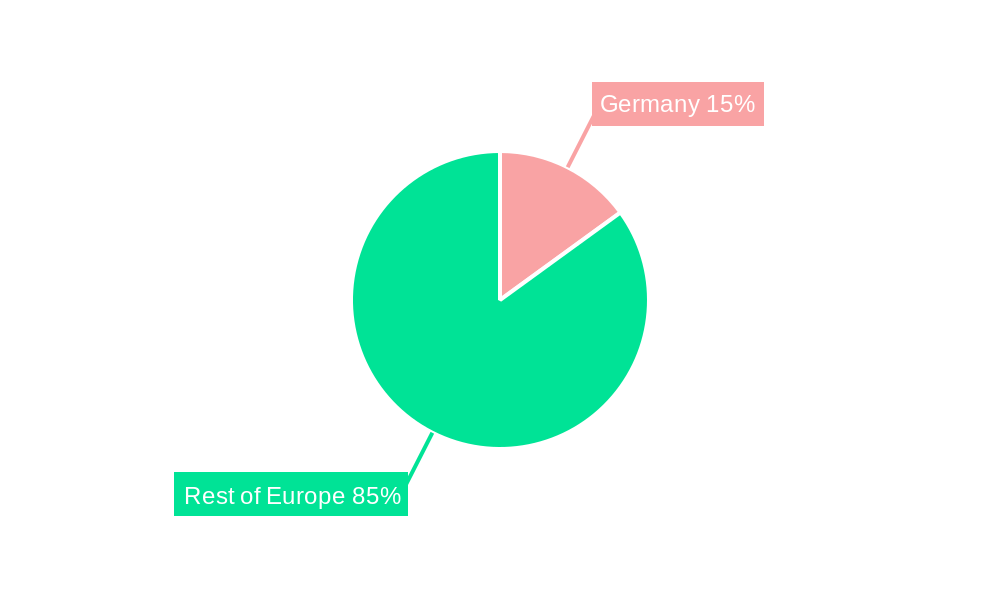

The German animal protein market, a significant segment within the broader European landscape, is experiencing robust growth, fueled by increasing demand from diverse end-user sectors. The market's Compound Annual Growth Rate (CAGR) of 7.00% from 2019 to 2024 suggests a consistently expanding market. This growth is primarily driven by several factors: the rising popularity of animal-based protein in food and beverage products, particularly among health-conscious consumers; the expanding sports nutrition sector, which heavily relies on high-quality animal protein supplements; and the consistent demand within the animal feed industry, where animal protein serves as a crucial component of livestock diets. Furthermore, innovations in protein extraction and processing technologies are enhancing product quality and efficiency, contributing to market expansion. However, challenges remain, including fluctuating raw material prices, stringent regulations concerning food safety and animal welfare, and growing consumer interest in plant-based alternatives. The market segmentation highlights the dominance of whey protein within the protein type category and the substantial contribution of the food and beverage sector to end-user demand. Germany's well-established food processing industry and strong regulatory framework position it favorably for continued growth.

Within the German context, the whey protein segment is likely the largest contributor due to its prevalent use in food and beverage applications as well as in sports nutrition products. The market is competitive, with both domestic and international players vying for market share. Companies like Kerry Group PLC, Arla Foods amba, and MEGGLE GmbH & Co KG have strong regional presence and established distribution networks, giving them a competitive edge. The success of these companies is tied to their ability to adapt to changing consumer preferences, innovate in product development, and maintain efficient supply chains. Future growth will depend on navigating sustainability concerns linked to animal agriculture, responding to increased consumer demand for transparency and traceability, and developing innovative products that meet evolving dietary trends. The projected growth in the sports nutrition and functional food sectors creates promising opportunities for market expansion within the forecast period (2025-2033).

Germany Animal Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany animal protein market, offering invaluable insights for stakeholders across the food, beverage, animal feed, and sports nutrition industries. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Expect detailed analysis of market size, CAGR, segment performance, key players, and future growth opportunities, all supported by robust data and industry expertise.

Germany Animal Protein Market Market Concentration & Dynamics

The German animal protein market exhibits a moderately concentrated structure, with a few large multinational players alongside numerous smaller, specialized businesses. Market share distribution is dynamic, influenced by factors such as M&A activity, technological advancements, and shifting consumer preferences. The regulatory landscape plays a crucial role, impacting production standards, labeling requirements, and the overall market competitiveness. Substitute products, particularly plant-based proteins, are emerging as a significant challenge, forcing established players to innovate and adapt.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025. This concentration is expected to xx% by 2033.

- M&A Activity: The period 2019-2024 witnessed xx M&A deals in the German animal protein sector. This suggests a consolidating market.

- Innovation Ecosystem: The market shows a moderate level of innovation, with focus on sustainable sourcing, improved processing technologies and value-added products.

- Regulatory Framework: EU regulations on food safety and labeling significantly influence market operations.

- Substitute Products: The rise of plant-based alternatives presents a competitive pressure on the traditional animal protein market.

- End-User Trends: Growing demand for high-protein diets in sports and health-conscious consumers fuels market growth.

Germany Animal Protein Market Industry Insights & Trends

The German animal protein market is experiencing significant growth, driven by rising consumer demand for protein-rich foods, the expanding food and beverage industry, and increasing pet ownership. Technological advancements, such as improved extraction techniques and innovative product formulations, are transforming the industry. Evolving consumer behaviors, with a greater emphasis on health, sustainability, and ethical sourcing, are shaping market trends and influencing product development. The market size reached approximately €xx Million in 2024 and is projected to reach €xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Key Markets & Segments Leading Germany Animal Protein Market

The German animal protein market is segmented by protein type (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein) and end-user (Animal Feed, Food and Beverages, Sport/Performance Nutrition). While the food and beverage sector currently dominates, the sports/performance nutrition segment shows the fastest growth rate.

- Dominant Segments: Whey protein and collagen are currently the leading protein types, driven by high demand in the food and beverage sector and sports nutrition respectively.

- Drivers for Whey Protein:

- Increasing demand from the dairy industry.

- Growing popularity of protein supplements and functional foods.

- Technological advancements in whey protein processing and purification.

- Drivers for Collagen:

- Growing awareness of collagen’s health benefits for skin, hair, and joints.

- Increased use in food and beverage products for texture and nutritional value.

- Expansion of the beauty and personal care market.

- Regional Dominance: No specific region dominates; market distribution is relatively even across the country.

Germany Animal Protein Market Product Developments

Recent years have witnessed substantial innovation in animal protein products, including the development of novel protein sources (such as insect protein), functionalized proteins with enhanced nutritional value, and improved processing technologies for enhanced yield and quality. These innovations cater to evolving consumer demands for healthier, more sustainable, and convenient protein sources, enhancing the competitiveness of the market. Specific examples include the rise of collagen hydrolysates for various applications and the introduction of insect protein as a more sustainable alternative.

Challenges in the Germany Animal Protein Market Market

Several challenges hinder the growth of the German animal protein market. These include fluctuations in raw material prices, increasing regulatory scrutiny regarding animal welfare and sustainability, and intense competition from both domestic and international players. Supply chain disruptions, particularly concerning feedstock availability, also pose a significant obstacle. The estimated impact of these challenges on market growth is a reduction of xx% in the forecast period.

Forces Driving Germany Animal Protein Market Growth

Several factors are driving growth within the German animal protein market. These include: rising consumer disposable incomes and increasing demand for protein-rich diets; strong growth of the food and beverage sector, incorporating animal proteins in new and innovative ways; ongoing technological advancements in protein extraction and processing, enhancing efficiency and product quality; and government support for sustainable and innovative agricultural practices, promoting a healthier animal protein supply chain.

Long-Term Growth Catalysts in the Germany Animal Protein Market

The long-term growth of the German animal protein market is fueled by ongoing innovation in protein processing technologies, strategic partnerships between food companies and animal protein producers, and expansion into emerging markets, such as specialized functional foods and personalized nutrition. The market shows potential for growth with a focus on sustainable and ethical sourcing.

Emerging Opportunities in Germany Animal Protein Market

Emerging opportunities include the growing demand for insect-based proteins, the development of novel functional animal proteins with health benefits (e.g., improved digestibility, enhanced bioavailability), the increasing focus on personalized nutrition based on individual protein requirements and expansion into high-growth segments like sports nutrition and specialized diets.

Leading Players in the Germany Animal Protein Market Sector

- Lapi Gelatine SpA

- Hoogwegt Group

- Darling Ingredients Inc

- Tessenderlo Group

- Arla Foods amba

- MEGGLE GmbH & Co KG

- GELITA AG

- Ynsec

- Koninklijke FrieslandCampina N V

- Lactoprot Deutschland GmbH

- Kerry Group PLC

- Fonterra Co-operative Group Limited

- Morinaga Milk Industry Co Ltd

- Agrial Enterprise

Key Milestones in Germany Animal Protein Market Industry

- December 2021: Lapi Gelatine's acquisition of Juncà Gelatines expands its market presence.

- April 2021: Ÿnsect's acquisition of Protifarm strengthens its position in the insect protein market.

- January 2021: Rousselot (Darling Ingredients) launches MSC-certified marine collagen peptide, expanding product offerings.

Strategic Outlook for Germany Animal Protein Market Market

The German animal protein market presents significant long-term growth potential, driven by evolving consumer preferences, technological innovations, and strategic partnerships within the industry. Focusing on sustainable production methods, developing innovative and functional products, and adapting to changing consumer demands will be critical for success in this dynamic and competitive market. The strategic emphasis should be on product diversification, sustainable sourcing, and investment in research and development to address the challenges and harness the opportunities available in this evolving landscape.

Germany Animal Protein Market Segmentation

-

1. Protein Type

- 1.1. Casein and Caseinates

- 1.2. Collagen

- 1.3. Egg Protein

- 1.4. Gelatin

- 1.5. Insect Protein

- 1.6. Milk Protein

- 1.7. Whey Protein

- 1.8. Other Animal Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Germany Animal Protein Market Segmentation By Geography

- 1. Germany

Germany Animal Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Casein and Caseinates

- 5.1.2. Collagen

- 5.1.3. Egg Protein

- 5.1.4. Gelatin

- 5.1.5. Insect Protein

- 5.1.6. Milk Protein

- 5.1.7. Whey Protein

- 5.1.8. Other Animal Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Germany Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Germany Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lapi Gelatine SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hoogwegt Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Darling Ingredients Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tessenderlo Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Arla Foods amba

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 MEGGLE GmbH & Co KG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 GELITA AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ynsec

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Koninklijke FrieslandCampina N V

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lactoprot Deutschland GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kerry Group PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Fonterra Co-operative Group Limited

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Morinaga Milk Industry Co Ltd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Agrial Enterprise

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Lapi Gelatine SpA

List of Figures

- Figure 1: Germany Animal Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Animal Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 3: Germany Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Germany Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Germany Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 14: Germany Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Germany Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Animal Protein Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Germany Animal Protein Market?

Key companies in the market include Lapi Gelatine SpA, Hoogwegt Group, Darling Ingredients Inc, Tessenderlo Group, Arla Foods amba, MEGGLE GmbH & Co KG, GELITA AG, Ynsec, Koninklijke FrieslandCampina N V, Lactoprot Deutschland GmbH, Kerry Group PLC, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Agrial Enterprise.

3. What are the main segments of the Germany Animal Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

December 2021: Lapi Gelatine acquired Juncà Gelatines of Spain to expand its presence in the industrial gelatine industry for food and pharmaceutical applications. Lapi Gelatine, based in Italy, finalized the acquisition in collaboration with DisproInvest, the holding firm that controls the international distributor of raw materials, and Disproquima, which operates in the life science market.April 2021: Ÿnsect acquired Protifarm, one of the leading insect protein producers for human applications. The joint offering accelerated its manufacturing capabilities with a third production site, strengthening Ÿnsect’s position in the global insect protein market.January 2021: Rousselot, a Darling Ingredients brand that produces collagen-based solutions, launched an MSC-certified marine collagen peptide, known as Peptan®, at the virtual Beauty & Skincare Formulation Conference in 2021. This ingredient is sourced from 100% wild-caught marine white fish, certified by the Marine Stewardship Council (MSC), and it is majorl

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Animal Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Animal Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Animal Protein Market?

To stay informed about further developments, trends, and reports in the Germany Animal Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence