Key Insights

The global High Temperature Sealants market is projected to reach approximately $12.27 billion by 2025, driven by a robust CAGR of 10.34%. Key growth catalysts include escalating demand from the Electrical and Electronics, Automotive and Transportation, and Building and Construction sectors. High temperature sealants are essential due to their superior thermal resistance, adhesion, and chemical inertness. Innovations in material science, particularly advanced epoxy and silicone formulations, are enhancing performance and market adoption. The increasing complexity of electronic devices and the rise of electric vehicles are creating significant new opportunities for advanced sealant solutions.

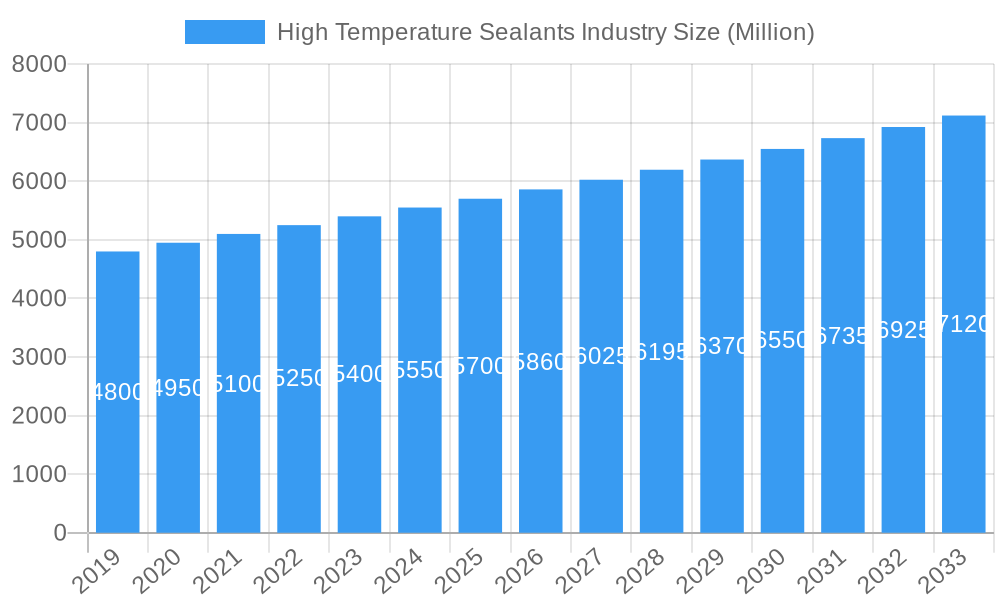

High Temperature Sealants Industry Market Size (In Billion)

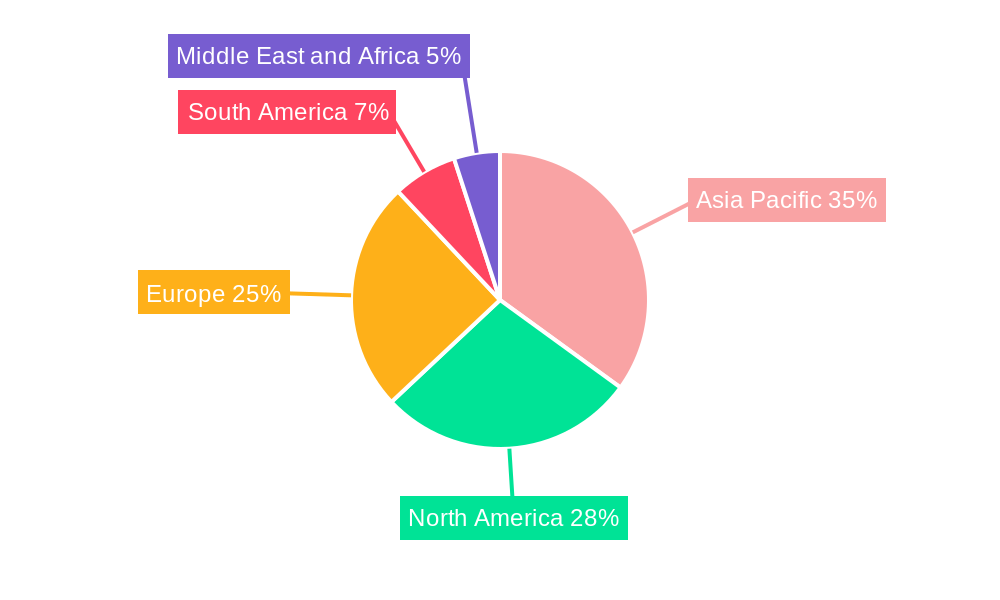

Market growth faces challenges including raw material price volatility and the emergence of alternative joining technologies. However, drivers such as stringent safety standards, infrastructure development, and continuous innovation from leading companies like Henkel AG & Co KGaA, PPG Industries Inc, and 3M are expected to propel the market forward. The market is segmented by Chemistry (Epoxy, Silicone, Others) and End-user Industry (Electrical and Electronics, Automotive and Transportation, Chemical and Pharmaceutical, Building and Construction, Other End-user Industries). The Asia Pacific region, particularly China and India, is expected to be a major market contributor due to its expanding industrial landscape.

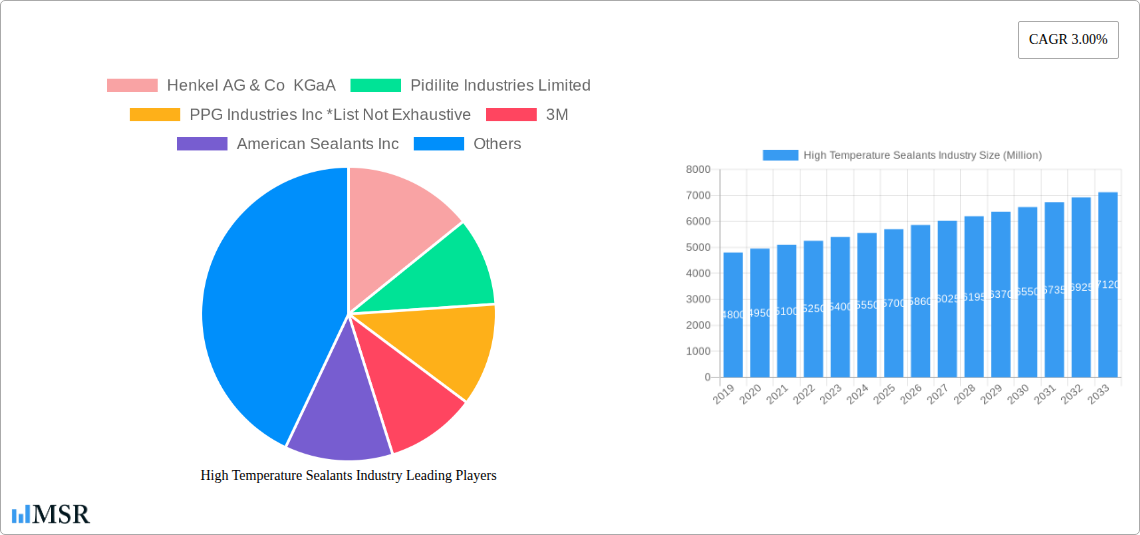

High Temperature Sealants Industry Company Market Share

High Temperature Sealants Industry Market Research Report: Unlocking Future Growth (2019–2033)

This comprehensive High Temperature Sealants Industry market report provides an in-depth analysis of the global market landscape, offering crucial insights for stakeholders seeking to capitalize on the expanding demand for advanced sealing solutions. Covering the historical period from 2019–2024 and projecting future growth from 2025–2033, with a base and estimated year of 2025, this report delivers actionable intelligence on market dynamics, key trends, leading players, and emerging opportunities within the high-temperature sealants sector.

High Temperature Sealants Industry Market Concentration & Dynamics

The high temperature sealants market exhibits a moderate concentration, with a mix of established global players and regional specialists. Key companies like Henkel AG & Co KGaA, PPG Industries Inc, and Dow are prominent, alongside significant contributors such as Pidilite Industries Limited, 3M, Arkema Group, and H B Fuller Company. The innovation ecosystem is driven by continuous research and development in epoxy sealants, silicone sealants, and advanced polymer formulations to meet increasingly stringent performance requirements. Regulatory frameworks are evolving, focusing on environmental compliance and enhanced safety standards for industrial sealants and automotive sealants. Substitute products exist, but their performance at extreme temperatures remains a limiting factor, reinforcing the demand for specialized high-temperature solutions. End-user trends show a growing preference for durable, high-performance, and easy-to-apply sealants across diverse industries. Merger and acquisition activities are anticipated to intensify as companies seek to expand their product portfolios, geographical reach, and technological capabilities, further shaping the market landscape. For instance, approximately 5-10 significant M&A deals are projected annually during the forecast period.

High Temperature Sealants Industry Industry Insights & Trends

The high temperature sealants industry is poised for robust growth, driven by a confluence of technological advancements, increasing industrialization, and the growing demand for materials capable of withstanding extreme conditions. The global high temperature sealants market size is projected to reach $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.XX% from the base year of 2025. This expansion is fueled by several key market growth drivers. The burgeoning automotive and transportation sector, with its increasing adoption of electric vehicles and advanced engine technologies requiring superior thermal management, is a significant contributor. Similarly, the electrical and electronics industry, where miniaturization and higher power densities necessitate reliable sealing against elevated temperatures, presents a substantial demand. The chemical and pharmaceutical sectors, along with critical infrastructure projects in building and construction, also represent strong growth avenues for high-performance heat-resistant sealants.

Technological disruptions are playing a pivotal role in shaping the industry. Innovations in epoxy sealants and silicone sealants are leading to enhanced thermal stability, chemical resistance, and adhesion properties. The development of novel formulations, including advanced composites and inorganic binders, is further broadening the application scope for industrial high temperature sealants. Furthermore, the growing emphasis on energy efficiency and sustainability is driving the demand for sealants that can improve insulation and prevent heat loss in various industrial processes and structures. Evolving consumer behaviors, particularly in industrial procurement, lean towards solutions offering longer service life, reduced maintenance, and improved operational safety, directly benefiting the high-temperature sealants market. The increasing complexity of manufacturing processes and the need for reliable containment of hazardous materials at elevated temperatures are also compelling factors for market expansion. The forecast anticipates a steady upward trajectory, supported by sustained investment in research and development and the continuous emergence of new application areas.

Key Markets & Segments Leading High Temperature Sealants Industry

The high temperature sealants market is experiencing dominant growth in the Asia-Pacific region, particularly in China and India, driven by rapid industrialization, significant infrastructure development, and a burgeoning manufacturing base. Economic growth and government initiatives promoting advanced manufacturing and renewable energy projects in these countries are creating substantial demand for specialized high-performance sealants.

Within the Chemistry segment, Silicone sealants are anticipated to lead the market due to their excellent thermal stability, flexibility across a wide temperature range, and resistance to UV radiation and moisture. These properties make them indispensable in applications within the Automotive and Transportation sector, especially for sealing engines, exhaust systems, and battery packs in electric vehicles. The Electrical and Electronics industry also heavily relies on silicone-based sealants for protecting sensitive components from heat and environmental factors. Epoxy sealants represent another significant and growing segment, offering exceptional mechanical strength, chemical resistance, and adhesion, making them ideal for demanding applications in the Chemical and Pharmaceutical industries and for high-stress structural bonding. The "Others" category, encompassing materials like polysulfides, polyurethanes, and inorganic sealants, will also witness steady growth, catering to niche applications requiring specific properties such as exceptional flame retardancy or resistance to extreme chemical environments.

In terms of End-user Industry, the Automotive and Transportation sector is a primary growth driver. The increasing complexity of vehicle designs, the transition to electric mobility requiring advanced thermal management solutions, and the general demand for durable and reliable components all contribute to this dominance. The Electrical and Electronics industry follows closely, with the relentless pursuit of miniaturization and higher power densities in devices demanding robust sealing against heat. The Building and Construction sector is also a crucial market, with high-temperature sealants being essential for sealing expansion joints in bridges, tunnels, high-rise buildings, and industrial facilities exposed to thermal fluctuations and fire risks. The Chemical and Pharmaceutical industries utilize these sealants for reactors, piping, and storage tanks where containment and resistance to aggressive chemicals at elevated temperatures are paramount. The "Other End-user Industries," including aerospace, defense, and heavy machinery, also contribute to the overall market demand with their specialized requirements for high-temperature sealing solutions.

High Temperature Sealants Industry Product Developments

Continuous innovation is a hallmark of the high temperature sealants industry. Recent product developments focus on enhancing thermal performance beyond 500°C, improving chemical inertness, and developing more sustainable and user-friendly formulations. Advancements in silicone sealants include the introduction of single-component, fast-curing RTV silicones with superior adhesion to challenging substrates. For epoxy sealants, innovations are centered on high-strength, low-viscosity formulations that offer excellent gap-filling capabilities and resistance to thermal cycling. The market is also witnessing the rise of specialized inorganic sealants designed for extremely high-temperature applications, such as in furnaces and industrial ovens. These innovations are driven by the need for improved reliability, extended product lifespans, and enhanced safety in demanding industrial environments.

Challenges in the High Temperature Sealants Industry Market

The high temperature sealants market faces several challenges that can impact its growth trajectory. Stringent regulatory hurdles related to VOC emissions and hazardous materials necessitate ongoing investment in research and development to create compliant formulations, potentially increasing production costs. Supply chain issues, including the availability and price volatility of key raw materials, can affect manufacturing efficiency and profitability. Intense competitive pressures from both established players and emerging low-cost alternatives can squeeze profit margins. The specialized nature of high-temperature applications also requires significant technical expertise and a longer sales cycle, presenting a barrier to market entry for new entrants. Quantifiable impacts include potential cost increases of 5-15% for R&D to meet new regulations and occasional disruptions to raw material supply impacting production by up to 10%.

Forces Driving High Temperature Sealants Industry Growth

Several potent forces are propelling the growth of the high temperature sealants industry. Technological advancements leading to enhanced thermal stability and durability are a primary driver. The increasing industrialization worldwide, particularly in developing economies, creates a sustained demand for robust sealing solutions in manufacturing, construction, and infrastructure projects. The automotive sector's evolution towards electric vehicles and more efficient internal combustion engines necessitates advanced thermal management, thus boosting the need for specialized sealants. Furthermore, stringent safety regulations in various industries mandate the use of reliable sealing materials to prevent leaks and failures at elevated temperatures, acting as a significant growth catalyst. The continuous development of new applications in renewable energy, aerospace, and advanced electronics further expands the market potential.

Challenges in the High Temperature Sealants Industry Market

While the high temperature sealants industry is experiencing significant growth, long-term sustainability hinges on addressing critical challenges. Continuous innovation is essential to develop sealants that can withstand even more extreme temperatures and harsher chemical environments. Strategic partnerships between raw material suppliers, sealant manufacturers, and end-users are crucial to foster collaborative development and accelerate the adoption of new technologies. Market expansion into emerging economies with developing industrial bases presents a significant long-term growth opportunity, but requires localized product development and distribution strategies. Investing in advanced manufacturing processes to improve efficiency and reduce costs will also be vital for sustained competitiveness.

Emerging Opportunities in High Temperature Sealants Industry

The high temperature sealants industry is ripe with emerging opportunities. The burgeoning renewable energy sector, particularly in solar and wind power generation, requires high-performance sealants for extreme temperature and environmental resistance. The growth of 5G infrastructure and advanced semiconductor manufacturing presents new demand for specialized electronic sealants. The increasing focus on energy efficiency in industrial processes and buildings will drive demand for sealants that offer superior thermal insulation properties. Furthermore, the aerospace and defense sectors continue to demand innovative sealing solutions for increasingly demanding operational conditions. The development of bio-based or sustainable high-temperature sealants also presents a significant opportunity to cater to the growing eco-conscious market.

Leading Players in the High Temperature Sealants Industry Sector

- Henkel AG & Co KGaA

- Pidilite Industries Limited

- PPG Industries Inc

- 3M

- American Sealants Inc

- Arkema Group

- Dow

- H B Fuller Company

- Bond It

- MAPEI S p A

Key Milestones in High Temperature Sealants Industry Industry

- 2019: Introduction of next-generation silicone sealants with enhanced UV resistance for automotive applications.

- 2020: Development of advanced epoxy formulations offering superior adhesion to composite materials in aerospace.

- 2021: Launch of eco-friendly, low-VOC high-temperature sealants to meet evolving environmental regulations.

- 2022: Significant investment by Dow in R&D for advanced materials for electric vehicle battery thermal management.

- 2023: Arkema Group acquires a specialized producer of high-performance inorganic sealants.

- 2024: Pidilite Industries Limited expands its industrial adhesives portfolio with high-temperature sealant offerings.

- 2025 (Estimated): Market introduction of novel inorganic-organic hybrid sealants with unprecedented thermal stability.

Strategic Outlook for High Temperature Sealants Industry Market

The strategic outlook for the high temperature sealants market is exceptionally promising. Growth will be primarily driven by continued innovation in material science, enabling sealants to perform under even more extreme conditions. Expansion into rapidly industrializing regions, coupled with a focus on the burgeoning electric vehicle and renewable energy sectors, will be key growth accelerators. Companies that can offer integrated solutions, combining advanced product offerings with technical support and application expertise, will gain a significant competitive edge. Furthermore, strategic acquisitions and partnerships will be crucial for market players to enhance their technological capabilities, broaden their product portfolios, and secure their positions in this dynamic and expanding industry. The overall market is set for sustained expansion, offering substantial opportunities for stakeholders who can adapt to evolving demands and technological advancements.

High Temperature Sealants Industry Segmentation

-

1. Chemistry

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Others

-

2. End-user Industry

- 2.1. Electrical and Electronics

- 2.2. Automotive and Transportation

- 2.3. Chemical and Pharmaceutical

- 2.4. Building and Construction

- 2.5. Other End-user Industries

High Temperature Sealants Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

High Temperature Sealants Industry Regional Market Share

Geographic Coverage of High Temperature Sealants Industry

High Temperature Sealants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Electrical and Electronics Industry; Growing Demand owing to its Wide Range of Applications

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Electrical & Electronics Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electrical and Electronics

- 5.2.2. Automotive and Transportation

- 5.2.3. Chemical and Pharmaceutical

- 5.2.4. Building and Construction

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Chemistry

- 6. Asia Pacific High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electrical and Electronics

- 6.2.2. Automotive and Transportation

- 6.2.3. Chemical and Pharmaceutical

- 6.2.4. Building and Construction

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Chemistry

- 7. North America High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electrical and Electronics

- 7.2.2. Automotive and Transportation

- 7.2.3. Chemical and Pharmaceutical

- 7.2.4. Building and Construction

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Chemistry

- 8. Europe High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electrical and Electronics

- 8.2.2. Automotive and Transportation

- 8.2.3. Chemical and Pharmaceutical

- 8.2.4. Building and Construction

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Chemistry

- 9. South America High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electrical and Electronics

- 9.2.2. Automotive and Transportation

- 9.2.3. Chemical and Pharmaceutical

- 9.2.4. Building and Construction

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Chemistry

- 10. Middle East and Africa High Temperature Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Electrical and Electronics

- 10.2.2. Automotive and Transportation

- 10.2.3. Chemical and Pharmaceutical

- 10.2.4. Building and Construction

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Chemistry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pidilite Industries Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PPG Industries Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Sealants Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dow

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 H B Fuller Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bond It

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MAPEI S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global High Temperature Sealants Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 3: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 4: Asia Pacific High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 9: North America High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 10: North America High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 15: Europe High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 16: Europe High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 21: South America High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 22: South America High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by Chemistry 2025 & 2033

- Figure 27: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by Chemistry 2025 & 2033

- Figure 28: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa High Temperature Sealants Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa High Temperature Sealants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 2: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global High Temperature Sealants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 5: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 13: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 19: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 27: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global High Temperature Sealants Industry Revenue billion Forecast, by Chemistry 2020 & 2033

- Table 33: Global High Temperature Sealants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global High Temperature Sealants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa High Temperature Sealants Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Temperature Sealants Industry?

The projected CAGR is approximately 10.34%.

2. Which companies are prominent players in the High Temperature Sealants Industry?

Key companies in the market include Henkel AG & Co KGaA, Pidilite Industries Limited, PPG Industries Inc *List Not Exhaustive, 3M, American Sealants Inc, Arkema Group, Dow, H B Fuller Company, Bond It, MAPEI S p A.

3. What are the main segments of the High Temperature Sealants Industry?

The market segments include Chemistry, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.27 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Electrical and Electronics Industry; Growing Demand owing to its Wide Range of Applications.

6. What are the notable trends driving market growth?

Increasing Demand from Electrical & Electronics Industry.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Temperature Sealants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Temperature Sealants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Temperature Sealants Industry?

To stay informed about further developments, trends, and reports in the High Temperature Sealants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence