Key Insights

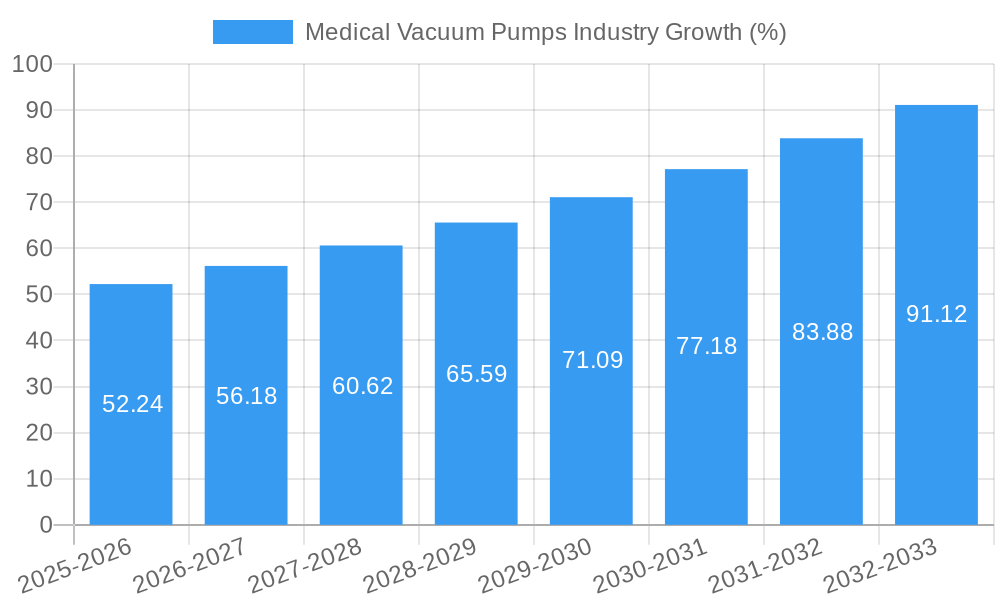

The global medical vacuum pump market, valued at approximately $704 million in 2025, is projected to experience robust growth, driven by a CAGR of 7.41% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of surgical procedures, particularly minimally invasive surgeries, necessitates reliable and efficient vacuum pump systems for suctioning fluids and tissues. Advancements in medical technology, such as robotic surgery and improved diagnostic imaging, further enhance demand for sophisticated vacuum pumps. Furthermore, the rising geriatric population, with its increased susceptibility to various medical conditions requiring vacuum-assisted procedures, contributes significantly to market growth. Stringent regulatory requirements regarding safety and hygiene in healthcare settings are also driving the adoption of advanced and reliable medical vacuum pump technologies. Competition amongst established players like Tsurumi Manufacturing, Ingersoll Rand, and Pfeiffer Vacuum, coupled with the emergence of innovative solutions from smaller companies, further shapes the market landscape.

Geographic segmentation reveals a strong presence in North America and Europe, driven by well-established healthcare infrastructure and high per capita healthcare spending. However, Asia-Pacific is expected to witness significant growth in the coming years, fueled by expanding healthcare facilities, increasing disposable incomes, and a rising middle class. Within the product segmentation, rotary vacuum pumps and reciprocating vacuum pumps hold considerable market share, while advancements in kinetic and dynamic pump technologies are expected to propel future growth. Specific end-user applications such as hospitals, clinics, and diagnostic centers are major contributors to the overall demand. Challenges to market growth might include the high initial investment costs associated with advanced vacuum pump systems and potential supply chain disruptions affecting the availability of critical components. Despite these challenges, the long-term outlook for the medical vacuum pump market remains positive, driven by continued technological innovation and the increasing reliance on vacuum-assisted procedures in modern healthcare.

Medical Vacuum Pumps Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Medical Vacuum Pumps industry, covering market size, segmentation, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. We project a robust market expansion during the forecast period (2025-2033), driven by several key factors detailed within. This report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this vital sector. The global market value is predicted to reach xx Million by 2033.

Medical Vacuum Pumps Industry Market Concentration & Dynamics

The Medical Vacuum Pumps market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise figures for individual market share are proprietary within the full report, companies like Ingersoll Rand Inc, Ebara Corporation, and Busch Vacuum Solutions are key contenders. The level of competition is influenced by factors including technological innovation, regulatory compliance, and mergers and acquisitions (M&A) activity.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the industry is estimated at xx, indicating a moderately concentrated market.

- Innovation Ecosystems: Continuous advancements in pump technology, such as energy-efficient designs and improved materials, drive market innovation.

- Regulatory Frameworks: Stringent safety and performance standards influence product development and market access.

- Substitute Products: Limited direct substitutes exist, but alternative technologies for specific applications may pose some competitive pressure.

- End-User Trends: Growing demand from healthcare facilities and the increasing adoption of minimally invasive surgical procedures fuels market growth.

- M&A Activities: The number of M&A deals in the industry averaged xx per year during the historical period (2019-2024), primarily driven by strategies to expand market reach and enhance technological capabilities.

Medical Vacuum Pumps Industry Insights & Trends

The Medical Vacuum Pumps market is experiencing robust growth, driven by several factors. The global market size reached xx Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Key drivers include increasing demand from healthcare settings, technological advancements leading to more efficient and reliable pumps, and rising disposable incomes in developing economies. The market is also witnessing a shift towards more energy-efficient and environmentally friendly vacuum pump technologies. Furthermore, advancements in medical procedures requiring vacuum assistance are pushing the demand further. These trends contribute to an overall positive outlook for market growth throughout the forecast period.

Key Markets & Segments Leading Medical Vacuum Pumps Industry

The Medical Vacuum Pumps market is segmented by pump type, end-user application, and geography. While a detailed breakdown is provided in the full report, key observations include:

- By Type: Rotary vacuum pumps dominate the market due to their versatility and reliability across various applications. Roots pumps and reciprocating vacuum pumps also hold significant market share.

- By End-user Application: The medical sector is a major driver of growth, followed by the chemical processing, oil and gas, and electronics industries.

- By Geography: North America and Europe currently hold the largest market share, driven by high adoption rates and technological advancements. However, Asia-Pacific is projected to experience significant growth in the coming years.

Key Growth Drivers:

- Rapid advancements in minimally invasive surgical techniques.

- Rising demand for improved patient care and safety protocols in hospitals and healthcare facilities.

- Increased government funding for healthcare infrastructure development in several regions.

- Technological improvements resulting in higher efficiency, reliability, and performance.

The dominance of specific regions and segments are further analyzed within the complete report, providing detailed market share breakdowns and competitive landscape analyses.

Medical Vacuum Pumps Industry Product Developments

Recent advancements focus on energy efficiency, quieter operation, and improved reliability. Manufacturers are introducing pumps with variable speed drives, optimized air-end designs, and advanced materials to enhance performance and reduce maintenance requirements. These innovations cater to the growing demand for sophisticated medical procedures and improved operational efficiency in various industrial settings. The market is also witnessing the development of specialized pumps designed for specific medical applications, contributing to an increasingly diverse product landscape.

Challenges in the Medical Vacuum Pumps Industry Market

The Medical Vacuum Pumps market faces challenges such as increasing raw material costs, stringent regulatory compliance requirements, and intense competition. Supply chain disruptions can impact production and delivery, potentially affecting market stability. Furthermore, maintaining a competitive edge requires continuous innovation and adaptation to evolving industry standards. These factors represent significant barriers to industry growth, necessitating strategic planning and adaptability from market players.

Forces Driving Medical Vacuum Pumps Industry Growth

Key growth drivers include technological advancements in pump design and materials, the rising demand for minimally invasive surgical procedures, and increasing government investments in healthcare infrastructure. The expanding healthcare sector globally plays a critical role, along with stringent regulatory frameworks emphasizing safety and efficiency, driving demand for advanced medical vacuum pumps. These factors collectively contribute to a positive trajectory for market expansion.

Long-Term Growth Catalysts in the Medical Vacuum Pumps Industry Market

Long-term growth will be fueled by strategic partnerships and collaborations for research and development. The introduction of innovative designs and materials promises to enhance pump efficiency and longevity. Expansion into emerging markets with significant healthcare investment potential will unlock substantial growth opportunities. Focusing on sustainability and developing eco-friendly solutions will become increasingly important for long-term success in the market.

Emerging Opportunities in Medical Vacuum Pumps Industry

Emerging opportunities lie in the development of specialized pumps for niche medical applications, incorporating advanced control systems and integration with digital health platforms. The increasing demand for portable and compact vacuum pumps presents significant potential for innovation. Furthermore, focusing on energy-efficient designs and sustainable manufacturing processes will offer substantial competitive advantages in a market increasingly sensitive to environmental concerns.

Leading Players in the Medical Vacuum Pumps Industry Sector

- Tsurumi Manufacturing Co Ltd

- Ingersoll Rand Inc

- Wintek Corporation

- Ebara Corporation

- Flowserve Corporation

- Busch Vacuum Solutions (Busch group)

- Graham Corporation

- Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG)

- Atlas Copco AB (Edwards)

- ULVAC Inc

- Global Vac

- Becker Pumps Corporation

Key Milestones in Medical Vacuum Pumps Industry Industry

- February 2023: Busch Vacuum Solutions' new Indian plant builds its 4000th vacuum pump, signifying a significant commitment to the Indian market. The DOLPHIN LX series is manufactured at this facility.

- March 2023: Kaishan USA launches the KRSV series of oil-flooded rotary screw vacuum pumps, known for their energy efficiency and variable speed drive technology.

Strategic Outlook for Medical Vacuum Pumps Industry Market

The Medical Vacuum Pumps market is poised for continued growth, driven by technological innovations, expanding healthcare infrastructure, and rising demand from various end-use sectors. Strategic partnerships, focus on sustainability, and expansion into new markets will be crucial for maximizing long-term success. Companies that prioritize research and development, and adapt to changing regulatory landscapes, are well-positioned to capitalize on the substantial growth potential of this dynamic market.

Medical Vacuum Pumps Industry Segmentation

-

1. Type

-

1.1. Rotary Vacuum Pumps

- 1.1.1. Rotary Vane Pumps

- 1.1.2. Screw and Claw Pumps

- 1.1.3. Roots Pumps

-

1.2. Reciprocating Vacuum Pumps

- 1.2.1. Diaphragm Pumps

- 1.2.2. Piston Pumps

-

1.3. Kinetic Vacuum Pumps

- 1.3.1. Ejector Pumps

- 1.3.2. Turbomolecular Pumps

- 1.3.3. Diffusion Pumps

-

1.4. Dynamic Pumps

- 1.4.1. Liquid Ring Pumps

- 1.4.2. Side Channel Pumps

-

1.5. Specialized Vacuum Pumps

- 1.5.1. Getter Pumps

- 1.5.2. Cryogenic Pumps

-

1.1. Rotary Vacuum Pumps

-

2. End-user Application

- 2.1. Oil and Gas

- 2.2. Electronics

- 2.3. Medicine

- 2.4. Chemical Processing

- 2.5. Food and Beverage

- 2.6. Power Generation

- 2.7. Other En

Medical Vacuum Pumps Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Medical Vacuum Pumps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Crude Oil Production and the Newer Oilfields; Increasing Demand for Dry Vacuum Pump

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas

- 3.4. Market Trends

- 3.4.1. Rotary Vacuum Pump Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rotary Vacuum Pumps

- 5.1.1.1. Rotary Vane Pumps

- 5.1.1.2. Screw and Claw Pumps

- 5.1.1.3. Roots Pumps

- 5.1.2. Reciprocating Vacuum Pumps

- 5.1.2.1. Diaphragm Pumps

- 5.1.2.2. Piston Pumps

- 5.1.3. Kinetic Vacuum Pumps

- 5.1.3.1. Ejector Pumps

- 5.1.3.2. Turbomolecular Pumps

- 5.1.3.3. Diffusion Pumps

- 5.1.4. Dynamic Pumps

- 5.1.4.1. Liquid Ring Pumps

- 5.1.4.2. Side Channel Pumps

- 5.1.5. Specialized Vacuum Pumps

- 5.1.5.1. Getter Pumps

- 5.1.5.2. Cryogenic Pumps

- 5.1.1. Rotary Vacuum Pumps

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Oil and Gas

- 5.2.2. Electronics

- 5.2.3. Medicine

- 5.2.4. Chemical Processing

- 5.2.5. Food and Beverage

- 5.2.6. Power Generation

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rotary Vacuum Pumps

- 6.1.1.1. Rotary Vane Pumps

- 6.1.1.2. Screw and Claw Pumps

- 6.1.1.3. Roots Pumps

- 6.1.2. Reciprocating Vacuum Pumps

- 6.1.2.1. Diaphragm Pumps

- 6.1.2.2. Piston Pumps

- 6.1.3. Kinetic Vacuum Pumps

- 6.1.3.1. Ejector Pumps

- 6.1.3.2. Turbomolecular Pumps

- 6.1.3.3. Diffusion Pumps

- 6.1.4. Dynamic Pumps

- 6.1.4.1. Liquid Ring Pumps

- 6.1.4.2. Side Channel Pumps

- 6.1.5. Specialized Vacuum Pumps

- 6.1.5.1. Getter Pumps

- 6.1.5.2. Cryogenic Pumps

- 6.1.1. Rotary Vacuum Pumps

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Oil and Gas

- 6.2.2. Electronics

- 6.2.3. Medicine

- 6.2.4. Chemical Processing

- 6.2.5. Food and Beverage

- 6.2.6. Power Generation

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rotary Vacuum Pumps

- 7.1.1.1. Rotary Vane Pumps

- 7.1.1.2. Screw and Claw Pumps

- 7.1.1.3. Roots Pumps

- 7.1.2. Reciprocating Vacuum Pumps

- 7.1.2.1. Diaphragm Pumps

- 7.1.2.2. Piston Pumps

- 7.1.3. Kinetic Vacuum Pumps

- 7.1.3.1. Ejector Pumps

- 7.1.3.2. Turbomolecular Pumps

- 7.1.3.3. Diffusion Pumps

- 7.1.4. Dynamic Pumps

- 7.1.4.1. Liquid Ring Pumps

- 7.1.4.2. Side Channel Pumps

- 7.1.5. Specialized Vacuum Pumps

- 7.1.5.1. Getter Pumps

- 7.1.5.2. Cryogenic Pumps

- 7.1.1. Rotary Vacuum Pumps

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Oil and Gas

- 7.2.2. Electronics

- 7.2.3. Medicine

- 7.2.4. Chemical Processing

- 7.2.5. Food and Beverage

- 7.2.6. Power Generation

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rotary Vacuum Pumps

- 8.1.1.1. Rotary Vane Pumps

- 8.1.1.2. Screw and Claw Pumps

- 8.1.1.3. Roots Pumps

- 8.1.2. Reciprocating Vacuum Pumps

- 8.1.2.1. Diaphragm Pumps

- 8.1.2.2. Piston Pumps

- 8.1.3. Kinetic Vacuum Pumps

- 8.1.3.1. Ejector Pumps

- 8.1.3.2. Turbomolecular Pumps

- 8.1.3.3. Diffusion Pumps

- 8.1.4. Dynamic Pumps

- 8.1.4.1. Liquid Ring Pumps

- 8.1.4.2. Side Channel Pumps

- 8.1.5. Specialized Vacuum Pumps

- 8.1.5.1. Getter Pumps

- 8.1.5.2. Cryogenic Pumps

- 8.1.1. Rotary Vacuum Pumps

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Oil and Gas

- 8.2.2. Electronics

- 8.2.3. Medicine

- 8.2.4. Chemical Processing

- 8.2.5. Food and Beverage

- 8.2.6. Power Generation

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rotary Vacuum Pumps

- 9.1.1.1. Rotary Vane Pumps

- 9.1.1.2. Screw and Claw Pumps

- 9.1.1.3. Roots Pumps

- 9.1.2. Reciprocating Vacuum Pumps

- 9.1.2.1. Diaphragm Pumps

- 9.1.2.2. Piston Pumps

- 9.1.3. Kinetic Vacuum Pumps

- 9.1.3.1. Ejector Pumps

- 9.1.3.2. Turbomolecular Pumps

- 9.1.3.3. Diffusion Pumps

- 9.1.4. Dynamic Pumps

- 9.1.4.1. Liquid Ring Pumps

- 9.1.4.2. Side Channel Pumps

- 9.1.5. Specialized Vacuum Pumps

- 9.1.5.1. Getter Pumps

- 9.1.5.2. Cryogenic Pumps

- 9.1.1. Rotary Vacuum Pumps

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Oil and Gas

- 9.2.2. Electronics

- 9.2.3. Medicine

- 9.2.4. Chemical Processing

- 9.2.5. Food and Beverage

- 9.2.6. Power Generation

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Rotary Vacuum Pumps

- 10.1.1.1. Rotary Vane Pumps

- 10.1.1.2. Screw and Claw Pumps

- 10.1.1.3. Roots Pumps

- 10.1.2. Reciprocating Vacuum Pumps

- 10.1.2.1. Diaphragm Pumps

- 10.1.2.2. Piston Pumps

- 10.1.3. Kinetic Vacuum Pumps

- 10.1.3.1. Ejector Pumps

- 10.1.3.2. Turbomolecular Pumps

- 10.1.3.3. Diffusion Pumps

- 10.1.4. Dynamic Pumps

- 10.1.4.1. Liquid Ring Pumps

- 10.1.4.2. Side Channel Pumps

- 10.1.5. Specialized Vacuum Pumps

- 10.1.5.1. Getter Pumps

- 10.1.5.2. Cryogenic Pumps

- 10.1.1. Rotary Vacuum Pumps

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Oil and Gas

- 10.2.2. Electronics

- 10.2.3. Medicine

- 10.2.4. Chemical Processing

- 10.2.5. Food and Beverage

- 10.2.6. Power Generation

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Medical Vacuum Pumps Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Tsurumi Manufacturing Co Ltd*List Not Exhaustive

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Ingersoll Rand Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Wintek Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Ebara Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Flowserve Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Busch Vacuum Solutions (Busch group)

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Graham Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG)

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Atlas Copco AB (Edwards)

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 ULVAC Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Global Vac

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Becker Pumps Corporation

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Tsurumi Manufacturing Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: Global Medical Vacuum Pumps Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medical Vacuum Pumps Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Medical Vacuum Pumps Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Medical Vacuum Pumps Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 17: North America Medical Vacuum Pumps Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 18: North America Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Medical Vacuum Pumps Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Medical Vacuum Pumps Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Medical Vacuum Pumps Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 23: Europe Medical Vacuum Pumps Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 24: Europe Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Vacuum Pumps Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Medical Vacuum Pumps Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Medical Vacuum Pumps Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 29: Asia Pacific Medical Vacuum Pumps Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 30: Asia Pacific Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Medical Vacuum Pumps Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Medical Vacuum Pumps Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Medical Vacuum Pumps Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 35: Latin America Medical Vacuum Pumps Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 36: Latin America Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Medical Vacuum Pumps Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Medical Vacuum Pumps Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Medical Vacuum Pumps Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 41: Middle East and Africa Medical Vacuum Pumps Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 42: Middle East and Africa Medical Vacuum Pumps Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Medical Vacuum Pumps Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 4: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Medical Vacuum Pumps Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 52: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 55: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 58: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 61: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 64: Global Medical Vacuum Pumps Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Vacuum Pumps Industry?

The projected CAGR is approximately 7.41%.

2. Which companies are prominent players in the Medical Vacuum Pumps Industry?

Key companies in the market include Tsurumi Manufacturing Co Ltd*List Not Exhaustive, Ingersoll Rand Inc, Wintek Corporation, Ebara Corporation, Flowserve Corporation, Busch Vacuum Solutions (Busch group), Graham Corporation, Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG), Atlas Copco AB (Edwards), ULVAC Inc, Global Vac, Becker Pumps Corporation.

3. What are the main segments of the Medical Vacuum Pumps Industry?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Crude Oil Production and the Newer Oilfields; Increasing Demand for Dry Vacuum Pump.

6. What are the notable trends driving market growth?

Rotary Vacuum Pump Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas.

8. Can you provide examples of recent developments in the market?

March 2023: Kaishan USA, a global manufacturer of industrial air compressors, has introduced the KRSV series of industrial vacuum pumps. The brand-new Kaishan KRSV oil-flooded rotary screw vacuum pumps come completely assembled and prepared to be plugged into any system or used independently right out of the box. The vacuum pumps are a market pioneer in energy efficiency and have a combination of variable speed drive and variable discharge port airend.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Vacuum Pumps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Vacuum Pumps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Vacuum Pumps Industry?

To stay informed about further developments, trends, and reports in the Medical Vacuum Pumps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence