Key Insights

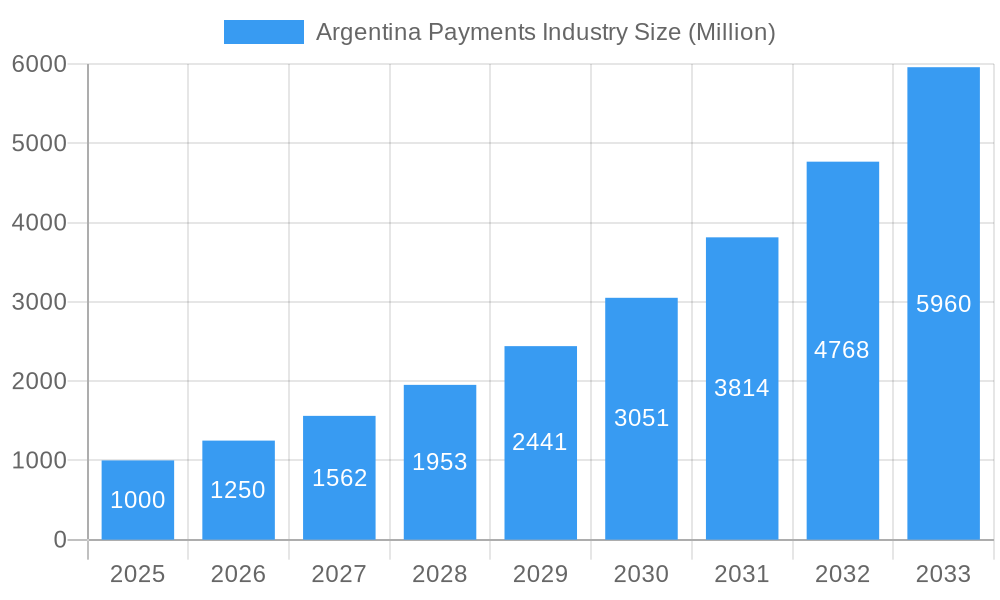

The Argentinian payments industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 25.08% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of e-commerce and digital financial services, coupled with a young and tech-savvy population, is significantly boosting online payment transactions. Furthermore, government initiatives promoting financial inclusion and the expansion of mobile network coverage are contributing to the wider penetration of digital payment methods across various demographics. The retail, entertainment, and hospitality sectors are major contributors to this growth, with a growing preference for contactless payments and mobile wallets. However, economic volatility and inflation pose challenges, potentially impacting consumer spending and investment in the sector. Competition among established players like Visa, Mastercard, and Mercado Pago, alongside emerging fintech companies like Coda Payments and Dlocal, is intensifying, leading to innovation in payment solutions and increased customer choice. The market is segmented by payment modes (point-of-sale, online) and end-user industries, reflecting the diverse applications of payment technologies within the Argentinian economy. This dynamic environment presents opportunities for both established and new entrants, albeit within a context that requires careful consideration of economic factors.

Argentina Payments Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of international giants and local players. International companies bring established technology and global reach, while local firms possess deep understanding of the Argentinian market and its unique needs. The future success hinges on adapting to the evolving regulatory landscape, navigating economic uncertainty, and focusing on user experience to build trust and loyalty. Growth within the online sales segment is expected to outpace that of traditional point-of-sale systems, driven by increasing internet and smartphone penetration. This shift is also impacting the end-user industries, with businesses across sectors increasingly integrating online payment options into their operations to improve efficiency and customer reach. Continuous innovation, including the adoption of new technologies like Buy Now Pay Later (BNPL) options, will further shape the industry's trajectory.

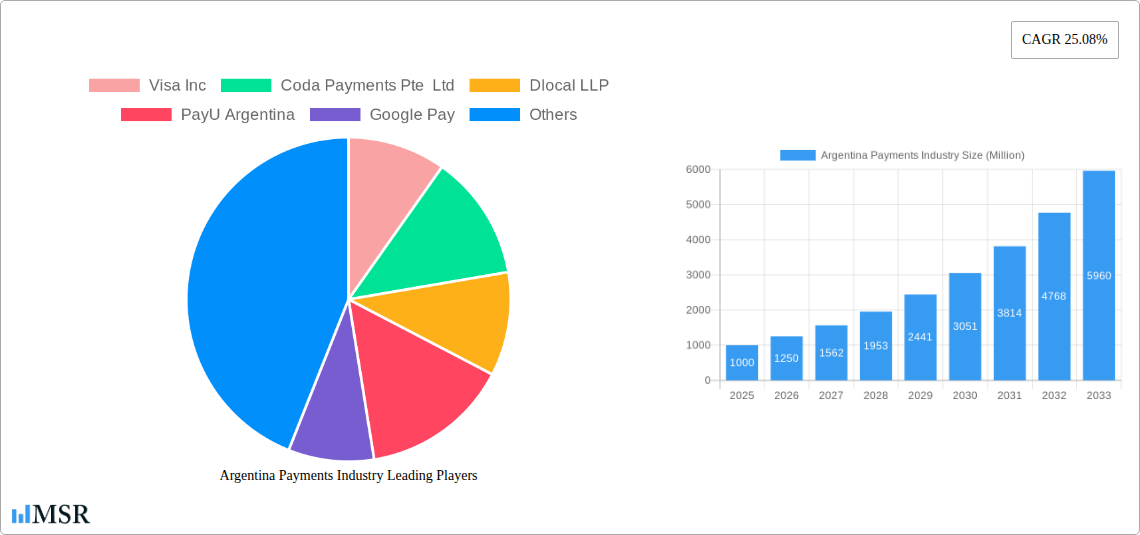

Argentina Payments Industry Company Market Share

Argentina Payments Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Argentina payments industry, offering invaluable insights for stakeholders including investors, businesses, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The Argentina payments market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This report unlocks critical data on market segmentation, competitive landscape, and technological advancements shaping the future of payments in Argentina.

Argentina Payments Industry Market Concentration & Dynamics

The Argentinian payments landscape is characterized by a blend of established international players and thriving domestic companies. Market concentration is moderate, with Mercado Pago (MercadoLibre SRL) and other local players holding significant shares alongside global giants like Visa Inc. and Mastercard International Incorporated. The market exhibits a dynamic innovation ecosystem, driven by fintech startups and established players alike, constantly introducing new products and services.

Regulatory frameworks play a crucial role in shaping the industry, impacting both domestic and international players. The presence of substitute products, such as cash and informal payment methods, continues to influence market share. End-user trends, particularly the increasing adoption of digital payments, are driving significant growth. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx M&A deals recorded between 2019 and 2024. Key metrics include:

- Mercado Pago Market Share (2024): xx%

- Visa Inc. Market Share (2024): xx%

- Mastercard Market Share (2024): xx%

- Number of M&A deals (2019-2024): xx

Argentina Payments Industry Industry Insights & Trends

The Argentinian payments industry is experiencing robust growth fueled by several key factors. Rising smartphone penetration, increasing internet access, and a growing middle class are driving the adoption of digital payment methods. Technological disruptions, including the rise of mobile wallets like Google Wallet (formerly Google Pay) and the increasing use of contactless payments, are transforming the industry landscape. Consumer behavior is shifting towards greater convenience and security, leading to a preference for digital transactions. The market is witnessing a surge in the adoption of e-commerce, further stimulating growth in online payment solutions. Furthermore, government initiatives promoting financial inclusion are contributing to wider access to financial services and driving market expansion.

Key Markets & Segments Leading Argentina Payments Industry

The Argentinian payments industry is dominated by the Retail segment within the end-user industry, followed by Entertainment and Hospitality. In terms of payment mode, Point-of-Sale (POS) transactions continue to hold the largest share, although Online Sales are experiencing rapid growth. The dominance of these segments is driven by several factors:

Drivers for Retail Dominance:

- High consumer spending in the retail sector.

- Extensive POS infrastructure across the country.

- Growing adoption of digital payment options by retailers.

Drivers for Online Sales Growth:

- Rapid expansion of e-commerce in Argentina.

- Increasing internet and smartphone penetration.

- Preference for convenient and contactless payment methods.

Drivers for other segments: Growth in entertainment and hospitality is propelled by increasing tourist numbers and the adoption of online booking and payment systems.

Argentina Payments Industry Product Developments

Recent years have seen significant product innovations in the Argentinian payments industry. The emergence of Super Apps, offering integrated financial services, is transforming the customer experience. The expansion of mobile wallets, such as Google Wallet, is offering seamless and secure payment solutions. The introduction of innovative payment technologies, such as biometric authentication and blockchain-based solutions, are further enhancing security and efficiency. These advancements are creating a more competitive and dynamic market, benefiting both consumers and businesses.

Challenges in the Argentina Payments Industry Market

The Argentinian payments industry faces several challenges, including high inflation impacting transaction values, regulatory complexities in adapting to new technologies, and the persistent presence of informal payment methods, which limit formal sector penetration and create challenges in collecting data. Furthermore, security concerns related to online payments and the need for robust fraud prevention mechanisms remain a significant hurdle. These issues hinder market growth and pose risks to businesses operating in the industry. The impact is estimated to be a xx% reduction in overall market growth compared to projected figures.

Forces Driving Argentina Payments Industry Growth

Several factors are driving the growth of the Argentinian payments industry. The expanding digital economy is a key driver, with increasing e-commerce and online transactions fueling demand for digital payment solutions. Government initiatives focused on financial inclusion are broadening access to financial services, while technological advancements, such as the adoption of mobile wallets and contactless payments, are further enhancing convenience and accessibility. Economic growth, although volatile, provides a foundation for increased spending and transaction volumes.

Long-Term Growth Catalysts in the Argentina Payments Industry

Long-term growth in the Argentinian payments market will be fueled by several catalysts. The continuous development and adoption of innovative technologies, including blockchain and AI-powered solutions, will improve efficiency and security. Strategic partnerships between fintech companies and traditional financial institutions will foster collaboration and accelerate market penetration. Expansion into underserved markets and the development of tailored solutions for specific customer segments will open up new avenues for growth.

Emerging Opportunities in Argentina Payments Industry

Emerging opportunities abound in the Argentinian payments industry. The rise of Buy Now, Pay Later (BNPL) services presents a significant opportunity for growth, catering to consumer demand for flexible payment options. The increasing integration of payments with other financial services, creating super apps, will drive broader adoption. Furthermore, the potential for expansion into rural and underserved areas through mobile money solutions presents a vast untapped market.

Leading Players in the Argentina Payments Industry Sector

- Visa Inc

- Coda Payments Pte Ltd

- Dlocal LLP

- PayU Argentina

- Google Pay

- CABAL COOPERATIVA DE PROVISION DE SERVICIOS LTDA

- Naranja Digital Financial Company SAU

- Rapipago (GIRE S A )

- Mastercard International Incorporated

- Mercado Pago (MercadoLibre SRL)

- Servicios Electronico de Pago SA (PagoFacil)

- Paysafe Limited

Key Milestones in Argentina Payments Industry Industry

- November 2022: Google launched Google Wallet in Argentina, expanding its contactless payment services.

- June 2023: Mastercard announced the launch of its Multi Token Network (MTN), enhancing blockchain-based transactions.

Strategic Outlook for Argentina Payments Industry Market

The Argentinian payments industry is poised for significant growth over the next decade. The convergence of technological advancements, increasing digital adoption, and government initiatives supporting financial inclusion will create a favorable environment for expansion. Strategic investments in infrastructure, innovation, and partnerships will be crucial for companies seeking to capitalize on the market’s potential. The continued development of secure and convenient payment solutions will be essential for attracting and retaining customers in a dynamic and competitive landscape.

Argentina Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point-of-Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other Point-of-Sale Types

-

1.2. Online Sale

- 1.2.1. Other On

-

1.1. Point-of-Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Argentina Payments Industry Segmentation By Geography

- 1. Argentina

Argentina Payments Industry Regional Market Share

Geographic Coverage of Argentina Payments Industry

Argentina Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of E-commerce

- 3.2.2 Including the Rise of M-commerce and Cross-border E-commerce Supported by the Increase in Purchasing Power; Increasing Government Initiatives for the Promotion of Digital Payments; Growing Penetration of Smartphones

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1 High Proliferation of E-commerce

- 3.4.2 Including the Rise of M-commerce and Cross-border E-commerce Supported by the Increase in Purchasing Power

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point-of-Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other Point-of-Sale Types

- 5.1.2. Online Sale

- 5.1.2.1. Other On

- 5.1.1. Point-of-Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Visa Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coda Payments Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dlocal LLP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PayU Argentina

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google Pay

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CABAL COOPERATIVA DE PROVISION DE SERVICIOS LTDA *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Naranja Digital Financial Company SAU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rapipago (GIRE S A )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mastercard International Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercado Pago (MercadoLibre SRL)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Servicios Electronico de Pago SA (PagoFacil)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Paysafe Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Visa Inc

List of Figures

- Figure 1: Argentina Payments Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Argentina Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Argentina Payments Industry Revenue undefined Forecast, by Mode of Payment 2020 & 2033

- Table 2: Argentina Payments Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Argentina Payments Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Argentina Payments Industry Revenue undefined Forecast, by Mode of Payment 2020 & 2033

- Table 5: Argentina Payments Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Argentina Payments Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Payments Industry?

The projected CAGR is approximately 38.4%.

2. Which companies are prominent players in the Argentina Payments Industry?

Key companies in the market include Visa Inc, Coda Payments Pte Ltd, Dlocal LLP, PayU Argentina, Google Pay, CABAL COOPERATIVA DE PROVISION DE SERVICIOS LTDA *List Not Exhaustive, Naranja Digital Financial Company SAU, Rapipago (GIRE S A ), Mastercard International Incorporated, Mercado Pago (MercadoLibre SRL), Servicios Electronico de Pago SA (PagoFacil), Paysafe Limited.

3. What are the main segments of the Argentina Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of E-commerce. Including the Rise of M-commerce and Cross-border E-commerce Supported by the Increase in Purchasing Power; Increasing Government Initiatives for the Promotion of Digital Payments; Growing Penetration of Smartphones.

6. What are the notable trends driving market growth?

High Proliferation of E-commerce. Including the Rise of M-commerce and Cross-border E-commerce Supported by the Increase in Purchasing Power.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

June 2023: Mastercard announced the launch of a Multi Token Network (MTN), a set of foundational capabilities designed to make transactions within the blockchain and digital asset ecosystems secure, scalable, and interoperable making that enables payment and commerce applications to be more efficient.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Payments Industry?

To stay informed about further developments, trends, and reports in the Argentina Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence