Key Insights

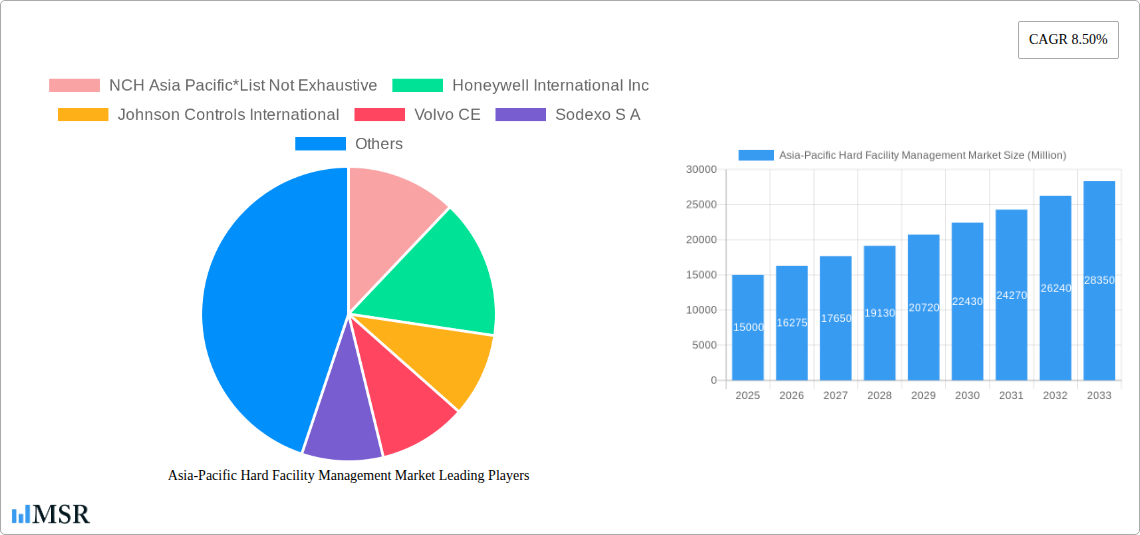

The Asia-Pacific Hard Facility Management (Hard FM) market is experiencing robust growth, driven by increasing urbanization, expanding industrial sectors, and a rising demand for efficient and reliable building operations. The market, segmented by services (MEP, HVAC, Enterprise Asset Management, and other hard FM services) and end-users (commercial, institutional, public/infrastructure, industrial, and others), is projected to maintain a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This growth is fueled by the significant investments in infrastructure development across the region, particularly in rapidly developing economies like China and India. Furthermore, the adoption of advanced technologies like Building Information Modeling (BIM) and IoT-enabled solutions is streamlining operations and boosting efficiency, contributing significantly to market expansion. The increasing focus on sustainability and energy efficiency within building management further adds to market demand. Major players like Honeywell, Johnson Controls, and CBRE are actively expanding their presence in the region, leveraging strategic partnerships and technological advancements to capture market share.

The competitive landscape is characterized by both established international players and regional service providers. While international companies offer comprehensive solutions and advanced technologies, local players benefit from intimate knowledge of the regional market and specific regulatory environments. Despite the positive outlook, the market faces challenges such as a skilled labor shortage and the need for consistent regulatory frameworks across different countries in the Asia-Pacific region. Nevertheless, the long-term prospects remain promising, driven by sustained economic growth, increasing infrastructure spending, and the continued adoption of innovative technologies within the hard FM sector. The market's value in 2025 is estimated (based on the provided CAGR and a logical extrapolation from past trends) to be substantial and poised for significant expansion over the forecast period.

Asia-Pacific Hard Facility Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific Hard Facility Management market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The report leverages extensive market research, incorporating data from the historical period (2019-2024) to project future trends accurately. The market is segmented by Type (MEP, HVAC Maintenance, Enterprise Asset Management, Other Hard FM Services) and End-User (Commercial, Institutional, Public/Infrastructure, Industrial, Other).

Asia-Pacific Hard Facility Management Market Concentration & Dynamics

The Asia-Pacific Hard Facility Management market exhibits a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. Market concentration is influenced by factors such as brand recognition, technological capabilities, and geographical reach. While precise market share figures for individual players are proprietary data, we estimate that the top 5 players collectively hold approximately xx% of the market in 2025. The market witnesses continuous innovation driven by technological advancements in areas like IoT-enabled building management systems and AI-powered predictive maintenance.

Regulatory frameworks concerning building codes, sustainability, and safety standards significantly impact market dynamics. These regulations push for energy-efficient solutions and environmentally friendly practices, thereby driving the adoption of green technologies within the hard FM sector. Substitute products such as cloud-based facility management software pose a competitive threat to traditional service providers. End-user trends, particularly the increasing adoption of smart building technologies and the rising demand for sustainable facility management practices, create new avenues for market expansion. M&A activity within the sector remains significant, with deal counts averaging xx annually over the historical period (2019-2024). These mergers and acquisitions are largely driven by companies aiming to expand their service portfolios and geographical reach.

- Market Share: Top 5 players hold approximately xx% in 2025 (estimated).

- M&A Activity: Average of xx deals annually (2019-2024).

- Key Drivers: Technological advancements, regulatory changes, and end-user demand for sustainable solutions.

Asia-Pacific Hard Facility Management Market Industry Insights & Trends

The Asia-Pacific Hard Facility Management market is experiencing robust growth, driven by factors such as rapid urbanization, increasing infrastructure development, and rising awareness regarding the importance of efficient facility management. The market size was valued at approximately xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is fuelled by the burgeoning commercial real estate sector, coupled with significant investments in public infrastructure projects across the region.

Technological advancements, including the widespread adoption of Building Information Modeling (BIM) and the Internet of Things (IoT), are fundamentally reshaping the industry. These technologies enhance operational efficiency, optimize resource allocation, and improve predictive maintenance capabilities. Evolving consumer behavior emphasizes sustainability and transparency. End-users increasingly demand environmentally friendly facility management practices and efficient energy consumption. This shift in preference drives the adoption of green building technologies and sustainable solutions within the sector. The demand for outsourcing facility management services is also increasing, driven by a focus on core competencies and cost optimization among businesses.

Key Markets & Segments Leading Asia-Pacific Hard Facility Management Market

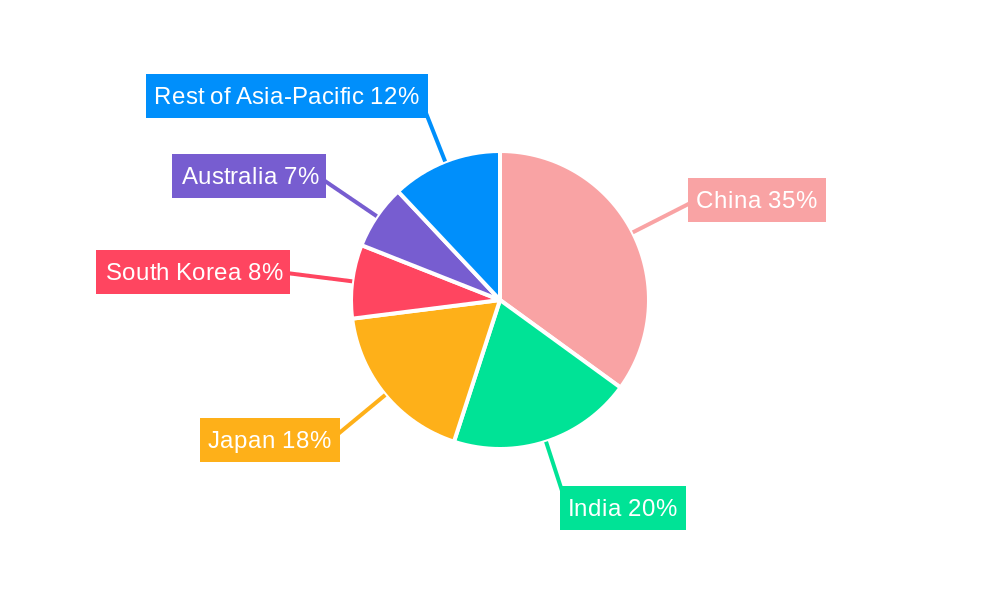

While the entire Asia-Pacific region exhibits robust growth, China, India, and Japan are prominent markets within the Hard Facility Management sector. These nations represent significant concentrations of commercial, industrial, and public infrastructure developments. Among the various segments, the MEP (Mechanical, Electrical, Plumbing) and HVAC Maintenance services segment holds the largest market share, driven by the continuous need for maintenance and upgrades of building systems. The Enterprise Asset Management segment is also experiencing significant growth due to the increasing focus on optimizing asset utilization and reducing operational costs.

- Dominant Regions: China, India, and Japan.

- Dominant Segments:

- By Type: MEP and HVAC Maintenance services hold the largest market share, followed by Enterprise Asset Management.

- By End-User: Commercial and Institutional segments are the key contributors to market growth.

- Growth Drivers:

- Economic Growth: Rapid economic expansion in key markets is driving infrastructural developments and construction activities.

- Urbanization: Increasing urbanization leads to a greater need for efficient facility management services across residential, commercial, and industrial sectors.

- Infrastructure Development: Significant investments in public infrastructure projects are creating substantial demand for hard FM services.

- Technological Advancements: The adoption of advanced technologies like BIM and IoT is driving operational efficiency and market growth.

Asia-Pacific Hard Facility Management Market Product Developments

Recent product developments in the Asia-Pacific Hard Facility Management market are characterized by a focus on integrating smart technologies into facility management solutions. This includes the development of IoT-enabled sensors for predictive maintenance, cloud-based asset management platforms, and AI-powered analytics for optimizing energy consumption. These advancements provide facility managers with real-time data and insights, enhancing operational efficiency and reducing operational costs. Furthermore, there’s a growing focus on developing environmentally friendly solutions, such as energy-efficient HVAC systems and sustainable building materials, aligning with global sustainability initiatives. These innovations provide a competitive edge for providers offering cutting-edge technology and eco-friendly solutions.

Challenges in the Asia-Pacific Hard Facility Management Market Market

The Asia-Pacific Hard Facility Management market faces several challenges. These include stringent regulatory compliance requirements, which can increase operational costs and complexity for service providers. Furthermore, the industry experiences fluctuations in the availability and pricing of raw materials and skilled labor, creating supply chain disruptions and impacting project timelines. Intense competition from both established multinational corporations and smaller regional players creates pressure on pricing and profitability. These factors cumulatively impact overall market growth and require strategic adaptation by industry players. The estimated impact of these challenges is a reduction of xx% in projected market growth in 2030.

Forces Driving Asia-Pacific Hard Facility Management Market Growth

The Asia-Pacific Hard Facility Management market is driven by several key factors. Technological advancements such as AI-powered predictive maintenance and IoT-enabled building management systems are enhancing operational efficiency and cost savings. The region’s robust economic growth and significant investments in infrastructure development create a strong demand for facility management services. Stringent regulatory frameworks promoting energy efficiency and sustainable practices are encouraging the adoption of green technologies. For example, the agreement between JLL India and Tata Power for green energy solutions highlights the increasing emphasis on sustainability. These factors are collectively propelling market expansion.

Long-Term Growth Catalysts in Asia-Pacific Hard Facility Management Market

Long-term growth in the Asia-Pacific Hard Facility Management market will be fueled by continuous innovation in building technologies and the expanding adoption of smart building solutions. Strategic partnerships between technology providers and facility management companies will drive the integration of cutting-edge technologies across the sector. Expansion into new markets and underserved regions within the Asia-Pacific region presents significant growth opportunities. Government initiatives promoting sustainable development and energy efficiency will further accelerate market expansion, while initiatives towards smart city infrastructure development will bolster the demand for sophisticated hard FM services.

Emerging Opportunities in Asia-Pacific Hard Facility Management Market

The Asia-Pacific Hard Facility Management market presents numerous emerging opportunities. The growing adoption of smart building technologies, like AI-powered predictive maintenance and IoT-enabled sensors, creates avenues for providers offering data-driven solutions. The rising demand for sustainable and green building practices presents opportunities for companies specializing in eco-friendly solutions. Expansion into new and underserved markets within the region offers significant growth potential, especially in rapidly developing economies. Moreover, increasing focus on workplace experience and employee well-being presents new opportunities for providing integrated facility management solutions tailored to enhance productivity and employee satisfaction.

Leading Players in the Asia-Pacific Hard Facility Management Market Sector

- NCH Asia Pacific

- Honeywell International Inc

- Johnson Controls International

- Volvo CE

- Sodexo S A

- CBRE Group Inc

- Siemens AG

- Jones Lang LaSalle Incorporated (JLL)

- Fujitsu Limited

- Aden Group

Key Milestones in Asia-Pacific Hard Facility Management Market Industry

- July 2022: JLL India partnered with Tata Power to promote green energy solutions in real estate, reflecting the growing focus on sustainability.

- August 2022: ISS acquired Livit FM Services AG, demonstrating consolidation and expansion within the facility management sector. This merger is expected to be completed in Q1 2023, potentially impacting market share dynamics.

Strategic Outlook for Asia-Pacific Hard Facility Management Market Market

The Asia-Pacific Hard Facility Management market holds significant future potential, driven by ongoing urbanization, infrastructure development, and technological advancements. Companies focusing on innovation, sustainability, and strategic partnerships will be well-positioned to capitalize on emerging opportunities. Expansion into new markets, particularly in Southeast Asia and South Asia, will be crucial for long-term growth. Embracing digitalization and integrating cutting-edge technologies will be vital for enhancing operational efficiency and offering competitive, value-added services. The market is poised for sustained expansion, offering attractive opportunities for both established players and new entrants.

Asia-Pacific Hard Facility Management Market Segmentation

-

1. Type

- 1.1. MEP (Mec

- 1.2. Enterprise Asset Management

- 1.3. Other Hard FM Services

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End Users

-

3. Geography

- 3.1. Australia

- 3.2. China

- 3.3. India

- 3.4. Japan

- 3.5. Indonesia

- 3.6. Malaysia

- 3.7. Singapore

- 3.8. South Korea

- 3.9. Taiwan

- 3.10. Thailand

- 3.11. Rest of Asia-Pacific

Asia-Pacific Hard Facility Management Market Segmentation By Geography

- 1. Australia

- 2. China

- 3. India

- 4. Japan

- 5. Indonesia

- 6. Malaysia

- 7. Singapore

- 8. South Korea

- 9. Taiwan

- 10. Thailand

- 11. Rest of Asia Pacific

Asia-Pacific Hard Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Commercial Construction in the region; Escalated Demand for HVAC Services

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption in the Region

- 3.4. Market Trends

- 3.4.1. Growth of Commercial Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. MEP (Mec

- 5.1.2. Enterprise Asset Management

- 5.1.3. Other Hard FM Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Australia

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Japan

- 5.3.5. Indonesia

- 5.3.6. Malaysia

- 5.3.7. Singapore

- 5.3.8. South Korea

- 5.3.9. Taiwan

- 5.3.10. Thailand

- 5.3.11. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.4.2. China

- 5.4.3. India

- 5.4.4. Japan

- 5.4.5. Indonesia

- 5.4.6. Malaysia

- 5.4.7. Singapore

- 5.4.8. South Korea

- 5.4.9. Taiwan

- 5.4.10. Thailand

- 5.4.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Australia Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. MEP (Mec

- 6.1.2. Enterprise Asset Management

- 6.1.3. Other Hard FM Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Institutional

- 6.2.3. Public/Infrastructure

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Australia

- 6.3.2. China

- 6.3.3. India

- 6.3.4. Japan

- 6.3.5. Indonesia

- 6.3.6. Malaysia

- 6.3.7. Singapore

- 6.3.8. South Korea

- 6.3.9. Taiwan

- 6.3.10. Thailand

- 6.3.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. MEP (Mec

- 7.1.2. Enterprise Asset Management

- 7.1.3. Other Hard FM Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Institutional

- 7.2.3. Public/Infrastructure

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Australia

- 7.3.2. China

- 7.3.3. India

- 7.3.4. Japan

- 7.3.5. Indonesia

- 7.3.6. Malaysia

- 7.3.7. Singapore

- 7.3.8. South Korea

- 7.3.9. Taiwan

- 7.3.10. Thailand

- 7.3.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. MEP (Mec

- 8.1.2. Enterprise Asset Management

- 8.1.3. Other Hard FM Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Institutional

- 8.2.3. Public/Infrastructure

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Australia

- 8.3.2. China

- 8.3.3. India

- 8.3.4. Japan

- 8.3.5. Indonesia

- 8.3.6. Malaysia

- 8.3.7. Singapore

- 8.3.8. South Korea

- 8.3.9. Taiwan

- 8.3.10. Thailand

- 8.3.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. MEP (Mec

- 9.1.2. Enterprise Asset Management

- 9.1.3. Other Hard FM Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Institutional

- 9.2.3. Public/Infrastructure

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Australia

- 9.3.2. China

- 9.3.3. India

- 9.3.4. Japan

- 9.3.5. Indonesia

- 9.3.6. Malaysia

- 9.3.7. Singapore

- 9.3.8. South Korea

- 9.3.9. Taiwan

- 9.3.10. Thailand

- 9.3.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Indonesia Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. MEP (Mec

- 10.1.2. Enterprise Asset Management

- 10.1.3. Other Hard FM Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Institutional

- 10.2.3. Public/Infrastructure

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Australia

- 10.3.2. China

- 10.3.3. India

- 10.3.4. Japan

- 10.3.5. Indonesia

- 10.3.6. Malaysia

- 10.3.7. Singapore

- 10.3.8. South Korea

- 10.3.9. Taiwan

- 10.3.10. Thailand

- 10.3.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Malaysia Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. MEP (Mec

- 11.1.2. Enterprise Asset Management

- 11.1.3. Other Hard FM Services

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Commercial

- 11.2.2. Institutional

- 11.2.3. Public/Infrastructure

- 11.2.4. Industrial

- 11.2.5. Other End Users

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Australia

- 11.3.2. China

- 11.3.3. India

- 11.3.4. Japan

- 11.3.5. Indonesia

- 11.3.6. Malaysia

- 11.3.7. Singapore

- 11.3.8. South Korea

- 11.3.9. Taiwan

- 11.3.10. Thailand

- 11.3.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Singapore Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. MEP (Mec

- 12.1.2. Enterprise Asset Management

- 12.1.3. Other Hard FM Services

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Commercial

- 12.2.2. Institutional

- 12.2.3. Public/Infrastructure

- 12.2.4. Industrial

- 12.2.5. Other End Users

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Australia

- 12.3.2. China

- 12.3.3. India

- 12.3.4. Japan

- 12.3.5. Indonesia

- 12.3.6. Malaysia

- 12.3.7. Singapore

- 12.3.8. South Korea

- 12.3.9. Taiwan

- 12.3.10. Thailand

- 12.3.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. South Korea Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. MEP (Mec

- 13.1.2. Enterprise Asset Management

- 13.1.3. Other Hard FM Services

- 13.2. Market Analysis, Insights and Forecast - by End User

- 13.2.1. Commercial

- 13.2.2. Institutional

- 13.2.3. Public/Infrastructure

- 13.2.4. Industrial

- 13.2.5. Other End Users

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. Australia

- 13.3.2. China

- 13.3.3. India

- 13.3.4. Japan

- 13.3.5. Indonesia

- 13.3.6. Malaysia

- 13.3.7. Singapore

- 13.3.8. South Korea

- 13.3.9. Taiwan

- 13.3.10. Thailand

- 13.3.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Taiwan Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. MEP (Mec

- 14.1.2. Enterprise Asset Management

- 14.1.3. Other Hard FM Services

- 14.2. Market Analysis, Insights and Forecast - by End User

- 14.2.1. Commercial

- 14.2.2. Institutional

- 14.2.3. Public/Infrastructure

- 14.2.4. Industrial

- 14.2.5. Other End Users

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. Australia

- 14.3.2. China

- 14.3.3. India

- 14.3.4. Japan

- 14.3.5. Indonesia

- 14.3.6. Malaysia

- 14.3.7. Singapore

- 14.3.8. South Korea

- 14.3.9. Taiwan

- 14.3.10. Thailand

- 14.3.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Thailand Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - by Type

- 15.1.1. MEP (Mec

- 15.1.2. Enterprise Asset Management

- 15.1.3. Other Hard FM Services

- 15.2. Market Analysis, Insights and Forecast - by End User

- 15.2.1. Commercial

- 15.2.2. Institutional

- 15.2.3. Public/Infrastructure

- 15.2.4. Industrial

- 15.2.5. Other End Users

- 15.3. Market Analysis, Insights and Forecast - by Geography

- 15.3.1. Australia

- 15.3.2. China

- 15.3.3. India

- 15.3.4. Japan

- 15.3.5. Indonesia

- 15.3.6. Malaysia

- 15.3.7. Singapore

- 15.3.8. South Korea

- 15.3.9. Taiwan

- 15.3.10. Thailand

- 15.3.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Type

- 16. Rest of Asia Pacific Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - by Type

- 16.1.1. MEP (Mec

- 16.1.2. Enterprise Asset Management

- 16.1.3. Other Hard FM Services

- 16.2. Market Analysis, Insights and Forecast - by End User

- 16.2.1. Commercial

- 16.2.2. Institutional

- 16.2.3. Public/Infrastructure

- 16.2.4. Industrial

- 16.2.5. Other End Users

- 16.3. Market Analysis, Insights and Forecast - by Geography

- 16.3.1. Australia

- 16.3.2. China

- 16.3.3. India

- 16.3.4. Japan

- 16.3.5. Indonesia

- 16.3.6. Malaysia

- 16.3.7. Singapore

- 16.3.8. South Korea

- 16.3.9. Taiwan

- 16.3.10. Thailand

- 16.3.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Type

- 17. China Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 18. Japan Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 19. India Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 20. South Korea Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 21. Taiwan Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 22. Australia Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 23. Rest of Asia-Pacific Asia-Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 24. Competitive Analysis

- 24.1. Market Share Analysis 2024

- 24.2. Company Profiles

- 24.2.1 NCH Asia Pacific*List Not Exhaustive

- 24.2.1.1. Overview

- 24.2.1.2. Products

- 24.2.1.3. SWOT Analysis

- 24.2.1.4. Recent Developments

- 24.2.1.5. Financials (Based on Availability)

- 24.2.2 Honeywell International Inc

- 24.2.2.1. Overview

- 24.2.2.2. Products

- 24.2.2.3. SWOT Analysis

- 24.2.2.4. Recent Developments

- 24.2.2.5. Financials (Based on Availability)

- 24.2.3 Johnson Controls International

- 24.2.3.1. Overview

- 24.2.3.2. Products

- 24.2.3.3. SWOT Analysis

- 24.2.3.4. Recent Developments

- 24.2.3.5. Financials (Based on Availability)

- 24.2.4 Volvo CE

- 24.2.4.1. Overview

- 24.2.4.2. Products

- 24.2.4.3. SWOT Analysis

- 24.2.4.4. Recent Developments

- 24.2.4.5. Financials (Based on Availability)

- 24.2.5 Sodexo S A

- 24.2.5.1. Overview

- 24.2.5.2. Products

- 24.2.5.3. SWOT Analysis

- 24.2.5.4. Recent Developments

- 24.2.5.5. Financials (Based on Availability)

- 24.2.6 CBRE Group Inc

- 24.2.6.1. Overview

- 24.2.6.2. Products

- 24.2.6.3. SWOT Analysis

- 24.2.6.4. Recent Developments

- 24.2.6.5. Financials (Based on Availability)

- 24.2.7 Siemens AG

- 24.2.7.1. Overview

- 24.2.7.2. Products

- 24.2.7.3. SWOT Analysis

- 24.2.7.4. Recent Developments

- 24.2.7.5. Financials (Based on Availability)

- 24.2.8 Jones Lang LaSalle Incorporated (JLL)

- 24.2.8.1. Overview

- 24.2.8.2. Products

- 24.2.8.3. SWOT Analysis

- 24.2.8.4. Recent Developments

- 24.2.8.5. Financials (Based on Availability)

- 24.2.9 Fujitsu Limited

- 24.2.9.1. Overview

- 24.2.9.2. Products

- 24.2.9.3. SWOT Analysis

- 24.2.9.4. Recent Developments

- 24.2.9.5. Financials (Based on Availability)

- 24.2.10 Aden Group

- 24.2.10.1. Overview

- 24.2.10.2. Products

- 24.2.10.3. SWOT Analysis

- 24.2.10.4. Recent Developments

- 24.2.10.5. Financials (Based on Availability)

- 24.2.1 NCH Asia Pacific*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Hard Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Hard Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 44: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 45: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 49: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 53: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 55: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 57: Asia-Pacific Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Hard Facility Management Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Asia-Pacific Hard Facility Management Market?

Key companies in the market include NCH Asia Pacific*List Not Exhaustive, Honeywell International Inc, Johnson Controls International, Volvo CE, Sodexo S A, CBRE Group Inc, Siemens AG, Jones Lang LaSalle Incorporated (JLL), Fujitsu Limited, Aden Group.

3. What are the main segments of the Asia-Pacific Hard Facility Management Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Commercial Construction in the region; Escalated Demand for HVAC Services.

6. What are the notable trends driving market growth?

Growth of Commercial Construction.

7. Are there any restraints impacting market growth?

Supply Chain Disruption in the Region.

8. Can you provide examples of recent developments in the market?

July 2022: JLL India entered an agreement with Tata Power to campaign for green energy solutions in the real estate sector. Given that the real estate industry is responsible for around 40% of all greenhouse gas emissions, the industry must adopt green energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Hard Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Hard Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Hard Facility Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Hard Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence