Key Insights

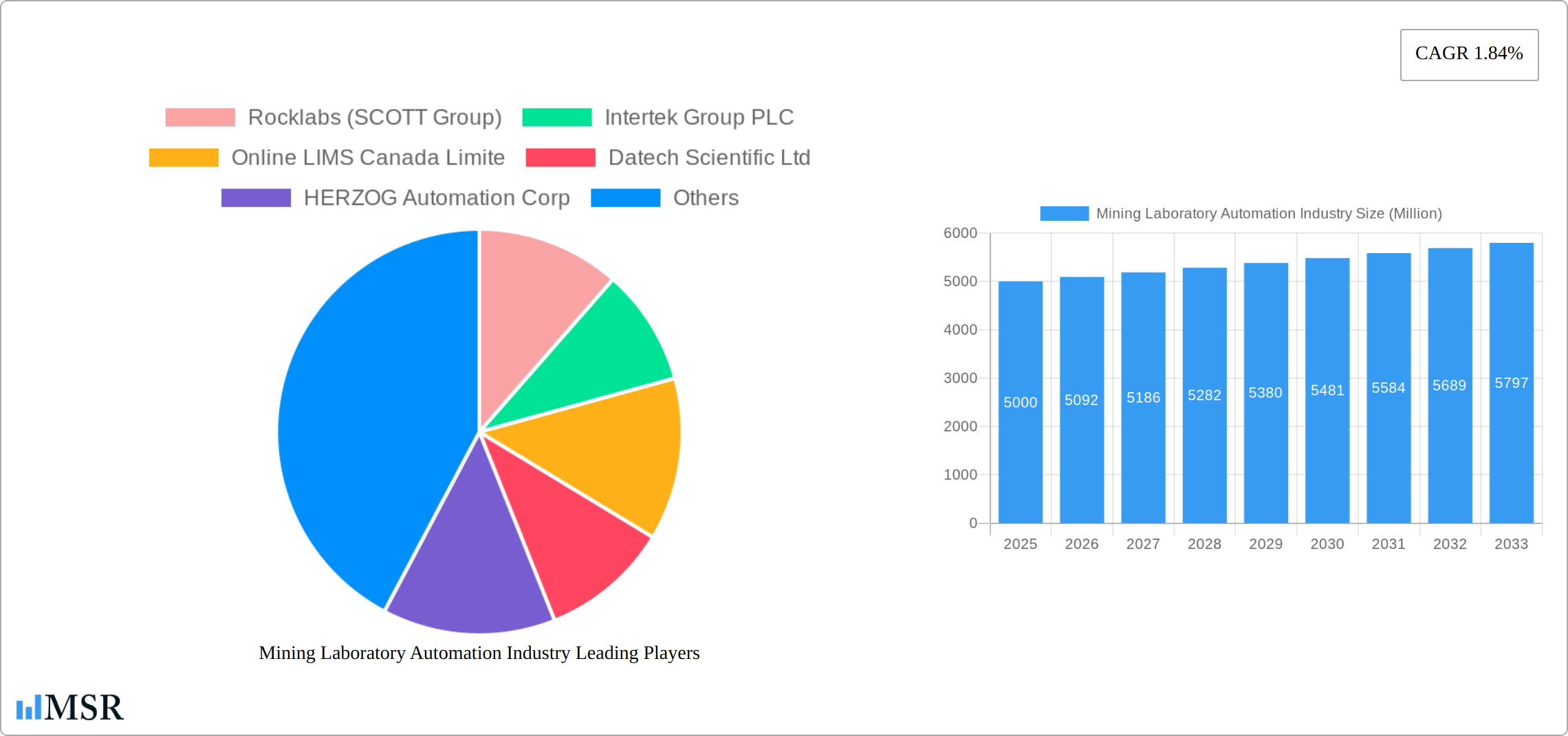

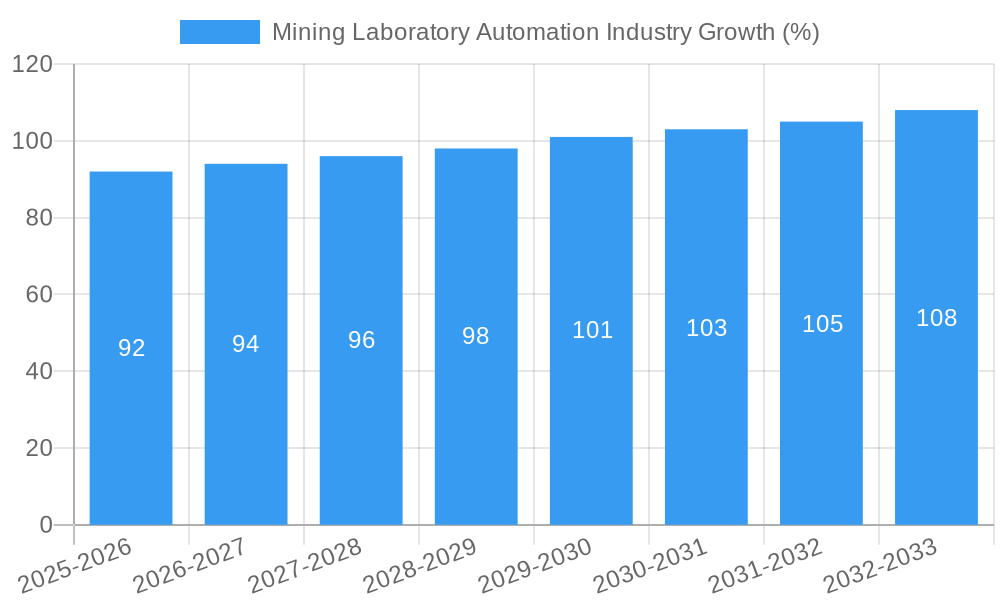

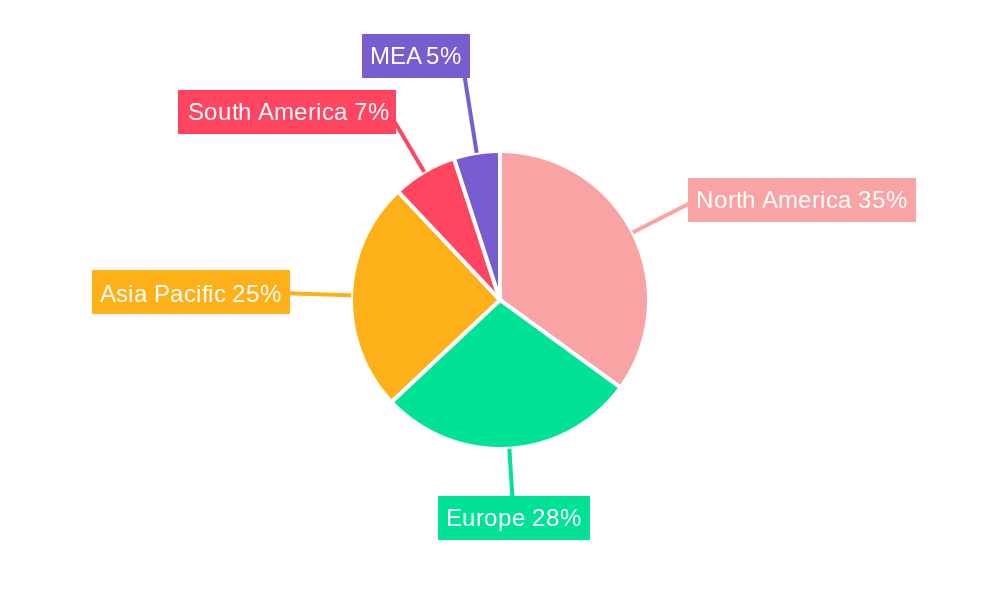

The global mining laboratory automation market is experiencing steady growth, projected at a CAGR of 1.84% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing demand for efficient and accurate mineral analysis necessitates automation to improve throughput and reduce human error. Secondly, stringent environmental regulations and the need for sustainable mining practices are pushing companies to adopt automation solutions for better data management and compliance. Thirdly, advancements in robotics, artificial intelligence, and laboratory information management systems (LIMS) are providing more sophisticated and integrated automation solutions, further fueling market expansion. The market is segmented by product type, encompassing robotics, LIMS, container laboratories, automated analyzers, and sample preparation equipment. While robotics and automated analyzers represent significant portions of the market, the demand for integrated LIMS solutions is rapidly rising, enabling seamless data flow and analysis across the entire laboratory workflow. Key players in this space, including Thermo Fisher Scientific, Bruker Corporation, and FLSmidth, are actively developing and integrating advanced technologies to maintain their competitive edge. Geographical expansion is also a key trend, with North America and Europe currently holding significant market share due to established mining operations and advanced infrastructure. However, the Asia-Pacific region is expected to experience notable growth driven by increasing mining activity and investments in technological upgrades. While the initial investment cost for automation can be high, the long-term benefits, including reduced operational costs, improved accuracy, and enhanced efficiency, are strong drivers of market adoption.

Despite the positive growth outlook, certain restraints exist. High implementation costs and the need for skilled personnel to operate and maintain automated systems can pose challenges for smaller mining companies. Furthermore, integrating new technologies into existing laboratory workflows can present significant operational hurdles. Addressing these challenges requires collaboration between technology providers and mining companies to develop customized solutions and comprehensive training programs. Overcoming these hurdles will be crucial for unlocking the full potential of mining laboratory automation and accelerating market growth in the coming years. The forecast period, 2025-2033, suggests continued expansion, with emerging markets in Asia-Pacific and South America expected to play a larger role as their mining sectors mature.

Mining Laboratory Automation Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Mining Laboratory Automation Industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of current market dynamics and future growth trajectories. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report analyzes key market segments, including Robotics, Laboratory Information Management Systems (LIMS), Container Laboratories, and Automated Analyzers and Sample Preparation Equipment, and profiles leading players such as Rocklabs (SCOTT Group), Intertek Group PLC, and Thermo Fisher Scientific Inc.

Mining Laboratory Automation Industry Market Concentration & Dynamics

The Mining Laboratory Automation industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. The market share of the top five players is estimated to be around xx%. Innovation is a key driver, with continuous advancements in robotics, LIMS software, and analytical equipment shaping the competitive landscape. Regulatory frameworks, particularly concerning environmental compliance and data security, heavily influence industry practices. Substitute products, such as traditional manual laboratory methods, are gradually being replaced by automated solutions driven by efficiency gains and accuracy improvements. End-user trends show a strong preference for integrated solutions that streamline workflows and reduce operational costs. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Share: Top 5 players: xx%

- M&A Activity (2019-2024): xx deals

- Key Regulatory Factors: Environmental regulations, data security standards.

- Substitute Products: Traditional manual laboratory methods.

Mining Laboratory Automation Industry Industry Insights & Trends

The Mining Laboratory Automation industry is experiencing robust growth, driven by increasing demand for efficient and accurate mineral analysis. The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033. Several factors contribute to this growth, including rising exploration activities, the increasing complexity of mining operations, and the need for enhanced data management. Technological advancements, particularly in automation and artificial intelligence (AI), are significantly impacting the industry, enabling higher throughput, improved accuracy, and reduced operational costs. Evolving consumer behavior, reflecting a preference for sustainable and environmentally responsible mining practices, further propels the adoption of automated solutions that minimize waste and improve resource utilization.

Key Markets & Segments Leading Mining Laboratory Automation Industry

The North American region currently dominates the Mining Laboratory Automation market, followed by Asia-Pacific. Within product segments, Automated Analyzers and Sample Preparation Equipment hold the largest market share, driven by their crucial role in accelerating sample processing and analysis. Robotics are witnessing increasing adoption, particularly in large-scale mining operations, to automate repetitive tasks and enhance safety. LIMS solutions are essential for managing the vast amounts of data generated in modern mining laboratories. Container laboratories, while a niche segment, are gaining traction for their ability to provide on-site analysis in remote locations.

- Dominant Region: North America

- Largest Segment: Automated Analyzers and Sample Preparation Equipment

- Key Growth Drivers:

- Increasing mining exploration and production activities.

- Growing demand for efficient and accurate mineral analysis.

- Technological advancements in automation and AI.

- Stringent environmental regulations.

Mining Laboratory Automation Industry Product Developments

Recent product innovations focus on integrating AI and machine learning capabilities into analytical instruments and LIMS software. This enhances the speed and accuracy of analysis, facilitating faster decision-making in mining operations. New robotic systems are being developed to handle more complex tasks, including sample preparation and automated instrument loading. These advancements provide mining companies with a competitive edge by improving efficiency, reducing costs, and enhancing data analysis capabilities.

Challenges in the Mining Laboratory Automation Industry Market

The Mining Laboratory Automation industry faces several challenges, including high initial investment costs for automation equipment and skilled labor shortages. Regulatory compliance and stringent safety standards add complexity. Supply chain disruptions and volatile raw material prices impact production costs, while intense competition necessitates continuous innovation to maintain market share. These challenges limit the market growth potential and need proactive strategies from industry players.

Forces Driving Mining Laboratory Automation Industry Growth

Key growth drivers include the increasing demand for higher throughput and improved accuracy in mineral analysis, driven by the growing complexity of mining operations. Technological advancements, like AI-powered analytics and automation, improve efficiency and reduce costs. Government initiatives supporting sustainable mining practices and stricter environmental regulations are indirectly boosting the adoption of automation technologies that improve resource utilization and minimize waste.

Long-Term Growth Catalysts in the Mining Laboratory Automation Industry

Long-term growth will be fueled by continuous innovation in automation technologies, particularly the integration of AI and machine learning for advanced data analytics. Strategic partnerships between automation equipment providers and mining companies will drive technology adoption. Expansion into new geographic markets and the development of customized solutions for specific mining applications will also contribute to sustainable growth.

Emerging Opportunities in Mining Laboratory Automation Industry

Emerging opportunities lie in the development of portable and mobile laboratory solutions for remote mining operations, and in the integration of blockchain technology for secure data management. The increasing demand for environmentally friendly and sustainable mining practices will also drive opportunities for the development of automated solutions that minimize environmental impact.

Leading Players in the Mining Laboratory Automation Industry Sector

- Rocklabs (SCOTT Group)

- Intertek Group PLC

- Online LIMS Canada Limite

- Datech Scientific Ltd

- HERZOG Automation Corp

- Thermo Fisher Scientific Inc

- FLSmidth A/S

- Nucomat

- Malvern Panalytical Ltd

- Bruker Corporation

Key Milestones in Mining Laboratory Automation Industry Industry

- June 2020: FLSmidth & Co. AS secured a contract with Gold Fields Limited for the Salares Norte project in Chile, supplying three system packages for a gold and silver processing plant expected to produce 2.6 Million ounces of silver and 286,000 ounces of gold annually for its first seven years. This showcases the significant investment in downstream gold processing automation.

- April 2020: Bruker Corporation launched the S2 PUMA Series 2 EDXRF spectrometer, featuring HighSense technology, resulting in a threefold increase in throughput and 40% faster evaluation times. This exemplifies the ongoing advancements in analytical instrumentation.

Strategic Outlook for Mining Laboratory Automation Industry Market

The Mining Laboratory Automation industry is poised for significant growth over the next decade, driven by the increasing demand for efficient and accurate mineral analysis, coupled with continuous technological advancements. Strategic partnerships and acquisitions will be key to expanding market share and developing innovative solutions. Companies that can adapt to changing regulatory landscapes and offer integrated, sustainable solutions will be best positioned to capitalize on the vast potential of this market.

Mining Laboratory Automation Industry Segmentation

-

1. Product

- 1.1. Robotics

- 1.2. Laboratory Information Management Systems (LIMS)

- 1.3. Container Laboratory

- 1.4. Automate

Mining Laboratory Automation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Mining Laboratory Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift From Traditional Practices to Automation; New and Innovative Solutions

- 3.3. Market Restrains

- 3.3.1. Higher Initial Setup Costs for Overall Module

- 3.4. Market Trends

- 3.4.1. Laboratory Information Management System Expected to Exhibit Maximum Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Robotics

- 5.1.2. Laboratory Information Management Systems (LIMS)

- 5.1.3. Container Laboratory

- 5.1.4. Automate

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Robotics

- 6.1.2. Laboratory Information Management Systems (LIMS)

- 6.1.3. Container Laboratory

- 6.1.4. Automate

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Robotics

- 7.1.2. Laboratory Information Management Systems (LIMS)

- 7.1.3. Container Laboratory

- 7.1.4. Automate

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Robotics

- 8.1.2. Laboratory Information Management Systems (LIMS)

- 8.1.3. Container Laboratory

- 8.1.4. Automate

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Robotics

- 9.1.2. Laboratory Information Management Systems (LIMS)

- 9.1.3. Container Laboratory

- 9.1.4. Automate

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Robotics

- 10.1.2. Laboratory Information Management Systems (LIMS)

- 10.1.3. Container Laboratory

- 10.1.4. Automate

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Mining Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Rocklabs (SCOTT Group)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Intertek Group PLC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Online LIMS Canada Limite

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Datech Scientific Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 HERZOG Automation Corp

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Thermo Fisher Scientific Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 FLSmidth A/S

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Nucomat

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Malvern Panalytical Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Bruker Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Rocklabs (SCOTT Group)

List of Figures

- Figure 1: Global Mining Laboratory Automation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mining Laboratory Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Mining Laboratory Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Mining Laboratory Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Mining Laboratory Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Mining Laboratory Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 23: Asia Pacific Mining Laboratory Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 24: Asia Pacific Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Mining Laboratory Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 27: Latin America Mining Laboratory Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 28: Latin America Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Mining Laboratory Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Middle East and Africa Mining Laboratory Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Middle East and Africa Mining Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East and Africa Mining Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa Mining Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 52: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 54: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 58: Global Mining Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mining Laboratory Automation Industry?

The projected CAGR is approximately 1.84%.

2. Which companies are prominent players in the Mining Laboratory Automation Industry?

Key companies in the market include Rocklabs (SCOTT Group), Intertek Group PLC, Online LIMS Canada Limite, Datech Scientific Ltd, HERZOG Automation Corp, Thermo Fisher Scientific Inc, FLSmidth A/S, Nucomat, Malvern Panalytical Ltd, Bruker Corporation.

3. What are the main segments of the Mining Laboratory Automation Industry?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift From Traditional Practices to Automation; New and Innovative Solutions.

6. What are the notable trends driving market growth?

Laboratory Information Management System Expected to Exhibit Maximum Share.

7. Are there any restraints impacting market growth?

Higher Initial Setup Costs for Overall Module.

8. Can you provide examples of recent developments in the market?

June 2020 - FLSmidth & Co. AS made a contract with a Gold fields project in Chile by selling three system packages to Gold Fields Limited for the Salares Norte project in Chile. The plant is expected to produce an average of 2.6 million ounces of silver and 286,000 ounces of gold annually during its first seven years in operation. The large Downstream Gold product line project comprises three complete process Islands: a Merrill Crowe, an AARLelution circuit, and a Refinery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mining Laboratory Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mining Laboratory Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mining Laboratory Automation Industry?

To stay informed about further developments, trends, and reports in the Mining Laboratory Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence