Key Insights

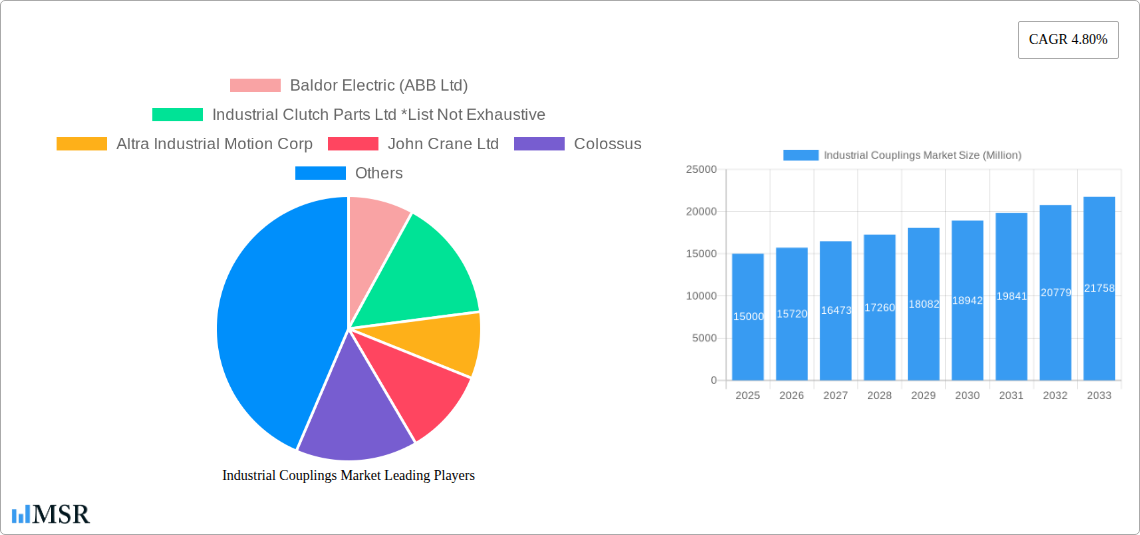

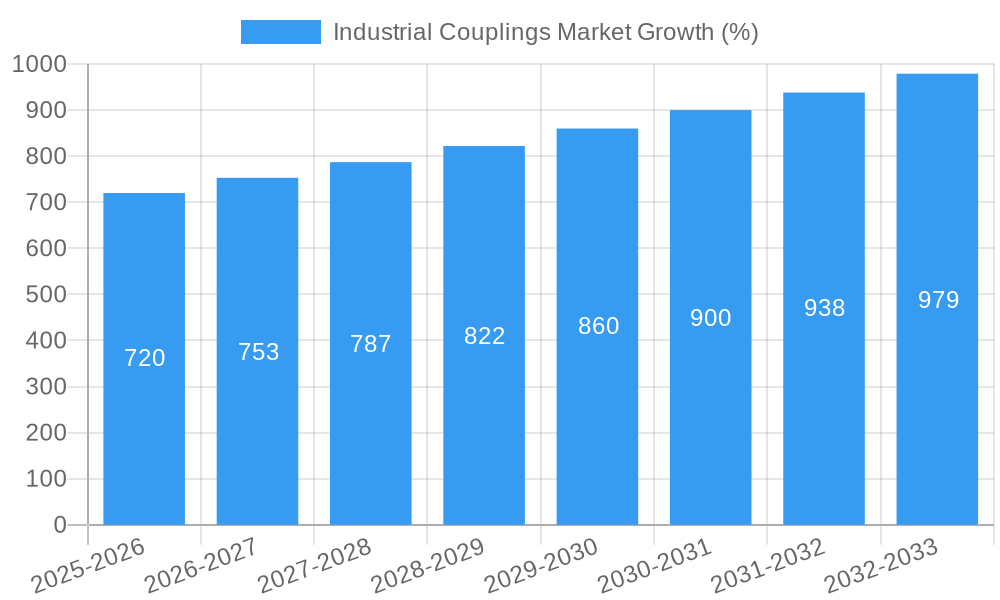

The global industrial couplings market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.80% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing automation across diverse industries, particularly in manufacturing, automotive, and energy sectors, necessitates efficient power transmission solutions, driving demand for industrial couplings. Furthermore, the rising adoption of sophisticated machinery and equipment in various sectors requires durable and reliable couplings capable of withstanding high loads and vibrations. Growth in renewable energy projects, including wind and solar power, also contributes to market expansion, as these projects utilize couplings in their energy generation and distribution systems. The market is segmented by type (flexible and rigid couplings) and end-user industry (automotive, healthcare, aerospace & defense, oil & gas, metal & mining, and others). Flexible couplings dominate due to their ability to accommodate misalignment and vibrations. The automotive industry is a major end-user, followed by the oil and gas sector, driven by the substantial use of couplings in pumps, compressors, and other critical equipment.

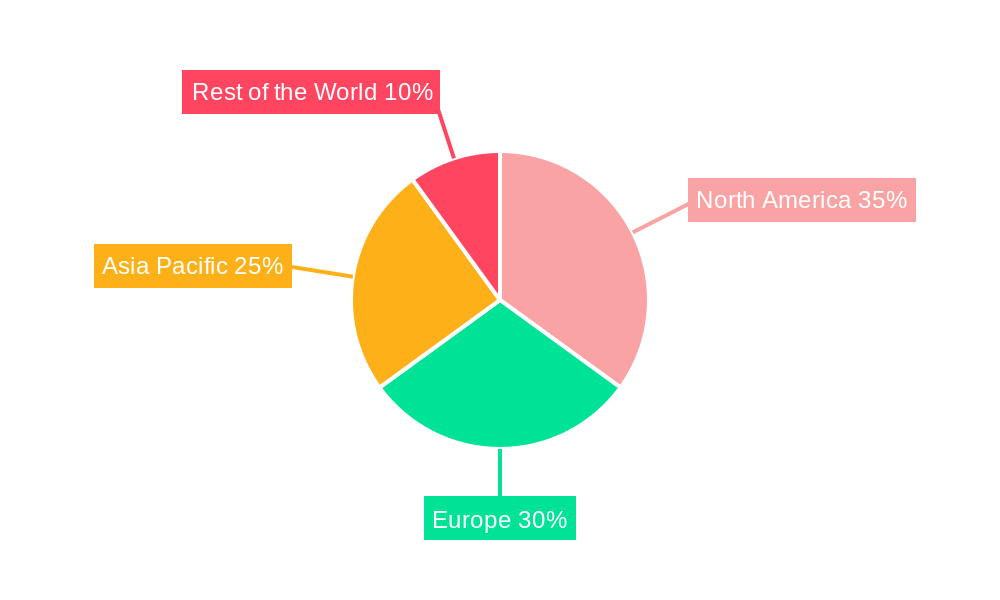

However, market growth faces some restraints. Fluctuations in raw material prices, particularly metals, can impact production costs and profitability. The cyclical nature of certain end-user industries, such as oil and gas, can lead to demand volatility. Furthermore, intense competition among numerous established players and emerging manufacturers requires continuous innovation and cost optimization strategies for sustained success. Companies like Baldor Electric (ABB Ltd), Altra Industrial Motion Corp, John Crane Ltd, Emerson Electric Co, Siemens AG, and Rexnord Corporation are key players shaping market dynamics through product innovation, strategic partnerships, and acquisitions. Geographical distribution sees North America and Europe holding significant market share currently, but the Asia-Pacific region is expected to witness the fastest growth due to rapid industrialization and infrastructure development. This creates opportunities for companies to expand their presence in emerging markets by catering to local needs and establishing strong distribution channels.

Unlock Growth Potential: A Comprehensive Analysis of the Industrial Couplings Market (2019-2033)

This meticulously researched report provides a deep dive into the Industrial Couplings Market, offering actionable insights for stakeholders across the value chain. Spanning the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamic landscape, growth drivers, and future opportunities. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key players like ABB Ltd, Altra Industrial Motion Corp, and Siemens AG are analyzed, alongside emerging trends and technological advancements.

Industrial Couplings Market Concentration & Dynamics

This section analyzes the competitive intensity and dynamics influencing the Industrial Couplings Market. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller players creates a dynamic and competitive environment. Market share data for key players will be detailed in the full report. Innovation is a key driver, with continuous development in materials, design, and functionalities. Regulatory frameworks, particularly concerning safety and environmental standards, exert a significant influence. Substitute products, such as alternative power transmission mechanisms, pose a challenge. End-user trends, especially toward automation and increased efficiency in various industries, are shaping demand. Mergers and acquisitions (M&A) activity has been relatively moderate, with xx M&A deals recorded between 2019 and 2024. The report includes a detailed analysis of:

- Market Concentration: Herfindahl-Hirschman Index (HHI) analysis and market share distribution among top players.

- Innovation Ecosystems: Analysis of R&D spending, patent filings, and collaborative partnerships.

- Regulatory Frameworks: Impact of safety standards and environmental regulations on market growth.

- Substitute Products: Evaluation of competitive threats from alternative power transmission technologies.

- End-User Trends: Analysis of evolving demand patterns across key industries.

- M&A Activities: Detailed overview of significant merger and acquisition transactions and their market implications.

Industrial Couplings Market Industry Insights & Trends

The global Industrial Couplings Market is experiencing robust growth driven by increasing industrialization, rising demand across diverse end-user industries, and technological advancements. The market size in 2024 was estimated at xx Million, and is projected to reach xx Million by 2025. Several key factors contribute to this growth trajectory:

- Expanding Industrial Automation: The growing adoption of automation and robotics in manufacturing and other industries significantly fuels demand for high-performance couplings.

- Infrastructure Development: Global infrastructure projects, particularly in developing economies, necessitate substantial investments in industrial machinery, driving demand for industrial couplings.

- Technological Advancements: Innovations in materials science and manufacturing processes lead to the development of more efficient, durable, and specialized couplings.

- Rising Energy Efficiency Demands: The growing need for improved energy efficiency across industries is driving demand for couplings that minimize energy loss during power transmission.

- Stringent Safety Regulations: The implementation of increasingly stringent safety regulations is pushing manufacturers to adopt advanced couplings that enhance operational safety.

Key Markets & Segments Leading Industrial Couplings Market

The report identifies key regions, countries, and segments exhibiting substantial growth within the Industrial Couplings Market. The Oil and Gas sector is a significant driver of demand, along with the Automotive industry. In terms of coupling types, the Flexible Coupling segment holds a dominant position due to its versatility and adaptability.

By Type:

- Flexible Couplings: Dominant due to versatility and ability to accommodate misalignment. Growth driven by increasing demand for smooth power transmission in industrial machinery.

- Rigid Couplings: Significant share, particularly in applications requiring precise alignment. Growth is driven by demand in high-precision manufacturing.

By End-user Industry:

- Automotive: Strong growth due to the increasing automation in manufacturing processes and the demand for advanced couplings in electric vehicles. Drivers include growing vehicle production, and the increasing demand for electric and hybrid vehicles.

- Oil and Gas: Significant market share driven by the demand for reliable and durable couplings in challenging environments. Drivers include exploration and production activities and the need for robust power transmission in harsh conditions.

- Metal and Mining: High demand for robust and durable couplings to withstand heavy loads and harsh operating conditions. Drivers include ongoing mining activities and rising metal demands.

- Aerospace and Defence: Growth is fueled by the increasing demand for reliable and high-performance couplings in aircraft and defense systems. Drivers include defense modernization programs and aerospace industry growth.

Geographic Dominance: Analysis will be included in the full report, highlighting regions with the highest market share and growth potential.

Industrial Couplings Market Product Developments

The Industrial Couplings Market is witnessing continuous product innovations, focusing on improved performance, durability, and efficiency. Recent advancements include the development of lightweight yet robust couplings using advanced materials and designs. These innovations cater to diverse applications, providing competitive advantages by enhancing operational efficiency, reducing maintenance costs, and minimizing downtime. The development of smart couplings that incorporate sensors for real-time monitoring and predictive maintenance further enhances their market appeal.

Challenges in the Industrial Couplings Market Market

Several factors pose challenges to the growth of the Industrial Couplings Market. Supply chain disruptions, particularly in the procurement of raw materials, impact production costs and delivery timelines. Intense competition among numerous players necessitates continuous innovation and cost optimization to maintain market share. Regulatory compliance concerning safety and environmental standards adds complexity to operations. Fluctuations in raw material prices directly influence production costs. The impact of these factors will be quantified in the full report.

Forces Driving Industrial Couplings Market Growth

Several key factors are driving the growth of the Industrial Couplings Market. The ongoing trend towards industrial automation in various sectors drives demand for efficient and reliable power transmission solutions. Government initiatives promoting infrastructure development further boost the market. Technological advancements, such as the development of smart and customized couplings, are improving efficiency and operational safety. The increasing focus on energy efficiency across industries drives the demand for low-energy-loss couplings.

Long-Term Growth Catalysts in the Industrial Couplings Market

Long-term growth in the Industrial Couplings Market will be fueled by strategic partnerships and collaborations among key players. Investments in research and development of advanced materials and designs will pave the way for innovative products. Expansion into new geographic markets with growing industrial sectors will unlock additional growth opportunities. The emergence of smart couplings, and the increasing adoption of Industry 4.0 principles, are also pivotal factors for long-term expansion.

Emerging Opportunities in Industrial Couplings Market

The Industrial Couplings Market presents promising opportunities in emerging economies with rapid industrialization. The rising adoption of electric vehicles (EVs) in the automotive sector creates significant demand for specific types of couplings. The growing need for sustainable and environmentally friendly manufacturing processes is driving demand for couplings designed to minimize energy consumption and waste. The development of customized couplings tailored to specific industry needs presents significant market potential.

Leading Players in the Industrial Couplings Market Sector

- Baldor Electric (ABB Ltd)

- Industrial Clutch Parts Ltd

- Altra Industrial Motion Corp

- John Crane Ltd

- Colossus

- Emerson Electric Co

- Siemens AG

- KTR Systems

- Baker Hughes Company

- Rexnord Corporation

Key Milestones in Industrial Couplings Market Industry

- July 2022: Altra Industrial Motion Corporation announced the development of custom gearboxes and gear couplings for the San Francisco Cable Car System. The Cable Car Barn Propulsion Gearbox Rehabilitation Project was recently finished by the San Francisco Municipal Transportation Agency (SFMTA). This highlights the increasing demand for customized solutions in specialized applications.

- May 2022: ASC Engineered Solutions announced a new flexible Gruvlok Fig. 70 SlideFLEX coupling. These couplings are ideal for use in mechanical and mining systems with an operating pressure of up to 1,000 psi. This signifies ongoing innovation in flexible coupling technology to meet the demands of high-pressure applications.

Strategic Outlook for Industrial Couplings Market Market

The Industrial Couplings Market is poised for sustained growth, driven by technological advancements and increasing industrialization globally. Strategic partnerships and collaborations among industry players will play a crucial role in shaping future market dynamics. Companies focusing on innovation, particularly in the development of smart and customized couplings, are well-positioned to capture significant market share. Expansion into emerging markets and focusing on sustainable solutions will also be key growth accelerators.

Industrial Couplings Market Segmentation

-

1. Type

- 1.1. Flexible Coupling

- 1.2. Rigid Coupling

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defence

- 2.4. Oil and Gas

- 2.5. Metal and Mining

- 2.6. Other End-user Industries

Industrial Couplings Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Couplings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in Various End-user Industries; Increased Investment in R&D leading to better Functionality

- 3.3. Market Restrains

- 3.3.1. ; High Initial Costs of Advanced Flow Sensor Products

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Coupling

- 5.1.2. Rigid Coupling

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defence

- 5.2.4. Oil and Gas

- 5.2.5. Metal and Mining

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Coupling

- 6.1.2. Rigid Coupling

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Healthcare

- 6.2.3. Aerospace and Defence

- 6.2.4. Oil and Gas

- 6.2.5. Metal and Mining

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Coupling

- 7.1.2. Rigid Coupling

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Healthcare

- 7.2.3. Aerospace and Defence

- 7.2.4. Oil and Gas

- 7.2.5. Metal and Mining

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Coupling

- 8.1.2. Rigid Coupling

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Healthcare

- 8.2.3. Aerospace and Defence

- 8.2.4. Oil and Gas

- 8.2.5. Metal and Mining

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible Coupling

- 9.1.2. Rigid Coupling

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Healthcare

- 9.2.3. Aerospace and Defence

- 9.2.4. Oil and Gas

- 9.2.5. Metal and Mining

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Baldor Electric (ABB Ltd)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Industrial Clutch Parts Ltd *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Altra Industrial Motion Corp

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 John Crane Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Colossus

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Emerson Electric Co

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Siemens AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 KTR Systems

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Baker Hughes Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Rexnord Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Baldor Electric (ABB Ltd)

List of Figures

- Figure 1: Global Industrial Couplings Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Couplings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Industrial Couplings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Couplings Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Industrial Couplings Market?

Key companies in the market include Baldor Electric (ABB Ltd), Industrial Clutch Parts Ltd *List Not Exhaustive, Altra Industrial Motion Corp, John Crane Ltd, Colossus, Emerson Electric Co, Siemens AG, KTR Systems, Baker Hughes Company, Rexnord Corporation.

3. What are the main segments of the Industrial Couplings Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in Various End-user Industries; Increased Investment in R&D leading to better Functionality.

6. What are the notable trends driving market growth?

Automotive Sector to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Initial Costs of Advanced Flow Sensor Products.

8. Can you provide examples of recent developments in the market?

July 2022 - Altra Industrial Motion Corporation announced the development of custom gearboxes and gear couplings for the San Francisco Cable Car System. The Cable Car Barn Propulsion Gearbox Rehabilitation Project was recently finished by the San Francisco Municipal Transportation Agency (SFMTA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Couplings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Couplings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Couplings Market?

To stay informed about further developments, trends, and reports in the Industrial Couplings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence