Key Insights

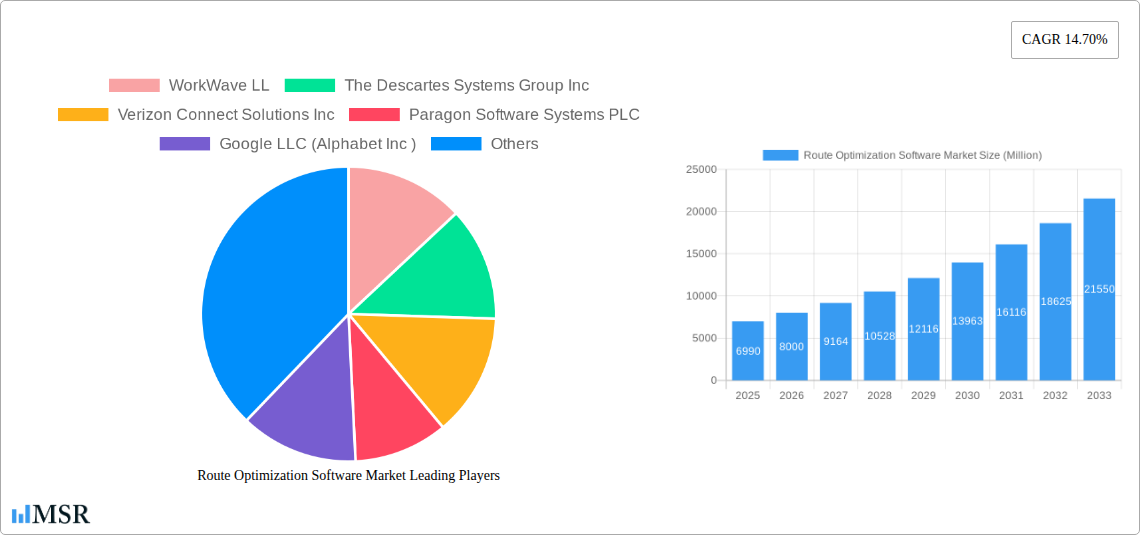

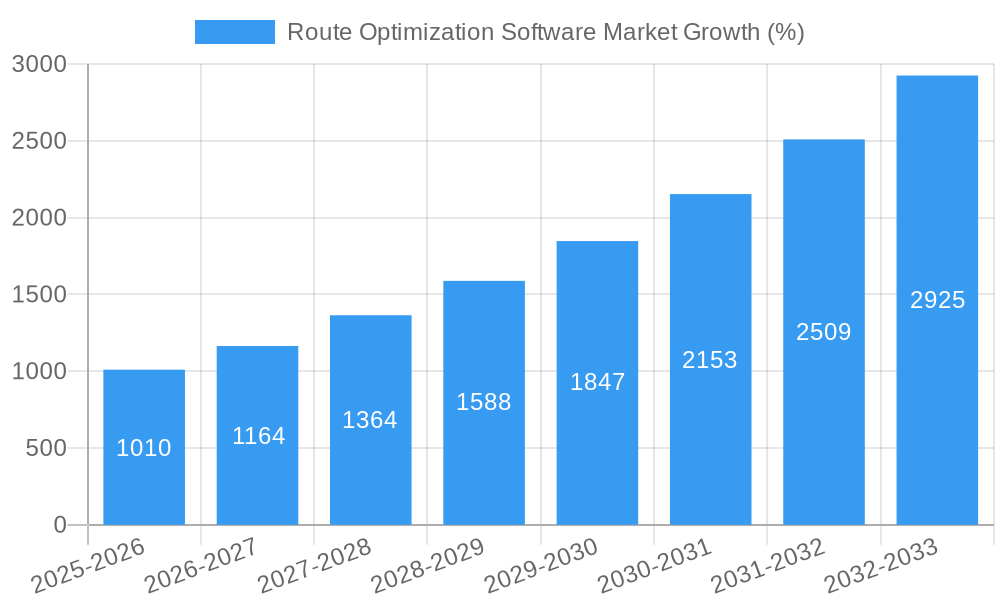

The Route Optimization Software market, valued at $6.99 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.70% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of e-commerce and on-demand services, particularly in the food delivery and retail sectors, necessitates efficient delivery routes to minimize costs and maximize customer satisfaction. Simultaneously, the rise of last-mile delivery challenges is pushing businesses to adopt sophisticated route optimization solutions to improve delivery times and reduce operational expenses. Furthermore, the growing integration of advanced technologies such as GPS tracking, AI-powered route planning, and real-time traffic data analysis further enhances the efficiency and effectiveness of these software solutions. The market is segmented by end-user vertical (on-demand food delivery, retail, field services, ride-hailing), organizational size (SME, large enterprises), and deployment mode (cloud, on-premise). The cloud deployment model is expected to dominate due to its scalability, cost-effectiveness, and accessibility. Major players like WorkWave, Descartes Systems Group, Verizon Connect, and others are actively shaping market dynamics through continuous innovation and strategic partnerships.

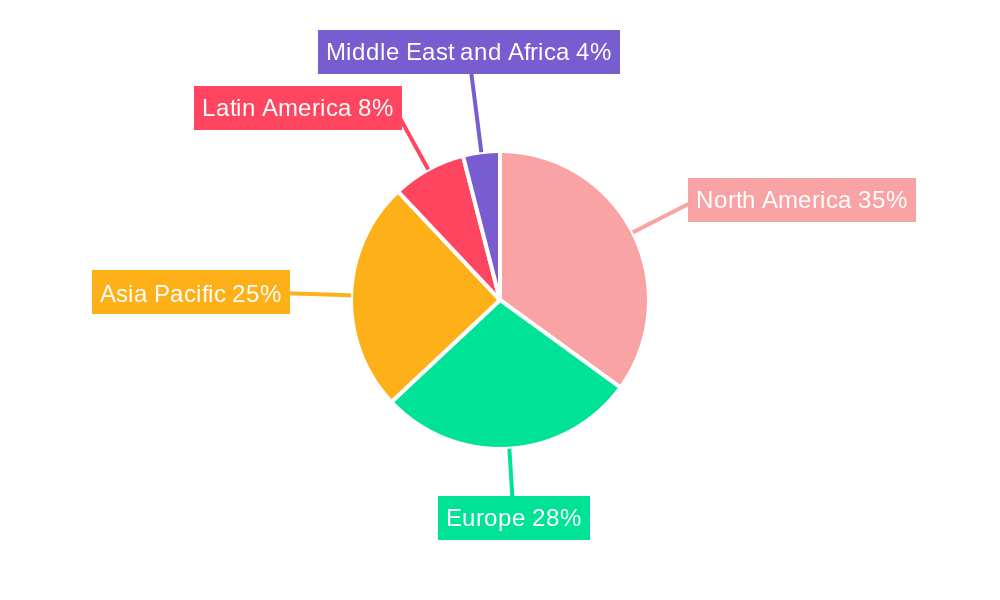

Competition within the market is intensifying, with established players facing challenges from emerging technology providers offering innovative solutions and improved functionalities. The market’s growth, however, isn't without constraints. High initial investment costs for implementing such software and the need for specialized technical expertise can act as barriers to entry for some businesses. Furthermore, data security concerns and integration complexities with existing systems remain significant hurdles. Nevertheless, the long-term prospects of the route optimization software market remain positive, driven by the increasing need for efficiency and cost optimization across various industries. The market is poised for significant expansion across North America, Europe, and the Asia-Pacific region, fuelled by growing digitalization and the expanding adoption of delivery-based business models.

Route Optimization Software Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Route Optimization Software Market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for businesses, investors, and stakeholders seeking actionable insights into this rapidly evolving market. The global market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period.

Route Optimization Software Market Market Concentration & Dynamics

The Route Optimization Software market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller players and continuous innovation fosters a dynamic competitive environment. Market concentration is influenced by factors such as technological advancements, M&A activities, and the evolving needs of diverse end-user verticals.

The innovation ecosystem is robust, characterized by ongoing R&D investments in AI, machine learning, and cloud-based solutions. Regulatory frameworks, varying across geographies, impact the adoption and implementation of route optimization software. Substitute products, such as traditional map-based route planning, pose a competitive threat, albeit a diminishing one as technology advances.

End-user trends reveal a growing preference for cloud-based solutions due to their scalability, cost-effectiveness, and ease of integration. Mergers and acquisitions (M&A) activities are frequent, with larger players acquiring smaller firms to expand their product portfolios and market reach.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024. (Data based on publicly available information and industry reports).

Route Optimization Software Market Industry Insights & Trends

The Route Optimization Software market is experiencing substantial growth, driven by several factors. The increasing adoption of e-commerce and on-demand services necessitates efficient delivery networks, significantly boosting demand for route optimization solutions. Furthermore, technological advancements, such as the integration of AI and machine learning, enhance route planning accuracy and efficiency, leading to cost savings and improved customer satisfaction.

The market expansion is further accelerated by rising fuel costs and stricter environmental regulations, prompting businesses to optimize routes to reduce fuel consumption and emissions. Evolving consumer behaviors, characterized by an expectation of faster and more reliable deliveries, put pressure on businesses to adopt advanced route optimization technologies. The global market size is expected to reach xx Million by 2033, propelled by the aforementioned drivers and a consistent CAGR.

The transition to cloud-based solutions presents a major technological disruption. This shift simplifies implementation, lowers upfront costs, and facilitates seamless integration with other business systems. Further, the increasing adoption of IoT devices and real-time data analytics contributes to the development of more sophisticated and responsive route optimization platforms.

Key Markets & Segments Leading Route Optimization Software Market

The Route Optimization Software market is segmented by end-user vertical, organization size, and deployment mode. While the market is geographically diverse, North America and Europe currently dominate due to high technological adoption and robust infrastructure.

By End-user Vertical:

- On-demand Food Delivery: This segment is a major growth driver due to the rapid expansion of food delivery platforms.

- Retail and FMCG: Businesses are actively seeking solutions to streamline supply chains and improve delivery efficiency.

- Field Services: Route optimization software is increasingly vital for managing field technicians and optimizing service schedules.

- Ride Hailing and Taxi Services: This sector benefits from optimized routes for drivers, reducing travel time and enhancing profitability.

- Other End-user Verticals: Logistics, transportation, and healthcare are showing increasing adoption.

By Size of the Organization:

- Large Enterprises: These companies are early adopters, leading to significant market share in this segment.

- Small and Medium Enterprises (SMEs): The adoption rate among SMEs is rising due to the affordability and accessibility of cloud-based solutions.

By Deployment Mode:

- Cloud: Cloud-based deployments dominate the market due to their scalability, flexibility, and cost-effectiveness.

- On-Premise: On-premise deployments are still relevant for enterprises with stringent data security and control requirements.

Drivers:

- Robust economic growth in developed economies.

- Expansion of e-commerce and on-demand services.

- Increasing adoption of cloud-based technologies.

- Stringent regulations focusing on emission reduction and fuel efficiency.

- Advancements in AI and machine learning leading to more efficient routing solutions.

Route Optimization Software Market Product Developments

Recent product innovations focus on enhancing the integration of AI and machine learning algorithms to provide real-time route optimization capabilities. These advancements allow for dynamic adjustments based on real-time traffic conditions, unexpected delays, and other unforeseen circumstances. This leads to greater efficiency, cost reduction, and improved customer experience. Moreover, seamless integration with various business software, such as CRM and ERP systems, further enhances the value and usability of these solutions. The competitive edge is largely driven by the accuracy, speed, and adaptability of algorithms and integration capabilities.

Challenges in the Route Optimization Software Market Market

The Route Optimization Software market faces several challenges. High initial investment costs and implementation complexities can be prohibitive for SMEs. Data security and privacy concerns are critical, especially with the increasing reliance on cloud-based solutions. The competitive landscape is intense, requiring continuous innovation to maintain a market edge. The lack of standardized data formats can hinder interoperability between different systems. The reliance on accurate real-time data for route optimization also represents a challenge. These factors could cumulatively impact market growth by approximately xx% by 2030 (estimated).

Forces Driving Route Optimization Software Market Growth

The market's growth is fueled by several key factors: the rise of e-commerce and on-demand services, technological advancements like AI and ML, the increasing need for efficient logistics and supply chain management, and growing environmental concerns pushing for fuel-efficient routes. Government regulations promoting sustainable transportation further accelerate adoption. For example, the EU's focus on reducing carbon emissions directly impacts the demand for optimized routing solutions.

Challenges in the Route Optimization Software Market Market

Long-term growth hinges on continued innovation in AI and machine learning, fostering more precise and adaptive route optimization. Strategic partnerships between software providers and logistics companies can unlock new market opportunities. Expansion into emerging markets with growing e-commerce and delivery services will play a significant role in long-term growth.

Emerging Opportunities in Route Optimization Software Market

The integration of advanced analytics and predictive modeling into route optimization platforms presents significant opportunities. The expansion into new verticals, such as healthcare and public transportation, offers untapped potential. The development of solutions tailored to specific industry needs, such as last-mile delivery optimization for e-commerce, will unlock further market growth. The development of environmentally conscious routing algorithms that prioritize fuel efficiency and reduced emissions will also present significant opportunities.

Leading Players in the Route Optimization Software Market Sector

- WorkWave LL

- The Descartes Systems Group Inc (Descartes Systems Group)

- Verizon Connect Solutions Inc (Verizon Connect)

- Paragon Software Systems PLC (Paragon Software Systems)

- Google LLC (Alphabet Inc ) (Google)

- PTV Planung Transport Verkehr GMBH (PTV Group)

- ESRI Global Inc (Esri)

- TrackoBit (InsightGeeks Solutions Pvt Ltd)

- Routific Solutions Inc (Routific)

- Microlise Group PLC (Microlise)

- Route4me LLC (Route4me)

- Omnitracs LLC (Omnitracs)

- Trimble Inc (Trimble)

- Caliper Corporation (Caliper)

- Ortec BV (Ortec)

Key Milestones in Route Optimization Software Market Industry

- October 2023: Google Maps launched AI-driven enhancements, including Immersive View and 3D tiles, improving route optimization capabilities.

- February 2024: Verizon Connect introduced customizable contract terms, enhancing customer flexibility and potentially boosting market adoption.

Strategic Outlook for Route Optimization Software Market Market

The Route Optimization Software market holds significant future potential, driven by continued technological advancements, expanding adoption across diverse sectors, and increasing demand for efficient and sustainable logistics solutions. Strategic opportunities lie in developing innovative solutions tailored to specific industry needs, leveraging AI and machine learning to enhance route optimization accuracy and efficiency, and forging strategic partnerships to expand market reach and integrate solutions into broader business ecosystems. The market's future success will depend on continuous innovation, adaptation to evolving market demands, and a focus on providing value-added solutions that improve efficiency and sustainability.

Route Optimization Software Market Segmentation

-

1. End-user Vertical

- 1.1. On-Demand Food Delivery

- 1.2. Retail and FMCG

- 1.3. Field Services

- 1.4. Ride Hailing and Taxi Services

- 1.5. Other End-user Verticals

-

2. Size of the Organization

- 2.1. Small and Medium Enterprise

- 2.2. Large Enterprises

-

3. Deployment Mode

- 3.1. Cloud

- 3.2. On-Premise

Route Optimization Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Route Optimization Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Logistics-Specific Solutions; Declining Hardware and Connectivity Costs

- 3.3. Market Restrains

- 3.3.1. Handling Structured and Unstructured Data

- 3.4. Market Trends

- 3.4.1. On-demand Food Delivery to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. On-Demand Food Delivery

- 5.1.2. Retail and FMCG

- 5.1.3. Field Services

- 5.1.4. Ride Hailing and Taxi Services

- 5.1.5. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 5.2.1. Small and Medium Enterprise

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. On-Demand Food Delivery

- 6.1.2. Retail and FMCG

- 6.1.3. Field Services

- 6.1.4. Ride Hailing and Taxi Services

- 6.1.5. Other End-user Verticals

- 6.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 6.2.1. Small and Medium Enterprise

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. Cloud

- 6.3.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. On-Demand Food Delivery

- 7.1.2. Retail and FMCG

- 7.1.3. Field Services

- 7.1.4. Ride Hailing and Taxi Services

- 7.1.5. Other End-user Verticals

- 7.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 7.2.1. Small and Medium Enterprise

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. Cloud

- 7.3.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia Pacific Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. On-Demand Food Delivery

- 8.1.2. Retail and FMCG

- 8.1.3. Field Services

- 8.1.4. Ride Hailing and Taxi Services

- 8.1.5. Other End-user Verticals

- 8.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 8.2.1. Small and Medium Enterprise

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. Cloud

- 8.3.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Latin America Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. On-Demand Food Delivery

- 9.1.2. Retail and FMCG

- 9.1.3. Field Services

- 9.1.4. Ride Hailing and Taxi Services

- 9.1.5. Other End-user Verticals

- 9.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 9.2.1. Small and Medium Enterprise

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. Cloud

- 9.3.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Middle East and Africa Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.1.1. On-Demand Food Delivery

- 10.1.2. Retail and FMCG

- 10.1.3. Field Services

- 10.1.4. Ride Hailing and Taxi Services

- 10.1.5. Other End-user Verticals

- 10.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 10.2.1. Small and Medium Enterprise

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.3.1. Cloud

- 10.3.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11. North America Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Route Optimization Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WorkWave LL

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 The Descartes Systems Group Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Verizon Connect Solutions Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Paragon Software Systems PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Google LLC (Alphabet Inc )

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PTV Planung Transport Verkehr GMBH

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ESRI Global Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 TrackoBit (InsightGeeks Solutions Pvt Ltd)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Routific Solutions Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Microlise Group PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Route4me LLC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Omnitracs LLC

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Trimble Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Caliper Corporation

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Ortec BV

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 WorkWave LL

List of Figures

- Figure 1: Route Optimization Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Route Optimization Software Market Share (%) by Company 2024

List of Tables

- Table 1: Route Optimization Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 3: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 4: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 5: Route Optimization Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Route Optimization Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Route Optimization Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Route Optimization Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Route Optimization Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Route Optimization Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 18: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 19: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 21: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 22: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 23: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 25: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 26: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 27: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 30: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 31: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Route Optimization Software Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 33: Route Optimization Software Market Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 34: Route Optimization Software Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 35: Route Optimization Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Route Optimization Software Market?

The projected CAGR is approximately 14.70%.

2. Which companies are prominent players in the Route Optimization Software Market?

Key companies in the market include WorkWave LL, The Descartes Systems Group Inc, Verizon Connect Solutions Inc, Paragon Software Systems PLC, Google LLC (Alphabet Inc ), PTV Planung Transport Verkehr GMBH, ESRI Global Inc, TrackoBit (InsightGeeks Solutions Pvt Ltd), Routific Solutions Inc, Microlise Group PLC, Route4me LLC, Omnitracs LLC, Trimble Inc, Caliper Corporation, Ortec BV.

3. What are the main segments of the Route Optimization Software Market?

The market segments include End-user Vertical, Size of the Organization, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Logistics-Specific Solutions; Declining Hardware and Connectivity Costs.

6. What are the notable trends driving market growth?

On-demand Food Delivery to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Handling Structured and Unstructured Data.

8. Can you provide examples of recent developments in the market?

February 2024 - Verizon Connect announced new customizable term options, enabling business owners and fleet managers to tailor their contracts better to match their company’s specific needs. When new customers in the US, the UK, and IE sign up for Verizon Connect Reveal fleet management solutions, they can now choose how long a commitment they want to make. In addition to introducing more flexible contracts, Verizon Connect is making it easier for customers by investing in multiple areas, such as seamless installation, training and onboarding, user experience, and customer support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Route Optimization Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Route Optimization Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Route Optimization Software Market?

To stay informed about further developments, trends, and reports in the Route Optimization Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence