Key Insights

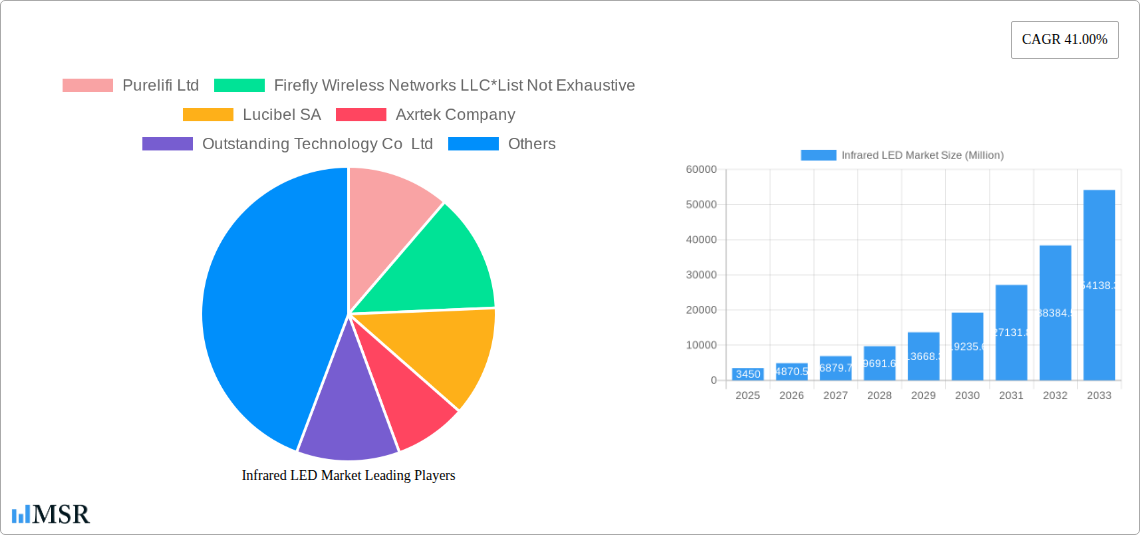

The infrared (IR) LED market is experiencing robust growth, projected to reach a market size of $3.45 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 41% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of IR LEDs in consumer electronics, particularly in smartphones for facial recognition and augmented reality applications, is a significant contributor. Furthermore, the defense and security sectors are leveraging IR technology for night vision, surveillance, and targeting systems, fueling market demand. The automotive industry's integration of IR LEDs in advanced driver-assistance systems (ADAS) and autonomous vehicles is another major growth driver. Growth within the public infrastructure sector stems from smart city initiatives, incorporating IR sensors for traffic management and environmental monitoring. Finally, the life sciences sector utilizes IR LEDs in medical imaging and diagnostics, contributing to the overall market expansion. Technological advancements in materials science leading to higher efficiency and lower cost IR LEDs are further enhancing market prospects.

Infrared LED Market Market Size (In Billion)

However, certain restraints exist. The high initial investment costs associated with adopting IR LED technology might deter some smaller businesses, particularly in developing economies. Additionally, the dependence on specialized manufacturing processes can limit widespread adoption, and the market's competitiveness can result in fluctuating prices. Segmentation analysis reveals that consumer electronics currently holds the largest market share, followed by defense and security. Light-emitting diodes (LEDs) are the dominant component, but the software and services segment is anticipated to experience strong growth due to increasing demand for integrated solutions. The bi-directional transmission type holds a larger market share compared to uni-directional, reflecting the growing preference for two-way communication in applications like remote controls and sensor networks. Leading companies such as Purelifi, Firefly Wireless Networks, and Philips are actively shaping market dynamics through innovation and strategic partnerships. The Asia-Pacific region, driven primarily by China and South Korea, is expected to lead the market growth, followed by North America, benefiting from technological advancements and robust R&D investments.

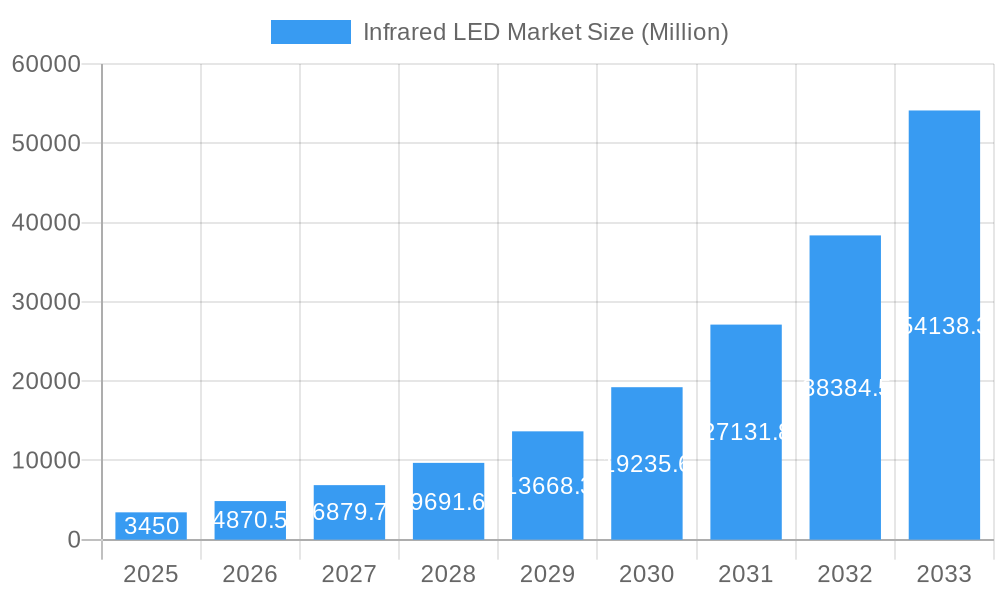

Infrared LED Market Company Market Share

Infrared LED Market Report: Unlocking Growth in Light Communication Technology (2019-2033)

This comprehensive report offers an in-depth analysis of the Infrared LED market, providing crucial insights for industry stakeholders seeking to capitalize on the burgeoning opportunities within this dynamic sector. Spanning the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, technological advancements, and competitive landscape. The report analyzes key segments including By Application (Consumer Electronics, Defense and Security, Transportation, Public Infrastructure, Life Sciences, Other Applications), By Component (Light Emitting Diodes, Photodetectors, Microcontrollers, Software and Services), and By Transmission Type (Uni-directional, Bi-directional). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Infrared LED Market Market Concentration & Dynamics

This section dissects the competitive landscape of the Infrared LED market, evaluating market concentration, innovation dynamics, regulatory influences, substitute product threats, end-user trends, and merger and acquisition (M&A) activity. The market exhibits a moderately concentrated structure, with key players such as Purelifi Ltd, Firefly Wireless Networks LLC, Lucibel SA, Axrtek Company, Outstanding Technology Co Ltd, LVX System, Koninklijke Philips NV, Oledcomm, Bytelight Inc (A Acuity Brand's Company), and Panasonic Corporation holding significant market share. However, the emergence of smaller, innovative companies is fostering competition and driving technological advancements.

The market share of the top 5 players is estimated at xx%, highlighting the presence of both established players and emerging innovators. The number of M&A deals in the Infrared LED sector over the past five years averaged xx per year, indicating a dynamic consolidation trend within the industry. Regulatory frameworks, particularly concerning data security and energy efficiency, are significantly influencing market dynamics. The ongoing development of alternative communication technologies presents both opportunities and challenges for Infrared LED players. Shifting end-user preferences towards faster, more energy-efficient communication solutions are impacting market demand.

Infrared LED Market Industry Insights & Trends

The Infrared LED market is experiencing robust growth, driven by several key factors. The increasing demand for high-speed, low-latency data transmission in various applications, coupled with the growing adoption of LiFi technology as a greener alternative to traditional Wi-Fi, is fueling market expansion. The market is witnessing significant technological disruptions, such as the development of higher-efficiency LEDs and improved data transmission protocols. The rising adoption of smart devices and the Internet of Things (IoT) is also contributing to the market's growth trajectory. Consumer preference for improved data security and energy-efficient communication is further accelerating demand for Infrared LED solutions. The global Infrared LED market size was valued at xx Million in 2024 and is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Key Markets & Segments Leading Infrared LED Market

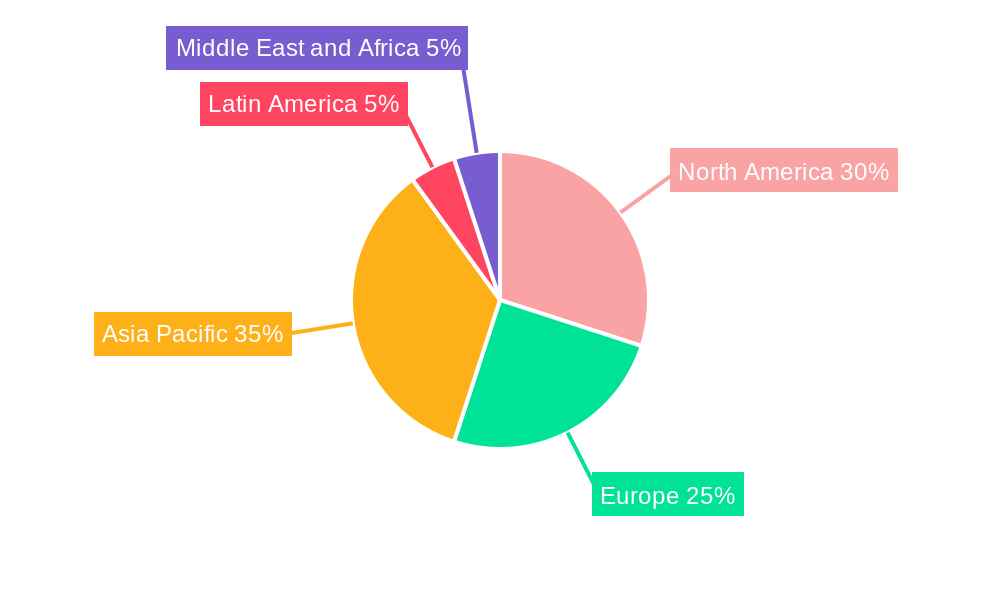

Dominant Regions/Countries: The North American and European regions currently dominate the Infrared LED market, driven by strong technological advancements and robust infrastructure development. However, the Asia-Pacific region is witnessing rapid growth, propelled by the expanding consumer electronics and IoT markets.

Dominant Application Segments: Consumer electronics accounts for the largest segment share, followed by defense and security and transportation. The demand for high-speed data communication in these sectors is driving the adoption of Infrared LED solutions.

Dominant Component Segments: Light Emitting Diodes (LEDs) constitute the largest segment within the market, representing xx% of total value. Photodetectors and microcontrollers are other critical components, while software and services are playing an increasingly important role in enhancing overall performance and accessibility.

Dominant Transmission Type: Bi-directional transmission solutions are gaining traction as the need for two-way communication increases across various applications.

Growth Drivers by Segment:

- Consumer Electronics: Increasing smartphone penetration, adoption of smart home devices, and demand for high-bandwidth communication.

- Defense and Security: Requirement for secure and reliable communication in sensitive environments, along with advanced surveillance technology implementation.

- Transportation: Growing demand for in-vehicle infotainment systems, autonomous driving capabilities, and improved vehicle-to-infrastructure communication.

- Public Infrastructure: Expansion of smart city initiatives and the deployment of advanced sensor networks for traffic management, environmental monitoring, and public safety.

- Life Sciences: Growing adoption of Infrared LED technology in medical imaging, diagnostic tools, and therapeutic applications.

Infrared LED Market Product Developments

Recent advancements in Infrared LED technology have focused on enhancing data transmission speeds, improving energy efficiency, and developing smaller, more compact devices. The introduction of Light Antenna ONE by pureLiFi, compliant with the upcoming IEEE 802.11bb standard, exemplifies the progress towards higher data rates and interoperability. Oledcomm's launch of LIFIMAX2G, showcasing a 2Gbps connection, represents a significant leap in performance. These developments underscore the industry's commitment to providing advanced solutions that cater to the evolving needs of various sectors.

Challenges in the Infrared LED Market Market

The Infrared LED market faces challenges including regulatory hurdles related to data security and spectrum allocation, potential supply chain disruptions impacting the availability of raw materials, and intensifying competition from established and emerging players. The xx% increase in raw material costs in 2024 significantly impacted production costs and profit margins. These factors pose obstacles to sustained market growth and necessitate innovative strategies for overcoming these challenges.

Forces Driving Infrared LED Market Growth

Technological advancements in LED materials and communication protocols, coupled with growing government support for smart city infrastructure initiatives, are significantly boosting Infrared LED adoption. The increasing demand for high-speed, secure, and energy-efficient data transmission across various sectors serves as a powerful growth catalyst. Furthermore, favorable regulatory frameworks that support the integration of LiFi technology further accelerate market expansion.

Long-Term Growth Catalysts in Infrared LED Market

Long-term growth in the Infrared LED market hinges on continued technological innovation, strategic partnerships between hardware and software providers, and the expansion into new and emerging markets. Further development of standards like IEEE 802.11bb will foster wider adoption and interoperability. Focusing on applications that offer unique value propositions beyond traditional communication will unlock new opportunities.

Emerging Opportunities in Infrared LED Market

Emerging opportunities lie in the integration of Infrared LED technology with IoT devices, the development of advanced sensing and imaging applications, and the expansion into new sectors like healthcare and industrial automation. The adoption of Infrared LED solutions in developing economies presents substantial growth potential. Meeting the growing need for secure and reliable communication in various sectors will define future success.

Leading Players in the Infrared LED Market Sector

- Purelifi Ltd

- Firefly Wireless Networks LLC

- Lucibel SA

- Axrtek Company

- Outstanding Technology Co Ltd

- LVX System

- Koninklijke Philips NV

- Oledcomm

- Bytelight Inc (A Acuity Brand's Company)

- Panasonic Corporation

Key Milestones in Infrared LED Market Industry

- March 2023: pureLiFi launched its Light Antenna ONE module for smartphones, leveraging LiFi technology and complying with the upcoming IEEE 802.11bb standard. This signifies a major step towards mainstream adoption of LiFi.

- January 2023: Oledcomm unveiled LIFIMAX2G, a 2Gbps LiFi solution, highlighting significant advancements in data transmission speed and energy efficiency within the LiFi ecosystem. This launch positions LiFi as a competitive alternative to radio waves and cables in high-bandwidth applications.

Strategic Outlook for Infrared LED Market Market

The Infrared LED market holds immense potential for future growth, driven by continuous technological innovations, strategic collaborations, and expansion into diverse sectors. Companies focused on developing energy-efficient, high-speed, and secure solutions will be best positioned to capture market share. Addressing the challenges related to standardization and interoperability will be key to unlocking the full potential of this technology.

Infrared LED Market Segmentation

-

1. Component

- 1.1. Light Emitting Diodes

- 1.2. Photodetectors

- 1.3. Microcontrollers

- 1.4. Software and Services

-

2. Transmission Type

- 2.1. Uni-directional

- 2.2. Bi-directional

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Defense and Security

- 3.3. Transportation

- 3.4. Public Infrastructure

- 3.5. Life Sciences

- 3.6. Other Applications

Infrared LED Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. South Korea

- 3.3. India

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Infrared LED Market Regional Market Share

Geographic Coverage of Infrared LED Market

Infrared LED Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 41.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Competition from other Wireless Communication Technologies; High Demand for Building Smart City Infrastructure

- 3.3. Market Restrains

- 3.3.1. Increasing Internet Penetration Leading to Online Media Solutions

- 3.4. Market Trends

- 3.4.1. The Consumer Electronics Segment is Anticipated to Witness a Significant Market Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Light Emitting Diodes

- 5.1.2. Photodetectors

- 5.1.3. Microcontrollers

- 5.1.4. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Transmission Type

- 5.2.1. Uni-directional

- 5.2.2. Bi-directional

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Defense and Security

- 5.3.3. Transportation

- 5.3.4. Public Infrastructure

- 5.3.5. Life Sciences

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Light Emitting Diodes

- 6.1.2. Photodetectors

- 6.1.3. Microcontrollers

- 6.1.4. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by Transmission Type

- 6.2.1. Uni-directional

- 6.2.2. Bi-directional

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Consumer Electronics

- 6.3.2. Defense and Security

- 6.3.3. Transportation

- 6.3.4. Public Infrastructure

- 6.3.5. Life Sciences

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Light Emitting Diodes

- 7.1.2. Photodetectors

- 7.1.3. Microcontrollers

- 7.1.4. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by Transmission Type

- 7.2.1. Uni-directional

- 7.2.2. Bi-directional

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Consumer Electronics

- 7.3.2. Defense and Security

- 7.3.3. Transportation

- 7.3.4. Public Infrastructure

- 7.3.5. Life Sciences

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Light Emitting Diodes

- 8.1.2. Photodetectors

- 8.1.3. Microcontrollers

- 8.1.4. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by Transmission Type

- 8.2.1. Uni-directional

- 8.2.2. Bi-directional

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Consumer Electronics

- 8.3.2. Defense and Security

- 8.3.3. Transportation

- 8.3.4. Public Infrastructure

- 8.3.5. Life Sciences

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Light Emitting Diodes

- 9.1.2. Photodetectors

- 9.1.3. Microcontrollers

- 9.1.4. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by Transmission Type

- 9.2.1. Uni-directional

- 9.2.2. Bi-directional

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Consumer Electronics

- 9.3.2. Defense and Security

- 9.3.3. Transportation

- 9.3.4. Public Infrastructure

- 9.3.5. Life Sciences

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Infrared LED Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Light Emitting Diodes

- 10.1.2. Photodetectors

- 10.1.3. Microcontrollers

- 10.1.4. Software and Services

- 10.2. Market Analysis, Insights and Forecast - by Transmission Type

- 10.2.1. Uni-directional

- 10.2.2. Bi-directional

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Consumer Electronics

- 10.3.2. Defense and Security

- 10.3.3. Transportation

- 10.3.4. Public Infrastructure

- 10.3.5. Life Sciences

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Purelifi Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Firefly Wireless Networks LLC*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lucibel SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Axrtek Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Outstanding Technology Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LVX System

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oledcomm

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bytelight Inc (A Acuity Brand's Company)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Purelifi Ltd

List of Figures

- Figure 1: Global Infrared LED Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Infrared LED Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Infrared LED Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Infrared LED Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 5: North America Infrared LED Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 6: North America Infrared LED Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Infrared LED Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Infrared LED Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Infrared LED Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Infrared LED Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Infrared LED Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Infrared LED Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 13: Europe Infrared LED Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 14: Europe Infrared LED Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Infrared LED Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Infrared LED Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Infrared LED Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Infrared LED Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific Infrared LED Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Infrared LED Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 21: Asia Pacific Infrared LED Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 22: Asia Pacific Infrared LED Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Infrared LED Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Infrared LED Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Infrared LED Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Infrared LED Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America Infrared LED Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Infrared LED Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 29: Latin America Infrared LED Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 30: Latin America Infrared LED Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Infrared LED Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Infrared LED Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Infrared LED Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Infrared LED Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Infrared LED Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Infrared LED Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 37: Middle East and Africa Infrared LED Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 38: Middle East and Africa Infrared LED Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Infrared LED Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Infrared LED Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Infrared LED Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 3: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Infrared LED Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 7: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Infrared LED Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 13: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Infrared LED Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 20: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Infrared LED Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 28: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 29: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Infrared LED Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Mexico Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Latin America Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Infrared LED Market Revenue Million Forecast, by Component 2020 & 2033

- Table 35: Global Infrared LED Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 36: Global Infrared LED Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Infrared LED Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Infrared LED Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared LED Market?

The projected CAGR is approximately 41.00%.

2. Which companies are prominent players in the Infrared LED Market?

Key companies in the market include Purelifi Ltd, Firefly Wireless Networks LLC*List Not Exhaustive, Lucibel SA, Axrtek Company, Outstanding Technology Co Ltd, LVX System, Koninklijke Philips NV, Oledcomm, Bytelight Inc (A Acuity Brand's Company), Panasonic Corporation.

3. What are the main segments of the Infrared LED Market?

The market segments include Component, Transmission Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Competition from other Wireless Communication Technologies; High Demand for Building Smart City Infrastructure.

6. What are the notable trends driving market growth?

The Consumer Electronics Segment is Anticipated to Witness a Significant Market Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Internet Penetration Leading to Online Media Solutions.

8. Can you provide examples of recent developments in the market?

March 2023: pureLiFi readied its light antenna module for smartphones. Light Antenna ONE from pureLiFi leverages Light Fidelity wireless communication technology to transmit data over visible light. It would comply with the upcoming IEEE 802.11bb Light Communication standard, which is in its final stages of ratification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrared LED Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrared LED Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrared LED Market?

To stay informed about further developments, trends, and reports in the Infrared LED Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence