Key Insights

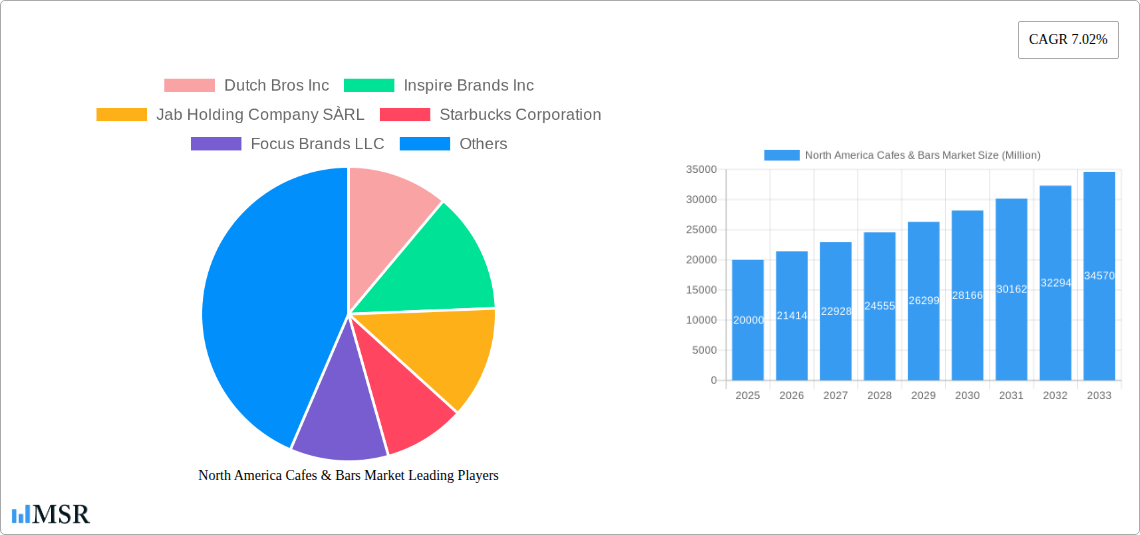

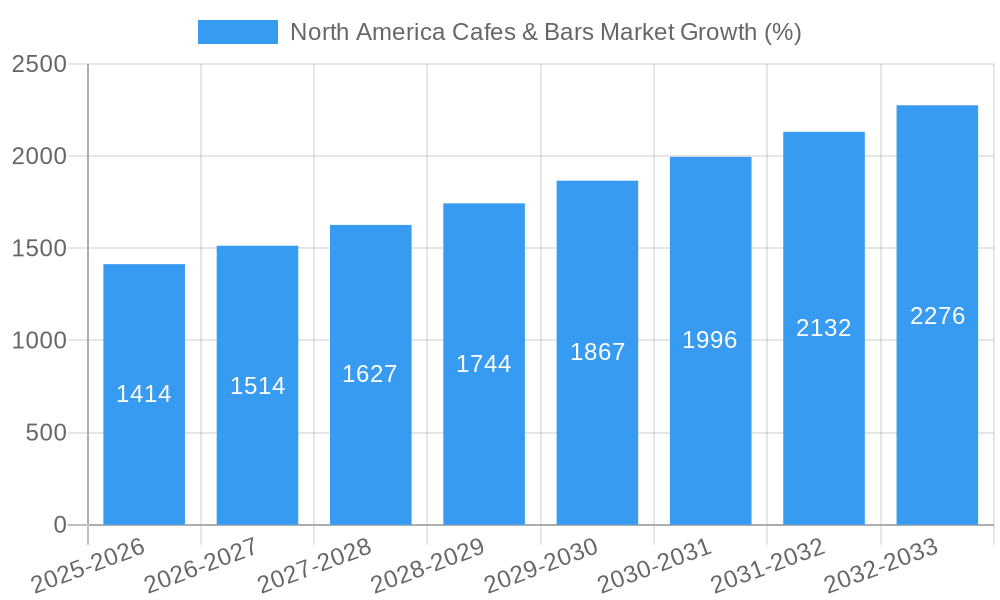

The North American cafes and bars market, encompassing diverse establishments from coffee shops and tea houses to pubs and smoothie bars, is experiencing robust growth. Driven by evolving consumer preferences for premium experiences, convenient grab-and-go options, and health-conscious choices, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.02% from 2025 to 2033. The market's segmentation reveals significant opportunities across various outlets, locations, and cuisines. Chained outlets, leveraging brand recognition and consistent quality, dominate market share, but independent outlets are also thriving, particularly those catering to niche markets or offering unique experiences. Location-wise, leisure and retail spaces represent key areas of growth, complemented by the increasing integration of cafes and bars within lodging establishments and travel hubs. The popularity of specialty coffee and tea shops, alongside the expanding demand for health-focused options like juice and smoothie bars, reflects a growing emphasis on healthier lifestyles and premium beverages. Competition is fierce, with established players like Starbucks and McDonald's alongside smaller, rapidly-growing chains competing for market share.

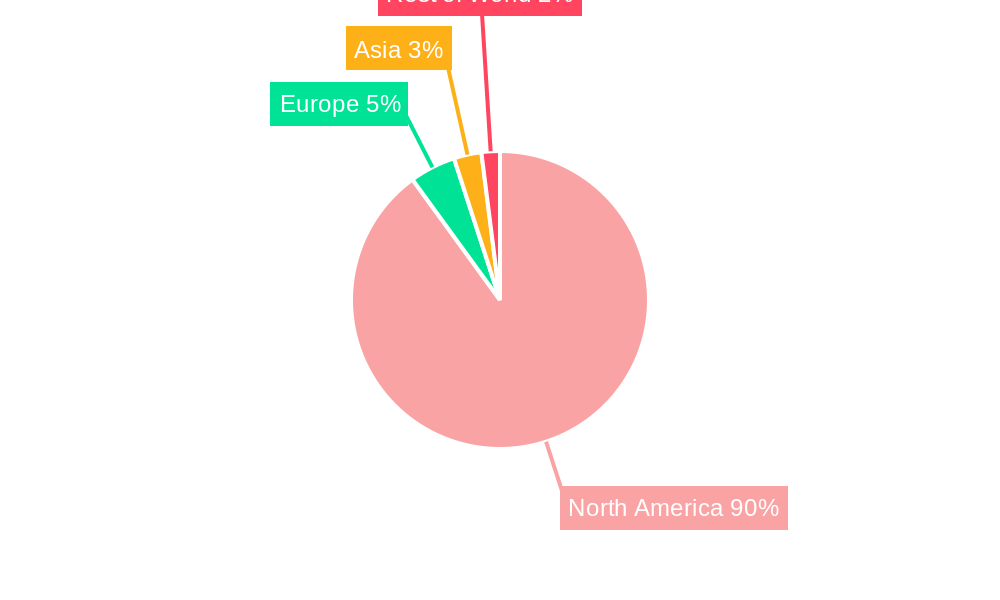

Regional variations exist within North America. The United States, with its large and diverse population, forms the largest market segment, followed by Canada and Mexico. Growth in the Rest of North America region is expected to be slightly slower due to smaller population sizes and potentially lower per capita spending on food and beverage services. However, strategic expansion by established players and emerging local chains is likely to fuel gradual growth in this segment as well. Key restraints on market growth include rising input costs (especially for coffee beans and other ingredients), labor shortages within the hospitality industry, and increasing competition. Nevertheless, the market’s overall positive outlook is underpinned by consumer demand for diverse and high-quality food and beverage experiences, sustained economic growth in many parts of North America, and continued innovation in both offerings and service models.

North America Cafes & Bars Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America cafes & bars market, offering a comprehensive overview of market dynamics, key segments, leading players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic sector. The report utilizes rigorous data analysis to project a market size of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Cafes & Bars Market Market Concentration & Dynamics

The North America cafes & bars market is characterized by a mix of large multinational chains and numerous independent operators. Market concentration is moderate, with a few dominant players holding significant market share, while independent outlets continue to thrive, particularly in niche segments. The market exhibits a dynamic innovation ecosystem, with constant introduction of new beverages, food items, and service models. Regulatory frameworks, varying across different states and provinces, significantly influence operational costs and expansion strategies. Substitute products, including home brewing and alternative beverage options, pose a competitive challenge, demanding continuous product innovation and differentiation. Evolving consumer preferences, driven by health consciousness and experiential consumption, shape market trends. Mergers and acquisitions (M&A) activity is relatively high, with larger players strategically expanding their portfolios through acquisitions of smaller chains and promising brands. For example, the number of M&A deals in the sector from 2021-2024 was approximately xx, indicating robust consolidation. Starbucks Corporation and McDonald's Corporation command significant market share, approximately xx% and xx% respectively, while other major players like Dutch Bros Inc. and Restaurant Brands International Inc. hold substantial shares. The ongoing M&A activity suggests a trend toward further market consolidation and an evolving competitive landscape.

North America Cafes & Bars Market Industry Insights & Trends

The North America cafes & bars market has witnessed robust growth over the historical period (2019-2024), driven primarily by the increasing demand for convenient and high-quality food and beverage options, rising disposable incomes, and the evolving consumer preference for out-of-home experiences. The market size in 2024 was estimated at xx Million, reflecting a significant expansion since 2019. The market's growth is fueled by several key factors: a growing millennial and Gen Z population with high disposable incomes, the increasing popularity of specialty coffee and tea, and the expansion of both chained and independent outlets in various locations. Technological disruptions, such as mobile ordering and loyalty programs, have further enhanced customer convenience and engagement. Consumer behaviour is evolving towards healthier options and personalized experiences, creating opportunities for cafes and bars offering customized and nutritious products. This has spurred cafes and bars to invest heavily in developing tailored food and beverage offerings. The growth is expected to continue in the forecast period (2025-2033), driven by ongoing innovations in product offerings, increasing urbanization, and the growth of the tourism industry.

Key Markets & Segments Leading North America Cafes & Bars Market

The United States represents the largest market within North America, followed by Canada and Mexico. The chained outlet segment holds a dominant market share compared to independent outlets. While standalone locations are most prevalent, growth in leisure and travel locations is driving market expansion.

Leading Segments & Drivers:

- Country: United States (Strong economic growth, high disposable incomes, large population)

- Outlet: Chained Outlets (Brand recognition, established supply chains, efficient operations)

- Location: Standalone (High visibility, greater control over operations) and Leisure (Growing tourism and entertainment sectors)

- Cuisine: Cafes (High demand for coffee, tea, and pastries), Specialist Coffee & Tea Shops (Niche appeal and premium pricing strategies)

The dominance of the US market stems from its large population, robust economy, and high coffee and beverage consumption rate. The popularity of chained outlets reflects consumers' preference for established brands and consistent quality. The growth of leisure and travel locations highlights the importance of convenient and accessible options in high-traffic areas.

North America Cafes & Bars Market Product Developments

Recent years have witnessed significant product innovations, including the rise of plant-based alternatives, customized beverages, and technological integrations like mobile ordering and loyalty programs. Companies are enhancing their offerings by introducing unique flavors, healthier options, and personalized experiences to cater to evolving consumer tastes. These advancements provide competitive edges in a crowded market. The emphasis on sustainability and ethically sourced ingredients is also driving product development strategies.

Challenges in the North America Cafes & Bars Market Market

The North America cafes & bars market faces several challenges. Labor shortages and rising labor costs are impacting profitability, particularly for smaller businesses. Supply chain disruptions and increasing ingredient prices pose significant cost pressures. Intense competition from both established chains and independent operators requires continuous innovation and differentiation to maintain market share. Stricter regulations around food safety and hygiene standards add to operational complexity and costs, particularly in the independent outlet segment. These challenges have resulted in a roughly xx% increase in operational costs for many businesses.

Forces Driving North America Cafes & Bars Market Growth

Several factors contribute to the continued growth of the North America cafes & bars market. Rising disposable incomes, particularly among younger demographics, fuel spending on out-of-home experiences. Urbanization and population growth provide a broader customer base for new outlets. Technological advancements, such as advanced brewing equipment and efficient point-of-sale systems, enhance productivity and reduce operating costs. Government initiatives supporting small businesses and local entrepreneurs also foster market expansion.

Long-Term Growth Catalysts in the North America Cafes & Bars Market

Long-term growth will be fueled by continuous innovation in product offerings, including health-conscious and sustainable choices. Strategic partnerships, such as collaborations with technology providers and ingredient suppliers, will enhance efficiency and reach. Expansion into new markets and geographic regions, particularly within underserved areas, presents significant opportunities for growth.

Emerging Opportunities in North America Cafes & Bars Market

Emerging opportunities include the growing demand for personalized experiences and customized beverages, creating a need for flexible and responsive service models. The expansion of drive-through and delivery services caters to consumer preferences for convenience. The increasing popularity of plant-based and allergen-free options provides opportunities for businesses to tap into growing health-conscious demographics. Integration of technology, such as AI-powered recommendation systems, will enhance customer engagement and operational efficiency.

Leading Players in the North America Cafes & Bars Market Sector

- Dutch Bros Inc

- Inspire Brands Inc

- Jab Holding Company SÀRL

- Starbucks Corporation

- Focus Brands LLC

- Restaurant Brands International Inc

- McDonald's Corporation

- Smoothie King Franchises Inc

- MTY Food Group Inc

- Tropical Smoothie Cafe LL

- International Dairy Queen Inc

Key Milestones in North America Cafes & Bars Market Industry

- August 2023: Baskin-Robbins franchise agreement with McMaster Group Holdings for 25 new shops in Canada (Vancouver and Calgary). This expansion reflects the continued demand for ice cream and dessert options within the broader cafes and bars market.

- January 2023: Dutch Bros launched White Chocolate Lavender across 650 locations. This new product offering demonstrates the ongoing innovation within the specialty coffee segment, driving customer interest and market competition.

- December 2022: Dutch Bros launched eight classic drinks with sugar-free options. This caters to the growing demand for healthier beverage choices, a key trend influencing the cafes and bars industry.

Strategic Outlook for North America Cafes & Bars Market Market

The North America cafes & bars market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic investments by key players. Future market potential hinges on the ability of companies to adapt to changing consumer demands, invest in innovative products and services, and efficiently manage operational challenges. Strategic opportunities lie in expanding into new markets, leveraging technology to enhance customer experiences, and building strong brands that resonate with evolving consumer values.

North America Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

North America Cafes & Bars Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. United States North America Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Dutch Bros Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Inspire Brands Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jab Holding Company SÀRL

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Starbucks Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Focus Brands LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Restaurant Brands International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 McDonald's Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Smoothie King Franchises Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MTY Food Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Tropical Smoothie Cafe LL

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 International Dairy Queen Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Dutch Bros Inc

List of Figures

- Figure 1: North America Cafes & Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cafes & Bars Market Share (%) by Company 2024

List of Tables

- Table 1: North America Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: North America Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: North America Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: North America Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 12: North America Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: North America Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: North America Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cafes & Bars Market?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the North America Cafes & Bars Market?

Key companies in the market include Dutch Bros Inc, Inspire Brands Inc, Jab Holding Company SÀRL, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, MTY Food Group Inc, Tropical Smoothie Cafe LL, International Dairy Queen Inc.

3. What are the main segments of the North America Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

August 2023: Baskin-Robbins entered a franchise development agreement with real estate and franchise operator McMaster Group Holdings to further expand the ice cream brand in Canada. The agreement was done with plans to open 25 new shops in the Vancouver and Calgary markets.January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the North America Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence