Key Insights

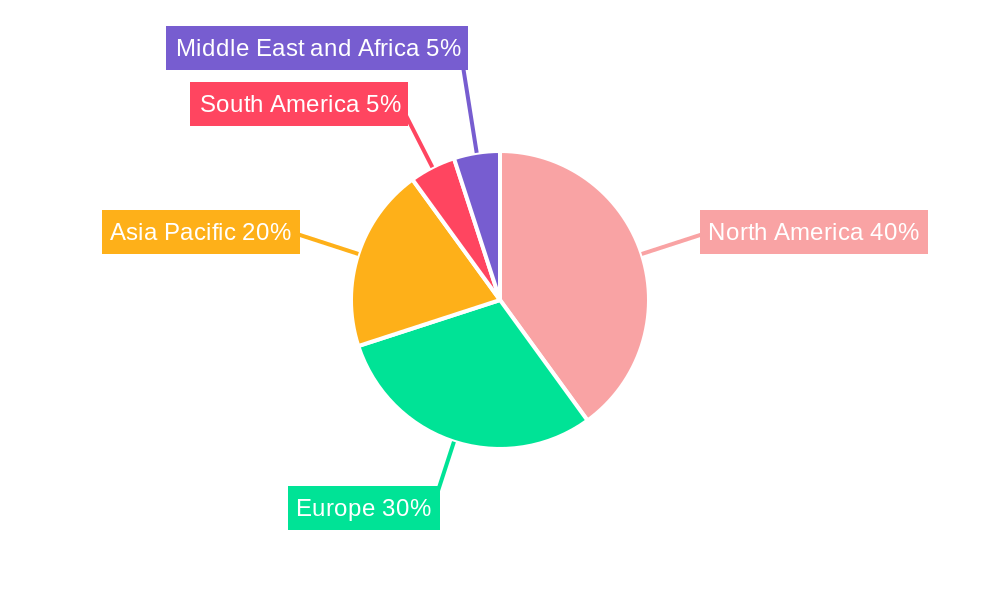

The global nutritional supplements market, valued at $139.38 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key drivers. Rising health consciousness among consumers, coupled with increasing prevalence of chronic diseases like diabetes and cardiovascular conditions, is driving demand for supplements targeting specific health needs. The growing popularity of functional foods and beverages further contributes to market growth, as consumers seek convenient ways to enhance their nutritional intake. Moreover, the expanding online retail channels offer increased accessibility and convenience, boosting sales. Significant regional variations exist; North America and Europe currently dominate the market, but the Asia-Pacific region is poised for significant growth driven by rising disposable incomes and increasing awareness of health and wellness. Key product segments include vitamins and minerals, herbal supplements, and protein products, each catering to different consumer needs and health goals. The market's growth, however, isn't without challenges. Concerns regarding the efficacy and safety of certain supplements, coupled with stringent regulatory requirements in some regions, can impede market expansion.

The competitive landscape is characterized by a mix of large multinational corporations and smaller specialized companies. Major players like Abbott Nutrition, Bayer AG, and Glanbia PLC leverage their extensive distribution networks and established brand reputations to maintain market share. However, smaller companies are gaining traction by focusing on niche segments and innovative product offerings. Product innovation, such as the development of targeted supplements and convenient delivery formats (e.g., gummies, powders), is crucial for attracting consumers and maintaining a competitive edge. Future growth will likely be shaped by personalized nutrition approaches, utilizing advancements in genetic testing and data analytics to tailor supplement recommendations to individual needs. The market will also witness increased focus on sustainability and transparency, with consumers demanding eco-friendly packaging and ethically sourced ingredients. Furthermore, the integration of technology, such as telemedicine and personalized health apps, is expected to further enhance market growth and accessibility.

Nutritional Supplements Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global nutritional supplements market, encompassing market size, growth drivers, key players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The global market is projected to reach $xx Million by 2033.

Nutritional Supplements Industry Market Concentration & Dynamics

The nutritional supplements market is a dynamic blend of large multinational corporations and smaller, specialized players. Market concentration is moderate, but the competitive landscape is intensifying. While precise market share figures fluctuate, the top 10 companies held an estimated X% of the global market share in 2024 (Source needed). Key players include Suntory Holdings Ltd, Amway Corporation, Bayer AG, Abbott Nutrition, Glanbia PLC, Haleon Plc, Herbalife Nutrition, Otsuka Holdings Co Ltd, The Bountiful Company, and Pfizer Inc., alongside numerous other significant competitors. This industry thrives on a robust innovation ecosystem, fueled by ongoing research and development in novel formulations, advanced delivery systems, and the incorporation of functional ingredients with proven efficacy.

Regulatory landscapes vary significantly across different regions, influencing product approvals, labeling standards, and overall market access. The market faces competition from substitute products like functional foods and beverages. However, strong growth drivers include escalating consumer demand for personalized nutrition, proactive healthcare measures, and a growing awareness of the role of supplements in overall wellness. Mergers and acquisitions (M&A) activity has been substantial, with an estimated XX M&A deals recorded between 2019 and 2024 (Source needed), indicating a trend toward industry consolidation and expansion strategies among leading players. This activity reflects the strategic importance of securing market share and technological advancements.

- Estimated Market Share (2024): Top 10 companies: X% (Source needed)

- Estimated M&A Deal Count (2019-2024): XX (Source needed)

Nutritional Supplements Industry Insights & Trends

The global nutritional supplements market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily driven by rising health consciousness, an aging global population, increasing prevalence of chronic diseases, and growing adoption of preventive healthcare measures. Technological advancements, such as personalized nutrition and targeted delivery systems, are further fueling market expansion. Consumer behavior is shifting towards more natural, organic, and transparent products, influencing product development and marketing strategies. The market size in 2025 is estimated to be $xx Million.

Key Markets & Segments Leading Nutritional Supplements Industry

The North American region currently dominates the global nutritional supplements market, followed by Europe and Asia Pacific. Within segments:

- Type: Vitamins & Minerals remains the largest segment, driven by widespread awareness of their health benefits. However, segments like Prebiotics & Probiotics and Protein & Amino Acids are experiencing significant growth.

- Form: Capsules and tablets are the most prevalent forms, but the demand for convenient formats such as gummies and powders is increasing.

- Health Application: General health, Bone & Joint Health, and Energy & Weight Management are the leading applications, reflecting consumer focus on overall wellness, aging, and physical fitness.

- Distribution Channel: Pharmacies and drug stores remain the primary distribution channel, but online retail is rapidly gaining traction, owing to its convenience and reach.

Drivers for Market Growth:

- Rising disposable incomes in developing economies

- Increased awareness of health and wellness

- Growing prevalence of chronic diseases

- Technological advancements in formulation and delivery

- Government initiatives promoting healthy lifestyles

Nutritional Supplements Industry Product Developments

Recent product innovations focus on enhanced bioavailability, targeted delivery, and improved taste and texture. Companies are investing in advanced technologies like liposomal encapsulation and personalized nutrition to create more effective and appealing products. For instance, Abbott's new Ensure formulation with HMB exemplifies the trend towards science-backed products addressing specific health concerns. The launch of Optimum Nutrition's Gold Standard Protein Shake demonstrates the continued focus on convenient and high-quality protein supplements.

Challenges in the Nutritional Supplements Industry Market

The nutritional supplements industry faces several challenges including stringent regulatory hurdles in certain regions, supply chain disruptions, and intense competition. These factors can increase production costs and limit market expansion. Counterfeit products also pose a significant threat, impacting consumer trust and brand reputation. Regulatory inconsistencies across different countries add complexity to international market entry strategies.

Forces Driving Nutritional Supplements Industry Growth

Several factors are driving the long-term growth of the nutritional supplements market. These include: rising disposable incomes, increased health awareness, technological advancements in supplement formulation, and expanding distribution channels. The increasing prevalence of chronic diseases is also a major factor. Government initiatives promoting healthy lifestyles and wellness also contribute to market growth.

Challenges in the Nutritional Supplements Industry Market

Sustained growth will depend on overcoming challenges such as stringent regulations, ensuring product quality and safety, and managing supply chain complexities. Strategic partnerships, innovative product development, and expanding into new markets are crucial for long-term success.

Emerging Opportunities in Nutritional Supplements Industry

Several key opportunities are shaping the future of the nutritional supplements industry. The rise of personalized nutrition, catering to individual health needs and genetic predispositions, presents a significant avenue for growth. Targeted formulations addressing specific health concerns, such as immune support, cognitive function, and joint health, are experiencing increased demand. Expansion into new geographical markets, particularly in developing economies with growing middle classes, offers considerable potential. The increasing popularity of plant-based and vegan lifestyles is driving demand for alternative, sustainable supplement options. Finally, advancements in delivery systems, including nanotechnology and microencapsulation, are improving product efficacy, absorption rates, and overall consumer experience.

Leading Players in the Nutritional Supplements Industry Sector

- Suntory Holdings Ltd

- Amway Corporation

- Bayer AG

- Abbott Nutrition

- Glanbia PLC

- Haleon Plc

- Herbalife Nutrition

- Otsuka Holdings Co Ltd

- The Bountiful Company

- Pfizer Inc

Key Milestones in Nutritional Supplements Industry Industry

- September 2022: Abbott launched a new Ensure formulation with HMB, enhancing muscle and bone strength.

- August 2022: Optimum Nutrition launched its Gold Standard Protein Shake, expanding its product portfolio.

- March 2022: PharmaNutrics launched five new dietary supplements targeting various health needs.

Strategic Outlook for Nutritional Supplements Industry Market

The nutritional supplements market is expected to experience continued growth, driven by several key factors. Evolving consumer health consciousness, ongoing technological advancements resulting in more effective and targeted products, and the expansion of diverse distribution channels are all contributing to this positive outlook. Strategic partnerships, a commitment to continuous innovation in product development, and the implementation of effective marketing strategies will be crucial for success in this highly competitive environment. Companies that prioritize product quality, safety, transparency, and demonstrable efficacy will be best positioned to secure substantial market share and long-term sustainability in this dynamic sector. Building strong consumer trust through rigorous quality control and clear communication will be paramount.

Nutritional Supplements Industry Segmentation

-

1. Type

- 1.1. Vitamins & Minerals

- 1.2. Herbal Supplements

- 1.3. Proteins and Amino Acids

- 1.4. Fatty-acids

- 1.5. Prebiotics & Probiotics

- 1.6. Other Types

-

2. Form

- 2.1. Tablets

- 2.2. Capsules

- 2.3. Powders

- 2.4. Gummies

- 2.5. Softgels

- 2.6. Liquids

- 2.7. Other Forms

-

3. Health Application

- 3.1. General Health

- 3.2. Bone & Joint Health

- 3.3. Energy & Weight Management

- 3.4. Gastrointestinal Health

- 3.5. Immunity

- 3.6. Cardiac Health

- 3.7. Diabetes

- 3.8. Skin/Hair/Nails

- 3.9. Other Health Applications

-

4. Distribution Channel

- 4.1. Pharmacies and Drug Stores

- 4.2. Supermarkets/Hypermarkets

- 4.3. Online Retail Channels

- 4.4. Other Distribution Channels

Nutritional Supplements Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Nutritional Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Escalating Consumer Investment In Preventive Healthcare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins & Minerals

- 5.1.2. Herbal Supplements

- 5.1.3. Proteins and Amino Acids

- 5.1.4. Fatty-acids

- 5.1.5. Prebiotics & Probiotics

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablets

- 5.2.2. Capsules

- 5.2.3. Powders

- 5.2.4. Gummies

- 5.2.5. Softgels

- 5.2.6. Liquids

- 5.2.7. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Health Application

- 5.3.1. General Health

- 5.3.2. Bone & Joint Health

- 5.3.3. Energy & Weight Management

- 5.3.4. Gastrointestinal Health

- 5.3.5. Immunity

- 5.3.6. Cardiac Health

- 5.3.7. Diabetes

- 5.3.8. Skin/Hair/Nails

- 5.3.9. Other Health Applications

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Pharmacies and Drug Stores

- 5.4.2. Supermarkets/Hypermarkets

- 5.4.3. Online Retail Channels

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vitamins & Minerals

- 6.1.2. Herbal Supplements

- 6.1.3. Proteins and Amino Acids

- 6.1.4. Fatty-acids

- 6.1.5. Prebiotics & Probiotics

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablets

- 6.2.2. Capsules

- 6.2.3. Powders

- 6.2.4. Gummies

- 6.2.5. Softgels

- 6.2.6. Liquids

- 6.2.7. Other Forms

- 6.3. Market Analysis, Insights and Forecast - by Health Application

- 6.3.1. General Health

- 6.3.2. Bone & Joint Health

- 6.3.3. Energy & Weight Management

- 6.3.4. Gastrointestinal Health

- 6.3.5. Immunity

- 6.3.6. Cardiac Health

- 6.3.7. Diabetes

- 6.3.8. Skin/Hair/Nails

- 6.3.9. Other Health Applications

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Pharmacies and Drug Stores

- 6.4.2. Supermarkets/Hypermarkets

- 6.4.3. Online Retail Channels

- 6.4.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vitamins & Minerals

- 7.1.2. Herbal Supplements

- 7.1.3. Proteins and Amino Acids

- 7.1.4. Fatty-acids

- 7.1.5. Prebiotics & Probiotics

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablets

- 7.2.2. Capsules

- 7.2.3. Powders

- 7.2.4. Gummies

- 7.2.5. Softgels

- 7.2.6. Liquids

- 7.2.7. Other Forms

- 7.3. Market Analysis, Insights and Forecast - by Health Application

- 7.3.1. General Health

- 7.3.2. Bone & Joint Health

- 7.3.3. Energy & Weight Management

- 7.3.4. Gastrointestinal Health

- 7.3.5. Immunity

- 7.3.6. Cardiac Health

- 7.3.7. Diabetes

- 7.3.8. Skin/Hair/Nails

- 7.3.9. Other Health Applications

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Pharmacies and Drug Stores

- 7.4.2. Supermarkets/Hypermarkets

- 7.4.3. Online Retail Channels

- 7.4.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vitamins & Minerals

- 8.1.2. Herbal Supplements

- 8.1.3. Proteins and Amino Acids

- 8.1.4. Fatty-acids

- 8.1.5. Prebiotics & Probiotics

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablets

- 8.2.2. Capsules

- 8.2.3. Powders

- 8.2.4. Gummies

- 8.2.5. Softgels

- 8.2.6. Liquids

- 8.2.7. Other Forms

- 8.3. Market Analysis, Insights and Forecast - by Health Application

- 8.3.1. General Health

- 8.3.2. Bone & Joint Health

- 8.3.3. Energy & Weight Management

- 8.3.4. Gastrointestinal Health

- 8.3.5. Immunity

- 8.3.6. Cardiac Health

- 8.3.7. Diabetes

- 8.3.8. Skin/Hair/Nails

- 8.3.9. Other Health Applications

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Pharmacies and Drug Stores

- 8.4.2. Supermarkets/Hypermarkets

- 8.4.3. Online Retail Channels

- 8.4.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vitamins & Minerals

- 9.1.2. Herbal Supplements

- 9.1.3. Proteins and Amino Acids

- 9.1.4. Fatty-acids

- 9.1.5. Prebiotics & Probiotics

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.2.3. Powders

- 9.2.4. Gummies

- 9.2.5. Softgels

- 9.2.6. Liquids

- 9.2.7. Other Forms

- 9.3. Market Analysis, Insights and Forecast - by Health Application

- 9.3.1. General Health

- 9.3.2. Bone & Joint Health

- 9.3.3. Energy & Weight Management

- 9.3.4. Gastrointestinal Health

- 9.3.5. Immunity

- 9.3.6. Cardiac Health

- 9.3.7. Diabetes

- 9.3.8. Skin/Hair/Nails

- 9.3.9. Other Health Applications

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Pharmacies and Drug Stores

- 9.4.2. Supermarkets/Hypermarkets

- 9.4.3. Online Retail Channels

- 9.4.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Vitamins & Minerals

- 10.1.2. Herbal Supplements

- 10.1.3. Proteins and Amino Acids

- 10.1.4. Fatty-acids

- 10.1.5. Prebiotics & Probiotics

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Tablets

- 10.2.2. Capsules

- 10.2.3. Powders

- 10.2.4. Gummies

- 10.2.5. Softgels

- 10.2.6. Liquids

- 10.2.7. Other Forms

- 10.3. Market Analysis, Insights and Forecast - by Health Application

- 10.3.1. General Health

- 10.3.2. Bone & Joint Health

- 10.3.3. Energy & Weight Management

- 10.3.4. Gastrointestinal Health

- 10.3.5. Immunity

- 10.3.6. Cardiac Health

- 10.3.7. Diabetes

- 10.3.8. Skin/Hair/Nails

- 10.3.9. Other Health Applications

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Pharmacies and Drug Stores

- 10.4.2. Supermarkets/Hypermarkets

- 10.4.3. Online Retail Channels

- 10.4.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Spain

- 12.1.2 United Kingdom

- 12.1.3 Germany

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Nutritional Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Suntory Holdings Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Amway Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bayer AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Abbott Nutrition

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Glanbia PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Haleon Plc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Herbalife Nutrition

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Otsuka Holdings Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 The Bountiful Company*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Pfizer Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Suntory Holdings Ltd

List of Figures

- Figure 1: Global Nutritional Supplements Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Nutritional Supplements Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Nutritional Supplements Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Nutritional Supplements Industry Revenue (Million), by Form 2024 & 2032

- Figure 15: North America Nutritional Supplements Industry Revenue Share (%), by Form 2024 & 2032

- Figure 16: North America Nutritional Supplements Industry Revenue (Million), by Health Application 2024 & 2032

- Figure 17: North America Nutritional Supplements Industry Revenue Share (%), by Health Application 2024 & 2032

- Figure 18: North America Nutritional Supplements Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: North America Nutritional Supplements Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: North America Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Nutritional Supplements Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Nutritional Supplements Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Nutritional Supplements Industry Revenue (Million), by Form 2024 & 2032

- Figure 25: Europe Nutritional Supplements Industry Revenue Share (%), by Form 2024 & 2032

- Figure 26: Europe Nutritional Supplements Industry Revenue (Million), by Health Application 2024 & 2032

- Figure 27: Europe Nutritional Supplements Industry Revenue Share (%), by Health Application 2024 & 2032

- Figure 28: Europe Nutritional Supplements Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Europe Nutritional Supplements Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Europe Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Form 2024 & 2032

- Figure 35: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Form 2024 & 2032

- Figure 36: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Health Application 2024 & 2032

- Figure 37: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Health Application 2024 & 2032

- Figure 38: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Asia Pacific Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: South America Nutritional Supplements Industry Revenue (Million), by Type 2024 & 2032

- Figure 43: South America Nutritional Supplements Industry Revenue Share (%), by Type 2024 & 2032

- Figure 44: South America Nutritional Supplements Industry Revenue (Million), by Form 2024 & 2032

- Figure 45: South America Nutritional Supplements Industry Revenue Share (%), by Form 2024 & 2032

- Figure 46: South America Nutritional Supplements Industry Revenue (Million), by Health Application 2024 & 2032

- Figure 47: South America Nutritional Supplements Industry Revenue Share (%), by Health Application 2024 & 2032

- Figure 48: South America Nutritional Supplements Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: South America Nutritional Supplements Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: South America Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Type 2024 & 2032

- Figure 53: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Form 2024 & 2032

- Figure 55: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Form 2024 & 2032

- Figure 56: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Health Application 2024 & 2032

- Figure 57: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Health Application 2024 & 2032

- Figure 58: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 59: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 60: Middle East and Africa Nutritional Supplements Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Nutritional Supplements Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nutritional Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 5: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Global Nutritional Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Spain Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Russia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: South Africa Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East and Africa Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 36: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 37: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: United States Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Mexico Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of North America Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 45: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 46: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 47: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Spain Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: United Kingdom Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Germany Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: France Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Italy Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Russia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 57: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 58: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: China Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: India Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Australia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 67: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 68: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 69: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Global Nutritional Supplements Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 74: Global Nutritional Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 75: Global Nutritional Supplements Industry Revenue Million Forecast, by Health Application 2019 & 2032

- Table 76: Global Nutritional Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 77: Global Nutritional Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: South Africa Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Saudi Arabia Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Middle East and Africa Nutritional Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nutritional Supplements Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Nutritional Supplements Industry?

Key companies in the market include Suntory Holdings Ltd, Amway Corporation, Bayer AG, Abbott Nutrition, Glanbia PLC, Haleon Plc, Herbalife Nutrition, Otsuka Holdings Co Ltd, The Bountiful Company*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the Nutritional Supplements Industry?

The market segments include Type, Form, Health Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Escalating Consumer Investment In Preventive Healthcare Products.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

September 2022: Abbott launched a brand-new Ensure formulation with HMB. As a science-based nutritional supplement, the new Ensure contains 32 essential nutrients such as protein, calcium, and vitamin D to help improve muscle and bone strength. It contains HMB or hydroxy-methyl butyrate, a new ingredient that helps counteract muscle loss and increases the strength and power of the body.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nutritional Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nutritional Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nutritional Supplements Industry?

To stay informed about further developments, trends, and reports in the Nutritional Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence