Key Insights

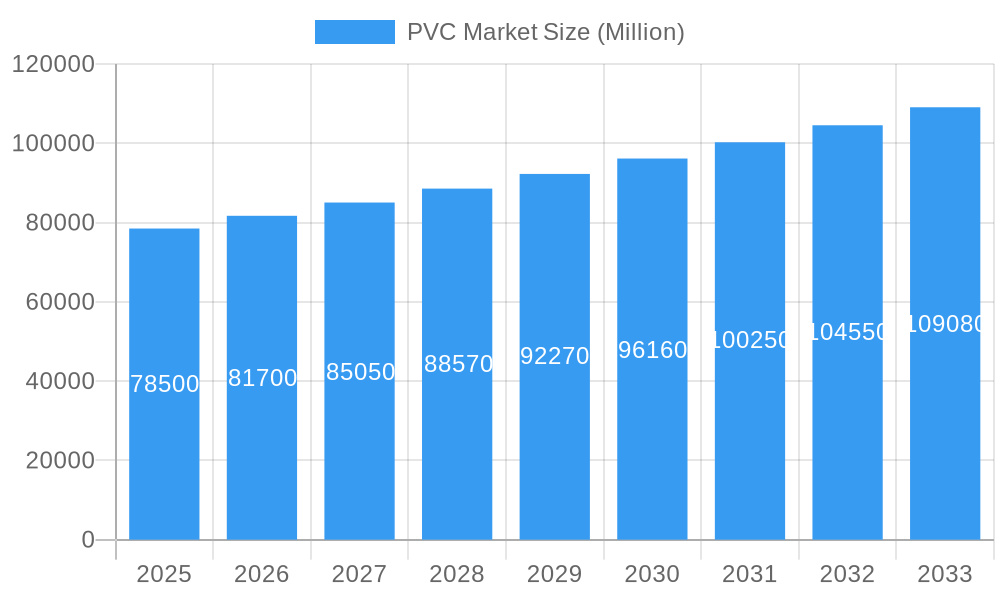

The global Polyvinyl Chloride (PVC) market is projected for significant expansion, anticipated to reach 78426.15 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.4% from 2025 to 2033. Key growth drivers include escalating demand from the building and construction sector, propelled by global urbanization and infrastructure development. PVC's inherent versatility, cost-effectiveness, and durability make it essential for pipes, fittings, window profiles, flooring, and roofing. The automotive and healthcare industries also contribute significantly, demanding lightweight components and medical devices, respectively. The Asia Pacific region is expected to be a primary growth engine due to industrialization and rising disposable incomes.

PVC Market Market Size (In Billion)

Market dynamics are influenced by product innovation and sustainability initiatives. The demand for low-smoke PVC is increasing, particularly for applications where fire safety is critical. The adoption of calcium-based stabilizers (Ca-Zn) is rising as an eco-friendly alternative to lead-based stabilizers, aligning with environmental regulations. While challenges such as fluctuating raw material prices and competition from substitute materials exist, PVC's excellent chemical resistance, electrical insulation, and ease of processing ensure its continued market prominence.

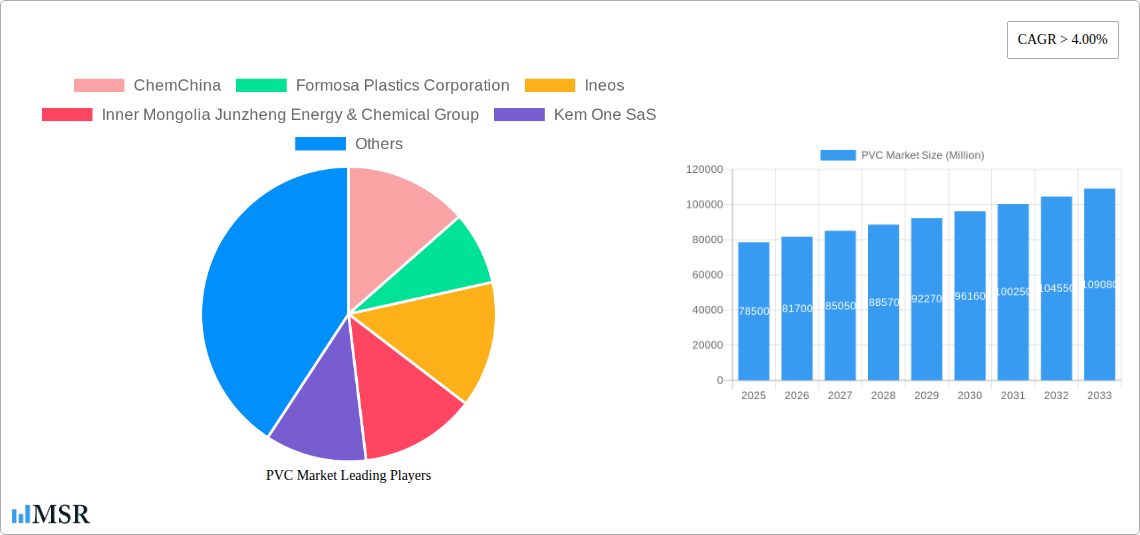

PVC Market Company Market Share

Unveiling the Global PVC Market: A Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the global Polyvinyl Chloride (PVC) market, offering critical insights for industry stakeholders. Spanning the historical period of 2019-2024, the base year of 2025, and a comprehensive forecast period from 2025-2033, this study delves into market dynamics, segmentation, key players, and emerging trends. We meticulously examine market concentration, product type dominance, regional performance, and the impact of innovative technologies and sustainability initiatives. Discover actionable intelligence to navigate the evolving PVC landscape, identify growth opportunities, and gain a competitive edge.

PVC Market Market Concentration & Dynamics

The global PVC market exhibits a moderate to high concentration, with a few dominant players controlling a significant share of production and supply. Key companies like Westlake Chemical Corporation, Shin-Etsu Chemical Co Ltd, Formosa Plastics Corporation, and INEOS are instrumental in shaping market trends through their extensive manufacturing capabilities and integrated value chains. Innovation ecosystems are flourishing, particularly in the development of sustainable PVC alternatives and advanced processing techniques. Regulatory frameworks are increasingly emphasizing environmental compliance, influencing the adoption of specific stabilizer types like Calcium-based Stabilizers (Ca-Zn Stabilizers) over Lead-based Stabilizers (Pb Stabilizers). The threat of substitute products, while present, is mitigated by PVC’s cost-effectiveness and versatility across diverse applications. End-user trends indicate a growing demand for high-performance and eco-friendly PVC solutions, particularly in the Building and Construction and Automotive sectors. Merger and acquisition (M&A) activities, though not consistently high, are strategically focused on capacity expansion and vertical integration, with an estimated XX M&A deal counts over the study period.

PVC Market Industry Insights & Trends

The global PVC market is poised for steady growth, projected to reach a market size of approximately USD XXX Billion by 2033, driven by robust demand from key end-user industries and sustained infrastructure development. The Compound Annual Growth Rate (CAGR) is estimated to be around X.X% during the forecast period (2025–2033). Market growth drivers include the burgeoning Building and Construction sector, fueled by urbanization and government investments in infrastructure projects, particularly in emerging economies. The Automotive industry's increasing adoption of lightweight and durable PVC components for interior and exterior applications further bolsters demand. Technological disruptions are primarily centered around the development of bio-attributed PVC and low-smoke PVC, catering to environmental concerns and safety regulations. Evolving consumer behaviors are pushing manufacturers towards sustainable sourcing and production, prompting investments in recycling technologies and the use of recycled PVC. The Electrical and Electronics industry also contributes significantly, with PVC being a preferred material for wire and cable insulation due to its excellent dielectric properties and flame retardancy. Furthermore, the expanding Packaging sector, particularly for rigid PVC in bottles and flexible PVC in films and sheets, adds to the market's upward trajectory.

Key Markets & Segments Leading PVC Market

The Building and Construction end-user industry stands as the dominant force in the global PVC market, driven by continuous infrastructure development and the widespread use of PVC in pipes and fittings, profiles, and flooring. This segment is experiencing robust growth due to increasing urbanization and renovation activities worldwide.

- Drivers for Building and Construction Dominance:

- Global population growth and urbanization leading to increased demand for housing and infrastructure.

- Government initiatives and investments in public works and affordable housing projects.

- PVC's cost-effectiveness, durability, and ease of installation in construction applications.

- Growing adoption of energy-efficient building materials.

The Pipes and Fittings product type segment is a major contributor, witnessing high demand for potable water distribution, sewage systems, and irrigation. Rigid PVC, especially Non-clear Rigid PVC, is the preferred choice for these applications due to its excellent chemical resistance and structural integrity. The Automotive sector is another significant driver, with increasing use of PVC in interior components, dashboards, and wire harnesses, favoring Flexible PVC for its adaptability and durability.

- Dominance Analysis by Product Type:

- Rigid PVC: Dominates due to its extensive application in pipes, fittings, profiles, and windows, where structural strength and rigidity are paramount. Non-clear Rigid PVC holds a larger share than Clear Rigid PVC in these critical applications.

- Flexible PVC: Holds significant sway in wire and cables, automotive interiors, and medical devices, owing to its pliability and versatility. Non-clear Flexible PVC is extensively used in films, sheets, and automotive applications.

- Low-smoke PVC: Gaining traction in specialized applications within the Electrical and Electronics and Building and Construction sectors where fire safety is a critical concern.

- Chlorinated PVC (CPVC): Finds application in hot water piping and fire sprinklers due to its enhanced temperature and fire resistance.

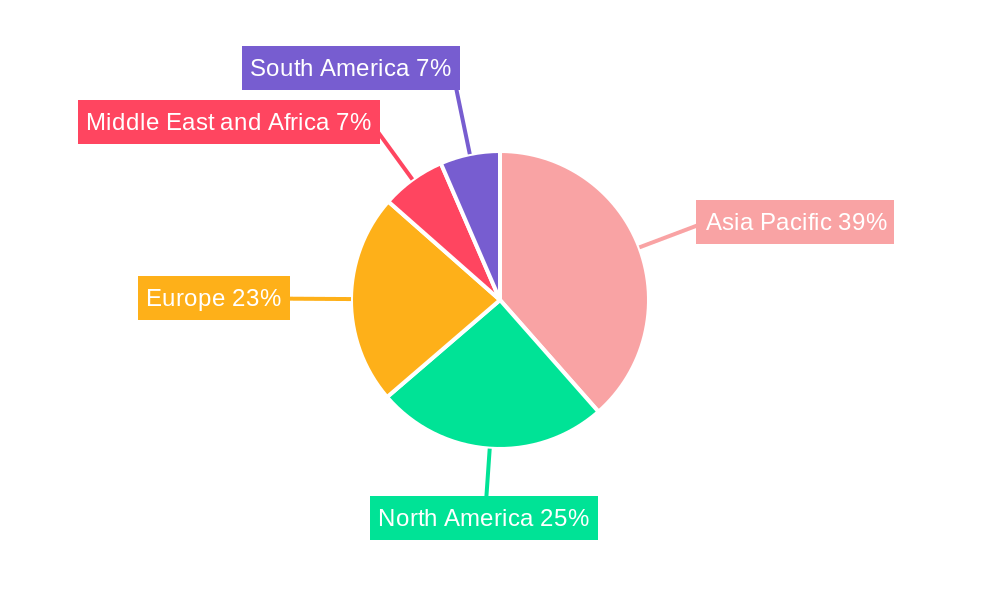

The Asia-Pacific region, particularly China, continues to lead the global PVC market due to its massive manufacturing base, rapid industrialization, and significant investments in construction and infrastructure.

- Dominance Analysis by Stabilizer Type:

- Calcium-based Stabilizers (Ca-Zn Stabilizers): Witnessing strong growth due to environmental regulations restricting the use of lead-based alternatives. Their increasing adoption is a key trend shaping the market.

- Lead-based Stabilizers (Pb Stabilizers): While still in use in some regions, their market share is declining due to health and environmental concerns.

- Tin and Organotin-based (Sn Stabilizers): Used in niche applications requiring high transparency and heat stability.

PVC Market Product Developments

Recent product developments in the PVC market are focused on enhancing sustainability and performance. The introduction of bio-attributed PVC, such as BIOVYN from INOVYN, marks a significant step towards reducing the carbon footprint of PVC products, as seen in Continental's adoption for automotive surface materials. Innovations are also emerging in low-smoke PVC formulations for improved fire safety in confined spaces like tunnels and public buildings. Manufacturers are investing in R&D to develop PVC compounds with enhanced UV resistance, antimicrobial properties, and improved recyclability, catering to the growing demand for durable, safe, and environmentally responsible materials across diverse applications like construction, automotive interiors, and healthcare products.

Challenges in the PVC Market Market

The PVC market faces several challenges, including increasing scrutiny regarding the environmental impact of PVC production and disposal, leading to regulatory pressures and a push for greener alternatives. Volatility in raw material prices, particularly for ethylene and chlorine, can impact profit margins. Supply chain disruptions, exacerbated by geopolitical events, pose risks to production and delivery schedules. Furthermore, intense competition from other plastics and traditional materials necessitates continuous innovation and cost optimization to maintain market share. The phase-out of lead-based stabilizers also presents a significant technical and economic challenge for manufacturers needing to adapt to new formulations.

Forces Driving PVC Market Growth

Several key forces are driving the growth of the PVC market. The ongoing global expansion of the Building and Construction sector, particularly in developing economies, remains a primary catalyst. Government investments in infrastructure development, including water and sanitation systems, directly translate into higher demand for PVC pipes and fittings. The automotive industry's continued demand for lightweight and durable components, coupled with the electrical and electronics sector's need for effective insulation materials, further fuels market expansion. Technological advancements in PVC processing, leading to enhanced product performance and the development of specialized PVC grades, also contribute significantly to market growth.

Challenges in the PVC Market Market

Long-term growth catalysts for the PVC market are intrinsically linked to overcoming sustainability challenges and embracing innovation. The development of advanced recycling technologies and the establishment of robust circular economy models for PVC will be crucial for its continued relevance. Partnerships and collaborations between raw material suppliers, PVC manufacturers, and end-users will drive the development of next-generation, eco-friendly PVC compounds. Market expansion into emerging applications, such as renewable energy infrastructure and advanced medical devices, presents significant long-term growth potential, provided these applications align with environmental and safety standards.

Emerging Opportunities in PVC Market

Emerging opportunities in the PVC market lie in the growing demand for sustainable and bio-based PVC solutions, driven by increasing environmental consciousness and stringent regulations. The development of specialty PVC grades with enhanced properties, such as high-temperature resistance or improved flame retardancy, will open doors in niche applications within the automotive, aerospace, and healthcare sectors. The expansion of the electrical and electronics market, especially in data centers and renewable energy installations, presents opportunities for high-performance PVC insulation and sheathing. Furthermore, the increasing focus on circular economy principles offers opportunities for companies that invest in PVC recycling infrastructure and the production of high-quality recycled PVC.

Leading Players in the PVC Market Sector

- ChemChina

- Formosa Plastics Corporation

- Ineos

- Inner Mongolia Junzheng Energy & Chemical Group

- Kem One SaS

- LG Chem

- Orbia

- Occidental Petroleum Corporation

- SABIC

- Shaanxi Coal and Chemical Industry Group

- Shin-Etsu Chemical Co Ltd

- Tianye Group

- Westlake Chemical Corporation

- Xinjiang Zhongtai Chemical Co Ltd

Key Milestones in PVC Market Industry

- August 2022: Continental's strategic decision to utilize BIOVYN, bio-attributed PVC from INOVYN, for its automotive surface materials underscores a significant shift towards sustainable sourcing and reduced carbon footprints.

- January 2021: Shintech's substantial capital investment of USD 1.25 billion to expand its integrated PVC business, boosting Shin-Etsu Chemical Co. Ltd's capacity, signifies a major commitment to increasing production capabilities and market dominance in the US.

- January 2021: Orbia's planned divestment of its PVC Unit, driven by market demand constraints, highlighted potential shifts in market strategies and portfolio management among key industry players, though the final decision remains pending.

Strategic Outlook for PVC Market Market

The strategic outlook for the PVC market is characterized by a dual focus on sustainable innovation and market penetration. Companies that prioritize the development and adoption of eco-friendly PVC formulations, including bio-attributed and recycled variants, will be best positioned for future success. Strategic investments in advanced recycling technologies and the establishment of robust circular economy models will be crucial for long-term viability and consumer trust. Furthermore, expanding into high-growth application segments within the automotive, healthcare, and renewable energy sectors, while also capitalizing on infrastructure development in emerging economies, will drive significant market growth and profitability.

PVC Market Segmentation

-

1. Product Type

-

1.1. Rigid PVC

- 1.1.1. Clear Rigid PVC

- 1.1.2. Non-clear Rigid PVC

-

1.2. Flexible PVC

- 1.2.1. Clear Flexible PVC

- 1.2.2. Non-clear Flexible PVC

- 1.3. Low-smoke PVC

- 1.4. Chlorinated PVC

-

1.1. Rigid PVC

-

2. Stabilizer Type

- 2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 2.2. Lead-based Stabilizers (Pb Stabilizers)

- 2.3. Tin and Organotin-based (Sn Stabilizers)

- 2.4. Barium-b

-

3. Application

- 3.1. Pipes and Fittings

- 3.2. Film and Sheets

- 3.3. Wire and Cables

- 3.4. Bottles

- 3.5. Profiles, Hoses, and Tubings

- 3.6. Other Applications

-

4. End-user Industry

- 4.1. Building and Construction

- 4.2. Automotive

- 4.3. Electrical and Electronics

- 4.4. Packaging

- 4.5. Footwear

- 4.6. Healthcare

- 4.7. Other End-user Industries

PVC Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

PVC Market Regional Market Share

Geographic Coverage of PVC Market

PVC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application in the Healthcare and Medical Devices Industries; Increasing Demand from the Construction Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Application in the Healthcare and Medical Devices Industries; Increasing Demand from the Construction Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PVC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid PVC

- 5.1.1.1. Clear Rigid PVC

- 5.1.1.2. Non-clear Rigid PVC

- 5.1.2. Flexible PVC

- 5.1.2.1. Clear Flexible PVC

- 5.1.2.2. Non-clear Flexible PVC

- 5.1.3. Low-smoke PVC

- 5.1.4. Chlorinated PVC

- 5.1.1. Rigid PVC

- 5.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 5.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 5.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 5.2.3. Tin and Organotin-based (Sn Stabilizers)

- 5.2.4. Barium-b

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pipes and Fittings

- 5.3.2. Film and Sheets

- 5.3.3. Wire and Cables

- 5.3.4. Bottles

- 5.3.5. Profiles, Hoses, and Tubings

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Building and Construction

- 5.4.2. Automotive

- 5.4.3. Electrical and Electronics

- 5.4.4. Packaging

- 5.4.5. Footwear

- 5.4.6. Healthcare

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific PVC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid PVC

- 6.1.1.1. Clear Rigid PVC

- 6.1.1.2. Non-clear Rigid PVC

- 6.1.2. Flexible PVC

- 6.1.2.1. Clear Flexible PVC

- 6.1.2.2. Non-clear Flexible PVC

- 6.1.3. Low-smoke PVC

- 6.1.4. Chlorinated PVC

- 6.1.1. Rigid PVC

- 6.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 6.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 6.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 6.2.3. Tin and Organotin-based (Sn Stabilizers)

- 6.2.4. Barium-b

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Pipes and Fittings

- 6.3.2. Film and Sheets

- 6.3.3. Wire and Cables

- 6.3.4. Bottles

- 6.3.5. Profiles, Hoses, and Tubings

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Building and Construction

- 6.4.2. Automotive

- 6.4.3. Electrical and Electronics

- 6.4.4. Packaging

- 6.4.5. Footwear

- 6.4.6. Healthcare

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America PVC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid PVC

- 7.1.1.1. Clear Rigid PVC

- 7.1.1.2. Non-clear Rigid PVC

- 7.1.2. Flexible PVC

- 7.1.2.1. Clear Flexible PVC

- 7.1.2.2. Non-clear Flexible PVC

- 7.1.3. Low-smoke PVC

- 7.1.4. Chlorinated PVC

- 7.1.1. Rigid PVC

- 7.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 7.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 7.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 7.2.3. Tin and Organotin-based (Sn Stabilizers)

- 7.2.4. Barium-b

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Pipes and Fittings

- 7.3.2. Film and Sheets

- 7.3.3. Wire and Cables

- 7.3.4. Bottles

- 7.3.5. Profiles, Hoses, and Tubings

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Building and Construction

- 7.4.2. Automotive

- 7.4.3. Electrical and Electronics

- 7.4.4. Packaging

- 7.4.5. Footwear

- 7.4.6. Healthcare

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe PVC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid PVC

- 8.1.1.1. Clear Rigid PVC

- 8.1.1.2. Non-clear Rigid PVC

- 8.1.2. Flexible PVC

- 8.1.2.1. Clear Flexible PVC

- 8.1.2.2. Non-clear Flexible PVC

- 8.1.3. Low-smoke PVC

- 8.1.4. Chlorinated PVC

- 8.1.1. Rigid PVC

- 8.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 8.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 8.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 8.2.3. Tin and Organotin-based (Sn Stabilizers)

- 8.2.4. Barium-b

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Pipes and Fittings

- 8.3.2. Film and Sheets

- 8.3.3. Wire and Cables

- 8.3.4. Bottles

- 8.3.5. Profiles, Hoses, and Tubings

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Building and Construction

- 8.4.2. Automotive

- 8.4.3. Electrical and Electronics

- 8.4.4. Packaging

- 8.4.5. Footwear

- 8.4.6. Healthcare

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America PVC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rigid PVC

- 9.1.1.1. Clear Rigid PVC

- 9.1.1.2. Non-clear Rigid PVC

- 9.1.2. Flexible PVC

- 9.1.2.1. Clear Flexible PVC

- 9.1.2.2. Non-clear Flexible PVC

- 9.1.3. Low-smoke PVC

- 9.1.4. Chlorinated PVC

- 9.1.1. Rigid PVC

- 9.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 9.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 9.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 9.2.3. Tin and Organotin-based (Sn Stabilizers)

- 9.2.4. Barium-b

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Pipes and Fittings

- 9.3.2. Film and Sheets

- 9.3.3. Wire and Cables

- 9.3.4. Bottles

- 9.3.5. Profiles, Hoses, and Tubings

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Building and Construction

- 9.4.2. Automotive

- 9.4.3. Electrical and Electronics

- 9.4.4. Packaging

- 9.4.5. Footwear

- 9.4.6. Healthcare

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa PVC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rigid PVC

- 10.1.1.1. Clear Rigid PVC

- 10.1.1.2. Non-clear Rigid PVC

- 10.1.2. Flexible PVC

- 10.1.2.1. Clear Flexible PVC

- 10.1.2.2. Non-clear Flexible PVC

- 10.1.3. Low-smoke PVC

- 10.1.4. Chlorinated PVC

- 10.1.1. Rigid PVC

- 10.2. Market Analysis, Insights and Forecast - by Stabilizer Type

- 10.2.1. Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 10.2.2. Lead-based Stabilizers (Pb Stabilizers)

- 10.2.3. Tin and Organotin-based (Sn Stabilizers)

- 10.2.4. Barium-b

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Pipes and Fittings

- 10.3.2. Film and Sheets

- 10.3.3. Wire and Cables

- 10.3.4. Bottles

- 10.3.5. Profiles, Hoses, and Tubings

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Building and Construction

- 10.4.2. Automotive

- 10.4.3. Electrical and Electronics

- 10.4.4. Packaging

- 10.4.5. Footwear

- 10.4.6. Healthcare

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ChemChina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Formosa Plastics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ineos

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inner Mongolia Junzheng Energy & Chemical Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kem One SaS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Orbia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Occidental Petroleum Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SABIC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shaanxi Coal and Chemical Industry Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shin-Etsu Chemical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tianye Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Westlake Chemical Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Xinjiang Zhongtai Chemical Co Ltd*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ChemChina

List of Figures

- Figure 1: Global PVC Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific PVC Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: Asia Pacific PVC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific PVC Market Revenue (million), by Stabilizer Type 2025 & 2033

- Figure 5: Asia Pacific PVC Market Revenue Share (%), by Stabilizer Type 2025 & 2033

- Figure 6: Asia Pacific PVC Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific PVC Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific PVC Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific PVC Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific PVC Market Revenue (million), by Country 2025 & 2033

- Figure 11: Asia Pacific PVC Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America PVC Market Revenue (million), by Product Type 2025 & 2033

- Figure 13: North America PVC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: North America PVC Market Revenue (million), by Stabilizer Type 2025 & 2033

- Figure 15: North America PVC Market Revenue Share (%), by Stabilizer Type 2025 & 2033

- Figure 16: North America PVC Market Revenue (million), by Application 2025 & 2033

- Figure 17: North America PVC Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America PVC Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 19: North America PVC Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: North America PVC Market Revenue (million), by Country 2025 & 2033

- Figure 21: North America PVC Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe PVC Market Revenue (million), by Product Type 2025 & 2033

- Figure 23: Europe PVC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Europe PVC Market Revenue (million), by Stabilizer Type 2025 & 2033

- Figure 25: Europe PVC Market Revenue Share (%), by Stabilizer Type 2025 & 2033

- Figure 26: Europe PVC Market Revenue (million), by Application 2025 & 2033

- Figure 27: Europe PVC Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe PVC Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 29: Europe PVC Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe PVC Market Revenue (million), by Country 2025 & 2033

- Figure 31: Europe PVC Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America PVC Market Revenue (million), by Product Type 2025 & 2033

- Figure 33: South America PVC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: South America PVC Market Revenue (million), by Stabilizer Type 2025 & 2033

- Figure 35: South America PVC Market Revenue Share (%), by Stabilizer Type 2025 & 2033

- Figure 36: South America PVC Market Revenue (million), by Application 2025 & 2033

- Figure 37: South America PVC Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America PVC Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 39: South America PVC Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: South America PVC Market Revenue (million), by Country 2025 & 2033

- Figure 41: South America PVC Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa PVC Market Revenue (million), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa PVC Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Middle East and Africa PVC Market Revenue (million), by Stabilizer Type 2025 & 2033

- Figure 45: Middle East and Africa PVC Market Revenue Share (%), by Stabilizer Type 2025 & 2033

- Figure 46: Middle East and Africa PVC Market Revenue (million), by Application 2025 & 2033

- Figure 47: Middle East and Africa PVC Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Middle East and Africa PVC Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 49: Middle East and Africa PVC Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East and Africa PVC Market Revenue (million), by Country 2025 & 2033

- Figure 51: Middle East and Africa PVC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 3: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global PVC Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 8: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 9: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global PVC Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: China PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: India PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Japan PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: South Korea PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 18: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global PVC Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: United States PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Canada PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Mexico PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 25: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 26: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 27: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global PVC Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Germany PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Italy PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: France PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Spain PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 36: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 37: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global PVC Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Brazil PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Argentina PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Rest of South America PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Global PVC Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 44: Global PVC Market Revenue million Forecast, by Stabilizer Type 2020 & 2033

- Table 45: Global PVC Market Revenue million Forecast, by Application 2020 & 2033

- Table 46: Global PVC Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 47: Global PVC Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Saudi Arabia PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Africa PVC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa PVC Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PVC Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the PVC Market?

Key companies in the market include ChemChina, Formosa Plastics Corporation, Ineos, Inner Mongolia Junzheng Energy & Chemical Group, Kem One SaS, LG Chem, Orbia, Occidental Petroleum Corporation, SABIC, Shaanxi Coal and Chemical Industry Group, Shin-Etsu Chemical Co Ltd, Tianye Group, Westlake Chemical Corporation, Xinjiang Zhongtai Chemical Co Ltd*List Not Exhaustive.

3. What are the main segments of the PVC Market?

The market segments include Product Type, Stabilizer Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 78426.15 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application in the Healthcare and Medical Devices Industries; Increasing Demand from the Construction Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Building and Construction Industry.

7. Are there any restraints impacting market growth?

Increasing Application in the Healthcare and Medical Devices Industries; Increasing Demand from the Construction Industry.

8. Can you provide examples of recent developments in the market?

August 2022: Continental is to use BIOVYN, bio-attributed PVC, from INOVYN to produce its technical and decorative surface materials for its automotive customers. The agreement will help to reduce its carbon footprint and meet customer demand for sustainable bio-based products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PVC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PVC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PVC Market?

To stay informed about further developments, trends, and reports in the PVC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence