Key Insights

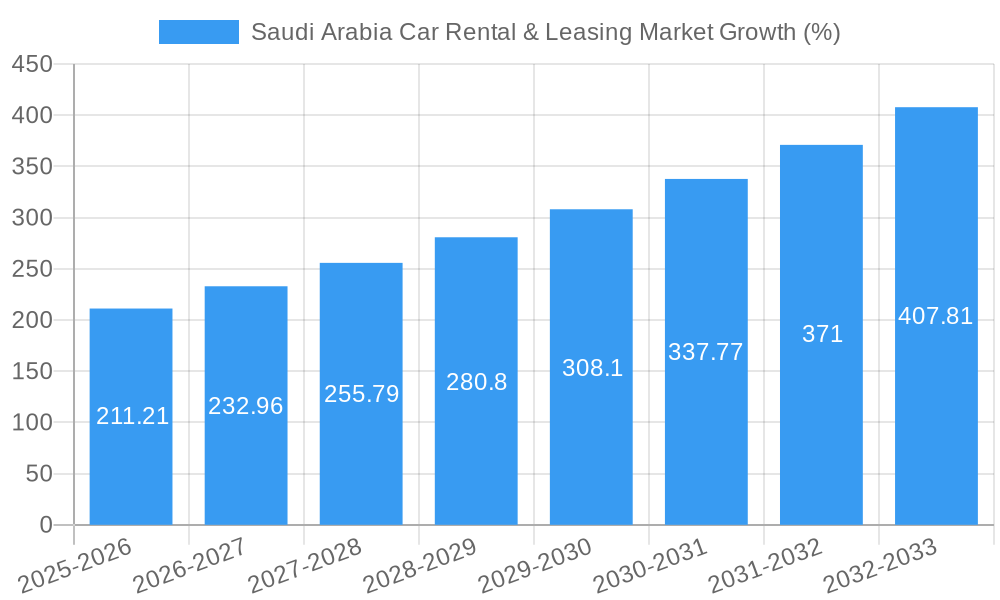

The Saudi Arabia car rental and leasing market, valued at $2.30 billion in 2025, is projected to experience robust growth, driven by a burgeoning tourism sector, increasing disposable incomes, and the expansion of the Kingdom's infrastructure. The market's Compound Annual Growth Rate (CAGR) of 9.21% from 2025 to 2033 indicates significant potential for expansion. Several factors contribute to this growth. The rising popularity of short-term rentals, fueled by the ease of online booking platforms and the increasing preference for flexible transportation solutions, is a key driver. Moreover, the diverse vehicle segments available, ranging from economical hatchbacks to luxury SUVs, cater to a wide range of consumer needs and preferences. The development of smart cities and improved transportation networks further support the growth, making car rentals a convenient and accessible option. However, fluctuating fuel prices and potential regulatory changes could pose challenges to market expansion. Competition among established players like Hertz, Avis Budget Group, and local operators like Bin Hadi and National Car Rental is intense, prompting innovation in services and pricing strategies. The long-term leasing segment is expected to see substantial growth, driven by businesses and individuals seeking cost-effective solutions for personal and fleet management.

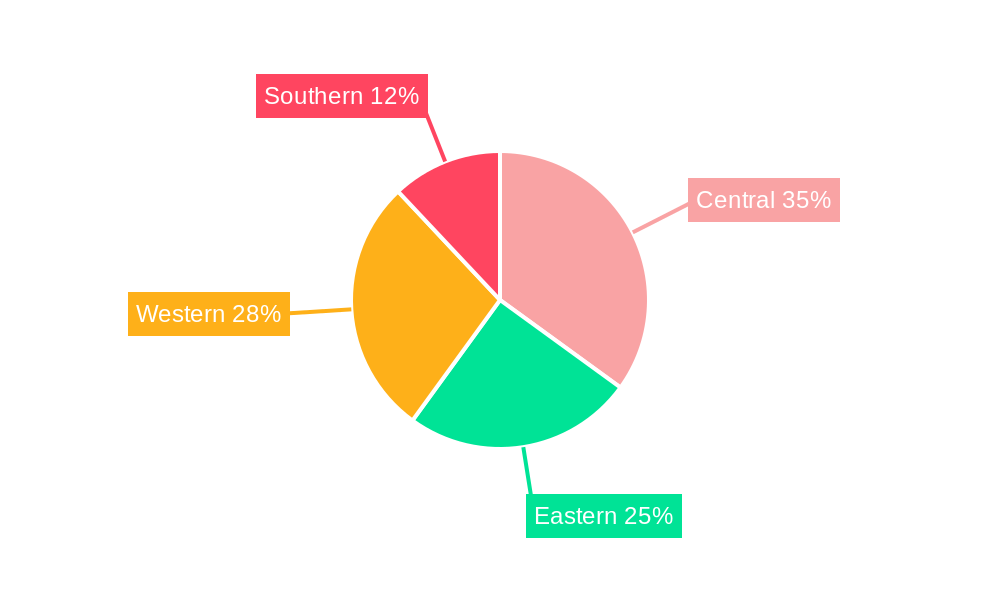

The segmentation of the Saudi Arabia car rental and leasing market provides valuable insights into consumer preferences and market dynamics. The short-term leasing segment, favored by tourists and visitors, is expected to contribute significantly to overall market revenue, particularly during peak tourist seasons. Premium and luxury vehicle segments are expected to witness accelerated growth driven by the increasing disposable incomes of Saudi citizens. Online booking is becoming the preferred method, indicating a trend towards digitalization in the industry. Regional variations exist, with the Western and Central regions potentially showcasing higher growth rates due to their significant population density and economic activity. The substantial forecast period from 2025 to 2033 offers considerable opportunities for market participants to capitalize on the continued expansion of the Saudi Arabian economy and its evolving transportation needs.

Saudi Arabia Car Rental & Leasing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia car rental and leasing market, covering the period 2019-2033. It offers valuable insights for industry stakeholders, including established players like Bin Hadi, National Car Rental, and Hertz Corporation, as well as emerging disruptors such as Turo and Zipcar, and regional leaders like Theeb Rent A Car and Ejaro. The report meticulously examines market dynamics, growth drivers, key segments, and emerging opportunities, equipping readers with actionable intelligence to navigate this rapidly evolving landscape. The base year for this analysis is 2025, with estimations for 2025 and a forecast extending to 2033, based on historical data from 2019-2024.

Saudi Arabia Car Rental & Leasing Market Market Concentration & Dynamics

The Saudi Arabia car rental and leasing market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller regional operators. Market share data for 2024 indicates that the top five players hold approximately xx% of the market, while the remaining share is distributed among numerous smaller businesses. This fragmentation presents opportunities for both expansion by larger firms and niche market penetration by smaller enterprises.

The market's dynamic nature is driven by several factors:

- Innovation Ecosystems: The increasing adoption of online booking platforms, mobile apps, and digital payment solutions is transforming customer interactions and operational efficiencies. Telematics and connected car technologies are also gradually integrating into fleet management.

- Regulatory Frameworks: Government regulations concerning licensing, insurance, and vehicle standards significantly influence market operations. Recent policy changes focused on promoting sustainable transportation and supporting the growth of the local car rental sector will directly impact future market trajectories.

- Substitute Products: Ride-hailing services and public transportation compete with car rentals, particularly in urban areas. The rise of subscription-based vehicle services also poses a competitive challenge.

- End-User Trends: The growing preference for convenience, technological integration, and diverse vehicle options (Economy/Budget, Premium/Luxury; Hatchback, Sedan, SUV, MUV) is driving demand for specialized services and customized offerings.

- M&A Activities: The number of M&A deals in the sector has witnessed a xx% increase from 2020 to 2023, reflecting the market's consolidation trend and companies' strategic moves to expand their footprint.

Saudi Arabia Car Rental & Leasing Market Industry Insights & Trends

The Saudi Arabia car rental and leasing market is experiencing robust growth, driven by factors including a burgeoning population, increasing tourism, rising disposable incomes, and government initiatives to stimulate economic diversification. The market size in 2024 reached approximately xx Million USD, expanding at a CAGR of xx% during the historical period (2019-2024) and projected to reach xx Million USD by 2025. This growth trajectory is expected to continue in the forecast period (2025-2033) with a projected CAGR of xx%.

Several factors are contributing to this positive outlook:

- Technological Disruptions: The integration of technology across booking platforms, fleet management, and customer service is streamlining operations, enhancing customer experience, and driving efficiency gains. The rise of shared mobility services and subscription models are altering consumer preferences.

- Evolving Consumer Behaviors: Consumers increasingly prioritize convenience, transparency, and value. The demand for online booking, flexible rental durations (short-term and long-term leasing), and a wider selection of vehicles is influencing market strategies. The preferences for specific body types (Hatchbacks, Sedans, SUVs, MUVs) vary across demographic groups and are directly affecting inventory strategies and pricing. Premium/Luxury vehicles are also witnessing growing demand within specific segments of the market.

Key Markets & Segments Leading Saudi Arabia Car Rental & Leasing Market

The Saudi Arabia car rental and leasing market demonstrates strong growth across various regions, with significant variations between urban and rural areas. Riyadh and Jeddah are the leading cities in terms of market share, driven by high population density and significant tourist traffic.

- Duration: Long-term leasing is gaining traction, fueled by the increasing demand for corporate fleets and growing adoption among individuals seeking cost-effective transportation solutions. Short-term leasing remains popular for tourists and business travelers.

- Vehicle Type: The Economy/Budget segment remains the largest in terms of volume, but the Premium/Luxury segment is demonstrating impressive growth rates, driven by rising affluence and increased tourist spending.

- Body Type: SUVs and Sedans dominate the market, catering to varied needs. However, the demand for Hatchbacks and MUVs are steadily increasing within specific consumer segments.

- Booking Type: While offline bookings retain a significant share, the online booking segment is experiencing exponential growth, aided by user-friendly mobile applications and increased internet penetration.

Drivers of Growth:

- Economic Growth: The continuous expansion of the Saudi economy supports high demand for cars for both personal and business use.

- Tourism Development: The increasing number of tourists visiting the Kingdom fuels the demand for rental services, particularly in popular tourist destinations.

- Infrastructure Development: Ongoing infrastructure projects and improved transportation networks facilitate both domestic and international travel, boosting the market for car rental and leasing.

Saudi Arabia Car Rental & Leasing Market Product Developments

Recent product developments focus on enhancing customer experience and operational efficiency. This includes the introduction of user-friendly mobile apps, improved online booking systems, and integrated fleet management software. The integration of telematics data for better vehicle tracking, maintenance scheduling, and insurance risk management also represents a significant technological advancement in the sector. These developments are crucial for competitiveness and improving operational efficiency.

Challenges in the Saudi Arabia Car Rental & Leasing Market Market

The Saudi Arabia car rental and leasing market faces several challenges:

- Regulatory Hurdles: Navigating complex licensing procedures and regulatory compliance can be time-consuming and expensive. Changes in regulations also require frequent adaptation of business strategies.

- Supply Chain Issues: Global supply chain disruptions and fluctuations in vehicle prices can affect the availability of vehicles and impact profitability.

- Competitive Pressures: Intense competition from both established players and new entrants, coupled with the rise of alternative mobility solutions, puts pressure on pricing and margins. This necessitates continuous innovation and differentiation to maintain competitiveness.

Forces Driving Saudi Arabia Car Rental & Leasing Market Growth

Several factors drive the growth of the Saudi Arabia car rental and leasing market:

- Technological Advancements: Digitalization enhances customer convenience and operational efficiency, while telematics and connected car technologies improve fleet management.

- Economic Expansion: Continued economic growth leads to higher disposable incomes and increased demand for personal and business transportation.

- Government Support: Government initiatives supporting tourism and economic diversification positively impact market expansion.

Long-Term Growth Catalysts in the Saudi Arabia Car Rental & Leasing Market

Long-term growth hinges on continued innovation in technology and service offerings, strategic partnerships to expand market reach, and the successful integration of sustainable transportation solutions into fleet management. Expansion into new market segments, such as corporate leasing and niche customer groups will also contribute to long-term growth.

Emerging Opportunities in Saudi Arabia Car Rental & Leasing Market

Emerging opportunities include tapping into the growing demand for luxury and specialized vehicles, expanding into underserved markets, and leveraging technological advancements for enhanced customer service and operational efficiency. The integration of sustainable vehicles into rental fleets also presents a significant opportunity for environmentally conscious businesses.

Leading Players in the Saudi Arabia Car Rental & Leasing Market Sector

- Bin Hadi

- National Car Rental

- Turo

- Zipcar

- Best Rent A Car

- Hanco Automotive

- Budget Rent-A-Car

- Auto Rent

- Theeb Rent A Car

- Ejaro

- Key Car Rental

- Strong Rent a Car

- Yelo Corporation (Al Wefaq)

- Hertz Corporation

- Sixt SE

- Samara Land Transportation Services

- Autoworld (Al-Jazira Equipment Company Limited)

- Esar International Group

- Europcar Mobility Group

- Avis Budget Group Inc

Key Milestones in Saudi Arabia Car Rental & Leasing Market Industry

- October 2022: Lumi, Seera’s car rental and leasing unit, opened its first car showroom in Riyadh, signaling an expansion beyond rental and leasing services.

- April 2023: ALTAWKILAT Premium partnered with PEAX to supply 100 luxury Hongqi cars, strengthening the luxury car rental segment.

- June 2023: Lumi Rental Company secured a significant leasing agreement with Saudi Post for 855 vehicles, highlighting the increasing demand for commercial vehicle leasing.

- November 2023: Budget Saudi (United International Transportation Company) secured a SAR 39.8 million (USD 10.6 million) long-term leasing contract with SABIC, demonstrating large-scale fleet leasing activities.

Strategic Outlook for Saudi Arabia Car Rental & Leasing Market Market

The Saudi Arabia car rental and leasing market presents substantial growth potential. Strategic opportunities lie in capitalizing on technological innovations, expanding into underserved segments, and forging strategic alliances. The focus should be on enhancing customer experience, streamlining operations, and leveraging sustainable practices to capture market share in this dynamic sector.

Saudi Arabia Car Rental & Leasing Market Segmentation

-

1. Duration

- 1.1. Short-term Leasing

- 1.2. Long-term Leasing

-

2. Vehicle Type

- 2.1. Economy/Budget

- 2.2. Premium/Luxury

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Multi Utility Vehicle and Sports Utility Vehicle

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

Saudi Arabia Car Rental & Leasing Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Car Rental & Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market

- 3.3. Market Restrains

- 3.3.1. Impact of Inflation on Costs and Consumer Spending is a Key Challenge

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sports Utility Vehicles to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 5.1.1. Short-term Leasing

- 5.1.2. Long-term Leasing

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Economy/Budget

- 5.2.2. Premium/Luxury

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Multi Utility Vehicle and Sports Utility Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 6. Central Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bin Hadi

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 National Car Rental

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Turo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zipcar

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Best Rent A Car

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hanco Automotive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Budget Rent-A-Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Auto Rent

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Theeb Rent A Car

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ejaro

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Key Car Rental

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Strong Rent a Car

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yelo Corporation (Al Wefaq)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hertz Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Sixt SE

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Samara Land Transportation Services

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Autoworld (Al-Jazira Equipment Company Limited

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Esar International Group

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Europcar Mobility Group

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Avis Budget Group Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Bin Hadi

List of Figures

- Figure 1: Saudi Arabia Car Rental & Leasing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Car Rental & Leasing Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 3: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 6: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Central Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 13: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 15: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 16: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Car Rental & Leasing Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Saudi Arabia Car Rental & Leasing Market?

Key companies in the market include Bin Hadi, National Car Rental, Turo, Zipcar, Best Rent A Car, Hanco Automotive, Budget Rent-A-Car, Auto Rent, Theeb Rent A Car, Ejaro, Key Car Rental, Strong Rent a Car, Yelo Corporation (Al Wefaq), Hertz Corporation, Sixt SE, Samara Land Transportation Services, Autoworld (Al-Jazira Equipment Company Limited, Esar International Group, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Saudi Arabia Car Rental & Leasing Market?

The market segments include Duration, Vehicle Type, Body Type, Booking Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Sports Utility Vehicles to Drive the Market.

7. Are there any restraints impacting market growth?

Impact of Inflation on Costs and Consumer Spending is a Key Challenge.

8. Can you provide examples of recent developments in the market?

November 2023: The United International Transportation Company, Budget Saudi, secured a long-term deal with Saudi Basic Industries Corp. (SABIC) for leasing the transport firm’s 263 vehicles. The contract, valued at SAR 39.8 million (USD 10.6 million), is for four years. The leasing deal will be automatically renewed for 12 months at the end of the initial term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Car Rental & Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Car Rental & Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Car Rental & Leasing Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Car Rental & Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence