Key Insights

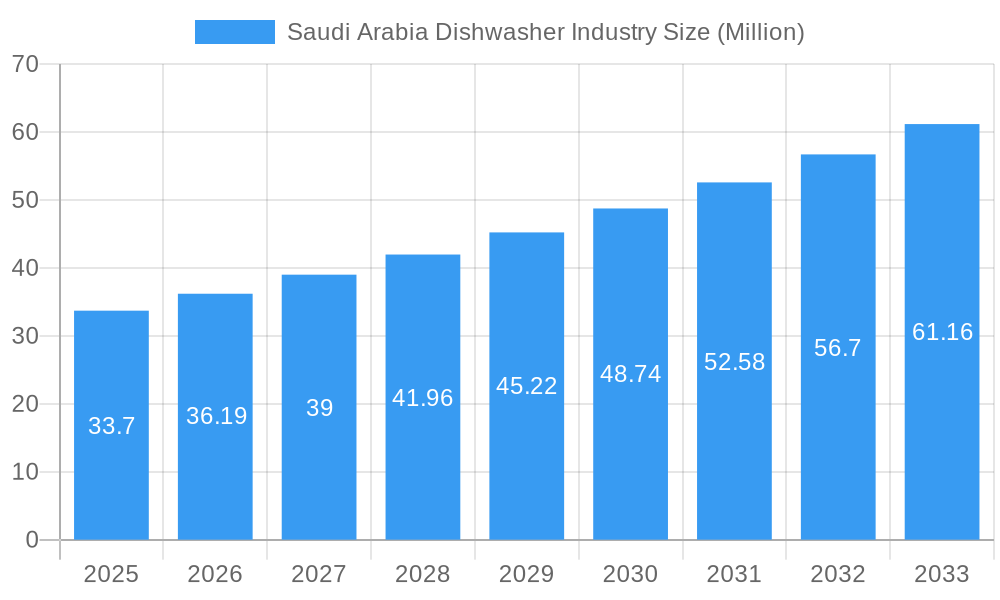

The Saudi Arabian dishwasher market, valued at $33.70 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.44% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes among Saudi households are fueling increased demand for modern kitchen appliances, including dishwashers, which offer convenience and time-saving benefits. Furthermore, a growing emphasis on hygiene and sanitation, particularly in urban areas, is boosting the adoption of dishwashers. The market is segmented by product type (free-standing and built-in), application (residential and commercial), and distribution channel (online and offline). The residential segment currently dominates, although the commercial segment is poised for significant growth due to the expansion of the hospitality and food service industries. Key players like Whirlpool, Bosch, Electrolux, and LG Electronics are actively competing, driving innovation and offering diverse product ranges to cater to consumer preferences across different price points. The market's distribution channels are evolving, with online sales witnessing a notable increase, indicating a shift towards e-commerce platforms. Regional variations exist within Saudi Arabia, with urban centers like Riyadh, Jeddah, and Dammam showing higher adoption rates compared to rural areas. Future growth will likely depend on sustained economic growth, government initiatives promoting energy-efficient appliances, and continued expansion of the online retail sector.

Saudi Arabia Dishwasher Industry Market Size (In Million)

The competitive landscape is characterized by a mix of international and local brands. International brands leverage their established brand reputation and technological advancements, while local players focus on price competitiveness and regional adaptation. The market is expected to witness increased product diversification, focusing on energy efficiency, smart features, and enhanced cleaning capabilities. Government initiatives promoting energy conservation and sustainable consumption patterns may influence future growth trajectories. The ongoing infrastructural development in Saudi Arabia, particularly in housing and commercial spaces, is expected to provide a favorable environment for the growth of the dishwasher market. Challenges include price sensitivity among certain consumer segments and the need to address awareness regarding the benefits of dishwashers in some regions. The market will likely see continued innovation in terms of design, functionalities, and energy efficiency to cater to the evolving needs of the Saudi Arabian consumer.

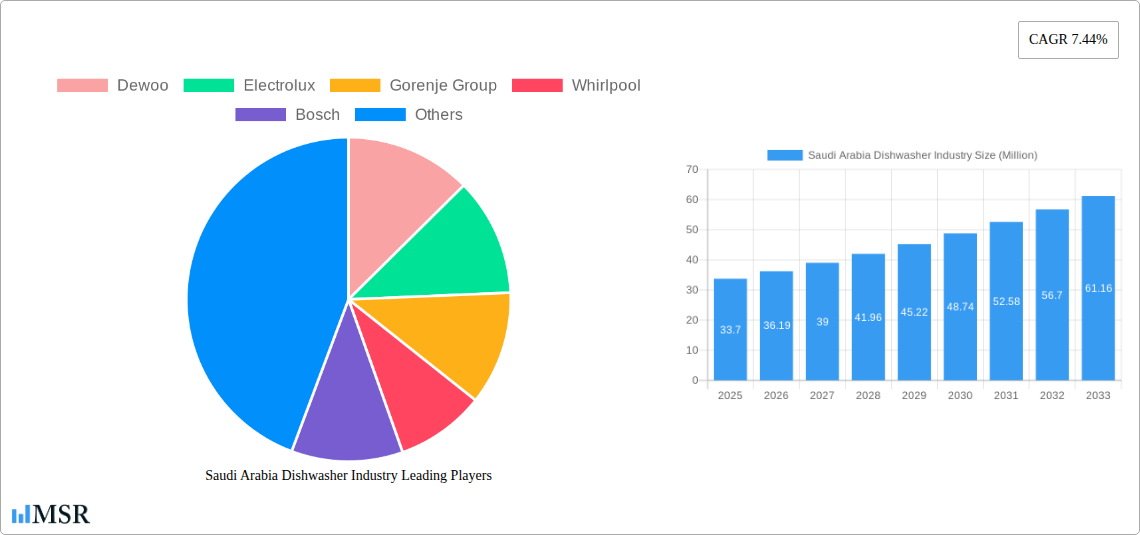

Saudi Arabia Dishwasher Industry Company Market Share

Saudi Arabia Dishwasher Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia dishwasher industry, offering valuable insights for stakeholders including manufacturers, distributors, investors, and policymakers. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. Expect detailed breakdowns of market size (in Millions), CAGR, segment performance, and competitive dynamics. This report is crucial for understanding current market trends and forecasting future growth opportunities within the Saudi Arabian dishwasher market.

Saudi Arabia Dishwasher Industry Market Concentration & Dynamics

The Saudi Arabia dishwasher market exhibits a moderately concentrated landscape, with key players like Whirlpool, Bosch, and LG Electronics holding significant market share. The exact market share for each company is currently unavailable, but estimations suggest that the top five players control approximately xx% of the market. Innovation in the sector is driven by a combination of international players introducing advanced technologies and local players focusing on cost-effective solutions. The regulatory framework, while largely supportive of market growth, could benefit from further clarity on energy efficiency standards. Substitute products, primarily manual dishwashing, are less prevalent due to rising disposable incomes and changing lifestyles. End-user trends are shifting towards more energy-efficient and technologically advanced dishwashers, with a growing demand for built-in models. M&A activity in the sector remains relatively low; with only xx M&A deals recorded in the last five years.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (estimated).

- Innovation Ecosystem: Driven by international players and local cost-focused manufacturers.

- Regulatory Framework: Supportive but could benefit from further clarity on energy efficiency standards.

- Substitute Products: Limited due to rising incomes and lifestyle changes.

- End-User Trends: Increasing demand for energy-efficient and technologically advanced dishwashers, particularly built-in models.

- M&A Activity: Relatively low, with xx deals recorded in the last five years.

Saudi Arabia Dishwasher Industry Industry Insights & Trends

The Saudi Arabia dishwasher market experienced significant growth during the historical period (2019-2024), with a market size of approximately xx Million in 2024. This growth is primarily attributed to factors such as rising disposable incomes, urbanization, and a growing preference for modern kitchen appliances. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching an estimated size of xx Million by 2033. Technological disruptions, such as the introduction of smart dishwashers with advanced features like Wi-Fi connectivity and automated cleaning cycles, are driving further market expansion. Evolving consumer behaviors are favoring energy-efficient and water-saving models, aligning with the global trend towards sustainability. Furthermore, the government's focus on infrastructure development and affordable housing contributes to this upward trend.

Key Markets & Segments Leading Saudi Arabia Dishwasher Industry

The residential segment dominates the Saudi Arabia dishwasher market, accounting for approximately xx% of total sales. Within the types segment, built-in dishwashers are gaining popularity due to their space-saving design and integration with modern kitchens. The offline distribution channel is the primary sales route, although online sales are steadily growing, particularly among younger demographics. Key growth drivers include:

- Residential Segment: Dominant segment driven by rising disposable incomes and preference for modern kitchens.

- Built-in Dishwashers: Increasingly popular due to space-saving design and aesthetic appeal.

- Offline Distribution: Remains the primary sales channel, supplemented by growing online sales.

Growth Drivers:

- Rising disposable incomes and improving living standards.

- Increasing urbanization and the growth of modern housing.

- Government investments in infrastructure and affordable housing projects.

Saudi Arabia Dishwasher Industry Product Developments

Recent product innovations in the Saudi Arabian dishwasher market focus on improved energy efficiency, enhanced cleaning performance, and advanced features like smart connectivity. Manufacturers are also responding to consumer demand for quieter operation and more compact designs. These innovations contribute to competitive advantages and enhance product appeal.

Challenges in the Saudi Arabia Dishwasher Industry Market

The Saudi Arabia dishwasher market faces challenges including fluctuating raw material prices, competition from cheaper imported products, and potential disruptions to the supply chain. These factors can lead to price volatility and impact profitability. Regulatory compliance and adherence to energy efficiency standards are also important considerations for manufacturers.

Forces Driving Saudi Arabia Dishwasher Industry Growth

Several factors contribute to the long-term growth of the Saudi Arabian dishwasher market. These include rising disposable incomes, increased awareness of hygiene and convenience, and government initiatives promoting energy efficiency. The expansion of the modern housing sector and ongoing infrastructure projects provide a further impetus to market growth.

Challenges in the Saudi Arabia Dishwasher Industry Market

The Saudi Arabia dishwasher market faces challenges such as import tariffs and competition from regional manufacturers. Addressing these headwinds is key to unlocking the full potential of the market. Furthermore, variations in consumer preferences and fluctuating oil prices pose potential uncertainties to business growth.

Emerging Opportunities in Saudi Arabia Dishwasher Industry

Emerging opportunities exist in the expansion of the commercial segment, particularly within the hospitality and food service industries. The growing preference for energy-efficient and water-saving appliances also presents opportunities for manufacturers to develop and promote sustainable products. Moreover, there's potential for growth in smart dishwashers with internet-based features and capabilities.

Leading Players in the Saudi Arabia Dishwasher Industry Sector

- Dewoo

- Electrolux

- Gorenje Group

- Whirlpool

- Bosch

- Toshiba

- Mastergas

- Midea

- LG Electronics

- Arsiton

Key Milestones in Saudi Arabia Dishwasher Industry Industry

- March 2021: Samsung introduced a new range of kitchen appliances, including microwaves with enhanced features, indicating a broader trend toward innovative kitchen solutions.

- February 2022: LG Electronics showcased its advanced HVAC solutions, highlighting a focus on energy efficiency and smart technology, which indirectly supports the market for energy-efficient appliances like dishwashers.

Strategic Outlook for Saudi Arabia Dishwasher Industry Market

The Saudi Arabia dishwasher market is poised for continued growth, driven by sustained economic development, rising living standards, and technological advancements. Strategic opportunities exist in focusing on energy-efficient, smart, and compact models to cater to the evolving consumer preferences. Expanding into the commercial sector and leveraging online sales channels will further enhance market penetration and growth potential.

Saudi Arabia Dishwasher Industry Segmentation

-

1. Types

- 1.1. Free Standing Dishwasher

- 1.2. Built-in Dishwasher

-

2. Applications

- 2.1. Residential

- 2.2. Commercial

-

3. Dsitribution Channel

- 3.1. Offline

- 3.2. Online

Saudi Arabia Dishwasher Industry Segmentation By Geography

- 1. Saudi Arabia

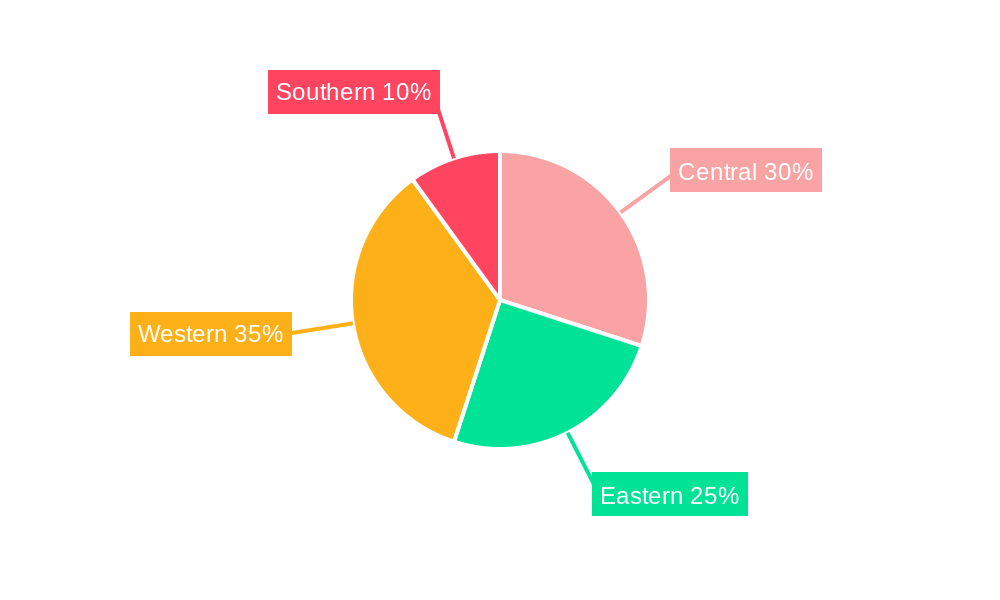

Saudi Arabia Dishwasher Industry Regional Market Share

Geographic Coverage of Saudi Arabia Dishwasher Industry

Saudi Arabia Dishwasher Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income & Urbanization is Augmenting Dishwasher's Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Free Standing Dishwasher

- 5.1.2. Built-in Dishwasher

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Dsitribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dewoo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Electrolux

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gorenje Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Whirlpool

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toshiba

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mastergas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Midea

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LG Electronics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arsiton

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dewoo

List of Figures

- Figure 1: Saudi Arabia Dishwasher Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Dishwasher Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Types 2020 & 2033

- Table 2: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Types 2020 & 2033

- Table 3: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 5: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Dsitribution Channel 2020 & 2033

- Table 6: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Dsitribution Channel 2020 & 2033

- Table 7: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Types 2020 & 2033

- Table 10: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Types 2020 & 2033

- Table 11: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 12: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 13: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Dsitribution Channel 2020 & 2033

- Table 14: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Dsitribution Channel 2020 & 2033

- Table 15: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Dishwasher Industry?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Saudi Arabia Dishwasher Industry?

Key companies in the market include Dewoo, Electrolux, Gorenje Group, Whirlpool, Bosch, Toshiba, Mastergas, Midea, LG Electronics, Arsiton.

3. What are the main segments of the Saudi Arabia Dishwasher Industry?

The market segments include Types, Applications, Dsitribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Rising Disposable Income & Urbanization is Augmenting Dishwasher's Sales.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

On Feb 2nd 2022, LG Electronics (LG) showcased its robust 2022 lineup of commercial, light commercial and residential HVAC solutions - including industry-leading Variable Refrigerant Flow (VRF) technology, latest energy efficient heat pump systems, indoor air quality solutions and flexible building automation and connectivity products - at the 2022 AHR Expo in Las Vegas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Dishwasher Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Dishwasher Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Dishwasher Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Dishwasher Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence