Key Insights

The India steam room market is projected to reach $1.6 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 14.4% from 2024 to 2033. Key growth drivers include rising disposable incomes and increasing consumer awareness of steam therapy's health benefits, such as stress reduction and improved respiratory health. Growing adoption of wellness practices and self-care is also fueling demand. The market is segmented by type (conventional and infrared) and end-user (residential and commercial). The residential segment currently leads, driven by rising homeownership and the desire for home spa experiences. The commercial segment, including hotels, spas, and fitness centers, is expected to grow significantly due to wellness tourism and luxury hotel trends.

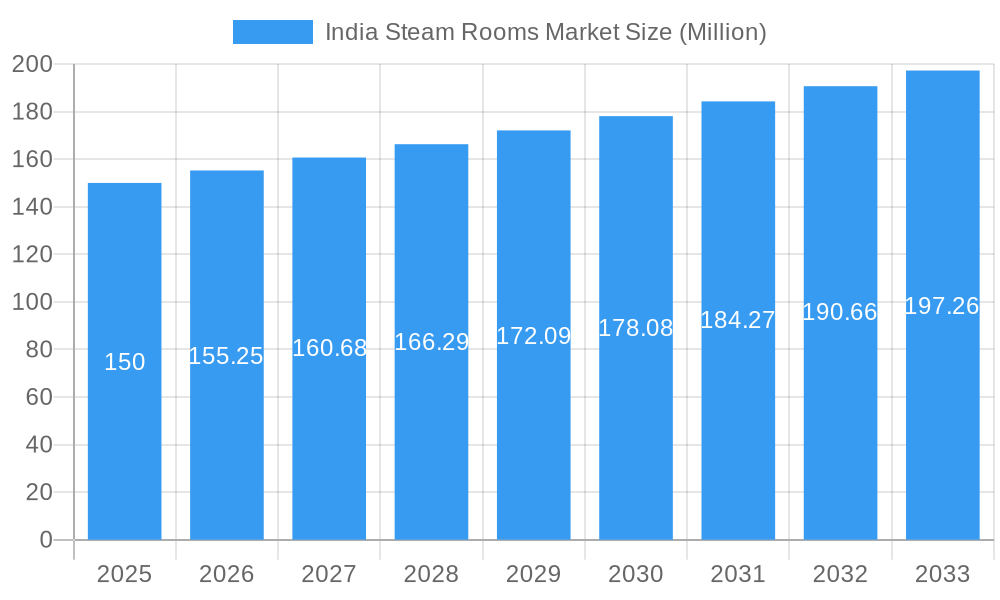

India Steam Rooms Market Market Size (In Billion)

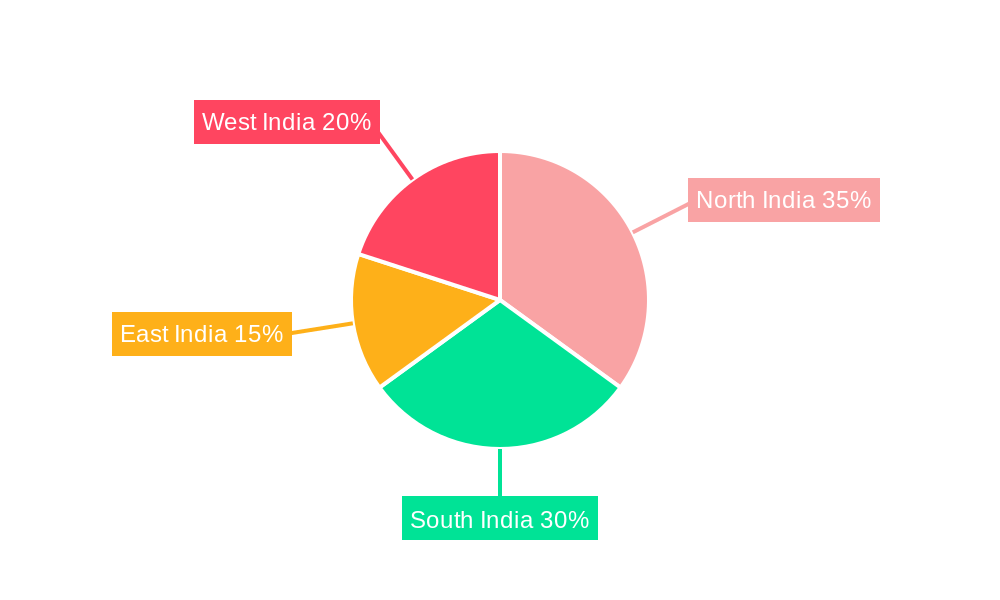

Challenges include high initial installation costs and competition from alternative wellness solutions. However, the introduction of innovative and affordable models, coupled with expanding financing options, is expected to overcome these restraints. Urban areas in North and South India show higher adoption rates. Leading players such as Kohler and Hi-tech Bath Solutions are driving market evolution through innovation and expansion. The India steam room market demonstrates a positive outlook with substantial expansion potential through the forecast period.

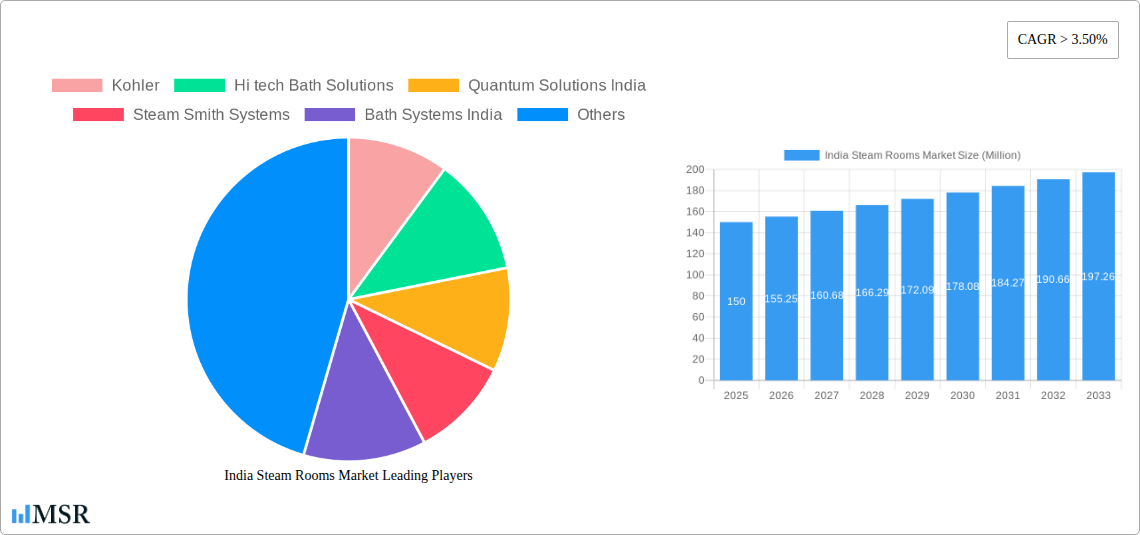

India Steam Rooms Market Company Market Share

India Steam Rooms Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Steam Rooms Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on market size, segmentation, key players, and future trends, this report covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to provide actionable intelligence on this dynamic market. The total market size in 2025 is estimated at xx Million, with a CAGR of xx% during the forecast period.

India Steam Rooms Market Concentration & Dynamics

The India steam room market exhibits a moderately fragmented landscape, with several key players vying for market share. While no single company dominates, larger players like Kohler and Hi-tech Bath Solutions hold significant positions. The market concentration ratio (CRx) for the top 5 players is estimated at xx%. The innovation ecosystem is relatively active, driven by new product launches and technological advancements in steam generation and control systems. Regulatory frameworks regarding safety and energy efficiency are evolving, influencing product design and market access. Substitute products, such as traditional saunas and hot tubs, present competitive pressure. End-user trends show increasing demand for luxury and wellness-focused steam rooms in both residential and commercial settings. M&A activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024. This suggests consolidation is a potential future trend.

- Market Share (2025): Kohler (xx%), Hi-tech Bath Solutions (xx%), Quantum Solutions India (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Safety standards, energy efficiency norms

India Steam Rooms Market Industry Insights & Trends

The India Steam Rooms market is experiencing robust growth, fueled by increasing disposable incomes, rising health consciousness, and a growing preference for wellness and luxury products. The market size is projected to reach xx Million by 2033, driven by a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, particularly in smart home integration and energy-efficient steam generation, are further stimulating market expansion. Changing consumer behaviors, including increased adoption of home wellness solutions and a growing preference for personalized experiences, are also contributing to market growth. The shift towards compact and aesthetically pleasing steam rooms catering to smaller residential spaces is another notable trend. The market’s growth is not without challenges, with factors such as infrastructural limitations in certain regions needing to be addressed.

Key Markets & Segments Leading India Steam Rooms Market

The residential segment currently dominates the India steam rooms market, accounting for approximately xx% of the total market share in 2025. However, the commercial segment is expected to witness significant growth in the coming years, driven by increasing adoption in hotels, spas, and fitness centers.

By Type:

- Conventional Steam Rooms: This segment currently holds a larger market share due to established presence and cost-effectiveness.

- Infrared Steam Rooms: This segment is experiencing growth due to its faster heating times and perceived health benefits, however, it currently holds a smaller market share.

By End-user:

- Residential: Driven by rising disposable incomes and focus on home wellness.

- Commercial: Growing adoption in hotels, spas, and wellness centers.

Dominance Analysis:

The residential segment's dominance is primarily due to increased disposable incomes and urbanization within the major cities of India. However, the commercial segment is poised for considerable expansion, driven by the growing hospitality industry and increasing health awareness among consumers, leading to a greater demand for wellness facilities. The infrastructural development, especially in metropolitan areas, further contributes to market expansion in the commercial sector.

India Steam Rooms Market Product Developments

Recent product innovations in the India steam rooms market focus on enhancing user experience, energy efficiency, and design aesthetics. Manufacturers are introducing smart features, such as app-based controls and aromatherapy integration. The focus on compact designs caters to space constraints in urban areas. Competitive advantages are gained through superior build quality, innovative features, and stylish designs, creating a diverse range of products to meet evolving customer needs.

Challenges in the India Steam Rooms Market

The India steam rooms market faces several challenges, including high initial investment costs that can be a barrier for certain consumer segments, the comparatively high cost of installation for larger-scale commercial setups, and the need for skilled installation and maintenance technicians. The supply chain for specialized components can also be a source of disruption. Furthermore, competition from substitute products and the availability of affordable alternatives can impact the growth rate. These factors collectively pose challenges to sustained and rapid market expansion.

Forces Driving India Steam Rooms Market Growth

Key growth drivers for the India steam rooms market include increasing disposable incomes among the middle- and upper-class population; the growing trend of wellness and self-care; government support for infrastructure development in the hospitality sector; and the rise of luxurious and health-focused homes. These factors, along with the adoption of innovative and energy-efficient models, are driving market growth. Technological advancements such as smart controls and energy-efficient designs further encourage adoption.

Long-Term Growth Catalysts in India Steam Rooms Market

The long-term growth of the India steam rooms market is fueled by continuing innovation in design, smart features, and energy-efficient technologies. Strategic partnerships between manufacturers and wellness businesses are also expanding market reach. The increasing focus on creating custom designs to meet niche market demands further contributes to the market’s long-term growth. The continuous development of technologically advanced, sustainable models is a major catalyst.

Emerging Opportunities in India Steam Rooms Market

Emerging opportunities lie in expanding into smaller towns and cities, leveraging e-commerce channels for increased accessibility, and targeting specific niche markets (such as senior-citizen friendly steam rooms or eco-friendly options). Technological advancements in artificial intelligence and virtual reality could also enhance product features and user experience. The introduction of aromatherapy and chromotherapy features is creating new possibilities for value addition and luxury experiences.

Leading Players in the India Steam Rooms Market Sector

- Kohler

- Hi tech Bath Solutions

- Quantum Solutions India

- Steam Smith Systems

- Bath Systems India

- Orion Bathing Concepts

- Potent Water Care

- Steamers India

- Omega Bath Solutions

- Woven Gold India

Key Milestones in India Steam Rooms Market Industry

- 2021: Hi-tech Bath Solutions launched a new indoor steam room model accommodating up to five individuals, featuring pre-assembled panels, backrests, and benches for easy home installation. This launch highlights a shift toward user-friendly, aesthetically pleasing designs.

Strategic Outlook for India Steam Rooms Market

The India steam rooms market presents significant growth potential in the coming years. Strategic investments in research and development, targeted marketing campaigns focused on health and wellness benefits, and the adoption of efficient distribution channels are key to capturing market share. Expansion into untapped markets and strategic partnerships will further accelerate market growth and consolidate leadership positions within the industry.

India Steam Rooms Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Steam Rooms Market Segmentation By Geography

- 1. India

India Steam Rooms Market Regional Market Share

Geographic Coverage of India Steam Rooms Market

India Steam Rooms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.144% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Urbanization; Advancements in Kitchen Technology

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in Tourism is Driving the Indian Steam Room Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steam Rooms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kohler

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hi tech Bath Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Quantum Solutions India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Steam Smith Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bath Systems India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orion Bathing Concepts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Potent Water Care**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Steamers India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omega Bath Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Woven Gold India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kohler

List of Figures

- Figure 1: India Steam Rooms Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Steam Rooms Market Share (%) by Company 2025

List of Tables

- Table 1: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Steam Rooms Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Steam Rooms Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steam Rooms Market?

The projected CAGR is approximately 0.144%.

2. Which companies are prominent players in the India Steam Rooms Market?

Key companies in the market include Kohler, Hi tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care**List Not Exhaustive, Steamers India, Omega Bath Solutions, Woven Gold India.

3. What are the main segments of the India Steam Rooms Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Urbanization; Advancements in Kitchen Technology.

6. What are the notable trends driving market growth?

Growth in Tourism is Driving the Indian Steam Room Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Hitech bath solutions launched a new steam room. It is an indoor model that seats up to five individuals. The entire sauna showcases a beautiful blending of vertical and horizontal lines and is designed for corner placement. The panels, backrests, and benches come pre-assembled for an easy, seamless in-home assembly by two individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steam Rooms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steam Rooms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steam Rooms Market?

To stay informed about further developments, trends, and reports in the India Steam Rooms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence