Key Insights

The Saudi Arabian portable air conditioner market is experiencing significant expansion, propelled by escalating temperatures, increasing urbanization, and a growing demand for energy-efficient cooling solutions. The market has demonstrated a robust Compound Annual Growth Rate (CAGR) of 2.5%, with an estimated market size of 990.75 million in the base year of 2025. This growth is attributed to the expanding residential sector's need for individualized climate control, the adoption of cost-effective cooling solutions by commercial establishments, and the convenience offered by online sales channels. The market is segmented by product type (single-hose, double-hose, others), end-user (residential, commercial), and distribution channel (direct sales, multi-brand stores, specialty stores, online). Key players such as Panasonic, LG, Daikin, and Samsung are actively competing based on product features, pricing, and brand recognition. Regional demand varies across Saudi Arabia's Central, Eastern, Western, and Southern regions, influenced by distinct climatic conditions and population densities. Continued market expansion is anticipated, supported by government initiatives promoting energy efficiency and rising disposable incomes within the Saudi population.

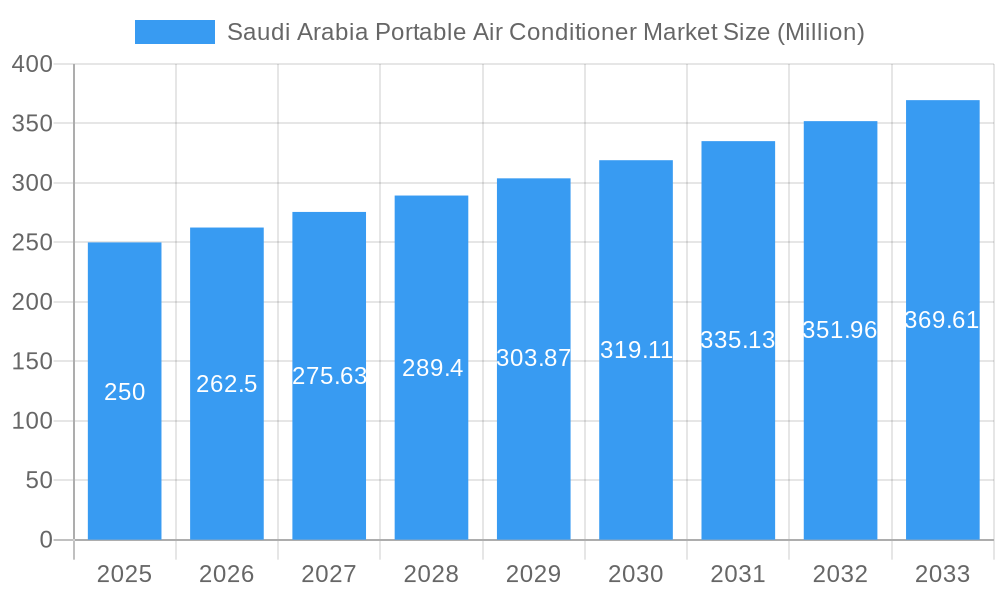

Saudi Arabia Portable Air Conditioner Market Market Size (In Million)

Projecting towards 2033, the Saudi Arabian portable air conditioner market is forecast to maintain its growth trajectory. Potential challenges, including fluctuations in energy prices and the impact of energy consumption regulations, may influence the pace of expansion. The market's segmentation presents opportunities for specialized product development and targeted marketing efforts. Companies are expected to prioritize innovation in energy-efficient technologies, smart features, and enhanced distribution networks to maintain a competitive advantage. The increasing preference for online purchases opens new avenues for market penetration, while ongoing investments in infrastructure and economic development will further contribute to overall market growth. Growing environmental awareness is also likely to drive consumer preference towards eco-friendly models, serving as an additional long-term growth catalyst.

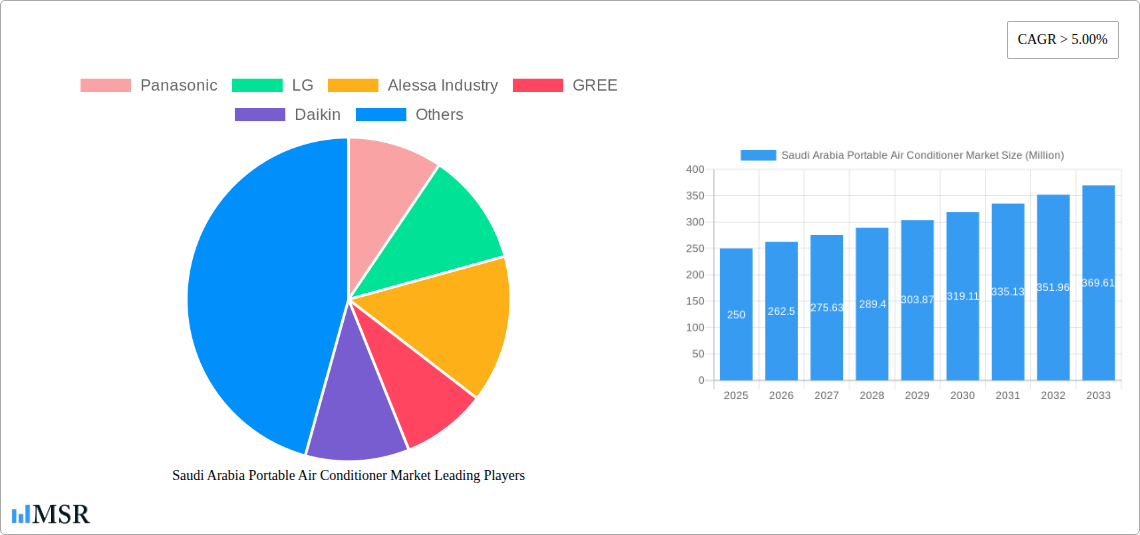

Saudi Arabia Portable Air Conditioner Market Company Market Share

Saudi Arabia Portable Air Conditioner Market Analysis: Size, Growth, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Saudi Arabian portable air conditioner market, providing critical insights for industry stakeholders, investors, and businesses seeking to leverage growth opportunities. The report details market size, segmentation, key players, growth drivers, challenges, and future trends, with a precise forecast from 2025 to 2033. Delivering actionable intelligence, this report is an indispensable resource for informed decision-making within this dynamic market.

Saudi Arabia Portable Air Conditioner Market Concentration & Dynamics

The Saudi Arabia portable air conditioner market exhibits a moderately concentrated landscape, with several key players commanding significant market share. Key players include Panasonic, LG, Alessa Industry, GREE, Daikin, Samsung, Zamil AC, Carrier, Awal Gulf Manufacturing, and Hitachi. The market share held by the top five players in 2024 was estimated to be approximately 60%, indicating a substantial level of competition. However, the market is also characterized by the presence of numerous smaller players, contributing to a dynamic and competitive environment.

Innovation plays a crucial role, with companies focusing on energy efficiency, smart features, and eco-friendly refrigerants. Regulatory frameworks, particularly those concerning energy consumption standards, influence product development and adoption. Substitute products, such as evaporative coolers, compete primarily based on price, although portable air conditioners offer superior cooling performance. End-user trends favor energy-efficient and technologically advanced models. Recent years have witnessed a moderate level of M&A activity, with notable partnerships like the Zamil AC and Samsung collaboration driving market consolidation. Specifically, in 2022 and 2023 alone we witnessed xx M&A deals in the Saudi portable air conditioner market indicating a potential increase in consolidation activity.

Saudi Arabia Portable Air Conditioner Market Industry Insights & Trends

The Saudi Arabia portable air conditioner market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a preference for convenient cooling solutions. The market size reached approximately $XX Million in 2024, and is projected to exhibit a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), reaching an estimated $XX Million by 2033. Technological advancements, such as the introduction of inverter technology and smart features, are driving premiumization within the market. Evolving consumer preferences are shifting towards energy-efficient and technologically advanced models that offer features such as remote control and Wi-Fi connectivity. The market shows a growing demand for eco-friendly portable air conditioners owing to increased awareness on the environmental implications.

Key Markets & Segments Leading Saudi Arabia Portable Air Conditioner Market

The residential segment dominates the Saudi Arabia portable air conditioner market, accounting for approximately 75% of total sales in 2024. The commercial segment is also experiencing steady growth, driven by increased investment in retail and hospitality sectors. Within product types, Single-Hose Portable Air Conditioners hold the largest market share.

Drivers for Market Growth:

- Rising Disposable Incomes: Increased purchasing power fuels demand for consumer durables.

- Urbanization: Rapid urbanization increases demand for effective cooling solutions in densely populated areas.

- Tourism Expansion: The growing tourism sector drives demand in hotels and other hospitality establishments.

- Government Initiatives: Policies promoting energy efficiency influence product adoption.

Dominance Analysis:

The residential segment's dominance is attributed to rising household incomes and the increasing preference for individual comfort. The strong growth in the commercial sector reflects the increasing investments in the hospitality and retail industries. Single-hose units dominate the product segment due to their affordability and suitability for residential use.

Distribution Channel Analysis: The multi-brand retail channels are the most prominent distribution channels, followed by specialty stores and online channels. Direct sales remain a significant channel for larger commercial projects.

Saudi Arabia Portable Air Conditioner Market Product Developments

Recent product innovations in the Saudi Arabia portable air conditioner market focus on enhanced energy efficiency, smart features, and improved design. Manufacturers are integrating inverter technology to optimize energy consumption and reduce running costs. Smart features, such as Wi-Fi connectivity and remote control, are becoming increasingly prevalent, allowing users to manage their air conditioners remotely. Compact designs and aesthetically pleasing models are gaining popularity. These advancements provide significant competitive advantages, enabling manufacturers to cater to a wider range of consumer preferences.

Challenges in the Saudi Arabia Portable Air Conditioner Market Market

The Saudi Arabia portable air conditioner market faces challenges including fluctuating energy prices, supply chain disruptions, and intense competition. These factors impact profitability and market stability. Furthermore, stringent regulatory standards regarding energy efficiency and safety place significant compliance burdens on manufacturers. The impact of these challenges on the market is estimated to reduce the overall market growth by approximately xx% annually.

Forces Driving Saudi Arabia Portable Air Conditioner Market Growth

Several factors drive growth in the Saudi Arabia portable air conditioner market. Technological advancements, particularly in energy efficiency and smart features, are attracting consumers. Economic growth, reflected in rising disposable incomes, further fuels demand for convenient cooling solutions. Government initiatives promoting energy efficiency in buildings also positively influence market growth. For instance, government subsidies for energy-efficient appliances have stimulated the adoption of advanced portable air conditioners.

Challenges in the Saudi Arabia Portable Air Conditioner Market Market

Long-term growth hinges on innovation and strategic partnerships. Companies are focusing on developing energy-efficient models, incorporating smart features, and expanding their distribution networks. Collaborations between manufacturers and technology providers are enhancing product capabilities. Expansion into new market segments and regions also contributes to long-term growth.

Emerging Opportunities in Saudi Arabia Portable Air Conditioner Market

The Saudi Arabia portable air conditioner market presents opportunities for manufacturers to capitalize on the growing demand for energy-efficient and technologically advanced models. The rising adoption of smart home technology presents a significant opportunity to integrate smart features into portable air conditioners. Expanding distribution networks and exploring new market segments, such as the healthcare sector, also offer promising avenues for growth. Additionally, the increasing awareness of environmental concerns opens opportunities for eco-friendly portable air conditioners.

Key Milestones in Saudi Arabia Portable Air Conditioner Market Industry

- December 2022: Al Hassan Ghazi Ibrahim Shaker Co. strengthens its partnership with LG Electronics through a new supply agreement, expanding its product portfolio.

- February 2023: Zamil Air Conditioners Company and Samsung Electronics collaborate on domestic VRF air conditioner production.

Strategic Outlook for Saudi Arabia Portable Air Conditioner Market Market

The Saudi Arabia portable air conditioner market is poised for continued growth, driven by technological advancements, rising disposable incomes, and government initiatives. Strategic opportunities lie in developing energy-efficient and smart models, expanding into new market segments, and forging strategic partnerships to enhance market reach and product capabilities. Focusing on sustainability and meeting the evolving needs of consumers will be crucial for achieving long-term success in this dynamic market.

Saudi Arabia Portable Air Conditioner Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Portable Air Conditioner Market Segmentation By Geography

- 1. Saudi Arabia

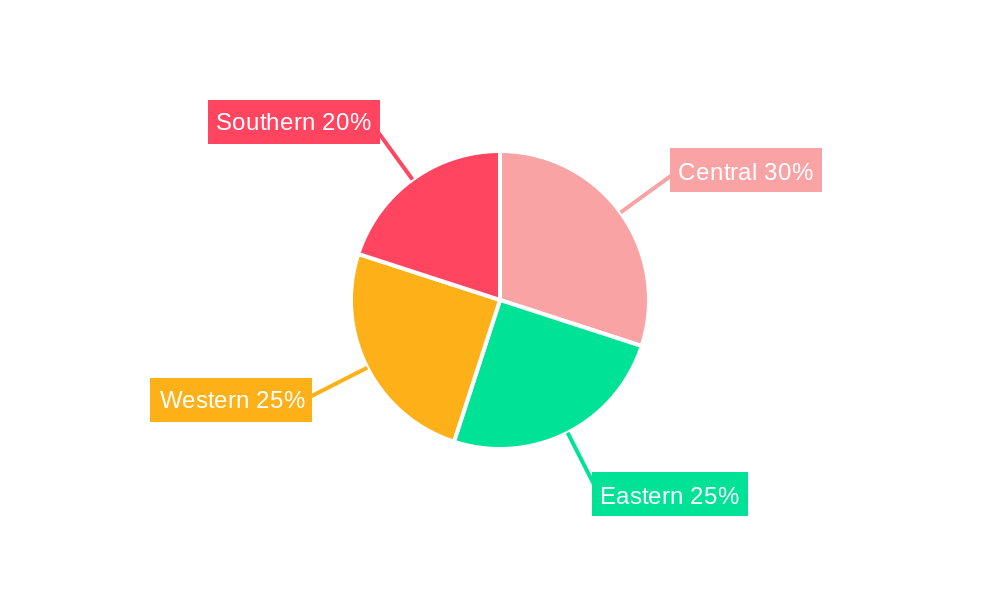

Saudi Arabia Portable Air Conditioner Market Regional Market Share

Geographic Coverage of Saudi Arabia Portable Air Conditioner Market

Saudi Arabia Portable Air Conditioner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer spending in Major Appliance; Expansion of Office and Commercial Space

- 3.3. Market Restrains

- 3.3.1. Rising AC Price with Supply Chain Disruption; Higher Electricity Consumption of AC Appliances

- 3.4. Market Trends

- 3.4.1. Rising Household Expenditure On Home Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Portable Air Conditioner Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alessa Industry

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GREE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daikin

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zamil AC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carrier

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Awal Gulf Manufacturing

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Saudi Arabia Portable Air Conditioner Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Portable Air Conditioner Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabia Portable Air Conditioner Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Portable Air Conditioner Market?

The projected CAGR is approximately 2.5%.

2. Which companies are prominent players in the Saudi Arabia Portable Air Conditioner Market?

Key companies in the market include Panasonic, LG, Alessa Industry, GREE, Daikin, Samsung**List Not Exhaustive, Zamil AC, Carrier, Awal Gulf Manufacturing, Hitachi.

3. What are the main segments of the Saudi Arabia Portable Air Conditioner Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 990.75 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer spending in Major Appliance; Expansion of Office and Commercial Space.

6. What are the notable trends driving market growth?

Rising Household Expenditure On Home Appliances.

7. Are there any restraints impacting market growth?

Rising AC Price with Supply Chain Disruption; Higher Electricity Consumption of AC Appliances.

8. Can you provide examples of recent developments in the market?

February 2023: Zamil Air Conditioners Company inked a significant collaborative agreement with Samsung Electronics. This partnership serves to bolster and broaden their cooperative efforts in the domestic production of air conditioners utilizing VRF technology. Zamil Air Conditioners and Samsung Electronics will work closely together to enhance this manufacturing initiative.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Portable Air Conditioner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Portable Air Conditioner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Portable Air Conditioner Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Portable Air Conditioner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence