Key Insights

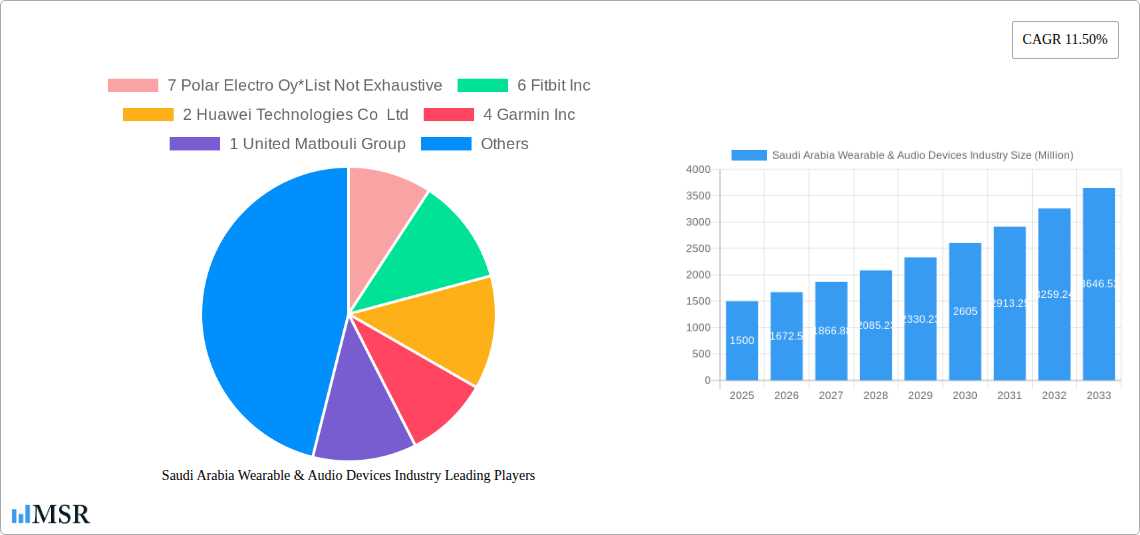

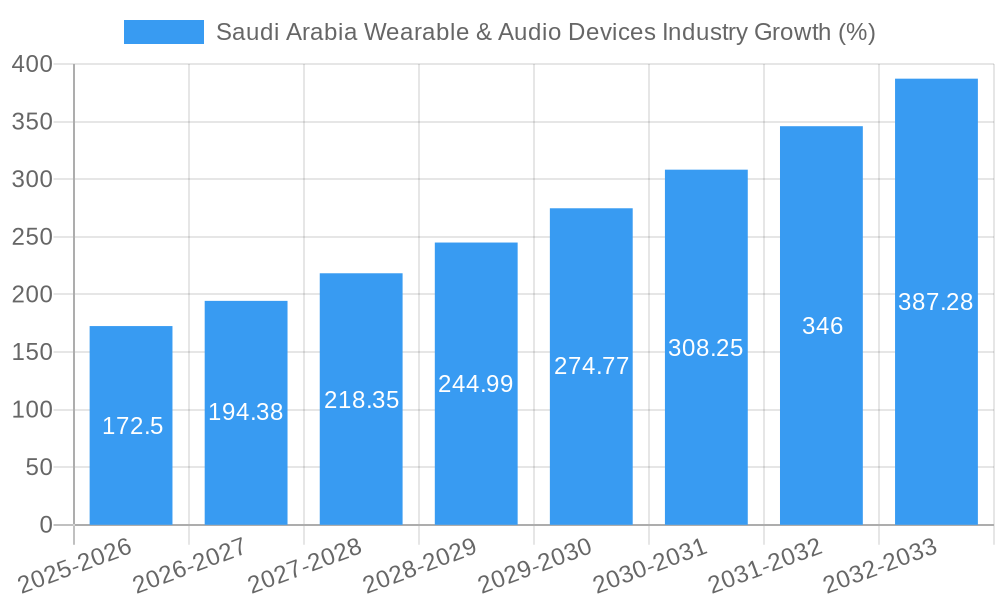

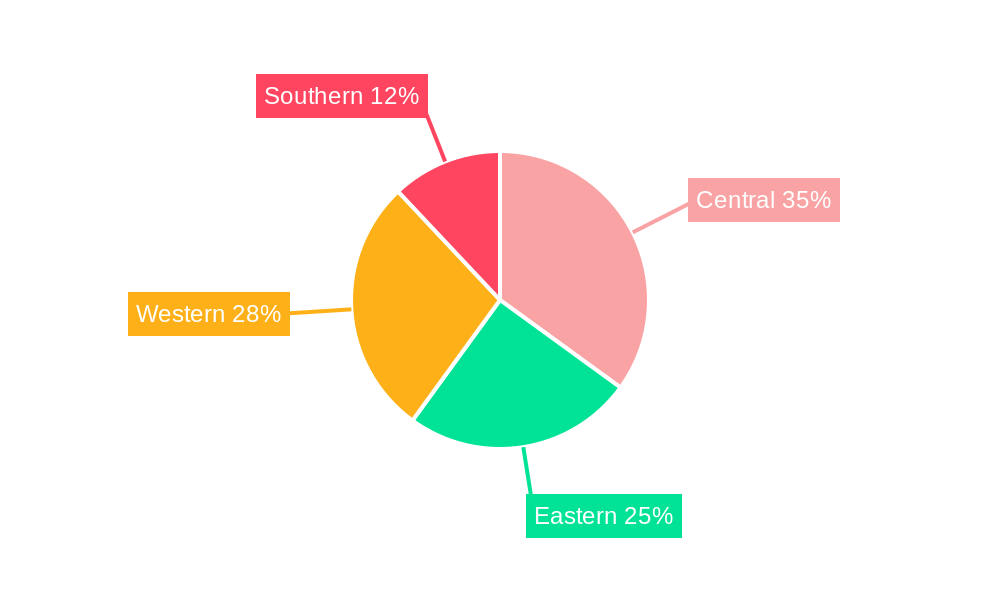

The Saudi Arabian wearable and audio devices market is experiencing robust growth, projected to reach a significant market size by 2033. A Compound Annual Growth Rate (CAGR) of 11.50% from 2019-2033 indicates a strong upward trajectory driven by several key factors. Increasing disposable incomes, a young and tech-savvy population eager to adopt the latest gadgets, and the rising popularity of fitness and health-conscious lifestyles are fueling demand. The market is segmented by channel (e-commerce and offline retail) and device type (speakers, digital media player docks, hi-fi systems, audio separates, home cinema and speaker systems, and hearables). E-commerce is likely experiencing faster growth than offline channels, mirroring global trends. Within the device types, hearables (earbuds, headphones) and smartwatches are expected to be the fastest-growing segments, driven by their convenience and integration with smartphones. Competition is fierce, with established international brands like Apple, Fitbit, and Garmin vying for market share alongside local players. While data for specific market segments is unavailable, a logical estimation based on global trends suggests hearables and smartwatches will dominate market share within the device types. The regional distribution across Saudi Arabia (Central, Eastern, Western, Southern) is likely skewed toward more urbanized regions, reflecting higher purchasing power and internet penetration. Government initiatives to promote digital transformation and healthy lifestyles further contribute to the positive outlook for this market.

The market's growth is, however, subject to certain limitations. Potential restraints include the price sensitivity of some consumer segments, particularly for higher-end audio equipment. The market's dependence on fluctuating oil prices and global economic conditions also pose a risk. Despite these potential challenges, the long-term outlook remains positive, fueled by continuing technological advancements, an expanding middle class, and sustained government support for digital infrastructure development. Furthermore, the increasing awareness of health and fitness is a compelling factor in the growth of wearables, specifically smartwatches and fitness trackers. The competitive landscape is dynamic, with both established international brands and local players competing, creating a robust and innovative market. The Saudi Arabian government's investment in infrastructure and digitalization is expected to further accelerate the market growth.

Saudi Arabia Wearable & Audio Devices Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia wearable and audio devices industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market concentration, key segments, technological advancements, and future growth potential. The study leverages rigorous data analysis and incorporates expert insights to offer actionable recommendations for businesses operating within or planning to enter this dynamic market. The report encompasses a detailed analysis of key players such as Apple, Samsung, and Fitbit, providing a clear understanding of their market positioning and competitive strategies.

Saudi Arabia Wearable & Audio Devices Industry Market Concentration & Dynamics

The Saudi Arabia wearable and audio devices market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market is characterized by increasing competition from both established international brands and emerging local players. Innovation is a key driver, with ongoing advancements in technology leading to the development of new product features and functionalities. The regulatory framework plays a crucial role in shaping market access and competition, impacting product approvals and distribution channels. Substitute products, such as traditional audio equipment and basic fitness trackers, continue to exert some competitive pressure. Consumer trends toward health and wellness, coupled with increasing smartphone penetration, are fueling demand for wearable devices. Mergers and acquisitions (M&A) activity in the sector remains relatively low (xx deals in the last five years), but strategic partnerships are becoming more prevalent as companies seek to expand their reach and enhance their product offerings.

- Market Share: Apple, Samsung, and Fitbit hold approximately xx%, xx%, and xx% of the market share respectively in 2025 (estimated).

- M&A Activity: xx deals recorded between 2019 and 2024.

- Innovation Ecosystem: Strong focus on app development and integration with health and fitness platforms.

- Regulatory Framework: Generally supportive of technological advancements, but specific regulations regarding data privacy and product safety are evolving.

Saudi Arabia Wearable & Audio Devices Industry Industry Insights & Trends

The Saudi Arabia wearable and audio devices market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing health consciousness, and the growing adoption of smartphones are major contributors to market expansion. The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, such as the development of advanced sensors, improved battery life, and enhanced connectivity features, are significantly influencing market dynamics. Consumer behavior is shifting towards premium, feature-rich devices with seamless integration across multiple platforms and applications. The increasing demand for personalized health and fitness tracking solutions is driving the adoption of smartwatches and other wearable technologies. The market also witnesses a growing interest in immersive audio experiences, leading to increased demand for high-quality headphones and speakers.

Key Markets & Segments Leading Saudi Arabia Wearable & Audio Devices Industry

The Saudi Arabian wearable and audio devices market demonstrates strong growth across both online and offline channels, with a slight preference towards e-commerce platforms driven by the convenience and broad reach they offer. Within product types, the Hearables segment (earbuds, headphones) experiences the highest demand due to its portability and integration with smartphones. The Home Cinema and Speaker Systems segment shows steady growth as the demand for high-quality home entertainment systems increases among the population.

Key Market Drivers:

- Economic Growth: Rising disposable incomes and a growing middle class are driving demand for consumer electronics.

- Technological Advancements: Continuous innovation in wearable technology and audio solutions fuels market expansion.

- Infrastructure Development: Enhanced digital infrastructure supports the growth of e-commerce and online distribution.

- Government Initiatives: Support for digital transformation and the promotion of a knowledge-based economy create a favorable environment.

Dominant Segments:

- Channel: E-commerce and offline channels exhibit relatively equal market share in 2025.

- Type: Hearables segment holds the largest market share, followed by Speakers and Home Cinema and Speaker Systems.

Saudi Arabia Wearable & Audio Devices Industry Product Developments

Recent years have witnessed significant product innovations in the Saudi Arabian wearable and audio devices market. Advancements in sensor technology have enabled more accurate health monitoring capabilities in smartwatches and fitness trackers. The integration of artificial intelligence (AI) and machine learning (ML) algorithms has enhanced personalized features and user experiences. Noise-canceling technology and improved audio quality are driving demand for premium headphones and earbuds. The convergence of wearable technology and audio devices is creating new product categories, such as smart earbuds with integrated health sensors. These developments are enhancing the competitive landscape and driving market growth.

Challenges in the Saudi Arabia Wearable & Audio Devices Industry Market

The Saudi Arabian wearable and audio devices market faces several challenges, including the high cost of premium devices, which limits affordability for a large segment of the population. Supply chain disruptions due to global events and the prevalence of counterfeit products can impact market stability and growth. Strong competition from established international brands and emerging players further intensifies the challenge for smaller companies. Furthermore, the regulatory environment concerning data privacy and cybersecurity needs to keep evolving to safeguard consumers’ data and maintain confidence in the sector. These factors can lead to slower market growth if not addressed strategically.

Forces Driving Saudi Arabia Wearable & Audio Devices Industry Growth

Several factors contribute to the positive outlook for the Saudi Arabia wearable and audio devices market. Technological advancements leading to enhanced functionalities and user experiences are driving demand. Strong economic growth and rising disposable incomes fuel consumer spending on these devices. Government initiatives focusing on digital transformation and the promotion of a knowledge-based economy create a favorable environment for growth. Moreover, increasing awareness of health and fitness, coupled with the rising adoption of smartphones, supports market expansion. These factors will collectively propel the industry forward in the coming years.

Challenges in the Saudi Arabia Wearable & Audio Devices Industry Market

Long-term growth in the Saudi Arabia wearable and audio devices market relies heavily on continuous innovation and technological advancements to offer increasingly sophisticated and user-friendly devices. Strategic partnerships between domestic and international players can help expand market access and enhance product competitiveness. Expansion into new market segments and the exploration of emerging technologies, such as augmented reality (AR) and virtual reality (VR) integration, will also contribute to market growth. Focusing on affordable and accessible devices for a broader audience is crucial.

Emerging Opportunities in Saudi Arabia Wearable & Audio Devices Industry

The Saudi Arabia wearable and audio devices market presents numerous emerging opportunities. The demand for personalized health and fitness tracking is leading to innovations in wearable sensor technology. The integration of AI and ML is creating more intelligent and adaptive devices. The growing popularity of virtual and augmented reality applications creates potential for new product categories. Finally, expansion into niche markets, such as specialized sports and medical wearables, promises significant growth potential. These opportunities will shape the future of the market and provide significant scope for expansion and innovation.

Leading Players in the Saudi Arabia Wearable & Audio Devices Industry Sector

- Polar Electro Oy

- Fitbit Inc

- Huawei Technologies Co Ltd

- Garmin Inc

- United Matbouli Group

- Nike Inc

- Apple Inc

Key Milestones in Saudi Arabia Wearable & Audio Devices Industry Industry

- December 2022: Apple launched the smartwatch Series 8 in Saudi Arabia, signifying a significant advancement in wearable technology and market penetration of premium products.

- October 2022: Xiaomi's launch of its 12T smartphone series, featuring advanced camera technology, indirectly boosted the demand for compatible wearable devices.

- February 2022: Nokia's agreement with Zain KSA to improve digital infrastructure signals a positive development that supports the wider digital ecosystem, including wearable and audio devices.

Strategic Outlook for Saudi Arabia Wearable & Audio Devices Industry Market

The Saudi Arabia wearable and audio devices market is poised for significant growth in the coming years. Continued technological innovation, expanding consumer base, and supportive government initiatives will fuel market expansion. Companies that focus on delivering high-quality, feature-rich products at competitive prices will be best positioned to capitalize on this growth. Strategic partnerships and mergers & acquisitions could be instrumental in accelerating expansion. The market’s future hinges on successful adaptation to evolving consumer preferences, the adoption of innovative technologies, and the ability to navigate the competitive landscape effectively.

Saudi Arabia Wearable & Audio Devices Industry Segmentation

- 1. KSA Wear

-

2. Channel

- 2.1. E-Commerce

- 2.2. Offline

-

3. Type

- 3.1. Head

- 3.2. Body

- 3.3. Wrist

-

4. Application

- 4.1. Fitness and Wellness

- 4.2. Healthcare

- 4.3. Lifestyle

- 4.4. Gaming and Entertainment

-

5. COMPETITIVE INTELLIGENCE

- 5.1. List of Online Marketplaces for Wearables in KSA

- 5.2. Vendor Market Share

-

5.3. Company Profiles

- 5.3.1. United Matbouli Group

- 5.3.2. Huawei Technologies Co. Ltd

- 5.3.3. Apple Inc.

- 5.3.4. Garmin Inc.

- 5.3.5. Nike Inc.

- 5.3.6. Fitbit Inc.

- 5.3.7. Polar Electro Oy

- 6. KSA Mark

-

7. Channel

- 7.1. E-Commerce

- 7.2. Offline

-

8. Type

- 8.1. Speakers

- 8.2. Digital Media Player Docks

- 8.3. Hi-Fi Systems

- 8.4. Audio Separates

- 8.5. Home Cinema and Speaker Systems

-

8.6. Hearables Segment

- 8.6.1. Headsets (In/On Ear Headphones/Earphones)

- 8.6.2. Earbuds

- 8.6.3. Hearing Aids

Saudi Arabia Wearable & Audio Devices Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Wearable & Audio Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Adoption of Smart Wearables as Fashion Accessories; The Growing Area of m-Health (mobile health); Increasing Share of Technologically Connected Youth Population

- 3.3. Market Restrains

- 3.3.1. Decline in Home Cinema and Speaker Spending; Lower Consumer Spending Power and Longer Replacement Cycles

- 3.4. Market Trends

- 3.4.1. Healthcare Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Wearable & Audio Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by KSA Wear

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. E-Commerce

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Head

- 5.3.2. Body

- 5.3.3. Wrist

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Fitness and Wellness

- 5.4.2. Healthcare

- 5.4.3. Lifestyle

- 5.4.4. Gaming and Entertainment

- 5.5. Market Analysis, Insights and Forecast - by COMPETITIVE INTELLIGENCE

- 5.5.1. List of Online Marketplaces for Wearables in KSA

- 5.5.2. Vendor Market Share

- 5.5.3. Company Profiles

- 5.5.3.1. United Matbouli Group

- 5.5.3.2. Huawei Technologies Co. Ltd

- 5.5.3.3. Apple Inc.

- 5.5.3.4. Garmin Inc.

- 5.5.3.5. Nike Inc.

- 5.5.3.6. Fitbit Inc.

- 5.5.3.7. Polar Electro Oy

- 5.6. Market Analysis, Insights and Forecast - by KSA Mark

- 5.7. Market Analysis, Insights and Forecast - by Channel

- 5.7.1. E-Commerce

- 5.7.2. Offline

- 5.8. Market Analysis, Insights and Forecast - by Type

- 5.8.1. Speakers

- 5.8.2. Digital Media Player Docks

- 5.8.3. Hi-Fi Systems

- 5.8.4. Audio Separates

- 5.8.5. Home Cinema and Speaker Systems

- 5.8.6. Hearables Segment

- 5.8.6.1. Headsets (In/On Ear Headphones/Earphones)

- 5.8.6.2. Earbuds

- 5.8.6.3. Hearing Aids

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by KSA Wear

- 6. Central Saudi Arabia Wearable & Audio Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Wearable & Audio Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Wearable & Audio Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Wearable & Audio Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 7 Polar Electro Oy*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 6 Fitbit Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Huawei Technologies Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 4 Garmin Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 1 United Matbouli Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 5 Nike Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 3 Apple Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 7 Polar Electro Oy*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Wearable & Audio Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Wearable & Audio Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by KSA Wear 2019 & 2032

- Table 3: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 4: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by COMPETITIVE INTELLIGENCE 2019 & 2032

- Table 7: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by KSA Mark 2019 & 2032

- Table 8: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 9: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Central Saudi Arabia Wearable & Audio Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Eastern Saudi Arabia Wearable & Audio Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Wearable & Audio Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Wearable & Audio Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by KSA Wear 2019 & 2032

- Table 17: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 18: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by COMPETITIVE INTELLIGENCE 2019 & 2032

- Table 21: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by KSA Mark 2019 & 2032

- Table 22: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 23: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Saudi Arabia Wearable & Audio Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Wearable & Audio Devices Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Saudi Arabia Wearable & Audio Devices Industry?

Key companies in the market include 7 Polar Electro Oy*List Not Exhaustive, 6 Fitbit Inc, 2 Huawei Technologies Co Ltd, 4 Garmin Inc, 1 United Matbouli Group, 5 Nike Inc, 3 Apple Inc.

3. What are the main segments of the Saudi Arabia Wearable & Audio Devices Industry?

The market segments include KSA Wear, Channel, Type, Application, COMPETITIVE INTELLIGENCE, KSA Mark, Channel, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Adoption of Smart Wearables as Fashion Accessories; The Growing Area of m-Health (mobile health); Increasing Share of Technologically Connected Youth Population.

6. What are the notable trends driving market growth?

Healthcare Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Decline in Home Cinema and Speaker Spending; Lower Consumer Spending Power and Longer Replacement Cycles.

8. Can you provide examples of recent developments in the market?

December 2022: Apple launched the smartwatch Series 8 in Saudi Arabia. It helps run apps, display smartphone notifications, and monitor heart rate. It is the most recent generation of smartwatches that do much more than just tell time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Wearable & Audio Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Wearable & Audio Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Wearable & Audio Devices Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Wearable & Audio Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence