Key Insights

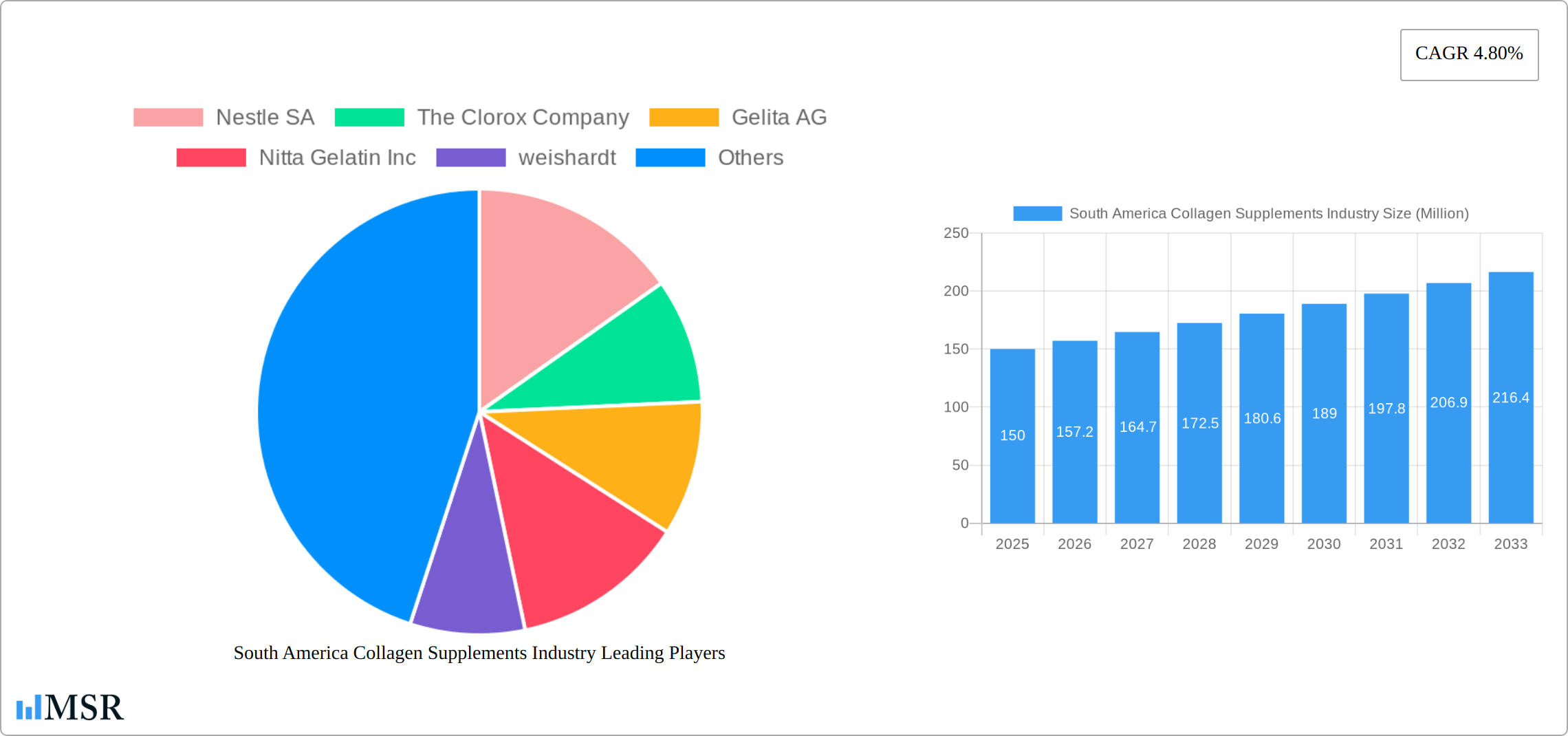

The South American collagen supplements market, valued at approximately $XX million in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033. This expansion is driven by several key factors. Rising consumer awareness regarding the health benefits of collagen, particularly for skin, hair, and joint health, is a significant driver. The increasing prevalence of aging populations across South America further fuels demand for products promoting anti-aging and improved joint mobility. The growing popularity of fitness and wellness lifestyles among younger demographics also contributes significantly to market growth. Furthermore, the expanding availability of diverse product formats, including powders, capsules, gummies, and drinks, caters to varied consumer preferences, enhancing market penetration. While the market faces some restraints, such as potential concerns about product purity and sourcing, as well as price sensitivity in certain market segments, these are largely offset by the significant overall growth drivers.

Within South America, Brazil and Argentina are expected to be the leading markets, accounting for a substantial share of the regional sales. The growth in these countries is spurred by increased disposable incomes, rising health consciousness, and the proliferation of online retail channels. The market segmentation by source (animal-based, plant-based, marine-based) highlights the diversity of offerings, with animal-based collagen currently dominating but plant-based alternatives gaining traction due to growing vegetarian and vegan populations. Similarly, the distribution channels show a dynamic mix, with supermarkets/hypermarkets holding a considerable share, while online stores are witnessing rapid expansion, reflecting changing consumer shopping habits. Major players like Nestle SA, The Clorox Company, and others are actively competing in this growing market, driving innovation and expansion. The forecast period (2025-2033) promises significant opportunities for established and emerging players alike, particularly those focusing on product innovation, effective marketing strategies, and robust distribution networks.

South America Collagen Supplements Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the South America collagen supplements industry, offering invaluable insights for stakeholders, investors, and industry professionals. We delve into market dynamics, key trends, leading players, and future growth potential, utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The market is segmented by form (powdered supplements, capsules and gummies, drinks and shots, other forms), source (animal-based, plant-based, marine-based), and distribution channel (supermarket/hypermarket, pharmacies/drug stores, online stores, other distribution channels). The total market size in 2025 is estimated at xx Million USD.

South America Collagen Supplements Industry Market Concentration & Dynamics

The South American collagen supplements market exhibits a moderately consolidated structure, with several major players holding significant market share. Nestle SA, The Clorox Company, Gelita AG, Nitta Gelatin Inc, Weishardt, Tessenderlo Group NV, Optimum Nutrition Inc, Rousselot, Hunter & Gather, and Novaprom are key players, although the market also includes numerous smaller, regional brands. The market share distribution is dynamic, subject to mergers and acquisitions (M&A) activity and new product introductions. The innovation ecosystem is active, with companies continuously developing new formulations and delivery methods to cater to evolving consumer preferences. Regulatory frameworks vary across South American countries, influencing product labeling, marketing claims, and ingredient approvals. Substitute products, such as other dietary supplements aimed at joint health and skin elasticity, exert competitive pressure. End-user trends show a growing preference for natural, clean-label products and convenient formats like ready-to-drink collagen shots.

- Market Concentration: Moderately Consolidated

- M&A Activity (2019-2024): xx deals (estimated)

- Key Innovation Areas: Sustainable sourcing, novel delivery systems, functional blends

- Regulatory Landscape: Variable across countries; requires compliance with local regulations

South America Collagen Supplements Industry Insights & Trends

The South America collagen supplements market is experiencing robust growth, driven by increasing consumer awareness of collagen's health benefits, rising disposable incomes, and expanding distribution networks. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx Million USD by 2033. Technological advancements are improving collagen extraction and processing techniques, leading to higher-quality, more bioavailable products. Evolving consumer behaviors reflect a preference for natural, plant-based alternatives to traditional animal-derived collagen, while the demand for convenient formats such as gummies and ready-to-drink products continues to increase. The growth is also influenced by the rising prevalence of conditions linked to aging and joint health, fueling demand for collagen supplements.

Key Markets & Segments Leading South America Collagen Supplements Industry

Brazil and Argentina are the dominant markets within South America, driven by factors such as larger populations, higher per capita income, and increased health consciousness. Within segments:

- By Form: Powdered supplements maintain a significant market share due to cost-effectiveness and versatility. Capsules and gummies show strong growth due to convenience. The ready-to-drink segment is rapidly expanding.

- By Source: Animal-based collagen continues to dominate, though plant-based and marine-based alternatives are gaining traction due to ethical and sustainability concerns.

- By Distribution Channel: Supermarkets and hypermarkets are the primary distribution channels, although online sales are exhibiting rapid growth, particularly in urban areas.

Drivers in Key Markets:

- Brazil: Strong economic growth, expanding middle class, rising health awareness.

- Argentina: Growing demand for functional foods and beverages.

- Chile: Increasing adoption of online shopping for health and wellness products.

South America Collagen Supplements Industry Product Developments

Recent years have seen significant advancements in collagen supplement formulations. Innovations include the development of hydrolyzed collagen peptides for enhanced bioavailability, the incorporation of functional ingredients such as vitamins and antioxidants to enhance product benefits, and the introduction of more sustainable sourcing practices to address environmental concerns. These innovations provide manufacturers with a competitive edge, enabling them to cater to a wider range of consumer needs and preferences.

Challenges in the South America Collagen Supplements Industry Market

The South American collagen supplements market, while exhibiting significant growth potential, faces a complex web of challenges impacting profitability and expansion. These hurdles necessitate strategic planning and adaptation for market players to thrive.

- Regulatory Hurdles and Market Fragmentation: Navigating the diverse regulatory landscapes across South American nations presents a significant challenge. Varied standards for labeling, ingredient sourcing, and product claims increase compliance costs and complexity, creating barriers for smaller companies and hindering seamless cross-border trade.

- Supply Chain Vulnerabilities and Price Volatility: The South American collagen supplements industry is susceptible to fluctuations in raw material prices, particularly given the dependence on global sourcing. Furthermore, logistical complexities, infrastructure limitations, and potential political instability can disrupt supply chains, leading to unpredictable production costs and delays.

- Intensifying Competition and Market Saturation: The market is becoming increasingly saturated, with both established international players and emerging local brands vying for market share. This necessitates continuous innovation in product formulations, marketing strategies, and distribution channels to differentiate offerings and attract consumers.

- Consumer Awareness and Education: While health awareness is growing, a significant portion of the population may lack a complete understanding of collagen's benefits and its role in overall well-being. Effective educational campaigns are crucial to drive demand and build consumer confidence.

- Economic Fluctuations and Consumer Spending: Economic instability in certain South American countries can impact consumer spending on non-essential products like collagen supplements. Market players need to adapt their pricing and marketing strategies to navigate economic volatility.

These challenges, while significant, do not negate the considerable growth opportunities. Addressing these issues proactively is key to unlocking the market's full potential.

Forces Driving South America Collagen Supplements Industry Growth

Despite the challenges, several powerful forces are propelling the expansion of the South American collagen supplements market:

- Booming Wellness and Beauty Culture: A growing emphasis on preventative health and wellness is fueling demand for collagen supplements, particularly among health-conscious consumers seeking to enhance skin health, hair vitality, and joint mobility.

- Rising Disposable Incomes and Expanding Middle Class: The expanding middle class in many South American countries translates into increased disposable income, enabling consumers to invest in premium health and wellness products like collagen supplements.

- Technological Advancements in Product Formulation: Continuous innovation in collagen extraction methods, product formulations, and delivery systems is leading to higher-quality, more bioavailable supplements with enhanced efficacy and absorption rates.

- Increased Online Accessibility and E-commerce Growth: The rise of e-commerce platforms is making collagen supplements more readily accessible to consumers across South America, regardless of geographic location.

- Strategic Partnerships and Brand Building: Collaboration between international brands and local distributors is essential for effective market penetration and building trust among consumers. Strong brand building initiatives are vital to establish market leadership.

Long-Term Growth Catalysts in the South America Collagen Supplements Industry Market

Long-term growth is supported by ongoing innovations in product formulations, strategic partnerships between supplement brands and health and wellness influencers, and expansion into new markets within South America, coupled with a focus on education to ensure higher consumer understanding of collagen benefits.

Emerging Opportunities in South America Collagen Supplements Industry

Significant opportunities exist in:

- Developing innovative product formats: Targeting specific demographics with tailored formulations.

- Expanding into underserved markets: Reaching consumers in smaller cities and rural areas.

- Leveraging digital marketing: Reaching a broader audience through social media and online platforms.

Leading Players in the South America Collagen Supplements Industry Sector

- Nestle SA

- The Clorox Company

- Gelita AG

- Nitta Gelatin Inc

- Weishardt

- Tessenderlo Group NV

- Optimum Nutrition Inc

- Rousselot

- Hunter & Gather

- Novaprom

Key Milestones in South America Collagen Supplements Industry Industry

- February 2022: Nestle Health Science acquires Vital Proteins, significantly increasing market share and product portfolio.

- December 2020: Hunter and Gather launches a new marine collagen supplement, expanding the marine collagen category.

- February 2020: Tessenderlo Group expands collagen peptide production in Argentina, boosting global supply.

Strategic Outlook for South America Collagen Supplements Industry Market

The South America collagen supplements market holds substantial long-term growth potential. Strategic opportunities lie in developing innovative products, expanding distribution networks, and capitalizing on the rising consumer demand for natural and functional foods and beverages. Focusing on sustainable sourcing practices and addressing regulatory challenges will be key to long-term success.

South America Collagen Supplements Industry Segmentation

-

1. Form

- 1.1. Powdered Supplements

- 1.2. Capsules and Gummies

- 1.3. Drinks and Shots

- 1.4. Other Forms

-

2. Source

- 2.1. Animal-based

- 2.2. Plant-based

- 2.3. Marine-based

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Pharmacies/Drug Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Argentina

- 4.2. Brazil

- 4.3. Rest of South America

South America Collagen Supplements Industry Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Collagen Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The numerous benefits offered by collagen in the food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Increasing vegan population in the region

- 3.4. Market Trends

- 3.4.1. The Growing Awareness Regarding Benefits of Health Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powdered Supplements

- 5.1.2. Capsules and Gummies

- 5.1.3. Drinks and Shots

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Animal-based

- 5.2.2. Plant-based

- 5.2.3. Marine-based

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Pharmacies/Drug Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Argentina

- 5.5.2. Brazil

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Argentina South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powdered Supplements

- 6.1.2. Capsules and Gummies

- 6.1.3. Drinks and Shots

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Animal-based

- 6.2.2. Plant-based

- 6.2.3. Marine-based

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/Hypermarket

- 6.3.2. Pharmacies/Drug Stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Argentina

- 6.4.2. Brazil

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Brazil South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powdered Supplements

- 7.1.2. Capsules and Gummies

- 7.1.3. Drinks and Shots

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Animal-based

- 7.2.2. Plant-based

- 7.2.3. Marine-based

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/Hypermarket

- 7.3.2. Pharmacies/Drug Stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Argentina

- 7.4.2. Brazil

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Rest of South America South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powdered Supplements

- 8.1.2. Capsules and Gummies

- 8.1.3. Drinks and Shots

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Animal-based

- 8.2.2. Plant-based

- 8.2.3. Marine-based

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/Hypermarket

- 8.3.2. Pharmacies/Drug Stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Argentina

- 8.4.2. Brazil

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Brazil South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Collagen Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nestle SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 The Clorox Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gelita AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nitta Gelatin Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 weishardt

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tessenderlo Group NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Optimum Nutrition Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rousselot

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hunter & Gather*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Novaprom

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nestle SA

List of Figures

- Figure 1: South America Collagen Supplements Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Collagen Supplements Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Collagen Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Collagen Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 3: South America Collagen Supplements Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 4: South America Collagen Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South America Collagen Supplements Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Collagen Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Collagen Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Collagen Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Collagen Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Collagen Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Collagen Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 12: South America Collagen Supplements Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 13: South America Collagen Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: South America Collagen Supplements Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: South America Collagen Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Collagen Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 17: South America Collagen Supplements Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 18: South America Collagen Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: South America Collagen Supplements Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Collagen Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Collagen Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 22: South America Collagen Supplements Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 23: South America Collagen Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: South America Collagen Supplements Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Collagen Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Collagen Supplements Industry?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the South America Collagen Supplements Industry?

Key companies in the market include Nestle SA, The Clorox Company, Gelita AG, Nitta Gelatin Inc, weishardt, Tessenderlo Group NV, Optimum Nutrition Inc, Rousselot, Hunter & Gather*List Not Exhaustive, Novaprom.

3. What are the main segments of the South America Collagen Supplements Industry?

The market segments include Form, Source, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The numerous benefits offered by collagen in the food and beverage industry.

6. What are the notable trends driving market growth?

The Growing Awareness Regarding Benefits of Health Supplements.

7. Are there any restraints impacting market growth?

Increasing vegan population in the region.

8. Can you provide examples of recent developments in the market?

In February 2022, Nestle Health Science announced the acquisition of Vital Proteins, a leading collagen brand and a lifestyle and wellness platform offering supplements, beverages, and food products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Collagen Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Collagen Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Collagen Supplements Industry?

To stay informed about further developments, trends, and reports in the South America Collagen Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence