Key Insights

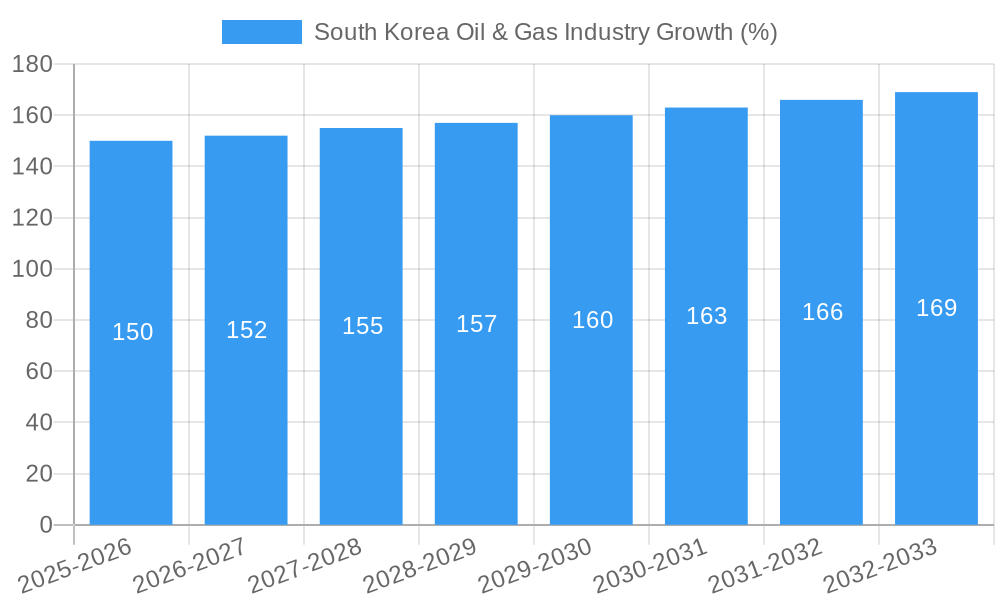

The South Korean oil and gas industry, valued at approximately $XX million in 2025, exhibits a robust growth trajectory, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 1.50% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the nation's strong economic performance and expanding industrial sector create consistent demand for energy resources. Secondly, ongoing investments in infrastructure development, including pipeline expansions and upgrades to refining capabilities, enhance the industry's efficiency and capacity. Government initiatives promoting energy security and diversification further bolster market expansion. However, challenges exist. Fluctuations in global oil prices and increasing environmental regulations present considerable headwinds. The transition towards renewable energy sources also poses a long-term challenge, necessitating strategic adaptation by industry players. Market segmentation reveals a diversified landscape, with significant contributions from tanker fleets, container fleets, and bulk/general cargo fleets, reflecting the diverse needs of South Korea's maritime and industrial sectors. Major players such as SK Energy, GS Caltex Corp, and S-Oil Corporation dominate the market, leveraging their established infrastructure and refining expertise.

The competitive landscape is characterized by both domestic and international companies. While established players benefit from strong brand recognition and existing distribution networks, emerging companies are actively investing in innovative technologies and sustainable practices to gain a foothold. The industry's future hinges on its ability to navigate the complexities of global energy markets, embrace sustainable practices, and adapt to evolving consumer demands. Analyzing the market segments reveals opportunities for specialized service providers focusing on specific needs within the tanker, container, and bulk cargo segments. Furthermore, strategic partnerships and technological advancements in areas such as refining efficiency and emission reduction will be crucial for sustained growth and long-term competitiveness. The forecast period of 2025-2033 presents a window for significant expansion, offering opportunities for both established and emerging players to capitalize on the industry's momentum.

South Korea Oil & Gas Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the South Korea oil & gas industry, covering market dynamics, key players, industry trends, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages a wealth of data and insights to offer actionable intelligence on this dynamic market.

South Korea Oil & Gas Industry Market Concentration & Dynamics

This section assesses the South Korea oil & gas market's competitive landscape, examining market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activity. The report analyzes the market share of key players such as SK Energy, GS Caltex Corp, and S-Oil Corporation, revealing the degree of market concentration. Furthermore, it explores the impact of government regulations, technological advancements (e.g., LNG as a green fuel), and the emergence of substitute products on market dynamics. M&A activity during the historical period (2019-2024) is quantified, indicating the level of consolidation within the industry. The study period (2019-2033) provides a long-term perspective on these factors. For example, the xx Million deal count in M&A activities during the period illustrates the level of industry consolidation. The report also details the influence of end-user trends across sectors like tanker, container, and bulk cargo fleets.

South Korea Oil & Gas Industry Industry Insights & Trends

This section provides an in-depth analysis of the South Korea oil & gas market's growth trajectory, encompassing market size (estimated at xx Million in 2025), Compound Annual Growth Rate (CAGR) projections for 2025-2033, and a comprehensive assessment of market drivers. Technological disruptions, including advancements in LNG technology and the push towards cleaner energy sources, are meticulously evaluated. The impact of evolving consumer behaviors, particularly the growing demand for cleaner energy solutions, is analyzed, alongside the influence of government policies promoting sustainable energy. Key market growth drivers and technological advancements are discussed in detail. The report forecasts a CAGR of xx% for the forecast period (2025-2033), reflecting the industry's anticipated growth trajectory.

Key Markets & Segments Leading South Korea Oil & Gas Industry

South Korea's oil and gas market is a complex interplay of various segments, each contributing uniquely to the nation's energy landscape. This section analyzes the dominant segments within the end-user landscape, including but not limited to: the Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries, Offshore Support Vessels (OSVs), and other specialized maritime transport. We identify the leading segment and delve into a detailed explanation of its market dominance, supported by robust data and insightful analysis. Our analysis considers factors such as market share, revenue generation, growth projections, and profitability.

- Drivers for the Dominant Segment(s): The dominance of specific segments is often driven by a confluence of factors. We analyze these drivers in detail, including:

- Economic Growth and Energy Demand: South Korea's robust economic growth fuels an increased demand for energy transportation, directly impacting the volume and type of vessels required.

- Infrastructure Development and Efficiency: The efficiency of South Korea's port infrastructure and transportation networks significantly influences the competitiveness of different segments. Investment in modernizing ports and logistics plays a key role.

- Government Policies and Regulations: Government initiatives promoting maritime trade, environmental regulations, and investments in infrastructure development heavily influence the trajectory of the market. We analyze the impact of key policies and regulations.

- Geopolitical Factors and Global Trade: South Korea's position in global trade and its dependence on imported energy resources significantly impacts the dynamics of the oil and gas transportation market. Fluctuations in global energy prices and trade relations have notable effects.

Our detailed dominance analysis goes beyond simple market share figures. We examine the underlying reasons for a segment's success, providing a comprehensive understanding of the market dynamics and competitive landscape.

South Korea Oil & Gas Industry Product Developments

This section summarizes recent product innovations, applications, and their market relevance, emphasizing the role of technological advancements in enhancing the competitiveness of companies in the South Korean oil & gas sector. This includes discussions of efficiency improvements in extraction and refining processes and the development of cleaner energy solutions.

Challenges in the South Korea Oil & Gas Industry Market

The South Korean oil and gas industry faces a number of significant challenges that impact its growth and profitability. These challenges are multifaceted and interconnected, including:

- Regulatory Hurdles: Complex and evolving regulations related to environmental protection, safety, and emissions can create significant operational and investment barriers. We quantify the impact of these hurdles, providing estimates of potential revenue losses or delays in project implementation.

- Supply Chain Vulnerabilities: Dependence on global supply chains for equipment, technology, and resources exposes the industry to price volatility, geopolitical instability, and potential disruptions. We analyze the implications of these vulnerabilities and suggest potential mitigation strategies.

- Intense Competition: The South Korean oil and gas market is competitive, with both domestic and international players vying for market share. This competition affects pricing, profitability, and innovation. We assess the competitive landscape and identify key competitive pressures.

- Energy Transition and Sustainability Concerns: The global shift towards renewable energy sources and increasing emphasis on environmental sustainability present both challenges and opportunities for the oil and gas industry in South Korea. We examine the impact of this transition on market demand and investment.

Our analysis quantifies the impact of these challenges on market growth, providing concrete examples and data-driven insights.

Forces Driving South Korea Oil & Gas Industry Growth

This section outlines the key growth drivers, focusing on technological advancements (e.g., improved extraction techniques, LNG as a green fuel), supportive economic conditions (e.g., government incentives for energy infrastructure), and enabling regulatory frameworks (e.g., policies encouraging renewable energy integration). The report explains the specific contributions of each factor to the industry's growth.

Long-Term Growth Catalysts in the South Korea Oil & Gas Industry

This section highlights factors that will contribute to the long-term growth of the South Korean oil & gas industry. This includes innovations in renewable energy sources, strategic partnerships among industry players, and market expansions into new geographical areas. Specific examples and their potential impact on market growth are discussed.

Emerging Opportunities in South Korea Oil & Gas Industry

Despite the challenges, the South Korean oil and gas industry presents several emerging opportunities for growth and innovation. These opportunities are driven by technological advancements, evolving consumer preferences, and government initiatives. Specifically, we examine:

- Renewable Energy Integration: The integration of renewable energy sources into the existing energy mix presents opportunities for diversification and creating more sustainable energy solutions.

- Technological Advancements: Advancements in areas such as offshore exploration, enhanced oil recovery, and carbon capture technologies offer potential for improving efficiency and reducing environmental impact.

- Energy Efficiency Initiatives: Government initiatives and consumer demand for energy-efficient solutions drive the adoption of new technologies and practices across the industry.

- Strategic Partnerships and Investments: Collaborations between domestic and international companies can unlock new opportunities for technology transfer, investment, and market expansion.

Our analysis identifies specific opportunities and assesses their potential for market disruption and long-term growth.

Leading Players in the South Korea Oil & Gas Industry Sector

- SGS Group

- CNCITY energy Co Ltd

- Hankook Shell Oil Co Ltd

- Daesung Industrial Co Ltd

- Korea Gas Corporation (KOGAS)

- Hyundai Oilbank Co Ltd

- Kukdong Oil & Chemicals Co Ltd

- Korea National Oil Corporation (KNOC)

- SK Energy

- GS Caltex Corp

- S-Oil Corporation

Key Milestones in South Korea Oil & Gas Industry Industry

- July 2021: KOGAS signs a 20-year LNG supply agreement with Qatar for 2 Million tons annually starting in 2025, adding to existing contracts totaling 13.9 Million tons annually. This significantly secures South Korea’s LNG supply.

- January 2022: South Korea designates LNG as a green fuel, impacting green financing, carbon taxes, coal plant decommissioning, and the country's energy mix. This accelerates the transition to cleaner energy sources.

Strategic Outlook for South Korea Oil & Gas Industry Market

The future of the South Korean oil and gas industry is shaped by a dynamic interplay of global energy trends, technological advancements, and government policies. This section provides a strategic outlook, identifying key growth accelerators and highlighting the considerable future market potential. We analyze the long-term prospects, emphasizing strategic opportunities for companies to capitalize on market trends and navigate the challenges effectively. Our analysis provides actionable insights for strategic planning and decision-making, enabling companies to position themselves for success in this evolving market. This includes examining potential investment opportunities, emerging technologies, and evolving regulatory landscapes.

South Korea Oil & Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Korea Oil & Gas Industry Segmentation By Geography

- 1. South Korea

South Korea Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital and Operational Expenditures

- 3.4. Market Trends

- 3.4.1. Downstream segment to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SGS Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNCITY energy Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hankook Shell Oil Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daesung Industrial Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korea Gas Corporation (KOGAS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Oilbank Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kukdong Oil & Chemicals Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Korea National Oil Corporation (KNOC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Energy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GS Caltex Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 S-Oil Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SGS Group

List of Figures

- Figure 1: South Korea Oil & Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Oil & Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: South Korea Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2019 & 2032

- Table 5: South Korea Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South Korea Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South Korea Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South Korea Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South Korea Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 15: South Korea Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 17: South Korea Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2019 & 2032

- Table 19: South Korea Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 21: South Korea Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: South Korea Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: South Korea Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: South Korea Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Oil & Gas Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the South Korea Oil & Gas Industry?

Key companies in the market include SGS Group, CNCITY energy Co Ltd, Hankook Shell Oil Co Ltd, Daesung Industrial Co Ltd, Korea Gas Corporation (KOGAS), Hyundai Oilbank Co Ltd, Kukdong Oil & Chemicals Co Ltd, Korea National Oil Corporation (KNOC), SK Energy, GS Caltex Corp, S-Oil Corporation.

3. What are the main segments of the South Korea Oil & Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply.

6. What are the notable trends driving market growth?

Downstream segment to dominate the market.

7. Are there any restraints impacting market growth?

4.; High Capital and Operational Expenditures.

8. Can you provide examples of recent developments in the market?

In January 2022, the country passed a resolution labelling LNG as a green fuel, as a part of its decarbonisation strategy to achieve a clean energy transition. This move is expected to have an impact on green financing, the future course of carbon taxes/emissions caps, the decommissioning pathway of coal-fired plants and South Korea's future energy mix

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the South Korea Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence