Key Insights

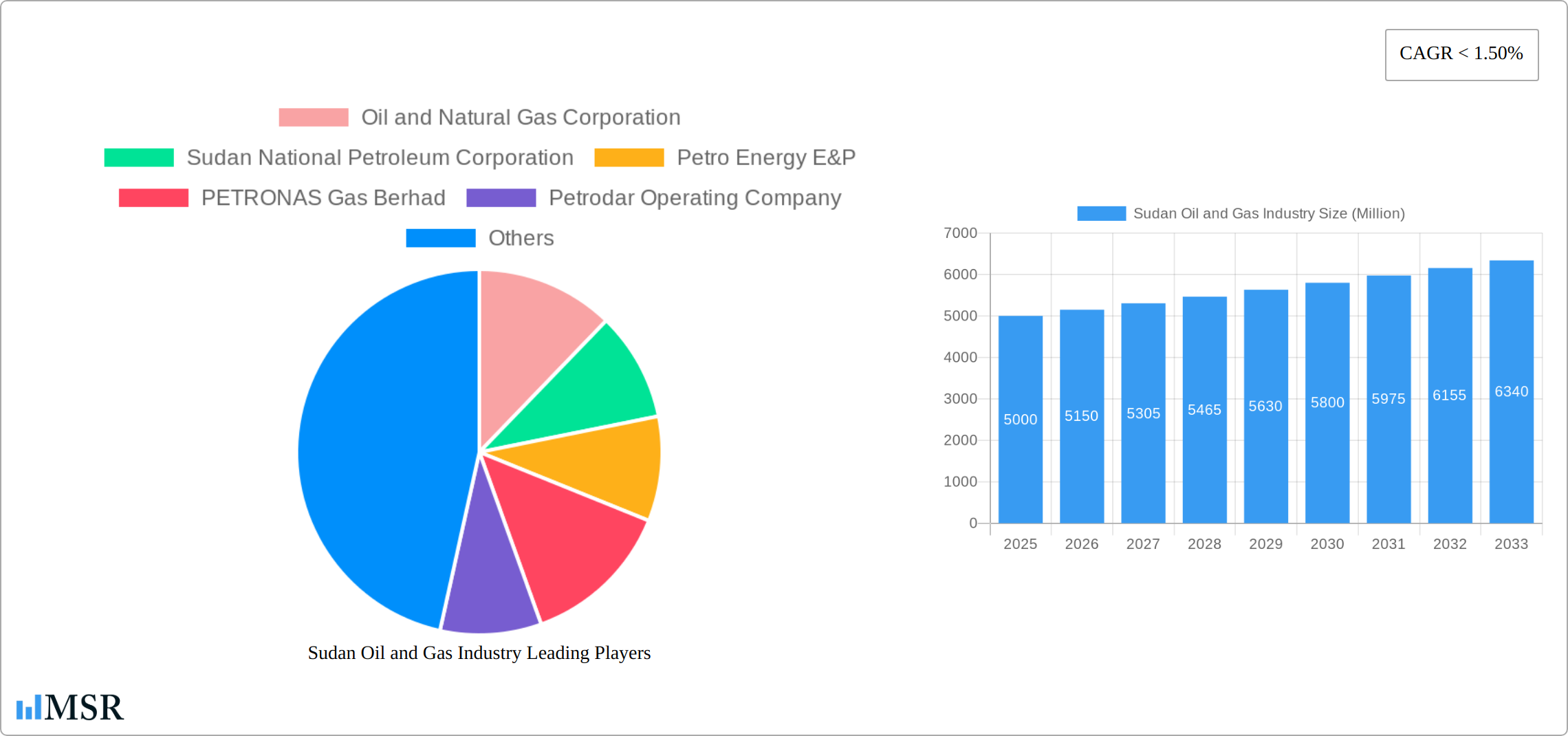

The Sudanese oil and gas industry, while possessing significant potential, faces complex challenges impacting its growth trajectory. The historical period (2019-2024) likely saw fluctuating production levels due to political instability, infrastructure limitations, and international sanctions. While precise figures for market size are unavailable, a reasonable estimate for the market size in 2025 could be around $5 billion USD, considering Sudan's proven oil reserves and historical production levels adjusted for recent economic conditions. This estimation accounts for factors like operational efficiency, global oil prices, and potential investment in exploration and production. The Compound Annual Growth Rate (CAGR) from 2025-2033, although not specified, is projected to be modest, likely ranging from 3-5%, reflecting the ongoing challenges and the need for substantial foreign investment to unlock the sector's full potential. This moderate growth is contingent upon improved political stability, increased investment in infrastructure development, and effective regulatory frameworks to attract international oil companies.

Looking ahead to the forecast period (2025-2033), sustainable growth hinges on several factors. These include addressing security concerns to ensure safe operations, attracting foreign direct investment to modernize infrastructure and boost exploration activities, and fostering a stable and transparent regulatory environment that encourages both domestic and international participation. Furthermore, diversifying revenue streams beyond oil and gas, exploring renewable energy options, and aligning the industry with global sustainability standards will be crucial for long-term growth and resilience. Successful implementation of these strategies could lead to a noticeable increase in market value by 2033, but significant hurdles remain before the Sudanese oil and gas industry can realize its full economic potential.

Sudan Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Sudan oil and gas industry, offering crucial insights for stakeholders navigating this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future trends and opportunities. The report encompasses market size estimations in Millions, detailed segment analysis, and profiles of key players like Oil and Natural Gas Corporation, Sudan National Petroleum Corporation, and China National Petroleum Corporation, among others.

Sudan Oil and Gas Industry Market Concentration & Dynamics

This section analyzes the competitive landscape, regulatory environment, and market forces shaping the Sudanese oil and gas sector. The market is characterized by a mix of international and national players, with varying degrees of market share. While precise figures are unavailable for all companies, we estimate the market share of the Sudan National Petroleum Corporation to be approximately xx%. The presence of international giants like China National Petroleum Corporation and Zarubezhneft indicates a high level of foreign investment.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller operators.

- Innovation Ecosystems: Limited, with opportunities for technological advancements in exploration, production, and refining.

- Regulatory Frameworks: Currently undergoing revisions, impacting investment decisions and operational strategies.

- Substitute Products: Limited availability of substitutes currently, but renewable energy sources are posing a long-term threat.

- End-User Trends: Primarily focused on domestic consumption and export markets, with growing demand for refined products.

- M&A Activities: A moderate number of M&A deals have been recorded in the recent past (xx in the last 5 years), primarily focused on asset acquisition and joint ventures.

Sudan Oil and Gas Industry Industry Insights & Trends

The Sudanese oil and gas industry presents a complex landscape of opportunities and obstacles. While production has seen fluctuations, the nation possesses substantial untapped reserves. Market estimates for 2025 vary, but projections suggest a substantial market value with a promising Compound Annual Growth Rate (CAGR) throughout the forecast period (replace xx with specific figures). This growth is fueled by rising domestic energy demand, active exploration efforts, and the potential influx of foreign direct investment (FDI). However, significant headwinds persist, including persistent political instability, security risks, and infrastructural limitations. The sector also faces the challenge of adapting to evolving global energy dynamics, including the increasing adoption of renewable energy sources and the pressure to transition towards cleaner energy solutions. Technological advancements, such as enhanced oil recovery (EOR) techniques and modernized refining processes, offer pathways to improved efficiency and competitiveness. A comprehensive strategy that addresses both the challenges and opportunities is crucial for sustainable development within the sector.

Key Markets & Segments Leading Sudan Oil and Gas Industry

By Type of Resource: Crude oil currently dominates the market, contributing xx Million USD in 2025, representing the largest segment. Natural gas and NGLs production are comparatively smaller, with potential for future expansion.

By Exploration and Production Stage: The development and production stages account for the largest portion of industry activity, contributing to the majority of the overall market value. Exploration activities are ongoing, with the potential for significant discoveries that can shape future market dynamics.

Regional Dominance: The majority of production and exploration activities are concentrated in the central and western regions of Sudan, driven by existing infrastructure and the presence of significant hydrocarbon reserves. This concentration is supported by favorable geological conditions and government incentives.

Drivers: The discovery of new reserves, improved infrastructure development, government policies promoting investment, and increasing domestic demand all contribute to the dominance of these key segments.

Sudan Oil and Gas Industry Product Developments

Recent developments focus on enhancing oil recovery techniques, improving the efficiency of refining processes, and exploring potential for petrochemical development. Technological advancements, such as improved seismic imaging for exploration and the adoption of enhanced oil recovery (EOR) techniques, aim to improve production efficiency and extend the lifespan of existing fields. These efforts are crucial to maintaining a competitive edge in the global market.

Challenges in the Sudan Oil and Gas Industry Market

The Sudanese oil and gas sector confronts considerable challenges that hinder its growth and development:

- Geopolitical Instability and Security Risks: Political instability and ongoing security concerns create a volatile investment climate, disrupting operations and deterring long-term investments. This uncertainty significantly impacts production levels and hinders the implementation of large-scale projects.

- Regulatory and Bureaucratic Hurdles: Complex bureaucratic procedures and a constantly evolving regulatory landscape create uncertainty for investors and operators, increasing transaction costs and delaying project implementation.

- Infrastructure Deficiencies and Logistical Constraints: Inadequate infrastructure, including transportation networks and storage facilities, contributes to higher operational costs and delays in project timelines. This necessitates significant investment in infrastructure development to enhance the sector’s efficiency.

- Intensifying Global Competition: The sector faces intense competition from both international oil and gas companies and the rapidly growing renewable energy sector. This necessitates strategies to enhance competitiveness and secure market share.

- Environmental Concerns and Sustainability: Growing global awareness of environmental issues and the push for sustainable energy sources put pressure on the sector to adopt environmentally friendly practices and explore ways to minimize its carbon footprint.

Forces Driving Sudan Oil and Gas Industry Growth

Despite the challenges, several factors contribute to the potential for growth within the Sudanese oil and gas industry:

- Expanding Domestic Energy Demand: Rapid population growth and industrialization are driving up domestic consumption of oil and gas, creating a strong foundation for local market expansion.

- Untapped Hydrocarbon Reserves and Exploration Activities: The country possesses significant yet largely unexplored hydrocarbon reserves, presenting significant opportunities for new discoveries and production increases. Ongoing exploration efforts hold the potential to significantly expand the resource base.

- Potential for Foreign Direct Investment (FDI): Attracting foreign investment is crucial for injecting capital into the sector, supporting infrastructure development, and fostering technological advancements. Government incentives and improved regulatory clarity can attract FDI.

- Government Support and Policy Initiatives: Supportive government policies, including streamlined regulatory frameworks and incentives for investment, are vital to stimulating growth and fostering a stable investment environment.

Long-Term Growth Catalysts in the Sudan Oil and Gas Industry

Long-term growth hinges on fostering a stable investment climate, enhancing infrastructure, and adopting technologically advanced exploration and production methods. Partnerships between international and national companies can leverage expertise and capital, leading to sustainable development. Exploration of new reserves, coupled with technological advancements in EOR and refinery modernization, are critical for maintaining the long-term viability of the industry.

Emerging Opportunities in Sudan Oil and Gas Industry

Emerging opportunities include:

- Exploration and development of new reserves: Untapped reserves offer significant potential for future growth.

- Adoption of advanced technologies: Implementing innovative technologies enhances exploration, extraction, and refining efficiency.

- Development of downstream industries: Growth of petrochemical and related industries creates value-added opportunities.

- Regional cooperation: Collaboration with neighboring countries facilitates access to regional markets and infrastructure.

Leading Players in the Sudan Oil and Gas Industry Sector

- Oil and Natural Gas Corporation

- Sudan National Petroleum Corporation

- Petro Energy E&P

- PETRONAS Gas Berhad

- Petrodar Operating Company

- China National Petroleum Corporation

- Sunagas

- JSC Zarubezhneft

- Khartoum Refinery Co Ltd

- List Not Exhaustive

Key Milestones in Sudan Oil and Gas Industry Industry

- August 2022: Zarubezhneft plans to expand operations in Sudan, securing new oil exploration and production blocks, and expanding cooperation beyond production to include technology transfer in oil recovery, associated gas utilization, refining, petrochemicals, and training.

- April 2022: Sudan's Minister of Energy and Oil invites Algerian companies (including Sonatrach) to explore investment opportunities, highlighting a desire for collaboration in gas expertise and capacity building.

Strategic Outlook for Sudan Oil and Gas Industry Market

The long-term success of the Sudanese oil and gas industry hinges on addressing the fundamental challenges related to political stability, security, and regulatory uncertainties. A strategic approach that prioritizes sustainable development, attracts responsible foreign investment, embraces technological innovation, and promotes transparency is essential for unlocking the sector's vast potential. By focusing on these key areas, Sudan can pave the way for significant economic growth and create a more robust and sustainable energy sector.

Sudan Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Sudan Oil and Gas Industry Segmentation By Geography

- 1. Sudan

Sudan Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Adoption of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Limited Natural Resources

- 3.4. Market Trends

- 3.4.1. Midstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sudan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. UAE Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Sudan Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Oil and Natural Gas Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sudan National Petroleum Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Petro Energy E&P

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PETRONAS Gas Berhad

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Petrodar Operating Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 China National Petroleum Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sunagas

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JSC Zarubezhneft

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Khartoum Refinery Co Ltd *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: Sudan Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sudan Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Sudan Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sudan Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 3: Sudan Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 4: Sudan Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 5: Sudan Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sudan Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Sudan Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sudan Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 12: Sudan Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 13: Sudan Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 14: Sudan Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sudan Oil and Gas Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Sudan Oil and Gas Industry?

Key companies in the market include Oil and Natural Gas Corporation, Sudan National Petroleum Corporation, Petro Energy E&P, PETRONAS Gas Berhad, Petrodar Operating Company, China National Petroleum Corporation, Sunagas, JSC Zarubezhneft, Khartoum Refinery Co Ltd *List Not Exhaustive.

3. What are the main segments of the Sudan Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Adoption of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Midstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Limited Natural Resources.

8. Can you provide examples of recent developments in the market?

In August 2022, the Russian company Zarubezhneft plans to expand its operations in Sudan, where the government has offered new blocks for oil exploration and production. During the preparation process, Zarubezhneft, in collaboration with Sudan's Energy and Oil Ministry and Sudapec, increased the number of oil blocks that would be developed. As part of the agreement, the companies will discuss extending cooperation beyond production in the oil sector to include technologies related to oil recovery, the use of associated gas, oil refining, petrochemicals, and training.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sudan Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sudan Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sudan Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Sudan Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence